Legislative aspects of property tax

The analyzed tax falls within the purview of Chapter 30 of the Tax Code of the Russian Federation. Property assets are included in the tax base according to the conditions declared in Art. 374 Tax Code of the Russian Federation. Clause 4 of this article provides a list of objects for which this tax is not required to be paid. Art. 381 of the Tax Code of the Russian Federation considers certain types of activities that do not involve the collection of this tax from the entrepreneur.

In general, Russian organizations, as well as foreign ones with a representative office in the Russian Federation, are required to pay tax on property on their balance sheet, movable, capitalized before 2013, and/or immovable. Some categories of organizations are beneficiaries.

This tax is regional, which means that the constituent entities of the Russian Federation can independently reduce the tax rate of 2.2% established by the Government.

REFERENCE! If an entrepreneur wants to find out the tax rate of his region, he can refer to the official website of the Federal Tax Service, which contains background information on various rates and benefits, including property tax.

How can an individual calculate property tax on a destroyed property?

Since the publication of Federal Law No. 63-FZ, the issue of calculating tax in relation to objects that have ceased to exist, including as a result of demolition or destruction, has been settled (Article 408 of the Tax Code of the Russian Federation was supplemented with clause 2.1).

In such cases, tax calculation stops on the 1st day of the month of death or destruction of the taxable object on the basis of an application submitted by the taxpayer to the tax authority of his choice. With this application, the taxpayer has the right to submit documents confirming the fact of the loss or destruction of the object. If such documents are not available to the tax authority, it, based on the information specified in the taxpayer’s application, requests information confirming the fact of destruction or destruction of the object from persons who have this information.

The body or other person that received the tax authority’s request fulfills the request within seven days from the date of its receipt or, within the same period, reports the reasons for non-fulfillment of the request. The tax authority, within three days from the date of receipt of the specified message, is obliged to inform the taxpayer about the failure to receive information upon request and about the need to submit supporting documents.

The application form for the death or destruction of a taxable object and the procedure for its submission must be approved by the Federal Tax Service. Until this form is approved, you can use the recommended one, provided for by Letter of the Federal Tax Service of Russia dated November 14, 2018 No. BS-4-21/22148 (see Letter of the Federal Tax Service of Russia dated April 17, 2019 No. BS-4-21 / [email protected] ), or send an application in any form indicating the month of death or destruction of the taxable object (clause 8 of article 3 of Federal Law No. 63-FZ)

Who will make and submit payments?

According to the legislation of the Russian Federation, payers of property tax are those organizations in respect of which three conditions are met:

- ownership, temporarily, by power of attorney or part-time ownership of real estate and/or movable property included in the balance sheet before 2013, not included in depreciation groups 1 and 2;

- accounting of these property assets is carried out in accounts 01 “Fixed assets” or 03 “income investments in tangible assets”;

- all these assets are provided for by the corresponding article of the Tax Code (Article 374) and are not included in the list of exceptions.

ATTENTION! The specific person in the organization responsible for the calculation and timely payment of property tax is the founder of the trust management (Article 378 of the Tax Code of the Russian Federation).

The tax base

The tax base is the average annual price of things that are accounted for by the company as fixed assets.

It is the responsibility of companies to calculate the basis using the average property price for the year. For some real estate objects it is necessary to use the cadastral price (their list contains Article 378.2 of the Tax Code of the Russian Federation). Accounting is carried out separately.

Previously, until January 1, 2014, the base was calculated only at the average annual cost.

It should be noted that the law provides for a rule in relation to individual assets for which the base is calculated separately:

- if the objects of taxation belong to separate divisions of the company;

- if the assets are not located in the area where the company is registered;

- if tax rates for different types of assets are different;

- when the property is located on the territory of various constituent entities of the Russian Federation;

- if the tax is paid at the value determined in the cadastre.

Who doesn't have to worry about property taxes?

Some business entities are legally exempt from the obligation to pay property tax. These include the following groups of businessmen.

- Organizations whose balance sheet accounts do not have fixed assets that can be recognized as objects of property tax.

- The organization's property is associated with oil production in offshore fields.

- Property of individual entrepreneurs and individuals.

Rules for calculating property tax

The tax base is the book value of the property subject to tax accounting. The average annual value of the residual value is taken into account, which must first be calculated according to the procedure established in the regulatory acts of the organization.

To find out the residual value, you need to subtract the depreciation amount from the original balance sheet estimate.

ST.rest. = ST.first – Ananum.

Where:

- ST.rest. – total residual value of property assets subject to taxation;

- ST.first – initial book value of assets;

- Ananum. – accrued depreciation.

And to calculate the average annual cost, you need to know the balance on the 1st day of the month, as well as the final cost at the end of the year. For this, the following principle applies:

ST.WED-year. = (ST.start.1 + ST.start.2 + … + ST.start.12 + ST.fin.) / 13

Where:

- ST.beginning 1-12 – residual value of property on the 1st day of each month;

- ST.fin. – residual value as of the 31st day of the last month of the year.

Then the tax base must be multiplied by the tax rate adopted in the region and by 100%.

Submission of advance payment calculations

Filing quarterly declarations on advance payments of property tax is the responsibility of all its payers (Article 386 of the Tax Code of the Russian Federation). In this case, it does not matter what the value of the declared property is, it may even be zero - you still need to submit calculations (letter of the Federal Tax Service of the Russian Federation dated February 8, 2010 No. 3-3-05/128).

If a taxable object is accounted for not at its residual value, but at its cadastral value, calculations of advance tax payments for it are made on a general basis.

Calculations must be submitted to the tax authority at the place of registration, and if the object is recorded at the cadastral value, then to the tax authority at the location of such objects.

Correct calculations

The Federal Tax Service of the Russian Federation has developed a special form for submitting calculations of quarterly payments for property tax (approved by Order of the Federal Tax Service dated November 24, 2011 No. ММВ-7-11/895). According to this order, this can also be done electronically, and for organizations with a large number of personnel this requirement is mandatory.

NOTE! If the organization has more than 100 personnel for the reporting year, it is impossible to submit calculations in paper form, such documents will not be considered submitted, and the organization will be fined (clause 3 of Article 80 of the Tax Code of the Russian Federation).

Filling out the form requires entering the following data.

The title page should include:

- company details;

- correction code (is it a primary or updated document);

- reporting period code and year;

- Tax office code (look on the Federal Tax Service website);

- full name of the company;

- OKVED code;

- contact number;

- number of pages in calculation;

- number of application sheets (if any);

- the date of recieving;

- signature of the responsible person.

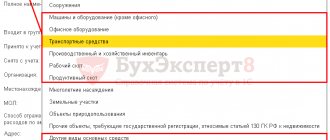

Section 1 – justification of the amount contributed to the budget as an advance payment for property tax. Section 2 – calculation of property tax on objects reflected at book value (separately for each category of assets). Section 3 – calculation of property tax on objects reflected at cadastral value.

How to transfer advances

The terms and procedure for paying property tax and advances on it are established by the constituent entities of Russia by their laws (clause 1 of Article 383 of the Tax Code of the Russian Federation). For example, in Moscow and the Moscow region, advance payments must be transferred no later than 30 calendar days from the end of the corresponding reporting period. The total tax amount must be paid to the budget no later than March 30 of the year following the reporting year. Such deadlines are established in Article 3 of the Moscow Law of November 5, 2003 No. 64 and Article 2 of the Moscow Region Law of November 21, 2003 No. 150/2003-OZ.

Transfer advance payments to the budget at the location of the company (clause 2 of Article 383 of the Tax Code of the Russian Federation). That is, according to the details of the Federal Tax Service where the company is registered.

If there are geographically remote real estate objects on the balance sheet, transfer the tax (advance payment) to the budgets of those regions where these objects are registered (Article 385 of the Tax Code of the Russian Federation). At the same time, keep in mind that the location of sea and river vessels (except for small ones) is the place of their state registration, and aircraft - the location of the owner (subclause 1, clause 5, article 83 of the Tax Code of the Russian Federation).

Separately, let’s talk about the procedure for paying property tax if the organization has separate divisions. If the “isolation” has a separate balance sheet and fixed assets are listed on its balance sheet, then pay tax advances to the budget of the region where the division is located (Article 384 of the Tax Code of the Russian Federation). In this case, the advance payment for real estate, which is listed on the balance sheet of the division, but is located in another region, must be paid at the actual location of the property (Article 385 of the Tax Code of the Russian Federation).

If the unit does not have a separate balance sheet, then transfer the advance payment for the property assigned to it to the budget of the region where the head office of the organization is located (clause 3 of Article 383 of the Tax Code of the Russian Federation).

One more thing. Property tax relief can be taken into account when calculating advance payments. This follows from paragraphs 4.2 and 5.3 of the Procedure for filling out property tax calculations, approved by order of the Federal Tax Service of Russia dated November 24, 2011 No. ММВ-7-11 / [email protected] The amount of the advance payment that needs to be transferred to the budget is determined as the amount of the advance payment calculated based on the results of the reporting period, minus benefits (line 030 of section 1 = line 180 of section 2 – line 200 of section 2).

Don't miss deadlines

The reporting period for this tax is a quarter.

- For objects with a reflected book value, time goes “increasingly” - for 1 quarter, for half a year, for 9 months.

- For property with cadastral value, calculations are made quarterly.

Calculations and advance payments must be submitted no later than 30 days of the first month of the next quarter. If it coincides with a holiday or weekend, you are allowed to submit the invoice on the next working day.

Late deadlines are fraught with a fine: 200 rubles. for each report not submitted on time, and if the deadlines required by the tax authorities are violated, the organization may be fined 300-500 rubles.

IMPORTANT! Calculation of an advance payment is not a tax return, therefore responsibility for late filing occurs not under Article 119 of the Tax Code of the Russian Federation, but under clause 1 of Art. 126 of the Tax Code of the Russian Federation and Part 1 of Art. 15.6 Code of Administrative Offenses of the Russian Federation. The property tax return is submitted only at the end of the year.

At the end of the accounting year, you need to calculate the annual payment and subtract from it the amount already paid as advance payments. This is the number that will appear on your annual tax return.

Example of calculating advance payments

On the balance sheet of Metal-Service LLC there is equipment, the residual value of which as of January 1, 2021 is equal to 90,000 rubles. Every month the equipment is depreciated by 3,000 rubles. The tax rate is the maximum. Let's calculate the advance payment for the 1st quarter.

At the end of January 2021, the residual value of the equipment will be 90,000 - 3,000 = 87,000 rubles, at the end of February 2021 - 87,000 - 3000 = 84,000 rubles, and at the beginning of March - 84,000 - 3000 = 81,000 rubles. Let's find the average quarterly value of the asset, which will be the tax base: (90,000 + 87,000 + 84,000 + 81,000) / 4 = 85,500 rubles.

We multiply the resulting tax base by the rate of 2.2 and find the percentage: 85,500 x 2.2/100 = 1881 rubles. This amount will be an advance payment for the equipment of Metal-Service LLC for the 1st quarter.

How to calculate advances from cadastral value

When calculating the tax based on the cadastral value, determine advance payments for property tax for the reporting period using the formula:

AVpl = (Kst × StN): 4,

Where

– AVpl – advance payment of property tax for the reporting period; – Kst – cadastral value of property as of January 1 of the tax period (reporting year); – StN – tax rate.

This is provided for in paragraph 7 of Article 382 and subparagraph 1 of paragraph 12 of Article 378.2 of the Tax Code of the Russian Federation.