Description of account 62

Account 62 is active-passive, so it can have both a credit and a debit balance.

IMPORTANT! The balance at the beginning and end of the period must be reflected in subaccounts in detail. This is due to the fact that the debit balance is the debt of customers, and the credit balance is the prepayment received for future shipments and work.

For a breakdown of accounts payable and receivable, see the material.

It is convenient to conduct analytical accounting for this account both in the context of subaccounts and for each customer. Many accounting programs allow you to support such analytics. As a result, turnover for the account as a whole is formed, and if necessary, it is always possible to generate SALT for each customer. Such a report can also serve as the basis for drawing up a statement of reconciliation of settlements with the counterparty.

In what cases are receivables revalued, find out from the Ready-made solution from ConsultantPlus. Trial full access to the system can be obtained for free.

Formation of SALT according to account 62

Let's look at the process of generating a statement using an example.

Alfa Center LLC, on the basis of an agreement concluded with Polar Star LLC, must ship products worth 120,000 rubles to it. (including VAT 20,000 rubles) in March 20XX. In February 20XX, Polyarnaya Zvezda LLC transferred an advance payment for the full amount to Alpha Center LLC.

Read about how to fill out TORG-12 in this material.

For information about the features of the UTD, see the material “Universal transfer documents” .

Postings in the accounting of Alfa Center LLC:

| Dt accounts | CT account | Sum | Description | Primary document |

| February 20XX | ||||

| 51 | 62 "Advances" | 120 000 | Received advance payment reflected | Payment order, bank statement |

| 76 “VAT on advances received” | 68 “VAT payable” | 20 000 | VAT charged on advance payment | Invoice for advance payment, entry in the sales book |

| March 20XX | ||||

| 62 “Payments for products” | 90 | 120 000 | Sales reflected in accounting | TORG-12, invoice |

| 90 | 68 “VAT payable” | 20 000 | VAT reflected | Invoice |

| 62 "Advances" | 62 “Payments for products” | 120 000 | Prepayment under the contract has been credited | Accounting information |

| 68 “VAT payable” | 76 “VAT on advances received” | 20 000 | Accepted for deduction of VAT on advance payment | Entry in the purchase book |

For more information on how to reflect revenue, read the article “Controversial issues regarding the reflection of revenue with or without VAT (90 and 91 accounts)” .

IMPORTANT! The debit balance at the end of the period is formed according to the formula: debit balance at the beginning of the period plus the amount of debit transactions minus credit turnover. Credit balance at the end of the period: credit balance at the beginning of the period plus the amount of credit transactions minus debit turnover.

SALT in the accounting of Alfa Center LLC in March 20XX.

SALT for account 62 “Advances”:

| Initial balance | Revolutions | Final balance | |||

| Dt | CT | Dt | CT | Dt | CT |

| – | 120 000 | 120 000 | – | – | – |

SALT for account 62 “Payments for products”:

| Balance at the beginning | Revolutions | Closing balance | |||

| Dt | CT | Dt | CT | Dt | CT |

| – | – | 120 000 | 120 000 | – | – |

SALT for count 62 (synthetic):

| Initial balance | Revolutions | Final balance | |||

| Dt | CT | Dt | CT | Dt | CT |

| – | 120 000 | 240 000 | 120 000 | – | – |

If no postings were made between subaccounts, then the SALT will look like this:

SALT for account 62 “Advances”:

| Initial balance | Revolutions | Final balance | |||

| Dt | CT | Dt | CT | Dt | CT |

| – | 120 000 | – | – | – | 120 000 |

SALT for account 62 “Payments for products”:

| Balance at the beginning | Revolutions | Closing balance | |||

| Dt | CT | Dt | CT | Dt | CT |

| – | – | 120 000 | – | 120 000 | – |

SALT for count 62 (synthetic):

| Initial balance | Revolutions | Final balance | |||

| Dt | CT | Dt | CT | Dt | CT |

| – | 120 000 | 120 000 | – | 120 000 | 120 000 |

The concept of accounts receivable is discussed in this publication.

Payments by bill of exchange

The instructions for the chart of accounts also pay attention to the peculiarities of settlements with bills of exchange. If the buyer issues his own bill of exchange to the supplier, then the debt is not repaid, but by this action a deferred payment is issued and a guarantee of payment is issued. To account for bills received, it is recommended to allocate a separate sub-account, for example, 62.3 “Bills received”. The following entries are made in the seller's accounting:

| Dt | CT | Description |

| 62.1 | 90.1 | Revenue accrued |

| 90.3 | 68 subaccount “VAT” | VAT charged on sales |

| 62.3 | 62.1 | Received own bill from buyer |

| 51 | 62.3 | Received funds upon presentation of a bill of exchange |

| 51 | 91.1 | Interest received on the bill |

Another situation arises if the debt is paid by a bill of exchange from third parties. Such a bill of exchange is recognized as a financial investment and is accounted for in account 58. The entries shown in the table are made in the supplier’s accounting:

| Dt | CT | Description |

| 62.1 | 90.1 | Revenue accrued |

| 90.3 | 68 subaccount “VAT” | VAT charged on sales |

| 58.2 | 62.1 | Received a third party promissory note as payment |

SALT for account 62 and balance sheet indicators

The credit balance of account 62 is included in the balance sheet liability, in accounts payable, and the debit balance is included in the balance sheet asset, in accounts receivable. This is directly stated in paragraph 73 of the order of the Ministry of Finance of the Russian Federation “On approval of the Regulations on accounting and financial reporting” dated July 29, 1998 No. 34n.

As can be seen from the example, if you do not make postings between subaccounts, the balance of account 62 will be overstated in both debit and credit. And this, in turn, will lead to distortion of balance sheet lines.

You can see an example of filling out a line for accounts receivable in the balance sheet in ConsultantPlus. Trial access to the system is provided free of charge.

Learn about the balance sheet from the following materials:

- “Balance sheet (assets and liabilities, sections, types)”;

- “Methodology for analyzing the balance sheet of an enterprise”;

- “How to fill out a balance sheet using the simplified tax system?”

Results

The meaning of such an accounting register as SALT is quite simple. This statement shows the expanded balance at the beginning of the period, all turnover for the period, and the expanded balance at the end of the period. Each side of account balance 62 affects the balance lines.

If an organization receives an advance payment for its products or services, then you need to remember that after shipping the products or completing the work, when accounts receivable appear in the accounting, it must be closed with an advance payment, making internal postings between subaccounts.

Otherwise, the organization’s reporting will be compiled incorrectly. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

D 62 to 41

Dt 51 Kt 51 is a common entry in accounting that reflects non-cash receipts and expenses of a business entity. We will tell you in our article which accounts account 51 can correspond with and which transactions using it are most popular.

What is count 51 used for?

What does the entry Debit 51 Credit 51 mean?

In which transactions is account 51 found?

Results

What is count 51 used for?

Account 51 “Current accounts” accumulates all non-cash cash flows of the company in rubles. The debit of account 51 characterizes the amount of funds entering the current account of a business entity. A loan, on the contrary, records the outflow of money from a company to pay for goods, work or services.

In accordance with the order of the Ministry of Finance of Russia “On approval of the chart of accounts for accounting financial and economic activities...” dated October 31, 2000 No. 94n (hereinafter referred to as the chart of accounts), account 51 can be paired with a large number of accounts, both debit and credit:

- 50 "Cashier";

- 60 “Settlements with suppliers and contractors”;

- 62 “Settlements with buyers and customers”;

- 66 “Calculations for short-term loans and borrowings”, etc. (according to the instructions for the chart of accounts).

In this case, correspondence with account 51 itself is allowed (posting Dt 51 Kt 51).

For more information about the chart of accounts, see the article.

What does the entry Debit 51 Credit 51 mean?

Posting Dt 51 Kt 51 is often used to reflect the movement of money from one company current account to another.

Let me explain. The company has 2 current accounts: one in bank 1, the second in bank 2. To detail the flow of funds in both accounts, the company can open sub-accounts to account 51:

- 51.01 - settlements on account in bank 1;

- 51.02 - settlements on bank account 2.

Then, when transferring funds from an account in bank 2 to an account in bank 1, instead of the not very clear posting Debit 51 Credit 51, you can make an entry: Dt 51.01 Kt 51.02.

We should not forget that the subaccounts that will be used by your organization should be indicated in the working chart of accounts approved in the accounting policy.

Important! Analytical accounting for 51 accounts can be built not only using subaccounts, but also subaccounts, which, in particular, are used in a number of accounting programs (for example, 1C).

In which transactions is account 51 found?

The most common uses of account 51 debit are found in the entries:

- Debit 51 Credit 62.

- Debit 51 Credit 66.

- Debit 51 Credit 91.

Let's look at a few examples.

Example 1

The buyer transferred payment for the goods to the supplier.

In the supplier's accounting, this will be reflected using the posting: Dt 51 Kt 62. In the buyer's accounting: Dt 60 Kt 51.

Example 2

The company received a payment to repay the previously borrowed funds.

In this case, you can write: Dt 51 Kt 66.

You will find detailed information about borrowed funds in the article “Borrowed funds are…”.

Example 3

Interest on the deposit was received in the LLC's current account: Dt 51 Kt 91.

For the credit of account 51, the following entries are often used:

- for salary transfer: Dt 70 Kt 51;

- for payment to suppliers: Dt 62 Kt 51;

- for payment of taxes: Dt 68 Kt 51;

Other postings are also possible, the use of which does not contradict the chart of accounts.

Results

Analysis of account 51 will allow us to determine bank balances on ruble accounts of a business entity. In posting Dt 51 Kt 51, it is better to use subaccounts to account 51 in order to see the balances for each current account of a company or entrepreneur.

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

Account 90 in accounting. Accounting for the sale of finished products, goods, services. Postings

To account for the sale of finished products, goods, services, account 90 “Sales” is used. Account 90 is complex, having several sub-accounts. In this article, we will look at how this account is structured and what postings to account 90 are made when selling products, goods and services.

The account structure is similar to it. 91 “Other income and expenses”, which we will discuss shortly.

Structure of account 90 “Sales”, subaccounts

Account 90 “Sales” consists of several subaccounts, the main subaccounts that are always used are:

- subaccount 1 - the credit of this subaccount reflects the proceeds from the sale.

- 2 - debit reflects the cost of finished products, goods, services, that is, what we sell.

- 3 - the debit reflects VAT accrued on products sold.

- 9 - this subaccount calculates the total financial result for the month, the debit reflects the profit for the month, and the credit reflects losses.

An accounting account is a table with two columns Debit and Credit, let's present account 90 in the form of a table:

On the topic of the article! The shortage of materials identified during the inventory transaction was written off

During the month, all sales made are reflected in the account. 90.

-lesson. Account 90 in accounting: postings, examples

The video lesson explains in detail account 90 accounting, typical entries and examples. The lesson is taught by a consultant, expert of the site “Accounting for Dummies”, chief accountant Gandeva N.V. ⇓

You can download the slides and presentation for the video using the link below.

Download the presentation “Account 90 in accounting: entries, examples” in PDF format

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

Postings to account 90 “Sales”

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

D62 K90/1 - revenue from the sale of products, goods, services is reflected.

D90/2 K41 (43, 45, 20) - reflects the cost of goods sold, products, services.

D90/3 K68 - VAT is charged on products sold.

At the end of the month, based on the account data. 90 is considered a financial result.

For this:

- The debit turnover for the month is calculated (the values of subaccounts 2 and 3 are summed up)

- The loan turnover for the month is calculated (subaccount 1).

- From the debit turnover we subtract the credit turnover:

a) if the result is a negative number, then this is a profit, we reflect it in the debit of subaccount 9 of account 90 in correspondence with the account. 99 “Profit and loss”, posting D90/9 K99,

b) if the result is a positive number, then these are losses reflected on the credit of subaccount 90/9 in correspondence with account 99, posting D99 K90/9.

At the end of the year in December, the account is completely closed in such a way that the balance for each subaccount becomes equal to 0. All subaccounts are closed to the 90/9 subaccount.

Subaccount 1: all entries are reflected only on credit, accordingly, the balance on this subaccount is always credit, to make it equal to 0, you need to calculate the loan balance and make an entry for this amount D90/1 K90/9. As a result, the ending balance on this subaccount becomes 0.

2: all entries are reflected only in debit, the balance is always debit. This means we count the turnover and debit balance and make the entry D90/9 K90/2 for this amount. As a result, the debit and credit balances are the same, and the ending balance is 0.

3: similar to subaccount 2.

9: as a result of the above transactions, the balance on this subaccount also becomes equal to 0.

Account 90 is closed, its balance is 0, from January of the new year we will re-open account 90 “Sales” and again begin accounting for the sale of products, services and goods.

In order for the principle of accounting for sales on the account. 90 has finally become clear, I propose to consider an example in numbers. Let's take 3 months as an example: October, November and December. Let's see what transactions we make on the account during the months. 90, and how the account will close. 90 at the end of the year in December.

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

Example of sales accounting on account 90

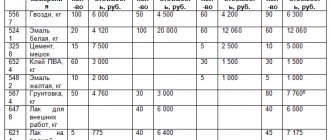

The organization sells its products, for example, lamps.

October:

Sales:

first batch: cost 80,000 rubles, revenue 100,000 rubles, VAT for ease of calculation, let’s assume 15,000 rubles. (in fact, in this case, VAT should have been calculated as revenue * 18 / 118 = 15,254 rubles, but we will round for simplicity; you can read more about this in the article “How to calculate VAT?”; you can also use an online VAT calculator for the calculation ).

second batch: cost 120,000 rubles, revenue 200,000 rubles, VAT 30,000 rubles.

Postings to account 90 in October:

| Sum | Debit | Credit | Operation name |

| 80000 | 90/2 | 43 | The first batch was sent for sale, the cost was written off |

| 100000 | 62 | 90/1 | Revenue from the sale of the first batch is reflected |

| 15000 | 90/3 | 68 | VAT charged on the first batch |

| 120000 | 90/2 | 43 | The cost of the second batch is written off |

| 200000 | 62 | 90/1 | Revenue from the sale of the second batch is reflected |

| 30000 | 90/3 | 68 | VAT charged on the second batch |

| 55000 | 90/9 | 99 | The financial result for this month is reflected |

Algorithm:

- Within a month, we record all sales and charge VAT.

- At the end of the month, we calculate the financial result. Financial result = debit turnover - credit turnover = (80,000 + 120,000) + (15,000 + 30,000) - (100,000 + 200,000) = - 55,000 rubles. made a profit. The profit received is reflected by posting D90/9 K99.

For clarity, let's imagine the count. 90 and counting 99 in the form of a table and reflect all sales transactions (the final balance is highlighted in red, current transactions are highlighted in black):

November:

We are opening a new account in November. 90, we transfer the final balance for each subaccount from October; in November it will be the opening balance.

Sales:

1st batch: cost 90,000, revenue 150,000, VAT 23,000.

2nd batch: cost 180,000, revenue 300,000, VAT 46,000.

Algorithm:

Account 90 and counting 99 at the end of the month will look like this (the beginning balance is marked in green, the ending balance in red, the current transactions in black):

December:

We transfer the ending balance for each subaccount from November, it will be the beginning balance for December.

Sales:

On the topic of the article! General production expenses posted and written off

1st batch: cost 75,000, revenue 100,000, VAT 15,000.

Algorithm:

- We carry out the necessary sales transactions and calculate VAT.

- Financial result for the month = 75,000 + 15,000 - 100,000 = - 10,000 - profit.

- We close account 90. Let me remind you that we close each subaccount to subaccount 9; in the figure, account closure is shown in blue. As a result of closing, the balance for all subaccounts is 0.

I hope that now the issue of accounting for the sale of finished products, goods, and services does not cause difficulties. In the next article we will continue the topic of accounting for financial results, consider accounting for other income and expenses on the account. 91.

Working with the score 90 is often linked to other scores, click on the link and read:

→ Account 99. Accounting for financial results “Profit and loss”. Basic postings + examples→ Account 68. Accounting for calculations of taxes and fees. Examples of transactions and postings

→ Account 62. Accounting for settlements with customers + postings