Owning a business is always associated not only with profit, but also with expenses: to pay hired labor, pay salaries to employees, pay taxes - money is needed for everything. But in addition to these costs, which are still more related to the result of the work, there are those that are associated with the direct process of activity - these are the costs associated with the production and sale of products. What are they, what does the state say about such costs, and is it possible to optimize them in any way?

The legislative framework

Let's start with the fact that costs associated with production and sales are subject primarily to the Tax Code, its Article 253, to be more precise. According to the Tax Code, this group includes costs for:

- Direct production (that is, manufacturing), storage and delivery of goods, as well as the performance of any work and provision of services, as well as the purchase and sale of works and services. That is, if a company produced, for example, a table, then the funds that were spent on its production (from purchasing raw materials to packing it in a box before sending it to a warehouse), renting storage space, transportation (logistics costs are calculated here) - all this considered production and selling expenses. The same group includes the costs of, say, nails that a handyman uses to provide his services.

- Maintaining the proper condition of equipment used in the production process or provision of services. This takes into account maintenance, timely repair work, and modernization if necessary - any costs associated with the tool.

- Development of natural resources - in this case they are considered as part of the tools of labor.

- Scientific and technical progress. Without it, it will be impossible to maintain the equipment in proper condition, as well as provide the most relevant services.

- Insurance. It is simply unreasonable to engage in business activities without ensuring the safety of not only employees, but also the safety of equipment. It is better to minimize all possible risks by insuring both human and technical resources.

- Other similar costs.

It is obvious that the costs associated with production and sales are divided into many groups. Almost everything that directly or indirectly relates to the provision of a service or the performance of some work, the production of a certain product and its preparation for sale can be classified in this large group. The only question is which particular cost category a particular product or service will fall into. The paradox is that the last mentioned categorization has no effect on taxation.

1. The concept of other expenses associated with production and (or) sales1.1. Legislative definition of other expenses associated with production and (or) sales 1.1.1. General concept of expenses

According to paragraph 1 of Art. 252 of the Tax Code of the Russian Federation, expenses are recognized as justified and documented expenses (and in cases provided for in Article 265 of the Tax Code of the Russian Federation, losses) incurred (incurred) by the taxpayer.

Expenses, depending on their nature, as well as the conditions for implementation and areas of activity of the taxpayer, are divided into expenses associated with production and sales, and non-operating expenses (clause 2 of Article 252 of the Tax Code of the Russian Federation).

1.1.2.

The concept of other expenses According to subparagraph 6 of paragraph 1 of Art. 253 of the Tax Code of the Russian Federation, costs associated with production and sales include other costs associated with production and (or) sales.

Arbitration courts note that the meaning of the concept of “other expenses associated with production and (or) sales” is disclosed by indicating in Chapter 25 of the Tax Code of the Russian Federation certain types of expenses related to this category of expenses (Resolution of the Federal Antimonopoly Service of the Ural District dated June 7, 2006 No. F09-4680 /06-C7 in case No. A60-37670/05, A60-40330/05).

The list of other expenses associated with production and (or) sales is given in Art. 264 Tax Code of the Russian Federation.

Based on the meaning of paragraph 1 of Art.

264 of the Tax Code of the Russian Federation, expenses incurred by the taxpayer can be classified as other expenses provided they are directly related to production and sales (resolution of the Federal Antimonopoly Service of the East Siberian District dated 04/06/2006 No. A33-9867/05-Ф02-1356/06-С1 in the case No. A33-9867/05). 1.2. The procedure for determining the amount of expenses for production and sales 1.2.1.

General provisions In accordance with paragraph 1 of Art. 318 of the Tax Code of the Russian Federation, if the taxpayer determines income and expenses on an accrual basis, production and sales expenses are determined taking into account the provisions of this article of the Code.

For the purposes of Chapter 25 of the Tax Code of the Russian Federation, production and sales expenses incurred during the reporting (tax) period are divided:

– for direct expenses;

- for indirect expenses.

Direct costs may include, in particular:

– material costs determined in accordance with subparagraphs 1 and 4 of paragraph 1 of Art. 254 Tax Code of the Russian Federation;

– expenses for remuneration of personnel involved in the production of goods, performance of work, provision of services, as well as the amount of the unified social tax and expenses for compulsory pension insurance aimed at financing the insurance and funded part of the labor pension, accrued on the amount of labor costs;

– the amount of accrued depreciation on fixed assets used in the production of goods, works, and services.

Indirect expenses include all other amounts of expenses, with the exception of non-operating expenses determined in accordance with Art. 265 of the Tax Code of the Russian Federation, which were carried out by the taxpayer during the reporting (tax) period.

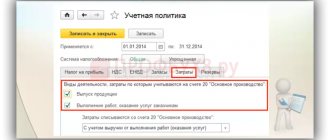

The taxpayer independently determines in the accounting policy for tax purposes a list of direct expenses associated with the production of goods (performance of work, provision of services).

1.2.2.

Approach of arbitration courts According to some arbitration courts, other costs are included in indirect costs. In this case, the amount of indirect costs for production and sales incurred in the reporting (tax) period is fully included in the expenses of the current reporting (tax) period, taking into account the requirements of the Tax Code of the Russian Federation. This point of view is set out in the resolution of the Federal Antimonopoly Service of the North-Western District dated February 12, 2007 in case No. A66-13850/2005.

Similar conclusions were made in the resolution of the Federal Antimonopoly Service of the Ural District dated January 19, 2006 No. F09-6174/05-S7. Thus, the court recognized that the costs of certification of products and services are recognized as other expenses of the organization and are included in indirect costs that are subject to accounting in the reporting period in which they were incurred. Other expenses include expenses for consulting and other similar services.

The Federal Antimonopoly Service of the North-Western District, in a resolution dated 06.06.2007 in case No. A66-4603/2006, indicated that the costs of an energy survey and the preparation of an energy passport are not related to its validity for any period. The above expenses relate to other expenses of the taxpayer due to the provisions of Art. 264 Tax Code of the Russian Federation. According to paragraph 1 of Art. 272 and paragraph 1 of Art. 318 of the Tax Code of the Russian Federation, other expenses are included in indirect expenses. In this case, the amount of indirect costs for production and sales incurred in the reporting (tax) period is fully included in the expenses of the current reporting (tax) period, taking into account the requirements provided for by the Tax Code of the Russian Federation.

In another case, the resolution of the Federal Antimonopoly Service of the North-Western District dated 07/09/2007 in case No. A56-22982/2006 recognized that payments for the right to use a trademark are included in other expenses associated with production and sales, and are fully included in the expenses of the current reporting (tax) period as indirect expenses.

1.2.3.

Position of the Ministry of Finance of Russia In accordance with the letter of the Ministry of Finance of Russia dated October 21, 2005 No. 03-03-02/117, the organization has the right to independently determine the list of direct and indirect expenses, securing this in its accounting policy for tax purposes.

According to the letter of the Ministry of Finance of Russia dated March 2, 2006 No. 03-03-04/1/176, the taxpayer has the right to determine the composition of direct costs associated with production. According to employees of the financial department, the provisions of Art. 318 of the Tax Code of the Russian Federation are aimed at bringing tax accounting closer to accounting, based on which the procedure for attributing production and sales costs incurred during the reporting (tax) period to expenses should be established for tax purposes by analogy with the procedure used by the organization in accounting.

It should be noted that the right of an organization to independently determine the list of expenses simultaneously requires it to justify the decision made so that the organization has the opportunity to take into account the features characteristic of different industries: mining, processing, etc.

At the same time, the Tax Code of the Russian Federation does not contain a direct obligation to provide for direct expenses in the accounting policy for tax purposes, without recognizing all expenses as indirect. At the same time, in paragraph 1 of Art. 319 of the Tax Code of the Russian Federation it is noted that the taxpayer independently determines the procedure for distributing direct expenses for work in progress and products (work performed, services rendered) manufactured in the current month. This provision can be interpreted as a presumption that direct costs must still occur, and they must correspond to the manufactured products.

Employees of the Russian Ministry of Finance believe that the procedure for classifying production and sales costs as expenses for tax purposes should be established by analogy with the procedure applied by the organization for accounting purposes.

Despite the fact that this point of view is the private opinion of the financial department and is not based on a direct requirement of tax legislation, it should be taken into account by taxpayers. 1.2.4.

Accounting rules A systematic interpretation of accounting rules allows us to conclude that when maintaining accounting records, organizations must divide expenses into direct and indirect. The Instructions for the application of the Chart of Accounts for accounting the financial and economic activities of organizations, approved by Order of the Ministry of Finance of Russia dated October 31, 2000 No. 94n, contain the following provisions.

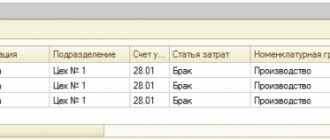

The debit of account 20 “Main production” reflects direct costs associated directly with the production of products, performance of work and provision of services, costs of auxiliary production, indirect costs associated with the management and maintenance of the main production, and losses from defects. Direct expenses are written off to the debit of account 20 from the credit of inventories accounts, settlements with employees for wages, etc.; expenses of auxiliary productions - from the credit of account 23 “Auxiliary productions”; indirect expenses - from accounts 25 “General production expenses” and 26 “General expenses”.

Within the meaning of the above provision, direct costs should include the costs of purchasing inventory and labor costs. It should be noted that these same types of expenses are also contained in the approximate list of direct expenses for tax purposes (Article 318 of the Tax Code of the Russian Federation). Indirect costs should include costs associated with the management and maintenance of production.

The Russian Ministry of Finance holds a similar opinion on this issue, noting in letter No. 07-05-06/294 dated November 8, 2005, that in accordance with the Accounting Regulations “Organization Expenses” PBU 10/99, approved by order of the Russian Ministry of Finance dated May 6, 1999 No. 33n, accounting organizes the accounting of expenses by cost items, the list of which is established by the organization independently.

So, the content of the concept of “direct expenses” in accounting is similar to the concept of “direct expenses” contained in Chapter 25 of the Tax Code of the Russian Federation.

Therefore, we can conclude that the procedure for allocating costs into direct and indirect should primarily be determined by the specifics of the organization’s activities. In addition, as a basis for classifying costs, they can be used as a list of direct costs, which is contained in Art. 318 of the Tax Code of the Russian Federation, and the list provided for reflecting expenses in accounting. 1.3. Basic requirements for expenses 1.3.1.

General provisions In paragraph 1 of Art. 252 of the Tax Code of the Russian Federation establishes three conditions necessary for including incurred costs in the composition of expenses taken into account when taxing profits:

– expenses must be justified;

– expenses must be documented;

– expenses must be incurred to carry out activities aimed at generating income.

1.3.2.

What expenses are recognized as economically justified As practice shows, one of the claims of the tax authorities is the reproach addressed to the taxpayer during a tax audit that the organization’s expenses are economically unjustified. In order to ensure the legality of such a claim, the taxpayer must have a clear understanding of what costs are considered justified from the point of view of tax law.

The concept of economic justification of costs.

Tax legislation requires that the organization's expenses be justified (clause 1 of Article 252 of the Tax Code of the Russian Federation). Otherwise, they cannot be taken into account when taxing profits (clause 49, article 270 of the Tax Code of the Russian Federation).

In this case, justified expenses are understood as economically justified expenses, the assessment of which is expressed in monetary form. It should be noted that the concept of “economic justification of costs” is not given in any act of the current legislation of the Russian Federation. The legislation on taxes and fees also does not contain explanations of this concept for tax purposes.

Therefore, the concept of “economic justification of expenses” is an evaluative category, which means that if doubt arises about the justification of expenses incurred, the tax authority must prove this circumstance [1]. Currently, three options are emerging for the interpretation of this term by arbitration courts, which are based on the following criteria:

– connection with activities aimed at generating income;

– production feasibility;

– compliance of prices paid for services with market levels.

In most cases, arbitration courts understand by economic justification the direction of the expenses incurred to generate income. This is confirmed by the decisions of the FAS of the North-Western District dated 08/02/2004 in case No. A56-1475/04, the FAS of the East Siberian District dated 10/06/2004 in case No. A19-2575/04-33-F02-4074/04-S1.

Economic justification for expenses that is not related to the actual receipt of income.

We emphasize that the economic justification of the expenses incurred by the taxpayer is determined not by the actual receipt of income in a particular tax period, but by the focus of such expenses on generating income [2].

A similar approach to resolving the issue under consideration can be seen in the resolution of the FAS Volga District dated July 10, 2007 in case No. A06-5861/2006-13, as well as in the resolution of the FAS Northwestern District dated April 10, 2006 in case No. A56-33381/2005.

According to the courts, the absence of an economic effect in the form of receiving additional profit associated with the sale of products does not prove that the expenses incurred are not economically justified (resolution of the Federal Antimonopoly Service of the Volga District dated May 17, 2007 in case No. A12-12334/06).

In particular, the organization has the right to take into account expenses under contracts related to the promotion and sale of products, even if they did not lead to an increase in its revenue (Resolution of the Federal Antimonopoly Service of the Moscow District dated October 24, 2005 No. KA-A40/10143-05).

Accounting for expenses.

The economic justification of costs can characterize a quantitative assessment of the costs incurred, that is, determine how reasonable and necessary the amount of costs incurred was from the point of view of market prices. This, in particular, is the basis of the Federal Antimonopoly Service of the Moscow District in its resolution dated July 6, 2005 in case No. A72-6211/04-8/585. As judicial practice shows, in order to recognize costs as unjustified, it is necessary to evaluate their size in relation to the costs of other persons in comparable circumstances (resolution of the Federal Antimonopoly Service of the Moscow District dated July 28, 2005 in case No. KA-A40/6950-05).

For example, a significant amount of expenses allocated by an organization to pay for services may raise doubts among the tax authority about the economic justification of the expenses incurred by the taxpayer.

At the same time, judicial practice knows of cases where the arbitration court has recognized very significant sums of money aimed at paying for the services of lawyers as economically justified. Thus, in a resolution dated August 30, 2005 in case No. A56-2639/2005, the FAS Court of the North-Western District allowed the organization to write off as expenses in tax accounting the costs of paying for the services of law firms in the amount of 1,262,588 rubles. At the same time, the above expenses accounted for a significant share of the organization’s expenses - 38% of the total expenses.

Justification of expenses and availability of employees.

Tax authorities often make claims against those organizations that, having qualified specialists in a certain field of knowledge on their staff, turn to the services of other companies.

For example, the economic feasibility of paying for legal services largely depends on whether the organization has its own legal advisers. Thus, if the organization’s staffing table provides for the position of a legal adviser and his functional responsibilities include representing the organization’s interests in arbitration courts, then the tax authority may doubt the economic feasibility of attracting lawyers to perform the work of the organization’s in-house legal adviser [3].

However, the fact that an organization has in-house legal counsel does not mean that it cannot use other legal counsel.

Thus, the Ministry of Finance of Russia, in letter No. 04-02-05/3/42 dated May 31, 2004, indicated that if there is a lawyer position in the staffing table, the issue of recognizing the costs of lawyers’ services for profit tax purposes should be considered in each individual situation. In this case, taxpayers must take into account the provisions of paragraph 5 of Art. 252 of the Tax Code of the Russian Federation regarding the re-inclusion of expenses into the taxable base for income tax, as well as the range of responsibilities assigned to the organization’s lawyer, the scope of work performed.

Meanwhile, even if the organization has a lawyer on staff, expenses for legal services can be included in the reduction of taxable profit if the functions performed by a third-party lawyer duplicate the duties corresponding to the position of a lawyer in this organization, for example, due to a high level of specialization. This can be confirmed by the resolution of the Federal Antimonopoly Service of the Moscow District dated July 14-18, 2005 in case No. KA-A40/6315-05.

The resolution of the Federal Antimonopoly Service of the Moscow District dated April 20, 2005 No. KA-A40/2944-05 emphasizes that the costs of marketing research under contracts with third-party organizations can be taken into account for profit tax purposes not only if the taxpayer does not have relevant employees on its staff .

At the same time, it is important, according to the resolution of the Federal Antimonopoly Service of the Volga Region dated July 31, 2007 in case No. A55-16334/2006, that the functions performed by the organization’s marketing service do not duplicate the responsibilities of performers under contracts for the provision of consulting and marketing services.

Position of the Constitutional Court of the Russian Federation.

The ruling of the Constitutional Court of the Russian Federation dated June 4, 2007 No. 320-O-P emphasizes that the taxpayer’s expenses must be economically justified.

According to the Court, the legislator justifiably abandoned the closed list of specific expenses of the taxpayer that can be taken into account when calculating the tax base, bearing in mind the diversity of content and forms of economic activity and types of possible expenses, which, if they were detailed and comprehensively established by law, would lead to a limitation of rights taxpayer.

Thus, taxpayers are given the opportunity to independently determine in each specific case, based on the actual circumstances and characteristics of their financial and economic activities, whether certain costs not listed in Chapter 25 of the Tax Code of the Russian Federation are classified as expenses for tax purposes or not.

At the same time, tax legislation does not use the concept of economic feasibility and does not regulate the procedure and conditions for conducting financial and economic activities, and therefore the validity of expenses that reduce income received for tax purposes cannot be assessed from the point of view of their feasibility, rationality, efficiency or the result obtained.

Due to the principle of freedom of economic activity, the taxpayer carries out this activity independently at his own risk and has the right to independently and solely assess its effectiveness and expediency.

The duty of tax inspectors to prove the unreasonableness of expenses.

The burden of proving the unreasonableness of the taxpayer's expenses rests with the tax authorities. This was directly indicated by the Constitutional Court of the Russian Federation in its ruling dated June 4, 2007 No. 320-O-P. The Ministry of Finance of Russia also agrees with this (letter dated December 12, 2007 No. 03-03-06/1/851).

Thus, if the tax authority has doubts about the economic justification of the organization’s expenses, it is he who must prove the unreasonableness of the organization’s expenses.

At the same time, employees of the organization must actively participate in the tax dispute, providing the court with the necessary evidence to support their position. 1.3.3.

The need for documentary evidence of expenses Provisions of tax legislation.

According to paragraph 1 of Art. 252 of the Tax Code of the Russian Federation, documented expenses mean expenses confirmed by the following documents:

– documents drawn up in accordance with the legislation of the Russian Federation;

– documents drawn up in accordance with business customs applied in the foreign country in whose territory the relevant expenses were incurred;

– documents indirectly confirming expenses incurred (including a customs declaration, business trip order, travel documents, report on work performed in accordance with the contract).

Norms of legislation on accounting.

All business operations of the organization must comply with the requirements of Art. 9 of the Federal Law of November 21, 1996 No. 129-FZ “On Accounting” (hereinafter referred to as the Law on Accounting), which was drawn to the attention of organizations in the letter of the Federal Tax Service of Russia dated September 5, 2005 No. 02-1-07/81 “On confirmation of economic transactions with primary accounting documents."

According to Art. 9 of the Accounting Law, all business transactions carried out by an organization must be documented with supporting documents, which serve as primary accounting documents for accounting.

Primary accounting documents are accepted for accounting if they are drawn up in the form contained in the albums of unified forms of primary accounting documentation, and documents whose form is not provided for in these albums must contain the following mandatory details:

- Title of the document;

– date of document preparation;

– name of the organization on whose behalf the document was drawn up;

– content of the business transaction;

– measuring business transactions in physical and monetary terms;

– names of positions of persons responsible for carrying out a business transaction and the correctness of its execution;

– personal signatures of these persons.

Position of arbitration courts.

Arbitration courts in their decisions indicate that documented expenses mean expenses supported by documents drawn up in accordance with the legislation of the Russian Federation (resolution of the Federal Antimonopoly Service of the Volga District dated 06/07/2007 in case No. A55-17126/06).

At the same time, expenses can be confirmed not only by documents drawn up in accordance with the legislation of the Russian Federation, but also by other alternative methods.

Based on this, the FAS of the West Siberian District, in resolution dated December 11, 2007 No. F04-8408/2007 (40770-A81-41) in case No. A81-2115/2007, recognized the organization’s expenses as documented based on advance reports and invoices. From these documents it followed that the expenses for hotel accommodation were made on the territory of Germany, and the payment of the visa fee was made on the territory of the embassy of this state. 1.3.4.

The connection between expenses and activities aimed at generating income. Norms of legislation on taxes and fees.

According to paragraph 1 of Art. 252 of the Tax Code of the Russian Federation, any expenses are recognized as expenses, provided that they are incurred to carry out activities aimed at generating income. In accordance with Art. 41 of the Tax Code of the Russian Federation, income is considered to be an economic benefit in cash or in kind, taken into account if it is possible to evaluate it and to the extent that such benefit can be assessed, and determined in accordance with Chapters 23, 25 of the Tax Code of the Russian Federation.

According to the letter of the Federal Tax Service of Russia for Moscow dated July 11, 2007 No. 20-12/067498 on the basis of clause 1 of Art. 252 of the Tax Code of the Russian Federation, expenses in the form of interest on loans received can be taken into account when calculating taxable profit only if the borrowed funds are intended for use in activities aimed at generating income.

Analysis of judicial practice.

In the decisions of the Federal Antimonopoly Service of the West Siberian District dated December 12, 2007 No. F04-8399/2007 (40777-A46-37) in case No. A46-9795/2006, the Federal Antimonopoly Service of the Far Eastern District dated September 7, 2007, August 31, 2007 No. F03-A59/07 -2/3303 in case No. A59-6100/2005-C24 it is emphasized that any expenses are recognized as expenses if they are incurred to carry out activities aimed at making a profit.

According to the FAS of the Volga District, expressed in the resolution of November 23, 2005 in case No. A06-3590U-4/04NR, the legislator does not make the recognition of costs as appropriate dependent on the fact that the taxpayer receives profit (income), since in reality the final result of the activity may be unprofitable. An indispensable condition for accepting certain costs is their focus on generating income.

According to the resolution of the Federal Antimonopoly Service of the North-Western District dated November 8, 2007 in case No. A05-4024/2007, the validity of expenses taken into account when calculating the tax base must be assessed taking into account circumstances indicating the taxpayer’s intentions to obtain an economic effect as a result of real business or other economic activity. In this case, we are talking specifically about the intentions and goals (direction) of this activity, and not about its result.

The Plenum of the Supreme Arbitration Court of the Russian Federation in paragraph 9 of Resolution No. 53 dated October 12, 2006 “On the assessment by arbitration courts of the validity of a taxpayer receiving a tax benefit” indicated the following. The court's determination of the presence of reasonable economic or other reasons (business purpose) in the taxpayer's actions is carried out taking into account the assessment of circumstances indicating his intentions to obtain an economic effect as a result of real business or other economic activity.

Thus, according to the resolution of the Federal Antimonopoly Service of the Far Eastern District dated October 09, 2007 No. F03-A04/07-2/3828 in case No. A04-8150/2006-9/778, Chapter 25 of the Tax Code of the Russian Federation regulates the taxation of profits of organizations and establishes for these purposes a certain correlation of income and expenses and the connection of the latter specifically with the organization’s profit-making activities.

Illegal cost accounting.

If an organization's expenses are not related to business activities, then they are not reflected in tax accounting.

Thus, in one of the disputes, the court found that payments made by a public association to individuals under civil contracts (for services provided in organizing a working meeting and payment for editing a newspaper) were made within the framework of a working meeting of environmental non-governmental organizations of the Republic of Karelia held by the taxpayer, payment there was no fee for participation, and the Karelian environmental newspaper “Green Leaf” was distributed free of charge. These payments were related to the non-entrepreneurial statutory activities of the association, “aimed at achieving harmony between society and nature, preserving and restoring the natural and cultural environment, and the spiritual world of man,” that is, activities not aimed at generating income.

Consequently, the court recognized that the payments made by the association could not be attributed to expenses taken into account for the purposes of calculating and paying income tax (Resolution of the Federal Antimonopoly Service of the North-Western District dated December 20, 2004 No. A26-4048/04-210).

In the letter of the Ministry of Finance of Russia dated May 23, 2007 No. 03-03-06/4/68, the following situation was analyzed. A non-profit organization (charitable foundation) purchased a car in 2003 to carry out its statutory activities. In 2006, the organization sold this car at a price lower than its purchase price. The proceeds from the sale of the car were used to carry out the statutory activities of the organization. In this regard, the question arose: are losses from the sale of this car taken into account when calculating income tax?

Since the car was operated in the course of carrying out the statutory activities of a non-profit charitable foundation, which was not aimed at generating income, the losses from the sale of this car, in the opinion of the financial department, did not meet the criteria of paragraph 1 of Art. 252 of the Tax Code of the Russian Federation and, accordingly, were not taken into account for profit tax purposes.

The Russian Ministry of Finance emphasizes that one of the main criteria for accepting expenses for profit tax purposes is their focus on generating income.

In connection with the above, in the opinion of the Ministry of Finance of Russia, expressed in letter No. 03-03-06/1/311 dated May 25, 2007, expenses aimed at purchasing stands and pots for indoor plants, which are intended for office interior decoration, are not expenses related to the activities of the organization. Therefore, such expenses cannot be taken into account for profit tax purposes, since they do not meet the basic criteria established by paragraph 1 of Art. 252 of the Tax Code of the Russian Federation.

Table of contents

Components

In addition, it is worth noting that the costs associated with production and sales consist of costs for:

- Material part of production or provision of services. Here we are talking about all the resources used in the process of manufacturing a certain product or fulfilling one’s obligations related to a service. These costs can be divided into two subgroups: direct and distributed. Direct costs associated with production and sales go towards providing only one type of service or producing a single type of goods; their costs are fixed by measurements (it is known in advance how much of a particular resource will be needed to provide a certain service or produce a product). Distributed costs are associated with the participation of a resource in the manufacture of several types of products, and they are accounted for by distributing their cost to all goods in the production of which they were used. For example, if a company is engaged in the production of furniture, then the use of granite is not very typical for it; it will only be used in the manufacture of one model, that is, it will be a direct expense. As for wood, it is used for almost the entire range of products, that is, it will be recorded as an allocated expense.

- Remuneration. Here, the salaries of production workers, as well as payments of incentives and social support are taken into account. This also includes remuneration for freelancers whose services the company uses irregularly (invited economists, if the company cannot afford its own, or designers, if they are usually not needed).

- Amounts of accrued depreciation. Many entrepreneurs like to play with this point. Depreciation expenses cover the costs of maintaining equipment (most often) in a condition suitable for further production. Typically, a certain amount, which in the future will be invested in the modernization of equipment, its repair and other work with it, is distributed over a certain period of time. Monthly depreciation costs are built into the price of the product, so the buyer pays for it when purchasing the product. The trick is that when the depreciation period decreases, the amount of monthly costs for it will increase (the total costs will remain the same, but they will increase if they are divided into a shorter period of time), that is, the manufacturer will receive more profit in a shorter period of time.

Certification

Situation: is it possible to take into account the costs of voluntary certification of products when calculating income tax?

Yes, you can.

The costs of carrying out both voluntary and mandatory certification of products are included in other expenses (subclause 2, clause 1, article 264 of the Tax Code of the Russian Federation). A similar point of view is reflected in the letter of the Ministry of Finance of Russia dated March 18, 2013 No. 03-03-06/1/8186.

In this case, the organization must carry out the examination in the manner prescribed by Law of December 27, 2002 No. 184-FZ. Certification is carried out to confirm the compliance of products, production processes, operation, storage, transportation and sales with technical regulations and standards. In addition, certification is needed to increase the competitiveness of manufactured products (Article 18 of the Law of December 27, 2002 No. 184-FZ). In this case, an agreement is concluded between the organization and the certification body (Article 21 of the Law of December 27, 2002 No. 184-FZ).

The costs of certification are indirect. Therefore, when calculating income tax, they should be recognized at a time in the reporting (tax) period in which the date of receipt of the certificate falls. Such clarifications are contained in the letter of the Ministry of Finance of Russia dated March 28, 2014 No. 03-03-RZ/13719. The provisions of the letter allow us to conclude that the one-time method of recognizing expenses is always applied - regardless of the period for which the certificate was issued to the organization.

It should be noted that previously the financial department took a different position. Letters from the Ministry of Finance of Russia dated March 18, 2013 No. 03-03-06/1/8186 and dated May 25, 2011 No. 03-03-06/1/307 stated that costs associated with certification should be recognized evenly during the validity period of the certificate. Representatives of the Russian Ministry of Finance substantiated this point of view with the provisions of paragraph 1 of Article 272 of the Tax Code of the Russian Federation. However, with the release of the letter of the Ministry of Finance of Russia dated March 28, 2014 No. 03-03-RZ/13719, the previous clarifications seem irrelevant.

Arbitration practice on this issue is heterogeneous. There are examples of court decisions in favor of an even distribution of expenses during the validity period of the certificate (see, for example, decisions of the Federal Antimonopoly Service of the North-Western District dated March 22, 2006 No. A56-14268/2005 and the Volga District dated July 26, 2005 No. A72- 6739/04-7/50). However, recently, judges are increasingly recognizing the legitimacy of a one-time write-off of certification costs. In particular, this position is reflected in the ruling of the Supreme Arbitration Court of the Russian Federation dated February 19, 2009 No. VAS-15494/08, resolutions of the Federal Antimonopoly Service of the Central District dated February 15, 2012 No. A35-1939/2010, and the Volga District dated July 18, 2011 No. A65 -20361/2010, Ural District dated August 4, 2008 No. F09-3096/08-S3, dated January 19, 2006 No. F09-6174/05-S7. The judges note that certification agreements are not conditional on the receipt of income over several periods. This means that the provisions of paragraph 3 of paragraph 1 of Article 272 of the Tax Code of the Russian Federation are not applicable in such situations. The costs of obtaining a certificate are recognized as indirect and in full amount relate to the expenses of the current period (clause 2 of Article 318 of the Tax Code of the Russian Federation). Taking into account the emerging arbitration practice, organizations that write off such costs at a time have a high chance of defending their position in court.

In any case, the costs of voluntary certification of products must be economically justified and documented (clause 1 of Article 252 of the Tax Code of the Russian Federation).

An example of how expenses for certification are reflected in accounting and taxation

In September 2015, Alpha LLC conducted voluntary certification. The goal is to increase the competitiveness of manufactured products.

The certificate is valid from September 1, 2015 to August 31, 2016.

The costs of certification amounted to 17,700 rubles. (including VAT - 2700 rubles).

The cost of finished products submitted for certification as a sample is 2000 rubles.

In accounting, costs for product certification are classified as expenses for ordinary activities (clause 5 of PBU 10/99) and are recognized evenly over the validity period of the certificate.

Alpha's accountant made the following entries in the accounting records:

Debit 60 Credit 51 – 17,700 rub. – paid for work on voluntary certification of products;

Debit 97 Credit 60 – 15,000 rub. (17,700 rubles – 2,700 rubles) – the cost of work on product certification is reflected as part of deferred expenses;

Debit 19 Credit 60 – 2700 rub. – VAT on expenses for voluntary certification of products is taken into account;

Debit 97 Credit 43 – 2000 rub. – the cost of product samples submitted for examination has been written off;

Debit 68 subaccount “Calculations for VAT” Credit 19 – 2700 rub. – accepted for VAT deduction.

Every month from September 2015 to August 31, 2021, the organization’s accountant makes the following entries:

Debit 20 Credit 97 – 1417 rub. ((RUB 15,000 + RUB 2,000): 12 months) – costs for voluntary product certification are written off.

In tax accounting, the accountant took into account the costs of certification at a time in September. Therefore, a temporary taxable difference arose, with which the accountant calculated the deferred tax liability:

Debit 68 subaccount “Calculations for income tax” Credit 77 – 3117 rub. ((RUB 17,000 – RUB 1,417) × 20%) – deferred tax liability from the difference between certification costs reflected in accounting and tax accounting is taken into account.

Situation: is it possible to take into account the costs of additional certification of goods purchased for resale when calculating income tax? The products are certified by the manufacturer.

No you can not.

When calculating profit tax, an organization has the right to take into account the costs of carrying out mandatory or voluntary certification of products and services (subclause 2, clause 1, article 264 of the Tax Code of the Russian Federation). According to the Russian Ministry of Finance, this norm applies only to those types of products (services) that the organization produces (provides) independently. Consequently, an organization has no reason to include in expenses that reduce taxable profit the costs of certification of products produced by other organizations and purchased for resale.

The Russian Ministry of Finance adheres to this point of view in letter dated May 25, 2006 No. 03-03-04/4/96.

Advice : there are arguments that allow you to take into account the costs of additional certification of goods purchased for resale when calculating income tax. They are as follows.

When calculating income tax, an organization has the right to take into account any economically justified expenses that are documented and related to activities aimed at generating income. This follows from the provisions of paragraph 1 of Article 252 of the Tax Code of the Russian Federation.

The organization has the right to conduct voluntary certification for:

- confirmation of compliance of goods sold with technical regulations and standards;

- assisting customers in competent selection of goods;

- creating conditions to ensure the free movement of goods across the territory of Russia, as well as for the implementation of international economic, scientific and technical cooperation and international trade.

This follows from the provisions of Article 18 and paragraph 2 of Article 20 of the Law of December 27, 2002 No. 184-FZ.

Carrying out additional voluntary certification increases the competitiveness of goods, promotes their promotion on the market and ultimately allows the organization to increase its profitability. In addition, if additional certification is provided for in an agreement between the seller and the buyer, then the presence of such a certificate is a prerequisite for the sale of goods. Since the sale of goods is impossible without additional certification, the costs of its implementation are considered economically justified. If these expenses are documented, they are included in the calculation of the tax base for income tax (clause 1 of Article 252 of the Tax Code of the Russian Federation). In the situation under consideration, the organization can take into account the costs of additional certification on the basis of subclause 49 of clause 1 of Article 264 of the Tax Code of the Russian Federation as other costs associated with production and sales (the list of such costs is open).

In arbitration practice, there are examples of court decisions in which it is recognized as legitimate to reduce taxable profit by the amount of expenses for additional certification of purchased goods (see, for example, the resolution of the Federal Antimonopoly Service of the Moscow District dated September 30, 2009 No. KA-A40/9717-09). At the same time, in the decision, the judges noted that the effect of subparagraph 2 of paragraph 1 of Article 264 of the Tax Code of the Russian Federation applies not only to goods of own production. That is, the costs of additional certification of purchased goods can be taken into account in the same manner as the costs of voluntary certification of products (services).

Situation: is it possible to take into account the costs of certification of the quality management system when calculating income tax?

Yes, you can.

The tax base for income tax is reduced by any economically justified and documented expenses that are associated with activities aimed at generating income (clause 1 of Article 252 of the Tax Code of the Russian Federation).

The quality management system certification procedure consists of confirming the compliance of certain objects (products, works, services, technological processes) with the requirements of technical regulations, the provisions of standards or the terms of contracts. The purpose of certification is to increase the competitiveness of products in the Russian and foreign markets, to create conditions for the free movement of goods, as well as for international cooperation and foreign trade. According to GOST R ISO 9001-2001 (ISO 9001:2000), the requirements for the quality management system are complementary to the requirements for product certification. It follows from this that certification of quality management systems is included in the general system of activities for product certification.

The certification procedure is regulated by the Law of December 27, 2002 No. 184-FZ. Moreover, it does not follow from Article 18 of this law that its norms do not apply to certification of the quality management system. Thus, if certification was carried out in accordance with Law No. 184-FZ of December 27, 2002, and the costs associated with it meet the criteria of Article 252 of the Tax Code of the Russian Federation, they can be taken into account when calculating income tax (subclause 2, 49 p. 1 Article 264 of the Tax Code of the Russian Federation).

Similar explanations are contained in letters of the Ministry of Finance of Russia dated September 4, 2013 No. 03-03-06/1/36419, Federal Tax Service of Russia dated June 27, 2006 No. 02-1-08/123. The legality of this approach is confirmed by arbitration practice (see, for example, decisions of the FAS of the West Siberian District dated June 24, 2009 No. F04-3764/2009(9413-A27-40), Northwestern District dated February 12, 2007 No. A66 -13850/2005 and the Ural District dated July 16, 2008 No. Ф09-5057/08-С3, dated January 19, 2006 No. Ф09-6174/05-С7).

other expenses

The above lists included other costs associated with production and sales. What is meant by them?

According to the Tax Code, this group includes taxes and fees that are levied on manufactured goods or services provided, as well as customs duties that exporters or importers of goods are forced to pay. Separately, it is worth noting that the law does not oblige entrepreneurs to include sales and production costs in the total amount of expenses, which will then be subject to taxes. Paying tax on them is a right, but not an obligation, so some entrepreneurs prefer to record such investments only in their own accounting departments, without informing the tax authorities about them. It is worth noting that with some effort, even these expenses can be attributed to income taxes, which will allow you to pay a much smaller amount for them.

Attention! Creation of working conditions

But not all costs escape the undue attention of tax authorities. There is a unique list of expenses that “controllers” check with special care.

Among them, for example, are the costs of good working conditions. They are usually not included in the income tax and are paid separately, which is completely unprofitable for the enterprise. True, it is possible to convince tax inspectors that such care for employees is not a whim of management, but a production necessity, thereby transferring other costs associated with production and sales into the category of taxable income.

For example, a company decided that its employees should eat in their own canteen rather than go to nearby cafes. Equipping the appropriate premises, purchasing furniture, hiring additional staff - all this has already required investment, and taxes have not yet been paid! In order for the company to prove that the canteen is a necessity, and therefore falls under income tax, the following arguments can be used:

- By law, an employer is required to provide its employees with a place to eat.

- If there are no public catering establishments near the place of work, then your own canteen is necessary to provide for the everyday needs of employees (the obligation of the latter is enshrined in the Labor Code).

And if a company decides to purchase air conditioners for its employees, you can put pressure on the fact that, according to sanitary standards, there are certain requirements for temperatures inside the workroom, for which an air conditioner is necessary. As for coolers in work areas, they will become a production necessity if tap water is not drinkable, and this must be confirmed by appropriate special documentation. Accounting for costs associated with production and sales may also be affected by the costs of rest rooms for employees, necessary to ensure the sanitary and household needs of workers; this type of expense is especially relevant for enterprises where there are several work shifts or there is an irregular work schedule, that is where the employee may even have a physical need to rest properly.

That is, in order to include some costs that, at first glance, are in no way related to the production of goods or the provision of services, in this list, it is enough to find suitable items in the sanitary rules or the Labor Code, and in addition, stock up on documents confirming the truth (for example, acts on the state of the occupied office). Theoretically, it is possible to prove the legality of claims without additional papers, but still, documentary evidence looks much more impressive than the words of neighbors and acquaintances.

Expenses of the period: accounting and tax accounting

In the activities of any enterprise there are costs and expenses that are associated with its operating activities.

Costs are a monetary assessment of the cost of material, labor, financial, natural, information and other types of resources spent on the production and sale of products over a certain period of time.

Expenses are expenses of a certain period of time, documented, economically justified (justified), which represent a decrease in economic benefits during the reporting period, occurring in the form of disposal or decrease in the value of assets or an increase in liabilities. The result of a decrease in economic benefit is a decrease in capital not associated with its distribution among participants.

Expenses are reflected when calculating the enterprise's profit in the income statement. The concept of “costs” is broader than the concept of “expenses”, but under certain conditions they can coincide.

Period expenses are usually classified into the following main groups:

– sales costs;

- Administrative expenses;

– financial expenses (remuneration expenses).

The significance of these expense groups is that although they are not included in the cost of production, they reduce the amount of taxable income, and therefore the amount of corporate income tax payable to the budget. All these expenses are united by the fact that they cannot be attributed to the cost of a specific type of product, since:

– they are related to the receipt of total annual income as a whole and are an industrial, legal or social necessity;

– some of them relate to costs that are long-term in nature;

– they are not stable in size;

– they pay off over a long period of time.

The variety of types of expenses for a period, unfortunately, leads to the fact that sometimes accounting workers incorrectly group them according to functional characteristics. Some of them are simply perplexed: “What difference does it make whether I allocate these costs to administrative costs, sales costs or financing costs?” Such accountants even include expenses related to the cost of goods, works and services sold as administrative expenses. Let's say frankly that such reasoning and actions can only be explained by a lack of professionalism, since the correct distribution of period expenses according to their functional characteristics affects the adoption of correct management decisions. Thus, a certain type of enterprise expenses may be important for making one type of decision and not even taken into account for another.

It is much easier to manage expense flows when they are correctly distributed according to group characteristics.

At the end of the calendar year, it is necessary to carry out an inventory of the expense items of the period and, based on its results, accordingly draw up accounting policies for the next year.

1. Allocation of costs in a manufacturing plant

All enterprise expenses can be classified according to many different functional characteristics. The largest share in all expenses of the enterprise is occupied by the costs of production, that is, the expenses that make up the cost of production.

The cost of production is all the costs of an enterprise for its production and sale, expressed in monetary form. But in addition to expenses directly or indirectly related to the production process, the enterprise also incurs expenses that are not related to the production of products and, as a rule, are not included in the cost price. Expenses of this type include period expenses.

Period expenses, unlike production costs, do not depend on the volume of production and are semi-fixed expenses not related to specific types of products or services sold. Period expenses are incurred by an enterprise even if it does not produce anything during a certain period.

The types of period expenses at different enterprises are not the same and depend on their specifics, place of formation, source and purpose.

The goal of any business activity is to meet the needs of the solvent population and generate income. At a manufacturing enterprise, this goal is realized in the production and economic process. The production and economic activity of an enterprise consists of individual business operations for the procurement of raw materials, production of finished products, sale to consumers, payment of wages, etc. The business transactions performed differ from each other in content, duration, technical means used in their fulfillment, and for a number of other reasons. However, they are all interconnected and represent components of a single economic process.

For profitable operation of an enterprise, period expenses accompanying business operations require constant monitoring and optimization.

The most typical cost items of the period for manufacturing enterprises are presented in the list:

– remuneration of employees related to administrative personnel;

– remuneration of personnel employed in service industries and farms;

– maintenance of the administrative apparatus of the department, employees serving the structural divisions of the subject, logistics and transport services, including the costs of maintaining official passenger transport and compensation for the use of personal passenger cars for official trips;

– expenses for the maintenance and servicing of technical controls, communication centers, alarm systems, computer centers and other technical controls not related to production (depreciation of fixed assets for general economic purposes; expenses for the maintenance and ongoing repairs of buildings, structures and equipment for general economic purposes);

– costs of preparatory work in the extractive industries, if they do not relate to capital costs (that is, they are not capitalized as fixed assets);

- maintenance of the directorate of the entity under construction, and in the absence of a directorate - a technical supervision group, as well as costs associated with the acceptance of new organizations and facilities into operation;

– expenses for eliminating deficiencies in design, construction and installation work, damage and deformations received during transportation of inventories to the main warehouse; costs of inspection (disassembly of equipment) caused by defects and other costs;

– costs of creating and improving administrative management systems and tools;

– payment for bank services;

– payment for services provided by third-party organizations for general economic management, in cases where the subject’s staffing table does not provide for certain functional services;

– travel expenses for administrative personnel of the department;

– office, printing, postal, telegraph and telephone expenses;

– entertainment expenses;

– expenses for maintaining service industries and farms (free provision of premises, payment of utility costs, etc.);

– expenses for organized recruitment of labor, personnel training, compensation for dismissal of employees, commission expenses;

– expenses for renting fixed assets for general purposes;

taxes, fees;

– utility costs; labor protection of workers; security of the subject, fire protection; expenses for carrying out recreational activities; for the maintenance of the board of directors and other general business expenses;

– excess losses, damage and shortages of inventories in warehouses and other unproductive expenses and losses;

– additional payments up to average earnings in case of temporary disability;

– one-time payments to non-production employees (management staff, etc.) related to length of service at the enterprise, in accordance with current legislation;

– payment for consulting (audit) and information services;

– expenses for the maintenance of healthcare facilities, preschool institutions, health camps, cultural and sports facilities, housing facilities;

– payments to employees released from organizations due to their reorganization, reduction in the number of employees and staff, when the employee is called up for military service;

- legal costs;

– awarded or recognized fines, penalties, penalties and other types of sanctions for violation of the terms of business contracts;

– losses from theft, the perpetrators of which have not been identified, or if it is impossible to reimburse the necessary amounts at the expense of the guilty party, and others.

2. Distribution of expenses at a trade and intermediary enterprise

The goal of a market economy is to make a profit by satisfying the needs of people in accordance with the capabilities of their wallets. That is, the product must not only be produced, but also sold profitably. And therefore in the technological chain:

The most significant place is occupied by the process of selling goods, works and services. This is especially true in modern conditions of overproduction.

A significant part of the costs of selling goods, works and services is borne by organizations engaged in trade, intermediary, commercial and entrepreneurial activities. Manufacturing enterprises incur such costs to a lesser extent compared to trading enterprises.

Sales of finished products (goods, works, services) is the process of transferring ownership rights to sold products on a paid or gratuitous basis. At the same time, the sale of products means not only the sale of manufactured goods that have a natural material form, but also the performance of work and the provision of services.

The agreement between the supplier and the product distributor defines the terms of delivery, in accordance with which the responsibilities of the parties and the composition of the costs associated with the delivery of products are distributed. These costs are included either in the costs of sales from the supplier, or in the costs associated with the sale of products and their promotion from the distributor.

Sales costs may also be associated with advertising and marketing research.

Sales costs include:

– costs of containers and packaging of products in finished product warehouses (packaging paper, wood, twine);

– transportation costs for the sale of products, incurred at the expense of the supplier, in accordance with the terms of the supply agreement (loading, delivery, unloading);

– payment for services for customs clearance, insurance, paramilitary security;

– commission fees (deductions) paid to sales and other intermediary enterprises;

– costs of maintaining premises for storing products at places of sale;

– advertising expenses;

– travel expenses associated with product promotion;

– other expenses similar in purpose.

3. Sales costs

3.1. Costs for containers and packaging

Costs for containers are included in sales costs in cases where packaging and packaging of finished products is carried out after they are delivered to the warehouse. If packaging is carried out in the workshops of a manufacturing enterprise before the finished product is delivered to the warehouse, then the cost of packaging is included in the production cost of the product.

In large supermarkets, groceries (flour, sugar, candies, cereals) are often packaged and packaged into containers that are more convenient for customers. These expenses of trading enterprises are classified as period expenses.

Containers and packaging are accounted for on a separate account from goods and finished products. In the current standard chart of accounts, there is no separate account in inventories for accounting for containers and packaging. However, if the costs of packaging and containers at the enterprise are significant, then on the synthetic account 1310 you can create a separate sub-account to account for such containers. For example, you can create a subaccount 1314 “Container and packaging”.

3.2. Fare

As a rule, transportation costs occupy a significant share in the group of sales costs. They depend on the terms of delivery specified in the contract. The most common types of transport delivery conditions are:

– ex-warehouse of the supplier, when all costs associated with shipment are included in the payment request by the supplier organization (cost of loading and unloading operations at the warehouse, at the railway station, transportation cost and railway tariff);

– free departure station – the supplier includes in the invoice (payment request) the costs of delivery to the departure station and the cost of loading products into wagons;

– free carriage – destination station – the supplier includes in the invoice (payment request) the costs of shipment and the amount of the railway tariff to the destination station;

– buyer’s ex-warehouse – in addition to the above costs, the supplier pays for unloading and loading work at the buyer’s station, at his warehouse and the cost of transportation to his warehouse, and others;

– free airport (FOB airport) – basic delivery conditions under which the supplier is responsible for the goods until they are delivered to the airport. The air carriage contract is concluded at the expense of the buyer;

– ex-works (EXW-ex works) – basic delivery conditions under which the goods are transferred to the buyer’s disposal already at the supplier’s enterprise or warehouse. The buyer is responsible for loading and further until delivery of the goods to the destination.

If the parties to the contract have determined the moment of transfer of ownership rights, then the recognition of delivery costs depends on this condition.

Delivery is the delivery of the goods to the purchaser, handing them over to the carrier for shipment to the purchaser. In this case, the transfer of a bill of lading or other shipping document is equivalent to the transfer of goods: the fact of transfer of goods to the seller directly, through an intermediary or through a carrier is recorded by shipping documents. The place of transfer of goods is also determined by the terms of the concluded agreement. Thus, the costs incurred by the supplier of the product until the transfer of ownership will be included in its distribution costs.

What expenses of the enterprise will be included in sales expenses? This issue is currently relevant in Kazakhstan, since when preparing some tax forms (for example, Form 328.00), it is required to show the cost of transportation costs separately from the cost of the goods.

Let's consider a small example of accounting for transport costs incurred by an enterprise that manufactures a product.

Example

Juice LLP, under a contract for the supply of finished products, sends its driver on a business trip. Transportation of cargo is carried out along the route Almaty - Karaganda, to the buyer’s warehouse. The driver is given an advance payment of travel expenses in the amount of 80,000 tenge.

When calculating depreciation, the production method is used, based on the mileage of the vehicle in kilometers. In this case, depreciation in the amount of 15 tenge is charged for one kilometer traveled. According to the internal standards of the enterprise, the daily allowance for 1 day during a business trip for employees is 3 MCI (in 2013, 1 MCI = 1,731 tenge). The diesel fuel write-off rate for this type of vehicle is 17 liters per 100 kilometers.

At the enterprise "Juice" LLP, expenses associated with the sale of products, in accordance with the working chart of accounts according to IFRS, are recorded in the accounts of group 7110 "Expenses for the sale of products and provision of services." This account records expenses in the context of each cost item by subconto.

After the driver returned from a business trip, an advance report was drawn up and the following calculations were made:

– the cost of diesel fuel purchased using gas station receipts is 50,000 tenge (500 liters at a price of 100 tenge per 1 liter);

– cost of accommodation for the driver in hotels – 15,000 tenge (three days at a price of 5,000 tenge per day);

– daily allowance for 5 days amounted to 25,965 tenge (3 MCI × 5);

– total mileage readings on the speedometer along this route are 2,600 km;

– fuel and lubricant expenses subject to deduction according to the established standards for this vehicle are 2,600 km / 100 km × 17 l × 100 tenge per liter = 44,200 tenge.

As a result, the overexpenditure of money spent on a business trip by the driver is equal to 10,965 tenge and is subject to reimbursement from the company’s cash desk.

The accounting entries will look like this:

Very often, when on business trips, drivers bring only cash register receipts received when purchasing fuel and lubricants at a gas station. However, there are no invoices confirming the purchase of fuels and lubricants. Many accountants have questions about the legality of deducting the cost of fuel and lubricants from taxable income only on the basis of fiscal receipts.

In accordance with paragraph 5 of Article 644 of the Tax Code, a control receipt is the primary accounting document of a cash register, confirming the fact of a monetary settlement between the seller (supplier of goods, work, services) and the buyer (client). According to many accountants, a fiscal receipt is not a sufficient document to confirm such expenses.

Indeed, the fiscal receipt itself cannot confirm that an enterprise has received fuel and lubricants and spent it in activities aimed at generating income. This means that in addition to the fiscal receipt, it is necessary to draw up documents confirming the receipt of supplies and their expenditure.

To deduct expenses for fuel and lubricants in accounting, the following documents are required: a waybill, an act for writing off fuel and lubricants, receipt invoices, expense invoices and other primary documents.

Enterprises that are VAT payers have the right to offset this tax only if the fuel was used for the purposes of taxable turnover and the fuel and lubricants supplier issued an invoice issued in accordance with the provisions of Article 263 of the Tax Code.

In accordance with paragraph 2 of Article 56 of the Tax Code, tax accounting is based on data from accounting documents.

In accordance with paragraph 1 of Article 7 of the Law of the Republic of Kazakhstan “On Accounting and Financial Reporting” dated February 27, 2007 (hereinafter referred to as the Accounting Law), accounting documentation includes primary documents, accounting registers, financial statements and accounting policies. In accordance with paragraphs 3, 4 of Article 7 of the Law on Accounting, primary documents on paper and (or) electronic media, the forms of which or the requirements for which are not approved in accordance with paragraph 2 of this article, are developed by individual entrepreneurs and organizations independently and must contain the following mandatory details:

1) name of the document (form);

2) date of compilation;

3) the name of the organization or the surname and initials of the individual entrepreneur on whose behalf the document was drawn up;

4) the content of the operation or event;

5) units of measurement of an operation or event (in quantitative and cost terms...

Transport costs

Another type of expense associated with production and sales, rather indirectly, is the cost of motor transport. Some companies prefer to use their employees’ personal vehicles rather than purchase their own, “company” vehicles. In order for such actions to be correct from the point of view of law, it is necessary either to draw up an appropriate lease agreement, or once in a certain period (usually once a month) to pay the employee a certain amount of money as compensation for the use of his car in the company’s business.

Compensation is subject to income tax, which already reduces the tax burden on it. In addition, it depends on the engine power (it will be either 1,200 or 1,500 rubles).

But renting a car will be more economical: absolutely all costs associated with transport can be included in the income tax. And the amount that the employee will receive for giving his car for temporary use will not be subject to insurance deductions, as would be the case in the case of compensation, when the costs associated with production and sales would be subject to serious payments. According to experts, the savings will almost double, which plays a significant role in the modern world.

Contributions to self-regulatory organizations

Situation: how to take into account, when calculating income tax, contributions to the SRO for admission to work that affects the safety of capital construction projects (including contributions transferred before and after the non-profit partnership is entered into the SRO register)?

Contributions, deposits and other mandatory payments to SROs can be taken into account when calculating income tax as part of other expenses. The main condition is that such a fee is a necessary condition for conducting the activities of the organization that transfers it. This procedure is established by subparagraph 29 of paragraph 1 of Article 264 of the Tax Code of the Russian Federation.

Some types of work related to capital construction can only be performed if you have a certificate of access to them. This is work in the field of engineering surveys, architectural and construction design, construction, reconstruction, and major repairs of capital construction projects. This is stated in part 2 of article 47, part 4 of article 48 and part 2 of article 52 of the Town Planning Code of the Russian Federation. A detailed list of works that affect the safety of capital construction projects, for the execution of which you need to have a certificate of access to them, was approved by Order of the Ministry of Regional Development of Russia dated December 30, 2009 No. 624.

Certificates of admission to such types of work are issued to their members by self-regulatory organizations (SROs), that is, non-profit organizations (Article 11 of the Tax Code of the Russian Federation, Articles 55.2, 55.8 of the Town Planning Code of the Russian Federation and Article 3 of the Law of December 1, 2007 No. 315-FZ ). Self-regulation in the construction industry (including the issuance of certificates of admission) was introduced instead of the licensing system (Articles 1 and 3 of the Law of July 22, 2008 No. 148-FZ, paragraph 1 of the letter of the Federal Tax Service of Russia dated April 3, 2009 No. ShS-22-3/256).

The certificate of admission is issued free of charge and without restrictions on the territory and period of its validity (Part 9, Article 55.8 of the Town Planning Code of the Russian Federation). However, its receipt, as well as its validity, depends, among other things, on the payment of contributions, the amount and procedure for payment of which is established by the SRO (clauses 6–7 of Article 55.9 of the Town Planning Code of the Russian Federation). For example, a certificate is issued only upon payment of the entrance fee and contribution to the compensation fund (Part 6 of Article 55.6 of the Town Planning Code of the Russian Federation). If, after receiving the certificate, a member of the SRO does not pay regular membership fees, he may be expelled from the organization’s membership. In this case, the certificate of admission will be declared invalid (subclause 3, part 2, article 55.7, subclause 5, part 15, article 55.8 of the Town Planning Code of the Russian Federation).

Thus, paying contributions to the SRO is a necessary condition for organizations that are engaged in work that affects the safety of capital construction projects.

Since in this case both conditions of subclause 29 of clause 1 of Article 264 of the Tax Code of the Russian Federation are met (transfer of contributions to a non-profit organization and their production necessity), such expenses can be taken into account when calculating income tax (subclause 29 of clause 1 of Article 264, clause 1 Article 252 of the Tax Code of the Russian Federation).

Similar clarifications are contained in letters of the Ministry of Finance of Russia dated February 11, 2010 No. 03-03-06/1/63, dated December 7, 2009 No. 03-03-06/1/790, dated April 16, 2009 No. 03- 03-06/1/254, dated April 2, 2009 No. 03-03-06/1/213, dated March 26, 2009 No. 03-03-05/52 and the Federal Tax Service of Russia dated April 3, 2009 No. ShS -22-3/256.

In this case, documents confirming the costs of paying contributions may be:

- a copy of the certificate of membership in the SRO;

- payment orders for the transfer of contributions;

- invoices and other documents issued by SRO.

This is stated in letters of the Ministry of Finance of Russia dated August 10, 2010 No. 03-03-06/4/75, dated April 1, 2010 No. 03-03-06/1/207.

If an organization does not need to join an SRO (the organization does not need certificates of admission to perform work), but it became a member of the SRO on a voluntary basis, the amount of contributions paid is not taken into account when calculating income tax: in this case, the conditions of subparagraph 29 of paragraph 1 of Article 264 The Tax Code of the Russian Federation is not followed. In addition, such expenses cannot be considered economically justified (clause 1 of Article 252 of the Tax Code of the Russian Federation). Such clarifications are contained in the letter of the Ministry of Finance of Russia dated September 22, 2010 No. 03-03-06/1/608.

Recognize expenses in the form of contributions depending on the method by which the organization calculates income tax.

If the organization uses the cash method, consider contributions as they are transferred. That is, in the reporting period in which the organization pays them. This procedure is established by paragraph 3 of Article 273 of the Tax Code of the Russian Federation.

If an organization uses the accrual method, expenses in the form of entrance fees, membership fees, as well as contributions to the SRO compensation fund are recognized in tax accounting at a time in accordance with subparagraph 3 of paragraph 7 of Article 272 of the Tax Code of the Russian Federation (for example, on the date of settlements). A similar point of view is reflected in letters of the Ministry of Finance of Russia dated August 10, 2010 No. 03-03-06/4/75, dated July 21, 2010 No. 03-03-06/1/479, dated July 12, 2010 No. 03 -03-05/150, dated March 25, 2010 No. 03-03-06/1/182, dated February 11, 2010 No. 03-03-06/1/63, dated April 1, 2010 No. 03- 03-06/1/207, dated March 25, 2010 No. 03-03-06/1/182, dated February 11, 2010 No. 03-03-06/1/63.

An example of reflecting in accounting and taxation the costs of paying the entrance fee and contribution to the compensation fund of an SRO, which allows for work that affects the safety of capital construction projects. The organization calculates income tax using the accrual method

Alpha LLC carries out activities in the preparation of design documentation for the construction of various facilities. You can do it if you have a certificate of admission to design work.

To obtain a certificate, in December “Alfa” joined the SRO NP “Proekt”. The entrance fee to the SRO was 10,000 rubles, the contribution to the compensation fund was 150,000 rubles. At the end of the month the certificate was received. The membership fee is 20,000 rubles. According to the regulations of the NP “Project”, membership fees are paid once a year in the month when the organization joined the SRO.

Alpha's accountant recorded the payment of contributions to SRO NP "Project" as follows:

Debit 76 Credit 51 – 180,000 rub. (RUB 10,000 + RUB 150,000 + RUB 20,000) – contributions to the SRO of designers are transferred;