- home

- About company

- News

- The invoice form will change noticeably from July 1, 2021 – the draft has been published

March 1, 2021

New columns will appear, including information about the primary source.

A draft amendment to Resolution 1137 is currently undergoing public discussion, that is, to the invoice form, the procedure for filling it out and other documents related to VAT. The form itself is presented in a new edition, but it has not been published. So its future form can be judged by changes in the order of filling.

Let us recall that in November last year, Law 371-FZ amended the Tax Code in connection with the introduction of product traceability (which currently exists in the form of an experiment). From July 1, participation in traceability will be mandatory, including additional information will have to be included in invoices. Accordingly, changes to Resolution 1137 will also come into force on July 1. The list of goods subject to traceability will be determined by the Cabinet of Ministers. It is planned to make all document flow for such goods electronic. Separate reporting in connection with traceability is also being introduced.

Let's define the concept

A registration number is a numeric or alphanumeric designation assigned to a document when it is registered.

The registration number of the goods declaration (DT) in accordance with the requirements of the “Instructions for filling out customs declarations and customs declaration forms” (approved by the CCC Decision No. 257 of May 20, 2010) consists of three elements:

- Code of the customs authority that registered the document.

- Registration date: day, month, last two digits of the year.

- The serial number of the declaration, which is assigned by the customs authority. Each new calendar year begins with one.

These three elements are separated by the “/” character, and no spaces are allowed between them. It would seem that everything is simple and clear.

Instructions for filling out an invoice 2021

Filling out the line part

Line 1 Number and date of the invoice. Documents are numbered in order, ascending. Please note that as of October 1, 2021, new rules for storing invoices have been established. Now they should be stored in chronological order - by date of issue or date of receipt. The storage period for invoices and delivery notes has not changed - it is still at least four years from the date of the last entry.

Lines 2, 2a and 2b Name, address, tax identification number and checkpoint of the seller. Be careful! The address from October 1, 2021 is indicated in the invoice according to the Unified State Register of Legal Entities, in detail, without abbreviations (which are acceptable in the constituent documents). Violation of this rule may be grounds for deduction.

Line 3 Information about the sender of the cargo. Indicated only when selling goods. When selling services or performing work, put a dash. If the seller is the sender of the goods, write “He” in this line.

Line 4 Information about the recipient of the cargo. The consignee and his address are indicated in the invoice only when selling goods. If you are submitting a document for services, work, property rights, put a dash.

Line 5 Payment order number - if there was an advance payment (that is, the invoice is drawn up for an advance payment). If not, put a dash. A dash is also placed if prepayment was made on the day of shipment.

Line 6 Name, address (from October 1 - strictly according to the Unified State Register of Legal Entities, without abbreviations), INN and KPP of the buyer.

Line 7 Currency and its code. The invoice is issued in the monetary unit in which prices and payments under the contract are expressed.

Line 8 Government contract number. The government contract identifier has been indicated in invoices since July 1, 2021, and everyone has managed to get used to the innovation. But be careful! Since October 1, 2017, line 8 of the invoice itself has a different name: a clarification has appeared that it is filled out only if data is available. This is what it looks like:

Let us remind you that companies that work with contracts with treasury support are required to indicate in the invoice the number of the government contract (or agreement or agreement on the provision of subsidies, investments, contributions to the authorized capital from the federal budget). They receive a 20-digit code. It is indicated in all contracts drawn up under government orders. You can find this code in the contract or in the Unified Information System. If you do not need to write the IGK on the invoice (that is, you are not working with a contract to which an identifier is assigned), then do not leave the line empty - put a dash in it.

Government Contract ID on Invoices: Sample

Filling out the tabular part of the invoice

Column 1 Name of the product or description of works, services, transferred rights.

Column 1a Here, in the invoice from 10/01/2017, the code of the type of goods is indicated. This applies only to those products that are exported to the EAEU countries.

If you need to indicate a product type code on the invoice, select it from the HS reference book. If not necessary, put a dash.

Column 2 Unit code. The invoice is indicated in accordance with the all-Russian OKEI classifier. The codes in it are in sections 1 and 2.

Column 2a National symbol of the unit of measurement. For example, "pack". You can also check or find out this designation using OKEI.

Column 3 Quantity or volume of goods, works or services. If they cannot be identified, a dash is added.

Column 4 Price per unit of measurement excluding tax. Indicated in the case where it is possible to indicate it, otherwise a dash is placed.

Column 5 Cost of goods, works, services. Indicated excluding tax.

Column 6 Excise tax amount. If you sell non-excisable goods, you cannot put a dash. In this case, write here “No excise duty”.

Column 7 Tax rate.

Column 8 Tax amount in rubles and kopecks - full, without rounding.

Column 9 The cost of the entire quantity or volume of goods, taking into account the amount of tax.

Columns 10 and 10a Country of origin of the goods (in the invoice, both fields are filled in only for imported products). The digital code and short name are indicated here. Both values are given in accordance with the All-Russian Classifier of Countries of the World. Do not write the digital code of Russia in the tenth column of the invoice: filling in is not required for domestically produced goods. In this case, put a dash, as in the next column.

Column 11 Registration number of the customs declaration (indicated in the invoice only for imported goods, in other cases a dash is placed). This column is also new as of October 1, 2021. Previously, the invoice indicated the customs declaration number, but it was serial, but now the registration number is indicated. It looks like this:

Why does the question arise

The fact is that now taxpayers enter detailed information in column 11 of the invoice: the registration number of the goods declaration, and in addition to it, through “/”, the serial number of the goods in this declaration.

They are guided by the letter of the Federal Tax Service of Russia dated August 30, 2013 No. AS-4-3/15798, which states that the customs declaration number should be considered the registration number indicating the serial number of the goods through “/”. Since this statement is true for the “Customs Declaration Number,” it is unclear how the column called “Customs Declaration Registration Number” will be filled out. What information in column 11 of the invoice will be considered correct and sufficient for the Federal Tax Service to accept the document without question?

No one will be bored

The mentioned law also provides for a change in the set of invoice details, which will affect everyone. In this regard, a new column 5a will appear in the invoice, where it will be necessary to enter the details of the corresponding primary document (shipment document, act). If there are several such papers, then it will be possible to list their details separated by “;”. In case of prepayment, you can put a dash in this column.

By the way, wherever it is now required to put a dash (in the absence of any indicator), the right of the taxpayer (tax agent) to put a dash will be stipulated. Apparently, the alternative of leaving the field empty will be allowed.

Instead of the name of the product or description of the work, in Column 1 you will have to enter the serial number of the record of the goods supplied (shipped) (work performed, services rendered), and transferred property rights. In this case, column 1a will be reserved for the name or description (all rules established for principals, agents, forwarders, and developers are preserved). Now in column 1a the code according to the Commodity Nomenclature of Foreign Economic Activity is indicated, which “moves” to the new column 1b.

Federal Tax Service opinion

The Department believes that in this case, adjusting the name of the column does not entail a change in its content; the information must be filled out as before: registration number of the DT and then through “/” the serial number of the product in this DT in the following form:

Part 1 - eight characters: customs post code;

Part 2 - six characters: date of registration of the motor vehicle;

Part 3 - seven characters: DT serial number;

Part 4 - three characters: the serial number of the product in the DT.

At the same time, according to the clarifications of the Ministry of Finance dated February 18, 2011 (letter No. 03-07-09/06), if column 11 of the Federation Council contains incomplete information about the DT number (there is no serial number of the goods) and such an invoice is not prevents the tax authorities from identifying the main terms of the transaction, this is not a basis for refusing a VAT deduction. In other words, the absence in column 11 of the serial number of the goods according to the declaration is not considered an error. To date, no additional recommendations or clarifications have been received from government agencies regarding otherwise entering information in column 11 of the invoice.

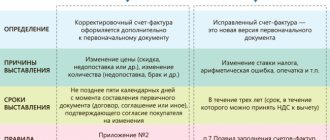

Adjustment invoice

Changes in the form of an adjustment invoice repeat changes in the form of the main invoice. Firstly , column 1b has been added to the adjustment account form. It indicates the product type code. We fill out this column if the organization exports goods to the countries of the EAEU (Eurasian Economic Union).

Secondly , from October 1, 2021, it is allowed to add additional lines and columns to the adjustment invoice (for example, details of the primary invoice). In this case, the form of the adjustment document itself should not change.

Technical side of the issue

The structure and format of the field “Registration number of the customs declaration” in the electronic document has not been subject to any changes since 10/01/2017. It allows you to enter from 1 to 29 characters. Thus, the electronic invoice format allows for a DT number in either four or three parts.

In Diadoc in printed form, which, we recall, is not a legally significant document, the name of column 11, in accordance with the new edition of Resolution No. 1137, will be changed to “Registration number of the customs declaration.” It will reflect the value that was entered when generating the electronic invoice.

Rules for storing invoices

The law requires that invoices be kept in the accounting department as they are issued or received in chronological order. The same rules apply to electronic document management of invoices: the dates of confirmation by the EDI operator of the issuance of invoices and notification of buyers are important here. The storage period for all types of invoices is 4 years. Copies of paper invoices from intermediaries must be certified by their signatures.

Keep records of invoices in the Kontur.Accounting web service. Easily generate invoices, send them to counterparties and receive them through electronic document management. Keep your accounting in our service, pay taxes and submit reports online.

Try for free

Invoice form 2019-2020: how the form has changed

Currently, the current version of the invoice form is valid from 08/19/2017.

The increase in the tax rate from 18 to 20% did not affect the invoice form, since the rate is not “hardwired” into the form, but is indicated when filling it out. Read more here.

Thus, now the following forms can be considered old-style invoices:

- until 07/01/2017 - as amended on 11/29/2014;

- from 07/01/2017 to 09/30/2017 - as amended on 05/25/2017.

Let us recall that the latest changes, which required adjustments to the invoice form of the old form, were caused by updating the list of mandatory details given in Art. 169 Tax Code of the Russian Federation:

- from 07/01/2017, an additional line appeared above the main table to indicate the data of the government contract (contract, agreement);

- from 10/01/2017, a new column “Product Type Code” was added to the main table, the name of the column “Customs Declaration Number” was changed by adding the definition “registration” to the word “number”; In the field reserved for signatures, an indication of the possibility of signing by an authorized person instead of an individual entrepreneur appeared.

But if the preparer does not need to enter the specified data into the document being drawn up, can he use the old invoice form when processing the shipment? What will be the consequences of accepting such a document for the recipient and is it possible to deduct VAT on old-style invoices? The answers to these questions follow from the significance that the invoice has among other documents used by the taxpayer.

Read about what has recently changed in the rules for registering purchase and sales books in the following articles:

- ;

- “What are the basic rules for filling out and maintaining a purchase book in 2021 - 2021?”

Fill out an invoice in a few minutes

MyWarehouse is a convenient program for printing invoices and other documents. Thanks to the intuitive interface of MyWarehouse, creating an invoice takes no more than a minute. Each step in drawing up a document is transparent to the user and is accompanied by clear comments.

Advantages of working with documents in the MoySklad service:

- saving 70% of time on preparing an invoice using a new form;

- no errors when entering data;

- automatic generation of an archive of printed documents;

- automatic continuous numbering of documents;

- output forms to Excel and PDF format.

Invoice deadline

The procedure for issuing a document has not been affected by changes since January 1, 2021. An invoice is issued within 5 days from the moment of: a) shipment of goods, performance of work, provision of services, transfer of rights, or b) receipt of advance payment. Calendar days are counted.

The period is counted from the day following the day of shipment or receipt of advance payment. If the last day of the term falls on a non-working day, the expiration date of the term is considered to be the nearest next working day.

According to the law, there is no penalty for missing the deadline for submitting an invoice. An organization can be fined only for the absence of a document. However, a violated procedure for issuing invoices at the junction of tax periods can still lead to a fine. Thus, late provision of a document may be considered as its absence. For example, when an organization issues an invoice at the beginning of the current tax period that should have been issued at the end of the previous one.

Can the old invoice form be used for sellers?

After changes are made to the legally established form of the document, the old forms become invalid. Therefore, the seller can no longer issue an old-style invoice - online or on paper. And if a document is incorrectly submitted using the old form, it should be corrected.

ATTENTION! The old invoice form must be used to make corrections to the original document (letter of the Federal Tax Service dated 06/07/2018 No. SD-3-3 / [email protected] ). Therefore, when drawing up an amended invoice or receiving one from the seller, pay attention to the period for which it was prepared.

The header of the revised document created on the new form will contain the following instructions:

- on the number and date of correction;

- number and date of the document being corrected.

Other information entered will remain the same as in the original (generated on the old form) document. Details new to the form, if there is no data to enter them, will remain blank or will be marked with a dash.

Results

The form of the invoice is established by law.

Changing it means that the old form will no longer be valid, so you should only use the form that is valid for the relevant period. Failure to apply this rule is fraught with consequences in the form of a fine for both the seller and the buyer. In addition, the buyer faces the risk of non-deduction of tax. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Possible liability for an old-style invoice issued

The use of an old-style document by tax authorities can be equated to the absence of this document. Therefore, for both the seller and the buyer there is a risk of being brought to tax liability under Art. 120 of the Tax Code of the Russian Federation, which regards the absence of invoices as a gross violation of the rules established for accounting for the taxable object. The fine can be either 10,000 rubles. (if violations relate to the 1st tax period), or 30,000 rubles. (if we are talking about several tax periods).

More information about the application of Art. 120 of the Tax Code of the Russian Federation, read this material.

The situation will be more serious for the buyer, since on the formal grounds of using an invoice form that does not comply with the law, he may be denied a deduction. You can try to challenge such a refusal in court if the seller does not need to fill out new details. But this will lead not only to unjustified losses of time and money, but also to unpredictable results.

Will buyers have problems accepting deductions on old invoices?

The situation is not as clear-cut as it might seem. On the one hand, an invalid invoice form cannot be used. On the other hand, the Tax Code of the Russian Federation clearly and comprehensively establishes the grounds on which a VAT deduction cannot be accepted: this is the absence in the document of the details listed in paragraphs. 5, 5.1 and 6 art. 169 of the Tax Code of the Russian Federation. At the same time, paragraph 2 of Art. 169 of the Tax Code of the Russian Federation does not pose any obstacles to accepting a deduction on an invoice that contains minor defects that do not interfere with the identification of:

- seller;

- buyer;

- name and cost of goods (work, services) supplied;

- amount and VAT rate.

This norm appeared in the Tax Code of the Russian Federation as a reflection of the position of the Constitutional Court of the Russian Federation (determination dated February 15, 2005 No. 93-O). The court clarified that the Tax Code of the Russian Federation does not prohibit the deduction of VAT if the tax authority is provided with all the necessary information and documents for conducting tax control.

Thus, if the lack of information provided for in the new columns and lines of the invoice does not prevent the identification of the information listed above, there is hope that the tax authorities will not refuse a deduction on the old forms. But, of course, it is better not to tempt fate and get the correct document from the supplier.

For information about which errors in filling out an invoice the Federal Tax Service considers non-critical for VAT deduction, see here.

Time will tell whether they consider the non-filling in (or incorrect formatting) of the added details of the new form critical.

How is this implemented?

The implementation of the new format depends on what function the document performs.

If the new format is used only with the invoice function

, then it is no different from the old format approved by Order No. 93. The file is still signed with a strong qualified signature.

If the function of an invoice and a document on the shipment of goods, transfer of property rights

(UPD format with status “1”), then the document must include 2 files:

- seller information exchange file, which is an invoice file containing the information established by Art. 169 of the Tax Code of the Russian Federation, and additional information of the transferring party about the economic entities participating in the transaction, the subject of the transaction and other material circumstances of the transaction being executed.

- buyer information exchange file to provide additional information to the receiving party, since in most cases the primary accounting document used to formalize the transaction is two-sided.

There may be no buyer information exchange file if a two-sided acceptance document is not required.

If the new format is used only as a document on the shipment of goods, transfer of property rights

(UPD format with status “2”), then it includes:

- seller information exchange file (information of the transferring party about the transaction being executed) – required;

- buyer information exchange file - depending on the provisions of the Civil Code of the Russian Federation.

Thus, the new invoice format may include not one file, but two. Moreover, these files move in different directions: from seller to buyer and from buyer to seller.

Soon a new form of invoice will be implemented in 1C.