Types of expenses

Accounting for existing expenses gives an idea of the cost of manufactured products (work performed). In this case, all costs that arise during both production and sales are taken into account. In this case, organizations must be guided by PBU 10/99 “Expenses of the organization”, the norms of which take into account the following as expenses:

- material costs;

- wages, transfer of social security contributions;

- depreciation;

- other expenses.

The list of costs can be established by organizations independently; the main criterion here is the specifics of work and economic activity.

Most of the expenses are production costs. Based on the nature of their occurrence, direct and indirect production costs are distinguished. Their main difference is as follows: direct costs are directly involved in the manufacture of goods and provision of services, while indirect costs are of a more general nature.

Accounting and calculation of the cost of finished products: regulatory documents

PBU 5/01 “Accounting for inventories” (order of the Ministry of Finance of the Russian Federation dated 06/09/2001 No. 44n);

Guidelines for accounting of inventories (order of the Ministry of Finance of the Russian Federation dated December 28, 2001 No. 119n);

Basic provisions for planning, accounting and calculating production costs at industrial enterprises, approved. State Planning Committee of the USSR, State Committee for Prices of the USSR, Ministry of Finance of the USSR, Central Statistical Office of the USSR July 20, 1970 No. AB-21-D;

Standard instructions for applying the standard method of accounting for production costs and calculating the standard (planned) and actual cost of products (work), approved. Ministry of Finance of the USSR, State Planning Committee of the USSR, State Committee for Prices of the USSR, Central Statistical Office of the USSR January 24, 1983 No. 12;

Instructions on the procedure for recording and storing precious metals, precious stones, products made from them and maintaining records during their production, use and circulation (Order of the Ministry of Finance of the Russian Federation dated August 29, 2001 No. 68n);

Methodological provisions for planning, formation and accounting of costs for the production and sale of products (works, services) of enterprises of the metallurgical complex (approved by the Ministry of Industry and Energy on October 20, 2004);

Methodology for planning, accounting and calculating the cost of housing and communal services, approved. Resolution of the State Construction Committee No. 9 dated February 23, 1999;

Methodological recommendations for accounting of production costs and calculating the cost of products (works, services) in agricultural organizations, approved. by order of the Ministry of Agriculture dated 06.06.2003 No. 792;

Instructions for planning, accounting and calculating production costs at oil refineries and petrochemical enterprises, approved. by order of the Ministry of Fuel and Energy of November 17, 1998 No. 371;

Methodological recommendations for accounting of costs included in distribution and production costs, and financial results in trade and public catering enterprises, approved. Roskomtorg and the Ministry of Finance of the Russian Federation of April 20, 1995 No. 1-550/32-2 (can be applied until the adoption of a new industry document - letter of the Ministry of Finance of the Russian Federation dated April 29, 2002 No. 16-00-13/03);

Methodological recommendations on planning and accounting of costs for the production and sale of products (works, services) at printing enterprises (approved by the Ministry of Press, Television and Radio Broadcasting and Mass Communications on November 25, 2002);

Methodological recommendations for maintaining separate accounting of income and expenses of telecom operators, approved. by order of the Ministry of Information and Communications dated March 21, 2006 No. 33;

Instructions for planning, accounting and calculating the cost of mining and processing of coal (shale), approved. Ministry of Fuel and Energy dated December 25, 1996;

Instructions for the composition, accounting and calculation of costs included in the cost of transportation, approved. Ministry of Transport 08/29/1995;

Instructions for accounting for income and expenses in road transport, approved. by order of the Ministry of Transport dated June 24, 2003 No. 153;

Methodological recommendations for accounting for production costs and calculating the cost of fat and oil products (approved by order of the Ministry of Agriculture dated December 14, 2004 No. 537);

Instructions for calculating the cost of production at enterprises of the dairy, butter, cheese and canned milk industries (approved by the Ministry of Agriculture and Food on March 19, 1996);

Methodological recommendations for planning, accounting and calculating the cost of production at bakery enterprises (approved by the Ministry of Agriculture and Food on January 12, 2000);

Methodological recommendations (instructions) for planning, accounting and calculating the cost of products of the timber industry complex (approved by the Ministry of Industry and Science on December 26, 2002);

Industry specific features of the composition of costs included in the cost of production at enterprises of the timber industry complex" (approved by the Ministry of Economy of the Russian Federation on October 19, 1994);

Methodological recommendations (instructions) for planning, accounting and calculating the cost of products of the timber industry complex, approved. Ministry of Economy of the Russian Federation 07/16/1999;

Industry instructions for calculating and accounting for finished products of other ministries and departments;

Collection of specific indicators of production and consumption waste generation (approved by the State Committee for Ecology on 03/07/1999).

Until the completion of work on the development and approval by ministries and departments of the relevant industry regulations, organizations, for the purpose of accounting for actual costs of production of products (works, services) and calculating the cost of products, should be guided by the currently applicable industry instructions (directives) insofar as they do not contradict the existing ones PBU (letters of the Ministry of Finance of the Russian Federation dated December 5, 2002 No. 04-02-06/1/155; dated April 29, 2002 No. 16-00-13/03 “On the application of regulatory documents governing the issues of accounting for production costs and calculating the cost of production (work) , services)").

What do direct and indirect production costs include?

A significant share of the cost of products is, as a rule, formed by direct costs. These usually include expenses that are directly used in the production of products. This is the purchase of raw materials, wages of personnel producing the goods, materials used.

Other expenses ensure the continuous operation of the enterprise as a whole. Often they cannot be directly attributed to the creation of a specific product group. Here you can highlight such expense items as maintenance and repair of equipment, electricity.

Indirect costs may not be directly related to the production process, but their presence is necessary for the needs of the enterprise. An example of such expenses is salaries of management personnel, rental payments, licensing costs, and others.

These types of expenses are divided into general and general production expenses. The organization independently distributes them according to the types of products produced.

Accounting for direct production costs

In accounting, information about production costs is generated on 20 accounts. Account 20 “Main production” includes information on direct and indirect costs, expenses of auxiliary production, losses from defects. Direct expenses from cost accounts are written off to the debit of account 20 using the following entries as an example:

- DT 20 - KT 10 - raw materials are taken into account in the production of products;

- DT 20 - KT 70 - wages accrued to employees manufacturing products.

Indirect expenses of auxiliary production, as well as general business expenses, can be written off to debit 20 of account:

- DT 20 - KT 26 - previously incurred material costs are taken into account when determining the cost of production;

- DT 20 - KT 23 - release of products for the needs of the main production.

Direct production costs are directly involved in the creation of a product, while other costs can be involved in other processes, for example, when performing work for other entities:

- DT 90 - KT 23 - provision of services to third parties.

Credit 20 of the account reflects the total cost of manufactured products. Written off to the debit of accounts 43, 90 and others.

Analytics 20 of the account reflects the total amounts of direct and indirect costs for each type of product (work). The total cost is a combination of direct costs directly related to production and other costs.

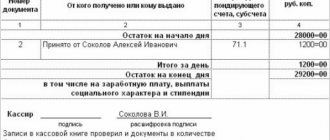

When studying this topic, the following documents were used: balance sheet (form No. 1); profit and loss statement (form No. 2); general ledger or balance sheet; regulations on the organization's accounting policies; accounting registers for accounts 20, 23, 26, 97, etc.; cards (statements) for orders; tables (statements) on the distribution of wages, contributions for social needs, services of auxiliary production, calculation of depreciation charges for fixed assets, intangible assets; statements of distribution of general business, general production expenses, expenses of future periods; acts of inventory of work in progress; consolidated cost accounting statements.

Having summarized all the information received during the pre-diploma internship and studied the internal working documents of VOLNA LLC, we can draw the following conclusions and suggestions:

Errors identified during the study of cost accounting at the VOLNA LLC enterprise are:

− Corrections and blots in some invoices and local estimates;

− The period of inclusion in the cost of work and services for accounting and taxation purposes of payment for work and services does not correspond to the dates specified in some invoices and acts for the performance of work and provision of services.

To improve and increase the efficiency of cost accounting in an enterprise, you should:

− timely reflect all business transactions to account for the costs of production, work performed and services provided;

− it is necessary to strengthen internal control over incoming primary documents;

− carry out timely accounting of incorrectly executed cost accounting documents;

− to improve the quality of all accounting work of the organization, it is necessary to draw up a document flow schedule for the work of the organization, namely for the purposes of accounting and tax accounting, as well as for internal control and timely adoption of management decisions. A correctly drawn up document flow schedule creates conditions for improving the quality of all accounting work of the organization, rational distribution of job responsibilities between employees, strengthening the control functions of accounting and timely preparation of reports. For each transaction, a list of documents necessary to reflect it in accounting is provided. Next, the chief accountant determines the responsible persons and the deadlines for preparing each document. The developed document flow rules must be consolidated in the accounting policies of the enterprise.

The results of studying the accounting policy of the enterprise VOLNA LLC indicate that the provisions adopted in the accounting policy regarding the accounting of costs for performing work and providing services do not contradict current regulatory documents. The company VOLNA LLC uses the custom method of cost accounting and calculating the actual cost of work and services. With the order-by-order method, the object of accounting and calculation is a separate order.

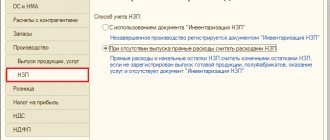

The organization does not provide a list of direct expenses in its accounting policy. The list of direct expenses of the organization must be fixed in the accounting policy for profit tax purposes. They need to be guided.

With the entry into force of Federal Law No. 58-FZ dated 06.06.2005 “On Amendments to Part Two of the Tax Code of the Russian Federation and Some Other Legislative Acts of the Russian Federation on Taxes and Fees,” taxpayers, for tax purposes, have the right starting from January 1, 2005 . independently determine the list of direct and indirect expenses, taking into account industry specifics and business conditions, establishing the principles of their distribution in its accounting policies. However, this does not mean that organizations may not formulate the composition of direct expenses or form it with distortions. Only with the right approach to the formation of expenses in accounting and tax accounting can we talk about the convergence of tax and accounting.

Before the adoption of this Law, the list of direct expenses was closed.

Therefore, taxpayers could not include expenses not indicated in this list in direct expenses, which included:

1. Material costs;

2. Expenses for remuneration of workers involved in the process of production of goods (performance of work, provision of services), as well as the amount of insurance premiums accrued on the specified amounts of labor expenses;

. Amounts of accrued depreciation on fixed assets used in the performance of work and provision of services.

In this case, it was necessary to solve a number of additional problems. For example, for tax purposes, indirect expenses included expenses that were recognized as direct in accounting (expenses for services of third-party organizations associated with the production process). In this regard, organizations had to apply the requirements of PBU 18/02 and create differences in accounting that arise due to different recognition of expenses, which, in turn, complicates the accounting process.

Go to page: 1

Other in economics

Payroll fund. Planning procedure Trade is one of the most important sectors of the national economy, since it ensures the circulation of goods, their movement from the sphere of production to the sphere of consumption. It can be considered as a type of entrepreneurial activity,...