Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

+7 (499) 938-81-90 (Moscow)

+7 (812) 467-32-77 (Saint Petersburg)

8 (800) 301-79-36 (Regions)

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

Financial assistance in the form of borrowing a certain amount from one party to another is quite common.

But what nuances should be taken into account if the parties to the transaction are legal entities? How might such a transaction affect their taxation?

Is such a loan possible between organizations?

At the legislative level, there are no obstacles to concluding an interest-free loan agreement between legal entities. In Art. 809 of the Civil Code of the Russian Federation there are no restrictions.

However, according to Art. 6 of the Federal Law of 07.08.2011 No. 115-FZ “On combating (legalization) of proceeds from crime and the financing of terrorism” states that the issuance of interest-free loans by legal entities that are not credit institutions to other legal entities is subject to mandatory control by the state.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

+7 (499) 938-81-90 (Moscow)

+7 (812) 467-32-77 (Saint Petersburg)

8 (800) 301-79-36 (Regions)

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

An agreement must be concluded in writing between legal entities. At the same time, it must indicate that the lender does not charge the borrower interest for using the loan.

Important! A loan will be considered interest-free by default if its subject is things rather than money.

Peculiarities

The main feature of an interest-free loan agreement will be that it must contain a direct indication of an interest-free loan.

Otherwise, unless otherwise specified, the loan will be considered interest-bearing, and the interest for its use will be equal to the refinancing rate of the Central Bank of the Russian Federation on the expiration date. From February 2014 to this day, the Central Bank of the Russian Federation has kept the refinancing rate at 8.25% per annum.

The agreement must be concluded in writing, it does not need to be notarized, nor does it need to be registered with Rosreestr.

A loan agreement is a real contract, that is, it is considered concluded not from the moment of signing, but from the moment of transfer of funds or things on loan.

There is one more feature in an interest-free loan agreement between legal entities. If there has not yet been a business relationship with the borrower, then the lender runs the risk of ending up with an unscrupulous borrower. Therefore, the contract must necessarily set a deadline for repayment of the debt.

For example, December 31, 2015. Of course, the borrower can return the money earlier, but after December 31, 2015, the lender has every right to go to court for forced collection of funds.

It is very important to describe in detail the responsibility of each party for failure to fulfill the terms of the contract.

It is necessary to specify fines and penalties for non-refund of funds:

- firstly, this will protect both parties from the opponent’s dishonesty;

- secondly, the more detailed the contract is, the easier it will be for the court to read.

Procedure for provision

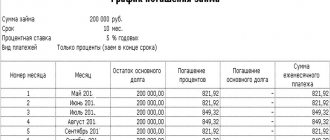

2.1. The Lender transfers the Loan Amount to the Borrower by transferring it to the Borrower's bank account specified in Section 9 of this Agreement. The date of transfer of funds is considered to be the date they are credited to the Borrower’s current account.

2.2. Confirmation of the transfer of the Loan Amount to the Borrower's bank account is a copy of the payment order with the bank's mark on execution.

2.3. The Borrower undertakes to repay the Loan Amount along with any interest due by “__”___________ ____.

2.4. The loan amount is repaid in accordance with Debt Repayment Schedule , which is an annex and an integral part of this Agreement (Appendix N ___).

2.5. The loan amount can be repaid by the Borrower ahead of schedule only with the written consent of the Lender.

Are there any restrictions on the amount

Under a loan agreement, money can be given to the borrower in cash or by bank transfer.

If money is issued in cash, then it is worth considering that there are restrictions on the amount. If payment under the agreement occurs by cashless means, then there are no restrictions on the amount.

However, there are some aspects to consider:

- if the lender is an LLC, then issuing a large loan amount may require mandatory approval, like a major transaction. This is stated in Art. 46 of the Law “On LLC”. Also, encouragement of LLC members may be required if at the general meeting the issue is raised that the issuance of an interest-free loan is an interested party transaction (Article 45 of the Law “On LLC”);

- if the loan amount exceeds 600 thousand rubles, the bank will require detailed information from the lender about the parties to the transaction. This information will be submitted by the bank to the Federal Financial Control Service. This is stated in paragraphs. 4 paragraphs 1 art. 6 of Law No. 115-FZ.

What is the maximum loan amount?

If an interest-free loan is issued between legal entities in cash, it is worth knowing that according to the Directives of the Central Bank of the Russian Federation dated March 11, 2014 No. 3210-U, it is stated that cash payments are limited to the amount of 100 thousand rubles within the framework of one agreement.

That is, the lender can give the borrower only 100 thousand rubles in cash, and receive the same amount back in cash.

In addition, you cannot take money from the cash register. They must first be deposited in the bank and then withdrawn from the account.

As already mentioned, if the loan funds are transferred non-cash, then there are no restrictions on the amount. But it is worth remembering pp. 1 clause 1 art. 6 of Law No. 115-FZ.

Find out what a subordinated loan is from the article: subordinated loan. Read about joint and several liability under a loan agreement here.

Early loan repayment

If the borrower violates his obligations, the lender may be guided by the basic rules that allow him to demand early repayment of the debt:

- Art. 811 explains that if the agreement provides for the repayment of the debt in parts, then if the borrowers violate the established deadlines, the creditor has the right to resort to early termination of the contract. In other words, violation of the payment schedule gives the lender the right to demand the balance of the debt along with the due interest.

- In Art. 813 it is noted that in case of improper fulfillment of obligations or refusal to fulfill them due to circumstances beyond the control of the borrower, the creditor has the right to demand early repayment of the debt, taking into account interest.

- Art. 814 explains the terms of the targeted loan. If the borrower misuses the amount of money for its intended purpose, this is a direct violation of such an agreement.

As a result, the lender has the right to demand early repayment of the loan. These rules of law allow the creditor to react in a timely manner to possible violations of the agreement.

True, quite often disputes arise when interpreting the phrase “interest due”. It is considered correct to assume that this amount is calculated for the entire term of the loan that was approved under the agreement.

This position is very unfavorable for the debtor, since by entering into a contractual relationship, he assumes serious responsibility and suffers serious losses in case of non-payment of the loan. Moreover, such a position gives the lender the right to receive lost profits.

Responsibility under the loan agreement is unilateral. Violations by the debtor of the terms of the agreement lead to consequences.

As a means of protection, the lender is provided with various measures of influence on the debtor. To do this, follow the rules of the agreement. If clauses on violation are not provided for in the contract, then liability is governed by Art. 811 and 395 of the Civil Code of the Russian Federation.

Help in drawing up a debt transfer agreement under a loan agreement will be provided by the article: debt transfer under a loan agreement. How you can pay off a loan from the Denga company is described here.

Sample loan agreement with an employee.

About material benefits

The concept of material benefit is used when receiving interest-free loans by individuals. They must pay income tax on this benefit.

This concept is not so common when issuing interest-free loans between legal entities, but, nevertheless, it is present.

Material benefit is the borrower's savings on interest on a loan or loan. For legal entities, material benefits increase the tax base for income tax.

The material benefit is calculated as the product of 2/3 of the refinancing rate by the actual term of the loan.

To calculate the material benefit for a legal entity, you must use the following formula:

mat. benefit = (2/3 * 8.25% * loan amount) * (actual number of days of using the loan / 365)

For example, Beta LLC issued an interest-free loan to Alpha LLC in the amount of 350 thousand rubles for a period of six months.

The material benefit will be equal to:

(350,000 * 2/3 * 8.25%) * (180 / 365) = 9,493.15 rubles

According to tax authorities, a legal entity should include this amount in the tax base for income tax. The date of inclusion of this income in the profit tax base will be considered the day the loan is repaid.

Tax consequences of an interest-free loan between legal entities

Tax authorities believe that receiving an interest-free loan is receiving non-operating income. In doing so, they refer to paragraph 8 of Art. 250 Tax Code of the Russian Federation. Hence the term material benefit for legal entities.

However, this is not the official opinion of the Ministry of Taxes of Russia, and the tax authorities of some municipalities use it exactly this way, calculating and additionally charging income tax to such taxpayers.

Undoubtedly, an interest-free loan is a way to obtain economic activity, since the loan was used by the borrower in his business activities.

In paragraph 10 of Art. 251 of the Tax Code of the Russian Federation provides a definition of income that is not included in the calculation of the tax base for income tax.

This point can also be attributed to the economic benefits of an interest-free loan. Consequently, the borrower does not have to pay either VAT or income tax on this amount.

If the borrower does not repay the debt on time under the loan agreement, then his debt will become his accounts payable.

As stated in paragraph 18 of Art. 250 of the Tax Code of the Russian Federation, the amount of accounts payable is included in the amount of non-operating income and is taken into account when taxing profits.

The amount of accounts payable is written off in equal parts throughout the entire limitation period under the contract. As you know, the civil statute of limitations for a loan agreement is 3 years. This is stated in Art. 195 of the Civil Code of the Russian Federation.

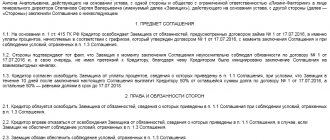

Sample contract

In order to correctly draw up an interest-free loan agreement, you need to know what clauses should be included in it, and what a sample agreement will roughly look like.

This:

- full name of the parties, details of the document on the basis of which they act, location address;

- subject of the agreement – the amount of the loan provided;

- rights and obligations of the parties - under such an agreement only the borrower has the obligation to return the funds to the lender;

- liability of the parties in case of failure to fulfill the terms of the contract;

- force majeure is force majeure circumstances that may prevent one of the parties from fulfilling the terms of the contract;

- confidentiality statement;

- methods for resolving disputes between the parties;

- the duration of the contract and other grounds for its termination;

- final provisions are an optional clause;

- details of the parties and signatures of the parties.

.

Measures to protect the rights of the lender in legislation

The legislation provides for the following ways to resolve the issue in case of refusal of the borrower’s obligations:

- coercion to fulfill the terms of the agreement in kind. The first method is the most common and is carried out by going to court;

Moreover, this right is fundamental for the protection of the rights of the lender described in Art. 309 and 310. Otherwise, the debtor would have the opportunity to refuse obligations at any time or independently replace the subject of the transaction.

- demand for damages. This method is the basis among other types of civil liability. The method involves paying compensation in favor of the injured party, in this case the lender;

Losses are usually understood as a loss measured in monetary terms, or a decrease in property benefits.

- payment of penalties. It is considered a more effective method when compared with compensation for losses. Penalty also means penalties or fines that the debtor is obliged to pay to the creditor. It is most often resorted to if the responsible party is in default under the loan agreement;

An important feature of the penalty is that in order to collect it, the lender does not need to prove that he suffered losses. Thus, the legislation uses this measure of protection as a punitive measure.

- termination of legal relations with the debtor or their change. By agreement of the parties, an additional agreement to the loan agreement may be concluded. To do this, they use innovations, when some obligations are replaced by others (in other words, they change the subject of the contract) or compensation.

The latter type involves the termination of relations after the actual transfer of property, funds or services.

If the borrower evades his obligations, then, by agreement of the parties, one can resort to a guarantee. This procedure is regulated by Art. 361 of the Civil Code and implies various third party responsibilities.

This may be the guarantor taking on part of the debt, the full amount, or performing a controlling function.

Compensation for losses

To take advantage of this measure of protection, the creditor will have to prove not only their occurrence, but also the amount of the amount that is required from the debtor as compensation.

It is guided by the general rules of the Civil Code and gives the lender the right to demand the full amount of losses received. It should be borne in mind that the rules of law are resorted to only in cases where the contract does not provide for compensation in a smaller amount.

Art. 15 explains that losses under a loan agreement should be understood as expenses incurred by a person to restore his rights. This also includes income due to the creditor under the contract when the debtor fulfills his obligations.

Collection of penalties

The Civil Code clearly outlines the process for paying compensation under this measure of protection. In Art. 394 it is noted that failure to fulfill obligations by the debtor or insufficient fulfillment of them may lead to a penalty.

In this case, it is customary to cover the losses in the part that is not covered by the penalty. It should be noted that Art. 394 is not a mandatory rule if other conditions are provided within the agreement.

This article gives the lender the following advantages:

- the position of the creditor is strengthened;

- the penalty in the hands of the lender becomes a flexible instrument of influence;

- gives the victim a dual position: on the one hand, he is not obliged to prove the damage caused, and on the other hand, having evidence of damage, he can demand compensation that exceeds the amount of the penalty.

To draw up an application for an interest-free loan agreement with an employee, read the article: interest-free loan agreement with an employee. A sample promissory note loan agreement can be found on the page.

Going to court

Quite often, the only way for a lender to get what is due under a loan agreement is to go to court. As a rule, the lender requires the borrower to fulfill the terms of the agreement in kind.

It is customary to draw up a statement of claim only after the other party has refused to resolve the dispute peacefully. To do this, the lender sends a claim to the borrower, which displays the amount of the debt and the conditions for its repayment.

In case of refusal or lack of response to this letter, the lender has the right to go to court.

In addition to the need to file a claim under the loan agreement, the lender must know that the search and provision of evidence rests with him.

Practice shows that sometimes the lender is unable to present before the court facts showing the connection between the losses caused to him and the loan agreement.

To prevent such a situation, it is recommended to contact a lawyer. If you win, all legal costs are borne by the defendant, including attorney fees.

It should be noted that there are consequences when choosing a remedy through the court:

- a claim demanding to force the borrower to fulfill the obligation in kind does not relieve the lender of the right to charge a penalty from the defendant for subsequent periods;

- When filing a claim for damages, the lender terminates the obligation under the loan agreement in question and deprives itself of the right to make any claims against the debtor.

A positive court decision for the creditor is an opportunity to hold the creditor accountable and force him to fulfill the terms of the contract with the support of the state.

After receiving the writ of execution, the creditor must contact the bailiffs. If the borrower refuses to comply with the court decision, the enforcement service has the right to impose a ban on the defendant crossing the border.

The law also protects the rights of the borrower, as in Art. 396 it is noted that if before the legal obligation he managed to pay the penalty or repay the debt, then he will not be forced to fulfill the obligation in kind. Otherwise, such a situation will be considered by law as unjust enrichment of the creditor.

How to avoid mistakes when drawing up a contract

To avoid mistakes when drawing up an interest-free loan agreement between legal entities, it is worth remembering that:

- An agreement between legal entities is concluded only in writing. Otherwise, the transaction will not be considered valid;

- It is not necessary to have the contract certified by a notary, but many legal entities do this;

Firstly, this provides a guarantee that the agreement is drawn up in accordance with the law and in case of going to court, it will not invalidate the transaction. Secondly, a notary is an additional witness to the conclusion of an agreement.

- There is no need to register the agreement with Rosreestr. However, if the loan agreement is accompanied by a collateral agreement, under which the collateral is real estate, then both of these agreements are subject to registration;

- the agreement comes into force not from the moment of signing, but from the moment of transfer of the loan subject;

- The subject of the contract can be not only money. But also things that are defined by the same generic characteristics. In this case, the borrower receives ownership of the items, not the right to use. Completely different items, also with the same generic characteristics, are subject to return;

For example, a borrower borrows a ton of apples. He will also return a ton, but of different apples. Such an agreement is interest-free by default.

- the contract must fully indicate the details of both parties, as well as their full names in accordance with the constituent documents;

- the loan amount must be indicated not only in numbers, but also written down in full;

- It is imperative to indicate in the agreement that the lender does not charge interest for using the loan from the borrower. Otherwise, the agreement will be considered by default to be interest-bearing, with a rate of 8.25% per annum;

- The contract must indicate the period for which the loan is issued. If this period is not specified, the contract will be considered unlimited. Under such an agreement, the borrower is obliged to repay the debt within a month after receiving a written request for repayment;

To correctly draw up loan agreements between legal entities, you need to contact professional lawyers.

If the parties want to draw up an agreement themselves, it is better to contact a notary for its certification. If the contract is not drawn up correctly, the notary will not be able to certify it.

Providing each other with interest-free loans is not uncommon between legal entities. As a rule, such relationships are entered into with trusted opponents.

Loans can be issued both in cash and non-cash.

Important! It is worth remembering the restrictions specified in the Directive of the Central Bank of the Russian Federation No. 3210-U and Law No. 115-FZ.

The features of a loan from a foreign legal entity in rubles are described in the article: loan from a foreign legal entity. What is said in the Civil Code of the Russian Federation about a targeted loan agreement, see on the page.

Methods for repaying an online loan from ZaimBeri are described here.

Interest-free borrowed funds - required documentation

When applying for a loan between an individual (IP) and a legal entity (LLC), the businessman-borrower and the company-lender draw up an agreement on the provision of borrowed funds.

According to Art. 808 of the Civil Code of the Russian Federation, an interest-free loan agreement between an individual entrepreneur and a company is concluded in writing if the loan amount is equal to at least 10 minimum wages. At the same time, if the lender is a legal entity, then the loans can be of any kind.

As a result, the Civil Code of the Russian Federation does not regulate interest-free loans between the lender - an individual and the borrower - an organization.

At the same time, in accordance with paragraph 1 of Art. 16 of the Civil Code of the Russian Federation, if one of the participants in the transaction is a legal entity (LLC company, firm, etc.), then the provision or receipt of borrowed funds must be formalized in writing. In other words, in such a transaction the parties are required to conclude an agreement on paper.

As a result, when interest-free loans are issued between an individual - the lender (IP) and a legal entity (company), an agreement is also drawn up.

An individual businessman can transfer an interest-free loan to the current account of the borrower LLC (for example, from his bank account) or deposit this amount in cash at the company’s cash desk.

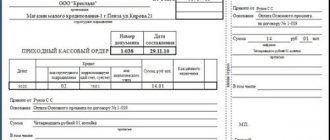

When providing interest-free borrowed funds to a legal entity - LLC in cash, an individual businessman uses a cash receipt order (form No. KO-1), which was approved by Decree of the statistics bodies of the Russian Federation dated August 18, 1998 No. 88.

The receipt for such an order is signed by the chief accountant of the borrower company and the cashier. When an individual entrepreneur gives borrowed funds to an LLC, the cashier puts a stamp on such a receipt and registers it in the journal for registering incoming and outgoing orders (Form No. KO-3).

As a result, the cashier leaves a receipt for the businessman-lender, and leaves the order itself with the borrowing company.

Also, according to the instruction of the Central Bank of the Russian Federation dated March 11, 2014 No. 3210-U, companies must transfer to a banking institution all cash that has accumulated in excess of the used cash balance limits.

As a result, the company must transfer the amount of debt received at the cash desk to a bank account.

The borrower-company must return the interest-free loans to the individual individual entrepreneur in 2 ways:

- through the transfer of money to a businessman’s account in a banking institution;

- or deposit cash through the cash desk of the individual entrepreneur.

In the latter case, when issuing borrowed funds, an expense cash order is issued (form No. KO-2).