Accounting statement for account 51

The balance sheet of 51 accounts is an internal report of the organization, which contains a final list of turnover and cash balances in non-cash form. It reflects the availability of money in the organization.

By order of the owner, the bank makes daily payments of obligations and expenses for economic activities. Provides cash for the daily needs of the organization: payment of wages, current business expenses.

If the organization does not have the required amount of money, the bank makes payments sequentially, paying off payment requests gradually. Payment transactions are carried out on the basis of clause 2 of Article 855 of the Civil Code of the Russian Federation, which establishes the order of payments with debtors.

What it is?

As you know, accounting account 51 refers to the cash section (Section V) , which is part of the Chart of Accounts, approved by a special regulatory act of the Ministry of Finance of the Russian Federation (we are talking about order No. 94n dated October 31, 2000).

A characteristic feature of account 51 is the fact that it is used as an active synthetic accounting account, which records all incoming and outgoing transactions made in Russian rubles with non-cash funds of the organization.

The receipt (credit) of non-cash money in rubles at the organization's bank account is always recorded by the accountant under debit 51.

Details of the statement of account 51

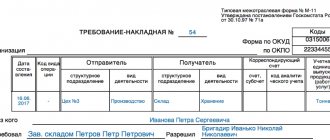

The bank provides the owner with a daily cash flow report, confirming each transaction with an official document. This is a payment request or order, a receipt and debit order.

From a bank statement you can find out to whom, on what basis (application, agreement) and in what amount the money was written off. What receipts were credited and the balance at the beginning and end of the operating day.

SALT for account 51 consists of the total turnover for the day, month and any necessary period. Since it is active, the balance on the report can only be debit or positive. The generation of turnover records occurs as follows:

Figure 1. Scheme of entries in OSV

All transactions reflected in the bank statement must be carefully checked.

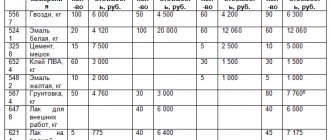

Only then enter into the journal entry or journal order No. 2, which is intended to create entries on the balance sheet of account 51. The journal form has a tabular form. Table 1. Journal - order

| Wiring no. | Date of operation | Debit | Credit | Amount of payment | Contents of operation |

| 1 | 21.02.2018 | 51.1 | 62.2 | 65 000 | Payment received from the buyer under the contract |

| 2 | 01.03.2018 | 60.2 | 51.1 | 36 000 | The advance payment to the supplier for the goods is written off |

| 3 | 03.03.2018 | 91.2 | 51.1 | 1550 | Bank commission for conducting transactions has been written off |

The log may have a significant number of lines. At the end of each day, the records are summarized and entered into a reverse table. To see the finished report. Movements in different banks are accounted for separately. Why is detailing by subaccounts provided?

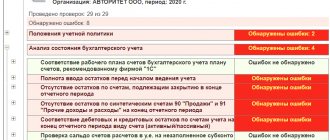

Analysis of turnover for account 51

Externally, the back looks like a table consisting of rows and columns. Movements in debit increase the balance, and movements in credit reduce it.

Figure 2. SALT for 51 accounts

In the table you can read which bank the organization works with. The balance at the beginning of the month was 322,327 rubles. During the month, 9,191,259.75 rubles were received. After paying current expenses, the organization had 779,525.84 rubles left at its disposal. It moves to a future period.

If the data is stored on paper, then for detailed analysis you need to refer to the transaction log. Select the desired payment day and amount. Automation allows you to quickly and error-free generate reports for any periods and monetary transactions.

The video will tell you more about this

Setting up a subconto for SALT on account 51 in 1C

To do this, you will need to perform several steps. In 1C, create 51 subaccounts for turnover. In the program, their role is played by subconto. And when generated, the statement will show data on items that will tell you where the money was spent and from whom it was received.

Figure 3. Decoding of the turnover of the statement of 51 accounts

If necessary, the table displays details for each bank separately if the organization works with several banks at the same time. You can also generate and track payments by day, week or any period.

Figure 4. Decoding of SALT by dates of 51 accounts

To get such a statement in 1C, you need to go to the “reports” section, select: “turnover balance sheet” and indicate 51 accounts. Next, the user will see a button: “show settings”. By opening this setting in the “grouping” tab, check the boxes next to frequency, movement items and bank names. Having noted the necessary, a turnover is formed with a detailed list of payments.

Figure 5. cash flows in SALT 51 accounts

In practice, such a report is more informative, but is used as an auxiliary report when analyzing cash flows for each individual item. This includes payment for services to suppliers, as well as receipts for the sale of goods and services.

For 1C, all settings are provided by default. Manual entries and modifications lead to distortion of declarations.

Subaccounts to account 90

To calculate the results of sales of products and provision of services with the calculation of profits and losses to account 90, in accordance with the accounting policy of the organization, additional sub-accounts are opened:

- 90.1 – to reflect revenue received in the company’s accounts;

- 90.2 – for accounting for production costs;

- 90.3 – to display the tax accrued on sales;

- 90.4 – for accounting for excise taxes included in the cost of goods;

- 90.5 – to display export duties paid;

- 90.7 – to account for expenses incurred during the sale;

- 90.8 – for fixing management expenses;

- 90.9 – if the month closes with a profit or turns out to be unprofitable.

Each subaccount accumulates a monthly balance, which is closed to zero at the end of the year.

Users of the turnover sheet for account 51

Accountants rarely use such a list in their work. In most cases, a turnover is required to disclose specific transactions for the required transaction. If money is received from the buyer, then the amount is reflected in the journal of settlements with customers. There, work is already underway on the generation of primary documents: invoice, delivery note or act.

To prepare a balance sheet, such a report contains all the necessary information. Turnover indicators are included in reporting for both ruble and foreign currency accounts.

The financier works with a statement and a detailed list of transactions by counterparties. In particular, when planning expenses and assessing income for the required period. Credit organizations also analyze cash flow movements if an application for lending or leasing is received.

Basic definitions

Income that was not received from the main activities of the enterprise is considered other income. Other income may include:

- Cash receipts that arose from the provision for temporary possession or use of an element or several assets of an organization.

- The financial benefit of the company, subject to its participation in the authorized capital of other companies. Income from accrued interest or other income on securities.

- Funds received as a result of joint activities as part of a simple partnership on the basis of an appropriate agreement.

- Profit that was received in the process of selling fixed assets and other types of assets that are not cash, manufactured products and goods sold. They may be income acquired from the execution of existing debt obligations, benefits from third party promissory notes and the sale of intangible assets (intangible assets).

- Accruals on interest accrued in connection with debt obligations of other companies.

- Bank interest charges incurred on existing deposits or accrued on the balance of open accounts.

- Cash received from the payment of fines, penalties and other sanctions for unfulfilled or overdue obligations of other companies.

- Assets that were transferred to the enterprise free of charge.

- Income received when covering losses incurred by a company or compensating for damage.

- Profit for previous years, which was identified during the audit.

- Funds for credit and deposit debts that have expired.

- Reimbursement of exchange rate differences.

- The amount of revaluation of assets in the direction of increasing their value. Billed in monetary terms.

- Other income not received from the sale of goods or products.

Among other things, they also include means of compensation for losses incurred from the occurrence of an emergency, which include compensation under an insurance contract, as well as the valuation of assets that are not suitable for use or cannot be restored. Since 2007, this information has been recorded on account 91 - other income and expenses, and not on account 99 on profits and losses.

Expenses that cannot be classified as basic are called other. They are as follows:

- Related to the leasing of company assets.

- Appear in connection with participation in the authorized capital of other companies.

- Arising from the sale, write-off or disposal of fixed assets and other assets not related to cash (except for the currencies of other countries), goods sold and manufactured products.

- Interest paid on credit and loan obligations.

- Related to fees for services provided by a credit institution.

- Contributions to valuation reserves, which are created in accordance with all accounting rules and regulations (reserves for debts of dubious origin, finances in case of depreciation of securities).

- Established reserves that were created in connection with the recognition of contingent facts of the economic activity of the enterprise.

- Other category, including payments for accounting services provided by third-party companies.

- The amount of penalties, penalties and penalties incurred due to failure to comply with the terms of the contract or in connection with failure to comply with its terms. Displayed in accounting documentation in the amount established by the court or with the consent of the debtor.

- Payment for damage caused to an enterprise or repayment by an organization of a loss resulting from its fault.

- Expenses of past years that were recognized in the reporting year.

- The amount of receivables with a past presentation period.

- The total amount of outstanding debts that cannot be collected.

- Expenses for compensation of exchange rate differences.

- The amount of revaluation of assets in the direction of reducing the cost of their valuation.

- Expenses for transferring contributions to finance charitable activities.

- Produced for the purpose of paying for recreation, entertainment, sports, cultural events or other similar purposes.

- Arose due to emergencies related to the economic activities of the enterprise (natural disasters, major accident or nationalization of property).

Starting from 2007, in accordance with PBU standards, expenses of these types are recorded on account 91 - other expenses, and not on account 99 for profits and losses. All available information is collected in this account and displayed in the balance sheet. Account 91 at the end of the reporting period will not have a residual balance.