Home • Blog • Online cash registers and 54-FZ • FFD 1.2 - deadlines for the transition to a new format of fiscal data

Russia has introduced a new format for fiscal data - FFD 1.2, the transition period to which will last until August 6 of this year. By the end of the announced period, entrepreneurs using online cash registers when paying consumers are required to switch to fiscal drives with the function of supporting the new version 1.2. At the same time, entrepreneurs selling any products must change the format for transmitting fiscal documents using cash register equipment to FFD 1.2. We will talk about exactly how the transition to the new format will take place, as well as all the advantages and specifics of the new version in this article. In addition, we will try to figure out which businessmen will be affected by the changes and which will not.

Why is the transition to FFD 1.2 being carried out?

To begin with, let's figure out what exactly the new FFD 1.2 gives, what changes it brings and what is the purpose of developing this format. Let us recall that 2 years ago amendments were made to Law No. 54-FZ (the law on CCP). Changes in the law were aimed at mandatory product labeling. More specifically, users of cash register equipment selling marked goods were given clear conditions: the need to generate requests for a marking code, as well as notifications confirming the sale of goods. These manipulations must be carried out through an online cash register and registered electronically. Thus, it was intended to confirm the reliability of information about goods sold by retail outlets.

A marking code is a two-dimensional Data Matrix barcode that contains encrypted information about a product. For example, country of manufacture or information about the manufacturer. The creation of such barcodes was aimed at simplifying the identification of each product individually.

However, previous versions of FFD 1.05 and 1.1 were created without the ability to ensure such interaction between retail outlets and the “Honest Sign” product labeling system. Therefore, in the fall of 2021, the Federal Tax Service published an improved list of additional details and FFD. The new version is called FFD 1.2.

Re-registration of cash registers without replacing the FN

Quick re-registration of the cash register with the Federal Tax Service when changing the address, SNO or OFD operator!

More details

The transition of stores to the new format of fiscal data is not yet necessary. However, by August 6, 2021, retail outlets selling products with barcodes are required to use only equipment that supports the latest format of fiscal documents.

What is the difference between FFD 1.2 and previous versions of FN? So, the new fiscal drives will be able to:

- create requests for marking codes;

- respond to inquiries;

- send notifications when selling labeled products;

- generate receipts in notifications.

Please note that these manipulations are carried out automatically. The cashier is not involved in the creation of fiscal documentation - it is generated and sent automatically. Sent requests are stored on the drive for a certain period of time. They are also deleted automatically after:

- receipt of a response from the “Honest Sign” system;

- the drive generates a new request for the same product;

- termination of the cashier's generation of a cash receipt;

- cancellation of the check by the seller.

Time frame for transition to FFD 1.2

So, analyzing the totality of all the new provisions and changes in laws, we can come to the conclusion that sellers of labeled products can use cash register equipment associated with old FN models that support only FFD 1.05 and 1.1. But only until the expiration date of the FN. Including registration of old-format drives with the Federal Tax Service is allowed, but only until August 2021. After registration, you can use the FN until the service life is exhausted (or other circumstances that will prevent further operation of the drive).

Entrepreneurs can also choose a fiscal storage device with any possible expiration date - 15 or 36 months. The main thing is to have time to submit an application for registration of this drive before August 6 of this year. For example, if a businessman registers an old version of the FN on August 4, 2021, and chooses a service life of 36 months, then he will be able to use this equipment until 2024 inclusive.

Consequently, businessmen, if desired and necessary, have the opportunity to delay the implementation of cash register equipment using fiscal drives FFD 1.2. You need to take care of this in advance and register cash register equipment with the old format FN on the date closest to August 6, and also select a drive with the maximum expiration date.

The need for entrepreneurs to delay the implementation of a new version, for example, may be due to unforeseen circumstances. Such as the shortage of fiscal drives of a new format on the market. The likelihood of a situation arising when a retail store wants to transfer its outlet to a new type of physical equipment, but they are out of stock, is small, but it exists. Therefore, it is worth preparing in advance and purchasing the necessary equipment. Let's take a closer look at fiscal drives compatible with FFD 1.2.

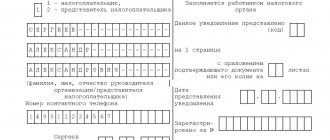

How to submit a notification of transition to the simplified tax system

The fastest and most reliable way is to send a scanned copy of the paper notice and related documents (if any) through the taxpayer’s personal account or through your electronic document management operator. To do this, you will need an enhanced qualified signature.

Also, a notification with attached documents can be given to your inspector in person at the department or sent by registered mail to the address of your Federal Tax Service office. When sending by mail, be sure to make a list of documents and order a notification of receipt. The date of sending the notice is considered to be the day on which you delivered the registered letter to the post office, and not the day the letter was received by the tax service.

Return to list

Which FNs support FDF 1.2?

It is worth noting that currently there is only one FN on the Russian market that supports the latest format. This device is FN-1.1M, which is produced. This information is also supported by data from the register published on the online website of the Federal Tax Service.

Important!

The list of FN, published on the Federal Tax Service website, contains information about the maintenance of FDF editions by fiscal drives.

And according to this list, the only device that supports the latest 1.2 format is a drive from . Relevant information is also provided on the manufacturer's website. However, not all entrepreneurs should rush to buy a new fiscal drive. It is worth noting that, judging by the information on the official website of the Tax Service, these drives are issued for a period of 15 months. This means that, for example, they are not suitable for enterprises operating on a simplified taxation system. Indeed, with this method of taxation, it is obligatory to use FN with a shelf life of at least 36 months (Clause 6, Article 4.1 of Law No. 54-FZ).

However, some sites offer equipment for purchase with a shelf life of 36 months. However, due to the lack of information about such drives on the official website of the tax authorities, the use of these devices is not possible. Such FNs are not registered, which means their use is illegal. Although, all this may hint at the fact that they are going to provide fiscal storage devices with a shelf life of 36 months for purchase in the future. In any case, simplified entrepreneurs selling goods with markings should wait for the release of the FN with a new format, or switch to the normal taxation regime.

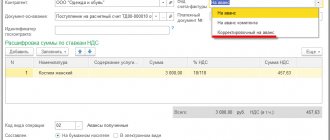

Comparison of tax regimes in 1C 8.3

The 1C 8.3 information base can calculate the tax burden in the context of taxation systems: OSNO, simplified tax system (6%) and simplified tax system (15%).

In the 1C 8.3 Enterprise Accounting 3.0 configuration, which supports the “Taxi” interface, the “Comparison of Tax Regimes” service is implemented in the “Manager” section:

In this service, you can use both planned and actual data for the current year. For example, if you have data for the previous year, you can use the “Fill in automatically” button and look at the tax burden. In our example, the lowest tax burden for the previous year is with a simplified tax system of 6%, where the amount of taxes is less than under other regimes:

If some indicators are planned, and they will differ next year, then they can be entered and the corresponding tax burden in 1C 8.3 will be calculated:

This calculation is not exact, but it gives a general picture of which regime is beneficial and the user of 1C 8.3 can quickly compare tax regimes. It should be taken into account that if the organization’s clients mainly work with VAT, then most likely it will not be possible to switch to the “simplified” tax system.

Preparing for the transition to FFD 1.2

The new version of the fiscal data format has already been put into operation. Therefore, improvements to cash register equipment and software are currently underway. However, it has already become clear that not all manufacturers are going to reconfigure their cash registers for the new version of the FFD. The same problems can occur with software. That is why, if you have labeled products in your assortment, you need to think now about all the problems that may arise. Namely:

Check the expiration dates of your current FN. If the work period ends after August 6 of this year, you need to think about whether you will have the opportunity to purchase new cash register equipment if the old one is unusable. If you cannot be sure of this, then it would be more rational to update the FN before the deadline established by law.

Check with the manufacturer of your cash register equipment to see if they plan to reconfigure their products for the new version of the FFD. If not, then think about alternative options in advance.

It is also worth asking the software manufacturer whether cash receipts will be generated according to the new requirements, and what steps need to be taken to update to the new version. The same compatibility questions should be asked about inventory programs.

We remind you that early preparation for innovations will help entrepreneurs simplify this task for themselves and their employees. But if you delay, you may encounter unforeseen pitfalls that will complicate the operation of the enterprise.

Penalties for flouting new laws

As expected, fines are expected to be imposed for violating the requirements of the Federal Law, namely for making payments using cash register equipment with an old format FN connected, which is not capable of generating receipts with the necessary details. Fines will be imposed in accordance with Article 14 of the Code of Administrative Offenses of the Russian Federation. Namely:

- An official of a company (or individual entrepreneur) is expected to impose a fine in the amount of 1,500 to 3,000 rubles.

- Legal entities, accordingly, are subject to a larger fine - in the amount of 5,000 to 10,000 rubles.

Changing the object of taxation under the simplified tax system in 1C 8.3

Let’s say an organization or individual entrepreneur under the simplified tax system has decided to change the object of taxation. For example, previously the taxation system “Income minus expenses” was used, but it was decided to switch to “Income”. To do this, you need to submit to the Federal Tax Service “Notification of changing the object of taxation from “Income” to “Income minus expenses” or vice versa.

During the year, “simplified” cannot change the object of taxation. It is possible to change the object of taxation only annually.

In 1C 8.3, select the “Reports” section – “Regulated reports” or “Notifications, messages and statements”. Using the “Notifications” hyperlink, we create a document “Changing the parameters of the simplified tax system”:

In 1C 8.3, a printed form “Notification of changes in the object of taxation (form No. 26.2-6)” is created for submission to the Federal Tax Service:

Conclusion

Fiscal drives are an important component of cash register equipment, which must meet all the criteria of the Federal Law of the Russian Federation. Starting from August 2021, trading enterprises selling labeled products will have the opportunity to register only a new format FN with the Tax Service. At the moment, there is only one available FN option for FFD 1.2., which is produced by. However, this FN is not suitable for all entrepreneurs, so it is worth considering in advance the options for switching to a new format of fiscal data.

Need help choosing a fiscal drive?

Don’t waste time, we will provide a free consultation and select a suitable fiscal drive for your online cash register.

Deadline for submitting notification of transition to simplified tax system

By default, switching to the simplified tax system or changing the tax base is possible only from the new year, and an application for this must be submitted no later than December 31 of the previous year. That is, when submitting an application during 2021, you will be able to apply the simplified system or change the tax base only from January 1, 2022.

For legal entities switching from OSNO to the simplified tax system, the filing period is actually limited to the last three months of the year, because they need to indicate income for the first nine months and the residual value of fixed assets as of October 1.

Only two categories of taxpayers are not tied to December 31:

Taxpayers who have lost the right to use the simplified tax system cannot apply for simplified taxation starting next year.

For example, in the third quarter of 2021, the company exceeds the maximum possible annual turnover limit for a simplifier of 206.4 million rubles. Starting from this quarter, it automatically switches to the main system and cannot apply for the use of the simplified tax system from the next 2022 - only from 2023.

You might also be interested in:

Online cash registers Atol Sigma - how to earn more

How to make a return to a buyer at an online checkout: step-by-step instructions

MTS cash desk: review of online cash register models

Scanners for product labeling

Shoe marking for retail 2021

Online cash register for dummies

Did you like the article? Share it on social networks.

Add a comment Cancel reply

Also read:

Online cash registers in 2021: latest changes

All businessmen conducting settlements with clients in the Russian Federation continue to use online cash registers in 2021.

As before, certain categories of entrepreneurs are indefinitely exempt from CCT, while for others the deferment continues until July 1. Essentially, the rules for working with an online cash register remain the same. Except for some nuances. In this article we will tell you in detail what rules are already in effect, and why... 825 Find out more

How to open a current account for an individual entrepreneur

To open a current account for an individual entrepreneur, you will have to go through several steps.

First of all, you need to study the conditions of different banking institutions in order to choose the most suitable one. Then collect the required package of documents and personally bring them to the bank branch. Opening a current account is quick - in most cases it is available for work the very next day after registration. Let's consider where it is better to open an individual entrepreneur current account... 682 Find out more

Programs for online cash registers

An online cash register program is software that is installed on a cash register and ensures the implementation of its capabilities.

There are many manufacturers involved in software development. Therefore, it can sometimes be difficult to make a choice in favor of one program or another. Programs for online cash registers Large selection of licensed software for online cash registers. Cash, inventory and profile programs. Software for EGAIS and labeling. Favorable rates. More details about the offer... 563 Find out more

How to open an individual entrepreneur: step-by-step instructions for beginners

Simple instructions will help you open an individual entrepreneur and work within the law. If you engage in entrepreneurial activity without registering with the tax authorities, the businessman will face fines in addition to tax charges. In this article we will look at what you need to know about individual entrepreneurship, who can become an individual entrepreneur, how to choose a tax system and much more. Open a current account for individual entrepreneurs on favorable terms Accept non-cash payments and...1027 Find out more

What is the simplified tax system

The simplified taxation system, or as it is affectionately called “simplified”, is the choice of more than 2 million small businesses. It allows you to optimize the tax burden and minimize the costs of reporting preparation. Suitable for both individual entrepreneurs and legal entities.

This special regime involves the payment of a single tax, which replaces three taxes of the main system:

Unlike other special regimes, the simplified tax system does not apply to a separate type of activity, but to everything that the company does. For this reason, the simplification cannot be combined with the main taxation system, which also applies to all activities of the company. The only possible combination in 2021 is the simplified tax system + patent.

Income or income reduced by expenses

The simplified system involves two taxation options. If you choose the simplified tax system “income”, your tax base is maximum, but the interest rate is minimum - 6%. If you choose “income minus expenses,” then, on the contrary, you have a minimum tax base (approximately equal to profit), and the maximum interest rate is 15%. Making the right choice means finding a balance for your enterprise between the amount of interest and the taxable object from which it is calculated.

Regional authorities can reduce the tax rate under the simplified tax system “income” to 1%, and under the simplified tax system “income minus expenses” to 5%. Thus, in Moscow, the rate for those using the simplified tax system “income minus expenses” has been reduced by one and a half times and amounts to 10%, and in St. Petersburg it has been reduced by half and amounts to 7%. In the Sverdlovsk region, newly registered individual entrepreneurs in certain areas of business on any tax object pay only 1%.

The main selection criterion for a business owner is the share of expenses. If they account for more than 65% of revenue, then it makes sense to apply the simplified tax system “income minus expenses.” Many people do this:

- retailers where the price of a product includes its purchase;

- catering establishments and manufacturing companies that have high costs for purchasing materials;

- companies are at the stage of their formation, when not everything is streamlined in the procurement system and there is a lot of spending on the acquisition of fixed assets.

It is more profitable for them to pay the maximum interest, but taken from a small amount, than the minimum interest, but taken from a huge amount, which includes expensive expenses.

If expenses account for less than 65% of revenue, then it is more profitable to use the simplified tax system “income”. This is what many enterprises in the service sector do to the public: beauty salons, household repair shops, car services, legal offices. Deducting expenses from income does not significantly reduce their tax base, so they prioritize low interest rates.

Conditions for switching to simplified tax system

The simplified tax system usually employs those who deal with counterparties in special regimes. If you often supply goods or provide services to enterprises on OSNO, then using a simplified system will only hinder you from concluding transactions. It’s all about VAT: in the simplified system you don’t pay this tax, but your counterparties in the main system do, and with any purchase of goods or order of services from you, they will have to lose on the deduction of input VAT. Therefore, in practice, a trend has taken hold: organizations on OSNO are reluctant to buy anything or order from suppliers in special modes.

The size of the business is also limited. In order not to lose the right to simplified taxation, you must comply with the following limits:

You can go beyond the limits a little, but subject to paying tax at a higher rate. If your annual turnover reaches the range from 154.8 million to 206.4 million* rubles and/or the number of employees is in the range of 100-130 people, then the rate for you this year will increase:

For legal entities there are also incoming requirements, without which they will not be transferred to the simplified tax system: