What is account 01

Account 01 01 in 2021 refers to assets reflecting fixed assets, their movement and cost. The account is considered non-current.

The concept of fixed assets

Account 01 identifies fixed assets as tangible assets owned by the organization. They are used in economic activities. Their cost is transferred to the cost of manufactured goods or products.

Fixed assets include:

- roads and all transport;

- tools, work equipment;

- breeding stock;

- power machines;

- production equipment;

- structures and buildings owned by the organization;

- all types of transmission networks, these include heating networks and electrical networks.

Included in the account are fixed assets that are capital investments in leased assets and leased land plots. They are non-current assets and take part in production activities not as a means, but as a direct object.

For an object to be recognized as a fixed asset, the following conditions must be met:

- It is used in the production activities of the enterprise.

- There are promising economic benefits.

- The object is not intended for resale.

If the cost of a fixed asset is less than 40,000 rubles, it can be immediately written off as an expense.

Results

Account 01 in accounting is used to accumulate data on the initial cost of property. Fixed assets are assets that meet 5 main requirements:

- the value of assets must be more than 40,000 rubles;

- service life - longer than 12 months;

- the asset is not intended for resale;

- the asset is used in production, commercial or management activities;

- The use of the asset allows the enterprise to obtain economic benefits.

The procedure for forming the initial value of enterprises entitled to a simplified form of accounting may differ from the procedure used by ordinary enterprises.

Fixed assets must be classified in accounting according to depreciation groups.

Starting from 2021, a new procedure for such classification is being introduced, therefore, by the end of 2016, all enterprises are required to switch to the classification established by Decree No. 640 dated July 7, 2016. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Account functions 01

Account zero one in accounting has a number of functions.

Formation of the cost of fixed assets

Initially, the price of the OS is taken into account as the initial price. Expenses for the acquisition of intangible assets include:

- amounts paid to the seller;

- delivery costs;

- expenses for advisory and information services;

- payment for services to intermediaries;

- customs duties when importing OS;

- expenses for contractors' services.

Customs duties as expenses on account 01

A number of costs remain unchanged. For example, amounts for general business expenses. Purchase costs are initially reflected on account 08. After they are fully formed, they are transferred to account 01.

Important! This is done only at the moment when the property is fully equipped and suitable for use. Therefore, if a company purchased a kettle, it should immediately be reflected in the balance of account 01, even if it was in the warehouse all this time.

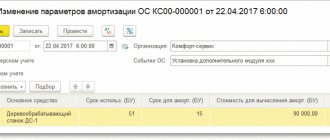

Depreciation of fixed assets

Depreciation of fixed assets in accounting means the transfer of their value to the cost of manufactured products. This is done gradually.

Depreciation process

There are categories of objects that are not subject to depreciation. These include:

- plots of land;

- livestock;

- environmental management facilities;

- external landscaping;

- road and forestry;

- residential properties that are not classified as non-industrial.

If the repair process took more than a year, and the objects were mothballed for a period of more than three months, then depreciation is no longer calculated.

On the balance sheet of the accounting department, residual funds are reflected at their residual value. This means that the first value minus the accumulated depreciation percentage is reported. Non-depreciated property must be accounted for on the balance sheet at its original cost.

According to the plan, depreciation begins the next day from the date of commissioning. The termination of accrual according to the approved standard occurs after the complete write-off of the cost.

From the moment the book value of a fixed asset becomes zero or receives a negative value, it ceases to be reflected in the balance sheet.

Other possible uses

Account 01 allows you to organize analytical accounting of funds. In this case, each object will be assigned an inventory number. If one object has several parts that have different service lives, in such a situation each part will be counted as separate.

Depreciation of fixed assets

All fixed assets accounted for on account 01 are divided into 3 groups in accounting:

- depreciable - those that are subject to depreciation;

- non-depreciable - not subject to depreciation;

- depreciated - depreciation is completed, the cost is transferred to expenses, but the OS continues to be used.

In turn, depreciable fixed assets are divided into certain groups according to their useful life.

The procedure for calculating depreciation of fixed assets in 2016 can be found in the material “Calculation of depreciation of fixed assets in 2016.”

What subaccounts are there in account 01

Sub-accounts are opened for account 01:

- 01-1 - this includes all means of primary activity, with the exception of livestock, perennial plantings, plots of land and environmental management facilities. This subaccount takes into account the availability and movement of funds from the main type of activity, which is established by the constituent documents.

- 01-2 - Other production operating systems. This takes into account the movement of funds from other productions and industries that are not related to the main activities of the organization.

- 01-3 - non-production OS. This subaccount records the movement and safety of funds aimed at servicing the social activities of the enterprise, housing and communal services, and consumer services for citizens.

- 01-4 is a subaccount that takes into account working and productive livestock.

- 01-5 - this includes all perennial plantings, including forest strips. Plantings accepted for use are recorded by type and year of planting. The object in this case will be the landing area. Maintenance costs are included in the cost of production obtained from these plantings. Depreciation is not charged for young plantings that have not been put into operation.

- 01-6 - subaccount takes into account the movement of plots of land, water and forest lands, minerals that are transferred to the enterprise for operation. Depreciation is not charged on these items.

- 01-7 - non-inventory objects - this will include movements of capital investments aimed at using land, water and forest resources.

- 01-8 - all household supplies, tools and equipment whose useful life is more than a year.

- 01-9 - these are objects received on lease, rent or credit. Account 001 is also used when a leasing agreement is concluded, but only if the fixed assets will be registered with the organization. Accounting is maintained for each object separately. Adjustments to the value of the leased property will be reflected through account 01k.

- 01-10 - this subaccount takes into account other objects not previously specified.

- 01-11 - the account reflects the disposal of fixed assets.

For analytical accounting, account card 01 is used. It is distributed by location, groups and individual objects.

Leasing concept

Analytical accounting should provide all the necessary data on the availability and movement of funds in Russia and abroad. If fixed assets contain precious metals, then their mass must be indicated on the cards.

GLAVBUKH-INFO

Account 01 “Fixed Assets” is intended to summarize information on the availability and movement of the organization’s fixed assets that are in operation, in reserve, on conservation, in lease, in trust management.Fixed assets are accepted for accounting under account 01 “Fixed assets” at their original cost.

An object of fixed assets owned by two or more organizations is reflected by each organization in account 01 “Fixed Assets” in the corresponding share.

Acceptance of fixed assets for accounting, as well as changes in their initial value during completion, additional equipment, reconstruction are reflected in the debit of account 01 “Fixed assets” in correspondence with account 08 “Investment in non-current assets”.

Changes in the initial value during the revaluation of component objects are reflected in account 01 “Fixed assets” in correspondence with account 83 “Additional capital”.

To account for the disposal of fixed assets (sale, write-off, partial liquidation, transfer free of charge, etc.), a subaccount “Retirement of fixed assets” can be opened to account 01 “Fixed Assets”. The cost of the disposed object is transferred to the debit of this subaccount, and the amount of accumulated depreciation is transferred to the credit. Upon completion of the disposal procedure, the residual value of the object is written off from account 01 “Fixed assets” to account 91 “Other income and expenses”.

Analytical accounting for account 01 “Fixed Assets” is carried out for individual inventory items of fixed assets. At the same time, the construction of analytical accounting should provide the ability to obtain data on the availability and movement of fixed assets necessary for the preparation of financial statements (by type, location, etc.).

| Debit | Credit | ||

| An object accounted for as part of fixed assets was acquired: | |||

| 1. fixed assets have been received (the purchase price is reflected without VAT) | invoice, contract | 08.4 | 60 |

| 2.VAT on received fixed assets | invoice | 19.1 | 60 |

| 3. costs directly related to the acquisition of fixed assets (excluding VAT) | agreement, account, deed | 08.4 | 60 |

| 4. VAT on costs | invoice | 19.1 | 60 |

| 5. the object is put into operation | act OS-1 | 01 | 08.4 |

| 6. VAT is written off for settlements with the budget | invoice | 68.2 | 19.1 |

| Purchased fixed assets requiring installation | |||

| fixed assets arrived | invoice | 07 | 60 |

| VAT on received fixed assets | invoice | 19.1 | 60 |

| fixed assets transferred for installation | act OS-15 | 08.4 | 07 |

| wages accrued to workers for installation | payslip | 08.4 | 70 |

| payroll taxes accrued | calculation | 08.4 | 69 |

| fixed assets put into operation | act OS-1 | 01 | 08.4 |

| VAT is written off for settlements with the budget | calculation | 68.2 | 19.1 |

| Fixed assets received as a contribution to the authorized capital: | |||

| fixed assets have been received (the cost is reflected in the valuation under the contract) | will establish contract, acceptance certificate | 08.4 | 75.1 |

| put into operation | act OS-1 | 01 | 08.4 |

| Fixed assets received free of charge: | |||

| fixed assets arrived | Act of Handover | 08.4 | 98.2 |

| put into operation | act OS-1 | 01 | 08.4 |

| the cost is written off as depreciation is calculated | calculation | 98.2 | 91.1 |

| Fixed assets implemented: | |||

| amount due from the buyer (incl. VAT) | contract, invoice | 62 | 91.1 |

| VAT charged | invoice | 91.VAT | 68. VAT |

| the original cost is written off | accounting card OS-6 | 01.Select | 01 |

| depreciation is written off | accounting card OS-6 | 02 | 01.Select |

| the residual value is written off | act OS-3 | 91.2 | 01.Select |

| Liquidation of fixed assets: | |||

| the original cost is written off | accounting card OS-6 | 01.Select | 01 |

| depreciation is written off | accounting card OS-6 | 02 | 01.Select |

| the residual value is written off | act OS-3 | 91.2 | 01.Select |

| Transfer of capital as a contribution to the authorized capital at the price of the agreement: | |||

| valuation of transferred fixed assets under the contract | will establish agreement, act | 58.1 | 91.1 |

| the original cost is written off | accounting card OS-6 | 01.Select | 01 |

| depreciation is written off | accounting card OS-6 | 02 | 01.Select |

| the residual value is written off | act OS-3 | 91.2 | 01.Select |

| A shortage or damage to fixed assets has been identified: | |||

| the original cost is written off | accounting card OS-6 | 01.Select | 01 |

| depreciation is written off | accounting card OS-6 | 02 | 01.Select |

| residual value is recognized as loss | act OS-3 | 94 | 01.Select |

| VAT on missing items: | |||

| if the shortage is identified before VAT is reimbursed from the budget | calculation | 94 | 19.1 |

| if the shortage is identified after VAT refund from the budget | calculation | 94 | 68.VAT |

| subject to recovery from the guilty persons | order | 73.2 | 94 |

| written off in the absence of culprits | order | 91.2 | 94 |

| Revaluation of fixed assets: | |||

| revaluation: | |||

| the amount of the revaluation (minus the amount of the previously made depreciation, if any) | revaluation materials | 01 | 83 |

| repayment of previously made markdown (if any) | revaluation materials | 01 | 84 |

| depreciation adjustment | revaluation materials | 83,84 | 02 |

| transfer of the revaluation amount upon disposal of the object | act OS-3 | 83 | 84 |

| transfer of the depreciation adjustment amount upon disposal of the asset | act OS-3 | 84 | 83 |

| markdown: | |||

| the amount of the markdown (minus the amount of the previous revaluation, if any) | revaluation materials | 84 | 01 |

| repayment of previously made revaluation (if any) | revaluation materials | 83 | 01 |

| depreciation adjustment | revaluation materials | 02 | 83,84 |

Account 01 “Fixed assets” corresponds with the accounts:

| 03 Profitable investments in material assets | 02 Depreciation of fixed assets |

| 08 Investments in non-current assets | 11 Animals for growing and fattening |

| 76 Settlements with various debtors and creditors | 76 Settlements with various debtors and creditors |

| 79 On-farm settlements | 79 On-farm settlements |

| 80 Authorized capital | 80 Authorized capital |

| 83 Additional capital | 83 Additional capital |

| 91 Other income and expenses | |

| 94 Shortages and losses from damage to valuables | |

| 99 Profit and loss |

Source: Correspondence of accounts E. Kholodenko, A. Rostovtsev

| < Previous |

Interaction with other accounts in accounting

01 accounting account is allocated according to the plan for accounting for fixed assets. There they must be used at their original cost. The budget account is active. This will mean that all receipts are recorded as a debit, and the decrease, the new value of the value, is taken into account as a credit.

Postings

In the debit budget, account 1 interacts with the credit of the following accounts:

- 03 - reflection of the return of fixed assets from income (for example, this may be a return from a creditor);

- 08 - receipt of funds, then increase in their price due to reconstruction, re-equipment;

- 76 - crediting fixed assets from other debtors (cases when no modification is required);

- 79 — on-farm calculations;

- 83 - price increase based on revaluation.

The loan interaction is carried out with the following accounts:

- 02 - reflection of the disposal of funds;

- 11 — transfer of animals to the main herd;

- 99 — write-off as a result of an emergency;

- 83 - price decrease as a result of revaluation, decrease in profit.

Brief conclusions

- To account for the property of other organizations, temporary rights and obligations, off-balance sheet accounts are used.

- Their data is not included in the preparation of the balance sheet.

- There are 11 off-balance sheet accounts in the standard accounting plan.

- The double entry rule is not followed for them; entries are reflected either as a debit or as a credit.

The full course “Accounting from scratch” can be purchased at this link »»».

Until April 30, 2021 there is a 25% discount.

Postings

The receipt of fixed assets to the account of the enterprise, the arrival of the object on the balance sheet could be carried out in different ways. This can be either a purchase, a gift agreement, or a contribution to the authorized capital.

Carrying out an inventory

As soon as an enterprise purchases a fixed asset, all the costs it incurred for the acquisition and preparation for operation are entered into account 08. Subsequently, the entire amount is transferred to account 01. This is where accounting is carried out. These postings control the receipt of all fixed assets in accounting.

An enterprise may become the owner of an object in connection with capital construction. In this case, the initial price will include payment for the work of contractors and all costs for materials and construction.

Fixed assets: concept and nuances

Generalized information about fixed assets (FPE) of an enterprise is collected on account 01 of any commercial organization that has such funds. PBU 06/01 gives several signs by which a tangible asset can be classified as fixed assets:

- The useful life of such an asset must exceed 12 months from the date of commissioning.

- The enterprise uses this asset to obtain economic benefits.

- An asset classified as a fixed asset must be used by the enterprise in production or management or for rental.

- The object is not intended for subsequent resale.

- The asset must have a value of more than RUB 40,000.

At the same time, the limit on the value of assets is 40,000 rubles. is not required for accounting purposes. If all the above 4 parameters are met, then the asset can be classified as fixed assets, even if its cost is less than 40,000 rubles. The main condition is that the parameters for classifying an asset as fixed assets must be clearly specified in the accounting policy. It is necessary that the first 4 criteria are met, according to which an asset is classified as fixed assets.

Assets with a value of less than 40,000 rubles can be reflected as part of inventories, if for some reason it is more convenient for the enterprise to account for them in this way (clause 5 of PBU 06/01). Then the write-off of such assets classified as inventories is carried out as part of the expenses of the period.

IMPORTANT! Clause 5 of PBU 06/01 only allows for the possibility of classifying assets worth up to 40,000 rubles. to the composition of reserves, without making this condition mandatory. For accounting purposes, an enterprise has the right to independently resolve this issue within the framework of its accounting policies.

Accounting for fixed assets on account 01 is carried out divided into groups, depending on the period of use. Inside, each group is divided into subgroups in accordance with the types of operating systems (buildings, equipment, mechanisms, vehicles, etc.). From January 1, 2021, changes are being introduced to the classification of fixed assets (Resolution of the Government of the Russian Federation dated July 7, 2016 No. 640 “On introducing amendments to Resolution of the Government of the Russian Federation dated January 1, 2002 No. 1”, hereinafter referred to as Resolution No. 640).

For information on the fixed assets classifier in 2021, see the material “Classifier of fixed assets by depreciation groups - 2016.”

Modernization

The main feature of the modernization procedure is that in the process of its implementation, the original characteristics of the objects are adjusted. As a result, the period of use and cost change. In order to properly record expenses, it is recommended to open a sub-account on account 08. All expenses that were necessary for the modernization will be collected here. The procedure is carried out in several types.

Sale

Revenue after the sale must be indicated in the reporting documents in the amount specified in the contract. This also includes all losses that went towards depreciation. All transactions must be reflected in account 91.

Liquidation

The procedure for liquidating an object is carried out if its use for the enterprise has become economically unprofitable. The fixed asset is subject to write-off. In the future, they have the right to disassemble it in order to use the resulting materials for other purposes.

Revaluation

The revaluation operation is not mandatory for the organization. But there are cases when this necessity is determined by local acts. In such a situation, the revaluation procedure will need to be carried out on the last day of the year. There are two types of revaluation possible. This can be a markdown or revaluation.

Unaccounted assets based on inventory results

All business entities are required to regularly conduct an inventory of the property on their balance sheet. This is necessary to ensure authenticity. If the inspection reveals objects that are not registered, they must be included in it in the same month. The cost will be indicated based on the current market price for similar properties.

OS shortage based on inventory results

Based on the results of the inventory, a shortage may occur. In such a situation, the company employee is responsible for the damage. If it is not determined, then it is written off as a loss. The amount is determined based on the actual residual value.

Account 01 in accounting plays an important role for the correct accounting of objects on the balance sheet of an organization, enterprise, and related to the main ones. Interaction between accounts helps to correctly track changes in their value during operation.

What documents are required to fill out the report?

Primary documents for accounting for fixed assets form postings to account 01. If received, the basis for the entry is: the act of acceptance and transfer of fixed assets (form OS-1). The cost of the object (excluding VAT) is reflected in debit. Other changes are made when:

- Revaluation of property;

- Modernization, completion, reconstruction of facilities.

In this case, the active part of the balance increases based on the norm of clause 14 of PBU 6/01. A decrease in the value of property is reflected on the loan in the following cases:

- Disposal of property;

- Reducing prices or liquidating objects.

To reflect changes, a unified form is used: act of write-off of an asset (form OS-4). A form is issued if the object has become unusable, damaged or outdated.

A detailed video review of accounting for fixed assets in 1C turnover can be viewed here:

Typical accounting entries

| Operation | Debit | Credit |

| The asset is accepted for accounting | 01 | 08 |

| The property of the head office was returned from the territorial division | 01 | 79 |

| The initial revaluation of fixed assets is reflected in accounting | 01 | 83 |

| The initial, replacement cost of the retiring fixed asset is written off from accounting | 01-11 | 01 |

| Depreciation of disposed assets is written off | 02 | 01-11 |

| The asset was transferred to a separate division, on a separate balance sheet | 79 | 01 |

| The depreciation of the object is reflected | 83 | 01 |

| The residual value of the sold asset is written off | 91 | 01-11 |

| Facts of shortages, damage, theft of company assets identified during inventory are reflected | 94 | 01-11 |

IMPORTANT!

Accounts for accounting for fixed assets taken or transferred for temporary use under lease agreements are not reflected in accounting account 01.

Which account is used to record fixed assets leased? Take such assets into account on the balance sheet, in special account 001 “Leased fixed assets”.

Leased fixed assets, which account to use in accounting? The property that the company has transferred for temporary use to third parties should be reflected in off-balance sheet account 011 “Assets for rent.”

However, in this case there are exceptions. For information on how to correctly reflect property transferred or received for temporary use, read the separate article “An example of a leasing entry on the lessee’s balance sheet.”