Any business activity involves expenses. You have to spend money on diverse processes and purchases: those needed for the production of products, equipment maintenance, the purchase of raw materials, packaging, and transportation. And also on management processes, not to mention wages. This multifactorial nature of costs indicates the need for their classification and separate accounting.

Let’s understand the concept of “overhead costs”, clarify which costs can be attributed to them and how to recognize them in financial accounting.

How are overhead expenses different from core expenses?

What is overhead

Not all costs in production go directly into the product and can be directly planned and taken into account in its cost. Nevertheless, the funds spent turn out to be absolutely necessary for the manufacture of products, their sale, promotion on the market, as well as the management of the organization itself.

The most accurate definition of overhead would be “everything else.” This type of costs is not highlighted in a separate article in the Tax Code of the Russian Federation; naturally, their structure is not spelled out there either. In accounting, it is also impossible to clearly differentiate them.

NOTE! The law establishes a list of overhead costs only in the construction and medical industries. All other enterprises must determine overhead costs themselves, fixing this in their accounting policies.

overhead costs, accepted in business, implies expenses that cannot be attributed directly to technological production processes, accompanying the production process, but not included in the cost of work and raw materials. Another name for overhead costs is indirect costs . They are indicated when planning and drawing up estimates for both the company as a whole and individual structural divisions.

How to calculate the cost of production taking into account overhead costs ?

Two types of costs in financial statements

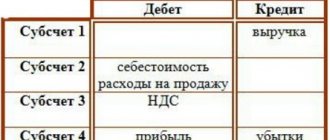

The general global accounting rules are currently such that the division of “costs for a product - costs for a period” is recognized as mandatory. PBU 10/99 in the river 2 establishes the concept of expenses for ordinary activities, determining the cost of goods sold, products, works, services based on expenses for ordinary activities.

In particular, paragraph 9 establishes the rule: “Commercial and administrative expenses may be recognized in the cost of sold products, goods, works, services in full in the reporting year of their recognition as expenses for ordinary activities.” Thus, the status of these expenses as period costs is confirmed, and in the period of occurrence they can be written off.

We said earlier that the costs of a product at the time the product is sold are reflected as expenses in the cost of goods sold. The income statement of financial statements contains the line “cost of sales”. It is possible to highlight other elements of the total cost of production - expenses by period. Note that in management accounting, other than accounting rules, division by type of costs for products and for the period may be used.

Why consider overhead costs?

The most obvious goal is planning future profits, which are affected by all the costs incurred by the entrepreneur. But in terms of overhead costs, this poses certain difficulties. If potential direct costs can be fairly accurately calculated for specific types of products, then it is quite difficult to determine how many indirect costs will result and how they will be distributed when, for example, expanding production or signing a certain contract.

IMPORTANT! To adequately determine the cost of a product, it is necessary to take into account and distribute overhead costs in proportion to direct expenses - calculate production costs .

What are the differences between the categories “cost” and “cost”?

First of all, it is important to determine the commonality and differences between the categories “cost” and “cost”. The monetary value of the costs that are incurred by an economic entity in the course of production activities represents expenses. The importance of costs is that they are the lower limit of price and profitability. The level of enterprise expenses is one of the main factors that influence production volumes, product sales and the profitability of the enterprise. The term “cost” is used as a resulting indicator of the current costs of all types of resources: materials, fuel, energy, labor, used directly in the process of producing products and performing work, as well as to maintain and improve production conditions and its improvement. The composition of costs included in the cost of production is determined by the state standard, and calculation methods are determined by the enterprises themselves.

What is included in overhead costs

Indirect costs can be roughly divided into 4 main groups:

- Management costs:

- his salary;

- money spent on training, certification and advanced training of management.

- Contents: purchase of computers, office supplies, expenses for office needs, including communication services.

- Expenses associated with the process of organizing production:

- maintenance repairs of structures, buildings, premises, equipment belonging to the organization;

- costs of transport owned by the company;

- payment of rent for warehouse premises and/or office;

- waste of money due to downtime, defects, etc.;

- money that needs to be spent on maintaining fixed assets.

- Personnel costs:

- social tax contributions;

- payments to social security and other funds;

- equipment of household premises, canteens, showers, etc.

- Non-production costs:

- advertising expenses;

- payment for consultations and examinations;

- payment of utility bills, etc.

Management accounting and problems of cost classification

Kerimov V.E.

,

Minina E.V.

Published in the issue: Management in Russia and abroad No. 1 / 2002

In economic theory, an approach has been established according to which any commercial enterprise strives to make decisions that would ensure it receives the maximum possible profit. Profit, as a rule, depends mainly on the price of the product and the costs of its production and sale.

The price of products on the market is a consequence of the interaction of supply and demand. Under the influence of the laws of market pricing in conditions of free competition, the price of products cannot be higher or lower at the request of the manufacturer or buyer; it is automatically equalized. Another thing is the costs that form the cost of production. They can increase or decrease depending on the volume of consumed labor and material resources, the level of technology, the organization of production and other factors. Consequently, the manufacturer has many cost-cutting levers that it can use with skillful management.

In economic literature and regulatory documents, terms such as “costs”, “expenses”, “expenses” are often used. An incorrect definition of these concepts, in our opinion, can distort their economic meaning.

A careful familiarization with the essence of the terms listed above allows us to conclude that basically all these concepts mean the same thing - the costs of the enterprise associated with the performance of certain operations. Thus, in the famous dictionary of the Russian language S.I. Ozhegova [2], the following definitions are given to denote these terms: “... costs - an amount spent on something, costs” (p. 208); “...cost is what is spent, spent” (p. 193); “... expense - 1) cost, expenses; 2) consumption, spending something for a specific purpose” (p.580).

In the article, without going into theoretical discussions, we will use the following definitions to designate these categories.

The term “costs” is usually used in economic theory. These are the total sacrifices of the enterprise associated with the performance of certain operations. They include both explicit (accounting, settlement) and implied (alternative) costs.

Explicit (calculated) costs are actual costs expressed in monetary terms, caused by the acquisition and expenditure of various types of economic resources in the process of production and circulation of products, goods or services.

Alternative (opportunity) costs mean the lost profit of an enterprise that it would have received if it had chosen to produce an alternative product, at an alternative price, on an alternative market, etc.

By costs we will understand the explicit (actual, estimated) costs of an enterprise, and by expenses a decrease in the enterprise’s funds or an increase in its debt obligations in the process of economic activity. Expenses mean the fact of using raw materials, supplies, and services. Only at the moment of sale does the enterprise recognize its income and the associated part of the costs - expenses.

Standard 18 IFRS “Revenue”, as well as domestic PBU 9/99 “Income of the organization” and 10/99 “Expenses of the organization” guide us towards this understanding of the above terms. According to these documents, expenses typically take the form of an outflow or reduction of an asset. Expenses are recognized in the income statement based on the direct relationship between the costs incurred and the revenues from certain items of income. This approach is called matching expenses and income. Based on this, in accounting, all income must be correlated with the costs of obtaining them, called expenses. From the point of view of accounting technology, this means that costs should be accumulated in the accounts “Materials”, “Depreciation”, “Payroll calculations”, etc., then in the accounts “Main production”, “Finished products” and not be written off to sales accounts until the products, goods, services with which they are associated are sold, since only at the time of sale will the organization recognize its expenses.

Among the qualitative indicators of the enterprise's activity, an important place is occupied by such an indicator as the cost of production. It, as a synthetic indicator, reflects all aspects of the production and financial and economic activities of the organization. The amount of profit and the level of profitability depend on the level of production costs. The more economically an organization uses labor, material and financial resources in the manufacture of products, performance of work and provision of services, the greater the efficiency of the production process, the greater the profit.

Currently, the composition of costs included in the cost of production is regulated by relevant regulations, primarily the provision “On the composition of costs for the production and sale of products (work, services), included in the cost of production (work, services), and on the procedure for the formation of financial results taken into account when taxing profits” (approved by Decree of the Government of the Russian Federation on August 5, 1992 No. 552 with subsequent amendments and additions).

Even from a simple listing of the component costs that form the cost of products (works, services), it is clear that they are not the same not only in their composition, but also in their significance in the manufacture of the product, performance of work and services. Some costs are directly related to the production of products (costs of raw materials, materials, wages of workers, etc.), others - with the management and maintenance of production (costs of maintaining the management apparatus, providing the production process with the necessary resources, maintaining fixed assets in working order and etc.), and still others, not having a direct relationship to production, are nevertheless included in production costs according to current legislation (contributions for the reproduction of the mineral resource base, social needs of the population, etc.). In addition, part of the costs is directly included in the cost of specific types of finished products, and the other part, in connection with the production of several types of products, is indirectly included. Therefore, for the effective organization of management accounting, it is necessary to apply an economically sound classification of costs according to certain criteria. This will help not only to better plan and take into account costs, but also to analyze them more accurately, as well as identify certain relationships between individual types of costs and calculate the degree of their influence on the level of cost and profitability of production.

In management accounting, the purpose of any cost classification is to assist the manager in making correct, informed decisions, since the manager, when making decisions, must know what costs and benefits they will entail. Therefore, the essence of the cost classification process is to highlight that part of the costs that the manager can influence.

The practice of organizing management accounting in economically developed countries provides for different options for classifying costs depending on the target setting and areas of cost accounting. Consumers of internal information determine the direction of accounting that they require to provide information on the problem under study.

In this regard, the classification of costs proposed by K. Drury deserves attention. In his opinion, first of all, accounting accumulates information about three categories of costs: costs of materials, labor and overhead costs. Then the generalized costs are distributed according to the areas of accounting: 1) for calculating and assessing the cost of manufactured products; 2) for planning and making management decisions and 3) for implementing the process of control and regulation. In addition, in each of the three areas listed above, in turn, further detailing of costs occurs depending on management goals [1, pp. 31-32].

Without in any way detracting from the merits of the proposed classification of costs, we believe that narrowing the capabilities of management accounting within the framework of only these areas does not entirely meet the requirements of the present time. As you know, management accounting is designed to achieve the intended goal through its functions. Each function has its own purpose, purpose, objectives, as well as methods, techniques and ways to achieve them. In this regard, we propose to expand the areas of cost classification, subordinating them to the capabilities of each management accounting function. It must be borne in mind that the same classification criterion in different directions can give different results and vice versa.

In general, the classification of enterprise costs in relation to management accounting can be presented in the following form (Table 1).

Table 1

Classification of costs in management accounting

| Classification characteristics taking into account management functions | Types of costs |

| 1. Management decision-making process | Explicit and alternative; relevant and irrelevant; effective and ineffective |

| 2. Forecasting process | Short term and long term |

| 3. Planning process | Planned and unplanned |

| 4. Rationing process | Standards, norms and regulations and deviations from them |

| 5. Organization process | By places and areas of origin; activity functions and responsibility centers |

| 6. Accounting process | Single-element and complex; according to calculation items and economic elements; constants and variables; main and invoices; direct and indirect; current and one-time |

| 7. Control process | Controlled and uncontrolled |

| 8. Regulatory process | Adjustable and non-adjustable |

| 9. Incentive process | Mandatory and incentive |

| 10. Analysis process | Actual; forecast, planning; estimates; standard; general and structural; full and partial |

An important point in management activities is the decision-making process, during which the tactics and strategy for the development of the enterprise are determined.

For these purposes, the costs of an enterprise are divided into explicit and alternative, relevant and irrelevant, effective and ineffective. For making management decisions, it is important to divide them into explicit and implicit (alternative)

.

Explicit

- These are the estimated costs that an enterprise must bear when carrying out production and commercial activities.

The costs caused by the refusal of one product in favor of another are called alternative (imputed) costs.

. They represent lost profits when choosing one action precludes the occurrence of another action. Opportunity costs arise when resources are limited. If resources are unlimited, opportunity costs are zero. Opportunity costs are sometimes called incremental costs.

Depending on the specifics of the decisions made, costs are divided into relevant

and

irrelevant

.

Relevant

(i.e. significant, significant) costs can only be considered those costs that depend on the management decision under consideration. In particular, past costs cannot be relevant because they can no longer be influenced. At the same time, opportunity costs (lost profits) are relevant for making management decisions.

The results of decisions made can be significantly influenced by dividing costs into effective

and

ineffective

.

Effective

– these are productive costs, as a result of which income is received from the sale of those types of products for the production of which these costs were incurred.

Ineffective

are costs of an unproductive nature, as a result of which no income will be generated, since the product will not be produced. Ineffective costs are losses in production. These include losses from defects, downtime, shortages and damage to inventory items, etc. The obligation to highlight ineffective costs is interpreted in order to prevent losses from penetrating into planning and rationing.

Any enterprise seeking to maximize its profits must organize its production in such a way that the cost per unit of output is minimal. This means that the decisions made should be focused on the task of minimizing costs. In fulfilling this task, important importance is attached to the forecasting process, during which the costs of the enterprise are considered in the short and long term.

In the short term

individual factors of production do not change: they are called

constant

(fixed) factors.

These usually include resources such as industrial buildings, machines, and equipment. However, this could also be land, the services of managers and qualified personnel. Economic resources that change during the production process are considered variable

factors.

In the medium term

, all input factors of production may change, but the basic technologies remain unchanged.

Over the long term,

underlying technologies may also change.

Management decisions cannot be implemented unless they have a direct connection with the planning process, during which the expected costs associated with the implementation of production and commercial activities are considered from the point of view of the possibilities of their coverage by the plan. For these purposes, enterprise costs are divided into planned and unplanned.

To the planned

include productive expenses of the enterprise, caused by its economic activities and provided for by the production cost estimate. In accordance with norms, regulations, limits and estimates, they are included in the planned cost of production.

Unplanned

– these are unproductive expenses that are not inevitable and do not arise from the normal conditions of the enterprise’s economic activity. These costs are considered direct losses and therefore are not included in the production cost estimate. They are reflected only in the actual cost of marketable products and in the corresponding accounts in accounting. These include losses from defects, downtime, etc. Their separate accounting facilitates the implementation of measures aimed at their prevention.

In management accounting, it is important to classify costs depending on their relationship to the norms, regulations, limits and standards

.

According to this criterion, all costs included in the cost of production are grouped according to established standards

in force at the beginning of the current month, and

according to deviations from current standards

that arose during the production process. This division of costs underlies regulatory accounting and is the most important means of current operational control over the level of production costs.

The process of enterprise management is impossible without its clear organization

. It forms the basis of daily management activities and without it, neither plans nor programs usually work. In the process of organization, management structures, places and areas of costs, as well as persons responsible for their implementation and behavior are formed.

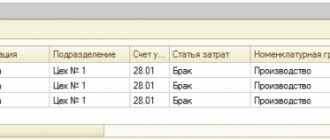

By place of origin

costs are grouped and taken into account by production, workshops, sections, departments, teams and other structural divisions of the enterprise, i.e. by responsibility centers. This grouping of costs allows you to organize internal cost accounting and determine the production cost of products. Accounting by responsibility centers “ties” cost accounting to the organizational structure of the enterprise. This grouping of costs directly depends on the current organizational structure.

Closely related to the above classification is the grouping of costs depending on the areas and functions of the enterprise.

.

Based on this criterion, costs are divided into supply and procurement

,

technological, commercial and sales

and

organizational and managerial

.

This grouping of costs makes it possible to organize functional accounting, in which costs are first collected by areas and functions of the enterprise, and only then by costing objects.

Functional cost accounting helps to strengthen intra-business accounting and strengthen the relationship and interdependence between cost centers, and ensures more accurate provision of information about costs incurred. This helps managers make joint informed decisions about the type, composition, price, ways of selling products and helps improve the efficiency of the enterprise’s production and commercial activities.

All measures taken aimed at carrying out management activities can be nullified if the enterprise does not have an effective accounting system.

. This area bears the main responsibility for information support for the processes of making and implementing the necessary management decisions. To implement accounting procedures, enterprise costs are grouped by composition, economic content, role in the technological process of manufacturing products, relation to production volume, method and time of inclusion in the cost of production, etc.

By composition

costs are divided into

single-element

and

complex

.

Single element

are called costs consisting of one element - materials, wages, depreciation, etc. These costs, regardless of their place of origin and intended purpose, are not divided into various components.

Comprehensive

are called costs consisting of several elements, for example, general production and general business expenses, which include wages of the relevant personnel, depreciation of buildings and other single-element costs.

By economic content

costs are classified according to

costing items

and

economic elements

.

Economic element

It is customary to call the primary homogeneous type of costs for the production and sale of products, which at the enterprise level cannot be decomposed into its component parts.

The regulation on the composition of costs included in the cost of production establishes a single list of economically homogeneous costs for all enterprises:

- material costs;

- labor costs;

- contributions for social needs;

- depreciation;

- other costs.

An element-by-element grouping of costs shows how much of certain types of costs were produced throughout the enterprise as a whole over a certain period of time, regardless of where they arose and for the production of which specific product they were used.

Grouping costs by economic elements is the object of financial accounting and is used in the preparation of annual financial statements in the form of an appendix to the balance sheet (Form No. 5). This grouping makes it possible to establish the need for fixed and working capital, determining the wage fund, etc.

However, the classification of costs by economic elements does not allow calculating the cost of individual types of products or establishing the amount of costs of specific structural divisions of the enterprise. For example, electricity at enterprises can be used both in the technological process of product production and for lighting the enterprise’s office, workshop premises, etc. In turn, in the technological process, electricity can be spent on the production of various products in different quantities: more for one product, less for another. To solve these problems, a classification of costs by costing items is used.

Calculation item

It is customary to call a certain type of cost that forms the cost of both individual types and all products as a whole.

Grouping costs by costing items allows you to determine the purpose of expenses and their role, organize control over expenses, identify qualitative indicators of economic activity of both the enterprise as a whole and its individual divisions, and establish in which areas it is necessary to search for ways to reduce production costs. On the basis of this grouping, analytical accounting of production costs is built, and planned and actual cost calculations of individual types of products are compiled.

in relation to production volume is important in choosing an accounting and costing system

.

Based on this criterion, costs are divided into fixed

and

variable

.

Variables

are called costs, the value of which changes with changes in production volume. These include the consumption of raw materials, fuel and energy for technological purposes, wages of production workers, etc.

To permanent

include costs, the value of which does not change or changes slightly with changes in production volume. These include general business expenses, etc.

Some costs are called mixed

, since they have both variable and constant components.

These are sometimes called semi-variable

and

semi-fixed

costs. All direct costs are variable costs, and general production, general and commercial expenses contain both variable and fixed cost components. For example, a monthly telephone fee includes a constant amount of the subscription fee and a variable part, which depends on the number and duration of long-distance and international telephone calls. Therefore, when accounting for costs, they must be clearly distinguished between fixed and variable costs.

The division of costs into fixed and variable is of great importance for planning, accounting and analysis of product costs. Fixed costs, while remaining relatively unchanged in absolute value, with production growth become an important factor in reducing production costs, since their value decreases per unit of production. Variable costs increase in direct proportion to the growth of production, but calculated per unit of production they represent a constant value. Savings on these costs can be achieved through the implementation of organizational and technical measures that ensure their reduction per unit of output. In addition, this grouping of costs can be used in analyzing and forecasting break-even production and, ultimately, in choosing the economic policy of an enterprise.

By method of inclusion in the cost of production

Enterprise costs are divided into

direct

and

indirect

.

Direct

are the costs of producing a specific type of product. Therefore, they can be attributed to calculation objects at the time of their commission or accrual directly on the basis of data from primary documents. These include: costs of raw materials, materials, wages of production workers, etc.

Indirect

expenses are associated with the production of several types of products, for example, costs of management and maintenance of production (overheads).

Indirect costs are first collected in the appropriate collection and distribution accounts, and then included in the cost of specific products using special distribution calculations. The choice of distribution base is determined by the characteristics of the organization and production technology and is established by industry instructions for planning, accounting and calculating product costs.

The division of costs into direct and indirect is conditional. Thus, in mining industries, where, as a rule, one type of product is extracted, the costs are direct. In complex industries, in which several types of products are made from the same types of raw materials, the main costs are indirect. Expanding the share of direct costs contributes to a more accurate determination of product costs.

By role in the technological process of product manufacturing and intended purpose

Enterprise costs are divided into

basic and overhead

.

Main

are costs directly related to the technological process of manufacturing products. These include costs included in the workshop production cost of products (the cost of raw materials, materials and semi-finished products that are materially included in the product; the cost of fuel and energy spent for technological purposes; the cost of paying production workers and contributions to social needs; operating costs production machines and equipment, etc.).

Invoices

expenses arise in connection with the organization, maintenance of production, sales of products and management. They consist of comprehensive general and selling expenses. Their value depends on the organization of production and commercial activities, the business policy of the administration, the duration of the reporting period and other factors.

The division of costs into basic and overhead is based on the fact that only production costs should be included in the cost of production. They, as necessary, form the production cost of the product and are used to calculate the cost per unit of production. Overhead costs are used to ensure the process of selling products and the functioning of the enterprise as an economic unit, and therefore should be written off as a decrease in profit from sales of products.

In international practice, the main costs are in the form of production costs, and overhead costs are periodic costs. Such a grouping is still rare in domestic accounting practice. Meanwhile, it has long been widely used in countries with developed market economies that use the Direct-Cost accounting system. In this case, the resulting accounting information more adequately reflects the process of market pricing and allows for a comprehensive analysis and planning of the relationship between production volumes, prices and production costs.

Of great importance in management accounting is the grouping of costs depending on the time of their occurrence and attribution to the cost of production

.

According to this criterion, costs are divided into current, future reporting period and upcoming

.

Current

include the costs of production and sales of products for a given period.

They have generated income in the present and have lost the ability to generate income in the future. Expenses of the future period

are expenses incurred in the current reporting period, but subject to inclusion in the cost of products that will be produced in subsequent reporting periods (for example, expenses for the development of commissioned workshops, production facilities, for the preparation and development of new types of products at existing enterprises ).

Such expenses should generate income in the future. Forthcoming includes

costs that have not yet been incurred in a given reporting period, but in order to correctly reflect the actual cost, they are subject to inclusion in the production costs for a given reporting period in a planned amount (expenses for paying workers' vacations, paying a one-time remuneration for long service and other costs that have periodic nature).

A control system is important in cost management

, which ensures the completeness and correctness of actions in the future aimed at reducing costs and increasing production efficiency.

To provide a cost control system, they are grouped into controlled

and

uncontrollable

.

Controlled

- these are costs that can be controlled by the subjects of management.

Uncontrollable

costs do not depend on the activities of management subjects. For example, revaluation of fixed assets, which entailed an increase in depreciation amounts, changes in prices for fuel and energy resources, etc.

When building a cost control system, it is necessary to determine:

- system of controlled indicators, composition and level of detail;

- reporting deadlines;

- distribution of responsibility for the completeness, timeliness and reliability of information contained in cost reports, that is, “tie” the control system to responsibility centers in the enterprise.

In order for the cost control system at an enterprise to be effective, it is necessary to first identify the centers of responsibility where costs are generated, classify costs, and then use a cost management accounting system.

As a result, the head of the enterprise will have the opportunity to timely identify bottlenecks in planning, formation of costs and make appropriate management decisions. The process of cost management at an enterprise includes the regulatory

their level.

For these purposes, costs are divided into regulated

and

unregulated

.

According to the degree of adjustability

costs are divided into fully, partially and weakly regulated.

Fully adjustable

costs arise primarily in the areas of production and distribution.

These are costs recorded by responsibility centers and their value depends on the degree of regulation on the part of the manager. Partially controlled

costs occur primarily in R&D (research and development), marketing, and customer service.

Weakly

regulated (

specified

) costs arise in all functional areas.

The degree of cost control depends on the specifics of a particular enterprise: the technology used; organizational structure; corporate culture and other factors. Therefore, there is no universal methodology for classifying costs according to the degree of adjustability - it can only be developed in relation to a specific enterprise. The degree of cost control will vary depending on the following conditions:

- the duration of the period of time (with a long period, it becomes possible to influence those costs that are considered given in a short period);

- the powers of the decision maker (costs that are specified at the level of the shop manager may turn out to be regulated at the level of the director of the enterprise).

The division of costs into regulated and unregulated must be provided for in reports on the execution of estimates by responsibility centers.

This will allow us to highlight the area of responsibility of each manager and evaluate his work in terms of controlling the costs of the enterprise department. A modern enterprise management system is not considered effective if it does not put the “human factor” first. The success of any production and commercial activity primarily depends on the efforts of the workforce, the professionalism of management subjects, and their interest in the results of their work. For this purpose, an incentive system is widely used in management activities .

Based on this characteristic, the enterprise’s costs are divided into

mandatory

, associated with the performance of basic job duties, and

incentive

, aimed at achieving high quality indicators.

The process of making management decisions is impossible without an effective system of economic analysis

, which allows you to evaluate the achieved results of the enterprise’s activities and identify internal and external reserves for its further development.

For these purposes, costs are grouped into actual, forecast, planned, estimated

, etc. During the analysis, both the total volume of costs and the individual elements and items that form it are examined, i.e. structure.

Our proposed classification of costs in the context of management functions will improve the efficiency of management accounting, enhance its analyticalness and the ability to identify reserves for increasing the effectiveness of production and commercial activities.

Literature:

- Drury K. Introduction to management and production accounting. – M.: Audit, UNITY, 1997.

- Ozhegov S.I. Dictionary of the Russian language: Ok. 57,000 words/Ed. N.Yu.Shvedova. – M.: Russian language, 1985.

Overhead distribution options

IMPORTANT! Recommendations for the distribution of overhead costs from ConsultantPlus are available here

Despite the difficulties of planning indirect costs, this is a necessary procedure that can be carried out in several ways:

- The "working wage" method. If the main production employs a large number of workers, especially if manual labor predominates, overhead costs can be calculated in proportion to the wage fund for their labor.

- The “sales volume” method is advisable to use if automated processes predominate in the company. You can distribute income in proportion to machine hours.

- The unit of production method is applicable when direct costs significantly exceed indirect costs. Then we can take as a basis the ratio of direct costs per unit of goods to the total amount of direct costs.

- Direct counting method. Indirect expenses are summed up separately for each expense item.

- Combined methods are applicable in large companies with a complex structure, where several types of products are produced. For example, you can account for manufacturing overhead on the payroll basis, and general business overhead on the basis of unit cost.

EXAMPLE OF CALCULATION. Avtokoleso LLC is engaged in the transportation of goods. The staff wage fund is 8 million rubles per year. The overhead expense ratio in 2021 was 80%, that is, 6 million 400 thousand rubles. The company decided to reduce overhead costs, for which it fired several people. At the same time, the wage fund decreased by 20%, which means that the overhead costs of Avtokoleso LLC for 2021 can be planned in the amount of 5 million 120 thousand rubles.

Is there any provision for rationing of overhead costs ?

Procedure for calculating overhead costs

Planning and accounting of all expenses, including overheads, is carried out in a certain order:

- The total amount of costs for general business activities of the company is calculated.

- The amount of overhead costs that will need to be included in the estimate per unit of each type from the product range is determined.

ATTENTION! It is necessary to take into account the legal limits for overhead costs for specific items and the standards defined by the company's internal regulations.

What are the functions of cost?

As an economic category, product cost performs a number of functions:

- is the basis for accounting and control over the level of costs for production and sales of products;

- is the basis for forming the wholesale price for the enterprise’s products and determining profit and profitability on this basis;

- represents an integral element of the economic justification of any management and investment decisions of the enterprise;

- reflects the efficiency of resource use, the results of introducing new equipment and technology, improving the system of organization and production management.

Legal limits regarding overhead costs

The law determines the composition and limits of overhead costs in the construction and medical industries.

Construction overhead

In this industry, overhead planning is especially important. An estimate is drawn up, which indicates the average costs for the industry, which are included in the cost of construction products or services.

Cost rationing in the construction industry is regulated by the Methodological Guidelines for determining the amount of overhead costs in construction, approved by the Resolution of the State Construction Committee of Russia (separately for regions of the Far North and equivalent regions). These documents define the coefficient that must be applied to determine overhead costs for a particular construction activity, and also clarify the scope of its application. The wage fund for construction workers is taken as the base. The distribution of coefficients is carried out according to the following main types of construction:

- industrial;

- agricultural;

- transport;

- housing;

- energy;

- related to water management;

- in the field of nuclear energy;

- restoration work;

- major repairs;

- other types.

FOR YOUR INFORMATION! Overhead costs according to construction standards must be applied at the stage of drawing up estimates, as well as when paying for work performed.

Medical overhead

The standards and composition of overhead costs in the medical industry are regulated by Order of the Ministry of Health and Medical Industry of Russia No. 60 dated March 14, 1995. According to the provisions of this order, the cost of medical care must include all annual costs of a medical institution:

- salaries of all types of personnel, except medical personnel, with all accruals;

- expenses for the purchase of furniture, stationery, household goods (everything, except medicines and dressings);

- means for repairs.

The basis is the wage fund of medical personnel providing specific medical services, based on a coefficient of 1.5.

IMPORTANT! Typically, overhead costs are significantly higher in medicine than in construction.