With the advent of new technologies, people are less and less likely to take a pen and write something on paper. When typing on the keyboard, all inaccuracies in words quickly disappear thanks to auto-correction and text replacement, and grammar and spelling rules are quickly forgotten. This is especially true for words with double consonants. Losing a letter while writing is a common mistake.

Let's remember how to write “adjustment” and similar lexemes in order to understand when the doubling of sounds occurs.

What is adjustment of project documentation

Until the design documentation is approved by the customer, has not undergone examination and issuance of a construction permit, it may change in the current regime. While architects, designers and other specialists are working with documents for a future facility, they make changes to the project after choosing each solution. If the PD has passed the examination, all safety indicators will be confirmed by experts. Therefore, it is impossible to arbitrarily make adjustments to the documents and begin construction work until a re-examination is carried out.

After the construction of the building, adjustments are necessary during reconstruction. In this case, the basic parameters of the object change, i.e. into constructive and other solutions. To develop documentation for reconstruction, the original project is used, and the feasibility of the work is assessed. To coordinate reconstruction work, it is necessary to undergo an examination of the project and obtain a construction permit.

Dear Clients!

The information in this article contains general information, but each case is unique. You can get a free consultation from our engineers using one of our telephone numbers - call:

8 Moscow (our address)

8 St. Petersburg (our address)

All consultations are free.

Adjustment of PD is the introduction of changes to the design and other solutions originally specified in the project. This may be an increase or decrease in area, height and number of floors, the choice of other planning or architectural solutions, the development of a new engineering system, or other changes that affect the safety indicators of the facility. If changes are made that do not in any way affect the design and other safety parameters, the design is modified. Based on the results, a sheet for making changes to the design documentation is prepared.

When is adjustment of project documentation necessary?

Adjustment of PD can be carried out by decision of the developer, or by virtue of direct instructions of the law. For example, in paragraph 7 of Art. 52 of the Town Planning Code of the Russian Federation states that changes need to be made if during reconstruction, construction or major repairs it is identified that the parameters of the object need to deviate from the original design. This does not mean that the designer made a mistake when developing the documents. Deviations from the initial indicators may be caused by changes in construction technology, the introduction of additional urban planning restrictions, the laying of new utility networks, and for other reasons.

Adjustments are also required if a decision is made to reuse the project, but a number of its provisions require changes and additions. For example, if a building was built according to design documentation, it can be used to construct standard facilities in other regions. However, taking into account the location of the future facility, the characteristics of the site and restrictions on permitted construction, the project may be adjusted. After making the necessary changes, an examination will be carried out and a construction permit will be issued.

The decision to reconstruct is also made by the owner of the property. This could be an increase in height and number of storeys, construction of an extension and expansion of the area. Also, during reconstruction, supporting structures may be changed or restored.

Rules

A dictionary will help you find out how to spell the word “adjustment”.

Correction is on the list of terms and scientific vocabulary of Latin origin. In Latin the word form is written “correctio”, with two “rr”. In Russian it is also written “pp”. According to the norms that are accepted in the Russian language, borrowed expressions belong to the dictionary and their spelling just needs to be remembered. There are no rules for dictionary words; they are apart from spelling norms.

Examples of using the word in sentences

We advise you to look at several examples where this word is used:

- The president's speech before a speech can be adjusted many times.

- The magazine material needs correction.

- It is necessary to adjust your life attitudes in order to find your path.

How wrong

Omitting one “r” is not the only mistake. You can see “correction” and “correction” as often as “correction”. Remember, this lexeme is written with “pp”, “o” and “e”.

Who and how can make changes to project documentation

Depending on the conditions for updating the project documentation, changes in the project documentation can be made by:

- when a negative expert opinion is issued - the design organization that prepared the original object (as well as change management in the project);

- if there is a positive expert opinion - the same company that prepared the original project, or another design organization;

- during reconstruction - any design organization contacted by the owner.

If the adjustment is carried out by another organization, all volumes and title pages must be changed and certified by the signatures of the designers of this company. This follows directly from Art. 761 of the Civil Code of the Russian Federation, Decrees of the Government of the Russian Federation No. 87 and No. 145.

The adjustment itself occurs as follows:

- The designer gets acquainted with his section, studying all the main points and agrees or not with the technical specifications;

- If the project is available in an editable format, then point changes to the project are made;

- If the project is in scannable form, then the designer reproduces the project in its entirety.

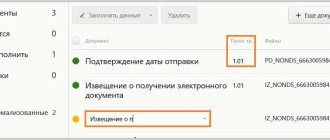

Decisions of the federal executive body

The federal executive authorities may make the following decisions:

- on providing a notice obliging to make symmetrical adjustments;

- on granting a refusal to transmit notifications on the basis of which symmetrical adjustments can be made;

- to inform about the reasons for suspending the deadlines associated with the issuance of notifications.

Decisions adopted establishing the possibility of issuing a notification must be sent to the second subject of transactions no later than the next day from the moment of their adoption.

Decisions to refuse are sent to the second subject within 24 hours from the time they were made.

Is approval required for adjustments and changes to project documentation?

Correction of PD is always accompanied by an examination. Depending on the reasons for making changes and the stage of work, approval will take place according to the following rules:

- when adjusting the project before the first request for examination, approval takes place as usual;

- if the conclusion is negative, the adjustment is sent for re-examination in terms of the changes made;

- if there is a positive conclusion, the adjustment will be re-examined and a conformity assessment will be issued;

- when agreeing on reconstruction - according to the general rules, i.e. Primary and re-examination is possible.

Project approval is not required if it has been modified. According to Letter of the Ministry of Construction No. 38231-AB/08, expert bodies issue an opinion on the recognition of the modified PD. This may require transferring all documents from the project.

Expert commentary. The examination is not the only approval for a construction or reconstruction project. After receiving a positive conclusion, you need to apply for a building permit. If the adjustment is carried out during the construction or reconstruction of the facility, an amended construction permit must be obtained based on the expert opinion. Experts from ]Smart Way[/anchor] can help you at every stage - if you have any questions, you can get advice from our designers - Moscow 8-499-322-05-14, St. Petersburg 8-812-425-35-90, by mail - , in the Telegram chat bot – Smway_bot.

Correction of design documentation must undergo an examination with a conclusion drawn up

Making adjustments

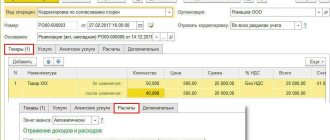

Adjustment invoice

After commented resolution No. 1137 comes into force, taxpayers must use a new (permanent) form for an adjustment invoice.

The main difference from the temporary form* is as follows. Previously, the indicators “before the change”, “after the change”, as well as the difference between “additional payment” and “reduction” had to be indicated in special columns. Now such indicators are allocated not columns, but rows.

In particular, for each item of the adjustment invoice there are four lines: A (before the change), B (after the change), C (increase) and D (decrease). To calculate the indicators for lines C and D, you need to subtract the figure from line B from the number in line A.

If the resulting value is less than zero, then we are dealing with an increase. It must be reflected in line B with a positive value, that is, without the minus sign. Line D should have a dash.

If the resulting value is greater than zero, we are dealing with a decrease. It must be reflected in line G with a positive value, that is, without the minus sign. There should be a dash in line B.

After filling out all the lines of the adjustment invoice, you need to summarize the following indicators: cost without VAT (column 5), the amount of VAT (column and cost with VAT (column 9). To do this, you need to sum up all the numbers indicated in the line In the data column , as well as all the numbers indicated in line D of the data column.The obtained values will be needed when filling out the purchase book, sales book or additional sheets to them.

and cost with VAT (column 9). To do this, you need to sum up all the numbers indicated in the line In the data column , as well as all the numbers indicated in line D of the data column.The obtained values will be needed when filling out the purchase book, sales book or additional sheets to them.

Let us add that in the “header” of the adjustment invoice there are fields for its number and date, as well as fields for the number and date of the original invoice. Plus, there are fields for the number and date of corrections made to the adjustment and original invoices.

Reducing the cost: actions of the seller

If the original cost decreases, the seller is obliged to issue an adjustment invoice and register it in part 1 of the log of received and issued invoices.

Next, the adjustment invoice must be registered in the purchase ledger. This must be done during the period when the following conditions are met: the seller has an adjustment invoice drawn up no earlier than three years ago, and primary documents for changing the terms of delivery.

The supplier is then entitled to deduct the difference between the VAT amount before and after the adjustment.

Please note that the seller should not record the adjustment invoice in Part 2 of the journal, which deals with invoices received. This nuance is separately specified in the new Journaling Rules.

Cost reduction: buyer actions

If the original cost is reduced, the buyer must register an adjustment invoice in part 2 of the journal of received and issued invoices.

Then the buyer is required to register one of two documents in the sales book: either an adjustment invoice or a contract (agreement, etc.) to change the terms of the transaction. The document that was received earlier is subject to registration. Accordingly, an entry in the sales book must be made for the period in which the registered document was received by the buyer.

After this, the buyer should restore the previously accepted deduction in the amount of the difference between the amount of tax before and after the adjustment.

Increasing value: seller actions

If the original cost increases, the seller must issue an adjustment invoice and register it in part 1 of the log of received and issued invoices.

Also, the adjustment invoice should be recorded either in the sales ledger or in an additional sheet in the sales ledger.

If the shipment and adjustment took place in the same quarter, then registration must be made in the sales book for that quarter.

If the shipment occurred in one quarter, and the adjustment occurred in another, then registration must be made in an additional sheet of the sales book for the quarter when the shipment took place. In this case, recording the data on the adjustment invoice in an additional sheet must be done with a positive value, that is, without the minus sign.

Finally, the seller is required to charge VAT in the amount of the difference between the tax amount before and after the adjustment. The accrual must be dated to the quarter in which the shipment took place.

Increasing value: buyer actions

If the original cost increases, the buyer should register an adjustment invoice in part 2 of the journal of invoices received and issued.

Then you need to make an entry in the purchase book for the period in which the buyer will have both an adjustment invoice drawn up no earlier than three years ago and a primary document for changing the terms of delivery (contract, additional agreement, etc.).

As a result, the buyer receives the right to accept a deduction in the amount of the difference between the VAT amount before and after the adjustment.

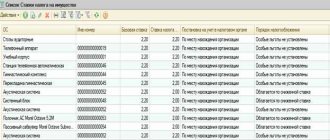

How to transfer data from an adjustment invoice to the journal, purchase ledger, and sales ledger

| From which field of the adjustment invoice? | In which column of the accounting journal? | In which column of the purchase book? | In which column of the sales book (additional sheet of the sales book) | |

| In part 1 | In part 2 | |||

| Line 1 | In columns 7 and 8 | In columns 7 and 8 | In column 2b | In column 1b |

| Line 1b | In columns 5 and 6 | In columns 5 and 6 | In columns 2 and 2a | In column 1 and 1a |

| When the original cost decreases | ||||

| Total reduction (sum of rows G) columns 5 | Not transferable | Not transferable | In column 8a (or 9a) | In column 5a (or 6a) |

| Total reduction (sum of rows G) columns 8 | In column 18 | In column 18 | In column 8b (or 9b) | In column 5b (or 6b) |

| Total reduction (sum of rows G) columns 9 | In column 16 | In column 16 | In column 7 | In column 4 |

| When the initial cost increases | ||||

| Total increase (sum of rows B) columns 5 | Not transferable | Not transferable | In column 8a (or 9a) | In column 5a (or 6a) |

| Total increase (sum of rows B) columns 8 | In column 19 | In column 19 | In column 8b (or 9b) | In column 5b (or 6b) |

| Total increase (sum of rows B) columns 9 | In column 17 | In column 17 | In column 7 | In column 4 |

Stages of updating design documentation. Sections that are often adjusted

The list of stages of designers’ work depends on the goals and reasons for adjusting the PD. For example, if engineering surveys are not required to correct design deficiencies, this stage will not be required. This is required for reconstruction. Given these rules, adjustment steps may include:

- determination of the purpose of changing project documentation, adjusted sections of the project;

- study of source documentation, including those previously prepared by another design organization;

- conducting surveys and surveys, obtaining initial data for design;

- selection of new constructive, architectural, planning, engineering or other solutions;

- description and justification for all selected solutions, filling out the modified sections of the project;

- preparation of new or modified graphic materials, working documentation;

- approval of the adjusted project by the customer, transferring it to an expert organization.

It is important that the organization making adjustments to the project by another design company is responsible for compliance of all documentation with laws, regulations, standards, and codes of practice. Interconnections between new solutions and previously developed sections are also carried out. The compliance of the entire project, including its non-corrected part, is indicated in the explanatory note.

Most often, adjustments are required in the following sections of project documentation:

Date of error detection

We have decided that there is no need to send the amended report to the Federal Tax Service after its approval. Now let’s look at the procedure for correcting errors in financial statements “before approval”. In this case, it is necessary to submit an updated balance sheet, Form 2 and other reports. If the reporting form has not yet been approved, then adjustments to the accounting must be made. But changes should be made taking into account the date the error was discovered. Legislators in PBU 22/2010 provided for several situations. Let's look at each of them.

Situation No. 1. Found an error before or during the preparation of financial statements

In this case, the accountant makes adjusting entries in the reporting period. In other words, if an error is found at the time of preparation of financial statements, then the incorrect entry (operation, posting) is corrected. Consequently, the report will include correct data, and adjustments to the financial statements after submission to the tax office will not be required.

Situation No. 2. The inaccuracy was identified before the financial statements were submitted to the Federal Tax Service

The annual report has been compiled, but has not yet been sent for verification to government agencies and has not been submitted to the owners for approval. If an error is identified during this period, then an adjustment is necessary to normalize the financial statements. The accountant is obliged to correct the inaccuracy and reform the balance sheet. Moreover, corrective entries are made in the last month of the reporting period (December). An incorrect version of the report must be replaced with a reliable copy.

Situation No. 3. Adjustment of financial statements after submission to the Federal Tax Service

The report has been generated and sent to the Federal Tax Service. At a meeting of the company's founders, a significant inaccuracy was identified, and the report was returned to the accounting department for revision. The accountant corrects the error found and records the corrections in accounting in December. Then it generates the financial report again, but with changes, and submits it to the founders for consideration. In this case, the question does not arise whether it is possible to resubmit the financial statements for 2021 - this must be done. The reporting document forms are the same, only the correction number is entered. For example, to submit the first corrective report, enter “001” or “-1”.

Timing and cost of updating project documentation

As with the development of initial design documentation, the timing and cost of adjustments depend on the following factors:

- volume and complexity of the work to be done (for example, changes in one section of the PD or in several sections at once will vary);

- location of the site and object, which can complicate measurements, surveys and surveys;

- type of the designed object (mkd, non-residential building, etc.).

]Smart Way[/anchor] will perform any type of design work at affordable prices. You can verify this if you call our specialists to draw up the terms of reference and contract. We offer our clients the most favorable terms of cooperation, short design deadlines with consistently high quality. If you have any questions, you can get advice from our designers - Moscow 8-499-322-05-14, St. Petersburg 8-812-425-35-90, by mail - , in the Telegram chat bot - Smway_bot.

Notification of the need for reverse adjustments

Decisions to carry out reverse adjustments can be made exclusively by the Federal Tax Service. The legislation establishes cases in which such actions are mandatory and necessary.

The first case includes changes, cancellation or invalidation of decisions established by the inspection and establishing liability in relation to the persons being inspected. This case is characterized by the presence of a court decision.

The second case includes the option of providing declarations with updated information, the numerical values of which indicate a decrease in the base amount of funds subject to tax calculation.

Author of the article

Difficulties in adjusting design documentation

Adjustment of PD always refers to work of increased complexity, since it is necessary to make changes to an existing project or reconstruct a constructed facility. This may lead to inconsistencies and inconsistencies between sections, which specialists from the expert organization will certainly identify. The following problems may also occur:

- erection of most of the building according to the original design, when the need for adjustments is identified;

- it is impossible to make do with changes in only one section of the project, since one new decision will entail a significant adjustment of all documents;

- identification of additional restrictions on permitted construction indicators (for example, if local authorities have approved new transport infrastructure schemes, regulations on the number of floors of buildings, etc.);

- inconsistency of the original project with new regulations, SNiP, GOST and SP (in this case, the entire project may need to be redone);

- changes in the main indicators of the object (height and number of storeys, area), which requires additional solutions to strengthen structures.

In some cases, adjusting the PD may not be practical at all, since the project will actually have to be developed anew.

Purposes of applying symmetrical adjustments

Within the framework of the current rules of law, tax obligations that are assigned to the buyer or customer under the contract can be reduced by additional taxes to the other party.

The goal of reducing the tax base is achieved as a result of an audit aimed at establishing the legality of taxation on a controlled transaction, which is carried out on the basis of a decision of the Federal Tax Service.

The authorities verify the transaction price, which is established by the interdependent parties. The price is checked in relation to the prices that operate on the market.

The second subject of the transaction can independently reduce the volume of the tax base and reduce the amount of accruals, for which it will be necessary to apply the prices established by the audit and, based on them, calculate the tax required to be paid.

conclusions

Adjustment of design documentation is the introduction of changes to design and other solutions that affect the safety indicators of the facility. Such design work can be carried out when deficiencies are eliminated based on a negative expert opinion, or in the presence of a positive expert opinion. Also, adjustments to the original project are carried out during reconstruction. After correction, the documents are sent for re-examination.

Get an estimate of the cost of this service using our price calculator - here

You can order a full range of design services from ]Smart Way[/anchor]. We will carry out work to adjust the documentation as quickly as possible and in compliance with the requirements of SP, GOST, SNiP, and other governing acts. Call us, we will advise you free of charge on all your questions. If you have any questions, you can get advice from our designers - Moscow 8-499-322-05-14, St. Petersburg 8-812-425-35-90, by mail - , in the Telegram chat bot - Smway_bot.

Refusal to issue a notification about the possibility of symmetrical adjustments

The tax control authorities may issue a refusal to the subject of the agreement, on the basis of which symmetrical adjustments cannot be made.

The procedure for making such a decision is regulated by the Tax Code and a number of regulations relating to acts of local significance.

On the part of the executive authorities, decisions on refusal must be sent to the interested party within a period that is limited to one day and begins to run from the date of issuance of such a document.

The reason for refusal may be the lack of proper grounds set out in the application for the right to make adjustments. In addition, the reason for a negative decision may be the insufficiency of the documentation provided by the interested party to resolve the issue on its merits.

How to remember the spelling of the word “adjustment”?

With the advent of new technologies, people are less and less likely to take a pen and write something on paper. When typing on the keyboard, all inaccuracies in words quickly disappear thanks to auto-correction and text replacement, and grammar and spelling rules are quickly forgotten. This is especially true for words with double consonants. Losing a letter while writing is a common mistake.

Let's remember how to write “adjustment” and similar lexemes in order to understand when the doubling of sounds occurs.