The Order provides forms of 133 checklists, which cover a large list of topics related to labor legislation. Checklists check whether the company complies with the hiring procedure, whether it violates labor law standards for conducting a special assessment of working conditions, whether it follows the rules for establishing and paying wages, as well as a number of other details in the formalization of relations between employees and the employer.

The introduction of checklists into practice is associated with the changes that have occurred in GIT inspections since 2021, as well as with a risk-based approach. We wrote about this earlier in the article “How to survive a GIT check without stress?”

Rostrud promises that the use of checklists will not lead to the imposition of additional requirements on legal entities and individual entrepreneurs during inspections, since, as before their use, State Labor Inspectorate officials will check the compliance of the activities of companies and entrepreneurs with the mandatory requirements of labor legislation.

What are checklists, how will they help individual entrepreneurs and organizations, what is their purpose?

Previously, GIT inspections were carried out quite chaotically - there was no clear list of questions that inspectors could ask those being inspected. However, with the entry into force of the Decree of the Government of the Russian Federation “On Amendments...” dated 09/08/2017 No. 1080, everything changed. Now, when scheduled inspections are carried out, the State Tax Inspectorate is obliged to use the lists of Rostrud checklists. These are documents approved by Rostrud, which contain questions regarding the application of labor law provisions in organizations, indicating the norms of the law that must be complied with without fail.

Thus, a labor inspection checklist is a list of control questions that inspectors can ask the management of any company or individual entrepreneur. Such questions were introduced for the purpose of Rostrud’s activities to prevent offenses in the field of labor law.

In 2021, not only questions for labor law inspections were approved. Various questionnaires have been adopted - on fire supervision, on supervision in the field of labor legislation, on environmental legislation, etc. However, within the framework of the article we consider exclusively issues of labor legislation.

Checklists for labor activities include issues of compliance with labor legislation, in particular, regarding personnel issues and labor protection.

The introduction of lists is a positive thing. Even before the audit, organizations and individual entrepreneurs will know what questions the inspectors will ask and what specific requirements may be presented. In addition, by studying all the checklists, you can find out which legal regulations could potentially be violated and what you should pay attention to.

Based on the fact that labor legislation contains many disparate requirements that employers are required to comply with, the introduction of lists of questions made it possible to bring them together. Rostrud checklists can be downloaded for free from the link at the end of the article. In addition, they are contained on the Rostrud website.

If the State Tax Inspectorate discovers even one non-compliance with the requirements specified in the mandatory checklists, the organization may be held administratively liable under Art. 5.27, 5.27.1 Code of Administrative Offenses of the Russian Federation.

Grounds for supervisory activities

Functional responsibilities of a specialist (leading specialist) in labor protection

To understand the reasons for the State Labor Inspectorate’s interest in the work of an organization, one should remember what labor inspections are, namely: scheduled and unscheduled.

Reasons for planned control:

- 3 years have already passed since the registration of the organization or the announcement of the start of its activities.

- The previous scheduled control took place more than 3 years ago.

Reasons for an unscheduled visit by an inspector:

- Expiration of the deadline for fulfilling the order based on the results of the previous visit.

- Order of the prosecutor's office, government.

- Appeals to the State Labor Inspectorate regarding violations of labor legislation in the organization (delays in salary payments, wages below the minimum wage, non-compliance with safety regulations and other legal rights of workers).

- A complaint sent to the State Tax Inspectorate by a current or already dismissed employee of an organization regarding a violation of his rights.

How often do scheduled inspections occur?

They are carried out every 3 years, and their schedule for the current year is approved no later than December of the previous year. The schedule is published on the websites of Rostrud and the Prosecutor General's Office of the Russian Federation. This frequency answers the question for what period the labor inspectorate checks - for the last 3 years.

In addition, the moratorium does not apply to an organization that has committed gross violations or lost any license for three years.

Introduction of Rostrud checklists: from what date the rules in question begin to apply

The list of checklists for checking the State Labor Inspectorate was put into effect by Order of Rostrud dated November 10, 2021 No. 655. It should be noted that from the date of entry into force of the Order (February 4, 2021), questionnaires are used in the case of scheduled inspections in relation to not all companies and individual entrepreneurs, but only those that fall into the moderate risk category. To understand which category a particular company belongs to, you can submit a request to the territorial branch of Rostrud at the place of registration, or check the data on their official website.

As for other categories, inspections are carried out using checklists from July 1, 2021. The GIT checklists used from this date are approved by the same Order No. 655, which means that verification actions during scheduled audits from July 1, 2021 are carried out in relation to any companies and individual entrepreneurs, and not just those belonging to the moderate risk category.

It is important to understand that questionnaires can only be used during routine inspections. If inspection activities take place outside the plan, the requirements for organizations and individual entrepreneurs are the same, but inspection sheets are not officially applied. In any case, if all the requirements for those being inspected, specified in the entered questionnaires, are met, this is reason to believe that there are no grounds for bringing to administrative responsibility.

About the inspection plan

To find out if you are facing a scheduled inspection, you should visit the website of the regional labor inspectorate office . The plan for next year will appear in December. If you are not on the list for inspection according to the plan, then they can only come to you unscheduled. Such inspections are most often carried out based on complaints from employees or other authorities.

By the way, the fact that the company had an unscheduled inspection does not mean that it will not be included in the plan. After all, the reasons for such checks are different.

What is a risk-based approach

We have already mentioned that until July 1, 2021, only firms and individual entrepreneurs that belong to the moderate risk category are subject to inspection according to the checklists contained in the labor inspection checklists, and from July 1 - all others. Thus, an approach is applied that is based on the degree of risk (Part 1, Article 8.1 of the Federal Law “On the Protection of Rights...” dated December 26, 2008 No. 294). Let's figure out what it is.

The method is that inspectors use a risk grading system during inspection. This gradation depends on how serious the danger may be caused by non-compliance with mandatory requirements. It is the GIT that determines the danger category of organizations and individual entrepreneurs, using the rules approved by Government Decree No. 806 of August 17, 2016. The number of possible scheduled inspections also depends on the risk category.

In the field of labor legislation, the following gradation of risks is applied:

- High. For such inspectees, only one inspection is possible every 2 years.

- Significant. One inspection per 3 years is possible.

- Average. One inspection is possible every 5 years.

- Moderate. One inspection is possible every 6 years.

- Short. Scheduled inspections are not carried out at all.

Thus, it makes sense to check whether the company falls into the latter category. It is possible that there will be no checks based on checklists.

As already mentioned, you can send a request to Rostrud and find out which risk group the company or individual entrepreneur belongs to. The answer is given within 15 days. If the person being inspected is classified as high or significant risk, such data is published on the GIT website. Information is available starting July 1 of the year preceding the year of inspection.

It is possible to send an application to Rostrud to reduce the risk class, if there are grounds for this. It is being considered by Rostrud officials. The decision can be challenged, for example, in administrative proceedings (CAS RF).

Who assigns hazard classes and how to change them

From Resolution No. 875 it is clear who has the right to assign employers a high-risk category.

Only the chief state labor inspector of the Russian Federation and his deputies have the right to classify a company or individual entrepreneur as the highest danger class. Decisions on assignment to other categories (moderate, medium and significant risk) are made by the chief state labor inspectors of the constituent entities of the Russian Federation. To change the hazard class, a legal entity or individual entrepreneur has the right to submit an application. But only the official who made it can review the decision on the risk category.

The hazard class changes automatically:

- increases if the employer has a fatal accident;

- is reduced if checks do not reveal any violations.

Who is checked using check sheets?

From July 1, 2021, Rostrud, as a federal body, and GIT (territorial bodies) inspect any organizations. This means that the company can be checked regardless of what legal form it belongs to (LLC, PJSC, etc.). As for individual entrepreneurs, any entrepreneurs who have employees under their command are checked. Let us remind you that until July 2021, the law does not provide for the possibility of inspecting organizations and individual entrepreneurs that are classified in any categories other than the moderate risk category.

And of course, inspection using checklists can only be expected by those companies and those individual entrepreneurs that are included in the plan of inspection activities of the State Tax Inspectorate using checklists for 2021. They are not used during unscheduled inspections.

How checks happen

The law defines the sequence of actions of inspectors:

- Notifying the organization about the upcoming visit.

- Request for documents of interest to the GIT inspector with a possible subsequent visit of the inspector to the organization being inspected.

- Drawing up a report on the results.

- Issuing instructions based on the results.

Planned

The GIT inspector is obliged to notify the organization no later than 3 days before the start date of the scheduled inspection, which can be:

- Documentary - the inspector requests certified copies of the documents he is interested in, which must be provided to him within 10 working days after the request, and studies them at his workplace.

- Traveling - the inspector travels to the location of the organization and there gets acquainted with the documents related to the subject of inspection. He must present his identification and an order to conduct an inspection. The deadline for providing documents is not regulated, but the inspector has the right to demand immediate access to them. If there is a large volume of requested documents, you must notify the inspector in writing and request additional time to collect them.

Unscheduled

GIT inspectors do not have the right to demand:

- seizure of original documents;

- notarization of requested documents;

- documents not related to the subject of control;

- during an unscheduled inspection based on an employee’s complaint - documents that are not related to this employee. However, the powers of the labor inspectorate when checking a complaint of this kind allow you to request documents for the entire period of operation of the organization, and not, as in other cases, only for the last 3 years.

What areas of work activity are checked using checklists?

Scheduled inspections are not carried out randomly. By virtue of clause 8 of Regulation No. 875, when checking, those sheets that are related to its subject are used. In total, 107 checklists of Rostrud were adopted with a decoding of the requirements and the rules of law that regulate the obligation to comply with such requirements (can be downloaded from the link at the end of the article). However, this does not mean that inspectors have the right to use only one sheet during one inspection. The subject of verification can be formulated quite broadly. For example, if the subject is compliance with labor protection requirements, then sheets 20 to 107 can be used.

Only questions contained in a particular sheet/sheets can be asked. Otherwise, the inspector goes beyond the scope of the inspection, which is unacceptable. However, it should be understood that there are also checklists from the State Labor Inspectorate, which are related to general topics. For example, sheets numbered 1-4 (Appendices No. 1-4 to Order of Rostrud dated November 10, 2017 No. 655) provide for checking the correctness of the conclusion of employment contracts.

Have a question? We'll answer by phone! The call is free!

Moscow: +7 (499) 938-49-02

St. Petersburg: +7 (812) 467-39-58

Free call within Russia, ext. 453

Supervisory holidays extended, but with nuances

On January 05, 2019, the provisions of the Federal Law of December 25, 2018 No. 480-FZ came into force, which amend the Federal Law “On the protection of the rights of legal entities and individual entrepreneurs in the exercise of state control (supervision) and municipal control.” Officials spelled out in the document the specifics of conducting scheduled inspections of companies from 01/01/2019 to 12/31/2019. They retained the so-called supervisory holidays for employers who belong to small or medium-sized businesses: over the next 2 years, inspectors will not be able to include such economic agents in the inspection plan, but with certain nuances.

In particular, in addition to the exceptions that were in 2016-2018, inspections organized by supervisory authorities that have switched to risk-based control are also not prohibited. And since Rostrud applies this approach to inspections, GIT employees have the right to periodically monitor the activities of small companies and individual entrepreneurs. But all control should be carried out on the basis of checklists.

Our selection will help you understand what the essence of the risk-based approach is, and find out what risk category the employer belongs to and where to get the checklists.

Please note that an entrepreneur can find out about the planned visit of GIT inspectors in advance using the Inspection Plan posted on the GIT website.

If an employee complains about the employer or information about violations committed by him appears in the media, then inspectors from Rostrud will come with an unscheduled inspection. Reasons for an unplanned visit may be:

- information about payment of wages below the minimum wage;

- delay or partial payment of wages;

- violation of the law resulting in a threat to the health of workers;

- refusal to conduct a special assessment of working conditions;

- expiration of deadlines for fulfilling orders for previously identified violations;

- receipt of a request to conduct an inspection in connection with an order from the president or government, the availability of materials and (or) requests from the prosecutor’s office.

Labor inspectors must notify the employer of an unscheduled inspection at least 24 hours before it is carried out. At the same time, Rostrud notes that inspections can only be carried out by officials who are listed in the order of the head of the GIT on the control event. Along with such an order, the employer must also receive a list of documents that inspectors will need for control.

What list of checklists is accepted by the State Transport Inspectorate?

Questionnaires are published in accordance with specific topics. The total number of GIT checklists is 107. Here are some of them, as an example:

- issues of termination of an employment contract (sheet No. 4);

- salary issues (sheet No. 7);

- issues of conducting a special assessment of working conditions (SOUT) (sheet No. 21);

- training on occupational safety issues (sheet No. 28).

The full list of questions can be found by studying Order No. 655, and all documents can be downloaded from the link at the end of the article.

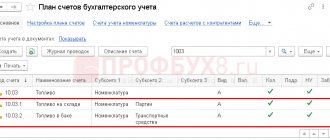

Test questions look like a table divided into several columns:

- the first of them contains item numbers;

- the second reflects the content of specific requirements;

- in the third - regulations governing the relevant obligation;

- in the fourth - answers to the question posed (yes, no, does not apply).

Let's give an example. The questionnaire, which is contained in Appendix No. 5 to Order No. 655, is intended to make it possible to check whether the working hours and recording of working hours are observed in the audited company or individual entrepreneur. An example question looks like this:

| № | Questions | Legal entity details | Answers on questions | ||

| Yes | No | Not applicable | |||

| 1 | Are working hours established? | Part 1 art. 100 Labor Code of the Russian Federation | |||

To be prepared for the test, you need to study the content of specific questions in advance and answer them. If everything is complied with, then there will be no grounds for prosecution.

Which claims of the GIT the court recognizes as unfounded?

So, the inspector has crossed the threshold of your office. Get ready to give him all the documents of interest (paragraph 3, part 1, article 357 of the Labor Code). The inspector has the right to request documents for previous years; there are no restrictions for this in the law (clause 3 of article 15 of Law No. 294-FZ). But you may not submit documents whose storage period has expired (List of standard management archival documents indicating storage periods, approved by Order of the Ministry of Culture dated August 25, 2010 No. 558).

First of all, prepare local regulations, employment contracts and staff in advance. They are requested at every inspection. Below you will receive advice on what to do when the State Tax Inspectorate is looking for redundant conditions and requires unnecessary documents from you.

Local acts. The inspector will check whether the company has PVTR, regulations on personal data of employees, instructions on labor protection, etc. Sometimes the State Labor Inspectorate asks for documents that the employer is not obliged to develop. For example, provisions on wages or indexation. Just explain that salary conditions are in another local act or collective agreement.

Employment contracts. Inspectors often find fault with the fact that in the clause on working conditions they did not indicate the details of the special assessment report or did not list harmful factors. At the same time, the law does not require this; it is enough to indicate the class and, if any, subclass of working conditions (paragraph 9, part 2, article 57 of the Labor Code).

Until recently, inspectors fined people for the fact that contracts with office workers did not include standards for the distribution of soap. GIT believed that working at a computer is associated with easily washable contaminants. The Ministry of Labor clarified that office workers do not need to be given detergents. Their work is not associated with contamination, even easily washed off (letters dated 08/30/2016 No. 15-2/OOG-3095, dated 05/06/2016 No. 15-2/OOG-1752). In addition, it is no longer necessary to specify the norms for issuing detergents in contracts with “pests”. It is enough to consolidate these norms in a local act and familiarize workers with it under signature (clause 9 of Appendix No. 2 to the order of the Ministry of Health and Social Development dated December 17, 2010 No. 1122n).

The inspector may point out that the contract did not list all types of compulsory social insurance. However, the types and conditions of insurance are not required to be listed; they are determined by law (paragraph 10, part 2, article 57 of the Labor Code, ruling of the St. Petersburg City Court dated June 16, 2011 No. 33-9102/2011). Therefore, in case of such a claim, refer to the Labor Code and judicial practice.

Pay slips. One of the frequent complaints of the State Tax Inspectorate is that pay slips are not issued to employees against signature. However, there is no such requirement in the law (letter of Rostrud dated March 18, 2010 No. 739-6-1). The courts agree that pay slips can be sent to employees by email or issued in another way (appeal ruling of the Supreme Court of the Karachay-Cherkess Republic dated April 29, 2013 in case No. 33-204/2013). The main thing is to prove that the sheets were actually handed to the employee.

The inspector may require evidence that payslips are issued with each salary payment. At the same time, there is a position of government agencies that the slip can be issued once a month, when paying the second part of the salary (letter from the Ministry of Labor dated 05.24.2018 No. 14-1/OOG-4375, Rostrud dated 12.24.2007 No. 5277-6-1). Tell the inspector about this, and if he insists, appeal his actions to a higher official of the State Inspectorate.

Staffing schedule. The inspector will compare salaries for similar positions. It is better to avoid “salary discrepancies”; the State Tax Inspectorate often fines for it or demands that the employee be paid additionally up to the maximum salary for the position. But if you are not ready to give up the salary range, challenge the inspector’s actions. The courts recognize the “salary gap” as legal if the employer can justify it (decision of the Moscow City Court dated January 28, 2014 in case No. 33-5568/2014).

| If you think that the inspector made a mistake when filling out the checklists, reflect the comments in the inspection report The inspection report form, as well as the checklists, do not contain a section in which the employer or his representative can indicate that he does not agree with the identified violations and their wording. This is the difference between an act and a protocol, where the employer’s explanations are a mandatory part. But this does not prevent the company representative from making notes on inspection reports, and the inspector cannot refuse this (clause 3, part 1, article 21 of Law No. 294-FZ). Thus, if you do not agree with the checklists completed based on the results of a scheduled inspection, then state your comments in the inspection report, since the checklists are an appendix to it. |

List of GIT checklists on personnel issues

As already mentioned, a total of 107 checklists were approved. Based on their content, they can be divided into questionnaires on personnel topics and on labor protection. There is no official division.

Personnel issues are disclosed in checklists No. 1-19.

Here is a list of them:

- Checking the correctness of the hiring process.

- Checking the content of contracts concluded with employees.

- Studying the correctness of changes in employment contracts.

- Checking the procedure for terminating employment contracts.

- Checking the correctness of establishing the work schedule and recording labor time.

- Study of compliance with leave issues.

- Checking the correctness of calculation and payment of wages.

- Checking the regulation of labor activities of persons under 18 years of age.

- Studying compliance with legislation when hiring foreigners.

- Checking the application of the provisions of the Labor Code of the Russian Federation when employing disabled people.

- Studying the correct application of labor law standards in the employment of women.

- Checking compliance with legislation regarding workers in the Far North and similar areas.

- Study of compliance with legislation in the field of establishing working hours.

- Checking the correct organization of dismissal and layoff procedures.

- Studying the correctness of granting basic leaves.

- Studying the correctness of providing additional leave and rest time.

- Checking salary deductions.

- Studying compliance with legislation in the field of labor regulation of employees who are engaged in underground work and work in hazardous conditions.

- Checking the correctness of engagement in overtime work and work outside working hours, for example on weekends.

Examples of questions contained in HR checklists

In order to have an idea of what questions may be contained in the checklists, here are some of them. The first check block (Appendix No. 1 to Order No. 655) contains the following questions:

- Are the conditions on the form of the employment contract met?

- Are the requirements for medical examinations observed for workers engaged in work with harmful and dangerous conditions?

- Did newly hired employees receive copies of employment contracts?

- Were civil contracts concluded instead of employment agreements?

- Are the requirements for drawing up employment orders met?

- Are employees familiar with local regulations and collective agreements?

What to do after the check is completed

Based on the results of the inspection, the inspector will draw up several documents and, possibly, hold the employer accountable. Let's consider when it makes sense to appeal the actions of the State Tax Inspectorate and how to do it.

What documents will the inspector draw up based on the results of the inspection? Based on the results of the inspection, the inspector will draw up a report in two copies and indicate in it all the circumstances that he studied. The standard form of the act was approved by the Ministry of Economic Development by order No. 141 dated April 30, 2009. The GIT will attach a completed checklist to the act (Part 11.5 of Article 9 of Law No. 294-FZ).

The inspector hands over a copy of the report with a copy of the checklist to the employer's representative against signature. If the completed checklist is not attached to the report or the company does not agree with the inspector’s conclusions, then within 15 days it can send objections to the State Tax Inspectorate (Part 12 of Article 16 of Law No. 294-FZ).

If the inspector has identified violations of labor legislation, then in addition to the report, he will draw up an order and indicate the time frame to eliminate them (clause 1, part 1, article 17 of Law No. 294-FZ). You can appeal the order within 15 days to a higher-ranking head of the State Labor Inspectorate or the Chief State Labor Inspector, or within 10 days to the court (clause 12 of article 16 of Law No. 294-FZ, part 2 of article 357 of the Labor Code).

When the law provides for administrative liability for violations and the one-year statute of limitations has not expired, the inspector will draw up a protocol on the offense (clause 2, part 1, article 17 of Law No. 294-FZ, art. 4.5, clause 1, part 1, article 28.1 of the Administrative Code) . The GIT transmits a copy of the protocol to the company representative. Based on the protocol, the inspector opens a case of an administrative offense, considers it and makes a decision (Article 29.10 of the Administrative Code). Based on the results of the audit, the company may be warned, fined, or, in rare cases, suspended. The director faces separate penalties.

When can you cancel the fine? If you think that you have not made serious mistakes, appeal the decision in court. Insist on the insignificance of the offense. The main thing is to prove that it did not entail significant consequences (Article 2.9 of the Administrative Code, paragraph 21 of the Resolution of the Plenum of the Supreme Court dated March 24, 2005 No. 5). For example, the institution was able to prove that it did not allocate funds for labor protection because it did not receive budget funding (resolution of the Smolensk Regional Court dated 02/09/2015 No. 4A-31/2015). In another case, the State Labor Inspectorate fined a personnel officer because the employment contract did not contain the employee’s signature confirming receipt of his copy. The court dismissed the case due to its insignificance (decision of the Oktyabrsky District Court of Penza dated December 16, 2016 in case No. 12-752/2016).

A company cannot be punished if the statute of limitations has expired. For most personnel violations, a one-year period applies (Part 1, Article 4.5 of the Administrative Code). Sometimes it is not easy to correctly calculate the statute of limitations, and the inspector gets confused. For example, he considers the violation to be ongoing, although it is not. So, if an employee’s salary was accrued, but not paid on time, then the violation will be ongoing. And when the employer has not paid any amount upon final payment, the statute of limitations will be one year from the date of dismissal (clause 56 of the resolution of the Plenum of the Supreme Court dated March 17, 2004 No. 2). After this period, you cannot punish for a violation. In addition, in this case, one can refer to the fact that the State Labor Inspectorate does not have the right to consider labor disputes (Article 382 of the Labor Code).

List of occupational safety checklists

A huge number of labor inspection checklists are devoted to labor protection (Appendices No. 20-107 of Order No. 655). Their presence greatly simplifies the procedure for preparing for inspections of organizations and individual entrepreneurs, since the questionnaires contain an exhaustive list of requirements in the field of labor protection that are presented to those being inspected.

The GIT labor safety checklists were put into effect in 2018, like others. It is important to note that not all of them are applicable in every organization and every individual entrepreneur. Most of the questions touch on the topic of labor protection in organizations of a certain focus, for example, in companies involved in construction, work at height, etc. Of course, for companies that are not engaged in such types of activities, there is no need to comply with the requirements specified in the above checklists in the field of labor protection.

As an example, we list several questionnaires related to labor protection in organizations. These include sheets containing questions related to the verification of labor protection requirements:

- When performing work at height.

- When carrying out activities related to the maintenance of electrical installations.

- When performing agricultural work.

- Conducting medical examinations.

- Based on the availability of personal protective equipment.

- To create a labor protection system.

- On the development and approval of labor protection instructions.

- Compliance with regulations that contain data on labor protection in accordance with the specifics of the company’s activities.

To help all employers - the Electronic Inspector service

Rostrud invites all employers to check themselves using the “Electronic Inspector” online service. To do this you need:

- go to the “Take a self-test” section on the official portal of Rostrud;

- select the subject of inspection from those proposed;

- prepare a list of documents defined by the service;

- enter the real or conventional name of the enterprise;

- answer the questions on the checklist.

As a result of such a check, the employer will receive:

- A conclusion indicating violations on the selected topic (or the absence of any will be reported).

- Assistance in eliminating violations - specific instructions for action, samples and templates of documents will be offered.

The service is currently operating in pilot mode. In the future, it is planned that its use will be mandatory for employers. An enterprise that successfully passes the inspection will receive a declaration confirming compliance with labor laws. It will need to be signed and sent to the State Tax Inspectorate. It is intended to exempt such employers from on-site scheduled inspections.

If violations are detected, they will need to be corrected and checked again. The employer does not face any sanctions at this stage.

Examples of questions contained in occupational safety checklists

As an example, let us cite the sheet approved in Appendix No. 49 to Order No. 655. It contains issues of labor protection in organizations that carry out repair work in buildings and structures.

Examples of questions:

- Do employees have a certificate confirming their training in labor safety requirements?

- Is there a list of positions that must undergo occupational safety training?

- Are employees familiar with work safety measures?

- Has targeted training been provided?

- Is there a record of the issuance of personal protective equipment?

- Are medical examinations carried out?

This is only a small part of the questions contained in the State Labor Safety Inspectorate checklists. To familiarize yourself with everything, it is advisable to refer to Order No. 655, since this document is voluminous and contains not only questions, but also references to regulations containing all the requirements. You can download it from the link at the end of the article.

Is there a list of answers to Rostrud checklists?

If there are questions, then there must be answers. However, in practice they are not necessary. The entire system of questionnaires is constructed correctly - for each question there is a list of regulations that contain answers to them. In addition, often the question itself contains the answer. For ease of understanding, we will give examples.

Appendix No. 2 to Order No. 655 contains questions regarding verification of compliance with labor law requirements by employers when concluding employment contracts. The first question is the following: “The employment contract states: Full name. employee and employer name?” It immediately becomes clear that the inspectors require full name. employee and employer in employment contracts, respectively, in order to pass the verification, it is necessary to clarify in advance whether this data is indicated.

Another example of a question from the same Appendix No. 2: “Fixed-term employment contracts are concluded for a period of up to 5 years.” Fixed-term employment agreements are concluded for no more than 5 years, as specified in Art. 58 of the Labor Code of the Russian Federation, accordingly, the question already contains an answer. It is enough to check whether there are fixed-term employment contracts in the organization and make sure that their validity period does not exceed 5 years.

Let's summarize. Since the beginning of 2021, GIT checklists have been used during scheduled inspections. You can download them from the link below (for free). In addition, the official website of the Ministry of Labor of the Russian Federation also contains a list of checklists available for download. Rostrud checklists are useful for employers who now know exactly what questions inspectors can ask them.

Filling rules

In the table, regarding control questions, in column 4, the inspector notes the employer’s compliance with the legal requirements, which are specified in the details of the regulatory act establishing the employer’s obligation.

If the legal requirement is met, the appropriate mark is placed in column 4. If a violation is detected, column 4 is not filled in, and the corresponding value is entered in column 5.

The “Does not apply” column, which Rostrud checklists contain, is filled out in special cases - only if the item is not related to the employer. For example, checklist No. 1 contains a list of questions regarding the conclusion of employment contracts with athletes (since athletes are subject to separate labor law standards and a separate procedure for carrying out mandatory labor protection measures). Accordingly, if a company is being evaluated that does not have athletes on staff, then “Not applicable” is indicated in column 6.