Legal regulation of tax legislation in relation to limited liability companies

The scope of legal regulation of tax legislation includes the activities of subjects of tax legal relations, so their identification is of great importance.

They will be endowed with a legal status that combines a set of rights, as well as obligations and corresponding liability for evading their execution.

Such entities, according to Art. 9 of the Tax Code of the Russian Federation are also limited liability companies, which are among the taxpayers.

The concepts of taxpayer and fee payer can be defined using Art. 19 Tax Code of the Russian Federation.

According to the law, they are individuals and organizations that were entrusted with paying taxes and fees.

Limited liability companies are required to choose a taxation system and promptly pay the correctly calculated amounts to the state.

Based on the Constitution of the Tax Code of the Russian Federation

the set of rights and obligations of taxpayers is determined.

There has been no increase in their rights recently.

All existing provisions are systematizing in nature and do not provide for significant innovations.

More information can be found by referring to the Tax Code of the Russian Federation

, namely chapter 4.

Here are the general rules regarding the fulfillment of obligations to pay taxes and fees.

Responsibility for non-payment of tax amounts

In the process of doing business, cases may arise when there are no funds to pay the appropriate taxes or their amount was unintentionally calculated incorrectly.

In this case, it is worth understanding that this is a serious violation that also affects limited liability companies.

To familiarize yourself with information about the violation, you should refer to Article 122, Chapter 16 of the Tax Code R

F.

This chapter describes the types of tax offenses, as well as responsibility for their commission. Limited liability companies may be subject to incomplete payment or non-payment of the fee.

According to the law, this action, committed as a result of understating the tax base and other illegal actions, including incorrect calculation of the fee, may result in a fine.

Its amount is 20% of the amount of unpaid tax.

The second paragraph of the article of the tax code, Chapter 16

, provides for a similar tax evasion, but in this case it will be intentional.

This entails a fine of 40% of the tax amount.

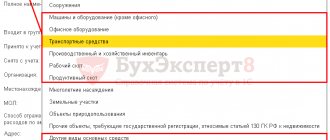

Enterprise property tax

This type of payment is accrued on all property of enterprises that is listed on the balance sheet. The exceptions are: funds in a current account and a list of what is exempt from taxation by law.

The full value of taxable property is determined by adding the value of all property at the beginning of the month. The entire amount is then divided by the total number of months in question.

The entire tax base is calculated based on the price of fixed assets, inventories and costs, intangible assets, which are visible from the relevant sections of the balance sheet.

Taxation options for LLCs: their advantages and disadvantages

The tax system applied by a limited liability company will influence the content and scope of its financial statements.

In order to select the most suitable option, a legal entity needs to consider the specifics of the organization’s activities.

In some cases, an entrepreneur will have the opportunity to independently choose between a simplified taxation system and a single tax.

It is worth knowing that the UTII system is acceptable for an LLC in cases where it is mandatory in accordance with the laws existing in the region and the type of activity of the enterprise.

If a company pays taxes using this option, it will also need to maintain the simplified tax system - a simplified taxation system or a general one.

The simplified system involves maintaining these two types separately, while the general system allows for combination with UTII.

In the first case, the entrepreneur will have to provide more reporting, which will entail significant costs.

This method can be chosen by small organizations, while the second option is more suitable for large companies.

This is just a small example of the choice between two tax systems.

All of them are worth considering in more detail to understand which one is suitable for a particular type of activity.

Simplified taxation system

This system is recommended for use by newly opened enterprises that are not able to pre-calculate their income.

In order to use it, a legal entity must confirm its desire at the time of registration of the company by submitting an appropriate application.

An organization whose profit does not exceed 20 million rubles per year can switch to a simplified taxation system.

In addition, it must have less than one hundred employees.

Under the simplified tax system, property and profit taxes, unified social tax and VAT should not be paid. The use of this system involves the payment of a single tax, personal income tax, and insurance premiums.

You may also be required to pay fees required by tax laws.

The simplified tax system allows an entrepreneur to independently choose one of two objects of taxation.

It will be more convenient to use net income. A limited liability company that chooses to pay tax on income less expenses will face calculation difficulties.

This problem is due to the fact that the legislation does not provide for complete deduction of expenses from the base.

For example, it will not include costs that were spent on the needs of the manager out of the profits received.

A legal entity will choose a taxable base; it is necessary to perform calculations of the amount required to be paid.

The interest rate will be 6% for the first option and 15% for the second.

If a company has significant expenses, it is much more profitable for it to pay a tax of 15%.

Without deductions, it is better to choose a base with low expenses for the organization.

Traditional tax system

In comparison with the option presented above, the traditional system will confront the entrepreneur with difficulties in the process of calculating the tax base.

In addition, difficulties are foreseen in the preparation of accounting records.

For this reason, the disabled community must hire a specialist who will have extensive experience and good practical skills.

At the same time, he must be familiar with special software, which cannot be done without.

This is explained by the fact that such programs significantly facilitate the work of an accountant.

The traditional system is chosen by those organizations that have existed for a long time and are sufficiently developed.

They must have large annual profits, as well as recurring income and expenses.

This company will have to pay VAT in the amount of 18%, as well as property tax - 2.2% and profit tax - 20%.

In addition, it will be mandatory to pay the unified social tax, which must be calculated from the amount of remuneration for individuals and amounts to 26%.

A significant disadvantage of this taxation system is that it will be extremely difficult for enterprises to cooperate with other organizations.

A single tax on imputed income

The proposed taxation system can be applied to certain types of business.

These may include limited liability companies.

Moreover, the amount of contributions paid to the state should be calculated from the imputed income, and not from the profit received for the quarter.

UTII provides for the exclusion of payment of income and property taxes, as well as VAT, if this does not apply to payments at customs.

If you want to switch to this taxation system, you should take into account the type of activity that will have access to this regime:

- Maintenance and parking of vehicles;

- Public catering centers;

- Freight and passenger transportation;

- Hotel business;

- Providing veterinary services;

- Provision of household services;

- Retail;

- Providing services for leasing land plots and retail space.

Information on calculating the monthly UTII payment can be found on the official website of the Federal Tax Service.

It is also provided by the economic department located in the city administration.

You will probably be interested in looking at the “Liquidation of a Limited Liability Company (LLC)” mind map, which explains in detail the procedure for selling a company

Or HERE you will find out how to urgently obtain an extract from the Unified State Register of Legal Entities

How to open an LLC on your own:

VAT and tax on transactions with securities

Taxation of legal entities persons often includes a type such as VAT - this is one of the indirect payments. It is charged at all stages of production and sale of goods without exception. Today the VAT rate is 18%. It is applied by default if the transaction is not included in the legislative list of those that are taxed at 10% or are not subject to interest on added value at all.

Tax on transactions with securities is paid upon issue. The payers are the issuers of these securities, and the object is the nominal value of the issue, which was declared by the issuer himself.

In this case, payment to the budget is made along with the provision of all documents, registering the issue.

Become an author

Become an expert

Unified agricultural tax

The Unified Agricultural Tax is a system of taxation of organizations that produce agricultural goods.

This option allows you to avoid paying taxes such as unified social tax, VAT, as well as taxes on profits and property.

Manufactured goods include products of livestock and crop production, agriculture and forestry.

This system can be used by those organizations whose income from this activity exceeds 70% of the total profit.

In addition, they cannot have more than a trust of employees.

Those enterprises that are engaged in primary subsequent processing of the listed products cannot apply the Unified Agricultural Tax.

The transition to this taxation system involves filling out two copies of a special notice.

They are then submitted to the registration authority. This can be done once a year.

In order to calculate this tax, it is necessary to apply the formula: Unified Agricultural Tax = tax base x 6%.

The tax base is the sum of income minus expenses.

To become more familiar with this concept, it is worth reading clause 2 of Art. 346.5 of the Tax Code of the Russian Federation, which contains a list of expenses for which the base will be reduced.

The amount of losses can also be used as them.

Tax rates for legal entities

The tax rate is determined as a mandatory component of the tax. It is presented in the form of the tax charge per taxable unit. Today there are 2 forms of tax rate:

- tax in the form of a share of the total value of the taxable object;

- tax on cash income from a unit of measurement of a taxable object (area, weight, quantity, etc.).

The monetary form of the tax rate is a percentage of taxable income. A number of monetary amounts are allocated to specific objects. The latter, for example, includes unpowered air and water transport. Tax rates vary depending on the type of tax assessed.

Transport tax is regional. This explains the differences in tax rates in different regions of the Russian Federation. The amount of tax, discounts on it and the procedure for preferential payments are established by regional authorities. The basis for calculating transport tax is the base rates approved by the Tax Code.

Regional differentiation of rates affects individual categories of vehicles and their useful life. Special conditions for the application of tax rates are regulated by current legislation.

Property tax is also regional. It is determined by the base rate, which can be differentiated. Property taxes are established for legal entities on OSNO.

Income tax is direct and personal. It is based on the principle of residence. According to current legislation, any legal entity registered in the Russian Federation is required to pay income tax. In this case, the place where the profit is made does not matter.

According to the established tax rates, interest is paid both on profits earned in the Federation and abroad. The taxable period is considered to be a calendar year. tax regimes do not pay income tax . The tax rate is 20% .

Land tax is paid by organizations and enterprises that own land plots recognized as objects of taxation.

- lands withdrawn from circulation;

- areas occupied by cultural monuments and especially valuable objects;

- water fund.

The tax rate is 0.3% and 1.5% . It depends on the category of the taxable object. At the local level, a decision may be made to provide the taxpayer with benefits in paying land tax.

Indirect tax is calculated by the seller when selling services or goods to the buyer. Its payers, according to current legislation, are not only legal entities, but also individual entrepreneurs. Taxpayers are divided into 2 groups:

- paying import VAT;

- paying internal VAT.

The Tax Code has approved three VAT rates.

Zero rate!

Zero is provided for sellers of export goods, goods sold in a free customs zone, as well as some other taxpayers.

The rate is 10%!

A rate of 10% is applied to the sale of main groups of goods: food, children's, non-food (printed publications, periodicals, books), medical.

The rate is 18%!

The 18% rate is most often used. It is established for goods not included in special lists.

Calculating taxes taking into account current rates is a procedure that requires scrupulousness, attention, and certain knowledge. Entrust it to the specialists of ProfBusinessAccounting; we guarantee the absence of tax errors and associated costs.

How to switch to one or another taxation system

To select and register a specific tax system, you must perform the following series of actions:

Simplified taxation system

In this case, all documents and their copies are submitted to the tax authorities during the LLC registration process.

The package of documents consists of:

- Agreement on the establishment of an LLC;

- Protocol on the establishment of a legal entity;

- Charter of the enterprise;

- Form 11001 Registration Statement;

- A certified copy of the founder's passport;

- A letter of guarantee received from the owner of the premises in which the LLC is registered or a copy of the certificate of ownership from the founder;

- Receipt for payment of state duty;

- Application for transition to a simplified system.

Traditional system

If an organization has not submitted an application to use the simplified taxation system within a month after registration, it will be automatically transferred to OSNO.

If you apply the simplified tax system and want to switch to the traditional system, you must contact the tax authorities and submit the appropriate application.

An additional application is submitted to waive the simplified tax system.

This must be done no later than 15 days before the end of the reporting period.

Unified agricultural tax

If the LLC meets the legal requirements for the transition to the Unified Agricultural Tax, it is necessary to submit a corresponding application during the process of registering the enterprise with the tax authorities.

If you want to switch to the Unified Agricultural Tax from another system, you must submit a corresponding application to the tax authorities in the period from October 20 to December 31.

In this case, the transition will be made from the new calendar year.

Income tax

This type of corporate tax is a personal direct tax, which is based on the principle of residence. This means that legal entities registered in the Russian Federation are required to pay a percentage of profits. In this case, it does not matter whether the legal entity received person profits in Russia or abroad.

Foreign legal entities persons transfer to the Federal Tax Service part of the profit received from the operation of a representative office in the Russian Federation or from other sources in Russia.

Moreover, profit is understood as income minus expenses incurred (for example, wages). The tax period is one year.