Transport tax and the Plato system: accounting and tax accounting

For many accountants, the question arose: how does transport tax and the Plato system reflect accounting and tax accounting? Owners of vehicles are required to pay movable property tax in accordance with Russian law.

This may also apply to lessees, if specified in the terms of the contract. Since 2015, owners of cars weighing more than 12 tons are required to pay a fee for causing damage according to the Platon system.

In this article you will also learn how to reduce the transport tax on Plato.

The essence of the Plato system

The Platon system was introduced at the end of 2015. With its help, the Government decided to pay fees for the restoration of federal highways, the destructive effect of which is caused by cars weighing over 12 tons. This indicator includes not only the weight of the car, but also the permissible weight of cargo, transportation of passengers and even drivers.

You can correctly determine, justify or refute the need to register a car using such a system using the following documents:

- vehicle passport;

- vehicle registration certificate.

If the total weight is more than 12 tons, you must register the vehicle with an authorized operator and pay a fee for each kilometer traveled on the federal highway.

In order to resolve controversial issues and the double taxation system, Federal Law No. 249 of July 3, 2021 was adopted. According to it, the owner of the vehicle can reduce the transport tax by the amount of payments under the Platon system, taking into account certain requirements.

To be able to reduce the tax, an application and a package of documents are submitted to the Federal Tax Service at the place of registration of the car owner.

A sample application to reduce transport tax at the expense of Plato can be found on the website of the tax service, in the taxpayer’s personal account or other systems.

The package should contain documents containing information about:

- owner of vehicles;

- vehicle indicating the weight and permissible weight;

- documents on payment of payments in the Platon system.

An application for a deduction for transport tax and a package of documents for Plato are submitted to the tax service. They must be submitted to the Federal Tax Service at the legal address of the organization if the owner is a legal entity. Payment documents are best prepared in your personal account.

If the vehicle requires a trailer of any kind, then the weight of the trailer must also be taken into account according to the vehicle title.

Calculation of transport tax taking into account payments using the Platon system

Owners of most vehicles are required to pay transport tax to the regional budget. It can be paid once a year or in equal installments throughout the year. This decision is made by the authorities of the region in which the car is registered. In most constituent entities of the Russian Federation, advance payments have been cancelled.

Tax calculations for owners - legal entities - are carried out by the organization itself, represented by accounting employees. For individuals, the tax amount is calculated by tax officials. Every year the tax is sent to the owner at his registered address.

The obligation to pay tax arises at the end of the calendar year. Tax calculation begins from the month of registration and does not depend on the specific date of that month. This also applies to the month of deregistration.

The calculation of car tax is regulated by the Tax Code of the Russian Federation and regional regulations.

To calculate it you need to know:

- Tax rate. It is approved at the state level.

- Tax base. It is the amount of horsepower in the vehicle (indicated in registration documents).

- Number of months of ownership. Reflected in the vehicle passport.

To calculate the tax amount, you need to multiply the figures and divide by 12 months.

For some categories of cars, an increasing factor is applied.

Transport tax is calculated for each individual vehicle. This also applies to payments under the Platon system. Heavy trucks traveling on federal highways are required to pay a fee for road damage. The calculation is made for each kilometer traveled.

In order to reduce the financial burden of vehicle owners, a decision was made to reduce transport tax and Platon payments. To take advantage of this deduction, you must confirm that you have paid for the cathedrals.

The calculation is made for each individual vehicle. If there are several registered funds on the organization’s balance sheet, then it is impossible to sum up the accrued tax for each fund and all Platon payments. A separate calculation is made for each car.

There can be two cases:

- car tax is more than the amount of payments according to Plato;

- The car tax is less than the amount of payments under Plato.

In the first case, the difference between these two indicators is paid to the regional budget. In the second case, no tax is paid at all.

Only the owner of the fund, who at the same time paid the fee according to Plato, can receive a deduction. If the car was rented, then payment of tax is the responsibility of the owner, and payment of payments for road damage is the responsibility of the lessee. These payments cannot be offset.

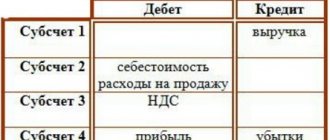

Reflection in accounting

Settlements with the authorized operator for payment of payments under “Plato” are reflected in full in the accounting records of the organization. To reflect in accounting, entries for Plato and transport tax recommended by financiers of the Ministry of Finance are used.

The following can be used as an example:

- payments to the operator’s account are reflected through the posting: Credit 51 “Current account” – Debit 76 “Settlements with various debtors and creditors”;

- reflection of payments to the budget: Credit 76 “Settlements with various debtors and creditors” – Debit 68 “Settlements with the budget”, subaccount “settlements according to Plato”;

- write-off of expenses: Credit 68 “Calculation with the budget”, subaccount “Calculations according to “Platon” - Debit 20 “Main production”.

Reflection of settlement transactions with the Platon system may differ from the recommended transactions and must be specified in the organization’s accounting policies. This right of the organization is reflected in the Accounting Policy.

Transport tax is calculated in the usual way without any nuances. To reflect the accrued tax, use the debit of account 68 with the corresponding subaccount. Payment of transport tax is reflected in the credit of the account. At the same time, only the difference between the costs of the system and the accrued tax on the car is reflected here.

Advance payments require special attention if they are applied in the region. The calculation and payment of such vehicle tax payments is made without taking into account expenses under “Plato”. The difference is reflected only at the end of the year.

Reflection of accounting entries for “Plato” and transport tax must be carried out separately for each transport.

Reflection in tax accounting

Payments under the Platon system are reflected differently in tax accounting. According to the Tax Code, such payments cannot be reflected in tax accounting. Explanations from the Ministry of Finance indicate that tax accounting should reflect only those costs under this system that exceed the amount of transport tax.

If regional legislation provides for advance payments, then it is necessary to reflect in tax accounting the difference between written-off expenses according to Plato and advance payments for the same period.

Tax records must also be maintained for each vehicle.

All tax accruals are reflected in the declaration. Its form, taking into account Plato payments, was approved in December 2021 and is valid from 2021. The form can be found on the tax service website. You can also find a sample form here.

To reflect Plato payments the following are used:

- line 290 – deduction according to Plato;

- line 280 – deduction according to Plato for each car.

The amount of deductions on line 280 should ultimately equal the total amount on line 290.

The reflection of amounts on these lines must be documented. Most often, documents are used from the Platon online system in the personal account of the car owner. It must reflect calculations of accrued and paid amounts for damage to federal highways.

Transport tax is reflected on line 190. If the organization has confirmed a deduction benefit using the Platon system, then line 300 reflects the amount payable taking into account the benefit. Negative amounts payable are not reflected in this line. In this case, a zero is entered.

Car owners are required to pay transport tax to the budget. In addition, heavy vehicles must pay a fee for damaging roads. In this article, we tried to explain how to correctly reduce the transport tax by the amount of fees according to Plato, in which cases this is possible and in which it is not.

You can reflect the costs of payments to the budget and the authorized operator in both accounting and tax accounting. Providing documents according to approved forms will allow you to receive a legal deduction and reduce the tax base for profits.

Payments for damage to federal highways are reflected in accounting, and in tax accounting - only the difference between payments and the amount of tax.

Source: //avtoved.com/oformlenie/nalogi/transportnyy-i-sistema-platon

1c:franchisee consultant accountant

As a result of creating this document, the corresponding transactions will be generated. To view the result of conducting the document “Routine operation” with the type of operation “Calculation of income tax” (Fig. 10), click the DtKt button. Fig. 10 Calculation of deferred taxes associated with payment of the amount of the “Platon” fee transferred to the budget by the operator for 2021. Constant tax liabilities are recognized = Amount of the “Platon” fee transferred to the budget by the operator * Income tax rate (1,530.00 RUB = RUB 7,650.00 * 0.20). A breakdown of the amount of deferred taxes can be viewed in the report “Calculation Reference for Tax Assets and Liabilities” (Fig. 11) (menu: Operations – Period Closing – Calculation References – Tax Assets and Liabilities). Fig.11 6.

Transport tax and the Plato system in 2021: how to reduce and receive benefits?

In Russia there is a transport taxation system called “Platon”. It only applies to large trucks. That's why it was called that. The pressing issue now is the reduction of Plato by the amount of transport tax in 2021.

The main function of this system is to collect funds from drivers of heavy vehicles for the damage they cause to roads.

The development of the described system was a necessity, since there are more and more trucks every year. Roads are losing their quality faster. And the financial resources that tax authorities accumulate from transport taxes are not enough to carry out restoration repairs. That is why the Plato system was created.

So, let's look at Plato and the transport tax itself, what are the nuances.

How does the Plato system work?

It performs several main tasks:

- Information processing;

- Collection of necessary information;

- Saving data on the movement of trucks on highways.

Motorists can use this system for free. However, they must register on the system website. You will have to pay 600 rubles every month for the service.

The Platonic program block is installed in the car. Through a mobile connection, he reports the coordinates of the vehicle to a special center. The received data is processed. After this, the driver is issued an invoice for trips on federal highways.

The functioning of the Plato system occurs automatically. If the car turns off the federal highway, the system turns off automatically. All vehicles weighing more than 12 tons are required to join the system. Only those cars that transport people, as well as various company cars, are exempt from taxes.

The tax payment scheme under this system is advance. Those. First, money is deposited, and after that the operator gradually writes off the required amount. Payment is made for each kilometer of travel.

Route map

The Plato route map is a document compiled on the basis of data about the route that will be taken. All data is provided by the truck owner.

You can make such a card in your personal account of the program. If there is no such card, a fine will be issued.

Tax benefits of the Platon system

Many motorists are interested in the question: how to reduce transport tax? Not long ago, some innovations were approved regarding the Plato system. According to them, a tax benefit was established for some vehicles. It applies to both individuals and legal entities.

If, according to the Platon system, the amount of payments is greater than the transport tax or equal to it, then there is no need to pay the tax. Individuals can apply for a reduction in the amount of transport tax. Legal entities will have to apply for the benefit through a tax return. All organizations that have a benefit will be exempt from paying advances on transport tax.

Any taxpayer can recalculate taxes from the date of entry into force of “Plato” and reduce the tax deduction.

To achieve a reduction in payments, you must provide an application, documents for the vehicle, a car passport, and data on payments made.

It is also recommended to make extracts from the Plato system.

Procedure for granting benefits

Vehicle owners can receive a benefit in the situation if:

- The car was entered into the register;

- System employees gave the motorist a receipt indicating that the payments had been made.

Once a year, prepares a report on the basis of which benefits are offered. You can order it on the website or at the Platon office.

Transport tax and tax according to the Platon system must be paid by individuals and legal entities equally. Those who want to reduce tax must show the following documents:

- Statement;

- Information about the owner of the vehicle;

- Vehicle passport;

- Data on payment for the use of highways.

You can send documents either independently or through a representative.

The application for the benefit must be submitted before the tax office begins generating notifications for the past period. The application must be written in 2 copies. The first remains with the tax office, the second with the owner of the vehicle. If the vehicle owner submits an application later than the deadline, he will still have the right to receive benefits. The amount of overpaid tax will be recalculated.

How to make advance payments?

The payment that was made to the Plato program reduces the tax deduction when paying for a certain heavy load. It does not affect the taxation of other vehicles.

At the end of the year, the difference between the transport tax and the total amount of money that was contributed to the Platon system is reimbursed. The amount of payment can be found in the operator’s report. If the amount of payments turns out to be greater than the tax amount, then there is no need to make a tax deduction.

When can the tax amount not be reduced?

If the plato is paid by the same person as the 2021 transport tax, then the benefits will not apply. This rule also applies to those vehicles that are leased.

In this situation, it will not be possible to take into account the amount of paid amounts under Plato in the form of a deduction for the car owner. After all, it is not he who will make the payments. The Ministry of Finance believes that this rule is completely justified. After all, the costs must be paid by different persons.

Fines

Fine up to 5,000 rubles. the following persons will have to pay:

- Drivers of a vehicle owned by a foreign carrier;

- Car owners

If a fine of 5,000 has not been paid, it is doubled.

If the program detects the same driver for several similar violations on the same day, then only the first fine will be subject to payment. Other violations will not be subject to penalties, because the fine is charged once.

Penalties will also have to be paid for the following actions:

- A trip without Plato and a route map;

- Carrying out a trip at a time that is not specified in the route map;

- Insufficient number of advance payments on Platon’s balance sheet.

The Plato program operates at the state level. So violators will receive notifications. Violators on the roads are detected by video cameras.

Information from these cameras is received by traffic police officers, who issue fines to motorists.

Accounting

Transport tax expenses are reflected in the accounting department in account 68. Transport tax relates to expenses for ordinary activities. The procedure for how it will be reflected in accounting depends on the organization in which the vehicle is used.

Here are the entries that reflect this tax:

- Dt 76 - Ks 51 - advance payment is transferred to the operator;

- Dt 20 - Kt 76 - the fee that was calculated for travel is included in expenses.

If this is provided for by the organization’s accounting policies, then the amount of fees that the operator transfers to the budget may additionally be reflected. This amount is reflected in the subaccounts of account 76.

Why was the right to deduction introduced?

Until 2021, there were two payments in our country:

- Transport tax;

- Tolls on federal highways.

These fees had one task - to maintain the quality of roads at a good level. The only difference was that the vehicle tax was paid to the regional budget, and payments to the federal budget.

Car owners paid the tax twice. Motorists fought against this injustice using legal methods and through protests. Later it was decided that the Plato system is not a transport tax. Life for heavy vehicle owners has become much easier.

So, the Platon system was created to attract funds to the budget and use them to maintain roads in good condition. If there is a benefit, then the amount of vehicle tax under this system is reduced. To receive the benefit, it is enough to confirm your right to it and provide all the necessary documents to the tax office.

instructions

Attention!

Due to frequent changes in the legislation of the Russian Federation, the information on the site does not always have time to be updated, so

free legal experts work for you around the clock!

Hotlines:

Moscow: +7, ext. 206

St. Petersburg: +7, ext.

997 Regions of the Russian Federation: +7, ext.

669 .

Applications are accepted around the clock, every day. Or use the online form.

Source: //pdd-helper.ru/sistema-platon-i-transportnyj-nalog/

Terminal for receiving and issuing waybills

The terminal is designed for printing, processing and closing waybills by drivers.

The terminal connects and interacts with the 1C working database.

You can use a specialized terminal (designed similar to payment terminals), or you can use a personal computer with a barcode scanner and magnetic card reader.

Before the flight, the driver can check and independently print the waybills prepared by the dispatcher.

Upon returning from a trip, the driver can independently close his waybill without visiting the control room.

When closing the waybill, the driver can sequentially enter the final data for the flight:

Check the data he filled in:

Is it possible to reduce the transport tax by the amounts paid under Plato?

Owners of trucks weighing more than 12 tons can reduce the amount of transport tax by the amount of the accrued Platon fee to compensate for damage caused to public roads of federal significance.

The system was put into operation in 2015.

Let's find out under what circumstances and in what cases a reduction in transport tax by the amount of Platon payments is available.

More than 50% of the total damage to federal roads is caused by heavy vehicles weighing more than 12 tons: the passage of one heavy truck is compared to the movement of 25,000 cars.

The Platon toll collection system was created and is used to ensure compliance with the procedure for collecting tolls to compensate for damage that was caused to public roads of federal significance. This is compensation for the destruction of highways by trucks .

The funds received go to the Federal Budget of the Russian Federation, then they are used to ensure the maintenance of highways, finance construction and repair work, and improve road and transport infrastructure.

The system is designed to improve the transport and operational condition of federal roads.

"Platon" collects data on the movement of vehicles weighing more than 12 tons, processes it, stores and transmits it automatically.

Applies to all public roads of federal significance. The full cycle of creation and operation of the system is provided by its operator, RTITS.

Operating principles of the system

Platon users carry out most transactions through their Personal Account (//lk.platon.ru/sign_in).

The capabilities of this service allow you to monitor what is happening online and manage your profile without wasting time on travel and queues.

By registering in the system, the owner of a heavy load for which a fee must be paid receives bank details. Payments are made on them.

The payment scheme is advance . First, money is deposited, then the operator gradually debits the corresponding amount from the account account.

The fee is not paid for vehicles if they:

- intended for transporting people (exception: passenger-and-freight vans);

- equipped with devices that provide light and sound signals for the work of the police, medical ambulance, fire department, emergency rescue services;

- intended for transportation of military weapons and equipment.

Those. “Platon” collects fees for the passage of heavy-duty and freight vehicles on federal highways in the Russian Federation.

The official website of the system (//platon.ru/ru/front-page/15-04-2021/6510/) states: based on the Resolution of March 24, 2021, from April 2021 the tariff is 1.90 rubles per kilometer.

Payment must be made for each kilometer traveled.

Information about vehicle movement is collected using special satellite navigation equipment. Processed automatically.

The on-board device provided by the Information Support Center determines the geographic coordinates of the moving truck. The coordinates are transmitted to the Data Processing Center.

The amount of payment for the distance traveled on federal highways is written off automatically. If there is no stationary control framework, mobile control is carried out.

Operating principles of the toll collection system:

- payment is made for the actual distance traveled;

- charged continuously;

- satellite systems GLONASS and GPS are used;

- The movement of vehicles weighing more than 12 tons is regularly monitored using stationary and mobile control systems.

Route map

Route map "Platon" is a document that is generated based on data about the planned route . This data is provided by the vehicle owner.

You can also register it in your Personal Account of the system. If a route map is missing, a fine will be charged.

The document contains the following data:

- card number;

- state registration plate of the vehicle;

- validity period, date and time of issue;

- the total length of road sections included in the route;

- route description;

- board size.

The card is issued:

- at Information Support Centers;

- through self-service terminals;

- in the Personal Account of the official website of the system;

- in the corresponding mobile application.

Penalties

In 2021, administrative liability is provided for the following actions:

- driving without Plato and a route map;

- driving with an inoperative or broken on-board unit;

- driving at a different time and date, along a route that was not stated in the route map;

- There are not enough advance funds on Platon’s balance sheet.

If a violation is recorded two or more times within 24 hours, the owner pays a fine for only one violation.

Fines can be avoided if:

- the heavy truck was registered in the system more than two months ago;

- the owner has no fines for non-payment or arrears in payment of fees.

In 2021, a law on the possibility of reducing fees was signed into law . Let's find out whether it is possible to reduce the transport tax by the amounts paid under the Platon system.

Why was the right to deduction introduced?

Until mid-2021, there were two payments in force in the country:

- transport tax;

- toll on federal highways.

Both fees had the same goal: maintaining roads in acceptable condition. The only difference between them: the duty for owning vehicles went to the regional budget, payments - to the federal budget.

Car owners had to pay twice for damage to roads. The new fee was fought both legally and through protests.

Later, the Constitutional Court came to the conclusion that the fee for the Platon system cannot be compared with the tax fee . But life has been made easier for heavy truck owners with the introduction of a tax break.

From July 3, 2021, transport tax can be reduced for payments to the Platon system . The payment reduces the amount of transport tax only for a specific truck weighing over 12 tons.

A company can take into account only one of two possible amounts as expenses:

- transport tax, which was reduced by the road tax if the tax was less than the tax;

- portion of the toll that exceeds the tax.

If a company has overpaid advances on transport tax for a cargo vehicle, they can be returned at the end of the year.

The question often arises: do you need to pay transport tax if you pay Platon?

If the amount payable to the system is equal to or greater than the amount of transport tax, you do not need to pay tax. If the fee is less, the owner reduces the tax by the amount he paid.

How to reduce transport tax on Platon?

Procedure for applying for tax reduction benefits, documents

Legal entities and individuals are in an equal position when it comes to the calculation and payment of transport tax. The tax is paid based on a notification from the Federal Tax Service.

To apply the benefit, the Federal Tax Service provides the following documents:

- statement;

- information about the owner of the vehicle (documents confirming ownership);

- vehicle passport (indicating the permitted weight over 12 tons);

- information on making payments for using the trails.

It is recommended to use extracts from the system’s Personal Account.

Documents are provided in person, through a representative, sent by mail (along with a list of attachments), through the Government Servants Portal (//www.gosuslugi.ru/10054) or the “Taxpayer Personal Account” service (//lkfl.nalog.ru/lk /).

An application for the “Platonov” benefit is sent to the Federal Tax Service before the tax inspectorate begins to generate notifications for the expired tax period.

The application is drawn up in two copies . The first is given to the inspection, the second remains with the applicant. Request that the inspector affix a stamp indicating acceptance of the application and documents from the current date.

The amount of transport tax, which is subject to transfer to the budget by car owners, is calculated by the tax authorities. Grounds - information provided to tax authorities by the authorities carrying out state registration of vehicles.

If the taxpayer is late in submitting the application, he remains entitled to the benefit. The amount of overpaid tax due to recalculation is returned for the period of recalculation.

An application for the return of overpaid funds must be submitted within three years from the date of payment of this amount. This means that individuals can provide documents that confirm their right to a deduction under the Platon system within three years from the date the right to the benefit arises.

Let’s find out how to include “Plato” in transport tax:

- At the end of the year, pay the difference between the tax and the fee for the year. The amount is taken from the operator's report. If the fee is greater than the tax, it may not be paid.

- In line 280 of the Tax Declaration, enter the code 40200. In line 290 - the fee for the year. Line 300 is the tax that was reduced by the fee. If the fee is larger, enter 0.

- In tax accounting, the difference between “Plato” and tax is taken into account in expenses. Example: the tax for the year was 14,000 rubles, the fee to the system was 11,000 rubles. Take into account only 3,000 rubles of tax.

- Advance tax payments on heavy goods vehicles can be calculated, but do not have to be paid. They are not reflected in the declaration. Calculated advance payments are also not taken into account in expenses.

The declaration is easy to fill out, but you must first confirm payment of the fee for using federal highways. Without this, the deduction will not apply.

Let's find out how to confirm the transport tax benefit using the Platon system.

Confirmation procedure

Car owners have the right to confirm the deduction if they meet the following conditions:

- vehicle weight exceeds 12 tons;

- The vehicle is included in a special register;

- the system submitted a report on the payment.

The report is generated once a year . It can be ordered through the official website or mobile application. First, create an account and enter the required information about the vehicle.

If it is more convenient for you to receive documents in paper form rather than electronically, go to the Platon representative office.

They also use their personal account:

- They go to the vehicles section, find the desired car, which gives the right to a deduction.

- In the “Request a Federal Tax Service certificate” section, indicate the period and confirm the entered data.

- The document will be automatically downloaded.

- The file is protected by an electronic signature. It is served without printing.

This document and other information about the vehicle owner will help you obtain a tax break. If you own several heavy trucks, repeat the above steps for each of them.

Integration with the freight exchange "ATI"

Currently, the integration supports the following business scenarios:

- adding and editing cargo to the site;

- working with counter offers from carriers;

- unconditional transactions (instant confirmation of the transaction by the carrier).

Integration with 1C is implemented on the basis of the “Tender” document.

* Interaction is supported only in 1C:Enterprise 8. Transport logistics, forwarding and vehicle management CORP.

For the STD and PROF versions of the product, an upgrade to the CORP version is available.

Integration with the “NO Fines” service

The service provides the opportunity to receive up-to-date information on fines issued to vehicles. An additional feature of the service is the payment of fines.

When integrated with the service in 1C, information about the fine, the status of its payment, photographs of the violation and payment details are loaded into the “Fine” document.

To record the payment of a fine, you can use the documents “Outgoing Payment Order” and “Cash Expenditure Order”.

And you can download information on all unpaid fines, check and pay them using the documents “Register of Payment of Fines” and “Invoice for Supplier Payment”.

Integration with the Parkomatika service

Integration with the Parkomatika system allows you to automatically load parking lots into 1C, register parking sessions, and also take into account the costs of paying for parking.

Parking lots are loaded into 1C into the “Parking” document.

To account for parking costs, it is possible to generate a standard document “Reflection of other income and expenses” for the “Parking” document.

To analyze the parking history of vehicles, there is a “Parking” report:

Integration with Yandex.Maps and Yandex.Routing services

Integration with the Yandex.Maps service allows you to search for addresses on the map, display the location of transport, and calculate the distance and travel time for a route.

Integration with the Yandex.Routing service* allows you to:

- automatically build optimal routes taking into account traffic jams;

- reduce route planning time;

- increase the recycling of transport, reduce transport costs.

More details about working with the service can be found in the thematic publication, as well as in the webinar: