A report is a paper that records information regarding completed actions and operations. Its main function is information. Compiled on the basis of official documentation. For example, a manager gave an employee a task. The specialist did all the work. Upon completion, he prepares a report. The latter confirms the fact that the work was performed and records what exactly the employee was doing. Report forms can be very different: from the simplest to detailed documents with tables, listings, and graphs. Complicated forms are used, for example, when compiling reports on scientific work.

Report on completed work

The employer sets tasks for employees. He must monitor the process of their solution. For convenient tracking and obtaining all the required information, a report on the work performed is compiled. This document is compiled with a certain regularity. The latter depends on the nuances of the work of a particular company.

The report is needed, first of all, by the manager. The document provides solutions to these problems:

- Accurate assessment of the quality and efficiency of problem solving.

- Formation of a general picture of work activity.

- Simplify tactical and strategic planning.

The employee himself also needs the report. The document solves these problems:

- A simple presentation of your work.

- Effective self-control.

- Simple identification of your weaknesses and strengths.

The report is a visual confirmation of how much work the employee has done and how well he did it. Correct work with the document form has a positive effect on the company’s activities as a whole.

There is no single form of document. Features of report preparation depend on its type. It is recommended to include these provisions in the document:

- List of tasks that were assigned to the employee.

- Specification of these tasks.

- Analysis of employee activity.

- Offers.

Suggestions and analysis - provisions that are included in the monthly or annual report.

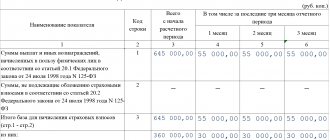

Material report

A material report is a paper that provides control over the receipt and expenditure of construction material. A variety of objects can be taken into account: bricks, plaster, tools, paint, spatulas. The document also records materials that are in warehouses.

A material report is a document that is commonly used by large construction organizations. Compiled according to form M-19. Responsibility for registration is usually assigned to the financially responsible person who is involved in the construction work. The use of form M-19 is a measure that is not mandatory. But if the company decides to use this document, it is necessary to consolidate this in its accounting policies.

When preparing a material report, you must adhere to this order:

- An inventory is assigned. Based on its results, data on inventory balances and their costs are recorded in the report. The latter is compiled for the same date for which the inventory was carried out.

- The document records the valuables stored in the warehouse. Information about them is entered on the basis of checks, invoices, and applications.

- The next step is to record the inventory items that were issued to customers. The total number of materials and their cost are determined. Information about the valuables that are present in warehouses at the end of the reporting period is recorded.

- All data is entered on the form. They are being verified.

- The accountant must check the report.

The company has the right to draw up a material report based on its own template. But the M-19 form, approved by law, is usually used. The document is drawn up in 1 copy. If a second copy is required, a second copy is made.

FOR YOUR INFORMATION! The report must contain the signatures of the financially responsible person, the accountant. It is not necessary to certify it with a seal.

IMPORTANT! The report must be kept for at least 5 years.

Competent accounting and correct preparation of various types of documents are an integral requirement for the activities of any successful organization. Due to numerous changes and innovations, it is difficult to monitor the relevance of the requirements for the preparation of a particular report or document. A lot sometimes depends on the degree of professionalism and knowledge of the accountant and specialist managing the company’s document flow. Thanks to our portal, everyone will be able to effortlessly comply with all legal requirements and standards when drawing up documents and various types of reporting.

| Code | Name | |

| Bank forms | ||

| — | Report on the movement of funds on accounts (deposits) in banks outside the territory of the Russian Federation | |

| S-09-1 | Message about opening (closing) an account (personal account) | |

| — | Notice of opening (closing) of an insurance premium payer account for submission to the territorial body of the Pension Fund of the Russian Federation | |

| — | Notification of the payer of insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity about the opening (closing) of a bank account | |

| 0402001 | Announcement for cash contribution (automated form) | |

| View all 14 | ||

| Forms and samples for special tax regimes (UTII, Unified Agricultural Tax, USN, PSN) and for individual entrepreneurs on OSNO | ||

| 26.1-1 | Notification on the transition to a taxation system for agricultural producers | |

| 26.1-2 | Notice of loss of the right to use the taxation system for agricultural producers | |

| 26.1-3 | Notice of refusal to apply the taxation system for agricultural producers | |

| 26.2-1 | Notice of transition to a simplified taxation system | |

| 26.2-2 | Notice of loss of the right to use the simplified taxation system | |

| View all 23 | ||

| Pension Fund forms | ||

| SZV-M | Information about the insured persons | |

| RSV-1 PFR | Calculation of accrued and paid insurance premiums for compulsory pension insurance in the Pension Fund of the Russian Federation, insurance premiums for compulsory medical insurance in the FFOMS and TFOMS by insurance premium payers making payments to individuals | |

| RSV-2 PFR | Calculation of accrued and paid insurance premiums for compulsory pension insurance in the Pension Fund of the Russian Federation, insurance premiums for compulsory medical insurance in the FFOMS and TFOMS by payers of insurance contributions who do not make payments and other remuneration | |

| RV-3 PFR | Calculation of accrued and paid contributions to the Pension Fund of the Russian Federation, used when monitoring the payment of contributions for employers paying contributions for additional social security | |

| SPV-1 | Information on accrued and paid insurance contributions for compulsory pension insurance and the insurance experience of the insured person | |

| View all 23 | ||

| VAT forms | ||

| — | Invoice | |

| — | Adjustment invoice | |

| — | Journal of received and issued invoices | |

| — | Book of purchases | |

| — | Sales book | |

| View all 5 | ||

| Forms when working with foreigners | ||

| U-IO | Notification of participation in foreign organizations (on the establishment of foreign structures without forming a legal entity) | |

| — | Notice of confirmation of the right to reduce the calculated amount of personal income tax by the amount of fixed advance payments paid by the taxpayer | |

| — | Form of notification of the conclusion of an employment contract or civil contract with a foreign citizen who arrived in the Russian Federation in a manner that does not require a visa | |

| — | Form of notification of termination of an employment contract or civil contract with a foreign citizen who arrived in the Russian Federation in a manner that does not require a visa | |

| — | Information on the conclusion by the employer of labor or civil contracts for the performance of work (provision of services) with foreign citizens who arrived in the Russian Federation to carry out work activities in a manner requiring a visa | |

| View all 7 | ||

| Financial statements | ||

| KND 0710099 | Financial statements | |

| KND-0710096 | Simplified forms of balance sheet, financial performance statement, report on the intended use of funds | |

| KND-0710098 | Accounting (financial) reporting of small businesses | |

| Form 1 | Balance sheet | |

| Form 2 | Income statement | |

| View all 11 | ||

| State registration and tax registration | ||

| P11001 | Application for state registration of a legal entity upon creation | |

| Р11001 for LLC (rec) | Application for state registration of a legal entity upon creation | |

| P12001 | Application for state registration of a legal entity created through reorganization | |

| Р12001 for LLC (rec) | Application for state registration of a legal entity created through reorganization | |

| P12002 | Application for state registration of a joint-stock company created through reorganization in the form of division or separation, with the simultaneous entry of an entry on the termination of its activities in connection with merger with another joint-stock company | |

| View all 50 | ||

| Cash documents | ||

| — | Application for registration of cash register equipment | |

| KM-1 | Act on transferring the readings of summing money counters to zeros and registering control counters of a cash register | |

| KM-2 | Act on taking readings of control and summing cash counters when handing over (sending) a cash register for repair and when returning it to the organization | |

| KM-3 | Act on the return of funds to buyers (clients) for unused cash receipts | |

| KM-4 | Cashier-operator's journal | |

| View all 15 | ||

| Tax reporting | ||

| KND-1110018 | Information on the average number of employees for the previous calendar year | |

| KND 1110025 | Notice of controlled transactions | |

| KND-1113020 | Annual report on the activities of a foreign organization | |

| KND-1150045 | Information on the share of the organization’s income from activities to provide social services to citizens in the total income of the organization and on the number of employees on the organization’s staff | |

| KND-1151001 | Tax return for value added tax | |

| View all 51 | ||

| Reporting of non-profit organizations | ||

| OH0001 | Report on the activities of a non-profit organization and information on the personnel of its governing bodies | |

| OH0002 | Notification about the expenditure of funds by a non-profit organization and the use of other property, including those received from international and foreign organizations, foreign citizens and stateless persons | |

| OH0003 | Information on the volume of funds and other property received by the public association from international and foreign organizations, foreign citizens and stateless persons, the purposes of their expenditure or use, as well as their actual expenditure | |

| SP0001 | Information from a structural unit of a foreign non-profit non-governmental organization on the amount of funds and other property received by this structural unit, their intended distribution, as well as the purposes of their expenditure or | |

| SP0002 | Information from a structural unit of a foreign non-profit non-governmental organization on the amount of funds and other property received by this structural unit, their intended distribution, as well as the purposes of their expenditure or | |

| View all 7 | ||

| Reporting on environmental payments | ||

| — | The calculation of payment for negative impact on the environment | |

| View all 1 | ||

| Reporting on ethyl alcohol, alcoholic and alcohol-containing products | ||

| — | Declaration on the volume of production and turnover of ethyl alcohol | |

| — | Declaration of volumes of ethyl alcohol use | |

| — | Declaration on the volume of production and turnover of alcoholic and alcohol-containing products | |

| — | Declaration on the volume of use of alcoholic and alcohol-containing products | |

| — | Declaration on the volume of turnover of ethyl alcohol, alcoholic and alcohol-containing products | |

| View all 9 | ||

| Statistical reporting | ||

| 1-healthy | Information about the organization providing medical care services to the population | |

| 1-IP (month) | Basic information about the activities of an individual entrepreneur | |

| 1-IP (trade) | Information on the activities of an individual entrepreneur in retail trade | |

| 1-conjuncture | Survey of market conditions and business activity in retail trade | |

| 1-conjugation (wholesale) | Survey of market conditions and business activity in wholesale trade | |

| View all 36 | ||

| Construction | ||

| — | Sample of filling KS-2, KS-3 (linking estimate - KSy) | |

| KS-14 | Certificate of acceptance of the completed construction site by the acceptance committee | |

| KS-9 | Analysis of temporary (non-title) structures | |

| KS-2 | Certificate of acceptance of completed work | |

| KS-3 | Certificate of cost of work performed and expenses | |

| View all 7 | ||

| Labor accounting and payment | ||

| T-1 | Order (instruction) on hiring an employee | |

| T-1a | Order (instruction) on hiring employees | |

| T-2 | Employee personal card | |

| T-2GS(MS) | Personal card of a state (municipal) employee | |

| T-3 | Staffing table | |

| View all 30 | ||

| Accounting policy | ||

| — | Sample accounting policy of a state budgetary institution | |

| — | Sample accounting policy of a state government institution | |

| — | Sample applications to the accounting policies of a state budgetary institution | |

| — | Sample Working Chart of Accounts | |

| — | Sample workflow schedule | |

| View all 6 | ||

| Social Insurance Fund | ||

| — | Application for entry into legal relations under compulsory social insurance in case of temporary disability and in connection with maternity of the policyholder | |

| 4 FSS RF | Calculation of accrued and paid insurance premiums for mandatory social services. insurance in case of temporary disability and in connection with maternity and compulsory social services. insurance against industrial accidents and occupational diseases | |

| — | Certification on the amount of wages, other payments and remunerations for two calendar years preceding the year of termination of work (service, other activities) or the year of applying for a certificate on the amount of wages, other payments and remunerations, and the current | |

| 4a-FSS RF | Report on insurance premiums voluntarily paid to the Federal Social Insurance Fund of the Russian Federation by certain categories of policyholders | |

| — | Report on the use of insurance premiums for compulsory social insurance against accidents at work and occupational diseases to finance preventive measures to reduce industrial injuries and professional | |

| View all 21 | ||

| Miscellaneous | ||

| — | Form of a report on the movement of funds of a legal entity - resident and individual entrepreneur - resident on an account (deposit) in a bank outside the territory of the Russian Federation | |

| — | Form of notification of the start of business activities | |

| KND-1150040 | Notification of selected tax objects in respect of which a tax benefit is provided for personal property tax | |

| KND-1125030 | Notice of confirmation of the taxpayer’s right to receive social tax deductions | |

| KND-1110055 | Application for confirmation of the right to reduce the calculated amount of personal income tax by the amount of fixed advance payments paid by the taxpayer | |

| View all 7 | ||

All forms and sample documents are organized in sections and can be used in large organizations, as well as among representatives of small and medium-sized businesses. Samples of primary documents, current forms and current accounting forms are presented to the attention of individual entrepreneurs. Constant replenishment of the database and updating will allow you to establish easy and correct document flow.

The most popular accounting forms

Of the tens of thousands of existing accounting forms, the most popular types can be downloaded in convenient Excel or Word document formats. The most commonly used document types include the following:

1. Accounting statements; 2. Tax reporting; 3. Primary accounting documents; 4. State statistics forms.

Types of financial statements

For organizations conducting economic or production activities, excluding financial and credit, budgetary and insurance institutions, an easy-to-use database of forms and samples is provided with which you can quickly set up the reporting process. The most popular types are the following forms related to activities:

• Drawing up a balance sheet; • Submission of profit and loss report; • Preparation of reports on changes in capital; • Preparation of a cash flow report.

In the relevant subsections dedicated to this or that type of reporting, you can familiarize yourself with the rules for filling them out and download the necessary forms.

Tax accounting

All the most important and popular tax accounting forms that have been approved by federal government agencies are present in the corresponding subsection. If necessary, you can use the following VAT reporting forms:

• VAT declaration; • Declaration of indirect taxes; • Current types of invoices; • Form of the Purchase Book and Sales Book; • Forms for notifications of exemption from taxpayers' obligations.

The subsections contain all current types of tax accounting documents and provide the regulations on the basis of which they operate. Detailed instructions for filling out will help to correctly reflect information regarding value added tax, corporate profits, income of individuals, excise taxes, etc. Detailed information is provided on the procedure for filling out data on various types of taxes: transport, land, unified agricultural, property. Contains sample documents on the simplified taxation system (imputed income).

Primary accounting documentation

The documents represent all popular and key forms of primary documentation currently in effect. If necessary, you can use information about approved standards and the accepted procedure for filling out forms. The information in this section will help you competently maintain personnel records, pay settlements with employees regarding wages, and maintain document flow associated with accounting for inventory, products, and goods of the organization

Approved state statistics forms

All necessary samples and most important forms of reporting and statistical document flow, valid and approved in accordance with the resolutions of the State Statistics Committee and Rosstat using the All-Russian Classifier of Management Documentation, are provided.

Samples

If necessary, each type of reporting and any document can be completed based on the provided samples. Any specialist will be able to competently draw up a standard agreement, internal document or contract, including constituent and organizational documentation. The forms were created taking into account all current requirements in Russian legislation and will allow you to easily resolve any issue related to the document flow of an organization of any line of activity.