Working with OS under the simplified tax system: main points

The norms contained in sub. 1 clause 1 art. 346.16 of the Tax Code of the Russian Federation, allow taxpayers working under the simplified tax system to take into account expenses that are associated with the following range of transactions with fixed assets:

- acquisition;

- manufacturing;

- construction.

Is depreciation charged on fixed assets for the purpose of calculating tax under the simplified tax system? You can find out the answer to this question in ConsultantPlus. Get trial access to the right system for free and go to the Ready-made solution.

Also read about depreciation of fixed assets under the simplified tax system in our article .

Determining the initial cost of the OS

The write-off of fixed assets under the simplified tax system should be carried out based on the original cost. The initial cost of fixed assets under the simplified tax system is determined according to the accounting rules (subclause 3, clause 3, article 346.16 of the Tax Code of the Russian Federation). In order to determine the initial cost of acquired fixed assets, it is necessary to sum up the actual costs of acquisition, construction, and production of fixed assets:

- cost of fixed assets in accordance with the supply contract (including VAT);

- possible costs for consulting, intermediary services (if they were directly related to the purchase of the OS); non-refundable taxes;

NOTE! According to sub. 3 p. 2 art. 170 of the Tax Code of the Russian Federation, enterprises operating on the simplified tax system and not generally related to VAT payers must take into account the amounts of VAT (for example, presented by suppliers or paid upon import into the territory of the Russian Federation) in the cost of fixed assets. This is due to the fact that non-refundable taxes (in this case, this is VAT for “simplified”), in accordance with PBU 6/01, must be included in the initial cost of the fixed assets. VAT cannot be recognized as a separate type of expense.

- state duty paid in connection with the acquisition of fixed assets; customs duties and duties;

- costs of delivery and bringing into a condition suitable for use;

- interest on a credit (loan) raised for the acquisition of fixed assets recognized as an investment asset;

- other costs directly related to the acquisition, construction and production of fixed assets.

Advantages of leasing for individual entrepreneurs

Compared to other options for purchasing equipment, long-term finance leases have a number of advantages. Thanks to these features, leasing has become one of the most popular ways to increase the assets of enterprises and individual entrepreneurs. These include:

- The ability to quickly receive equipment and start using it;

- Fewer requirements, conditions, documents;

- Newly registered individual entrepreneurs do not need to draw up a business plan confirming the profitability of the plan (as most banks and credit institutions require);

- Long term of the contract and the opportunity to renegotiate the terms;

- The approval of third parties (founders, others) is not required;

- Tax optimization.

However, there are also pitfalls. An advance payment (down payment) is almost always required, the amount of which can reach half of the cost of the property. Also, the property is owned by the lessor for the entire period of the contract and can be seized (for example, if the company is declared bankrupt). Installment plans - a loan without accrual of interest - are not provided for finance leases.

Not all banking organizations have leasing programs. Today, individual entrepreneurs can contact Sberbank, VTB, Tinkoff, Rosselkhozbank, Alfa Bank.

Any methods can be used to develop and optimize business processes. Leasing for individual entrepreneurs will be the best (and sometimes the only) option if you take into account and calculate all the nuances before completing the transaction. Before signing the document, you should carefully study each clause, especially the part about unilateral termination. Lawyers of leasing companies have significant experience and prescribe provisions with the benefit of their organization in the first place. If something raises concerns, and the representatives do not, it is better to find another organization.

OS requirements

Acceptance of fixed assets for accounting is possible only if they meet the requirements specified in clause 4 of PBU 6/01. So, it is unacceptable to use as an OS:

- goods and property that are subject to subsequent resale;

- goods and property that individual entrepreneurs or employees of a business company will use for personal needs;

- goods and property that are expected to be used for less than a year.

The most important criterion for taking into account a product or property as a fixed asset is its cost. Its minimum value is still 40,000 rubles (in tax accounting - 100,000 rubles). If the cost of the object is less, then it can be used as an inventory.

Specifics of leasing for individual entrepreneurs

Long-term financial lease with subsequent purchase is a transaction in which a leasing company purchases a vehicle or other equipment, and the client pays it money (cost and interest). Often third parties are involved in the contract - an insurance company, a seller or a supplier.

Attention! Registration entails changes in taxation for both participants - the lessor and the recipient. To avoid penalties and interest from the Federal Tax Service, you should carefully fill out the declaration and correctly enter accounting information.

The advantages of financial long-term leasing (compared to lending) are as follows:

- Quick conclusion of the contract;

- Minimum requirements – no collateral or guarantors required;

- The solvency of the lessee is checked, but is not always decisive - the object remains the property of the company for the entire period and can be withdrawn at any time;

- It is easier to agree on a deferred payment in case of difficulties;

- Possible term – up to 5 years (in some cases more);

- Upon completion, the subject matter of the agreement becomes the property of the tenant.

Attention! The main difference from a loan is that the applicant receives property for use, not cash. No additional agreements (purchase and sale, etc.) are required. For example, when applying for leasing for an individual entrepreneur, the entrepreneur immediately receives a car.

Terms of service

There are many leasing companies today. Before submitting an application, you should carefully study the possibilities of each - sometimes the conditions for obtaining leasing for individual entrepreneurs differ quite significantly (for example, the interest rate). The organization needs to be checked for transaction history, the presence of bankruptcy proceedings, and ask for reviews. General (average) conditions are as follows:

- The cost of the leased object is at least 100 thousand rubles, maximum 15 million rubles;

- Interest rate – 15-20% (close to mortgage values or higher);

- Duration – 5-7 years;

- Advance payment – from 10 to 50%.

Some companies are ready to lease property without a down payment for individual entrepreneurs. Most often - upon repeated application, subject to the correct implementation of the clauses of the first contract.

Attention! Insurance of the object is integral and mandatory. Maintenance costs are borne by the owner, as well as payment for possible risks (breakdowns and others). This is especially true when purchasing a car on lease for individual entrepreneurs (taxi drivers).

Business requirements

An individual entrepreneur differs from enterprises and organizations in many ways. This leads to the requirements put forward by the leasing company:

- Age – 21 years and older;

- From the date of registration as an individual entrepreneur, at least six months must pass, for most cases - 24 months;

- Proof of stable income is required;

- Providing a package of documents according to the list.

It is important to know! Some lessors prefer to avoid contractual relations with individual entrepreneurs for certain types of activities. There is no single (let alone official) list, so this point should be clarified immediately, even during telephone conversations.

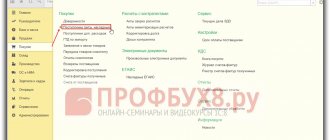

Documents required for OS adoption

The forms of documents that are used to accept fixed assets for accounting can be developed independently and approved in the accounting policy of the organization or use unified forms approved by Resolution of the State Statistics Committee of the Russian Federation dated January 21, 2003 No. 7.

If the accounting policy stipulates that unified forms are used, then:

- to accept a building as OS, form OS-1a is used;

- if a group of OS objects is accepted, then it is necessary to use the OS-1b form;

- For other types of OS, the OS-1 form is intended.

Acceptance of expenses

In order for the costs of purchased fixed assets to be taken into account as expenses, a number of conditions must be met, namely: the fixed asset must be:

- put into operation (subclause 1, clause 3, article 346.16 of the Tax Code of the Russian Federation);

- used in business activities (subclause 4, clause 2, article 346.17 of the Tax Code of the Russian Federation);

- paid (subclause 4, clause 2, article 346.17 of the Tax Code of the Russian Federation).

In addition, in order to recognize the costs of fixed assets as expenses for the purposes of calculating the simplified tax system, they must be justified and documented (clause 2 of article 346.16, clause 1 of article 252 of the Tax Code of the Russian Federation of the Tax Code of the Russian Federation). And in order to recognize as expenses the costs of fixed assets acquired from 01/01/1999 and requiring state registration, you also need documentary evidence of the fact of filing documents for registration of rights to the object (clause 3 of Article 346.16 of the Tax Code of the Russian Federation).

Important! ConsultantPlus warns You cannot take into account OS costs unless all the conditions for this are met, for example... For a list of such cases, see K+.

Accounting for expenses for the acquisition of fixed assets under the simplified tax system should be carried out evenly over the period remaining until the end of the tax period and recorded as of the last day of the tax period (clause 3 of Article 346.16 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of the Russian Federation dated March 27, 2012 No. 03-11-11 /103).

Example

If a company using the simplified tax system in April 2021 purchased a car worth 300,000 rubles as a fixed asset, then these expenses should be divided into 3 equal parts (according to the number of remaining quarters) and consistently reflected in the reporting documents in relation to the six months (as of June 30 ), 9 months (as of September 30) and tax year (as of December 31) - in each case, 100,000 rubles.

Personal car of an individual entrepreneur: how to take into account expenses

Any commercial activity is aimed at making a profit, and according to the principle “the more, the better.” And the activities of an individual entrepreneur are no exception; he also strives to get maximum profit by increasing income and optimizing his expenses. In this article we will consider the possibility of an entrepreneur taking into account the costs of maintaining a personal car when calculating taxes. Sometimes an individual entrepreneur really needs a car for business, and not for show-offs and personal travel. Is it possible to defend such expenses?

Car as a main means

The first point when an individual entrepreneur can take into account “car” costs in expenses is its inclusion in fixed assets. After all, then it becomes possible to either charge depreciation monthly (under the simplified tax system), or include the cost of the machine as an expense in the first year of its use (under the simplified tax system).

But not every individual entrepreneur has the right to include his personal car in fixed assets. Officials believe that only those vehicles that are directly involved in the entrepreneur’s income generation, for example, when carrying out freight or passenger transportation, can be recognized as the main means of transport. If a businessman uses a car as an auxiliary means (for example, for trips to the bank), then it cannot be recognized as an OS (letter of the Ministry of Finance of Russia dated March 26, 2008 No. 03-04-05-01/79).

But even if the businessman’s activities are directly related to the use of this vehicle, a new question arises - is it possible to take into account the cost of a car purchased before the owner registered as an individual entrepreneur? The Ministry of Finance dispelled doubts in its letter dated 06/06/2013. No. 03-11-11/164. It says that an individual entrepreneur who is on a simplified taxation system has the right to take into account the costs of purchasing a car during the first three years of applying the simplified tax system.

Please note that the letter discussed a situation where three circumstances occurred at once: the acquisition of a vehicle (fuel tanker) by an individual who subsequently registered as an individual entrepreneur and used this vehicle in his activities. Officials qualified the purchase of a fuel tanker as an operation carried out for the purposes of entrepreneurial activity, and recognized the right of an individual entrepreneur to take this asset into account as fixed assets with the subsequent inclusion of the costs of its acquisition in the calculation of the single tax under the simplified tax system.

Including a car as a fixed asset for an entrepreneur will not be particularly difficult - it is enough to have documents confirming the costs of its purchase, and an order or order recognizing it as a fixed asset. But if, during the audit, the tax authorities do not agree with this decision, the businessman will have to defend his position in court.

We take fuel and lubricants into account

When an entrepreneur does not want to take risks and decides not to include the cost of the car in expenses, how else can he reduce tax using “car” expenses? The easiest way is to factor in the cost of gasoline into your expenses. But here, too, there is a controversial question: should fuel costs be rationed or not?

Historically, there was an opinion that costs for fuel and lubricants must be rationed. There are Methodological recommendations of the Ministry of Transport of Russia dated March 14, 2008. No. AM-23-r, containing fuel consumption standards, as well as coefficients for various territories, seasons, etc. These standards were originally developed for motor transport enterprises, but tax authorities consider their application necessary for all taxpayers.

If you do not find standards for your car in the Recommendations, you can use the manufacturer’s data or develop fuel consumption standards yourself. But, please note, the Tax Code of the Russian Federation does not contain any provisions on rationing costs for fuels and lubricants, so you can refuse it. Only in this case, be prepared for legal proceedings with tax authorities.

The Ministry of Finance confirms the opinion that it is not necessary to standardize gasoline costs, nor to use the standards established by the Ministry of Transport (letter of the Ministry of Finance of Russia dated January 27, 2014 No. 03-03-06/1/2875).

The courts also side with taxpayers in disputes with tax authorities and allow the full cost of fuel to be written off as expenses (resolution of the Federal Antimonopoly Service of the Central District dated April 4, 2008 in case No. A09-3658/0729, resolution of the Federal Antimonopoly Service of the Moscow District dated September 25, 2007, September 28. 2007 in case No. KAA41/986607).

Regardless of whether you will normalize gasoline costs or not, you should draw up a decision with a list of personal property used in business activities. By including a car in it, you will have the right to take into account for tax purposes all economically justified expenses associated with its operation.

Documentary confirmation

In the case of justifying fuel costs, gas station receipts alone will not do; you will also have to draw up a document such as a waybill. It contains all the information about the trip route, departure and return times, as well as odometer readings. You can develop the form of the waybill yourself, indicating the mandatory details approved by the order of the Ministry of Transport dated September 18, 2008. No. 152. The procedure for filling out waybills is also specified in this regulatory act.

An important detail: if you use a personal car in business, then in contracts, invoices, letters and other documents indicate the fact that, for example, the delivery is carried out by the individual entrepreneur himself or that negotiations are being conducted on the territory of the partner, etc. Of course, this will not replace waybills, but will be additional confirmation of the economic feasibility of expenses.

Operating costs

Unlike the cost of fuel and lubricants, the cost of operating a car is not so easy to take into account. If the entrepreneur’s activities are directly related to the use of a personal vehicle, then operating costs will be justified. But if the car is used to travel to the office or to the bank, then tax inspectors will definitely not accept the costs of its maintenance as reducing the tax base.

In judicial practice, too, not all decisions are made in favor of the individual entrepreneur. For example, the Federal Antimonopoly Service of the West Siberian District did not agree with the entrepreneur’s decision to include in expenses the costs of paying for parking, technical inspection, compulsory motor insurance, purchase of fuels and lubricants (gasoline, oil, coolant), etc. (resolution dated February 26, 2008 No. F04-1130/2008 (973-A45-34)).

The judges based their decision on the fact that the businessman’s activities were related to the provision of legal services, and his personal car was used to travel to the office. Consequently, the costs of its maintenance were in no way related to the entrepreneur’s receipt of income from the provision of legal services, and therefore could not be included in expenses.

Determining the type of cost

So, “car” costs can be included in expenses and thereby reduce taxes. In particular, an entrepreneur who is on a simplified tax regime has his single tax reduced, and an individual entrepreneur who applies the general taxation regime can include these expenses as part of the professional deduction for personal income tax.

The “safest” expense for a businessman is the purchase of fuel and lubricants, since tax authorities pay virtually no attention to it (if everything is done correctly, of course). But you need to decide what type of cost to classify it as.

The purchase of fuel for a personal car used in business activities related to transportation can be classified as material expenses (clause 5, clause 1, article 254 of the Tax Code of the Russian Federation). If the activity of an individual entrepreneur is far from transportation, but the businessman actively uses his car to deliver orders, business trips, etc., then the cost of gasoline is included in other expenses associated with production and sales (clauses 11, 12, clause 1 Article 264 of the Tax Code of the Russian Federation).

In the simplified taxation system, these types of costs are also included in the closed list of expenses. Therefore, “simplified” workers, depending on the type of activity, can take into account the costs of purchasing fuel and lubricants both as material (clause 5, clause 1, Article 346.16 of the Tax Code of the Russian Federation), and as expenses for the maintenance of official vehicles (clause 12, clause 1, Article 346.16 of the Tax Code RF).

Read about business travel expenses for individual entrepreneurs here. Is it possible to take into account the expenses of individual entrepreneurs incurred before state registration, see here.

You might be interested in:

Individual entrepreneur on the simplified tax system: is it necessary to keep records of operating expenses?

Is the procedure for writing off expenses for the purchase of operating systems obligatory under the simplified tax system for individual entrepreneurs?

As you know, the term “fixed assets” refers to the category of accounting, which individual entrepreneurs under the simplified tax system (and in general) are not required to maintain. But if an entrepreneur works according to the “income minus expenses” scheme, then in the case of acquiring property and using it for the purpose of making a profit, he has the right to offset the corresponding expenses in reducing the tax base.

For more information about expenses accepted for reducing the tax base under the simplified tax system, see the material “List of expenses under the simplified tax system “income minus expenses”” .

As for the work of individual entrepreneurs under the simplified tax system according to the “income” scheme, on the one hand, entrepreneurs in this case are not obliged to write off expenses for fixed assets, on the other hand, it is necessary to keep records of them due to the fact that fixed assets may well be a criterion for terminating activities simplified - if their residual value exceeds 150,000,000 rubles. (letter of the Ministry of Finance of Russia dated September 28, 2017 No. 03-11-06/2/62973).

From 2021, the limits on the simplified tax system have been increased. See here for details.

Taxation nuances

Payment of fees for leased property depends on which taxation system the entrepreneur has chosen. If the calculation is carried out according to UTII, a financial lease will help optimize the total amounts for payments, which will make the use of such an agreement more profitable than standard lending. Payments under the lease agreement are expensed, which reduces the tax balance.

It is important to know! To use this method of reducing taxes, you will need to open several sub-accounts that will reflect the transaction. Correct registration in accounting is mandatory.

The issue of VAT refund is also relevant for individual entrepreneurs. Entrepreneurs on a simplified basis can claim value added tax as a deduction (through the Federal Tax Service) because it is included in the main payment amount (for example, when a car is purchased on lease for an individual entrepreneur taxi).

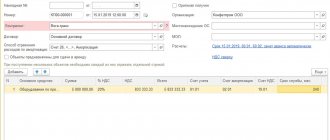

Fixed assets in KUDIR

Individual entrepreneurs do not keep accounting records, but they are required to record income and expenses in the appropriate accounting book (KUDIR) in the form approved by order of the Ministry of Finance of the Russian Federation dated October 22, 2012 No. 135n. Organizations also conduct KUDIR. It also reflects the recognition of expenses on acquired fixed assets.

The expenses in question must be recorded in section II of the accounting book. If several fixed assets were acquired during the reporting period, then each of them must be indicated in a separate line of section II.

The fact is that fixed assets may differ in terms of useful life, as a result of which the procedure for writing off expenses for them may be different (we will consider this feature later in the article).

An important aspect of working with fixed assets expenses in the accounting book: the total amount, which reflects the purchase costs taken into account when calculating the tax base of one or more fixed assets, and is indicated in the last line of section II in column 12, must also be entered in column 5, which is located in section I of the accounting book.

It is necessary, as we noted above, to reflect expenses associated with the acquisition of fixed assets under the simplified tax system in equal shares: the corresponding amounts should be recorded in column 11 of Section II of the accounting book.

Is it possible to take out a lease with a zero balance?

A lack of turnover of funds in the account of an individual entrepreneur or a zero balance may occur if the individual entrepreneur is just registered or business activities are simply not carried out. For most leasing companies, this is the reason for refusal to formalize the contract.

However, in some cases, landlords are willing to make concessions. For example, it is necessary to purchase cars on lease for individual entrepreneurs engaged in passenger transportation (taxi). Most entrepreneurs of this type do not yet have any account movements (they simply have nothing to start working on). The company can meet halfway, but change the conditions (increase the interest rate, for example).

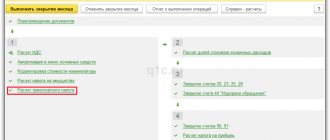

Recognition in expenses of fixed assets acquired before the start of work under the simplified tax system

It happens that a company acquires an OS object before it begins to work under the simplified tax system. According to the rules contained in subparagraph. 3 p. 3 art. 346.16 of the Tax Code of the Russian Federation, the residual value of fixed assets acquired before the start of work in the simplified tax system mode is taken into account in expenses in accordance with the following rules:

- If the useful life of the operating system is less than 3 years, then it should be included in the cost structure during the first calendar year in which the company began to apply the simplified tax system.

- If the useful life of the asset is more than 3 years, but less than 15, then during the first tax year in which the company operates under the simplified tax system, expenses include 50% of its cost, during the second year - 30%, and in the third year - 20%.

- If the useful life of the asset exceeds 15 years, then in each tax year, starting from the first, 10% of its cost is included in expenses.

- In each tax year, expenses are accepted in separate reporting periods in equal shares.

For the purposes of recognition as expenses under the simplified tax system, the residual value of fixed assets paid before the transition to the simplified tax system is determined as the difference between the purchase price (construction, manufacturing, creation by the organization itself) and the amount of accrued depreciation according to the rules of Chapter. 25 of the Tax Code of the Russian Federation (clauses 2.1 and 4 of Article 346.25 of the Tax Code of the Russian Federation).

An example of accounting for expenses for fixed assets purchased on OSNO during the transition to the simplified tax system from ConsultantPlus In February 2021, the organization acquired and put into operation a fixed asset. The purchase price was 300,000 rubles. without VAT. The useful life of the OS is 5 years. The total amount of accrued depreciation for 10 months of 2021 (from March to December) amounted to 50,000 rubles. From January 1, 2021, the organization applies the simplified tax system with the object “income minus expenses”. The residual value of fixed assets as of January 1, 2021 was RUB 250,000. (300,000 rubles - 50,000 rubles). The organization will write off the residual value of the operating system... See the full example in K+.

Postings for capitalization of fixed assets on the simplified tax system

Let's consider through what transactions the OS should be accepted for accounting in accounting.

This procedure involves the use of synthetic accounting accounts. The main wiring that needs to be used:

- Dt 08 – Kt 60, 70,69,10 and others.

Through these postings, the costs of purchasing (construction or manufacturing) property that will be included in the operating system are collected.

- Dt 01 – Kt 08.

This posting allows you to directly add property to fixed assets.

For more information about the transactions used when working on a simplified basis, read the article “Accrual of the simplified tax system (accounting entries)” .

Results

“Simplers” take into account fixed assets according to accounting rules, while their initial cost includes non-refundable taxes (VAT). To monitor compliance with the restrictions on the use of the simplified tax system, all “simplified” individuals (even individual entrepreneurs using the object of taxation “income”) must keep records of fixed assets. Costs for the purchase of fixed assets under the simplified tax system can be taken into account as expenses only when applying the object of taxation “income minus expenses.” The procedure for recognizing expenses for the acquisition of fixed assets depends on compliance with a number of conditions discussed in this article, and on when fixed assets were acquired - during the period of application of the simplified tax system or another tax regime.

Sources:

- Tax Code of the Russian Federation

- PBU 6/01, approved. by order of the Ministry of Finance of Russia dated March 30, 2001 N 26n

- KUDiR, approved. by order of the Ministry of Finance of the Russian Federation dated October 22, 2012 No. 135n

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.