The storage periods for documents are established by law and when determining them, as a rule, documents are divided into 3 main groups:

- tax;

- accounting;

- personnel

Submit reports in three clicks

Elba will help you work without an accountant. She will prepare reports, calculate taxes and will not require any special knowledge from you.

Try 30 days free Gift for new entrepreneurs A year on “Premium” for individual entrepreneurs under 3 months

Tax accounting documents

This group includes all documents that contain information for calculating tax (acts, invoices, checks, receipts, etc., as well as KUDiR) and tax payments that confirm the fact of its transfer. The general rule for storing such documents is established in the Tax Code (clause 8, clause 1, article 23): tax documents must be stored for 4 years . There are no other comments regarding the calculation of the document storage period, so it can be calculated from the next day the document is compiled.

Sometimes documents should be kept for more than 4 years. For example, if an acquired fixed asset is written off, then the storage period for documents should be counted from the moment this fixed asset is fully recognized as expenses. Also, when carrying forward losses to future periods, it is necessary to retain all supporting documents for the entire period when the loss will be taken into account when calculating tax.

When determining the document storage period, you must remember that on-site tax audits are carried out for the previous 3 years, so before destroying the document, make sure that it is no longer useful.

How to get a bank account statement

The bank independently determines the type of statement and the timing of its provision.

The statement can be provided to the bank client:

- In the bank office in hand;

- Sent by mail;

- Online in the client’s personal account;

- By email.

The contract may specify the frequency of issuing statements or it may be provided only at the client’s request.

A mini-statement can be provided:

- By mobile phone;

- Via SMS message;

- Online;

- Through an ATM.

Some banks, depending on how you request a statement, may charge fees.

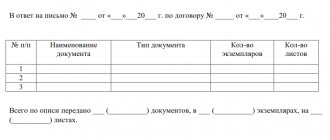

To receive a statement, you must submit a request to the bank, indicating:

- Full name and address of the individual entrepreneur, for legal entities - name of the organization;

- The period of time for which an extract is required to be provided;

- Indication of the reason for the request;

- Date of provision of the statement and signature of the bank client.

The bank may, for a number of valid reasons, close an account without the consent of the bank client. Sometimes a statement of a closed current account is required.

To obtain it, you must apply to the bank. If the activities of individual entrepreneurs and LLCs continue, then you can obtain an extract without any problems. If it has already been terminated, then it is still possible to obtain an extract. If an organization goes bankrupt and goes bankrupt, the bank does not provide information about the closed account. Data can only be provided at the request of the court.

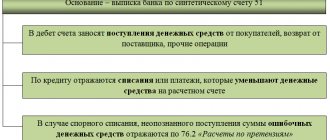

Place of statement among accounting documents

An extract, especially an extended one, tells a lot about the activities and financial position of the enterprise. In accounting documents it is the basic, primary document. The entry is required by the tax service when calculating taxes and in the event of various controversial situations.

Features of extract generation

An extract is generated in different ways. Each bank compiles it using different programs. It may differ in form and content. In addition, each statement must contain basic information:

- The name of the bank and the number of the branch issuing the document;

- Details of the account owner (full name of an individual or name of an LLC);

- Number and date of the bank agreement with the account holder;

- Client account number;

- Account currency;

- For what period was this statement compiled?

- Date of the last transaction on this account;

- The amount of the opening balance and the date;

- Dates of transactions on the client account;

- Numbers of payment documents, their dates;

- Corresponding account numbers;

- Name of correspondents;

- The name of the transactions performed, their code may also be indicated;

- The amounts for each debit/credit operation of the account are indicated;

- Balance of funds after each operation;

- Balance at the end of the day;

- Total amounts of funds written off and credited (turnovers on the debit and credit of the account);

- Closing balance as of the date of statement.

The bank, preserving the funds of the organization, is its debtor. are in the “Credit” column . When sending an extract to the tax office, you must provide a document certified by the bank.

Otherwise, a signature and seal on the statement is not required.

Accounting documents

This group includes all primary documents, cash and banking documents, accounting policies, inventory documents, and financial statements.

The storage periods for balance sheet documents are regulated by the Federal Law “On Accounting” No. 402-FZ dated December 6, 2011 and archival legislation (Rosarkhiv Order No. 236 dated December 20, 2019 “On approval of the List of standard management archival documents generated in the course of the activities of government bodies, local government bodies and organizations, indicating their storage periods").

The general storage period for accounting documents is 5 years. Moreover, it is calculated from the beginning of the year following the year of termination of use of the document.

For 5 years, it is necessary to preserve primary documents (contracts, acts, invoices, checks, financial statements, etc.), accounting policy documents, inventory results, bank and cash documents.

The storage period for primary documents in the Tax Code is defined as 4 years, but in the Accounting Law it is specified for a year longer.

Annual financial statements must be kept permanently , this period is defined in the Order of the Federal Archive No. 236.

Legislative regulation

According to Federal Law No. 129 of the Russian Federation “On Accounting”, it is required to document the transactions of the current account.

According to Federal Law No. 395-1 “On the Activities of Banks”, banks must store data on all transactions on the account. They are obliged to provide the client with a bank statement upon request. All current accounts must be maintained in accordance with the standards established by the Central Bank of the Russian Federation.

If you require an extended statement of your current account, you must contact the bank. You need to have a Russian passport with you.

Individuals require an extended statement in the following cases:

- Obtaining a visa abroad to confirm solvency and reliability;

- Applying for a loan to confirm the ability to pay monthly payments on time. Also to confirm the “working” of the account (payments are received);

- Requirements for other proof of solvency.

Personnel documentation

Storage periods are regulated only by archival legislation (Rosarkhiv Order No. 236).

The employer is required to keep all documents regarding its employees that are related to social benefits and benefits for citizens for 75 years. This storage period is established for employment contracts, personal cards, personal files, certification reports, etc.

Documents on the transfer of employees to full-time/short-time work, time sheets, documents on employee bonuses, documents on signing safety regulations, and business trip documents are stored for 5 years

Documents on labor discipline and vacation schedules can be stored for 3 years

In this article, we examined only the main documents that an entrepreneur most often encounters in his activities. A complete list of all documents with a definition of their storage period is given in the Order of the Federal Archive of Russia dated December 20, 2019 No. 236.

Statement of open current accounts

It is provided to individuals and legal entities. persons. More detailed information is provided if an extended statement of the LLC current account is generated.

The extended statement additionally indicates:

- Names of counterparties indicating their details;

- Places of operations (addresses of organizations, terminals);

- Commission amounts received by the bank.

An extended statement can be obtained online or ordered at a bank branch. In the Internet bank you can get it on electronic media free of charge and print it on paper. A statement received online can be certified at the bank. To submit to the tax office, a certified extract is required. The bank usually pays a commission when receiving a statement.

Tinkoff Bank current account statement

Tinkoff Bank is a special bank that does not have offices and operates only remotely. It is especially convenient for bank clients to work using Internet Banking. It has a lot of functions that make the work of entrepreneurs much easier.

The statement received from the bank contains basic information:

- Billing period;

- Outgoing balance;

- Amounts of expenses and revenues;

- Dates and times of all bank transactions.

The statement can be obtained almost instantly in the user’s personal account. If the user does not have Internet banking configured, you can download a special application on the bank’s website and create your account.

Features of electronic statements

More and more enterprises are switching to full computerization in financial activities. Many large banks provide all documents through Mobile Banking. Electronic statements are used by accountants working in the document flow of the Accounting 1C system.

The electronic statement is identical in content to the paper statement. To have it certified (signature, seal), you must contact the bank. Important features of the electronic statement: the ability to receive it yourself in a few seconds, at any time and completely free of charge.

Large enterprises usually have several current accounts and carry out numerous non-cash transactions every day. Storing statements online frees you from the need to print them and the attached documents. Not every company can afford voluminous archives.

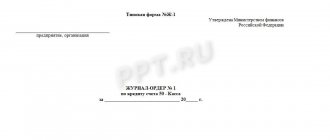

Let's look at an example of a statement from Sberbank of Russia.

How to get a current account statement in Sberbank Online

This service can be used continuously and is free. First, you need to register in the system online and log in to your personal account.

The statement can be printed on paper. The information in this case is for informational purposes only. An official document can only be obtained from a bank.

On the official website in your personal account, the following actions are required:

- Go to the link “Online transaction history”;

- Enter the operation you want to find. By clicking “advanced search”, you can specify the period for which you want to receive a receipt of all transactions;

- Click “Apply” by filling out the required fields on the page;

- Get a list of required operations.

Extract storage periods

According to the law, information about transactions with accounts must be retained by the bank for five years. Organizational accounting departments are also recommended to keep statements for at least five years. Sometimes some legal entities store archives for 10 years or more.

An extract is an official document summarizing the bank’s financial transactions. From the statements you can judge the financial activities of the organization. Statements help to constantly monitor the company’s cash flows, account transactions, use funds wisely and increase profits.

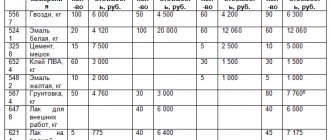

Sample statement of current account

The sample is usually in tabular form. It provides information on each financial transaction carried out by the bank. Indicates: the date of issue or receipt of payment, its amount, purpose, and so on.

The sample statement contains:

- The date and time when the transaction took place;

- Operation code;

- Payment document number;

- Bank correspondent account number;

- Accounts of the recipient and sender of funds;

- Movement of funds in the debit and credit of a given client account.