What is VHI for a company?

VHI is one of the types of medical insurance, but it covers a much larger list of medical services than a regular medical policy, which is issued to every citizen of the Russian Federation under the compulsory medical insurance system (Article 927 of the Civil Code of the Russian Federation and Article 4 of the Law of the Russian Federation No. 4015-1 “On Organization insurance business in the Russian Federation" dated November 27, 1992).

In order for a company to include in its benefits the availability of a voluntary health insurance program for its employees, the organization enters into an agreement with an insurance company (one or more) for one or more health insurance programs.

According to the terms of insurance on the territory of the Russian Federation, the employing company is recognized as the policyholder, and the insurance company is recognized as the insurer. The agreement is concluded in the manner and according to the requirements specified in Chapter. 48 Civil Code of the Russian Federation.

Concluding an agreement with an insurance company implies that the employing organization will have an expense item related to employee wage costs. In this connection, questions may arise about the accounting of expenses and the taxation of profits (accounting for these expenses in expense items that affect the formation of taxable profit).

Peculiarities

Financial assistance in the form of compensation for damage at the time of an unexpected or accidental event in people’s lives is a powerful and significant support, thanks to which it becomes possible to solve all problems with health and life.

The most important feature of voluntary accident insurance is its basis - voluntary participation, freedom or expression of the will of the parties.

This type of insurance will always have a certain period, which is agreed upon by the parties in advance, and is valid only when the premiums are paid on time.

Life insurance in the Renaissance company is discussed in the article: Renaissance life insurance. You can read about voluntary life insurance here.

Accounting for VHI expenses

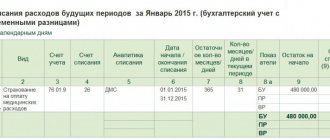

In accounting, expenses for payment of voluntary health insurance are recognized as labor costs during the period in which they were incurred (PBU 10/99 “Expenses of the organization”).

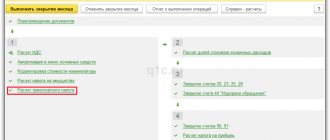

These expenses are charged entirely to cost accounts and are recorded as debit accounts (accounts 20, 25, 26, 44 - depending on the type of employee’s work). If the costs of voluntary health insurance arise in relation to those persons with whom the employer does not have an employment contract (with an entry in the work book), but is registered under a civil contract, then the costs of paying for voluntary health insurance are recognized as other expenses and are taken into account as the debit of account 91 (subaccount 02).

For the loan, these expenses are taken into account in subaccount 76.01 “Calculations for property, personal and voluntary insurance.”

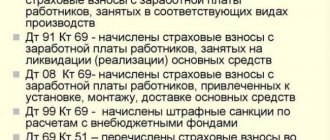

Thus, the main entries for VHI accounting are as follows:

- Dt 76.01 – Kt 51 – the amount of the insurance premium was transferred to the insurance company according to the list of employees entitled to receive VHI services.

- Dt 20 (25, 26, 44, etc.) – Kt 76.01 – write-off for expenses of amounts for voluntary health insurance of employees (monthly, in proportion to the duration of the insurance contract) for an amount within the limit (an example of the calculation is given below).

- Dt 91.02 – Kt 76.01 – write-off of amounts for employee voluntary health insurance for the amount exceeding the limit (reflected in accounting for tax differences).

- Dt 99 – Kt 68 – write-off of VHI expenses for the amount of permanent tax liability (after calculating the tax difference).

Since in accounting the costs of voluntary health insurance are fully included in the expenses of the enterprise, and in tax accounting - only partially, a tax difference arises, and, consequently, a difference in accounting and tax accounting.

Accident insurance in Rosgosstrakh

Among the numerous Russian insurance companies offering their services, one that is gaining momentum among the population is Rosgosstrakh (RGS) - state insurance protection of the population against accidents.

So that you are not caught off guard by a sudden illness, work injury or death of a loved one, you can always insure all these and other cases on conditions that are convenient and beneficial to you.

The RGS-Life enterprise is ready to offer the population guaranteed and stable insurance protection against accidents.

For this purpose, a number of programs have been developed and already launched:

- Fortune “Protection+” - for cases when a person leads an active lifestyle, for example, plays amateur sports with a possible risk to his health;

- Fortune “Family” – accident insurance for all family members, executed in one single contract;

- Fortuna “Children” – any insurance protection against accidents for children;

- “Driver” – insurance for both drivers and passengers against possible road accident situations.

| Program | Sum insured |

| Fortune "Family" | from 100 thousand to 1 million rubles |

| Fortune "Children" | from 100 thousand to 500 thousand rubles |

| "Driver" | from 100 thousand to 1 million rubles |

| Fortune "Protection+" | 100% sum insured |

The company makes payments after its agents investigate the incident (injury, burn and other damage), after the policy owner undergoes hospitalization, becomes disabled or dies.

The availability of obtaining a policy is limited only by citizenship, age (upon the age of majority of the insurance client) and the ability of the applicant to pay all necessary premiums on time. Otherwise, everyone can use the services of the RGS.

For ratings of endowment life insurance companies, see this article: endowment life insurance. Find out what the rules are for life insurance on this page.

Life insurance in Rosgosstrakh is described here.

Tax accounting of expenses for voluntary health insurance

When considering the taxation of expenses for voluntary medical insurance, there may be several nuances associated with different taxes: VAT, personal income tax, income tax.

VHI and VAT

Art. 149 of the Tax Code of the Russian Federation determines that transactions for the provision of insurance, coinsurance and reinsurance services are not subject to VAT, i.e. the employing company (insurer in this case) cannot use the VAT amount to receive a tax deduction.

VHI and personal income tax

Art. 213 of the Tax Code of the Russian Federation determines that amounts attributable to labor costs, but associated with the provision of voluntary health insurance services for employees (including their families) are not subject to personal income tax (and, accordingly, are not the basis for calculating social insurance contributions , since the employee is not recognized in this case as a recipient of additional income in kind or other forms).

VHI and income taxation

Because expenses for voluntary health insurance are included in the costs of remunerating the employee (Article 255 of the Tax Code of the Russian Federation), and expenses for remuneration in turn are included in expenses that reduce taxable profit, such as production and sales costs (Article 253 of the Tax Code of the Russian Federation), then with On the part of the Ministry of Finance of the Russian Federation, there is a clear limitation on the amount of expenses that the organization has the right to recognize. Those. In accounting, expenses are recognized in full, for tax purposes - partially.

So, paragraph 16 of Art. 255 of the Tax Code of the Russian Federation provides that contributions under VHI agreements in relation to company employees concluded for a period of at least a year (under Article 6.1 of the Tax Code of the Russian Federation) can be attributed to expenses in the amount of no more than 6% of labor costs.

The amount of labor costs should not include all those amounts of payments to employees that are excluded from wages for income tax accounting purposes (for example, compensation payments to employees are classified as other expenses, and not as wages for tax purposes).

An important addition is also the fact that labor costs can be attributed to VHI expenses only in relation to employees, but if VHI expenses were attributed in accounting to individuals who are not employees of the company, then such expenses are such expenses for tax purposes. accounting for income tax cannot be taken into account - this applies to employees under a civil contract and dismissed (resigned) employees (Letter of the Ministry of Finance dated 03/09/2011 No. 03-03-06/1/130 - based on Articles 252, 255 and 270 Tax Code of the Russian Federation).

Calculation example:

The company entered into a voluntary health insurance agreement from 03/01/2019 to 02/28/2020. The insurance premium is 450,000 rubles (payable at a time). Let's look at how the standard expenses for taxation are calculated using the example of one month.

Labor costs in March 2021 amounted to 615,248.37 rubles.

The amount of the insurance premium payable in March is calculated as follows:

B = C: CD x DP, where

B – the amount of contributions for a certain tax period;

C – total amount under the insurance contract;

KD – number of days of validity of the insurance contract;

DP – number of days in the reporting period.

B (March) = 450,000 rub. : 365 days x 31 days = 38,219.18 rubles

The maximum amount of expenses according to tax rules (SZN) is 6% of the amount of salary expenses:

Maximum SZN = 615,248.37 x 6% = 36,914.90 rubles.

Since the amount of VHI contributions in March exceeds the maximum amount of expenses in March, a permanent tax difference arises:

38,219.18 rubles – 36,914.90 rubles = 1,304.28 rubles.

After which the permanent tax liability is calculated for the amount of the tax difference:

1,304.28 x 20% = 250.86 rubles.

The amounts further, when determining the allowable amount of costs for VHI, are taken on an accrual basis from the start date of the contract.

It is important to understand that the Federal Tax Service monitors the reflection of actually incurred expenses in tax accounting, therefore the above calculation method is suitable for those companies that enter into an agreement with an insurance company and independently pay insurance premiums for employees in full.

If a company, when drawing up a contract for voluntary health insurance for employees, transfers part or all of the payment of insurance premiums to them, then as part of the expenses that affect the taxation of the company’s profits, only part (or none) of the expenses for voluntary health insurance can be taken into account - in proportion to the actual expenses incurred by the organization to pay for voluntary health insurance .

Important: the VHI agreement between the employer company and the insurance company must stipulate the right to make changes to the list of insured employees - since the number of insured employees entitled to the VHI policy affects the amount of the insurance premium and, accordingly, the procedure for calculating expenses that affect to reduce profits. The Federal Tax Service may require that expenses for voluntary health insurance be removed from the list of expenses that reduce profits if there are suspicions of a violation of the main points and principles for calculating these expenses.

What rules apply and what is said in the contract

Only with voluntary insurance, the company itself develops all the conditions and rules of the insurance procedure that will be offered to the policyholder.

Then, together with the client-insurer, all the necessary terms, conditions for making contributions and their return, the responsibility of the company and the client, as well as the amount of the insured amount are discussed.

The standard rules for voluntary insurance are the following:

- mutual expression of will between the insurance client and the company providing insurance protection;

- the solvency of the citizen - otherwise there is simply no point in concluding an agreement on voluntary accident insurance;

- timely payment of client fees, according to the agreement;

- compliance by the client with the conditions to prevent intentional damage to himself for the sake of insurance payment;

- compliance with the company’s conditions for timely payment of insurance premiums with interest, if any, and if they are stipulated in the insurance contract.

In voluntary accident insurance, contractual relations, according to Art. 927 of the Civil Code of the Russian Federation, must always be based on the free expression of both parties.

And this always requires written confirmation of consent. Most often, the contract is concluded for a period of one year, however, other terms are also practiced.

Life insurance rules.

Accident insurance contract.