Types of bonds in circulation and by form of income

In circulation there are state (federal, regional, municipal) securities and corporate ones - issued by legal entities. The date of transaction with bonds for their acquisition or disposal is the day of transfer of ownership.

According to the categories of income generation, there is a division into 2 types of securities - coupon and zero-coupon. Depending on the type of security, forms of income are established: (click to expand)

- In the form of interest with a specified payment period for coupon bonds. Payment control is carried out using cut-off coupons.

- In the form of a discount - the difference between the face value and the purchase price.

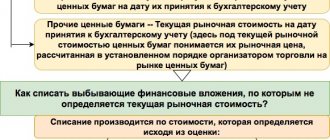

Securities, the market value of which is not determined, must reach the par value of the book value by maturity. The difference is taken into account evenly as part of other income or expenses throughout the entire period of use.

Sale of bonds: OSNO

If the organization selling the bond applies a general taxation system, then follow this procedure when calculating taxes.

Transactions on the sale of bonds do not affect the calculation of VAT. Since transactions with securities (including bonds) are not subject to VAT (Articles 142–143 of the Civil Code of the Russian Federation, subparagraph 12, paragraph 2, Article 149 of the Tax Code of the Russian Federation).

When calculating income tax, take into account the financial result from the sale of a bond according to the rules of Article 280 of the Tax Code of the Russian Federation (clause 15 of Article 274 of the Tax Code of the Russian Federation). Recognize income and expenses for profit tax purposes depending on the method of their determination (accrual method or cash method). This procedure follows from the provisions of paragraph 15 of Article 274 and paragraph 2 of Article 329 of the Tax Code of the Russian Federation.

Documentary form of securities

A security in the form of a bond is a document containing information about the details that allow it to be identified. The data contained on the document ensures the rights of the owner. The bond certifies only the material rights of the investor and does not affect non-property rights, for example, participation in the activities of the enterprise that issued the securities.

The form presented on paper or other media permitted by law is used. The placement of bonds into circulation is carried out through an issue that has a state registration number, and, if there is no need to register the issue, an identification number.

Bonds have pricing characteristics that allow holders to determine the costs and income received. Initially, the bond is assigned a par value - the price indicated on the document. When sold on the secondary circulation market, the bond acquires a market value - a market price that fluctuates during the circulation period.

At maturity, the bond primarily has a value equal to its par value.

What is the maturity date, its features

The maturity date of a bond paper is a specific date that is previously agreed upon between the issuer and the buyer. According to it, the holder receives the value of the debt security in the nominal amount.

According to statistics, today the stock market is dominated by terms ranging from 1 year to 30 years.

Bonds are divided into:

- short-term (up to 5 years);

- papers with an average term (from 5 to 12 years);

- long-term (from 12 to years).

Some debt securities may have early repayment, which means that the issuer can request that the bond be repurchased before the specified date.

Also, the holder has the right to stop using it before the agreed period. As a rule, if an investor claims a refund of his paid funds, regardless of the reason, he is invited to invest the money in other more profitable products of the same issuer.

Experts say that in such cases there is a so-called reinvestment risk, which is when the issuer refuses to fully fulfill its obligations.

Therefore, it is recommended to always purchase callable bonds.

Accounting for bonds with coupon income

The cost of bonds with accumulated coupon income differs from the nominal value either down or up. The value of a bond is the sum of the market price and the amount that has changed the value of the security. Bonds with accrued coupon income are purchased on the secondary market.

Example No. 2 for determining the amount to write off the difference in excess of the actual purchase amount over the nominal amount

The LLC Kontakt enterprise purchased a bond of OJSC Kedr with a par value of 50,000 rubles at a price of 55,000 rubles. According to the terms of the agreement, the income from the investment will be 10% of the value of the bond with payment twice a year and maturity 5 years after purchase. The amount of costs exceeding the nominal value must be written off in equal parts over the reporting periods - 500 rubles per six months. In the accounting of Contact LLC, entries are made, accompanied by the following entries:

| Operation | Wiring | Amount, rub. |

| Payment has been made for the purchased asset | Dt 76 Kt 51 | 55 000 |

| The bond is taken into account in the amount of actual expenses | Dt 58/2 Kt 76 | 55 000 |

| Part of the excess of actual costs over nominal costs was written off | Dt 91/2 Kt 58/2 | 500 |

| Interest accrued on the bond | Dt 76 Kt 91/1 | 2 500 |

| Interest income received | Dt 51 Kt 76 | 2 500 |

A uniform write-off of the excess amount over the par value of the bonds as part of other expenses will allow you to obtain the par value by the maturity date. If the purchase amount (actual expenses) is less than the nominal value, the difference is accrued in equal parts as part of other income.

Bonds. Just the main thing - for beginners

This article was written based on hundreds of requests from novice investors who were interested in bonds . We have identified the most frequently asked questions and tried to explain this tool as simply as possible.

Everyone is familiar with loans. The bank lends money to its customers and expects the money to be returned with interest for its use. Can we lend money to a bank or company, or maybe even to the state? Can!

What is a bond

A bond is a debt security issued by a company on which the buyer receives income. Payment periods are known in advance.

To carry out transactions with bonds, it is enough to open a brokerage account and make a transaction. There are many issuers on the Moscow Exchange that issue bonds.

How to earn income from bonds

Typically, the investor receives income in the form of coupons. Their volume is known in advance or may depend on various conditions that are determined when issuing these bonds. The frequency and schedule of coupon payments are known in advance.

Coupon period is the frequency with which coupons are paid. For example, every quarter or every six months.

At the end of the bond's life, the holder receives the face value. There are also bonds for which the par value is paid in installments over the circulation period.

What happens if I don’t wait for the coupon payment date?

The coupon payment is only formally tied to a specific date. An investor can earn a return even if he holds the bond for several days without waiting for the coupon payment. Transactions with bonds on the exchange require that the buyer pays a coupon to the seller. This means that upon sale you will be paid part of the coupon and the market value.

How much of the coupon will I receive upon sale?

The coupon counts as a cumulative total each day. As much as you held, you got as much.

Example. The coupon period is 30 days, the coupon amount is 60 rubles. We get 2 rubles. for each day of holding the bond. Having bought a bond at the start of the coupon period, the investor pays nothing, since the coupon is zero. If he wants to sell it in 10 days, he will receive the exchange rate difference and a coupon in the amount of 20 rubles. (10 days * 2 rubles = 20 rubles)

How much of the coupon will I pay upon purchase?

If we purchase a bond in the middle of the coupon period, then upon purchase, in addition to its price, we pay the accumulated coupon income (ACI). We pay it to the person from whom we buy bonds.

Many people ask what is the point of buying a bond on any day, since we pay NKD.

If the investor waits until the end of the coupon period, he will receive the entire coupon. Thus, he will reimburse the amount he paid upon purchase (NKD) and receive the remaining amount for the days of ownership.

But, even if you don’t wait until the end of the coupon period, the investor will still make money. The amount of ACI paid upon purchase will be less than the amount of ACI upon sale (during one coupon period).

Example. On the tenth day of the coupon period, the investor buys the bond and pays the market price plus 20 rubles. NKD. On the 30th day, coupons will be paid out, which will be equal to 60 rubles. As a result of this operation, the investor will receive 40 rubles. Then a new coupon period begins.

Coupons are different

There are the following types of bond income:

— Coupon with a fixed interest rate. Such bonds have a fixed interest rate on coupons, such as a bank deposit. That is, the date and amount of payment are known in advance.

— Variable coupon. The interest rate on such bonds is fixed until a certain date, which is called the offer (does not coincide with the maturity date of the bond). After this date the coupon rate changes. Until the offer comes, the coupon is known in advance. This payment option is most often found with corporate bonds.

— Coupon with a floating interest rate. It differs from a variable coupon in that its change does not depend on the company’s decision, but depends on some macroeconomic indicators. Profitability in this case can only be predicted. For example, an indicator for changing the coupon size can be the key rate or the inflation rate.

— Discount bond is a bond whose income is a discount. That is, such bonds do not pay coupons; they are sold at a price below par. The closer the maturity date, the higher the market price.

You can read more about the types of bonds in our article.

How can you track your coupon amount?

In order not to count the coupon yourself, you can use special programs. For example, in the My Broker application, the coupon amount will be included in the purchase/sale amount. In the QUIK terminal, in the current trading table, in addition to the coupon value, there is also the size of the cash deposit.

What types of bonds are there?

The market conducts trading on different types of bonds:

— OFZ (Federal Loan Bonds). The investor provides a loan to the state represented by the Ministry of Finance. — Regional and municipal bonds. This is a loan to a specific region or municipality. — Corporate bonds. The loan is made to the specific company that issued the bond.

Why is the price indicated as a percentage?

The price of a bond is measured as a percentage of its face value. The par value is the primary value of the asset set by the issuer. The most common are bonds with a par value of 1000 rubles.

If the cost of a bond is 110%, then with a par value of 1000 rubles. the market price will be 1100 rubles. As we said above, the amount of accrued income is also added to the market price.

What happens when the bond expires?

Bond maturity is the date on which the bond ceases to exist. On this day the last coupon payment takes place and the face value is paid. The money goes to the brokerage account.

Just like to receive a coupon, you do not have to wait for the bond to mature. You can buy or sell an asset at any time of circulation. In this case, it is necessary to take into account the liquidity of bonds, since it can be both high and low.

Do I need to pay taxes?

Yes, the tax for tax residents of the Russian Federation is 13%. Income from bonds can be:

— NKD, which the investor will receive upon sale. — Coupon received at the end of the coupon period. — Positive difference between the purchase and sale prices of a bond.

If the bond was purchased at a price below par, then the investor will receive par upon redemption. This difference is a positive result, which means it is also taxable.

What is an offer

An offer is an offer to buy part or all of the bonds by the issuer. A detailed analysis of the offers is in our article. Simply put, the offer is the date on which the issuer or investor has the right to redeem the bond.

Most often, investors are faced with an irrevocable Put offer. In this case, the investor has the right to present the bond for redemption. At the same time, he retains the opportunity to leave the papers until the next offer or the end of the circulation period. After the offer has passed, the interest rate on coupons usually changes.

There is also a revocable call offer, in which the issuer himself can redeem the bond, without the consent of the investor.

Can a bond be redeemed in installments?

Partial repayment of bonds is allowed, but this is known in advance. Such securities are called debt amortization bonds.

On the date of partial repayment, the investor receives money into his brokerage account, and the face value of the bond is reduced by the amount of the payment.

Risks

Defaults sometimes occur in the market, when the issuer cannot pay its obligations and goes through the bankruptcy process. It is worth paying attention to the bond rating. As a rule, the higher it is, the lower the risk of default. At the same time, bonds with increased risk offer higher returns.

Fitch credit rating scale Moody's credit rating scale Standard & Poor's credit rating scale The safest bonds are considered to be government OFZs. Municipal securities and issues of companies with state participation are also highly reliable.

Useful information about bonds:

We explain in the most accessible way what bonds are and how to make money on them

Assessing the reliability of the bond issuer

How to assess bond liquidity

OFZ: How are they different and which one should you buy?

OFZ-IN or how to guarantee protection against inflation

OFZ-PK with reference to RUONIA. How to protect funds from inflation

OFZ with a floating coupon - effective protection against rising rates

6 tips to avoid losing money on bonds

Duration. What is it and why is it important

BCS Broker

Accounting for transactions on federal loan bonds (OFZ)

The issue and circulation of OFZ are determined by orders of the Ministry of Finance of the Russian Federation. The transfer of a security is carried out in the order of transfer of ownership rights with the conclusion of an agreement and sale at auction. The conditions for treatment are determined:

- Nominal purchase price.

- The value of the bond on each day of circulation. Published monthly on the official website of the Ministry of Finance of the Russian Federation.

- Start, end and maturity dates.

- Release form (documentary).

- Circle of potential owners.

The nominal value of OFZ in circulation is determined taking into account the consumer price index. In addition to the changed value on the maturity date, the owner of the OFZ receives coupon income. Depending on the conditions of issue, a constant or variable coupon income is used in the calculation.

The amount of variable income is added up over individual payment periods. Accounting for OFZs must be taken into account separately from other types of securities. Detailed accounting is maintained for each bond, with data grouped according to the chronology of registration and price.

OFZs are not used to cover the cost of goods, work, services or other types of expenses within the framework of commercial activities.

Presentation of bonds for payment: simplified tax system

If the organization presenting the bond for redemption applies a simplified procedure, then when calculating the single tax, follow this procedure.

The operation to repay the bond should also be taken into account according to the rules of Article 280 of the Tax Code of the Russian Federation (clause 1 of Article 346.15 and clause 3 of Article 249 of the Tax Code of the Russian Federation).

Generate income and expenses as you pay (Article 346.17 of the Tax Code of the Russian Federation). At the same time, follow the procedure that a simplified organization must apply depending on the chosen object of taxation.

If an organization calculates a single tax on income, do not take into account expenses when calculating the tax (for example, the price of a bond or the coupon income paid upon its acquisition) (clause 1 of Article 346.18 of the Tax Code of the Russian Federation).

If an organization calculates a single tax on the difference between income and expenses, the tax base can be reduced by the cost of purchasing the bond (subclause 23, clause 1, article 346.16 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated January 24, 2011 No. 03-11-06/2 /08 and the Federal Tax Service of Russia dated February 14, 2005 No. 22-1-12/181). The written off amount of losses incurred in the previous tax period under the simplified tax system will also help reduce the tax base.

Mortgage coverage with bonds

Property can serve as collateral for the bond. Collateral is provided to reduce the risk of the acquirer (investor). The essence and types of bonds do not change depending on the presence of mortgage collateral. Operations and document flow are similar to the circulation of bonds without collateral. In the event of loss of property serving as collateral, the investor receives the insured amount.

The circulation of covered securities is carried out by credit institutions or mortgage agents. Issuers of bonds must provide detailed information about the securities. Organizations registered as LLC or JSC act as mortgage agents. The enterprise must fulfill the following conditions:

- Clearly state in the Charter the procedure for issuing bonds and follow it throughout the entire period of activity.

- Determine the maximum number of bonds allowed for issue and limit the issue to the constituent documents and is included in the Charter.

- Do not hire employees.

Record keeping is transferred to a specialized organization. Voluntary termination of the existence of an organization is permitted upon full repayment of obligations.

Securities reporting

Issuers issuing bonds are required to disclose information in reports published quarterly. Reporting begins from the first quarter after the issue of bonds and is carried out until the obligations are repaid, the issue is determined to be invalid, and the documents are declared invalid.

The reporting is presented in the form established in the document approved by the Bank of Russia on December 30, 2014 No. 454-P “Regulations on the disclosure of information by issuers of equity securities.” The reporting contains information about the issuer, its activities, liabilities, liquidity of securities, and investments made.

The issuer must submit a complete package of financial statements including all forms. The following information is subject to disclosure in the issuer's financial statements:

- Availability and change in the amount of debt on loans issued by bonds.

- Amounts, maturity dates of bonds.

- The amount of expenses incurred during the issue and circulation of bonds.

Repayment process

Redemption of bonds is simple. On the appointed day, which is stated in this agreement concluded between the issuer and the investor, the first, that is, the owner of the paper, buys it back. At the same time, he pays the former holder its entire nominal value.

This does not happen in person, but the amount is transferred to a previously opened account in a brokerage company, which is assigned to the investor.

The former holder of the bond paper can only cash out the funds received from there by requesting a transfer to his personal ruble account.

It happens that an investor wants to receive back the face value of the bond before the specified period and thereby interrupt cooperation with the issuer.

Then repayment of the bond by the issuer ahead of schedule occurs only after receiving a written application from the holder of the debt security.

But such a mechanism is rarely used in practice to avoid risky situations, for example, a technical default.

This means that the contract with the investor is terminated , but the funds will be transferred later, once the financial balance of the company is established.

Important! If the agreement stipulates that the bond can be repaid ahead of schedule at the initiative of the holder, then in such cases the terms within which the investor does not have the right to demand the return of the nominal value of the debt security are additionally indicated.

This is the so-called cushion period for the issuer. It is during this time that the securities and the amount that was paid by the buyer (the nominal price of the debt securities) will be ready.

Note!

Many novice investors are wondering: is it possible to sell bonds before the maturity date? Yes, you can sell, but the transaction must be agreed upon with the owner of the debt security (issuer).

It is worth noting that interest is paid in two ways: monetary and non-monetary. In the first case, the investor is paid the amount in banknotes; in the second, he has the right to choose whether he can receive the amount in cash or property equivalent.

All this must be written down in the contract at the initial stage of purchasing debt securities. An investor does not have the right to simply change his decision to receive payments.

also arrange a conversion - this is an exchange of expired bonds for new ones based on coupon payments.