Description of account 10

This account is active.

This means that the account balance can only be a debit balance, a credit balance is not allowed. The debit of the account reflects the receipt of materials, and the credit reflects the write-off (for example, for production, for sale). All inventories with the same name and dimensional characteristics must have their own unique item number (code). This allows the material to be identically identified by different employees of the organization: supplier, storekeeper, accountant.

The organization must maintain records of materials at storage locations. This is due to the fact that the same material can be stored in different warehouses. As a rule, a storekeeper or other employee is responsible for the safety of materials in a warehouse, with whom a liability agreement must be concluded.

IMPORTANT! The balance sheet for account 10, formed in the context of warehouses, shows the balances of material inventories for each materially responsible person.

FAQ

Question No. 1 What is a balance sheet?

Answer: The balance sheet for account 10 is a summary report that reflects the balances of materials at the beginning and end of the period under review, as well as what were the receipts during this period, as well as write-offs.

Question No. 2, if an enterprise has several warehouses and the receipt of one item of goods arrives at different warehouses, then how should this material be taken into account?

Answer: Materials of the same type that arrive at different warehouses should be reflected as follows. From the beginning, at each warehouse, a SALT is formed for this material, then the data is transferred to the accounting department, and there everything is entered into the general consolidated SALT.

Key points when forming SALT on a count of 10

The main thing that must be taken into account when forming OSV:

- SALT is a summary report that should indicate:

- opening balance in quantitative and monetary terms;

- income in quantitative and value terms;

- consumption in quantitative and monetary terms;

- ending balance in quantitative and monetary terms.

- The SALT is first generated for each warehouse, then all statements for warehouses are collected into a consolidated SALT for the organization as a whole. Then, based on the summary report, synthetic accounting data is obtained, which is reflected in the reporting.

- Despite automated accounting, warehouse cards for materials accounting must be required. The posting of receipts and disposals in them is carried out by the financially responsible person in quantitative terms. A card is created for each item number.

- Primary documents on the movement of materials must be on paper, and they must have “live” signatures.

ConsultantPlus experts explained in detail how to conduct analytical accounting. If you do not have access to the legal reference system, get a trial demo access for free.

Allowed simplifications

The applicable accounting policies and procedures are flexible. Depending on the prevailing circumstances and the requirements of the time, the necessary changes are made to these documents at the government level.

Thus, in 2021, some changes were made, according to which small businesses and non-profit organizations received the right to use simplified accounting methods, including accounting for materials.

These assumptions are given by the Ministry of Finance of the Russian Federation in order to enable this category of business entities to develop better. However, in order to be able to apply the presented preferences, they should be fixed in the accounting policies.

Thus, the Ministry of Finance of the Russian Federation allows:

- valuation of purchased goods and materials at the seller's price;

- simplified write-off of those inventories that are used for management needs;

- now the designated categories of business entities have the right to write off the cost of business and production equipment at a time;

- From now on, the initial cost of OS can be formed by including only the price that was paid to their supplier, as well as the costs of their installation. Other costs incurred in the process of purchasing an OS should be classified as expenses;

- Now it is possible to abandon the formation of a reserve fund designed to cover losses in the event of a decrease in the value of goods and materials.

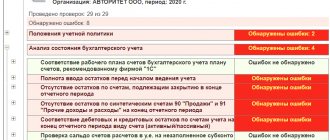

Checking SALT and warehouse data

Work with primary documents on the movement of materials in organizations can be structured in 2 directions:

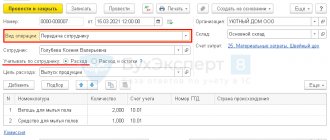

- The primary document (for example, an invoice in form M-4 or a demand invoice) is written out manually at the time of receipt or issue of material, signed and handed over to the accountant. The accountant enters data into the program, making entries in the appropriate accounts. In this case, the material code, the warehouse through which the movement took place, and balance sheet accounts must be correctly indicated.

- First, postings are made in the program, i.e. the movement of material is reflected, and then the primary document is printed, which must be signed by the persons participating in the business transaction.

We will not dwell on the pros and cons of each of these methods of reflecting and generating primary documents. Often it all depends on the software used in the enterprise. It is important to understand that in both cases the influence of the human factor is great. Data may be entered into the program using the wrong item number or warehouse. And this will lead to incorrect formation of OSV.

If the financially responsible person timely posts documents on the movement of materials in warehouse accounting cards, then at the end of the month he must have the correct balance for each item calculated. And when the SALT arrives from the accounting department to the warehouse, the storekeeper must check it with the data on the cards.

IMPORTANT! It is necessary to reconcile the data of the OCB and the cards. This procedure will allow timely identification of discrepancies, finding their causes and, if necessary, making changes to accounting or warehouse records.

Enterprise cost analysis

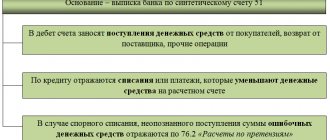

The turnover sheet is compiled at the end of the month, and it records the turnover and balances of all operating accounts. The turnover sheet is a table in which a separate line is allocated for each account. The name of the account, the initial debit and credit balances, debit and credit turnover and the final debit and credit balance (balance) are sequentially entered into the turnover sheet. Then you should check the correctness of the calculated final debit and credit balances. For this purpose, the debit turnover is added to the initial debit balance of active accounts and the credit turnover is subtracted, and in passive accounts, the credit turnover is added to the initial credit balance and the debit turnover is subtracted. If the received balance does not match the one transferred from the account, it means that an error was made in the account when withdrawing the balance. The next step is to calculate the totals - opening balances, turnover and ending balances. The calculation results are recorded below the line. There are three types of turnover sheets: 1) For synthetic accounts, which includes all accounts 2) For analytical accounts, which is maintained for each account separately 3) Checkerboard (only turnover is reflected in it) Turnover sheet for current accounts (used to determine whether the posting to the accounts was made correctly. Is the main document when drawing up the balance sheet. Advantage - one for all accounts. It contains generalized information about the status, changes and balances of the organization’s property and liabilities):

Based on the results of the turnover sheet, the accounts on synthetic accounts are checked, so according to the final line in the turnover sheet there should be three pairs of equalities: 1) balances at the beginning of the reporting period in debit and credit (shows that the total amount of all funds of the enterprise at the beginning of the period is equal to the total the sum of the sources of these funds. These figures reflect the balance sheet of the enterprise at the beginning of the period); 2) turnover in debit and credit (follows from the principle of double entry, in which each business transaction is reflected in the same amount in the debit and credit of different accounts, and if the amounts do not match, this indicates errors); 3) balances at the end of the reporting period for debit and credit (follows from the equality of the totals of funds and their sources and shows the balance at the end of the reporting period).

The turnover sheet for analytical accounts for the month for account 10 (“Materials”) is compiled separately for each synthetic account for which analytical accounting is maintained. three forms of turnover sheets: 1) when maintaining physical cost accounting; 2) when keeping records only in monetary terms; 3) when maintaining records of settlement accounts with different debtors and creditors. Turnover statements for analytical accounting accounts - a summary of turnover and balances for all analytical accounting accounts opened for a given synthetic account. To identify errors made in the accounts (for example, amounts may be recorded in the wrong accounts to which they relate), the results of the turnover sheets for analytical accounting accounts are compared with the data of the corresponding synthetic account in the turnover sheet for synthetic accounts. The totals of the turnover sheet for analytical accounting accounts must be equal to the totals for the synthetic account.

Turnover sheet for analytical accounts for the month for account 60 (“Expenses with suppliers”)

Blind statement (does not show balance, only revolutions):

If the turnover sheets are drawn up correctly, then when reconciling the turnover sheet using synthetic accounts, three pairs of equal totals should be obtained, of which the totals of the initial balances should be equal to the total of the initial balance, and the totals of turnover should be equal to the totals of the business transactions register. in order to draw up a final balance sheet based on the turnover sheet, it is necessary to transfer from it to the balance sheet the names and final balances of accounts: debit - to assets, and credit - to liabilities.

Balance sheet for account 10

Let us consider, using an example, the main points associated with the formation of the SALT, in particular, how the procedure for receipt and write-off of materials occurs and how these movements are reflected in the SALT.

Example

LLC NTK received materials from the supplier in November (at the beginning of the month there were already leftovers of some materials in its warehouse). Some of the inventory was written off for production, and some was sold. Materials are assessed at average cost.

Accounting for VAT when purchasing material assets has its own characteristics. Read about them in the article “How VAT is accounted for on purchased assets.”

Admission. NTK LLC received from the supplier TORG-12, invoice and materials:

| Name | Quantity | Unit price, without VAT | Code assigned to the material |

| Nails | 50 kg | 90 rub. | 5567 |

| White enamel | 100 kg | 200 rub. | 5241 |

| Primer | 30 kg | 100 rub. | 5874 |

| Varnish for external works | 40 kg | 150 rub. | 6478 |

| Water based varnish | 40 kg | 160 rub. | 6214 |

Write-off. Based on the invoice requirement for production needs, the following was used:

| Name | Quantity | Average unit cost | Code assigned to the material |

| Nails | 60 kg | 70 rub.1 | 5567 |

| Cement | 5 bags | 500 rub.2 | 3258 |

| Yellow enamel | 5 kg | 200 rub.3 | 5482 |

Implementation. The buyer was issued TORG-12 and an invoice:

| Name | Quantity | Average unit cost | Code assigned to the material |

| White enamel | 60 kg | 201 rub.4 | 5567 |

| PVA glue | 30 kg | 50 rub.5 | 6524 |

If you need to release material without VAT, our article “How to fill out a delivery note (TORG-12) when working without VAT (sample)” will help you fill out the documents correctly.

SALT for November of the year:

Explanations for the tables:

1 Remaining: 100 kg x 60 rub. + receipt: 50 kg x 90 rub. Average cost of 1 kg: (100 x 60 + 50 x 90) / 150 kg = 70 rub.

2 There was no arrival. The average cost is equal to 7,500 / 15 = 500 rubles.

3 There was no arrival. The unit cost is calculated based on the balance: 2,000 / 10 = 200 rubles.

4 Remaining: 20 kg x 206 rub. + receipt: 100 kg x 200 rub. Average cost of 1 kg: (20 x 206 + 100 x 200) / 120 = 201 rub.

5 There was no arrival. The average cost is calculated based on the balance: 3,000 / 60 = 50 rubles.

6 The average cost of 1 kg is calculated as follows: (balance at the beginning: 50 kg x 95.20 rubles + receipt: 30 kg x 100 rubles) / 80 = 97 rubles. Remaining at the end: 80 kg x 97 rub. = 7,760 rub.

In this example, we considered a situation where receipts and expenses were made within the same warehouse. If there are several storage locations, a similar OSV must be generated for each.

In addition to being valued at average cost, units of material can also be valued at cost per unit and using the first-in, first-out (FIFO) method. The procedure for assessing materials upon disposal from 2021 is regulated by FSBU 5/2019 “Reserves” (Section III) (until 2021, PBU 5/01).

SALT for account 10 is also used when filling out table 4.1 of the explanations to the balance sheet.

EXAMPLE of filling out a table from ConsultantPlus: Raw materials and materials intended for the production of products (performance of work, provision of services) and for the management needs of the organization: - purchased in the amount of 22,049,600 rubles; — released into production in the amount of RUB 27,900,000; - spoiled in the amount of 302,000 rubles. A reserve has been created to reduce the cost of inventories (materials) - 48,000 rubles. Balance sheet for account 10 for 2021.... Read the continuation of the example in K+. Trial access is available for free.

Subaccounts and classification of inventories

Before moving on to sub-accounts, we should dwell in more detail on the materials and their classification. This category refers to the types of company reserves that play the role of raw materials in the production process of one or another type of company product, as well as in meeting business needs.

There is a certain classification of materials, depending on which 11 subaccounts are provided in the Chart of Accounts. When classifying these materials by type, their economic characteristics are used as a basis:

- raw materials and materials that are the basis of manufactured products and ensure the adequacy and continuity of the production process;

- purchased semi-finished products and components that also take part in the production of goods. However, additional efforts are required on them for use in the production process;

- fuel, which is used to provide heat, continuous operation of equipment and other production needs of the company;

- containers, as well as materials used for its production;

- spare parts used in the process of repairing fixed assets;

- other inventory items that were formed due to defects, waste from the production process, as a result of write-off of fixed assets, etc.;

- inventories that were transferred for processing to third-party enterprises and the cost of which does not affect the price of manufactured goods;

- construction materials required for the developer’s work;

- inventory and household supplies used as means of labor;

- special clothing and special equipment in the warehouse; And

- special clothing and special equipment transferred into operation.

Results

It is difficult to imagine a production organization that purchases a small amount of material assets. The process of forming OSV itself is simple. The main problem is the variety of items, warehouses, financially responsible persons and a large volume of primary documents.

Several participants may be involved in the chains of acquisition and write-off of materials: a supplier, a storekeeper, workers or craftsmen who receive materials for production, and sales employees. The primary document can get lost at any stage of inventory movement and not reach the accountant. So, first of all, the accountant is interested in creating a document flow that will allow receiving primary data in a timely manner and in full.

Currently, SALTs are generated automatically, based on primary documents entered into accounting programs.

However, do not forget that you need to oblige the storekeeper (or other materially responsible person) to keep warehouse records in quantitative terms (in cards or special journals). Then, discrepancies identified during reconciliation of accounting and warehouse data will help you find documents that did not reach the accountant or storekeeper. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Technical characteristics of YA1-OSV

| Name of parameters | Ya1-OSV-1.5 | Ya1-OSV-2.5 | Ya1-OSV-4 | Ya1-OSV-6.3 | Ya1-OSV-10.0 |

| Type | Vertical with cooling system | ||||

| Geometric capacity, l | 1600 | 2600 | 4200 | 6600 | 10500 |

| Working capacity, l | 1500 | 2500 | 4000 | 63000 | 10000 |

| Inner diameter, mm | 1200 | 1600 | 1600 | 2000 | 2400 |

| Conditional diameter of the filling-emptying pipe, mm | 50 | 50 | 50 | 50 | 80 |

| Thermal insulation layer thickness, mm | 50 | 50 | 50 | 50 | 50 |

| Installed mixer drive power, kW | 0,75 | 0,75 | 0,75 | 0,75 | 0,75 |

| Mixer rotation speed, rpm | 18 | 18 | 18 | 18 | 18 |

| Conditional diameter of the refrigerant supply pipe, mm | 50 | 50 | 50 | 50 | 50 |

| Temperature of incoming refrigerant, °C not higher | +4 | +4 | +4 | +4 | +4 |

| Temperature of incoming coolant, °C | +24 | +24 | +24 | +24 | +24 |

| Pressure of incoming heat-coolant, MPa (kgf/cm2) no more | 0,15 | (1,5) | |||

| Conditional diameter of the pipe for supplying cleaning solutions, mm | 50 | 50 | 50 | 50 | 50 |

| Pressure of incoming cleaning solution, MPa (kgf/cm2) not less | 0,3 (3,0) | 0,3 (3,0) | 0,3 (3,0) | 0,3 (3,0) | 0,3 (3,0) |

dimensions

| Name of parameters | Ya1-OSV-1.5 | Ya1-OSV-2.5 | Ya1-OSV-4 | Ya1-OSV-6.3 | Ya1-OSV-10.0 |

| Width, mm (no more) | 1535 | 1735 | 2100 | 2500 | 2900 |

| Outer diameter, mm (no more) | 1335 | 1535 | 1735 | 2135 | 2535 |

| Height, mm (no more) | 2827 | 3548 | 3869 | 3912 | 4097 |

| Weight, kg (no more) | 535 | 900 | 1070 | 1500 | 2000 |