Absolutely all enterprises, of any form of ownership, use account 51 “Current Account”.

It is necessary to display the status of the organization’s accounts that are opened in banks. The number of current accounts can be any; the number of banking institutions for storing funds of legal entities is also not limited.

After reading this article, you will learn what a balance sheet for account 51 is - what it is needed for and when it is used.

- 1 Characteristics

- 2 Postings of 51 accounts in accounting 2.1 For a loan

- 2.2 Analysis of 51 accounts

Key points

The journal-order system of maintaining accounting provides for confirmation of all business transactions with the appropriate document - a primary documentation form. The primary is registered in a special journal. Entries are made in chronological order.

All transactions are grouped into accounting accounts. That is, when reflecting correspondence with one accounting account, a separate journal order is used; when creating an entry for another account, the entry is reflected in another accounting journal. Note that the same entry can and should be reflected in two journals at once: in one for the debited account, and in the other for the credited account. This method reflects the double entry method of accounting.

The final data at the end of the reporting period is transferred to the key register - the general ledger. Let us remind you that a balance sheet is formed based on the general ledger data at the end of the financial year. Consequently, the reliability of financial statements depends on the completeness and correctness of recording information in the journal.

Let's look at each magazine in more detail, and provide sample forms and samples to fill out.

IMPORTANT!

The forms below are examples! In accordance with the provisions of the Law “On Accounting” No. 402-FZ, each economic entity has the right to independently develop and approve its own forms of primary and accounting documentation. The company is not required to keep all logs if there are no transactions to complete them. Justify the company's position on this issue in its accounting policies. approve your own forms by a separate order or annex to the company’s accounting policies.

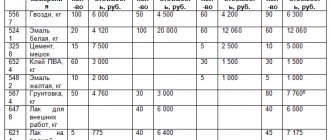

Bill of quantities for project documentation

A bill of quantities is a list of work that needs to be performed during the construction of a facility.

During major, current repairs, a defective list is drawn up, which describes the shortcomings and malfunctions that need to be eliminated, repaired, or replaced.

The bill of quantities is usually prepared by designers, estimators, foremen, foremen, or those responsible for the execution of work.

In the modern world, when there are many programs, the bill of quantities can be derived from the estimate program by pressing a couple of buttons. The name of the work will already be specified there in accordance with the collections for construction, installation, repair and commissioning work. Basically, such statements are compiled by Customers and organizers of tenders and auctions. The approximate cost has already been determined in the local estimate; on its basis, a list of quantities of work and materials that need to be taken into account is displayed.

At the moment, there is no approved form for the statement of quantities and it is recommended to take a sample from GOST 21.111-84.

Sample bill of quantities:

Bill of quantities example:

Magazine-order No. 1 “Cash desk”

To generate the organization’s cash turnover, a special journal order 1 is used (in Word and a sample filling can be found below). In other words, all operations in which account 50 “Cash” is involved should be reflected in order No. 1.

The basis for making entries is the cashier's report. The document is generated on the basis of issued PKO and RKO for the day (or several days). Credit turnover by account. 50 in the journal are disclosed in more detail than debit (receipts to the cash register). To detail cash receipts, order journal 1 and statement 1 are used. That is, statement 1 is a breakdown of profitable transactions with the company’s cash.

Form No. 1

Example of filling out order No. 1

Postings of 51 accounts in accounting

The receipt of money is represented by postings to account 51.

By loan

57 - receipt of money in transit to the current account;

58, 66, 67 - crediting funds after processing a loan or returning borrowed money;

86 — crediting of target financing money;

91 — transfer of funds from proceeds;

50 - cash from the cash register was transferred to a bank account;

55.03 - transfer of interest on the deposit, receipt of the deposit;

60, 76, 62 - crediting money from suppliers, buyers, and other debtors.

Characteristics of account 51 involve spending money on a credit in a message with a debit:

50 — withdrawal of money to replenish the cash register in cash;

55.03 - crediting money to the deposit;

99 - to cover expenses in the event of an emergency;

60.03 - shows the procedure for paying a bill;

62, 76 - transfer of money to counterparties;

66 - transfer of loan funds (repayment) and interest on it;

70 — transfer of wages to staff;

75 - transfer of money to the founders.

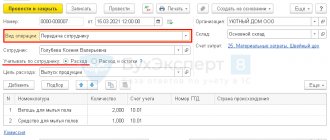

Analysis of 51 accounts

Analytical accounting of account 51 is carried out with a breakdown of turnover and balance. This is done for any of the accounts opened in them.

Most often, the analysis of 51 accounts in accounting programs is carried out using:

— balance sheet;

- account cards.

With their help, you can constantly monitor the movement of funds, as well as carry out the functions of quickly managing funds. Analysis of 51 accounts is an example of the correct creation of a balance at the end of any period. The procedure for calculating the balance involves adding the opening balance and debit turnover, and then subtracting the entire volume of loan movements for the entire period of time under consideration.

The reverse balance sheet for account 51 is the balance of the synthetic account, which is displayed at the end of the month. It provides for the presence of an opening and closing balance, as well as final amounts of debit and credit turnover.

REFERENCE! The balance sheet of account 51 can be compiled by subaccounts.

When conducting a final analysis of 51 accounts, certain conditions must be met:

— account balances and turnover in the organization’s accounting records must match the information in bank statements;

— the equality of the amounts of debit and credit transactions is ensured by the double entry rule; correct entries in 51 and other accounts are the basis for filling out the balance.

— SALT for 51 accounts must guarantee clear information by entering data on the account number, balances at the beginning and end of the required period, showing all turnover.

SALT 51 accounts must be compiled every day in order to confirm the reflected data in 51 accounting accounts. In order to carry out quick reconciliations with several banks, you need to create OCB 51 accounts for each structure separately.

In order to reflect all types of transactions with the organization's current accounts, an order journal is maintained for 51 accounts.

Magazines come in different forms:

No. 2 - for industrial institutions;

No. 2-с - for construction companies;

No. 2-SN - for companies that specialize in sales and supply.

REFERENCE! The journal is necessary for the chronological recording of credit turnover in communication with other accounts.

Statement of account 51, the form of which can be found and downloaded on the Internet, contains final data on banking and correspondent accounts. accounts at the beginning and end of the month. It shows each correspondence of 51 accounts in debit with credit of the remaining accounts, taking into account the sequence of events.

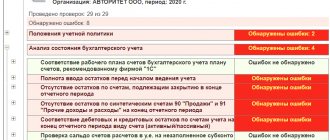

Magazine No. 2 “Current account”

To conduct business transactions on company current accounts opened in credit and banking institutions, use order journal 2 (and an example of filling can be found below). Entries should be made only on the basis of bank statements. They confirm the fact of movement of the company's monetary assets. The journal details debits from r/accounts. A special statement is kept to disclose information about receipts.

Journal warrant 2, form

Filling example

Found documents on the topic “statement 2 form”

- form for payment Accounting and financial documents → Invoice form for payment

The document “ form for payment” in excel format can be obtained from the link “download file” - Form travel order (sample)

Employment agreement, contract → Business trip order form (sample)travel order form form no. about business trip (full name) to travel 1. ...

- Sample. Certificate of write-off of damaged forms work records

Accounting statements, accounting → Sample. Act on writing off damaged work record formsm.p. I approve to the head of the enterprise (signature, surname and initials) an act for writing off damaged forms of work books of the year "" 20 by us (the positions, initials and surnames of the members of the commission for writing off the forms are listed ...

- Sample. Payment statement. Form No. 253

Accounting statements, accounting → Sample. Payment statement. Form No. 253standard form no. 253 organization page shop - to calculation. statement no. department payroll no . for issuance for 20 years - time sheet - last name, first name, patronymic amount of receipt...

- Form simple registered share

Securities and shares, issue → Form of simple registered shareform of a simple registered share +-+ a k c i i joint stock company "" Moscow May 5, 1991 (date of issue...

- Form preferred registered share

Securities and shares, issue → Form of preferred registered shareform of preferred registered share +-+ preferred share joint stock company "" Moscow May 5, 199...

- Form order

Enterprise records → Order formform 00.00.00 no. 00 title (brief content, what is it about) text of the stating part of the order. are revealed...

- Form simple registered share

Securities and shares, issue → Form of simple registered share... walkie-talkie January 22, 1992 annex to the regulations on the commission for the privatization of land and reorganization of a collective farm (state farm) form of a simple registered share share joint stock company "" Moscow May 5, 1991 (date of issue of shares) ten thousand rubles...

- Statement calculation and payment of salaries

Documents of the enterprise's office work → Statement of accrual and payment of wagesstatement of calculation and payment of wages No. organization (division): No. ...

- Sample. Statement № 11

Accounting statements, accounting → Sample. Statement No. 11statement no. 11 movement of material assets (at accounting prices) for 20 to workshops, farms (in production) (unnecessary...

- Sample. Statement № 1

Accounting statements, accounting → Sample. Statement No. 1statement no. 1 on the debit of account no. 50 “cash” from the credit of accounts +-+ balance at the beginning of the month rub. +- cash register date line 46...

- Calculated statement. Form N T-51

Enterprise records management documents → Payroll. Form N T-51... from to payslip ...

- Sample. Statement № 2

Accounting statements, accounting → Sample. Statement No. 2statement no. 2 on the debit of account no. 51 “current account” from credit accounts +-+ balance at the beginning of the month rub. +- string date of issue...

- Sample. Statement № 2.1

Accounting statements, accounting → Sample. Statement No. 2.1statement no. 2/1 on the debit of account no. 52 “currency account” on account credit +-+ balance at the beginning of the month rub. +- string date you...

- Statement inventory results

Accounting statements, accounting → Statement of inventory resultsstatement of inventory results appendix to the letter of the USSR Ministry of Finance dated December 30, 1982 no. 179 led...

Magazine No. 3 “Special Accounts”

If the company's funds are stored in special accounts opened with banks or other credit institutions, then transactions on such accounts are reflected in journal No. 3. Records are formed according to the account. 54, 55, 56 accounting. In other words, if an enterprise uses letters of credit, check books or stores money in other special accounts in its activities, then record the movement through these storage locations in form No. 3.

Example of filling out form No. 3

Journal order No. 4 “Borrowed capital” and No. 5 “Mutual offsets”

If a company receives loans or borrowed funds to conduct business, then settlements on the loans received are carried out in a special journal No. 4. The turnover in the account is entered into the register. 66 and 67, that is, for short-term and long-term loans and debt obligations.

Journal warrant 4, form

Filling example

Settlements by means of mutual offset of services rendered, works or goods supplied between economic entities are recorded in journal order 5 “Mutual Offsets”. Offsetting transactions between Russian companies are now carried out quite rarely. But offset of counterclaims is not prohibited.

Journal order, form

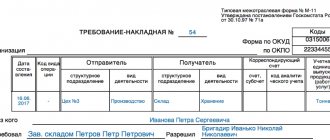

Journal-order No. 6 “Settlements with suppliers”

To register documents reflecting settlement transactions with current contractors, suppliers and other business partners, use order journal 6. Make entries based on received invoices, delivery notes and signed certificates for work and services performed. Enter expense transactions based on bank statements confirmed by completed payment orders. It is unacceptable to combine records even for one contractor (supplier). Each document is reflected separately.

Form No. 6

Magazine No. 10 “Main production”

All expenses that are aimed at ensuring the main activity are reflected in journal No. 10. Group business operations according to accounting accounts: fixed assets, depreciation, wages of key personnel, tax deductions, inventories and other expenses.

Journal-order 10,

Journal order 10, sample filling

Related documents

- Sample. Statement No. 2.1

- Sample. Statement No. 5

- Sample. Statement No. 7 on analytical accounting

- Sample. Sheet for monitoring the inclusion of the cost of shipped products in financial statements (Form No. 2) and in tax calculations

- Sample. Statement for replenishment (withdrawal) of a permanent stock of tools (devices). Form No. MB-1

- Sample. Statement of accrual and payment of wages

- Sample. Statement of receipt of funds at the cash desk of a branch of a foreign legal entity. Form No. 2-vpp (instruction of the State Tax Service of the Russian Federation dated June 16, 1995 No. 34 (as amended on December 29, 1995 No. vz-6-06-672))

- Sample. List of requirements for materials and calculation of the cost of materials for the object and sections of the estimate (form No. 4-mat)

- Sample. List of requirements for construction machines and calculation of the costs of operating these machines for the facility as a whole and sections of the estimate. Form No. 4-fur

- Sample. Statement of expenditure of funds from the cash desk of a branch of a foreign legal entity. Form No. 4-vpp (instruction of the State Tax Service of the Russian Federation dated June 16, 1995 No. 34 (as amended on December 29, 1995 No. vz-6-06-672))

- Sample. Statement of results identified by inventory (order of the Ministry of Finance of the Russian Federation dated June 13, 1995 No. 49)

- Sample. Record sheet for the issuance (return) of workwear, safety footwear and safety equipment. Form No. MB-7

- Sample. Payroll records for branch employees in the Russian Federation. Form No. 3-pp (instruction of the State Tax Service of the Russian Federation dated June 16, 1995 No. 34 (as amended on December 29, 1995 No. vz-6-06-672))

- Sample. Statement of accounting for intangible assets and depreciation (No. 17)

- Sample. A list of remaining materials in the warehouse. Form No. m-14

- Sample. Statement of accounting of expenses of a branch of a foreign legal entity. Form No. 2-vop (simplified) (instruction of the State Tax Service of the Russian Federation dated June 16, 1995 No. 34 (as amended on December 29, 1995 No. vz-6-06-672))

- Sample. Product sales accounting sheet for shipment (No. 16/1)

- Sample. Statement of financing of a branch of a foreign legal entity. Form No. 1-vop (simplified) (instruction of the State Tax Service of the Russian Federation dated June 16, 1995 No. 34 (as amended on December 29, 1995 No. vz-6-06-672))

- Sample. Statement-inventory of obligations and orders (obligations) issued by buyers for goods sold on credit. Specialized form No. 9-tkr

- Sample. Loose sheet 2 to statement No. 7

Magazine No. 11 “Finished products, sales”

Record the products produced in journal No. 11. If the company provides services or work, then record the results of its activities in journal order 11. Information can be grouped by product range, type of product or category of service. The company has the right to independently develop a form, taking into account the specifics and type of activity.

Journal warrant 11, form

Sample filling

Leave a comment on the document

Do you think the document is incorrect? Leave a comment and we will correct the shortcomings. Without a comment, the rating will not be taken into account!

Thank you, your rating has been taken into account. The quality of documents will increase from your activity.

| Here you can leave a comment on the document “Sample. Statement No. 2", as well as ask questions associated with it. If you would like to leave a comment with a rating , then you need to rate the document at the top of the page Reply for |

Magazine No. 13 “Property and capital”

Reflect the movement of fixed assets and intangible assets in the company in special order No. 13. Enter information based on primary documents. For example, OS cards, invoices for internal movement, intangible asset registration cards and other primary documentation. It also reflects depreciation operations on the company’s property assets. The register also records information about changes in the authorized capital.

Form No. 13

Journal order 13, sample filling

Application area

As part of a complete package of design documents, the statement is a list of products used in the project that are purchased from a third-party manufacturer. The completeness is determined by the design team taking into account the necessary requirements for the final product. The scope of the developer’s activities also includes design. Correct filling in accordance with GOST standards significantly facilitates the work of enterprises. The information is intended for the procurement department, accounting department, and finance department. It is mandatory to include permits for the use of purchased products in the statement. A list of examinations and tests is attached.

The list of purchased products is one of the main documents for simplified interaction with the procurement department, where drawings are not required.

It contains links to additional information about the products, details and contact information of manufacturers supplying the necessary types of electrical equipment and materials, mechanisms, and individual parts. A good choice for drawing up statements of purchased items can be the Visio program (Visio) included in the Office 365 package from Microsoft. A quick, effective way to visualize a document using diagrams and built-in stencils with product designs in accordance with GOST 2.113-75.

Download GOST 2.113-75

Despite the rapid development of electronics, the emergence of gadgets with many functions, the form of paper documentation and reporting in the industrial sector will remain a priority for a long time. The authenticity of signatures and seals cannot be verified on electronic media, which in some cases is a necessary condition for cooperation with the supplier of purchased products.

Not every production facility is equipped with modern electronic devices, so you have to work at a machine or on an assembly line using a drawing, a list, or a paper sheet. Researchers predict several more decades of active use of paper documentation in production.