Accounting for the seller.

If an organization transfers goods, the ownership of which has not yet transferred to the buyer, then use account 45 “Goods shipped” to account for such goods. Make the following entries in accounting:

Debit 45 Credit 41

At the time of transfer of ownership of the goods in accounting, make the following entries:

Debit 62 Credit 90-1

Debit 90-2 Credit 45

Buyer's accounting.

If the contract provides for a special procedure for the transfer of ownership, then until the moment of acceptance and transfer of goods by the buyer, the goods can be accepted for accounting in the subaccount to account 41 “Goods in transit.” At the moment of transfer of ownership of the goods, make the following entry:

Debit 41 Subaccount “Goods in transit” Credit 60

Goods in transit are accepted for registration.

At the time of acceptance of the goods by the buyer, make the following entry:

Debit 41 Subaccount “Goods in warehouse” Credit 41 Subaccount “Goods in transit”

– goods have arrived at the buyer’s warehouse.

The rationale for this position is given below in the materials of the Glavbukh System

write off the cost of goods sold (clause 5 of PBU 10/99, Instructions for the chart of accounts);

write off the sales expenses (clause 5 of PBU 10/99, Instructions for the chart of accounts).

Revenue recognition

Include revenue from the sale of goods as income from ordinary activities (clause 5 of PBU 9/99).

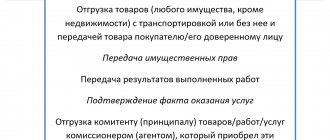

One of the conditions for recognizing revenue in accounting is the transfer of ownership of goods sold to the buyer (clause 12 of PBU 9/99).* The agreement (law) may provide for the following moments of transfer of ownership:

date of shipment (transfer) of the goods;

date of payment.

Depending on the terms of the agreement (law) on the moment of transfer of ownership and the payment scheme, the reflection of transactions in accounting will vary.

Revenue recognition on the date of shipment

If revenue is recognized on the date of shipment, reflect the sale of goods in accounting as follows.

On the date of shipment:

Debit 62 Credit 90-1 – revenue from the sale of goods is reflected;

Debit 90-2 Credit 41 – the cost of the goods is written off.*

If the organization that sells goods is a VAT payer, at the same time as recognizing revenue, accrue this tax:

– VAT is charged on the sale of goods.

On the date of payment:

Debit 51 (50) Credit 62 – payment by the buyer for the goods is reflected.

This procedure follows from the Instructions for the chart of accounts (accounts,).

The contract may provide for advance payment of goods by the buyer. The amounts of advances received (prepayments) are recorded separately on account 62 “Settlements with buyers and customers”. To do this, open sub-accounts, which may be called, for example, “Settlements for advances received” and “Settlements for shipped goods”. Such rules are established by the Instructions for the chart of accounts. Make the following entries in accounting.

On the date of payment:

Debit 51 (50) Credit 62 subaccount “Settlements for advances received” - prepayment received.

If the organization that sells goods is a VAT payer, simultaneously with receiving the advance payment, accrue this tax:

Debit 76 subaccount “Calculations for VAT on advances received” Credit 68 subaccount “Calculations for VAT” - VAT is charged on the amount of the prepayment.

On the date of shipment:

Debit 62 subaccount “Settlements for shipped goods” Credit 90-1 – revenue from the sale of goods is reflected;

Debit 90-2 Credit 41 – the cost of the goods is written off;

Debit 62 subaccount “Settlements for advances received” Credit 62 subaccount “Settlements for shipped goods” - the prepayment received is credited;

Debit 90-3 Credit 68 subaccount “Calculations for VAT” – VAT is charged on the sale of goods;

Debit 68 subaccount “Calculations for VAT” Credit 76 subaccount “Calculations for VAT from advances received” – VAT accrued on prepayments is accepted for deduction.

This procedure follows from the Instructions for the chart of accounts (accounts , , ).

Revenue recognition on the date of payment

If revenue is recognized on the date of payment, the procedure for recording the sale of goods in accounting depends on the terms of payment for it:

The contract may provide for subsequent (after shipment) payment of the goods by the buyer. In this case, the organization transfers goods, the ownership of which has not yet transferred to the buyer. To account for such goods, use account 45 “Goods shipped”. It reflects information about goods, the proceeds from the sale of which cannot be recognized in accounting for some time (Instructions for the chart of accounts). Make the following entries in accounting.

On the date of shipment of the goods to the buyer:

Debit 45 Credit 41 – goods shipped to the buyer.

If the organization that sells goods is a VAT payer, accrue this tax on the date of shipment:

Debit 76 subaccount “Calculations for VAT on shipped goods” Credit 68 subaccount “Calculations for VAT” - VAT is accrued on shipped goods.

On the date of payment:

Debit 51 Credit 62 – payment received from the buyer;

Debit 62 Credit 90-1 – revenue from the sale of goods is reflected;

Debit 90-2 Credit 45 – the cost of the goods is written off;

Debit 90-3 Credit 76 subaccount “VAT accrued on shipped goods” - reflects VAT accrued upon shipment of goods.

This procedure follows from the Instructions for the chart of accounts (accounts , , , ).*

Elena Popova,

In accounting, goods are any inventory items acquired for further sale (Instructions for the chart of accounts).

Accounting: admission

In accounting, goods can be capitalized after their acceptance and verification of quantity has been completed (clause 2.1.13 of the Methodological Recommendations, approved by letter of the RF Committee on Trade dated July 10, 1996 No. 1-794/32-5).

The procedure for reflecting received goods in accounting depends on: – the method of receiving the goods; – the terms of the contract governing the procedure for transferring ownership of the goods from the seller to the buyer;* – the applicable taxation system; – methods of accounting for goods enshrined in the accounting policy for accounting purposes.

Receipt under a purchase and sale agreement

If the organization received the goods under a purchase and sale agreement, then the actual cost of the goods consists of the amount paid to the seller and the costs associated with the acquisition (delivery, commissions to intermediaries, etc.). Such rules are established by paragraph 6 of PBU 5/01.

Typically, ownership of a product passes from the seller to the buyer at the time of its acceptance and delivery. At this point, reflect the receipt of goods in accounting by posting:

Debit 41 (15) Credit 60 (76...) – goods received under paid contracts.

This procedure is established by the Instructions for the chart of accounts (accounts).*

Situation: when the buyer must reflect in accounting the purchase of goods received outside the location of the organization. According to the contract, ownership passes at the moment of acceptance and transfer

Received goods must be capitalized at the moment the ownership of them transfers to the buyer. The fact of transfer of ownership must be documented. Therefore, if the buyer has correctly executed shipping documents, then he can accept the goods received for accounting in the contractual valuation.* After the actual cost has been generated (transportation and procurement costs are included), the cost of goods in accounting must be clarified (if it differs from negotiable). This conclusion can be made by paragraph 26 of PBU 5/01, part 2 of article 9 of the Law of December 6, 2011 No. 402-FZ.

Until documents or goods are received from the supplier, the buyer cannot reflect them in accounting (Part 1, Article 9 of Law No. 402-FZ of December 6, 2011). To recognize a product as accepted for registration, its receipt at the buyer’s warehouse is not necessary: goods in transit can be considered accepted for registration* (see, for example, resolutions of the Federal Antimonopoly Service of the Far Eastern District dated July 25, 2007 No. Ф03-А24/07-2/ 2145, dated July 19, 2007 No. F03-A24/07-2/2137).

Elena Popova,

State Advisor to the Tax Service of the Russian Federation, 1st rank

Sincerely,

Maya Zhmakina, expert of the BSS "System Glavbukh".

Answer approved by Sergey Granatkin,

leading expert of the BSS "System Glavbukh".

If the partners (seller, buyer) are located far from each other (different cities, countries), transportation takes several days. But the seller is obliged to issue documents for the cargo on the day of shipment; it turns out that the buyer accepts them in a different time period.

It often happens that we are talking about different months. The moment of transfer of ownership of the delivered values occurs, as a rule, upon shipment. So it turns out that the seller has already delivered the goods to his buyer, but in fact, in fact, the recipient has not yet met his purchase.

To carry out accounting operations in this case, it is recommended to use account No. 15 – procurement and acquisition of material assets. If it is not goods that are transported, but materials or raw materials, then by the 15th account create sub-accounts:

- materials on the way,

- raw materials are on the way.

According to the instructions of the chart of accounts, account No. 15 can only be used to display materials and goods at accounting prices. But you can step back from this and take into account inventory items on accounts 10, 41 at the actual cost, and use account No. 15 only for goods in transit. The selling company can include transportation costs in the price of the product - or take these costs into account separately: - selling costs.

Reflection of goods receipt at the “virtual” warehouse

After sending an order for a product to the supplier, he informs that he will be able to deliver the product by a certain date, or sends an electronic invoice to our address.

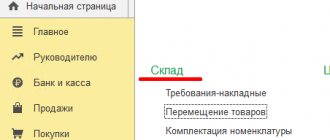

To reflect the fact of receipt of an electronic invoice or the date of receipt of goods, we reflect in the system the arrival at the “virtual” warehouse. First, let’s add a warehouse to the “Warehouses” directory (Directories -> Enterprise -> Warehouses (storage locations)). The warehouse type must be “wholesale”.

We reflect the receipt to the “virtual” warehouse from the supplier. Based on the order to the supplier, we enter the document “Receipt of goods and services” into the system.

Since we know from the supplier the expected date of actual receipt of goods at the organization’s real warehouse, it is necessary to assign this date to the receipt document (batch of goods).

You need to add the “Planned receipt date” property to the system and assign the date value to the receipt document. On the top command panel of the receipt document, you must click the “Open properties” button.

In the property editing window that opens, you need to add the “Planned receipt date” property and specify the purpose of the “Documents” property.

Next, we assign the value of the planned date of goods receipt received from the supplier to the created document property.

The result of the performed actions is the balance of the goods ordered by the buyer in the virtual warehouse; the balance of the goods can be tracked, for example, using the report “Statement of goods lots in warehouses” (Reports -> Inventory -> List of goods lots in warehouses).

You need to make the following report settings:

A) on the “General” tab we leave only the indicators of the “Final balance” group

B) check the “Advanced settings” and “Use properties and categories” checkboxes (to be able to display the values of the planned receipt date in the report).

C) on the “Groups” tab, add the value “Planned receipt date (receipt document property)”

D) on the “Selection” tab we indicate the value of the warehouse “Goods in transit”, and as “Order” we indicate the buyer’s order document.

As a result of generating the report, we receive information about the planned date of receipt of the goods and can inform the buyer about it if necessary.

Documenting

Inventories received at the warehouse without payment documents from suppliers are documented in a materials acceptance certificate, form No. $7$.

The act is drawn up in two copies, it is drawn up by the selection committee, the composition of which is established by order of the organization. In the acceptance certificate, the entry “Uninvoiced deliveries” is made; the inventory received is assessed at accounting prices.

The posting of such supplies is carried out on the basis of the first copy of the specified act. After the inventory is capitalized, acceptance acts are transferred to the accounting department. Subsequently, a second copy of the act is sent to the supplier to confirm acceptance of the inventory.

Accounting departments check the relationship of receiving acts to those supplier accounts for which inventories are listed as being in transit. The terms of the contract may provide that ownership is transferred after payment. Such goods should be accounted for in account $002$ “Inventory assets accepted for safekeeping.” This way they will be taken into account until they are paid.

As receipts are received, reversal entries are made of the amounts previously recorded on receipt acts. Reversal entries are made positionally.

At the end of the month, the total cost of inventories accepted as uninvoiced deliveries is calculated, and the reversal amounts for the same month are also calculated, after which the balance of inventories is displayed.

The cost of inventories and uninvoiced deliveries is reflected by the entry:

- Dt $10$ – Kt $60$ – at accepted accounting prices.

For accounting purposes, in some cases, instead of reversal entries, entries with a minus sign will be made. If the volume of uninvoiced deliveries is insignificant, accounting for them can only be kept in the register of settlements with suppliers and contractors.

If documents for inventories accounted for as uninvoiced supplies were received the following year after the organization submitted its annual financial statements, then entries are made for the amount of the difference in the financial results.

Shipment of goods to the buyer

The shipment of goods received from the supplier to the buyer is carried out using the document “Sales of goods and services” (Documents -> Sales -> Sales of goods and services).

It is also convenient to enter this document based on the “Buyer’s Order”. In this case, the document automatically sets the write-off method “From reserve”. Note: as reports that can be used to monitor the “condition” of goods in transit, you can also use the reports “Goods in reserve in warehouses”, “Goods in warehouses”, etc., specifying the appropriate settings.

Example No. 2. Without using a “virtual” warehouse

The advantage of this method is that document flow is reduced due to the absence of the need to use a virtual warehouse.

But at the same time there are also disadvantages:

- Using this method, we “artificially” believe that the generated order to the supplier tells us that the goods are already on the way. While 1C logic implies that an order to a supplier is only a request for the supply of goods and the generated document does not at all mean that the goods will be supplied by the supplier.

- In addition, if we are going to use the order to the supplier for its intended purpose, then it becomes problematic to separate orders that express our desire to buy the goods from orders that we have agreed to consider as orders in transit.

That is why we believe that this method of accounting can only be used in cases where an administrative decision of management has approved an unambiguous interpretation of the order to the supplier as a document reflecting the movement of goods in transit and excluding all other interpretations.

Income tax when accounting for goods in transit

If the supplier uses the accrual method, then the date of recognition of income from sales is the date of transfer of ownership. Taxable income arises on the date on which the goods are transferred from the carrier to the buyer. At the same time, the supplier has the right to reduce the base for calculating the tax on the cost of products sold, as well as on the costs of delivering them to the buyer.

If the supplier uses the cash method of revenue recognition, then revenue is recognized on the date cash is received from customers. The very fact of transfer of goods in this case will not affect the procedure for recognizing income (

Placing a buyer's order, placing orders with the supplier

We will place the buyer’s order and indicate “Product 1” and “Product 2” in the order.

We use the “Buyer’s Order” document. When entering a buyer’s order with the current date, the “Fill and Post” button will automatically indicate the placement of the buyer’s order in orders to suppliers. If the data on the buyer’s orders is not reflected in the system promptly (for example, when importing from external information systems), it will be additionally necessary to enter the document “Reservation of Goods” based on the buyer’s order to automatically place goods from the buyer’s order in orders to the supplier.

When entering the document “Reservation of Goods” based on the “Buyer’s Order”, the tabular part “Goods” is filled with positions from the buyer’s order. When you click on the “Fill and Post” button, the “New placement” field is automatically filled in with the “Order to supplier” documents, according to which the goods will be shipped to the buyer.

In the event of a lack of goods in the organization's warehouses (trade on order), the option of a reservation strategy is not important for auto-reservation.

What the Ministry of Finance says

As you know, one of the conditions for applying the deduction is the acceptance of goods for accounting. 1 tbsp. 172 Tax Code of the Russian Federation. But the Tax Code of the Russian Federation does not say at what point this happens.

The Ministry of Finance believes that the moment of acceptance of goods for registration will be the actual

date of receipt of goods received by the organization in the presence of primary Letter of the Ministry of Finance of Russia dated September 26, 2008 No. 03-07-11/318, drawn up according to standard unified forms pp. 1, 2 tbsp. 9 of the Federal Law of November 21, 1996 No. 129-FZ “On Accounting”. This means that it is impossible to deduct VAT amounts presented for the purchase of goods that were not actually received by the organization.

In accounting documents

To carry out transactions clearly and efficiently, synthetic accounts are used. Among them:

- “Materials” - used to summarize data on the movement of fuel, components, raw materials involved, packaging and other assets. The documentation indicates the actual cost. In some cases - discount prices. Divided into 11 subaccounts.

- “Animals for growing and fattening” is a list of animals, birds, and bee families that participate in the commercial activities of the organization. All information about young animals, adults that are fattened, as well as herds intended for marketing is entered.

- “Procurement and acquisition of material assets” is a set of information about the purchase of inventories that are involved in production cycles.

- “Deviation in value” - it displays all the data on the difference in the price of assets that were accepted into the enterprise. Their actual cost is indicated.

- “Products” - here the situation regarding the availability and movement of products that were purchased for further resale is described.

- "Finished products".

In addition to synthetic accounts, off-balance sheet accounts are also used in accounting for the movement of inventories. These include:

- “Materials accepted for processing” - here we monitor customer-supplied raw materials, which are not paid for by the company. This includes assets that are kept in warehouses for certain reasons. For example, if the customer received unpaid resources from the supplier, which, according to the terms of the contract, are prohibited from being put into operation until full payment is made.

- “Goods accepted for commission.” The terms of the concluded contract are taken into account.

Classification of inventory accounting according to PBU

Accounting regulations are a normative act that regulates the composition of inventories. The document was approved by the Ministry of Finance of the Russian Federation. According to the information contained in it, values are divided into the following categories:

- raw materials used in production;

- support resources;

- purchased semi-finished products;

- energy sources, returnable waste;

- packaging, as well as components;

- household equipment used in work.

It is worth mentioning what can be considered a unit of accounting for inventory materials. First of all, the code in the nomenclature is used. However, a party or group can perform. The main thing is to ensure that the full scope of information and control capabilities are provided.

Synthetic registration

It is maintained in the “Materials” account, which was mentioned earlier. Remaining assets are entered into debit, expenses and release for various needs, and vice versa - into credit. This is done at the cost price of each of them.

Sales of materials are shown in Other Income and Expenses. This takes into account the price of sold resources, VAT paid, expenses associated with the sales process, as well as revenue from it.

Commodity accounting

The article from the magazine “MAIN BOOK” is current as of May 25, 2012.

Contents of the magazine No. 11 for 2012 Yu.A. Inozemtseva, tax expert

How to take into account the cost of goods from purchase to sale

After the organization has decided on the list of costs that form the cost of goods, you need to choose a methodology that will allow you to correctly and timely:

- reflect goods in the balance sheet;

- recognize them as expenses in the income statement;

- write off the costs of purchasing goods in tax accounting.

Concept

Before describing the procedures and giving the specification, it is necessary to find out what we are dealing with. The abbreviation MPZ is often used in scientific sources and documents. In short, accounting of inventories at an enterprise is the totality of all assets of the company used as raw materials or materials in the process of producing goods or services, specifically for sale. For example, the ingredients from which dishes are prepared in a cafe. In addition, this list includes funds that are involved in management. If they are purchased for further sale, then they must also be included in this list. It is important to note that their full cost is included in the final price of the product on the market.

Procedure for registering uninvoiced supplies

Keeping records of the use of inventories often has to be carried out in the absence of a payment certificate. The regulations provide for a separate procedure for this. Received valuables are first received at the warehouse; later, employees draw up a receipt, which is then handed over to the accounting staff. In this case, the estimated prices of assets are used for the operation. Once entered into the journal, they are accepted. Payment is made in the month following the reporting month. The transaction is registered in a separate line of order number 6.

Postings

- Dr $91$ – Kr $60$ – losses from previous years are reflected in the amount exceeding the presented value for inventories over their book price

- Dr $19$ – Kr $60$ – VAT amount on the invoice.

If accounts $15$ and $16$ are used to record inventory, the $60$ account will be credited with a debit to the $15$ account (instead of the $10$ account). When making an inventory of payments, uninvoiced deliveries are reflected in the inventory lists in accordance with their acceptance certificates.

Are you a student at any Russian university? We invite you to a paid interview! The topic of the interview is preparation for the session and problems that arise during this Find out more

Inventory

At least once a year, according to the requirements, the company undertakes to conduct an inventory of the assets at its disposal. The procedure for conducting it is not regulated. It is designated by the head of the enterprise. The official decides how often the procedure needs to be carried out, on what dates it is carried out, as well as the list of property that is checked. Exceptions are cases when the operation is mandatory under current legislation.

To make the process easier, you can use special software. For example, “Warehouse 15” from Cleverens helps automate many warehouse operations, including inventory.

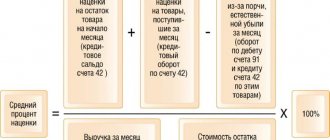

Inventory valuation

To better understand the issue, you can use the given example of inventory accounting. The table shows calculations using the FIFO method.

| Options | Number of units | Unit price | Sum |

| Balance at the beginning of the month | 30 | 15 | 450 |

| Receipts (batch) | |||

| number one | 40 | 18 | 720 |

| number two | 20 | 20 | 400 |

| number three | 80 | 25 | 2000 |

| Sum | 140 | – | 3120 |

| Expenses – 150 kilograms | |||

| Write-offs | 30 | 15 | 450 |

| 40 | 18 | 720 | |

| 20 | 20 | 400 | |

| 60 | 25 | 1500 | |

| Total losses for the specified period | 150 | – | 3070 |

| Remainder | 20 | 25 | 500 |

Posting

Inventories are accepted for accounting at the actual cost of each of them. It recognizes the amount of all expenses incurred by the company in the process of purchasing them. Exceptions include VAT and other refundable taxes, as well as cases regulated by law. The list of costs may include:

- transfer of money to suppliers in accordance with the contract;

- fees for consulting and other services;

- customs duties;

- intermediary remuneration;

- logistics costs;

- other items related to the procurement of inventories.

Organization and features of accounting for disposal of inventories

According to PBU, the company carries out this procedure in one of several available ways. The first is the cost of each unit supplied. In addition, you can calculate the average value for all. The third is the FIFO method. It was demonstrated in the table above.

Each of the described ways is applied for one year.

Postings for accounting for goods in transit

| Business transaction | Debit | Credit |

| Payment for goods (Cost of goods including VAT) | 62 | 51 |

| Ownership of the purchased goods has been obtained (Cost of goods excluding VAT) | 15 | 60 |

| VAT included | 19 | 60 |

| Transport services paid (Transportation cost) | 60 | 51 |

| Transport costs are included in the price of the goods (Transportation Cost) | 15 | 60 |

| VAT is calculated from the cost of transportation costs | 19 | 60 |

| The goods are capitalized at their actual cost (cost of goods without VAT + cost of transportation with VAT) | 41 | 15 |