The Federal Tax Service (FTS) has a special taxpayer personal account for individuals, the functionality of which allows you to view all your current tax accruals, track their status (need to be paid, overdue), and also pay current tax bills directly in your personal account online . As a rule, there is no fee for paying off tax obligations using a bank card in your personal account. Using your personal account, you can also register an individual entrepreneur, LLC, report on your objects subject to taxes, receive certificates or download programs for reporting to the tax service.

Tax ru: login to your personal account of the Federal Tax Service

People go to the tax website not only to find their answers to questions about taxation of citizens, but also to check payments for their taxable items in their personal account of the Federal Tax Service. Previously, you had to wait for the postman to come and throw the receipt in the mailbox, then go to the nearest bank and stand in a kilometer-long line at the cashier’s window with a payment order. As a result, it took almost the whole day to pay several receipts.

Now you can pay all possible taxes and duties yourself by going to the official tax website at https://www.nalog.ru/ , selecting the type of account (individual, individual entrepreneur or legal entity) and entering your login (your TIN) and password and then the “Login” button.

If you do not have information to log into your personal account, then register on the website of the federal tax service.

Information (Unified State Register of Legal Entities) for any organization (not individual entrepreneur) according to the organization’s TIN

Link: Information entered into the Unified State Register of Legal Entities Free

What do you need to enter?

It is enough to enter ONE of the fields: Name (simply Yandex, Gazprom, etc.) and/or OGRN\GRN\TIN and/or Address and/or Region and/or Registration Date.

What information will I receive?

- Name of the legal entity;

- Address (location) of the legal entity;

- OGRN;

- GRN;

- TIN;

- checkpoint;

- Information about the state registration of the organization;

- Date of entry in the Unified State Register of Legal Entities (registration of a legal entity);

- Name of the registering authority that made the entry (Tax);

- Address of the registration authority;

- Information on amendments to the Unified State Register of Legal Entities;

- Information on state registration of changes made to the constituent documents of legal entities;

- Information about licenses, registration as policyholders in funds, information about registration.

Also recently, on the same tax website, information appeared on the Unified State Register of Individual Entrepreneurs (OGRNIP, OKVED, etc.) for all individual entrepreneurs.

Search by: OGRNIP/TIN or full name and region of residence (patronymic name does not have to be entered)

The website contains a complete database of organizations and individual entrepreneurs of the Russian Federation. Websites where you can view data on individual entrepreneurs and organizations can be found here.

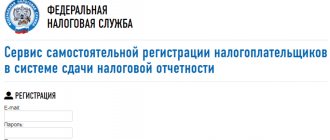

Registration of a personal account in Tax ru

Registration on the website of the Tax Service of the Russian Federation can be accomplished in several ways:

- Using your GosRegister portal account.

A registration form will appear where you will need to indicate your first and last name, as well as your mobile phone number and email address.

After clicking the “Registration” button, an SMS with a code will be sent to the specified mobile phone number to confirm your account registration.

Step 2. Confirm your personal information. To do this, indicate SNILS and passport details. The entered data will be checked by the pension fund and the migration service, after which you will receive an email response with the result of the check. (Takes from 2 hours to several days)

Step 3. At this stage, you need to confirm your identity in a way convenient for you:

- Personal visit with a passport to the nearest MFC (multifunctional and others)

- Online confirmation via Internet banks [anchor href=»cabinet-bank.ru/sberbank-online/»]Sberbank Online, Post Bank or Tinkoff (if you are already a client of one of the listed banks)

- By mail, ordering to receive an identification code using Russian Post (you will receive an envelope with an identification code that you will need to enter on the website, usually the envelope arrives in 2-3 weeks)

At this point, registration on the State Services portal has been successfully completed. You can log into your personal account using your mobile number and password specified during registration.

Now all you have to do is use the resulting account to register on the Russian Tax Service website.

To do this, go to the official tax website at https://www.nalog.ru and click on the “Login/Registration using a public services portal account” button on the right.

A window will open where you will need to log in to your government services account using your username and password. The login is your mobile phone number, e-mail, as well as the SNILS number specified when registering your account.

If the data is entered correctly, you will be taken to the main page of your personal account for individuals of the Russian Tax Service.

Registration using digital signature

This method is more time-consuming both in terms of time and money. Creating an electronic digital signature to log into the tax service website will cost you approximately 3,000 rubles.

EDS is issued by special accredited organizations. The issuance of the digital signature itself takes about 5-10 minutes, but filling out applications for issuance takes 15-20 minutes.

In addition to the digital signature itself, you will need to configure special software on your computer, consisting of special drivers and a program for working with digital signature “Crypro PRO”. Thus, you will spend 1-2 days of time, pay an amount of about 4500-6000 thousand (a license for the Crypto Pro program costs money because it is commercial) and you will need to spend a lot of time setting up your computer to work with digital signature. Not everyone can do this on their own. This method is convenient for those who already have an electronic signature.

Registration with the Federal Tax Service inspection

If you urgently need to get into the taxpayer’s personal account and the two methods described above do not suit you, we recommend using this option. Take your passport as a citizen of the Russian Federation with you and go to the nearest tax office (your place of registration does not matter). Join the electronic queue when you arrive at the operating room. Wait for your appointment with a Federal Tax Service employee and receive a login and password to enter the taxpayer’s personal account on the website nalog.ru.

Recovering your personal account password Tax ru

If you are unable to log into the website of the federal tax service, we recommend that you check that you have entered your login and password correctly. You may have misspelled a letter or number, or you may have pressed the Caps Lock key. If your next attempts to log into your account are unsuccessful, we recommend using the function to recover your personal account password.

To do this, go to the login page for your personal account on the tax website at https://lkfl.nalog.ru/lk/ and click the “Forgot your password?” button.

A page will open where you will need to enter your TIN number, email address and the control word you specified when registering on the site.

Next, click the “Recover Password” button. A letter from the tax office will be sent to your e-mail address with further instructions (the letter will contain a link to reset your password) on how to recover your password to your personal account.

Be careful and fill out your details slowly! If you enter the data incorrectly 3 times, the ability to recover the password from your account will be blocked for 1 day.

And now the last step - come up with a new password to log into your personal account and save it.

If suddenly you are unable to restore access to the site, contact the nearest Federal Tax Service office in person. Tax service employees will help you restore access to your personal account.

Mobile application of the Tax Service of the Russian Federation

Not everyone knows that you can use the personal account of a taxpayer of the Federal Tax Service not only on the official website, but also using a mobile application. The mobile client is provided free of charge and is available for download to owners of Android mobile devices.

To log in, use your login and password from your personal account of the Federal Tax Service of Russia or your account on the Gosuslugi.ru portal. You can download the application in the Google Play app store. To do this, launch it and enter the phrase “Personal Taxes” in the search bar. The application you are looking for will be displayed first in the search - you can distinguish it by the corporate logo of the tax office. To download, click on the “Install” button and wait until the download completes.

A new shortcut will appear in your smartphone application, which means the application is ready to launch.

Features of the mobile application of the Tax Service of the Russian Federation:

- obtaining information on accrued and paid taxes

- obtaining information about the existence of debt

- viewing information about property objects and insurance premiums

- viewing tax documents

- view user profile

- fast and easy tax payment

You can also download the official application of the Russian Tax Service from the link below:

Payment order or receipt.

Link: Filling out a payment document for the transfer of taxes, fees and other payments to the budget system of the Russian Federation

What do you need to enter?

- IRS code:

- Municipality:

- Type of payment:

- Payment type:

- KBK:

- Tax group:

- Tax:

- KBK:

- Status of the person who issued the payment document:

- Basis of payment:

- Taxable period:

- Date of signature of the declaration by the taxpayer:

- Payment order:

- Taxpayer Identification Number:

- Checkpoint:

- Name:

- Payer bank:

- Account No.:

- BIC:

- Sum:

What will I get?

Payment to the bank or receipt for Sberbank.

An individual entrepreneur can pay everything through Sberbank with receipts - any taxes and insurance payments (PFR, Social Insurance Fund, health insurance). Save your receipt!!!

Hotline Tax ru

If you are interested in any information related to the services of the federal tax service, you can contact the Federal Tax Service hotline at 8-800-222-2222. Calls within Russia are free. Use this Federal Tax Service contact center number to resolve general questions or obtain information.

The tax office also has a special helpline where you can anonymously report facts of corruption or bribes and other gross violations of the tax service. Calls to this number are accepted 24 hours a day.

Tax helpline of the central office of the Federal Tax Service of Russia

Determine OKATO, OKTMO, index, etc. by address.

Link: Federal Information Address System (FIAS)

While entering information, a drop-down list will appear containing information about the first 10 addresses corresponding to the entered parameters.

Search recommendations:

Entering information:

- It is advisable to start in the following order: street locality city region;

- implement through spaces;

- use only the name of address objects;

If you do not find the required address in the drop-down list, enter the name of a higher-level address element, for example, city, region.

What do you need to enter?

- street

- city

- Enough street and city

What will I get?

- Name

- Type

- Code KLADR 4.0

- OKATO

- OKTMO

- KBK:

- Status