Accounting

When issuing wages in finished products or goods, make the following entries:

Debit 70 Credit 90-1

– revenue from the transfer of finished products (goods) for wages is reflected;

Debit 90-2 Credit 43 (41)

– the cost of finished products (goods) transferred as wages is written off.

Reflect the transfer of other property (materials, fixed assets) on account of wages in accounting as follows:

Debit 70 Credit 91-1

– revenue from the transfer of property for salary is reflected;

Debit 91-2 Credit 01 (08, 10, 21...)

– the value of property transferred as salary is written off;

Debit 02 Credit 01

– depreciation on retired property is written off (upon transfer of fixed assets).

How are income in kind calculated?

Income in kind is taken into account at the market value of goods, works, and services (Article 211, Article 105.3 of the Tax Code of the Russian Federation). The price must include VAT and excise taxes. The taxpayer can independently make adjustments and pay additional tax based on the results of the calendar year if he considers that the value does not correspond to the market value and was underestimated (clause 6 of Article 105.3 of the Tax Code of the Russian Federation). In the absence of an adjustment from the taxpayer, the price is considered market price until the Federal Tax Service proves otherwise (clause 3 of Article 105.3 of the Tax Code of the Russian Federation).

In cases where an individual independently paid part of the cost of goods received (services, property rights), only the remaining share, minus the amount contributed by the individual, is included in the accounting of income.

Personal income tax and insurance premiums

From wages in kind you need to calculate:

- Personal income tax (clause 1 of article 210 of the Tax Code of the Russian Federation);

- contributions for compulsory pension (social, medical) insurance (part 1 of article 8 of the Law of June 24, 2009 No. 212-FZ);

- contributions for insurance against accidents and occupational diseases (clause 3 of article 20.1 of the Law of July 24, 1998 No. 125-FZ).

Personal income tax and insurance contributions must be calculated in the same manner as when paying wages in cash. That is, on the last day of the month from the entire accrued amount (clauses 3, 4 of Article 226, clause 2 of Article 223 of the Tax Code of the Russian Federation, part 3 of Article 15 of the Law of July 24, 2009 No. 212-FZ).

As a general rule, personal income tax is calculated on wages paid in kind at a rate of 13 percent (clause 1 of Article 224 of the Tax Code of the Russian Federation). Consequently, it is included in the employee’s income, which can be reduced by standard deductions (clause 3 of Article 210 of the Tax Code of the Russian Federation).

In this case, the tax base is the cost of transferred goods (work, services, other property), which is determined in the manner prescribed by Article 105.3 of the Tax Code of the Russian Federation. Such rules are established by paragraph 1 of Article 211 of the Tax Code of the Russian Federation.

Situation: is it necessary to withhold personal income tax when compensating (paying for an employee) the cost of utilities?

Yes, it is necessary if the organization pays utility costs for the employee.

If the organization reimburses the employee for utility costs, then such compensation is not subject to personal income tax, provided that it is provided for by federal (regional, local) legislation.

If an organization pays utility bills for an employee (in whole or in part), then such payment is his income received in kind and is subject to personal income tax (subclause 1, clause 2, article 211 of the Tax Code of the Russian Federation). For example, partial payment for an employee of electrical and thermal energy, provided for by industry tariff agreements, is subject to taxation in the generally established manner (letters of the Ministry of Finance of Russia dated July 4, 2011 No. 03-03-06/1/391, dated June 28, 2011 No. 03 -04-06/6-152).

If an organization reimburses an employee for utility bills, then such compensation is not subject to personal income tax, provided that it is provided for by current legislation.

A closed list of payments from which personal income tax does not need to be withheld is given in Article 217 of the Tax Code of the Russian Federation. In particular, compensation payments related to the free provision of residential premises and utilities, fuel or corresponding monetary compensation are exempt from tax. Moreover, such compensation must be provided for by federal laws, legislative acts of constituent entities of the Russian Federation or decisions of local authorities.

This conclusion follows from paragraph 3 of Article 217 of the Tax Code of the Russian Federation.

For example, teaching staff who live and work in rural settlements, workers' settlements (urban-type settlements) have the right to compensation for expenses for living quarters, heating and lighting. This is provided for by Part 8 of Article 47 of the Law of December 29, 2012 No. 273-FZ. The amount, conditions and procedure for reimbursement of such costs are established:

– The Government of the Russian Federation (if the teacher works in a federal state educational organization);

– legislation of the constituent entities of the Russian Federation (if the teacher works in a regional or municipal educational organization).

Consequently, compensation for utility services to teachers living and working in rural areas (urban-type settlements or workers' settlements), provided in the manner established by the Government of the Russian Federation (regional legislation), is not subject to personal income tax. However, this benefit does not apply to teaching staff living in other territories (not in rural areas). A similar point of view is contained in the letter of the Ministry of Finance of Russia dated September 12, 2011 No. 03-04-05/6-654.

At the same time, sectoral tariff agreements do not apply to legislative acts (letters of the Ministry of Finance of Russia dated August 4, 2011 No. 03-04-05/8-543, dated July 4, 2011 No. 03-03-06/1/391). Therefore, if the payment of compensation for utility services is provided for by an industry agreement, but is not a requirement of law (federal, regional or local), such compensation is subject to personal income tax on a general basis (clause 1 of Article 210 of the Tax Code of the Russian Federation).

Assigning payment to an employee for food costs

We can assign meals to an employee either as a separate document or monthly. Let's consider both configuration options.

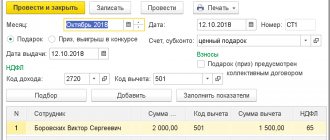

Payment of food costs according to a separate document

If it is established in the accrual card that the accrual is entered in a separate document, then to accrue payment for the cost of food to an employee within the established amounts, the document “Income in Kind” in the “Salary” section is used. Let's consider it.

Step 1. Open the “Income in Kind” journal in the “Salary” section.

Step 2. Fill out the header of the document (months, date, department). Select the type of income “Payment for food” and indicate the date the income was received. Fill out the tabular part with employees - the “Selection” or “Add” buttons. The table will be automatically filled with indicators and display the calculation.

Employees who have worked for a full month are credited with the full amount. And employee Vishnevskaya S.N. I quit after working for 6 days.

The program automatically calculated the cost of paying for food based on the actual time worked and the standard time according to the schedule. In August, the five-day work schedule is 21 working days.

4500/21*6=1285.71 rub.

Our formula works correctly.

Payment of food costs monthly

Let’s consider the option of paying for an employee’s meals if the accrual setting is set to “Monthly”.

In this case, such payment is fixed by personnel orders when hiring, personnel transfer, changing wages, assigning planned accrual, etc. You can assign an accrual using any document that contains the “Payment” section.

Let's consider the assignment of accrual to employees for payment of food costs from August 1 using the document “Assignment of planned accrual”.

Step 1. Go to the “Human Resources” section - “Change employee pay”. Click “Create” and select the “Planned Accrual Assignment” document.

Step 2. Fill out the header of the document: date, accrual name, validity period. Select a list of employees. The accrual indicator “Cost of food” is entered in the document itself. To do this, click the “Fill in indicators” button and indicate the value of the indicator - 4,500 rubles. Click “Ok” and the value will be transferred to the table for all employees.

When you enter an accrual using personnel documents and assign it to an employee, the entry will appear when accruing at the end of the month when you enter the “Payroll and Contributions” document.

Step 3. Accrue your salary and check the accrual lines “Payment for food”.

Having considered two methods of entering accruals, you can decide which method is more convenient for you.

Let's consider the situation further. We have introduced the accrual “Payment of the cost of food” in the amount determined by the norm at the enterprise - 4,500 rubles. In fact, the employee ate for a large amount. How to reflect this in the program? Let's look further.

Income tax

When calculating income tax, include the entire amount of accrued wages (regardless of the form of payment) as expenses (Clause 1, Article 255 of the Tax Code of the Russian Federation).

Situation: when calculating income tax, is it possible to take into account in labor costs wages paid in kind in excess of the established 20 percent of the accrued salary amount?

No you can not.

When calculating income tax, take into account wages paid in kind only in a part not exceeding 20 percent of the total amount of wages accrued to the employee (including bonuses, additional payments and allowances). This position is explained as follows.

As a general rule, the organization pays employees salaries in cash - in rubles. However, if certain conditions are met, part of the accrued salary can be paid in kind. In this case, the share of salary in kind should not exceed 20 percent of the total salary accrued to the employee for the month. This is stated in Article 131 of the Labor Code of the Russian Federation.

An organization can take into account the amount of accrued wages (including in kind) when calculating income tax as part of labor costs (clause 1 of Article 255 of the Tax Code of the Russian Federation). At the same time, Chapter 25 of the Tax Code of the Russian Federation does not contain rules limiting the extent to which wages in kind can be recognized as an expense. At the same time, prohibitions (restrictions) on the performance of certain actions established by law (including labor legislation) are also mandatory for tax purposes. This conclusion allows us to draw paragraph 1 of Article 11 of the Tax Code of the Russian Federation.

Consequently, wages paid in kind, in a portion exceeding 20 percent of the total amount of wages accrued to the employee, cannot be written off as labor costs.

Such clarifications are contained in letters of the Ministry of Finance of Russia dated September 6, 2013 No. 03-03-06/2/36774, dated March 24, 2010 No. 03-03-05/59, dated November 5, 2009 No. 03-03- 05/200.

Advice: there are arguments that allow organizations, when calculating income tax, to take into account wages paid in kind in a portion exceeding 20 percent of the total amount of wages accrued to the employee. They are as follows.

As part of labor costs, you can take into account the entire amount of accrued wages, regardless of the form in which it will be issued in the future (Article 255 of the Tax Code of the Russian Federation). By issuing wages in kind in amounts exceeding the specified standard, the organization violates only labor legislation. Chapter 25 of the Tax Code of the Russian Federation does not provide for any restrictions in this case. However, the organization will most likely have to defend this point of view in court. In arbitration practice there are examples of court decisions confirming this position (see, for example, the resolution of the Federal Antimonopoly Service of the Central District dated September 29, 2010 No. A23-5464/2009A-14-233). However, a stable arbitration practice has not yet developed.

Situation: is it possible to take into account the payment of utilities for an employee when calculating income tax?

Yes, it is possible if the obligation to pay utility bills for an employee is provided for by law.

Payment of utilities for an employee can be taken into account as part of labor costs (clause 4 of Article 255 of the Tax Code of the Russian Federation). In this case, expenses must be documented (clause 1 of Article 252 of the Tax Code of the Russian Federation). However, this possibility is provided only for cases where the obligation to pay utility bills for an employee is provided for by the legislation of the Russian Federation. These can be both federal and regional legislative acts for all areas of activity, and acts related to a specific industry. For example, Part 2 of Article 21 of Law No. 81-FZ of June 20, 1996 provides for the obligation of coal industry organizations to provide employees with free ration coal for heating according to the standards approved by the Government of the Russian Federation.

If the obligation to pay an employee the cost of utility services is not provided for by law, such expenses cannot be taken into account when calculating income tax. The fact is that in the list of labor costs given in Article 255 of the Tax Code of the Russian Federation, such costs are not directly named. Based on paragraph 25 of Article 255 of the Tax Code of the Russian Federation, which allows other types of expenses incurred in favor of an employee to be included in costs, it is also impossible to take into account payment for utilities. This is explained by the fact that such payment is not related to the employee’s performance of work duties, and therefore is not economically justified (clause 1 of Article 252 of the Tax Code of the Russian Federation).

Similar clarifications are contained in the letter of the Ministry of Finance of Russia dated February 16, 2012 No. 03-03-06/4/8.

Situation: is the payment of wages in kind (goods, finished products, other property of the organization) subject to VAT and income tax?

According to general standards, it is. But there are examples of court decisions that indicate the opposite.

The transfer of ownership of property is recognized as a sale (Clause 1, Article 39 of the Tax Code of the Russian Federation). Accordingly, if an organization issues wages in kind, then it actually sells its property. This operation is subject to VAT (subclause 1, clause 1, article 146 of the Tax Code of the Russian Federation) and income tax (clause 1, article 249 of the Tax Code of the Russian Federation). A similar point of view is reflected in the resolution of the Federal Antimonopoly Service of the Volga Region dated March 1, 2007 No. A65-15982/2006.

If you follow this position, the organization must charge VAT on the cost of the transferred property. In this case, you need to issue an invoice. In addition, recognize income from the transfer of property when calculating income taxes. Its cost can be reflected in expenses (clause 1 of Article 252 of the Tax Code of the Russian Federation). Depending on the type of property and the accounting policy applied, follow the provisions of Articles 318, 319 and 320 of the Tax Code of the Russian Federation.

However, the payment of wages to employees in kind is subject to regulation by labor law, not civil law. Therefore, such an operation cannot be recognized as an implementation. Therefore, there is no need to pay VAT and income tax on it. A similar point of view is set forth in the resolutions of the Federal Antimonopoly Service of the West Siberian District dated June 3, 2010 No. A03-12730/2009, dated January 18, 2006 No. F04-9650/2005(18711-A27-14), Volga District dated February 5, 2008 No. A65-15782/07-SA2-41, Ural District dated June 28, 2006 No. F09-5541/06-S2.

In addition, labor costs themselves are one of the elements that form the total cost of production. The organization is obliged to charge VAT and income tax on the cost of these products upon their sale. Charging taxes not only on the total cost of production, but also on its individual elements would mean double taxation of the same object. Therefore, if the value of property issued as salary is included in labor costs, there is no need to charge VAT and income tax on it. A similar point of view is reflected in the resolutions of the Federal Antimonopoly Service of the Ural District dated February 18, 2011 No. Ф09-11558/10-С2, the North-Western District dated February 10, 2006 No. A05-11177/2005-18, dated September 26, 2005 No. A44-1500/2005-15.

However, if the organization is guided by this point of view, it may have to defend its position in court. The only thing that is indisputable is the issue of non-assessment of VAT on agricultural products of own production transferred as payment for labor. But for this, the organization’s revenue from the sale of such products must be at least 70 percent of its total income. This is stated in subparagraph 20 of paragraph 3 of Article 149 of the Tax Code of the Russian Federation. Also, VAT is not charged when transferring property to employees, the sale of which is exempt from taxation (clauses 2 and 3 of Article 149 of the Tax Code of the Russian Federation).

An example of how to take into account the payment of wages in kind. General mode organization, accrual method

Torgovaya LLC paid manager A.S. Kondratiev receives part of his salary for April in kind. This possibility is provided for in the employment contract.

For April, the employee was accrued 16,000 rubles. According to Kondratiev’s application, he was given an iron (a product sold by the organization) worth 944 rubles as part of his salary. (including VAT - 189 rubles). This amount does not exceed 20 percent of the employee’s salary (944 rubles < 16,000 rubles × 20%).

The purchase price of the iron is 708 rubles. (including VAT - 108 rubles). Selling price – 1000 rubles.

Kondratiev has no rights to deductions for personal income tax. “Hermes” charges insurance premiums for pension (social, medical) insurance at general rates.

The contribution rate for insurance against accidents and occupational diseases is 0.2 percent. In tax accounting, the accountant takes into account contributions during the period of their accrual.

The deadline for issuing wages established at Hermes is from the 3rd to the 6th of the next month. Salaries for April were issued on May 6.

The Hermes accountant made the following entries in the accounting records.

In April:

Debit 44 Credit 70 – 16,000 rub. – Kondratiev’s salary was accrued;

Debit 70 Credit 68 subaccount “Personal Income Tax Payments” – 2080 rubles. (RUB 16,000 × 13%) – personal income tax withheld;

Debit 44 Credit 69 subaccount “Settlements with the Pension Fund” – 3520 rubles. (RUB 16,000 × 22%) – pension contributions have been accrued;

Debit 44 Credit 69 subaccount “Settlements with the Social Insurance Fund for social insurance contributions” – 464 rubles. (RUB 16,000 × 2.9%) – insurance premiums are charged to the Federal Social Insurance Fund of Russia;

Debit 44 Credit 69 subaccount “Settlements with FFOMS” – 816 rubles. (RUB 16,000 × 5.1%) – insurance contributions to the Federal Compulsory Medical Insurance Fund are accrued;

Debit 44 Credit 69 subaccount “Settlements for insurance against accidents and occupational diseases” – 32 rubles. (RUB 16,000 × 0.2%) – premiums for insurance against accidents and occupational diseases have been calculated.

In May:

Debit 70 Credit 90-1 – 944 rub. – goods were issued as payment for wages;

Debit 90-3 Credit 68 subaccount “VAT calculations” – 144 rubles. – VAT is charged;

Debit 90-2 Credit 41 – 600 rub. (708 rubles – 108 rubles) – the cost of the goods transferred to the employee is written off;

Debit 70 Credit 51 – 12,976 rub. (16,000 rubles – 2080 rubles – 944 rubles) – the rest of the salary was transferred to Kondratiev’s bank card.

When calculating income tax for April, the Hermes accountant included 20,832 rubles in expenses. (RUB 16,000 + RUB 3,520 + RUB 464 + RUB 816 + RUB 32). When calculating income tax for May, income includes revenue from sales in the amount of 800 rubles. (944 rubles - 144 rubles), and the cost of goods sold in the amount of 600 rubles is included in expenses.

Payments to non-employees in ZUP

Payments to non-employees in terms of other income are not paid in 1C:ZUP. To do this, you need to issue a cash settlement order or payment order in an accounting program. Amounts of other income in the ZUP are reflected for reference on the payslip if there are other accruals.

As we saw from the article, the modern version of the 1C:ZUP solution has received expanded functionality and advanced capabilities to more easily and conveniently solve user problems. Articles on our website describe the functionality of current versions, unless otherwise indicated in the title. Using the hashtag 1C:ZUP you can find many detailed texts on working with this solution, for example, “Hourly wages in 1C” and “Compensation for unused vacation in 1C.”

simplified tax system

The accrued salary (regardless of the form of payment) is taken into account in expenses when calculating the single tax (subclause 6, clause 1, article 346.16 of the Tax Code of the Russian Federation).

Situation: is the payment of wages in kind (goods, finished products, other property of the organization) subject to a single tax under simplification?

According to general standards, it is. But there are examples of court decisions that indicate the opposite.

The transfer of ownership of property is recognized as a sale (Clause 1, Article 39 of the Tax Code of the Russian Federation). Consequently, if an organization issues wages in kind, then it actually sells its property. This operation is subject to income tax (Clause 1 of Article 249 of the Tax Code of the Russian Federation, Resolution of the Federal Antimonopoly Service of the Volga Region dated March 1, 2007 No. A65-15982/2006). Thus, if you follow this position, the organization must reflect the value of the transferred property in taxable income (clause 1 of Article 346.15 of the Tax Code of the Russian Federation). In addition, if an organization applies a simplification of the difference between income and expenses, expenses can also be increased by the value of the transferred property (clause 2 of Article 346.16, clause 1 of Article 252 of the Tax Code of the Russian Federation).

However, the payment of wages to employees in kind is subject to regulation by labor law, not civil law. Therefore, such an operation cannot be recognized as a sale (see, for example, resolutions of the Federal Antimonopoly Service of the Ural District dated September 25, 2012 No. Ф09-8684/12, dated February 18, 2011 No. Ф09-11558/10-С2 and the West Siberian District dated January 18, 2006 No. F04-9650/2005(18711-A27-14)). Despite the fact that such arbitration practice is associated with organizations under the general regime, one can be guided by its conclusions under the simplified regime. Therefore, there is no need to pay a single tax during simplification.

In addition, labor costs themselves are one of the elements that form the total cost of production. The organization is obliged to charge a single tax on the cost of these products upon their sale. Charging taxes not only on the total cost of production, but also on its individual elements would mean double taxation of the same object. Therefore, if the value of property issued as wages is taken into account as part of labor costs, there is no need to charge a single tax on it when simplified.

However, if the organization is guided by this point of view, it may have to defend its position in court.

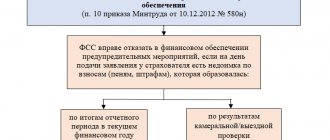

Situation: is it possible to take into account the payment of utilities for an employee when calculating the single tax? The organization pays a single tax on the difference between income and expenses.

Yes, it is possible if the organization is required by law to pay the employee’s utilities.

Simplified organizations take into account expenses in the manner prescribed for income tax payers (subclause 6, clause 1, clause 2, article 346.16 of the Tax Code of the Russian Federation). Payment of utilities for an employee can be taken into account in labor costs (clause 4 of Article 255, subclause 6 of clause 1 of Article 346.16 of the Tax Code of the Russian Federation). In this case, expenses must be documented (clause 1 of article 252, clause 2 of article 346.16 of the Tax Code of the Russian Federation). However, this possibility is provided only for cases where the obligation to pay utility bills for an employee is provided for by the legislation of the Russian Federation. These can be both federal and regional legislative acts for all areas of activity, and acts related to a specific industry. For example, Part 2 of Article 21 of Law No. 81-FZ of June 20, 1996 provides for the obligation of coal industry organizations to provide employees with free ration coal for heating according to the standards approved by the Government of the Russian Federation.

If the obligation to pay an employee the cost of utility services is not provided for by law, such expenses cannot be taken into account when calculating the single tax. The fact is that in the list of labor costs given in Article 255 of the Tax Code of the Russian Federation, such costs are not directly named. Based on paragraph 25 of Article 255 of the Tax Code of the Russian Federation, which allows other types of expenses incurred in favor of an employee to be included in costs, it is also impossible to take into account payment for utilities. This is explained by the fact that such payment is not related to the employee’s performance of job duties, and therefore is not economically justified (clause 1 of Article 252, clause 2 of Article 346.16 of the Tax Code of the Russian Federation).

Similar clarifications are contained in the letter of the Ministry of Finance of Russia dated April 15, 2013 No. 03-11-11/146.

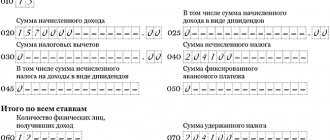

Setting up the accrual type in 1C: Accounting 8

To reflect income in the form of the value of a gift, a new type of accrual is created. You need to go to the “Salary and Personnel” section, then to “Salary Settings”, then to the “Payroll Calculation” tab and select “Accruals”.

Then you need to create a new type of accrual, for which you fill in its name and income code. After this, the user proceeds to directly setting up this accrual:

- in the “Personal Income Tax” section, you need to set the switch to the “Taxed” position, and then in the “Income Code” field, enter code 2720 “Cost of gifts.” The “Income Category” field indicates that this is “Income in Kind”;

- further you need o, since this type of gift is paid to the employee not in cash, but it must be taken into account for personal income tax purposes and reflected in salary reporting. In addition, entries for gifts in kind are not created, but correspondence for personal income tax and insurance contributions (if taxed) must be generated;

- in the “Insurance Premiums” section, the user selects “Income that is not subject to insurance premiums”;

- in the section “Income tax, type of income under Art. 255 of the Tax Code of the Russian Federation" you need to set the switch to the position "Not included in labor costs";

- in the “Reflection in accounting” section in the “Reflection method” column, the user needs to indicate the method of reflecting the accrual in accounting in order to create correspondence on it. The value is selected from the “Salary Accounting Methods” directory, for which you must first go to the “Salary and Personnel” section, then to “Salary Settings”, then to the “Reflection in Accounting” section and select “Salary Accounting Methods”. The field is filled in if the accrual of the gift needs to be reflected in accounting in the same way for all employees of the organization;

- in automatic mode, values are set for such accruals as “Regional coefficient” and “Northern surcharge”. The user can clear these checkboxes;

- The last action is to start the “Record and Close” button.