The taxpayer has the right to claim a VAT deduction if the conditions established by Chapter 21 of the Tax Code of the Russian Federation are met. If there is no such desire, then you can pay VAT on sales in full and not worry about possible additional charges during verification.

However, in practice, no one does this, because a deduction is a legal opportunity to reduce taxes, and the saved amount, which, by the way, is quite significant in large companies, can be spent on development, the purchase of new equipment, or bonuses for those who worked hard. Of course, there are many ways to spend money. Here everyone has the right to decide for themselves. But if the taxpayer nevertheless takes advantage of this opportunity or is just planning to do so, he should be aware of the main reasons that can lead to a refusal to deduct VAT, fines and penalties.

And Yulia Raguzina , tax consultant, founder and director of the accounting outsourcing company DKB Profuchet LLC, talks in detail about these reasons.

"Every Accountant Wants to Know"

Let's start with the balances on account 19, which could not have existed at all if the accountant had taken certain actions in time.

Here are at least four unpleasant situations.

- During the inspection, the inspector canceled the deduction. The accountant, which is absolutely correct, restored it in accounting as a debit to account 19. What next? There is nothing further to wait for: you need to write it off as a debit to account 91. However, this amount cannot be taken into account in tax accounting. But account 19 will not have an unreasonable balance.

- The following situation is when the accounting on account 19 gets clogged: they bought a fixed asset and allocated input tax. But here’s the problem: the property was accounted for on account 08, and an inexperienced accountant decided not to accept it for deduction until the fixed assets were transferred to account 01. This is wrong. The deduction can be claimed without waiting for such a transfer (see, for example, letter of the Ministry of Finance dated February 16, 2021 No. 03-07-11/9875).

- This is another not uncommon situation. It happens to importers. The price of goods (work, services) purchased abroad includes indirect tax. The accountant assigns its amount to account 19. If the purchased assets are intended for transactions subject to VAT or for resale, VAT is deducted in the quarter when the imported goods were recorded on the company’s balance sheet. And there is no need to wait to see whether the money for the goods has been transferred to the foreign partner by this time or not.

- And finally, the accountant simply forgot to submit a deduction, although all the conditions for it were met. If 3 years have not yet passed from that moment, it doesn’t matter: the deduction can still be claimed.

But if more than 3 years have passed since the end date of the period in which the invoice was issued, there is no right to deduction. Forgotten tax can only be written off to 91 accounts and not taken into account in tax expenses. And in this case, do not forget to take an inventory and reflect the amount written off in the act.

If you refuse the deduction of your own free will (for example, input VAT exceeds the amount of accrued tax), you have the right to do so. But don’t let things get to the point where you lose this right completely. The fact is that you can exercise the right to deduct VAT in cases specified by the Tax Code of the Russian Federation within three years, counting from the end of the quarter in which this right arose. If you miss this deadline, in the future you will have to write off the balance again to 91 accounts without the ability to include it in expenses.

#4 - Problematic Supplier

They try to avoid problematic counterparties. They cause a lot of problems. In particular, you may lose your VAT deduction. To avoid such problems, carefully check your counterparties. Use special services for this. The most popular is “Transparent Business” (https://pb.nalog.ru) on the official website of the Federal Tax Service of Russia (www.nalog.ru).

If tax officials prove that the taxpayer acted without due diligence and care when choosing a supplier, then the tax benefit (in the form of a deduction) may be considered unjustified. In other words, obtained illegally.

The supplier must pay VAT in good faith. If this does not happen, then, according to the judges, withdrawing a deduction from the taxpayer who actually received the goods, work or service is allowed only if inspectors from the Federal Tax Service can prove that the taxpayer was aware of the supplier’s dishonesty. If the case goes to court, it will be assessed whether the taxpayer acted reasonably or unreasonably when concluding the agreement. Could he have known, for example, about the lack of real activity of the seller?

The obligation under the contract must be fulfilled by the person specified in the contract and/or by the person to whom such an obligation is also transferred under the contract or law. Let's look at an example.

First case

enters into an agreement with. The subject of the contract is the supply of spare parts. In fact, it is engaged in the supply of spare parts. There are no contractual agreements between enterprises “B” and “C”. If he claims a deduction, it will be removed.

Second case

enters into an agreement with. The subject of the contract is the supply of spare parts. is a manufacturing enterprise. For a number of reasons, it cannot supply spare parts in the volume required under the contract. To avoid fines for failure to deliver, she enters into an agreement with, which produces the same spare parts. There should be no problems with deducting VAT, provided that the conditions established by tax legislation are met (availability of an invoice; use of parts in activities subject to VAT; must be a value added tax taxpayer; parts are accepted for accounting).

It is also important that:

●

the parts were delivered in reality and not on paper;

●

the deal made economic sense;

●

the purpose of the transaction is not only the return of VAT in the form of a deduction (a deduction cannot be the only purpose of the transaction).

Write-off of non-deductible VAT in accounting

To accept VAT for deduction, a number of conditions established by Art. 171 and 172 of the Tax Code of the Russian Federation. Mandatory items include the presence of correctly executed primary documents, including invoices. If there is no primary tax, the tax cannot be deducted, and after the expiration of the three-year period it must be written off. Also, the need to write off VAT may arise if the tax authorities refuse to deduct it. The reason could be:

- presence of shortcomings in the invoice received from the supplier;

- failure by the supplier to display sales in the sales book (tax gap). How to submit an explanation to the Federal Tax Service in case of a tax gap, read here.

ConsultantPlus has prepared for you a selection of judicial practice on the issue of claiming VAT for deduction in various situations. Sign up for free trial access to the system to find out the opinion of judges on the procedure for applying Art. 171 Tax Code of the Russian Federation.

You can find out the safe share of deductions by region here

Let's consider the algorithm for generating transactions when writing off non-deductible VAT using an example:

purchased for the amount of 12 thousand rubles. (including VAT RUB 2,000). The accountant recorded the following entries in accounting:

- Dt 26 Kt 60 - 10,000.00 rub. — service received from the supplier;

- Dt 19 Kt 60 — 2,000.00 rub. — incoming VAT is recorded;

- Dt 68 VAT Kt 19 - 2,000.00 rub. — input VAT is presented for deduction.

During the desk audit, a tax gap was revealed, because the supplier Stella LLC did not reflect the sales in the sales book, and the tax office refused to deduct it. In accounting, the unaccepted tax is written off as an enterprise expense. The accountant of Garant LLC recorded the following entries in the accounting:

- Dt 68 (VAT) Kt 19 - 2,000.00 rub. - reversal;

- Dt 91 Kt 19 — 2,000.00 rub. — input VAT is written off as expenses.

So, VAT is not accepted for deduction - where to write it off in tax accounting (TA)? Can such a tax be taken into account in profit expenses? We will answer in the next section.

We described in the article how to write explanations to the tax office regarding VAT

Amounts of “input” VAT that are not deductible

Amounts of “input” VAT that are not deductible

The material is prepared using

legal information by status

as of September 25, 2013

As a general rule, when calculating value added tax (VAT) payable, the total amount of VAT calculated on the sale of goods (work, services), property rights is reduced in accordance with clause 1 of Art. 107 of the Tax Code of the Republic of Belarus (hereinafter referred to as the Tax Code) to those established in Art. 107 Tax Code tax deductions.

In this case, VAT amounts are recognized as tax deductions (clause 2 of Article 107 of the Tax Code):

1) presented by sellers who are registered with the tax authorities of the Republic of Belarus and are payers, for payment to the payer when he purchases goods (work, services), property rights in the territory of the Republic of Belarus;

2) paid by the payer when importing goods into the territory of the Republic of Belarus;

3) paid to the budget when purchasing goods (work, services), property rights on the territory of the Republic of Belarus from foreign organizations that are not registered with the tax authorities of the Republic of Belarus.

However, the Tax Code establishes certain cases in which the above amounts of VAT or so-called. “input” VAT is not accepted for offset. Thus, amounts of “input” VAT can be attributed to the costs of production of goods (work, services), as well as to an increase in the cost of purchased goods (work, services) or attributed to the source of acquisition of goods (work, services).

All cases in which input VAT is not deductible are listed in clause 19 of Art. 107 NK.

Attribution of “input” VAT to costs

In accordance with sub. 19.1 Art. 107 of the Tax Code are not subject to deduction of VAT amounts included in the payer’s costs for the production and sale of goods (work, services), property rights, taken into account for taxation.

According to paragraph 2 of Art. 106 of the Tax Code, VAT amounts, with the exception of VAT amounts presented upon acquisition or paid upon import of fixed assets and intangible assets, are included in the payer’s costs for the production and sale of goods (work, services), property rights, taken into account for taxation, in the case of the use of acquired ( imported) goods (work, services), property rights for the production and (or) sale of goods (work, services), property rights, operations for the sale of which are exempt from taxation.

Clause 3 of Art. 106 of the Tax Code provides that in the case of simultaneous use of acquired (imported) goods (work, services), property rights in the production and (or) sale of goods (work, services), property rights, operations for the sale of which are exempt from taxation, and goods ( works, services), property rights, transactions for the sale of which are subject to taxation, inclusion of VAT amounts, with the exception of VAT amounts presented upon acquisition or paid upon import of fixed assets and intangible assets, into the payer’s costs for the production and sale of goods (works, services) , property rights taken into account for taxation are carried out on an accrual basis from the beginning of the year based on the share of turnover of operations for the sale of goods (work, services), property rights exempt from taxation, in the total volume of turnover for the sale of goods (work, services), property rights .

Thus, the legislation establishes that if the payer has preferential turnover, amounts of “input” VAT directly or indirectly related to the production (sale) of preferential goods (work, services) are not subject to deduction, but are charged as expenses.

Payers can determine the amount of “input” VAT that must be attributed to costs using the specific weight method or the separate accounting method (clause 24 of Article 107 of the Tax Code).

The application of one of the two methods of distribution of tax deductions in relation to tax deductions for certain types of activities (operations) by the payer (the specific weight method or the separate accounting method) is carried out for at least one calendar year and is approved by the accounting policy of the organization. If there is no indication in the organization's accounting policy about the applied method of distribution of tax deductions, all tax deductions are distributed using the specific weight method.

When determining the specific weight method of tax deductions attributable to a certain amount of sales turnover, this amount of turnover is divided by the total amount of sales turnover and multiplied by the amount of tax deductions attributable to the total amount of sales turnover. The percentage of specific gravity is calculated with an accuracy of at least four decimal places (Part 3, Clause 24, Article 107 of the Tax Code).

The determination of tax deductions by the separate accounting method requires the presence in accounting and the purchase book, if it is maintained by the payer, of information on the amounts of VAT presented upon purchase or paid upon import of goods (work, services), property rights, the inclusion of which in the costs of production and sales of goods (work, services), property rights taken into account for taxation are carried out in the same manner (Part 5, Clause 24, Article 107 of the Tax Code).

When distributing the total amount of tax deductions and determining that part of it that is to be attributed to expenses, it should be taken into account that:

1) the amount of “input” VAT on fixed assets and intangible assets is not included in expenses;

2) when determining the specific weight accepted for the distribution of tax deductions, the following are excluded from the amount of turnover:

● tax base and VAT amount for goods (work, services), property rights acquired on the territory of the Republic of Belarus from foreign organizations that are not registered with the tax authorities of the Republic of Belarus;

● operations for the sale of goods, the place of sale of which is not recognized as the territory of the Republic of Belarus, provided that these goods were purchased on the territory of a foreign state and upon their sale VAT was not calculated to the budget of the Republic of Belarus;

3) tax deductions of the previous tax period do not participate in the distribution, if this is provided for by the accounting policy of the organization. Otherwise, tax deductions from the previous tax period are subject to distribution using the specific weight method in the manner established by the Tax Code.

Example 1

The organization provides tourist services that are subject to VAT and exempt from VAT on the basis of subclause. 1.34 art. 94 NK. The total amount of the tax base reflected in the VAT return amounted to 150,000 thousand rubles, incl. the tax base exempt from VAT is 91,000 thousand rubles, the tax base for the purchase of services on the territory of the Republic of Belarus from a foreign organization is 5,000 thousand rubles.

The organization does not keep separate records of tax deductions; the total amount of “input” VAT amounted to 19,000 thousand rubles, incl. VAT on purchased fixed assets is 1,000 thousand rubles. The organization has a balance of tax deductions for goods (work, services) of the previous tax period in the amount of 1,200 thousand rubles. (the procedure for distributing tax deductions from the previous tax period is not specified in the accounting policy).

To determine the amount of input VAT attributable to turnover exempt from VAT and subject to attribution to costs, the following actions are performed:

● the total amount of turnover for the sale of VAT-exempt services is divided by the total amount of turnover for the sale of services (minus the tax base for the foreign organization): 91,000 / (150,000 – 5,000) = 0.62758620689, or 62.7586%;

● the total amount of tax deductions of the current and previous tax periods (except for deductions for acquired fixed assets) is multiplied by the percentage of the share of exempt turnover: (19,000 – 1,000 + 1,200) x 62.7586% = 12,050 thousand rubles;

● the amount of VAT determined in this way in the amount of 12,052 thousand rubles. relates to the costs of production and sale of goods (works, services) and is not subject to deduction.

Costs also include the amounts of “input” VAT attributable to turnover on the sale of goods, the place of sale of which is not recognized as the territory of the Republic of Belarus, including turnover on the sale of goods to the public at exhibitions and fairs held on the territory of the member states of the Customs Union (Part 2 Clause 2, Part 2, Clause 3, Article 106 of the Tax Code), with the exception of sales turnover:

● goods (works, services), property rights by organizations (branches, representative offices and other separate divisions of legal entities of the Republic of Belarus) registered as payers outside the Republic of Belarus;

● goods shipped to buyers - foreign organizations and (or) individuals from storage sites on the territory of foreign states and (or) from exhibitions and fairs held on the territory of foreign states, VAT amounts on which have been deducted in full.

The legislation establishes a case in which the amounts of VAT included in the payer's costs for the sale and (or) redemption of securities specified in subclause are not subject to deduction. 1.2 Art. 138 Tax Code (subclause 19.4 Article 107 Tax Code).

Based on the provisions of sub-clause 1.2 of Art. 138 of the Tax Code, when determining the gross profit from transactions with securities (except for bonds of its own issue), the payer’s costs when selling securities, as well as when redeeming them, are determined based on the costs of acquiring and selling or redeeming securities, paying for the services of the stock exchange, depository , other professional participants in the securities market and other direct expenses directly related to transactions with securities, including VAT amounts attributable to them.

In other words, VAT amounts on direct expenses directly related to transactions with securities are included in these expenses without deducting them.

In accordance with paragraph. 2 clause 5 of the Instructions for accounting for value added tax, approved by Resolution of the Ministry of Finance of the Republic of Belarus dated June 30, 2012 No. 41 (as amended on August 24, 2012; hereinafter referred to as Instruction No. 41), the amount of VAT on purchased ( imported) goods, works, services used in the production and (or) sale of goods, works, services, operations for the sale of which are exempt from taxation (not recognized as an object of taxation) VAT in accordance with the law, and not subject to deduction, are reflected in the debit of accounts 20 “Main production”, 23 “Auxiliary production”, 25 “General production costs”, 26 “General business expenses”, 29 “Servicing production and facilities”, 44 “Sales expenses” and credit account 18 “Value added tax on purchased goods , works, services."

Attribution of “input” VAT to the increase in the cost of goods (works, services)

In accordance with sub. 19.2 Art. 107 of the Tax Code are not subject to deduction of VAT amounts attributed to the increase in the cost of goods (work, services), property rights (including fixed assets and intangible assets).

It is necessary to distinguish in which cases the amounts of “input” VAT can be applied to an increase in the cost of goods (work, services) at the request of the payer, and in which – on a mandatory basis.

In accordance with Part 1, Clause 4, Art. 106 of the Tax Code, VAT amounts presented upon acquisition or paid upon import into the territory of the Republic of Belarus of goods (work, services), property rights, including fixed assets and intangible assets, may be applied by payers to the increase in the cost of these goods (work, services), property rights.

Provision of paragraph 4 of Art. 106 of the Tax Code is the right of the payer, and it should be taken into account that:

● the organization has the right (but is not obligated) to provide in its accounting policy for the attribution of VAT on all or individual goods (works, services) at its discretion to the increase in the cost of these goods (works, services);

● the legislation does not provide for the subsequent allocation of VAT for the deduction previously allocated to the increase in value in this case.

The amounts of “input” VAT must be attributed to the increase in the cost of goods (work, services), property rights in the following cases:

1) organizations that do not carry out entrepreneurial activities on the territory of the Republic of Belarus (including foreign organizations and representative offices of foreign organizations accredited in the prescribed manner), amounts of VAT presented upon acquisition or paid upon import of goods (work, services) into the territory of the Republic of Belarus , property rights, are attributed to the increase in the cost of these goods (works, services), property rights (Part 2, Clause 4, Article 106 of the Tax Code);

2) payers selling purchased goods, sales of which are exempt from taxation, the amounts of VAT paid when importing goods into the territory of the Republic of Belarus are attributed to the increase in the cost of goods on the date of acceptance of goods for registration (Part 1, Clause 5, Article 106 of the Tax Code );

3) individual entrepreneurs who are not recognized as VAT payers (with the exception of VAT charged when importing goods into the territory of the Republic of Belarus), the amounts of VAT paid by them when importing goods or presented to them when purchasing goods (work, services), property rights, as well as the amount VAT paid to the budget when purchasing goods (work, services), property rights on the territory of the Republic of Belarus from foreign organizations that are not registered with the tax authorities of the Republic of Belarus is attributed to the increase in their value (Part 2, Clause 5, Article 106 of the Tax Code );

4) individual entrepreneurs who have ceased to be recognized as payers, the amounts of VAT presented upon acquisition or paid when importing goods (work, services), property rights into the territory of the Republic of Belarus, which were not accepted for deduction in the reporting period in which they were recognized as payers, are attributed to increase in their cost (clause 6 of Article 106 of the Tax Code);

5) organizations and individual entrepreneurs applying special taxation regimes without calculating and paying VAT, VAT amounts presented upon acquisition or paid upon import of goods (works, services), property rights, as well as VAT amounts paid to the budget upon acquisition of goods (works) , services), property rights on the territory of the Republic of Belarus of foreign organizations that are not registered with the tax authorities of the Republic of Belarus are attributed to the increase in their value (clause 7 of Article 106 of the Tax Code).

Example 2

An organization that is a tax payer under the simplified taxation system (STS) without paying VAT, imported goods from the Russian Federation and purchased from a Lithuanian organization services for the design, development, design and modification of web pages. In this situation, the organization applying the simplified tax system is obliged to pay to the budget:

● VAT when importing goods into the territory of the Republic of Belarus on the basis of sub-clause. 3.1 Art. 286 Tax Code and Art. 3 Agreement on the principles of collecting indirect taxes on the export and import of goods, performance of work, provision of services in the Customs Union dated January 25, 2008;

● VAT on the acquisition of objects on the territory of the Republic of Belarus from foreign organizations that do not operate in the Republic of Belarus through a permanent representative office and are not registered with the tax authorities of the Republic of Belarus on the basis of clause. 4.4 Art. 286, paragraph 1, art. 92 of the Tax Code, due to the fact that, according to sub. 1.4 art. 33 of the Tax Code, the place of sale of services for the design, development, design and modification of web pages is the territory of the Republic of Belarus, because their customer operates on the territory of the Republic of Belarus.

At the same time, the above VAT amounts calculated and paid to the budget of the Republic of Belarus are not accepted by the organization for deduction, but are attributed to the increase in the cost of goods imported from the Russian Federation and to the increase in the cost of services purchased from the Lithuanian organization.

Paragraph 3 of clause 2 and clause 6 of Instruction No. 41 determines that VAT amounts that are not subject to deduction in accordance with the law are reflected:

● on the debit of account 41 “Goods” and the credit of account 18 “Value added tax on purchased goods, works, services” - for the amount attributable to the increase in the cost of goods accepted for accounting under account 41 “Goods”, VAT paid upon import specified goods, operations for the sale of which are exempt from taxation (not recognized as an object of taxation) VAT in accordance with the legislation, on the territory of the Republic of Belarus, by organizations selling these goods;

● debit of accounts 07 “Equipment for installation and building materials”, 08 “Investments in long-term assets”, 10 “Materials”, 11 “Animals for growing and fattening”, 25 “General production costs”, 26 “General business expenses”, 41 “Goods " and other accounts and credit accounts 60 "Settlements with suppliers and contractors", 76 "Settlements with various debtors and creditors" without reflection on account 18 "Value added tax on purchased goods, works, services."

Attribution of input “VAT” at the expense of targeted financing

In accordance with sub. 19.3 art. 107 of the Tax Code are not subject to deduction of VAT amounts presented upon acquisition or paid upon import of goods (work, services), property rights at the expense of gratuitously received budget funds or state extra-budgetary funds. The indicated amounts of VAT are attributed to these sources or to an increase in the cost of goods (work, services), property rights.

Example 3

An agricultural organization purchased fuel at its own expense in 2012 and accepted VAT for deduction based on primary accounting documents. In 2013, the local executive committee decided to allocate funds from the budget free of charge to pay off the debt for fuel to the supplier.

In the reporting period in which the purchased fuel will be paid for from the budget, the total amount of tax deductions must be reduced by the amount of VAT previously accepted for deduction on this fuel. This tax amount is subject to attribution from budget funds.

Provisions sub. 19.3 art. 107 Tax Code do not apply if:

● funds received from these sources are included in the tax base;

● the acquisition (import) of goods (work, services), property rights was made at the expense of the amounts of subsidies provided from the budget in connection with the use by the payer of prices determined (regulated) by law, or benefits provided to certain categories of citizens in accordance with the law.

VAT amounts from organizations engaged in forestry, presented upon purchase or paid upon import of goods (work, services), property rights at the expense of industrial production funds and transferred for forestry, are not subject to deduction. The indicated amounts of VAT are included in the costs according to the estimate for forestry management (subclause 19.7 of Article 107 of the Tax Code).

According to para. 5 clause 5 of Instruction No. 41, the amount of VAT paid (to be paid) upon the acquisition (import) of goods, works, services at the expense of funds received free of charge from the republican budget or state extra-budgetary funds, unless otherwise established by law, is reflected in the accounting records as a debit account 98 “Deferred income” and other accounts and credit account 18 “Value added tax on purchased goods, works, services.”

Other cases in which “input” VAT is not deducted

In the course of the organization’s activities, situations may also arise when VAT amounts are not accepted for deduction by the payer to whom, according to the primary accounting document, when purchasing goods (works, services), they were presented for payment, but are re-invoiced (transferred) to another business entity along with the goods ( work, service), property rights.

Such situations arise in rental relations, commission trade, in construction, in the delivery of manufactured products to customers by hired transport, under transport expedition agreements and in the acquisition (payment) of work (services) by the payer for its employees (members of their families, pensioners), and the VAT amount are not accepted for deduction on the basis of subparagraph. 19.9, 19.10 and 19.11 Art. 107 NK.

Example 4

The organization ordered and paid for furniture transportation services for its employee. The cost of transport services is inclusive of VAT.

In accordance with sub. 2.16 art. 93 of the Tax Code does not recognize as an object of taxation the cost of work (services) purchased (paid) by the payer for its employees and (or) members of their families, as well as for pensioners who previously worked for them.

At the same time, according to sub. 19.9 art. 107 of the Tax Code are not subject to deduction of VAT amounts presented upon acquisition or paid upon import of goods (work, services), property rights that are not recognized as objects of VAT taxation in accordance with subparagraph. 2.12, 2.16, 2.23 art. 93 NK.

The amount of furniture transportation services purchased for an employee is not reflected in the VAT return (calculation) and the amount of VAT on transport services is not deductible.

If the amount of transport services for the transportation of furniture is not reimbursed by the employee, then their cost, together with VAT, is included in other expenses for current activities, recorded in account 90 “Income and expenses for current activities” subaccount 90-10 “Other expenses for current activities” (clause 13 of the Instructions for accounting of income and expenses, approved by Resolution of the Ministry of Finance of the Republic of Belarus dated September 30, 2011 No. 102 (as amended on February 8, 2013; hereinafter referred to as Instruction No. 102)).

For payers who, before January 1, 2013, determined revenue using the method of payment for shipped goods (work performed, services rendered), the issue of writing off “input” VAT amounts in the event of non-payment of debt on purchased goods (work, services) and in connection with This makes it impossible to deduct VAT on unpaid items.

For payers for whom revenue from the sale of goods (work, services) in accounting was determined as payment for goods shipped (work performed, services provided), only the VAT amounts actually paid by the payer were subject to deductions, i.e. after payment for goods (work, services) (Part 1, Clause 6, Article 107 of the Tax Code as amended in 2012).

When writing off amounts of accounts payable for purchased goods (work, services) after the expiration of the statute of limitations or under other circumstances on the organization’s income (non-operating income for tax purposes) on the basis of clauses 13, 14, 27 of Instruction No. 102 and sub. 3.10, 3.10-1 and 3.10-2 art. 128 of the Tax Code, an organization needs to write off the amount of “input” VAT on purchased and unpaid objects (the right to deduct these amounts of VAT will not arise).

In accordance with paragraph. 4 clause 5 of Instruction No. 41 for the amount of VAT not accepted for deduction on goods, works, services, accounts payable for which is recognized as income, the following correspondence of accounts is drawn up: debit of accounts 90 “Income and expenses for current activities”, 91 “Other income and expenses "and credit to account 18 "Value added tax on purchased goods, works, services."

When is it permissible to write off VAT on expenses?

In general, according to paragraph 1 of Art. 170 of the Tax Code of the Russian Federation, the amounts of input VAT (that which you pay when purchasing goods, works, services, rights or carrying out import transactions) are not included in the expenses taken into account when calculating income tax (or personal income tax). However, this does not apply to the situations listed in paragraphs. 2 and 5 tbsp. 170 Tax Code of the Russian Federation. VAT can be attributed to expenses if:

- the purchased goods or services are planned to be used in VAT-free transactions (confirmation of this position is in letters of the Ministry of Finance of the Russian Federation dated November 2, 2010 No. 03-07-07/72 and 04.13.2009 No. 03-03-06/1/236);

- the place of their implementation is not Russia (letter of the Ministry of Finance of the Russian Federation dated October 1, 2009 No. 03-07-08/195);

- you, as a taxpayer, are exempt from paying VAT or are not a payer of this tax due to the use of special tax regimes (letters of the Ministry of Finance of Russia dated November 11, 2009 No. 03-07-11/296 and dated September 3, 2009 No. 03-11-06/3/227 );

- acquired inventory, services or rights will be used in operations not recognized as sales;

- assets were acquired by banks, non-state pension funds, insurers, clearing companies, trade organizers, professional stock market participants and similar organizations (in strictly established cases).

NOTE! You can write off not only input VAT as expenses, but also tax calculated for payment if you paid it at your own expense, without presenting it to the buyer, or write off accounts receivable for goods shipped but not paid for.

Read about it here .

ConsultantPlus experts explained how to take VAT into account in expenses in accounting and tax accounting, as well as when calculating taxable profit. Get trial access to the system and move on to the Ready-made solution for free.

Deduction for expenses that do not reduce income tax

Situation: is it possible to deduct VAT on expenses that are not taken into account when calculating income tax?

Yes, you can, but provided that the costs are related to operations subject to VAT. True, with this approach, disputes with the tax inspectorate are not excluded.

In private explanations, representatives of regulatory agencies take the following position. For expenses that are not taken into account when calculating income tax, input VAT cannot be deducted. This is due to the fact that the use of the deduction is provided only for expenses that are associated with the performance of operations subject to VAT, including sales. When calculating income tax, expenses not related to production and sales are not taken into account. This follows from paragraph 2 of Article 171 and paragraph 1 of Article 252 of the Tax Code of the Russian Federation.

Thus, the presence of expenses not taken into account when calculating income tax means that they are not related to the performance of operations subject to VAT.

There are examples of court decisions that contain similar conclusions (see, for example, the ruling of the Supreme Arbitration Court of the Russian Federation dated June 5, 2008 No. 6440/08, the resolution of the Federal Antimonopoly Service of the Far Eastern District dated January 24, 2008 No. F03-A51/07-2/6147 , Volga-Vyatka District dated January 10, 2008 No. A43-2450/2007-31-45, Central District dated August 20, 2007 No. A68-AP-104/18-06, dated July 19, 2006 No. A54- 9067/2005-C18).

However, there is an opposite arbitration practice. Many judges believe that the application of the deduction depends on the tax accounting of expenses only in relation to VAT accrued by the organization when performing construction and installation work for its own consumption (paragraph 3, paragraph 6, article 171 of the Tax Code of the Russian Federation).

In other cases, the Tax Code does not contain any restrictions on the use of VAT deductions for expenses that do not reduce taxable profit. The main condition for deducting input tax is the connection of expenses with the performance of operations subject to VAT. This follows from paragraph 2 of Article 171 of the Tax Code of the Russian Federation.

For example, an organization can give its employee a TV for his birthday. When calculating income tax, expenses for the purchase of a TV are not taken into account. However, such a transfer is recognized as a sale on which the organization must pay VAT. Consequently, the organization can deduct the input VAT presented by the supplier when purchasing a TV. At the same time, there is no need to wait until the gift is given to the employee and VAT is charged to the budget. The Tax Code does not establish a relationship between the period of presentation of VAT for deduction and the period of actual sales, including free of charge. Arbitration practice confirms the legality of this approach (see, for example, Resolution of the FAS Moscow District dated March 12, 2009 No. KA-A40/1726-09).

All this follows from the provisions of paragraph 2 of subparagraph 1 of paragraph 1 of Article 146, paragraph 1 of Article 172 and paragraph 16 of Article 270 of the Tax Code of the Russian Federation.

Thus, as a general rule, if expenses are aimed at performing operations subject to VAT, then, regardless of whether they are taken into account when calculating income tax, input VAT on them can be deducted. The courts also adhere to this position. For example, resolutions of the Federal Antimonopoly Service of the Moscow District dated February 26, 2010 No. KA-A40/978-10, dated July 14, 2009 No. KA-A40/5553-09, dated April 7, 2009 No. KA-A40/2620-09 , Volga District dated September 22, 2008 No. A65-5848/07, dated May 6, 2008 No. A65-12919/07-SA2-22, Ural District dated October 7, 2008 No. F09-7115/08-S3, West Siberian District dated August 23, 2007 No. F04-5630/2007(37318-A46-37), dated December 8, 2008 No. F04-6756/2008(15392-A45-37), Far Eastern District dated August 16, 2007 No. F03-A51/07-2/2293, Central District dated December 16, 2004 No. A36-135/2-04 and Northwestern District dated October 24, 2008 No. A56-46360/2007.

Account 19 in accounting

Accounts related to VAT calculations are among the most important in accounting. The amounts summarized on it are used to reduce the amount of tax payable.

On this account, the buyer reflects the amount of VAT paid along with payment for the delivered goods, services, or work. The amount of VAT is included by the seller in the amount of the goods and is highlighted on the invoice as a separate line.

In accounting, VAT accrual is described by posting Dt 19 - Kt 60 (76). Debiting from the account is usually done in conjunction with account 68 Tax calculations; these values are reflected in the purchase book and form the total amount of VAT deduction.

Example of writing off VAT on expenses: postings

As an example, consider the following situation: a Russian research institute purchases materials to carry out research work, and their payment is made from the federal budget.

Since according to sub. 16 clause 3 art. 149 of the Tax Code of the Russian Federation, such an operation is exempt from VAT; input tax in this case is not deducted, but is included in the cost of materials.

In postings, this operation will look like this:

- Debit 10 credit 60 (materials purchased).

- Debit 19 credit 60 (input VAT on purchased materials is reflected).

- Debit 10 credit 19 (input VAT is included in the cost of purchased materials).

How to avoid denial of deductions

VAT accounting practice shows that the Federal Tax Service may refuse to deduct in the following cases:

- the invoice from the supplier contains errors;

- there is no invoice from the supplier, and the tax is highlighted in the receipt documents;

- the supplier did not reflect the transaction in tax documentation (in the sales book);

- The three-year period for submitting VAT for deduction has expired.

The risk of failure can be minimized if:

- carry out preliminary reconciliation with counterparties, primarily permanent, large transactions associated with the company;

- store primary accounting and tax documents in full;

- do not miss the deadlines specified in the legislation for VAT deductions.

It's all in the invoice

A debit balance on account 19 may occur due to the fact that you did not receive an invoice at all or lost it. And by this time the supplier has already been liquidated, and there is no one to ask for the document.

Without an invoice, VAT deduction is prohibited. All that remains is to write off the amount of input tax as expenses. In accounting, again make an entry to the debit of account 91 and the credit of account 19. This expense is also not taken into account for tax purposes.

It may happen that there is an invoice from the seller, but it is compiled with errors that prevent deduction. These are errors in the name of the seller or buyer, the name of the product (work, service), in the cost of goods, in the rate or amount of VAT (clause 2 of Article 169 of the Tax Code of the Russian Federation). In this case, if you have asked the supplier to correct the defects and he has agreed, until you receive the corrected invoice, input VAT will be charged to account 19.

A revised invoice is a new invoice. It indicates the correct data compared to the originally issued document.

But you may receive a corrected invoice in another quarter. In this case, you will have to make adjusting entries on an additional sheet of the purchase ledger for the period in which the original erroneous invoice was recorded. Reflect the total indicators of the original document with a minus sign and, in the usual manner, the indicators of the corrected document. And it will be possible to accept a deduction on the corrected invoice also during the period of drawing up the original invoice.

Where to write off unaccepted VAT when calculating tax profit

When calculating taxable profit, unaccepted VAT cannot be taken into account (Clause 1, Article 170 of the Tax Code of the Russian Federation). Tax legislation also does not provide for the inclusion of such a tax in the cost of goods or services (clause 2 of Article 170 of the Tax Code of the Russian Federation).

Thus, expenses are generated only in accounting (BU), and a constant tax expense (PTR) arises between NU and BU. Accounting for commissioning and commissioning is regulated by PBU 18/02.

PPR is defined as the product of the amount not taken into account in the NU by the income tax rate and increases the amount of income tax payable. In accounting, PNR is accounted for in a separate subaccount of account 99.

Let's continue the example:

The PNR accountant of Garant LLC displayed 99.2 in the subaccount, and recorded the following entries in the accounting:

- Dt 99.2 Kt 68 subaccount “Income Tax” - 400.00 rub. (RUB 2,000.00 × 20%).

Starting from 2021, commissioning and commissioning work may not be reflected in the accounting department at all. With this method of accounting, income tax is accrued in the accounting system according to tax accounting data, and the income tax is determined by calculation and disclosed in the notes to the financial statements.

***

If VAT is not accepted for deduction, it should be written off as an expense to account 91. In tax accounting, such tax is not recognized as an expense for the purpose of calculating taxable profit, and permanent tax obligations are formed between tax and accounting.

Even more materials on the topic can be found in the “VAT” section.

#3 - Reality of Operations

Tax legislation, namely paragraph 1 of Art. 54.1 of the Tax Code of the Russian Federation prohibits a taxpayer from reducing the amount of tax payable as a result of distortion of information about the facts of activity. This refers to a situation where the work was completed only on paper, but did not exist in reality. It is not difficult to identify such operations during verification. Employees of the Federal Tax Service carefully study the documentation and check counterparties. If they understand that the contractor could not fulfill his obligations under the contract due to the lack of machinery, equipment, or personnel, then it will be almost impossible to protect the VAT deduction.

Let us give an example from judicial practice. Upon inspection, it was discovered that there were in fact no operations to export goods. Consequently, the taxpayer could not claim VAT as a deduction. The violator was issued a fine, and was also required to return the funds received (the deduction itself) and pay the interest established by clause 17 of Art. 176.1 Tax Code of the Russian Federation. The taxpayer did not agree. In his opinion, paying the fine and interest is a double responsibility. But the judges supported the Federal Tax Service. A fine is a measure of punishment for an offense, and interest is compensation for damages for the use of budget funds.

Options for writing off VAT on expenses

The moment at which VAT is written off as cost is not the same for different tax regimes. Let's consider the main cases.

- Taxpayers using UTII (before 01/01/2021) include the VAT amount in the cost of goods or materials as they are recorded.

- Taxpayers working on the simplified tax system for “income” have the right to take into account VAT in expenses at the time at their own discretion - the taxation procedure will not change. After all, expenses do not affect the object of taxation - income.

- For simplified people who use the simplified tax system “income minus expenses”, VAT on acquired assets can only be taken into account after their sale.

And of course, we must never forget that in order to write off VAT on expenses, you must have supporting documents.

To learn how VAT will be reflected in the book of income and expenses, read the article “How to take into account input VAT under the simplified tax system?” .

Next, we will consider several practical situations and the corresponding rules for writing off VAT.

No. 7 - Receiving a bonus from a supplier

The Ministry of Finance has formed a clear position regarding bonuses. If the funds are not associated with payment for goods sold and other things, then they are not included in the VAT tax base. It turns out that if the premium does not affect the price of delivery of the goods, then there is no need to adjust the VAT.

There is an exception. These are situations where there is a decrease in the cost of shipping goods, etc. the amount of the premium is established by the contract.

For this reason, you must always carefully sign all agreements and understand how the price of the product is formed, etc.

Let's look at the case law again. The taxpayer's audit ended with additional VAT assessment. According to tax inspectors, he should have adjusted deductions by receiving bonuses from the supplier that reduced the price of goods. But he did not do this, which means he received a deduction in a larger amount than required by law. The dispute between the taxpayer and inspectors moved to the courthouse. The result is a victory for the Federal Tax Service. The judges explained: in the case under consideration, the premium plays the role of a discount, which means that the price reduction should also be reflected in the deduction.

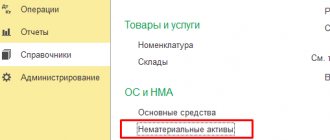

Postings for accounting for “incoming” VAT upon receipt of fixed assets for non-production purposes in 1C 8.2

According to accounting

Postings for accounting for “input” VAT on the debit of account 19.01 are generated by the document Receipt of goods and services - type of operation Equipment:

For tax accounting

The following entries were created in the VAT accumulation register:

Entry by movement type Receipt in the VAT register presented – event Presented by VAT by supplier. This entry is a potential purchase ledger entry:

Entry by the type of movement Receipt in the VAT register for acquired values, type of fixed assets value. The tax amount related to a specific batch of fixed assets is registered:

Recording by the type of movement Receipt in the VAT register for fixed assets, intangible assets, type of value of fixed assets. The tax amounts accepted for accounting on purchased fixed assets are registered in order to track the conditions under which these tax amounts can be accepted for deduction:

What VAT can be deducted?

- Amounts paid to the supplier of goods (services or works).

- VAT paid by a company at customs when importing goods.

- VAT paid to the budget if the goods were returned by the buyer.

- VAT on advances from buyers upon termination of the contract and return of the advance to the buyer.

- VAT presented by contractors during capital construction, installation and assembly of OS, and during their dismantling.

- VAT on supplies for construction and installation works.

- VAT paid when performing construction and installation works for the needs of the organization.

- VAT on business trips and entertainment expenses.

- VAT paid to the budget by tax agents.

- The amount of VAT recovered by a shareholder who contributed some property as a contribution to the authorized capital.

- Paid VAT on export transactions not confirmed on time, if supporting documents are received later.

- Tax amounts adjusted in the event of a retroactive decrease in the cost of goods sold.

No. 8 – “Import” VAT

If the goods were imported, then certain requirements established by tax law must be met for the deduction.

First, the goods must be imported under the customs procedures of release for domestic consumption, temporary import and processing outside the customs territory. The deduction can also be used when importing goods transported across the border of the Russian Federation without customs clearance.

Secondly, the goods must be recorded (capitalized) and intended for activities subject to VAT.

Thirdly, the “import” VAT must be paid in advance (before claiming a deduction), while retaining a document evidencing the payment.

There are situations when a problem with deductions may arise due to the fact that the VAT paid at customs on imports seems suspiciously high to tax officials.

Let's consider a specific situation. The Federal Tax Service refused to allow the taxpayer to deduct VAT paid at customs. The reason is that the price of the product is too high compared to what was formed on the market. Therefore, VAT is overestimated. Judges of three instances supported the tax inspectorate. They agreed that the deduction from the difference between the import and market prices was claimed illegally. The inspectors, in their opinion, did the right thing by changing the transaction price downward as required by Art. 40 Tax Code of the Russian Federation. The judges also indicated that the taxpayer has the right to apply to the customs authorities and return the tax overpaid when importing goods into the territory of the Russian Federation. The dispute continued and ultimately the taxpayer prevailed. The Supreme Court overturned previous decisions. The result was influenced by the fulfillment of all the requirements established by the Tax Code of the Russian Federation for obtaining a deduction. The tax has been paid, which means that a source has been formed in the budget for its subsequent return. The story ended well, but such a reason for refusal exists.