How to fill out the form

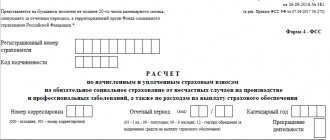

The current report form in Form 4-FSS for filling out is approved by Appendix No. 1 to the order of the Social Insurance Fund of Russia dated September 26, 2016 No. 381.

The official name of form 4-FSS is “Calculation of accrued and paid insurance premiums for compulsory social insurance against industrial accidents and occupational diseases, as well as expenses for the payment of insurance coverage.”

This order also approved the procedure for filling out the 4-FSS calculation (Appendix No. 2).

Form 4-FSS consists of several sheets that can be filled out or not depending on the situation:

- Title page.

- Table 1 “Calculation of the base for calculating insurance premiums.”

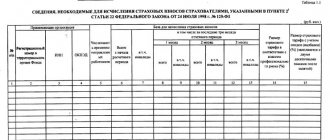

- Table 1.1 “Information required for calculating insurance premiums by policyholders specified in clause 2.1 of Art. 22 of Federal Law No. 125-FZ of July 24, 1998.”

- Table 2 “Calculations for compulsory social insurance against accidents at work and occupational diseases.”

- Table 3 “Expenses for compulsory social insurance against accidents at work and occupational diseases.”

- Table 4 “Number of victims (insured) due to insured events in the reporting period.”

- Table 5 “Information on the results of a special assessment of working conditions (results of certification of workplaces for working conditions) and mandatory preliminary and periodic medical examinations of workers at the beginning of the year.

Do I need to submit a zero report 4-FSS? It turns out yes. The procedure for filling out the zero 4-FSS has its own characteristics. They can be viewed in ConsultantPlus:

Law No. 125-FZ and the Procedure do not provide for the release of the policyholder from the obligation to submit a calculation in the event of absence of payments in favor of the insured persons, amounts of insurance premiums payable (so-called “zero” reporting), or other indicators in the reporting (calculation) period , which must be reflected in the calculation.

Read the complete solution.

Next, we will consider the procedure for filling out each of the parts and tables of form 4-FSS. But first, the general requirements for completing the calculation.

Basic Rules

There are two key documents that serve as sources of information for completing Table 4 of the 4-FSS. This:

1. Acts on accidents at work in form N-1 (approved by Appendix No. 1 to Resolution of the Ministry of Labor dated October 24, 2002 No. 73).

2. Acts on cases of occupational diseases (Appendix to the Regulations on the investigation and recording of occupational diseases, approved by Decree of the Government of the Russian Federation of December 15, 2000 No. 967).

Next, we will look in detail at how to fill out Table 4 of form 4-FSS:

| Props | Explanation |

| Line 1 – total accidents | The general indicator is taken from acts of form N-1 |

| Line 2 – accidental deaths | The indicator is isolated from N-1 acts |

| Line 3 – occupational diseases | The general indicator is taken from the relevant acts on occupational diseases |

| Line 4 – total number of victims | Sum up the indicators of lines 1 and 3 |

| Line 5 – number of cases limited to temporary sick leave | Data is taken from sick leave certificates |

In lines 1 – 3, the criterion for including an insured event in Table 4 is not the day of the incident/onset of the disease itself, but the date of the examination to verify the occurrence of the insured event.

Also see “Instructions for filling out 4-FSS in 2021.”

General rules for filling out 4-FSS

4-FSS is filled out on a computer or by hand with a ballpoint (fountain) pen in black or blue in block letters.

one is entered in each line and its corresponding columns . If there are no indicators provided for in Form 4-FSS, a dash is placed in the line and the corresponding column.

The title page, tables 1, 2 and 5 must be submitted by all employers.

If there are no indicators to fill out tables 1.1, 3 and 4, they are not filled out or submitted.

How to fix errors

The following steps need to be taken:

- Cross out the incorrect indicator value.

- Enter the correct one.

- Sign the employer or his representative on the correction, indicating the date of the correction.

- Certify with the seal (if any) of the employer (legal successor) or his representative.

Errors may not be corrected by correction or other similar means.

After completing the filling of 4-FSS, enter the continuous numbering of the completed pages in the “page” field.

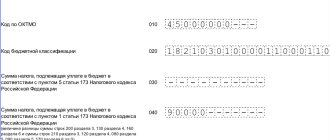

At the top of each page to be filled out, the fields “Insured's Registration Number” and “Subordination Code” are filled in in accordance with the notice (notification) of the insured issued during registration (registration) with the territorial body of the Social Insurance Fund.

At the end of each page, the signature of the policyholder (legal successor) or his representative and the date of signing 4-FSS are affixed.

Page 1

All details of the policyholder are filled in, data on the number of employees and people with disabilities is indicated, the budget level for the budgetary organization is indicated, and a mark is given by the representative of the fund who accepted the report.

If a report is submitted for a given period for the first time, then in the field:

The code is set to 000.

If an error is found in an already submitted report, then after correcting it, code 001 is set. With each correction, the code will increase by 1.

Consider the following field:

If the form is filled out for a certain period, the first two cells contain the numbers corresponding to this period, as indicated in the explanation. If you apply for insurance compensation, then indicate the serial number of the application (01 if it is the first, 02 if it is the second)

In the field: the letter “L” is written if the organization is in the process of liquidation or the individual entrepreneur ceases its activities. In all other cases it remains empty.

Who takes 4-FSS for 2020

Form 4-FSS contains information about accrued and paid “accidental” contributions at work. It is rented out:

- LLC and JSC;

- Individual entrepreneur with hired employees;

- lawyers, notaries and other private practitioners, if they pay citizens remuneration from which they pay contributions to the Social Insurance Fund.

If there was no activity and no income was paid to employees, the report will still have to be submitted, but with zero indicators. The same applies to companies with a single founder-CEO. More details on the procedure and example of filling out the zero 4-FSS can be found in

this

article.

Individual entrepreneurs without employees do not submit 4-FSS and do not pay contributions to Social Security. However, if he wishes, an individual entrepreneur can register with the Social Insurance Fund, transfer contributions there, and then be able to receive benefits for temporary disability, pregnancy and childbirth, and child care benefits up to 1.5 years. At the same time, there is no need to submit a 4-FSS report, since it is submitted only for hired employees.

How to fill out table No. 1 of the 4FSS form

The first table of the report concerns the calculation of the amount of earnings from which the amount of the insurance premium will be calculated. Here is the accrued salary, the amounts that reduce the basis for calculation, as well as what percentage of earnings should be transferred to the budget. The percentage of deduction is determined based on the type of activity in which the organization is engaged. It is established for each year on the basis of an application for confirmation of the main type of activity.

We will consider what information needs to be indicated in the table.

| Index | What information does it contain? |

| Salary amount | To reflect the amount of wages, 4 columns are allocated - one general (cumulative total) and three - information by month for the quarter |

| Amounts that are not subject to contributions | These columns reflect the amounts for sick leave, benefits, and everything that is not subject to contributions. Amounts are indicated as a whole for the period and monthly |

| The amount from which contributions are calculated | Here the difference between the first and second lines is stated. It is from this amount that insurance premiums will be calculated. |

| Contribution rate by risk class | There are several risk classes, each with its own tariff |

| Discounts and surcharges to the tariff | In some cases, increasing or decreasing coefficients may be applied to the basic tariff. Here you will need to indicate them and indicate the date from which they were installed |

| The contribution rate after discounts and surcharges | In this line we enter the tariff that was obtained after applying all discounts or surcharges |

Methods for passing 4-FSS

There are several ways to submit a report:

- On paper - if the average number of employees (SSH) is no more than 25 people.

Those whose SCN does not exceed 25 people are given the choice of submitting a report on paper or electronically.

- In electronic form - if the total number of employees exceeds 25 people.

4-FSS in electronic format is submitted via telecommunication channels (TCC) through electronic document management operators. Before this, the report must be signed with an electronic signature.

A short reminder on calculating the SSC (clause 78 of Rosstat Order No. 711 dated November 27, 2019):

- When calculating the average headcount, take into account only those employees for whom your organization is the main place of work.

- External part-time workers and employees under GPC agreements do not need to be included in the SSC.

- An internal part-time worker is counted as one person.

If you submit 4-FSS on paper and are required to submit it electronically, you will be fined 200 rubles.

Legislators plan to reduce the number threshold for passing the electronic 4-FSS from 25 to 10 people. The draft Federal Law “On Amendments...” is posted on the portal regulation.gov.ru.

Responsibility of the employer for violations in the preparation and submission of reports

As a result of the generation of the 4FSS report, liability may arise . The specificity of this particular report is that there are 2 types of liability :

- According to the personal injury law

- Administrative

Let's look at possible fines and their reasons in the table.

| Violation | Culprit | Responsibility | |

| In law | Administrative | ||

| Submitting a report later than the deadline | Legal entity or individual entrepreneur | 5% of the amount of accrued contributions for the last 3 months (but not less than 1000 rubles) | – |

| Executive | – | 300-500 rubles | |

| Supporting documents required by the fund have not been submitted | Legal entity or individual entrepreneur | 200 rubles for each document | – |

| Executive | – | 300-500 rubles | |

| The reporting is not compiled in the current form | Legal entity or individual entrepreneur | 200 rubles | – |

| Executive | – | 300-500 rubles | |

The fines are not large, but it will be a shame to receive one for such a simple report.

“Pilot” features of 4-FSS

From 01/01/2020, another group of regions joined the FSS pilot project: 3 republics (Sakha, Komi and Udmurtia), 5 regions (Tver, Saratov, Orenburg, Kemerovo and Kirov), as well as the Yamalo-Nenets Autonomous Okrug.

Filling out and submitting the 4-FSS for “pilots” has its own peculiarities (clause 2 of the FSS Order No. 114 dated March 28, 2017, clause 2, clause 3 of the Appendix to Order No. 114, clause 2 of the Procedure for filling out the 4-FSS). The calculations do not need to reflect information about benefits, since participants in the pilot project do not reduce insurance premiums for them.

If the employer is already participating in a pilot project at the beginning of the year, page 15 of Table 2 is not filled out (dashes are inserted), and Table 3 is not included in the calculation.

An employer who became a participant on July 1 of the current year fills out 4-FSS in a special way for 9 months and a year:

- on page 15 of table 2 in column 1 in the lines “for the last three months of the reporting period”, “1 month”, “2 month” and “3 month” you need to put dashes;

- Table 3 reflects data on expenses as of July 1 of the year in which the region joined the pilot project;

- the amounts of expenses of the current billing period that were not accepted for offset on July 1 of the year in which the region joined the pilot project should be reflected by reducing the previously reflected indicators on page 15 of Table 2 in columns 1 and 3. Also, these amounts should be reflected in the corresponding lines table 3.

How to fill out table No. 5 of the report

Table 5 concerns special labor assessments and mandatory medical examinations and contains information on indicators at the beginning of the year.

| Index | How to fill |

| Number of workplaces | This column contains information about the number of jobs in the company or entrepreneur. This is the total figure for all jobs |

| Conducting a special assessment | 3 columns are highlighted to indicate how many workplaces a special assessment was carried out. The total figure is indicated and broken down into classes 3 and 4 according to harmfulness. The number of such jobs is indicated at the beginning of the year and the figure does not change throughout the year. |

| Carrying out medical examinations | If there are harmful and dangerous conditions at the enterprise, then you need to indicate how many employees have undergone mandatory medical examinations |