Information on the movement of non-financial assets is presented:

- budgetary (autonomous) institutions in the form 0503768 (hereinafter referred to as information (f. 0503768));

- government institutions in form 0503168 (hereinafter referred to as information (f. 0503168)).

When filling out these forms for 2021, the following innovations must be taken into account:

Column number

| Filling procedure taking into account innovations | ||

| Information (f. 0503768) | Information (f. 0503168) | |

| 6 | Indicators of the value of objects of non-financial assets, rights to use assets received free of charge are reflected, based on data on the debit turnover of non-financial assets accounting accounts in correspondence with the credit of the corresponding analytical accounting accounts of account 0 401 10 190 “Gratuit non-cash receipts to the public administration sector” ( 0 401 10 191 , 0 401 10 192 , 0 401 10 193, 0 401 10 194 , 0 401 10 195 , 0 401 10 196 , 0 401 10 197 , 0 401 10 198 ) | Indicators of the amount of receipts of objects of non-financial assets, investments in non-financial assets received free of charge, are reflected based on data on the debit turnover of accounts of non-financial assets corresponding to accounts 1 304 04 000 , 1 401 10 191 , 1 401 10 192 , 1 401 10 193 , 1 401 10 194 , 1 401 10 195 , 1 401 10 196 , 1 401 10 197 , 1 401 10 198 |

| 7 | Indicators of the value of objects of non-financial assets capitalized based on the results of the inventory of non-financial assets, based on data on debit turnover of accounts for non-financial assets in correspondence with the credit of account 0 401 10 199 “Other non-cash gratuitous receipts” | Indicators of the amount of receipts of objects of non-financial assets, investments in non-financial assets as a result of taking into account previously unaccounted for objects, objects based on inventory results based on data on debit turnover of accounts of non-financial assets corresponding to the account 1,401 10,199 |

| 9 | Indicators of the value of objects of non-financial assets transferred free of charge are reflected based on data on credit turnover of non-financial assets accounting accounts in correspondence with the debit of the corresponding analytical accounting accounts 0 401 20 240 “Expenses on gratuitous transfers of a current nature to organizations”, 0 401 20 280 “Expenditures on gratuitous transfers of capital nature to organizations”, 0 401 20 250 “Expenses on gratuitous transfers to budgets” | Indicators of the amount of disposal of objects of non-financial assets, investments in non-financial assets as a result of gratuitous transfer are reflected based on data on credit turnover of accounts of non-financial assets corresponding to accounts 1 304 04 000 , 1 401 20 240 , 1 401 20 280 , 1 401 20 250 |

| 10 | Indicators of the value of non-financial assets written off from the balance sheet due to shortages identified during inventory, as well as in connection with theft, are based on data on credit turnover of non-financial asset accounts in correspondence with the debit of accounts 0 401 10 172 “Income from operations with assets", 0 401 20 273 "Extraordinary expenses on transactions with assets" | Indicators of the amount of disposal of objects of non-financial assets, investments in non-financial assets as a result of shortages, thefts are indicated based on data on credit turnover of accounts of non-financial assets corresponding to accounts 1 401 10 172 , 1 401 20 273 |

Form 4-OS is required to be submitted by legal entities and individual entrepreneurs that have fixed assets for environmental purposes, carry out environmental protection activities (independently or in the form of consuming third-party environmental services), and have facilities that have a negative impact on the environment.

Information is provided for a legal entity (a legal entity that has separate divisions), an individual entrepreneur if there are current costs for environmental protection and (or) payment for environmental services in excess of 100 thousand rubles per year.

If a legal entity has separate divisions, this form is filled out both for each separate division and for a legal entity without these separate divisions.

The federal statistical observation form is also provided by branches, representative offices and divisions of foreign organizations operating on the territory of the Russian Federation in the manner established for legal entities.

- major repairs of environmental fixed assets;

- procurement of environmental services from external organizations (payments to third parties for the reception and treatment of wastewater, as well as for the removal, disposal, disposal of production and consumption waste, for the provision of other environmental protection services).

Submission form and method of reporting “4-OS”

The report in form “4-OS” is submitted to the territorial body of Rosstat in the constituent entity of the Russian Federation. It is possible to submit the report electronically.

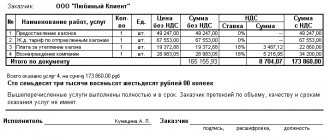

The form is filled out based on the primary accounting data of actual environmental protection costs and environmental payments. Data are presented in thousands of rubles, rounded to whole numbers. VAT is not taken into account.

The head of the enterprise is obliged to appoint an official who is authorized to provide this report on behalf of the company.

The document must be submitted by January 25 after the reporting period.

Who should submit form 4-TER

Only legal entities report on fuel and energy resources. The exception is small businesses. They do not submit the form, just like individual entrepreneurs.

According to standard rules, the following categories of respondents are required to report:

- bankrupt organizations at the stage of bankruptcy proceedings until they are liquidated with a corresponding entry in the Unified State Register of Legal Entities;

- branches, representative offices and divisions of foreign companies operating in the Russian Federation;

- companies that have suspended operations.

If an organization leases equipment, then 4-TER is sent to Rosstat by the company that uses this equipment for production.

You can check whether you have to submit a report in a special Rosstat service using TIN, OKPO or OGRN. You can find out about delivery obligations for 2021 after December 30, 2021.

If the organization does not have any of the events observed in the form, it is permissible to send an information letter to Rosstat or submit a blank report. The blank form must be signed, the title page and line 9990 must be filled out. There should not even be dashes or zeros in the remaining fields.

The Russian Treasury has updated control ratios for annual reporting

In the absence of accounting for the costs of manufactured products by elements and cost items, the organization distributes all costs of manufactured products by elements and items in accordance with the structure of costs incurred for the period in the main industry of the organization's economy.

In turn, the balance of the targeted subsidy is returned in the following cases:

- the presence of an unspent balance of the subsidy;

detection during the audit of violations regarding the expenditure of subsidy funds (misappropriation).

The amount according to the debit turnovers reflected in the corresponding analytical accounts of accounts is 0 302 00 000, 0 303 00 000, 0 304 00 000.

Liabilities and monetary obligations were accepted by the institution in the amount of 460,000 rubles. Transactions were carried out according to KVFO 4.

The report consists of a title page and a tabular section. It indicates the number, accrued wages of employees and hours worked. The procedure for filling out the form has changed slightly. In particular, an additional example is given of calculating the average number of employees who work part-time (clause 79.3 of the Instructions).

Accounting programs give the accountant another opportunity to verify the data of accounting registers and certificates (f. 0503710). To do this, you need to create a general ledger in the program (f. 0504072) without taking into account the final turns. Next, compare the balances on accounts 0 401 10 XXX and 0 401 20 XXX in it and in the certificate (f. 0503710). The amount of data on the account is 0 401 10 130 “Income from the provision of paid services (work), compensation of costs,” minus the VAT amounts accrued from this income (according to the debit of account 0 401 10 130).

Expenses for an official reception, for transportation of participants to the venue of a representative event or meeting of the governing body and back; expenses for buffet service during negotiations; expenses for the services of translators who are not on staff of the organization to provide translation during entertainment events.

Deadlines and procedure for delivery

Respondents take 4-TER once at the end of the year. The deadline for this is set for February 16th. If this day falls on a weekend, the delivery can be postponed until the next working day.

The form must be submitted to the Rosstat office corresponding to the location of the legal entity. If the place of actual business activity is different, the form is submitted to another department.

When the legal entity’s sole proprietorships are located in the same subject, information in the form is entered for the legal entity as a whole, including separate sections. If the legal entity's OPs are located in different regions, the divisions themselves submit the form at their location. It is also possible to submit one form at once for all educational institutions from one constituent entity of the Russian Federation; for this purpose, the manager appoints a responsible person.

What is it for - purpose

An annual cash flow report prepared by a legal entity in Form 4 allows a business entity to successfully solve the following tasks:

- Conduct factor analysis of money flows in order to distribute it correctly.

- Control real expenses (payments) made by a business entity in various items/directions.

- Timely identify and eliminate areas of deficit in the cash flow of the enterprise.

- Characterize the organization's net profit without taking into account costs.

- Assess the possibilities and reserves for increasing the company's cash flow.

- Check the sufficiency of available funds to ensure the normal functioning of the organization.

- Justify the economic feasibility of attracting additional investments, obtaining borrowed funds, and issuing securities.

- Compare the amount of profit earned with the flow of money.

Instructions for filling out the report

The 4-TER form form was approved by Rosstat order No. 419 dated July 22, 2019. Detailed explanations of the lines and columns are given in Rosstat order No. 713 dated November 28, 2019.

The form contains a title page and three sections. In them, respondents tell how many resources they received and spent during the reporting year, how much was spent on production, and also report on their equipment with accounting devices.

Compile a report on source documents that reflect data on production, as well as fuel and energy use. Let's look at each section.

Title page

Legal entities submit many forms to Rosstat and all title pages are almost identical. The title plate of form 4-TER was no exception. It must indicate the reporting year, full and short name, postal address with zip code, OKPO code or identification number.

Section 1

The first section is filled out by consumers, sellers and producers of fuel and energy resources. Depending on this, the filling order differs.

Enterprises that consume, sell wholesale and retail, or act as intermediaries provide data on all fuel actually received and consumed in 2021. This includes both fuel spent on the needs of the company and sold to the population, employees, and other individuals and legal entities. Including leftover fuel.

Enterprises that simultaneously consume and produce fuel and energy reflect in the first section only the fuel that they bought from others or produced themselves and used for their own needs, sold to the population or employees. Produced resources sold to legal entities do not need to be shown in this section.

Let's consider filling out the section by column. The first three are already filled in, you will only need to write down the numerical data in the lines corresponding to the type of fuel.

In column 2, show the amount of waste petroleum products that the organization collected during the reporting year.

In column 3, show all fuel consumption, including losses and shortages. Next, distribute fuel costs by type: boiler and furnace (column 4), motor (column 5), raw materials (column 6), non-fuel needs (column 7). In this case, reflect the unallocated volumes (losses) in column 4.

In column 8, indicate the volume of fuel that was sold to other organizations. Column 9 contains fuel sold to the population and used petroleum products sent for export.

In columns 1 and 10, show the balances at the beginning and end of 2021, respectively.

Section 2

In the second section, provide data on how many products were produced and sold, work or services performed in the appropriate units of measurement and the electricity, heat and fuel spent on them (tons of standard fuel).

In column 1, show the volume of production and work performed for the reporting year. Next, in columns 2–4, reflect the actual annual consumption of electricity and heat, as well as fuel for production.

Show the data in column 4 in tons of standard fuel. You need to convert it into a conditional one using the formula:

Volume of fuel in physical terms × K

K = Q / 7000 kcal/kg,

where: K is the conversion factor to conditional; Q—lower calorific value, kcal/kg; 7000 kcal/kg is the calorific value of 1 kg of standard fuel.

Next, column 4 needs to be deciphered by type of fuel; columns 5–27 are intended for this. Their sum for each line should be equal to column 4.

Section 3

In the third section, show how many metering devices you have and what is the total need for them, this will allow you to assess the equipment. In total, there are four types of metering devices: electricity, heat, water and gas.

In the first column, show the total need for metering devices at settlement points, including those that you already have and for which energy suppliers make payments to consumers.

In the second column, show the number of devices actually installed at the design points for which calculations are carried out. The installation time does not matter. In column 3, indicate the number of devices that were put into operation in the reporting year.

Sample filling

What are the key considerations for filing Form 12-F for 2021?

Composition of Form 12-F:

- title page;

- main information area;

- records certifying the information entered in the form.

The title page of the form states:

- reporting year number;

- name of the company submitting the form;

- company postal address;

- OKPO company code.

The main information area of Form 12-F is a table of data on areas of spending money. It reflects in total, as well as in relation to the fact of using the company’s profit as a source of funds, values for the following groups of indicators:

- expenses reflecting long-term investment;

- expenses related to the activities of service farms;

- social benefits for employees;

- transfer of funds to charity;

- payments to separate divisions that have their own balance sheet and current account;

- expenses classified as entertainment;

- payment for services provided by banks, advertising firms, auditors;

- contributions to funds engaged in scientific and development work.

The marked groups of indicators may contain specific expense items. For example, within the first group of indicators, total expenses for ordinary types of business activities are recorded, as well as related costs that are associated with:

- with capital investments;

- purchase of software and other intellectual property;

- carrying out research and development work.

The table also records the total amount of funds used by the company - without taking into account the source of financing, as well as indicating the amounts spent from the company's profits.

All values in the table are recorded in thousands of rubles.

The document must be signed by a manager or employee authorized to do so in accordance with local regulations. The contact information of the person who verified the form is also indicated.

You can familiarize yourself with the specifics of other reporting forms sent to Rosstat in the articles:

- “Information on financial investments - statistics form P-6”;

- “Information on the financial condition of the organization - Form P-3.”

How to pass 4-TER through Extern

The form can be submitted in one of two ways: paper or electronic. To submit a paper form to Rosstat, you will need to go to the post office, hire a courier, or personally visit a territorial office. Everything is complicated by the fact that if errors are found, the form will be returned to you - you will have to correct it and submit it again.

It is more convenient to submit reports electronically. This can be done right at your computer, all you need is an electronic signature. Kontur.Extern helps to submit reports to regulatory authorities: Federal Tax Service, Pension Fund of the Russian Federation, Social Insurance Fund, Rosstat, RPN and FSRAR. The service also has built-in automatic checking of reports before sending and correspondence with controllers - all problems can be solved remotely. Kontur.Extern gives a “Test Drive” for 3 months.

To send a report, log in to the system and go to the “Rosstat” tab. Download the finished report or fill out 4-TER in the system interface. Some fields are filled in automatically, according to the data entered during registration. Before submission, the report will be automatically checked against the control ratios established by Rosstat.

Sign the report electronically and send it to the department. Complete instructions for submitting reports.