Account 46 in accounting: application of accounts and postings

Accounting account 46 is the active account “Completed stages of work in progress”, provides information about the “independent” stages of work completed, according to the terms of the concluded agreement, so that they can be calculated by the organization.

Account 46 in accounting

The debit of account 46 “Completed stages of work in progress” takes into account the cost of completed stages of work (according to the established procedure) paid by the customer, and on the credit - funds received to the organization’s account from this customer:

Analytical accounting for account 46 is carried out by the organization by type of work.

Postings to account 46 “Completed stages of work in progress”

The main transactions for account 46 are presented in the table:

| Account Dt | Kt account | Wiring Description | A document base |

| 46 | 90 | The cost of the completed stage of work is reflected | Bank account statement, Certificate of acceptance of work performed and services rendered |

| 62 | 46 | Write-off of the cost of stages of work paid by the customer (after completion of all work as a whole) | Accounting information |

| 62 | 46 | Repayment of the cost of fully completed work using advances received from the customer. | Bank statement |

Postings to account 46 using the example of a construction contract

Let's say that IC "Vernex", according to a construction contract, where the price of work is 250,000 rubles, is the contractor.

Get 267 video lessons on 1C for free:

Conditions:

- construction costs - 180,000 rubles;

- period – from December 2021 to January 2021;

- advance payment (before the start of work) – 110,000 rubles.

Based on the results of December 2021:

- completed - 75% of the total scope of work under the contract;

- expenses incurred - 130,000 rubles.

Postings on account 46 in construction: long-term construction contract:

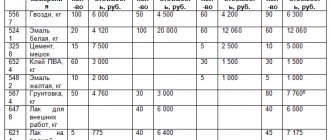

| Account Dt | Kt account | Transaction amount, rub. | Wiring Description | A document base |

| 51 | 62 | 110 000 | The advance received from the customer of the work is reflected | Bank statement |

| 62 | 68 VAT | 18 780 | VAT charged on advance payment | Invoice |

| 46 subaccount “Revenue not presented for payment” | 90.01 | 187 500 | Reflection of the cost of work performed “as ready” (revenue for December 2021) | Bank account statement, Certificate of acceptance of work performed and services rendered |

| 90.03 | 76.N.1 | 28 602 | The amount of VAT not claimed is reflected on the recorded revenue. | Invoice |

| 90.02 | 20 | 130 000 | Expenses written off (construction in December 2021) | Accounting certificate, Certificate of provision of production services |

| 90.09 | 99 | 57 500 | The financial result of construction under the contract for 2021 is reflected | Accounting information |

| 46 subaccount “Revenue not presented for payment” | 90.01 | 62 500 | Reflected revenue (balance) | Bank account statement, Certificate of acceptance of work performed and services rendered |

| 90.03 | 76.N.1 | 9 534 | The amount of VAT not claimed is reflected on the recorded revenue. | Invoice |

| 90.02 | 20 | 50 000 | Expenses written off (construction, balance) | Accounting certificate, Certificate of provision of production services |

| 90.09 | 99 | 12 500 | The financial result of construction is reflected | Accounting information |

| 62 | 46 subaccount “Revenue not presented for payment” | 250 000 | The customer has been invoiced | Certificate of acceptance of work performed and services provided, Invoice |

| 76.N.1 | 68 VAT | 38 136 | VAT charged | Accounting certificate, Certificate of acceptance of work performed and services rendered |

| 68 VAT | 62.04 | 18 780 | The amount of VAT from the advance received is offset | Accounting information |

| 62.04 | 62 | 110 000 | Advance payment from the customer has been credited | Certificate of acceptance of work performed and services provided |

| 51 | 62 | 140 000 | Payment (balance) under the contract has been received | Bank statement |

The degree of completion of the contract based on the accounting policy is determined by the share of completed work in the total volume (under the contract) as of the reporting date.

Source: //BuhSpravka46.ru/buhgalterskiy-plan-schetov/schet-46-v-buhgalterskom-uchete-primenenie-scheta-i-provodki.html

When to use account 46

According to the Chart of Accounts, account 46 is called “Completed stages of work in progress” (approved by order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n). Therefore, score 46 is most in demand in construction.

Thus, accounting entries for account 46 are made to summarize information about stages of work completed in accordance with concluded contracts that have independent significance.

By virtue of the official instructions for account 46, it is, if necessary, used by organizations performing long-term work, the initial and final deadlines for which usually relate to different reporting periods.

For example, entries in accounting account 46 in construction can directly reflect construction, as well as scientific, design, geological, etc. work.

The accounting department maintains analytical accounting for account 46 by type of work.

KEEP IN MIND

Completed stages of work can be reflected on account 46 only if they are paid for by the customer.

The use of account 46 must be specified in the organization’s accounting policies.

Account 46 in accounting

In an economic sense, account 46 in accounting describes the progress of the production process and shows the implementation of work allocated under the contract to independent sections. Conditions for reflecting transactions - the agreement is concluded for a long term and provides for phased execution of acts, preliminary step-by-step payment.

A long period is characterized by activity in the scientific, cartographic, and construction industries. By long-term is meant a contract under which the completion of work occurs in a reporting period different from the beginning.

Count 46 – characteristic

The financial nature of the register is ambiguous. It refers to active, inventory accounts, that is, taking into account information about the organization’s property. But the company ceases to own the property after signing the acceptance certificate. It turns out that the account collects information about fulfilled obligations, and not about material objects.

A similar dispute is caused by the reflection in the balance sheet. Standard accounting programs generate line 520 “Other long-term liabilities” for the advance received. And the cost of work performed is included in line 213 “Costs in work in progress.” There is no separate column provided.

According to PBU 4/99, financial statements must be reliable (clause 6), indicators are expressed in a net estimate (clause 35). Consequently, the advance received from the customer must be reduced after partial delivery.

The conclusion is also confirmed by the fact that account 46 in accounting contains information about the cost of paid work (Chart of Accounts), that is, about revenue. Work in progress is formed from the expenses of the enterprise - this results in unreliable information.

Based on the above arguments, it is more correct to show 62 invoices minus completed stages in the balance sheet.

Account 46 – postings

Debit account assignments are compiled on the basis of acceptance certificates for work sites. Upon completion of the entire volume specified in the contract, credit transactions are formed. Analytical accounting is built for each contract.

Example

The contract dated April 1 stipulates the construction of a woodworking shop on the site of a former dry cleaner. The due date is September 15. The hotel points highlight the stages - demolition of the building, installation of a heating system. The price of the agreement was 750 thousand rubles. An advance payment of 480 thousand rubles was transferred.

| Debit | Credit | Amount, thousand rubles | Name |

| 51 | 62 | 480 | Advance payment received |

| 76. AB | 68 | 73, 22 | Value added tax charged on advance payment |

| 68 | 51 | 73, 22 | VAT transferred |

| 46 | 90 | 80 | The old building was dismantled in May |

| 90 | 20 | 50 | Dismantling costs written off |

| 68 | 12, 20 | VAT according to the act | |

| 99 | 17,80 | The financial result for May is reflected | |

| 68 | 76. AB | 12, 20 | Part of the VAT calculated on the advance payment has been credited |

Balance as of June 1:

| Check | Amount, debit | Amount, credit | Explanation |

| 76.AB | 61,02 | Remaining VAT on advance payment | |

| 62 | 400 | Minus the indicator at 46 |

In July, the workshop was built, the construction of the building was estimated at 600 thousand rubles:

| Debit | Credit | Amount, thousand rubles | Name |

| 46 | 90 | 400 | The balance from the customer's advance payment |

| 62 | 90 | 200 | Reflection of the unpaid portion |

| 90 | 20 | 470 | Costs written off |

| 68 | 91,53 | VAT charged | |

| 99 | 38,47 | Profit for July reflected | |

| 68 | 76.AB | 61,02 | The balance of VAT calculated from the advance payment is credited |

Balance as of August 01:

| Check | Amount, debit | Amount, credit | Explanation |

| 76 | 0 | Remaining VAT on advance payment | |

| 62 | 200 | Minus the indicator at 46 |

In September, a certificate of completion of construction is signed:

| Debit | Credit | Amount, thousand rubles | Name |

| 62 | 90 | 70 | Reflection of unpaid stages |

| 90 | 20 | 40 | Costs written off |

| 68 | 10,68 | VAT charged | |

| 99 | 19,32 | Financial results | |

| 51 | 62 | 270 | Receivables transferred by the customer |

| 62 | 46 | 480 | Completion of the contract |

Attention! Account 46 “Completed stages of work in progress” is closed after final payment under the agreement. Signing the acceptance certificate is not the basis for generating a credit entry in accordance with the Chart of Accounts.

Source: //spmag.ru/articles/schet-46-v-buhgalterskom-uchete

Account calculation procedure 46

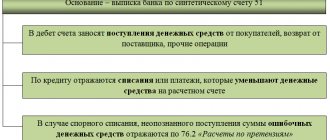

The debit of account 46 takes into account the cost of stages of work completed by the organization, paid by the customer, accepted in the prescribed manner, in correspondence with account 90 “Sales”.

At the same time, the amount of costs for completed and accepted stages of work is written off from the credit of account 20 “Main production” to the debit of account 90 “Sales”. The amounts of funds received from customers in payment for completed and accepted stages are reflected in the debit of cash accounts in correspondence with account 62 “Settlements with buyers and customers”.

Also see "".

The procedure for closing account 46 is as follows: upon completion of all work as a whole, the cost of the stages paid by the customer, recorded on account 46, is written off as a debit to account 62.

If at the time of completion of all work the stages were fully paid, account 62 for a specific customer is also closed.

When, as a result of final settlements, the customer overpaid for the work, the difference is returned to the contractor by posting:

Dt 62 – Kt 51, 52

The cost of fully completed work, recorded on account 62, is repaid from previously received advances and amounts received from the customer in final settlement in correspondence with the debit of cash accounts.

In the bay. On balance sheet 46, the account is reflected in line 1210 “Inventories,” i.e., costs of work in progress.

Also see “Work in Process: Line on the Balance Sheet.”

Accounting for services provided - a minimum of theory

The event is “Our company buys a service from other companies and pays for it.”

The main task is to decide which accounts to send the amount of the service to and what to call it. This is the second action. And the first action we must answer is the question. Is it possible for a company to buy this service at all?

Can. Any service can be purchased from a company. However, every time a business buys something, it is necessary to think before the end result. For example, like this:

“Whatever a company buys will ultimately fall into the financial result formula. The company is required to pay income tax. Of course, the tax code monitors what an enterprise can and cannot enter into the financial result formula. The Tax Code especially ardently monitors the types of expenses and clearly defines: “Any expense must be justified and have a production necessity. Those. directly influence the ability to conduct business"

What does this give us?

This is a mental filter through which we pass every purchase, especially the purchase of services. In other words, we may have services that can be included in the financial result formula and reduce income taxes. Or there may be services that cannot be included in the formula and reduce taxable income; The company will be able to pay for such services only from its net profit. A clear example of a service that cannot be included in the formula, but will have to be paid for out of net profit, may be the purchase of drinking water for the company’s offices, or payment for employees’ lunches in catering establishments. And why all? Because these are not production costs. They do not directly affect the implementation of activities.

So, we decided that we buy only those services that can be plugged into the financial result formula. The main list of accounting accounts where purchased services are collected is as follows: 20, 23, 25, 26, 44, 91.2

Now we will repeat a little bit of what we already know, just go through the cost accounts and repeat the main ideas.

What about taxes?

Regarding tax accounting of account 46, the balance on it is taken into account when calculating property tax. And VAT on account 46 is reflected indirectly.

Account 46 “Completed stages of unfinished work”

Account 46 “Completed stages of work in progress” is intended to summarize information about stages of work completed in accordance with concluded contracts that have independent significance. This account is used, if necessary, by organizations performing long-term work, the initial and final deadlines for which usually relate to different reporting periods (construction, scientific, design, geological, etc.).

The debit of account 46 “Completed stages of work in progress” takes into account the cost of stages of work completed by the organization, paid for by the customer, accepted in the prescribed manner, in correspondence with account 90 “Sales”. At the same time, the amount of costs for completed and accepted stages of work is written off from the credit of account 20 “Main production” to the debit of account 90 “Sales”. Amounts of funds received from customers in payment for completed and accepted stages are reflected in the debit of cash accounts in correspondence with account 62 “Settlements with buyers and customers”.

Upon completion of all work as a whole, the cost of the stages paid by the customer, recorded on account 46 “Completed stages for work in progress”, is written off to the debit of account 62 “Settlements with buyers and customers”. The cost of fully completed work, recorded on account 62 “Settlements with buyers and customers”, is repaid from previously received advances and amounts received from the customer in final settlement in correspondence with the debit of cash accounts.

Analytical accounting for account 46 “Completed stages of work in progress” is carried out by type of work.

Account 46 “Completed stages of work in progress” corresponds with the accounts:

| by debit | on loan |

| 90 Sales | 62 Settlements with buyers and customers |

Procedure for using the account

Etalon M LLC is a construction contractor. According to the contract, two stages of work must be completed.

The customer, Orbita LLC, signed an acceptance certificate for the work performed for the first stage in the amount of 65 million rubles on September 9, for the second stage - in the amount of 90 million rubles in October.

On July 14, Orbita transferred an advance towards the contract in the amount of 80 million rubles. The remaining amount was transferred to the contractor on October 24.

The accountant of Etalon M LLC reflects these transactions:

| Month | Dt | CT | Operation description | Sum |

| July | 62.2 | Reflection of advance payment from the customer | 80000000 | |

| August | 20 | 10,,69, etc. | Reflection of the contractor's costs for performing work | 48000000 |

| September | 20 | 10,,69, etc. | Reflection of the contractor's costs for performing work | 45000000 |

| 90.1 | Completion of the first stage of work | 65000000 | ||

| 90.2 | 20 | The write-off of the cost of work is reflected | 45000000 | |

| 90.9 | 99 | The financial result from the completion of the first stage is reflected | 20000000 | |

| October | 90.1 | Completion of the second stage of work | 90000000 | |

| 20 | 10,,69, etc. | Reflection of the costs of fulfilling the contract | 38000000 | |

| 90.2 | 20 | Reflection of write-off of the cost of work on the second stage | 38000000 | |

| 90.9 | 99 | The financial result from the completion of the second stage is reflected | 52000000 | |

| 62.1 | Write-off of the cost of work accepted by the customer on the project (65 million + 90 million) | 155000000 | ||

| 62.1 | Reflection of receipt of final payment from the customer | 75000000 |

The financial result must be determined every month. But the profit reflected as a result of these operations is not taken into account when calculating the amount of tax to the budget.

The remaining amount in account 62.1 is closed with the advance received earlier:

| Dt | CT | Operation description | Sum | Document |

| 62.1 | 62.2 | The offset of the advance is reflected | 80000000 | Accounting information |