How to fill out a balance sheet using a balance sheet (SAS)

Before we begin to consider such issues, it should be noted that the balance sheet allows you to make a forecast of the development of the enterprise for the short and long term. In other words, using the balance sheet, the financial viability of the company and its economic status, the stability of the organization and the level of its interaction with other companies are determined.

An asset can include all the property of an enterprise that can be converted into monetary terms. The group of such assets includes: equipment, vehicles, buildings that are owned by the company.

The company's assets also include amounts owed to it by other legal entities. All indicated indicators are displayed in the balance sheet in monetary terms.

In other words, an asset is all the property and property that an enterprise has at its disposal.

The liability is used to display the sources of funds that are indicated in the Asset of the balance sheet. This section also has its own structure and includes the following blocks: the authorized and equity capital of the company, loans and credits, external liabilities. The three main sections are called:

- funds belonging to the company;

- the amount of long-term liabilities;

- wages and accounts payable to suppliers.

The balance sheet is formed by the responsible person while filling out individual lines of the form. When filling out, it is necessary to take into account the specifics of the company’s activities, as well as correctly distribute the indicators.

Both report tables include lines that indicate indicators characterizing the financial position of the company and each has a separate serial number with the name of the position.

Drawing up a balance sheet is quite simple if you have an idea of the rules for its formation, as well as take into account the features and nuances of the distribution of assets and liabilities of the company.

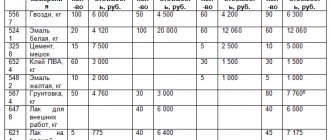

1. Quantitative-total analytical accounts. When using these accounts, accounting, in addition to the monetary equivalent, maintains quantitative records, for example, indicating the number of inventory items posted to the warehouse.

2. Analytical accounts. In total analytical accounts, accounting is used exclusively in monetary terms.

Let us note that quantitative accounting, as well as analytical accounting carried out in parallel with it, must be organized in such a way that the indicators for them coincide in the final value and allow for mutual control.

The principle of generating a turnover sheet for analytical accounts is the same as when generating a summary document for one or more synthetic type accounts.

The balances and turnover of accounts for the selected reporting period are entered into the turnover sheet.

Depending on the tasks set, accounting can create a statement in the context of an analytical or synthetic account.

The initial data for filling out the turnover sheets is taken from the accounting accounts for which some movement of assets or liabilities was recorded in the reporting period.

As a result, the created document consists of three pairs of columns, which contain all the necessary information, namely:

- The opening and closing balance for each selected account.

- Turnover for the reported reporting period.

Each column contains two columns called debit and credit.

Thus, the generated turnover sheet contains the final balances of credit or debit (balance), turnover of credit and debit, as well as the name of the account.

At the same time, with proper accounting, the equality of the total amounts in the columns of each pair is ensured.

The procedure and timing for the generation of statements are regulated by the established document flow of the organization and legislative acts.

The most common period used to compile analytical reports is a calendar month.

Turnover sheets for analytical accounting can take different forms.

These, for example, include reports from storekeepers - financially responsible persons, commodity reports, etc.

Analytical accounting chart of accounts

The modern chart of accounts is a multi-level hierarchy, which is built on linking accounts and sub-accounts.

Depending on the specifics of the enterprise’s activities, the chart of accounts developed for accounting may include a certain number of levels, as well as the required number of sub-accounts opened for each account. We suggest you familiarize yourself with where a Belarusian can go without a visa

In modern accounting programs, the number of subaccounts and nesting levels available for creation is not limited.

Purpose and advantages of analytical accounts

An analytical account is used to provide a detailed breakdown of business assets and other assets that are used in an enterprise. Analytical accounts are opened exclusively as a supplement to synthetic accounts. Modern accountants maintain analytical accounting in the context of registers of the second, third, fourth and fifth order.

Working with analytical accounts has certain advantages:

- Significantly simplifies accounting.

- Allows you to implement a well-structured hierarchy of accounts depending on their purpose, goals and characteristics.

- Allows you to create an effective accounting system.

Functions of analytical accounts

Analytical accounts are used to detail information.

Depending on the specialization of the enterprise, accounting can be kept in the context of labor and monetary measures, physical indicators, individual transactions, obligations or types of property.

An example of a synthetic account that maintains a large number of analytical accounts is account 10 “Inventory” and 41 “Goods”.

Another common example is account 60 “Settlements with suppliers and contractors”.

Consider account 41 “Goods”.

According to the Chart of Accounts, it is divided into the following subaccounts:

- 41.01—goods in the organization’s warehouses;

- 41.02 - goods in retail trade;

- 41.03 - containers under the goods and empty;

- 41.04 - purchased products.

Further, within each sub-account, detailing of analytical accounts occurs, for example:

- 41.04 “Purchased items” - accounting subaccount;

- Cotton fabric, chintz, flannel - analytical account.

Thus, the analytical account in this case will be the characteristics and designation of the type of property.

Further, its characteristics can be deepened by other parameters, for example, by color or by the width of the canvas.

Analytical accounts system

The analytical accounting system involves detailed accounting of the movement of assets (capitalization and disposal of assets) in monetary terms and in kind.

At the same time, the maximum possible amount of information is entered into the program so that it is possible to analyze the business activities of the company and monitor the correctness of analytical accounting.

The analytical account, despite its detailing function, allows you to group and summarize data that is reflected in synthetic accounts.

Note that opening an analytical account is possible and advisable only for a complex synthetic accounting account.

Monitoring the correctness of synthetic and analytical accounting

The fundamental accounting register for monitoring the correct display of entries in accounting accounts is the revolving balance sheet.

This document represents a grouping of data on accounting accounts, including sub-accounts, indicating their names, total balances at the beginning of the period, turnover for the period (according to the assets and liabilities of the accounts), the total amount as of a given date.

In this case, the turnover balance sheet can be compiled for any time period: both per day and per month, quarter, full and partial year.

To form a balance sheet, data from the turnover sheet for the reporting period is taken.

Note that the turnover balance sheet must satisfy the main principle - equality.

That is, the final balances of the debit and credit of the accounting account must be equal to each other.

Facts indicating the relationship between analytical accounting and synthetic accounting:

- The basis for records in both types of accounting is the same document.

- Analytics is an additional detailed characteristic to synthetic accounting.

- The total amount of turnover for analytical accounts is equal to the total turnover for a synthetic account that combines detailed analytics.

Maintaining accounting records using double entry in accounting accounts according to the working chart of accounts approved by the organization is the responsibility of the enterprise.

At the same time, the turnover and results of synthetic accounting are reflected in the General Ledger.

And the book is the main document for preparing financial statements, including the balance sheet.

https://www..com/watch?v=3JK6Ufa-ouY

Analytical accounting is reflected in a variety of accounting registers: cards on the movement of property, accumulative statements and other reporting documentation.

Source: https://mydigitalart.ru/sinteticheskim-schetam-zapolnit-balans/

Blog

The balance sheet is the main reporting form that must be submitted to all organizations by March 31.

When generating it in the 1C Accounting program, the accountant does not have any difficulties, because the report is generated automatically. The program also allows you to test yourself using the “Decipher” button.

Experts at our center recommend not filling out reports automatically, but checking yourself using the SALT (turnover balance sheet).

The financial year has ended, you have processed all the documents, made all the adjustments and corrections to the documents, and closed the period.

What should you pay special attention to?

1 block - goods and materials (inventory). Line 1210 “Inventories”.

Check accounts 10 (materials), 41 (goods) and 43 (finished goods). When generating SALT for these accounts, it is necessary to check the absence of negative balances in the final balance and the absence of amounts without quantity.

Related course

Advanced accountant

Find out more

It is IMPORTANT to generate “turnovers” according to these quantitative accounts.

These errors arise due to the difference in the time of processing documents for the receipt of goods and materials and its write-off. If you discover this fact, retransmit the documents, change the time for writing off documents and monitor the correctness of filling out the warehouses in the documents.

Block 2 – Cash. Line 1250.

This line takes into account the balances of all funds of the organization: cash, non-cash, funds for special purposes. accounts and on the go.

Create a cash book and check that there are no negative turnovers. Those. It often happens that funds according to a bank statement are withdrawn to the cash register, but the PKO (receipt cash order) is not issued and the entry for the receipt of money in the cash register is not generated.

Print and compare the SALT statement for 51 accounts for each of the organization’s existing accounts.

If you keep records in the context of “Cash Flow Items”, then you need to check the correctness of filling them out in the SALT for accounts 50 “Cash” and 51 “organizational current account”.

Block 3 – Tangible non-current assets. Line 1150.

Here fixed assets are taken into account at their residual value. Those. in SALT you need to calculate the difference between accounts 01 and 02 and check the indicator.

IMPORTANT. Depreciation is calculated automatically when the “Month Closing” is carried out.

Block 4 – Financial and other current assets. Line 1230.

This indicator collects data on accounts receivable and deferred expenses.

Check the SALT for accounts 60, 62,73, 76. The data must first of all be reliable. It is necessary to request reconciliation reports for each “Debtor” to confirm the correctness of data entry.

Request acts of reconciliation with regulatory authorities: Federal Tax Service, Pension Fund. Check overpayments of taxes and penalties.

Block 5 – Capital and reserves. Line 1370.

This indicator collects data on accounts 80 and 84 (in the case of small and micro businesses, since they practically do not use reserves).

The size of the authorized capital is specified in the organization’s Charter, and profit is formed on account 84 after the balance sheet reformation.

Block 6 – Long-term and short-term borrowed funds. Lines 1410 and 1510.

Check SALT for accounts 66 and 67. If you paid interest on loans and borrowings during the year, track their accrual. In SALT there should not be a balance on accounts 66.02, 66.04, 67.02 and 67.04.

Block 7 – Accounts payable. Line 1520.

We check accounts 60, 62, 76. Request reconciliation reports with suppliers, check that the data is entered correctly.

It is also necessary to check the balance of accounts 70, 68 and 69. To do this, use a reconciliation with the Federal Tax Service and payroll statements.

If you have doubts or questions about filling out reporting forms, the experts of our training center can advise you both in person and remotely.

Make an appointment by phone: +7(391) 287-7-287 or [email protected]

ps The “Advanced Accountant” course in our training center is conducted specifically for accountants who want to improve their skills. Details here:

/ “Accounting encyclopedia “Profirosta” 03/19/2019

Information on the page is searched for by the following queries: Accountant courses in Krasnoyarsk, Accounting courses in Krasnoyarsk, Accountant courses for beginners, 1C: Accounting courses, Distance learning, Accountant training, Training courses Salaries and personnel, Advanced training for accountants, Accounting for beginners Accounting services, VAT declaration, Profit declaration, Accounting, Tax reporting, Accounting services Krasnoyarsk, Internal audit, OSN reporting, Statistics reporting, Pension Fund reporting, Accounting services, Outsourcing, UTII reporting, Bookkeeping, Accounting support, Provision of accounting services services, Help for an accountant, Reporting via the Internet, Drawing up declarations, Need an accountant, Accounting policies, Registration of individual entrepreneurs and LLCs, Individual entrepreneur taxes, 3-NDFL, Organization of accounting, how to check

Drawing up a balance sheet based on the balance sheet

In the balance sheet, the accounting accounts ascending order. The accountant enters data at the end of each month from journals, in which daily business activities are conducted, expressed in monetary terms. The table is filled out, displaying the balances at the beginning and end of the reporting period, indicating the total turnover that has passed during this time.

As a result, a financial document is generated for any period necessary for analysis. It can be in the form of a monthly, quarterly, annual time period, providing a working picture of the enterprise, the turnover of funds to management, and any interested party.

Why do you need a completed document?

Every organization requires reporting, which is maintained by officials responsible for this type of activity. The report contains information showing balances, cash flows in each account and between them during the reporting period. Filling of the OSV occurs after:

- depreciation charges;

- write-off of production costs;

- tax assessments;

- formation of a financial report.

With the help of this document, items are formed in the balance sheet . He controls the correctness of the transactions made and systematizes the information expressed by them.

Based on the “turnover”, facts are visible that influenced the changes that occurred in qualitative and quantitative form in the balance sheet registers.

According to the data from the SALT, the digital values of various areas of activity are compared, from which it is clear what influenced the financial result of this institution.

An example that determines why a negotiable accounting instrument is needed can be presented in

the following diagram :

- The enterprise is working.

- Accounting records business transactions in primary documents.

- In special journals, transactions are carried out on transactions using ledger accounts.

- Each register accumulates the same type of information.

Using a table:

- analyze the company's activities;

- monitor results;

- identify and eliminate errors caused by postings.

For the head of any organization, it is necessary not only to be able to competently fill out the form, a leading economist will do this, but also to know how to read and decipher each thesis presented.

Formation procedure

Purchasing a form to keep track of the movement of funds is not a problem.

They are freely available:

- on financial sites;

- in stores selling office supplies.

You can easily create such a table yourself using Excel spreadsheets. Software systems allow you to use SALT for general accounts and with each account separately, which simplifies the accounting task. Although specialists almost never use manual labor to fill out financial papers, it is better for novice entrepreneurs to start with a fountain pen.

By filling out the statement manually, you will gain a deep understanding of the essence of the operation being carried out , for which double entry is carried out. Financiers use different registers, the choice depends on the area to be analyzed and the way the data is presented.

An example is synthetic accounts . To account for them, take the initial balance with turnover, and as a result, calculate the balance at the end of the billing period.

The total amount in a correctly prepared statement consists of three parts :

- equality between income and expense, where the debit balance reflects the value of the organization at the initial stage and the receipt of assets in the credit register;

- the equivalence of debit and credit turnover is achieved by double entry, in which money entered in debit to one of the accounts is credited to the other;

- the last column consists of the equality obtained as a result of calculations, this is the price of the asset, the amount at the end of the period.

The calculator clearly monitors pairs of numerical values. If a difference is detected in at least one case, it means the register is formed incorrectly or a simple arithmetic error has occurred. Based on the synthetic accounts included in the “turnover”, the balance sheet is processed, in which the names of the sections are often the same as the accounts.

Analytical accounts in SALT are formed depending on their purpose and the characteristics of specific parameters:

This part of the reporting is not equal in terms of turnover, because cash movements occur in the same register. The balance at the beginning of the month and at the end can be in the debit or credit column, which depends on the passivity or activity of the account. For example, you can give a salary account of 70.

The types of accounts include chess OSV from synthetic accounts . “Chess” receives data from operational logs in compliance with the final equations.

This type of financial table can be described with the following description:

- Debit accounts go vertically, credit values are written in the horizontal line;

- the completed lines and columns are equal to the accounts used with the opening balance and cash flows in the reporting period;

- the accountant posts accounts according to their opening balances;

- an angular calculation is performed from the summation of income and expense;

- values for all business transactions are transferred, the amount is indicated at the intersection of interacting accounts;

- circulating numbers are also calculated with their output in the corner of the table;

- The end of the ending balance calculation is the angular total.

In what form is the balance sheet compiled?

The balance sheet is formed according to a certain form ; it belongs to the official report. If the preparation of a financial certificate is carried out for internal use, different types of accounting are used, it depends on the purpose, the data taken as the basis for the calculations.

- Saldov - with data collected in a certain time period;

- negotiable - with completed operations for a limited period;

- presented according to information from conducted inventories ;

- calculated taking into account regulatory items (depreciation, reserves, markups) or without them;

- designed according to one professional profile, production site ;

- abbreviated or full;

- made for one enterprise or representing the financial picture of several organizations .

A report is prepared upon the request of some event in the form:

- introductory;

- liquidation;

- separating;

- unifying.

The balance of financial information can be:

The list goes on; economists of each enterprise are allowed to use any convenient reporting form, as long as the organizational financial issue is resolved reliably, and the approach to filling out is preserved with the fundamental rules.

Rules and technique of compilation

The balance sheet shows the balance of funds for a certain time . The accounting accounts display the work of the enterprise in monetary terms; values are set from the new results obtained, which are transferred to the table.

https://www.youtube.com/watch?v=wkdOEdv2Ips

The formation of a simplified balance sheet using a balance sheet occurs according to the following activities :

- processing of account data is carried out in order to carry out incoming and outgoing transactions to display final balances;

- a graphological system is compiled, in which the turnover of each account is recorded line by line under debit and credit;

- calculate all the figures for income and expenses, which are equated as a result;

- the total represents an inventory of all account balances;

- check the correctness of the final values, add active current accounts to the initial balance upon receipt, subtract all the values that are posted on the loan;

- for passive accounts, take the credit balance, add its current assets and subtract the values for the debit turnover;

- the resulting figure must be identical to the posting from the accounts.

The overall result consists of the final values :

All amounts are recorded under the balance sheet . Its working form represents the result obtained from the total of debit balances, which is equal to the credit balance, they are withdrawn from all financial accounts.

The full balance sheet form consists of the entire list of items recommended for allocation in a specific section. Financiers of organizations are allowed to remove from the reporting those designations that are not involved in the activities of the institution, or, conversely, add information for complete reliability.

What do the main abbreviations mean?

In accounting, abbreviations are often used that are understandable to specialists and unclear to beginners. Typically, the decoding represents the name from the first letters and indicates the working area, the name of the current funds or the economic activity of the unit. Such an abbreviation can be represented as:

- expenses for transport and procurement of materials - TZR ;

- assets belonging to fixed assets - OS ;

- intangible assets - intangible ;

- production at an unfinished stage - work ;

- expenses for future periods - RBP ;

- inventory items - goods and materials .

Filling example

It should be noted that turnover does not have clear regulatory requirements for its operation. But since this document is financial, it must be filled out within certain limits indicating the following details :

- name of the report form;

- data of the company that is responsible for the turnover of funds;

- period of information submission;

- responsible officials for reporting and those who performed the calculations.

Any activity starts from scratch, just like the work of an accountant. It is necessary to understand the obvious that it is impossible to learn balance in any form without understanding the meaning of the operations. Every beginner will become a specialist, for this you need to love your job, take postings seriously, then there will be no mistakes in postings, and the balance will definitely come together.

An example of a balance sheet is presented below.

August 30, 2015 7576 Comments (0)

In this article I was going to show how to make a balance sheet from SALT. However, having figured out how I would do this, I realized that I would start using accounting rules and terms. And I’m not sure that you and I will have the same understanding of them. So, I came up with this.

I am not interested in writing a purely theoretical article. I want to engage you so that together we can go from “reviewing SALT” to filling out the balance sheet.

Source: https://lawsexp.com/juridicheskie-sovety/sostavlenie-buhgalterskogo-balansa-po-oborotno.html

Reverse balance sheet

In this article I was going to show how to make a balance sheet from SALT. However, having figured out how I would do this, I realized that I would start using accounting rules and terms. And I’m not sure that you and I will have the same understanding of them. So, I came up with this.

I am not interested in writing a purely theoretical article. I want to engage you so that together we can go from “reviewing SALT” to filling out the balance sheet.

For this I have my own approach: when giving new knowledge, I strive to ensure that there is a repetition of the previous ones. In other words, we repeat the knowledge that serves us as a support for new ones.

https://www.youtube.com/watch?v=FUAp8FeeAu4

I would like to note that in this series of articles about filling out a balance sheet, I will talk about general ideas, basic rules, and show how it is done. Together with me, you will go all the way to creating a balance sheet based on the OCB of a real enterprise.

So, let's go...

Here is the OCB of a working enterprise. In the previous article, we prepared her for creating a balance sheet.

Please note that I added two empty columns to the OCB: “Name” and “AP”. Why did I do this? I answer - For independent work, for warming up and remembering past knowledge.

Here's what we should do now:

- download the balance sheet and open it

- In the “name” column, write the name of the account. No need to look at the chart of accounts. There is no need to achieve some exact match between the name of the account and what it is called in the chart of accounts. Just remember and write. It is enough that your name reflects the essence of the account. For example. I will call the 50th account “Cashier”. And in the chart of accounts it can be called “Enterprise Cash Office”.

- in the “AP” column for each account, indicate what it is, “A – active account”, “P – passive account” or “AP – active-passive account”. Hint: Active accounts are those that store information about what the company has and this is “what” helps the company operate and earn money. Usually “it” can be touched. Active accounts always have a debit balance or zero. Liability accounts are the debts/obligations of our company. This is simply information about the amounts owed. Passive accounts always have a credit balance or zero.

Of course, putting down “A, P and AP” is not an easy task. This requires knowledge and some reflection. I agree that there are invoices where you can issue them right away, and somewhere you can use a hint and enter the required characteristics. In any case, put it where you can do it. And fill in the remaining empty cells according to the chart of accounts. .

Once you solve the problem, compare it with what I did.

Some General Rules and Observations

I assume, reader, that you remember that accounting accounts collect and store information about the activities of a business. All information is separated according to certain criteria. So, the code and name of the accounting account serves as a separation criterion. As a result, OSV shows all the accounting accounts involved in our enterprise. From the OSV we see what information has been collected.

However, the balance sheet collects business information in a different way.

First, the balance sheet divides information into ASSETS and LIABILITIES.

Secondly, within ASSET and LIABILITY, information is divided into certain groups. Each such group is an economic indicator.

Ultimately, SALT is simply regrouped on the balance sheet.

- All debit balances, and these are accounts with characteristic A, go to the “ASSET balance” section

- All credit balances, and these are accounts with characteristic P, go to the “LIABILITY” section of the balance sheet.

- Accounts with the AP characteristic are transferred to the balance sheet as follows: if there is a debit balance, it goes to an ASSET, if there is a credit balance, it goes to a LIABILITY.

The amount received in ASSET or LIABILITY is entered into the specific name of the economic indicator. The basis for including the amount in the economic indicator will be the name of the accounting account, or, when it is not clear, we will use the law on filling out the balance sheet. Well, we will start filling out the balance very soon.

Fixed assets and intangible assets when filling out the balance sheet

Fixed assets are inextricably linked with such a concept as depreciation (accounted for in account 02). Depreciation is a gradual decrease in the initial cost of an asset associated with the operation of the asset. The depreciation process for fixed assets occurs over a certain period of time, but more than a year. As a result, everything will come to the point that the amount of depreciation will be equal to the original cost of the operating system.

Look at the SALT. Account 01 records the amounts of all fixed assets at their original costs. Account 02 takes into account the depreciation amounts of these fixed assets. Now you are asking yourself, what does this have to do with the balance sheet?

It would seem that according to the rules for posting amounts from SALT to the balance sheet, we must send the amounts from the 01st account to the ASSET, and send the amounts from the 02nd account to the LIABILITY of the balance sheet. However, there is an exception for Fixed Assets.

Its essence is that before sending the amount to the balance sheet, we take the amounts from 01, subtract the amounts from 02 and send the resulting amount to where????

IN THE ASSET balance. Because depreciation can never be more than the original cost of the asset, and therefore the difference between 01-02 will always be a debit. 01 account (A) > 02 account (P). Well, in extreme cases, it will be 0.

Exactly the same situation with accounts 04 and 05. This takes into account the assets of an enterprise that do not have a physical object, like a machine or a machine.

Account 04 takes into account such enterprise assets as licenses, the exclusive right to a patent, the exclusive right to software, etc.

Their shelf life is also more than 12 months and they are not intended for resale. Everything is the same as with the OS. Depreciation of Intangible Assets (IMA) is accounted for on account 05.

PS

I can't get this article out of my head. There is some feeling of incompleteness, or something. The goal is clear - to lead you, the reader, to filling out the balance. Make sure you are as prepared as possible for this action. And, although I have to try to make the explanation understandable, there is still something missing in this article.

I understand that there will still be questions, but I want to keep them to a minimum. I think that I will answer some of these questions in advance. Before we start filling out the balance sheet form, I suggest working with SALT a little more.

This is what we need to do.

- we continue to work with the first column of SALT - “opening balance”

- write down the invoices that you believe collect information about our company's debts. You can immediately start writing out those bills that you know are in SALT. You can go the opposite way - cross out those accounts that are responsible for the company’s property, for what you can touch. The remaining bills are what you need.

- Issued invoices have amounts in “Debit” or “Credit”, or even both. Write out the invoice, each amount, and write what kind of debt it is - “Should our

- Remember what is called “Our Debt” in accounting. In parentheses for these names, write accounting terms for each amount. For tips, read this article.

An asset less than a liability means that the company would not have enough money to pay its own current liabilities. This amount will be reflected in the balance sheet liability with a minus. The excess of an asset over a liability means that if the enterprise were liquidated at that moment, there would be profit left that would need to be transferred to the owner. Therefore, this amount will be reflected in the liability side of the balance sheet.

Balance Sheet Items BB items represent a breakdown of asset and liability indicators. The detailing option approved by the Ministry of Finance of the Russian Federation in 2015 is recommended, but not mandatory for use.

An enterprise has the right to develop its own clarifying breakdown if it believes that it will allow it to more accurately reflect information about its activities.

How to fill out a balance sheet using a balance sheet

Attention: Place a dash in line 1430 “Estimated liabilities”. The indicator in line 1510 “Borrowed funds” is equal to the credit balance in account 66 “Settlements on short-term loans and borrowings.” Calculate the indicator for line 1520 “Accounts payable” as follows.

Add up the credit balance: - all subaccounts to account 60; — all subaccounts to account 62; — all subaccounts to account 76; — all subaccounts to account 68; — all subaccounts to account 69; — accounts 70; — accounts 71; — accounts 73; - subaccount 75-2 “Calculations for the payment of income” to account 75. The indicator of line 1540 “Estimated liabilities” is equal to the credit balance of account 96 “Reserves for future expenses”. As a rule, the balance of the reserve for vacation pay is reflected here.

After you have filled out the balance sheet, check whether the balance sheet's total assets and liabilities are equal (line 1600 should be equal to line 1700).

Note that the indicator for this line is taken without taking into account the amounts of revaluation, which should be reflected in the line above. Reserve capital. The balance of the reserve fund is indicated on line 1360.

This reflects both reserves formed as required by law and reserves created in accordance with the constituent documents.

Decoding is required only if the indicators are significant. Retained earnings (uncovered loss). Retained earnings accumulated for all years, including the reporting year, are shown in line 1370.

It also reflects the uncovered loss (only this amount is included in brackets).

The components of the indicator (profit (loss) for the reporting year and (or) for previous periods) can be written down in additional lines, that is, a breakdown can be made based on the financial results obtained (profit/loss), as well as for all years of the company’s activity. Section IV.

How to fill out a balance sheet using a turnover balance sheet

Based on the results of the balance sheet, the total amount of assets should be equal to the total amount of liabilities; if this equality does not exist, then an error has crept into the balance sheet and you will have to look for it. How to fill out the balance sheet form No. 1? This report is prepared on the basis of the balance sheet. Sample of filling out a balance sheet form 1 The form consists of a “header” and two tables: assets and liabilities.

Let's fill in each part of the balance sheet sequentially. Fill out the “header”: At the top we indicate on what date the balance sheet is drawn up. We will give an example of the organization Confectioner LLC, which reports for the calendar year 2012. Accordingly, the balance sheet date is December 31, 2012.

Next, we write the name of the organization, its individual code OKPO, INN, type of activity OKVED, approved by the classifier of statistical authorities.

Source: https://zullus.ru/oborotno-saldovyj-balans/

Results

The balance sheet is the most important report in which the data of all accounting registers is grouped and summarized. The report can be considered as the last step in the preparation of financial statements. In addition, we can say that SALT is an independent type of reporting that is capable of fully conveying the information reflected in the financial statements. Despite the ease of forming OCB with modern accounting programs, an accountant should not forget the basics of its construction and the verification procedure.

See also materials on SALT:

- “Turnover balance sheet - sample filling 2020”;

- “How to read the balance sheet correctly?”;

- “How to draw up a balance sheet (example)?”;

- “Features of the balance sheet for account 60”;

- “Features of the balance sheet for account 62”;

- “Features of the balance sheet for account 70”, etc.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

How to make a balance sheet from SALT

In this article I was going to show how to make a balance sheet from SALT. However, having figured out how I would do this, I realized that I would start using accounting rules and terms. And I’m not sure that you and I will have the same understanding of them. So, I came up with this.

I am not interested in writing a purely theoretical article. I want to engage you so that together we can go from “reviewing SALT” to filling out the balance sheet.

For this I have my own approach: when giving new knowledge, I strive to ensure that there is a repetition of the previous ones. In other words, we repeat the knowledge that serves us as a support for new ones.

I would like to note that in this series of articles about filling out a balance sheet, I will talk about general ideas, basic rules, and show how it is done. Together with me, you will go all the way to creating a balance sheet based on the OCB of a real enterprise.

So, let's go...

Here is the OCB of a working enterprise. In the previous article, we prepared her for creating a balance sheet .

Please note that I added two empty columns to the OCB: “Name” and “AP”. Why did I do this? I answer - For independent work, for warming up and remembering past knowledge.

Here's what we should do now:

- download the balance sheet and open it

- In the “name” column, write the name of the account. No need to look at the chart of accounts. There is no need to achieve some exact match between the name of the account and what it is called in the chart of accounts. Just remember and write. It is enough that your name reflects the essence of the account. For example . I will call the 50th account “Cashier”. And in the chart of accounts it can be called “Enterprise Cash Office”.

- in the “AP” column for each account, indicate what it is, “A – active account”, “P – passive account” or “AP – active-passive account”. Hint : Active accounts are those that store information about what the company has and this is “what” helps the company operate and earn money. Usually “it” can be touched. Active accounts always have a debit balance or zero. Liability accounts are the debts/obligations of our company. This is simply information about the amounts owed. Passive accounts always have a credit balance or zero.

Of course, putting down “A, P and AP” is not an easy task. This requires knowledge and some reflection. I agree that there are invoices where you can issue them right away, and somewhere you can use a hint and enter the required characteristics. In any case, put it where you can do it. And fill in the remaining empty cells according to the chart of accounts. Download the chart of accounts.

Once you solve the problem, compare it with what I did.

If you are subscribed to blog updates by email, enter the access code from the last mailing letter. To receive an access code, subscribe to blog news.

CONCLUSION

To finish this article, I propose to do a practical task. We'll work a little with the numbers from the OS. The task is:

- divide your sheet in a notebook or notepad into two columns: “Asset” and “Passive”

- from SALT we will work with the column “Balance at the beginning of the period”

- according to all the rules studied in this article - write out the accounting accounts and amounts, what can be classified as “Asset” and what can be classified as “Liability”

- In each column, calculate the total of all amounts

- compare the total amount of “Asset” and the total amount of “Liability”

To complete the task, you already have previously downloaded OSV. If you haven't downloaded it yet, download it here.

If you are subscribed to blog updates by email, enter the access code from the last mailing letter. To receive an access code, subscribe to blog news.

Perhaps now we are ready to fill out the balance sheet. We will do this in the next article. I invite you.