“Invoices” or “invoices” – how to say and write correctly? This concept is used quite often, but the question of the correct declension by case and determining the gender of the word “invoice” still arises. And anyway: is this a word or a phrase? Our material will give you the answer to how to use “invoice” when writing and speaking according to all the rules of competent speech.

Also see:

- Invoice and delivery note as one single document

- Certification of invoice: signatures and seal

The form and format of the invoice has changed since 07/01/2021

The Ministry of Finance of Russia, by order No. 14n dated 02/05/2021, approved a new procedure for issuing and receiving electronic invoices. And the Federal Tax Service of Russia is going to change the form of the invoice. The composition of the invoice and adjustment invoice details will be supplemented with new details:

- registration number of the batch of goods subject to traceability;

- quantitative unit of measurement of a product used for traceability purposes;

- the quantity of a product subject to traceability, in the quantitative unit of measurement of the product used for traceability purposes.

The notification about the development of the corresponding order of the Federal Tax Service was published on a single portal for posting draft legal acts. The changes are expected to come into force on 07/01/2021, when the new product traceability system becomes operational.

According to the new procedure, taxpayers and tax agents must issue and receive electronic invoices using an enhanced qualified electronic signature. Besides:

- EDF operators will be required to check received documents if such a condition is in the agreement with the seller;

- will implement a procedure for dealing with positive and negative test results.

The new procedure will apply to all invoices issued under the goods traceability system.

Due to recent changes, the article is no longer relevant!

We are already updating it and will republish it soon. If you need up-to-date instructions right now, use free access to ConsultantPlus materials.

Preparation of invoices and disputes with tax authorities

Taxpayers and tax authorities regularly argue over the correctness of filling out invoices. The relevant question is whether the taxpayer has the right to tax deductions if the buyer’s TIN is incorrectly indicated on the invoice. Typically, courts on this issue believe that incorrect indication of the buyer’s TIN cannot be considered a significant violation; it cannot serve as a reason for refusing to apply tax deductions.

For example, if the contractor incorrectly indicated the customer’s TIN in the invoice, which is known to the tax authority, and other details of the invoices are filled out correctly, which makes it possible to identify the customer, and his TIN is correctly indicated in the contract, acceptance certificates of work performed, then technical the error cannot be considered as preventing tax control.

However, it must be borne in mind that a unified position of the courts on this issue is impossible. First of all, due to the fact that the same violation in different subjects can be associated with different circumstances.

According to the Federal Antimonopoly Service of the Central District, the tax authority’s arguments about the unreliability of the taxpayer’s TIN indicated in the invoices are incorrect, since the TIN only contained an extra zero. Such misrepresentation does not prevent the actual identification of the seller. You can verify this by reading the Resolution No. A14-7612/2011 dated 04/08/2013.

The Federal Antimonopoly Service of the North-Western District also rejected the tax authority’s argument that an invalid TIN invalidates the invoice. The taxpayer requested a real TIN from the counterparty, which he used in further documentation, and the tax authority was unable to prove that the taxpayer knew or could have known that the seller provided false or contradictory information necessary for tax control, but the tax authority did not provide it. This is evidenced by Resolution No. A42-2345/2010 dated July 23, 2012.

However, there are also counter examples. The indication by sellers in invoices of TINs, which, according to tax authorities, were assigned to other taxpayers or are fictitious, indicates that these documents do not comply with the requirements of paragraph 5 of Art. 169 of the Tax Code of the Russian Federation and entails negative legal consequences for the taxpayer. This conclusion can be drawn from the Resolution of the Federal Antimonopoly Service of the Central District dated 04/05/2012 No. A68-2733/11, the Determination of the Supreme Arbitration Court of the Russian Federation dated 08/06/2012 No. VAS-10258/12.

Of no small importance here is what the error was in its essence - a deliberate distortion of facts or a consequence of a random combination of circumstances.

What is an invoice

This is a form confirming the fact of shipment of goods or provision of services at a set cost. This is not the only function of this form. What is an invoice? An accounting form required to confirm the amount of VAT both on the sale of goods (services) and input VAT to prove the right to a tax deduction in order to avoid double taxation. The presence of an invoice is a prerequisite for crediting the amount of VAT on material resources (work, services) that were purchased by the taxpayer.

This is a very important document, often used in legal disputes, so it must be filled out correctly.

Who makes up

An invoice is issued by the seller (contractor, performer) to the buyer or customer. Drawing up this form is mandatory for business entities engaged in the sale of goods, performance of work or provision of services.

Why an invoice is needed has already been said (let us repeat briefly: it confirms the issuance and payment of VAT), accordingly, you need to fill out such a form:

- individual entrepreneurs and enterprises subject to the general taxation system (unless their services fall under the exceptions established by clause 2 of Article 149 of the Tax Code of the Russian Federation);

- Individual entrepreneurs and companies that partially work on OSN (for relevant types of activities), also combining it with UTII.

Taxpayers who have chosen UTII, the simplified tax system, or the patent system as their taxation system are exempt from paying VAT, with the exception of certain cases.

Why do you need an invoice if companies and individual entrepreneurs do not have to pay VAT? This may be required if there is commercial interaction with organizations and individual entrepreneurs that are VAT payers. In addition, the parties may decide to apply the invoice on their own initiative.

Rule 3. Special tax regime

As is known, merchants operating on a simplified taxation system or using patents are exempt from paying VAT. But in all cases? No, not all, the Russian Ministry of Finance recalled in letter dated January 26, 2021 No. 03-07-11/4424. And since in some cases businessmen using the simplified taxation system and PSN are VAT payers, this means that invoices also need to be prepared. In what cases is it necessary to create a document?

For businessmen using the “simplified language”, it is necessary to generate a document in case of import of goods into the territory of Russia and other territories under its jurisdiction, due to the requirements of Article 161 of the Tax Code “Peculiarities of determining the tax base by tax agents” and Article 174.1 of the Tax Code of the Russian Federation “Peculiarities of calculation and payment to the tax budget when carrying out operations in accordance with a simple partnership agreement (agreement on joint activities), an investment partnership agreement, a property trust management agreement or a concession agreement on the territory of the Russian Federation.”

For merchants working on a patent, transactions requiring the issuance of an invoice will be transactions for which the patent tax system is not applied when importing goods into Russia and other territories under its jurisdiction, “including the amount of tax payable upon completion of the customs procedure for a free customs zone on the territory of the Special Economic Zone in the Kaliningrad Region,” as well as due to the requirements of Article 174.1 of the Tax Code of the Russian Federation.

Subscribe to the magazine “Calculation” or “Calculation. Premium" for the 1st half of 2021!

Exposure deadlines

The general rule is as follows: an invoice is issued within 5 days from the date of transfer (shipment) of goods, performance of work or provision of services. Days are counted as calendar days. This norm is enshrined in paragraph 3 of Art. 168 Tax Code of the Russian Federation. The rules are the same for both paper and electronic invoices. Also, according to paragraph 3 of Art. 168 of the Tax Code of the Russian Federation, when preparing advance documents, this form must be issued within the same 5 calendar days, but from the moment of receipt of payment for future deliveries, performance of work, provision of services.

Rule 2. Late deduction

From time to time, situations occur when the seller sends an invoice after the end of the tax period. Is it possible to get a deduction in this case? It is possible, but with conditions, the Russian Ministry of Finance said in a letter dated August 17, 2021 No. 03-03-06/1/72012.

The department explained that in accordance with paragraph 1.1 of Article 172 of the Tax Code of the Russian Federation, upon receipt of an invoice after the end of the tax period in which the products were purchased or work or services were paid for, but before the deadline for submitting the declaration for the tax period, “before established by the article 174 of the Tax Code, the deadline for submitting a tax return for the specified tax period, the buyer has the right to deduct the amount of tax in relation to <...> from the tax period in which the specified goods (work, services) were registered,” the Ministry of Finance clarified.

Following the logic of the department, it turns out that if a late invoice was received before the 25th day of the month following the tax period when the shipment and recording of the purchase occurred, the company can claim a deduction.

When an invoice is not needed

The legislation specifies cases when an invoice is not a mandatory document, and the completion and execution of a transaction is confirmed by other data: an invoice, an invoice for payment. Based on the regulations, the invoice is not filled out under the following circumstances:

- the transaction is not subject to VAT (Articles 149 and 169 of the Tax Code of the Russian Federation);

- when selling goods for cash (in this case, a check or a strict reporting form is sufficient);

- when applying simplified taxation regimes;

- a legal entity - the employer transfers the goods to its employee without providing counterpayment, that is, free of charge (according to the letter of the Ministry of Finance of the Russian Federation dated 02/08/2016 No. 03-07-09/6171);

- when sending goods taxed at a zero rate for export, if the buyer is not a VAT payer, if the shipment took place no later than 5 calendar days from the date of receipt of the advance payment (according to the letter of the Ministry of Finance of Russia dated January 18, 2017 No. 03-07-09/1695).

Correct gender

An important question is what type of “invoice”? Intuitively, the conclusion suggests itself that this is feminine, based on the last word - texture. But this is a mistaken opinion.

The gender of a compound word is determined by the gender of the defining, main word. In our case, this is the first word - count.

Counting is masculine. We get the conclusion: invoice also applies to masculine words.

How to correctly use the term “invoice” from the point of view of belonging to the genera, we show in the diagram:

To practice using the term “invoice” correctly, you can read articles and regulations in which this word appears frequently. For example, re-read this article and pay attention to the spelling of a difficult word. The invoice is also often found in the already mentioned article. 169 of the Tax Code of the Russian Federation.

Kinds

There are three main types of invoice:

- ordinary, shipping. This document confirms that the goods have been transferred. This is the most common type of invoice, but legislation provides for more than just one;

- advance payment, written out and drawn up upon concluding a contract and receiving an advance payment for work performed or services rendered. This form does not confirm the fact of transfer;

- adjustment, filled in when the price or quantity of shipped products changes.

Requisites

What does an invoice look like? This is a table with columns about the product and a header providing information about the parties to the contract.

Required details:

- number and date;

- name, address and TIN, checkpoint of the buyer and seller, as well as the consignor and consignee, if any (please note, according to the new rules, the address must be written strictly as it is indicated in the Unified State Register of Legal Entities, you can check it on the Federal Tax Service website in the section “Check yourself and the counterparty ");

- number of the payment document if an advance was received for future deliveries;

- product name and unit of measurement;

- quantity;

- currency (ruble code - 643, US dollar - 840, euro - 978);

- price per unit of measurement;

- full cost;

- excise tax amount;

- tax rate;

- the amount of tax to be paid;

- total cost including taxes;

- country of origin of the goods (codes are set in accordance with the OK classifier (MK (ISO 3166) 004-97) 025-2001); if goods are produced in Russia, a dash is added;

- customs declaration number (if the goods were not produced in Russia);

- signatures of the manager and chief accountant (or an authorized person - by order or power of attorney) - on a paper document; enhanced qualified digital signature - on electronic.

Among the latest changes is the line

“Identifier of a government contract, agreement (agreement).” Applies to deliveries under government contracts. The filling rules specifically indicate that the line is filled only if there is an identifier. If absent, the line remains blank (there is no need to put a dash).

Filling by lines

Rules for filling out an invoice line by line:

- the first line is the serial number of the document in accordance with the established document flow rules;

- the date of preparation should not be earlier than the date of the original document;

- date and correction number are filled in if necessary;

- in the line “Seller” the full or abbreviated name is indicated in accordance with the constituent documents;

- the postal address is indicated in the “Address” line;

- in line 3, “same person” is entered if the seller and the shipper are the same person. Otherwise, you must provide the shipper's mailing address. When filling out an invoice for services and property rights, a dash is placed in this line;

- in term 4, according to the same rules, the data of the consignee is written;

- in line 5 “to the payment and settlement document” a dash is placed if the form is drawn up upon receipt of payment, partial payment or for upcoming deliveries using a non-cash form of payment;

- for line 7, the currency codes are given above.

The columns are filled in as follows:

- Column 1 indicates the name of the product or service provided;

- in column 2 - unit of measurement, if possible. A dash is placed upon receipt of payment or partial payment for upcoming deliveries. Columns 2 and 2a are filled out taking into account the All-Russian Classifier of Units of Measurement, introduced by Decree of the State Standard of the Russian Federation dated December 26, 1994 No. 366;

- Column 3 indicates the quantity or volume of the goods. If this indicator is not defined or is missing, you must put a dash. A dash is also added when payment or partial payment is received for upcoming deliveries;

- Column 4 (product price) is filled out according to similar rules;

- in column 6, if there is no excise tax amount, a corresponding note is made;

- in column 7 (tax rate) for transactions specified in paragraph 5 of Article 168 of the Tax Code of the Russian Federation, an entry “without VAT” is made;

- Column 8 is filled out according to similar rules;

- columns 10-12 are filled in if the country of origin of the goods is not Russia, in accordance with the OK of the world (MK (ISO 3166) 004-97) - 025–2001.

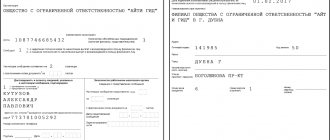

This is what the completed document looks like.

If the form is an advance or correction form, this must be indicated. As well as what changes are made to the form and on what basis. The signature of authorized persons is required: manager (trustee), chief accountant. A seal is not a mandatory requirement, but can be supplied (for example, at the buyer’s request).

All forms are stored in chronological order for at least 4 years, recorded in the journal of received and issued invoices, in the book of purchases and sales in order to be able to verify the calculation and payment of VAT.

Some nuances of issuing invoices and the legal relationship to them

The buyer is obliged to accept for deduction the amounts of tax presented by the seller, even if the requirements of paragraphs 5 and 6 of the article in question are not met.

In addition to the main ones, the invoice may also contain additional details, for example, the position of the authorized person who signed the invoice on the basis of some documents. The presence of such details cannot be a basis for refusing to deduct VAT amounts charged to the buyer by the seller.

If goods are purchased by an organization through its separate divisions, then invoices for goods shipped are issued in the name of the organization, since separate divisions cannot be VAT payers.

Common Mistakes

Errors that are most often encountered when filling out an invoice and their consequences:

- if the name, TIN, and address of the organization are incorrectly indicated or missing, it is difficult to establish the authorship and addressee of the document, so it may be declared invalid;

- if it is impossible to determine from the document what goods were transferred or service was provided, VAT will not be refunded;

- incorrect indication of currency, incorrect indication of the quantity of goods, errors in prices, incorrect calculation of cost lead to the fact that the exact cost of the goods cannot be determined. Thus, the document becomes uninformative;

- incorrect calculation of VAT. The absence of a VAT amount may also raise questions from regulatory authorities.

Minor errors in the form of missing characters, capital letters, or inaccuracies in payment details are usually not pursued by the tax authorities. It is also possible to abbreviate names if such an abbreviation allows you to identify the enterprise or product.

Rule 5. Right, not obligation

Will the company face liability if it does not issue an invoice for a transaction that is exempt from VAT? No, there is no threat, the Russian Ministry of Finance said in a letter dated December 16, 2021 No. 03-07-09/110092. The fact is that, by virtue of subparagraph 1 of paragraph 3 of Article 169 of the Tax Code, organizations are required to issue invoices only in relation to transactions subject to VAT. If the transaction between companies is exempt from VAT, then an invoice is not required in this case.

At the same time, the Russian Ministry of Finance drew attention to the following:

There is no prohibition on the preparation of invoices when carrying out these operations by the provisions of Article 169 of the Code.

Thus, enterprises can generate a document indicating that the payment is “Excluding tax (VAT).”

Adjustment invoice

When making adjustments, the following rules must be observed:

- changes are made to both copies;

- changes must be endorsed by the seller’s manager or an authorized person (the signature of the chief accountant is not required) and certified by a seal;

- it is necessary to set a date for making corrections;

- erroneous data is crossed out and new ones are entered, indicating the column, and the explanation “Corrected” must be included.

If there are too many errors, it is better to make a new document. The norms of the Tax Code of the Russian Federation do not contain a ban on such an action.

Relevance

The 2021 sample invoice is a transfer document that must be drawn up taking into account the above rules. It must take into account changes made since 10/01/2017.

Let's summarize: invoice - what is it in simple words? In short, this is confirmation of payment and payment of VAT. There are peculiarities of filling out this form, advance or corrective, but the essence does not change. It is in this form that there are signatures of authorized persons who actually confirm the execution of the contract. Therefore, this is an extremely important document that it is advisable to include in contractual obligations. Payers on the general taxation system will also need proof of payment of value added tax.

Rule 4. Deduction time

In what period can a company claim a deduction for value added tax when paying an invoice issued in advance? The answer to this question was given by the Russian Ministry of Finance in letter dated December 30, 2021 No. 03-07-11/116098.

The department recalled that in accordance with the rules of paragraph 12 of Article 171 of the Tax Code of the Russian Federation, when a company pays an advance invoice, an enterprise can receive a tax deduction. However, the company must have a number of supporting documents.

The financial department clarified:

At the same time, paragraph 9 of Article 172 of the Tax Code establishes that these deductions are made on the basis of invoices issued by sellers upon receipt of advance payment (partial payment), documents confirming the actual transfer of these amounts, and in the presence of an agreement providing for listing them.

Based on this, the department came to the conclusion that the buyer’s right to deduct VAT arises in the same tax period when the invoice was received.

New uniform in 2021

In connection with the increase in the basic VAT rate to 20%, a new form of invoice was introduced in accordance with the order of the Federal Tax Service of the Russian Federation dated December 19, 2018 No. ММВ-7-18/ [email protected] Changes were made to the electronic format of documents used for exchange via telecommunications communication channels. The order of the Federal Tax Service provides for a long transition period; until December 31, 2019, the right to apply the old format remains. Documents created using old formats must be accepted until December 31, 2022. Tax authorities recommend switching to the new format now in order to improve work efficiency.

Invoice form in Word format

Invoice in Excel format

Legal documents

- Article 149 of the Tax Code of the Russian Federation. Transactions not subject to taxation (exempt from taxation)

- Article 168 of the Tax Code of the Russian Federation. The amount of tax presented by the seller to the buyer

- Article 149 of the Tax Code of the Russian Federation. Transactions not subject to taxation (exempt from taxation)

- Article 169 of the Tax Code of the Russian Federation. Invoice

- Article 169 of the Tax Code of the Russian Federation. Invoice

- Decree of the Government of the Russian Federation of December 26, 2011 N 1137

- Resolution of the State Standard of Russia dated December 14, 2001 N 529-st

- "OK 015-94 (MK 002-97). All-Russian classifier of units of measurement"

On the issue of unscrupulous counterparties

From time to time, questions arise about whether a taxpayer has rights to a VAT refund on transactions made with unscrupulous counterparties. In such situations, courts sometimes take the side of the taxpayer.

One of the grounds for this is the Decree of the Supreme Arbitration Court of the Russian Federation dated October 12, 2006 No. 53, according to which the taxpayer can submit to the tax inspectorate all the documents he has in order to obtain tax benefits. In this case, the tax authority must prove any flaws in the documents, and the taxpayer enjoys the presumption of integrity until the contrary is proven.

The dishonesty of the organization's counterparty, in particular its absence from its legal address or failure to submit tax reports, does not in itself confirm the taxpayer's desire to receive an unjustified tax benefit.

If the tax service identifies circumstances confirming the dishonesty of suppliers as taxpayers, then the measures provided for by the current legislation are applied to such persons, which does not automatically entail the recognition of the buyer of their goods as an unscrupulous taxpayer.