The single tax on imputed income is a thing of the past - in 2021 it can be applied for the last time. Small businesses hoped that the imputation would be extended, but this did not happen. And after the coronavirus quarantine, many entrepreneurs are faced with a choice: switch to a different tax regime or stop their activities. Statistics show that some of them choose the second option. Our topic today will be relevant for them - filling out the UTII declaration when closing an individual entrepreneur.

Free tax consultation

Declaration on UTII when closing an individual entrepreneur: how to fill out, when to submit

An individual entrepreneur can terminate his activities at any time by performing a number of manipulations to close the business. First of all, this concerns the timely submission of reports and payment of payments provided for by the taxation system used. If an entrepreneur is on UTII, then in the event of termination of activity he must take into account certain features and nuances of such a system. Otherwise, a tax debt may arise, the obligation to pay which will be transferred to the individual.

Liquidation

The definition of liquidation of an individual entrepreneur is the termination of registration of an individual as an entrepreneur. As soon as a person goes through the entire procedure and receives written confirmation of removal from the register, he is immediately deprived of all rights and obligations that he had while carrying out his activities. Naturally, there is a limitation. If there are still debts, then an individual, without having the status of an entrepreneur, must pay them off.

In addition to the desire of an individual, liquidation of an individual entrepreneur on UTII can be carried out in the following cases:

- bankruptcy;

- expiration of the validity period of registration documents that allow you to legally stay in the country;

- making an appropriate decision by the court;

- death of an individual.

In principle, all the methods described can be classified as coercive measures, not counting the bankruptcy procedure, which was initiated by the individual himself.

General requirements

Individual entrepreneurs are required to submit a UTII declaration once a quarter.

This is an unchangeable requirement of the Federal Tax Service, which is applicable to all business entities on the “imputation”. Even if an entrepreneur plans to close the business or change the current legal form, he must report the results of work for the previous quarter to avoid penalties.

To fill out the declaration correctly, it is important to adhere to the following rules:

- If the document is filled out by hand, it is recommended to use black ink.

- Amounts are for numerical purposes only, rounded down.

- In all required fields, the text is written in block capital letters only.

- Incorrect information cannot be crossed out or corrected. Territorial divisions of the Federal Tax Service do not accept reports with edits and adjustments. If a mistake is made in any section when filling out the document, you will have to replace it with a new sheet.

- There should be no empty cells in the report. In the fields where they are located, dashes are placed on the unfilled part.

- The declaration sheets should not be stapled into one document.

In case of closure of an individual entrepreneur, to submit a declaration, you will have to use the form approved by the order of the Federal Tax Service No. ММВ-7-3 / [email protected] dated June 26, 2018. It contains 5 sheets: a title page and 4 mandatory sections.

Filling out an application

Before submitting documents, you must fill out an application on the approved form P26001. The form can be obtained from the territorial office of the Federal Tax Service or downloaded from the official website.

The application can be filled out on a computer or manually. If the second option is chosen, it is better to use a pen with black ink and write all letters in capitals.

When filling out a document on a computer, you must select Courier New font with a height of 18 pt.

At the top of the document, fill out the fields with information about the full name and OGRNIP of the individual entrepreneur. Then the method by which the application will be transmitted, contact information, even e-mail, is indicated.

How to fill out a declaration

The title page is filled out taking into account the general rules and information specified in the registration documents. In order for the tax service to accept the report, the title page must contain the following information:

- Page numbering according to the form approved by law (“001”, “002”, “003” and so on). Additionally, the fact of the presence of supporting documents or their copies is recorded.

- TIN according to documents evidencing delivery for tax registration.

- In the “Tax period” field, you should enter the number 50 to notify the Federal Tax Service of the termination of activity. This coding indicates that the company is filing reports for the last tax period.

- In the field “Form of reorganization, liquidation” the number is indicated.

- Code of the tax authority where the report is submitted and place of registration.

- Full details of the individual entrepreneur – full name and contact phone number.

After filling out the document, you will have to return to the design of the title page and indicate the number of its pages. If an individual entrepreneur submits a report independently, the field confirming the accuracy and completeness of the information is not filled in. The second half of the title page, intended for tax officials, should also not contain any inscriptions.

Sections of the declaration when closing an individual entrepreneur are filled out in accordance with the general rules and requirements of the Federal Tax Service. Information must be provided separately for each type of commercial or industrial activity. But in this situation, special attention will have to be paid to the second section of the document, where the calculation of the amount of tax according to “imputation” is carried out.

UTII declaration for less than a month

The UTII tax declaration for less than a full month is standard. If you fill out a declaration for an incomplete month when closing an individual entrepreneur, you must enter the number “50” in the tax period code and the number “0” in the “reorganization form” in the UTII declaration.

Sources

- https://ppt.ru/forms/nalogi/kak-prekratit-deyatelnost-na-yenvd

- https://vseproip.com/zakrytie-ip/prekrashhenie-deyatelnosti/prekrashhenie-deyatelnosti-po-envd.html

- https://kakzarabativat.ru/pravovaya-podderzhka/zakryt-torgovuyu-tochku/

- https://businessmens.ru/article/kak-zakryt-ip-na-envd

- https://kakzarabativat.ru/pravovaya-podderzhka/zakryt-ip-na-envd/

- https://nalog-nalog.ru/envd/snyatie_s_envd/

- https://lawgrupp.ru/migratsiya/kak-rasschitat-envd-pri-zakrytii-ip-za-nepolnyj-kvartal-2019

- https://my-biz.ru/nalogi/envd-nepolnyj-mesyac

- https://tbis.ru/nalogi/raschet-envd-za-nepolnyj-mesyac-v-2015-godu

Features of filling out a declaration when closing an individual entrepreneur

In the second section of the UTII declaration, in fields 070-090, the entrepreneur must indicate information about the results of his activities, based on the period of work during the reporting quarter. Special physical indicators are taken into account (number of hired specialists, space used), on which the amount of tax directly depends.

If the individual entrepreneur actually stopped working in the middle of the reporting period, then in the relevant part of the second section the number of days of business activity should be indicated. A dash is added if the work was carried out during all months of the quarter.

If during the reporting period the individual entrepreneur was no longer functioning, then the physical indicator will be equal to zero, which should be reflected in the last report. But the activity will be considered completed only if the entrepreneur:

- Closed all previously used points of sale (warehouses or production).

- He sold the remaining goods that were on his balance sheet.

- Fired employees or terminated existing employment contracts.

- I removed the cash register from tax registration.

In this section of the individual entrepreneur’s declaration, it is important to correctly calculate the volume of the tax base. In this case, the calculations should be adjusted taking into account the number of days of work. If the business operated for only 1-2 weeks or a few days of the quarter, the Federal Tax Service will not force the entrepreneur to pay tax for all three months. But it is important to reflect this in the report, supporting the calculations with the necessary documents.

The tax office will not accept UTII reporting if it is zero. Even in the event of termination of commercial activity, the entrepreneur is obliged to completely fill out all sections of the declaration and submit it within the period prescribed by law.

How to calculate the tax base based on “imputation”

To determine the tax base for a full month, the basic profitability, coefficients K1, K2 and the value of the physical indicator are multiplied. The resulting value is entered in the corresponding cell of Section 2 of the declaration.

If the month is not fully worked:

- First, the base is calculated for a full month;

- the resulting value is divided by the number of calendar days of the month and multiplied by the number of days actually worked in the special regime (from the 1st to the day of deregistration).

In the month when the individual entrepreneur did not work, dashes are placed in all cells.

The tax base for a quarter is formed by adding up the values of the bases for each month of the period.

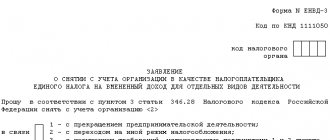

Application for deregistration

Along with the declaration, the entrepreneur must submit the UTII-4 form in order to be deregistered as a tax payer. This is a mandatory condition for closing an individual entrepreneur, otherwise, despite the cessation of work, the organization will still be forced to pay tax.

After specifying the registration data, it is important to select the correct reason for deregistration. Based on the current circumstances, this will be the termination of business activity.

If documents or copies thereof are attached to the UTII-4 form, such information must also be reflected in the application form. And dashes are placed in empty cells, although this rule does not apply in all regional divisions of the Federal Tax Service.

If the application for deregistration is submitted not by the entrepreneur, but by his authorized representative, then his personal and contact information is indicated in the appropriate fields. There should be no entries in the part of the form reserved for marks by Federal Tax Service employees.

If business activity was terminated during the quarter, it is better to submit UTII-4 within the next 5 days. If this deadline is missed, the individual entrepreneur will be considered to have worked until the end of the quarter.

What is the UTII-4 form and why is it important?

Form UTII-4 was approved by order of the Federal Tax Service No. ММВ-7-6/941. The form can be obtained from the order itself. It is located in Appendix No. 4 to this order.

You can also find out exactly how to fill out the UTII-4 form by visiting the official website of the Federal Tax Service, where there are detailed instructions and samples.

Without a completed UTII-4 form, the individual entrepreneur will not be considered closed!

And accordingly, you risk that taxes will continue to be charged to you, even if you do not work as an individual entrepreneur. By the way, there is no such form in other special taxation systems. Therefore, for an ignorant person, the need to fill out the form may go unnoticed.

Deadlines and procedure for submission

The liquidation declaration is submitted at the place of registration of the business within the time limits provided for by current legislation. Regardless of whether the individual entrepreneur will continue its activities or the procedure for closing the organization has been initiated, a report on the results of work for the previous quarter must be submitted next month (by the 20th). For example, if an entrepreneur worked until March 17, then he must submit a declaration by April 20.

You can submit the necessary documents to your Federal Tax Service division:

- On one's own.

- Through a representative who has the right to submit such documents. His powers must be confirmed by a notarized power of attorney. If the closure of an individual entrepreneur is carried out with the participation of a representative, then his data must be reflected in the tax reporting.

- Through an intermediary . In this case, you will have to pay not only the state fee, but also the services of a hired specialist.

Reporting

In addition to the measures described above, it is necessary to fill out UTII when liquidating an individual entrepreneur and submit reports, even for an incomplete period.

When paying tax on imputed income, reporting is submitted by the 20th day of the month following the reporting quarter. Therefore, if the certificate was received in March of the current year, then you must report before April 20. In cases where the 20th falls on a holiday or day off, you can transfer the papers on the next business day.

Filling out the UTII declaration when closing an individual entrepreneur 2021

The legal topic is very complex, but in this article we will try to answer the question “Filling out the UTII declaration when closing an individual entrepreneur 2020.” Of course, if you still have questions, you can consult with lawyers online for free directly on the website.

The deadline for submission is the 20th. For 2021 this is: Quarter number Deadline date First April 20 Second July 20 Third October 20 Fourth (annual reporting) January 20, 2021 If you have a small staff, no more than 25 people, submit the declaration in any way convenient for you:

Article 22.3 of Chapter VII of Federal Law No. 129-FZ states that if an individual entrepreneur does not provide this document, then the Federal Tax Service will request it independently from the Pension Fund. Therefore, refusal of registration due to the lack of the above-mentioned certificate is illegal. The documents are submitted to the regulatory authority:

Individual entrepreneur tax return for UTII in 2021: sample and form

The article will be of interest to entrepreneurs “on income” and “income minus expenses”. When filling out the form by hand, use only blue, purple or black ink; cost indicators must be indicated in full rubles; text and numeric fields are filled in from left to right in capital block letters; put dashes in empty cells; sheets must be numbered, starting with the title page;

Step-by-step instruction

To remove the status of an individual entrepreneur, an individual entrepreneur on UTII or another form of taxation is required to take a number of actions to liquidate the business. In this process, it is better to rely on step-by-step instructions, following which will help you avoid problems with the tax authorities.

Step 1: Employees

Even before the start of the process (at least 2 months in advance), the employer is obliged to warn its employees about the upcoming layoff. The entire staff is fired (even those on sick leave or on vacation and as provided for in paragraph 4 of Article 261 of the Labor Code of the Russian Federation). This cannot be done by email or telephone conversation: employees are required to sign certifying that they were notified of dismissal.

A notice of the impending liquidation of the individual entrepreneur is sent to the Employment Service 2 weeks in advance.

The employee receives a work book with a record that he was fired due to the liquidation of the individual entrepreneur (or under clause 1 of part 1 of Article 81 of the Labor Code of the Russian Federation), salary papers for the last 3 years (including the current one) and 2-personal income tax.

Declaration of UTII when closing an individual entrepreneur in 2021 sample

Individual entrepreneurs enter the amounts of mandatory fixed contributions on line 030. UTII is reduced by this amount; line 040 shows the amount of expenses spent on the purchase of cash register equipment, which reduces the amount of tax on UTII. The value of this indicator is determined as the sum of all indicator values on line 05 of Section 4 of the Declaration; line 050 must indicate the total amount of the single tax on imputed income payable to the budget for the tax period.

How to fill out the latest simplified taxation system declaration when closing an individual entrepreneur

We tell you how to do this, since the Tax Code of the Russian Federation only partially regulates this issue. Oddly enough, according to official statistics from the Unified State Register of Legal Entities and the Unified State Register of Individual Entrepreneurs, since April 2021 in Russia there have been more registered individual entrepreneurs than legal entities.

The tax is calculated based on a number of indicators and that are approved at the federal and local levels. In tax calculations, there is a physical indicator that determines the scale of your business in numerical terms. Let's assume that you ceased business before the end of the reporting period, dismissed staff, closed stores, sold off equipment, etc.

The title page of the “liquidation” declaration of an individual entrepreneur on the simplified tax system. For entrepreneurs, the legislation does not provide for separate deadlines for submitting a declaration upon deregistration, as, for example, for simplifiers. Depending on the quarter for which the “liquidation” declaration is submitted, the following tax period codes are indicated on the Title Page: 51 – when

Declaration on UTII when closing an individual entrepreneur

The physical indicator for trade is the trading area, in this case the size of the trading floor is 45 square meters. March 2021 consists of 31 days. KD is correspondingly equal to 31. The boutique began working on March 16, that is, KD1 = 16, the first working day is included in the calculation.

If we talk about a tax return, then it assumes the use of a 2-digit tax period code. However, payment orders must also contain this information, but a 10-digit code is required.

When carrying out such types of activities, organizations report on UTII to the Federal Tax Service at their location, and individual entrepreneurs - at their place of residence. If a businessman has several points and/or types of activities on UTII, then the declaration is submitted according to the following rules:

Tax period code when closing an individual entrepreneur

To complete this action, the businessman is given a period of five working days, counted from the date of entry into the Unified State Register of Individual Entrepreneurs indicating that he has ceased his business activities. In this case, the tax return must contain, among other things, codes for the tax period. How the document will be filled out and the deadline for filing will depend on which tax system is chosen by the individual entrepreneur. He could choose, for example, between a general or simplified taxation system, UTII, Unified Agricultural Tax.

Sometimes you can come across the opinion that in this case the rule from paragraph 1 applies. However, it is erroneous, since when deregistering, the entrepreneur does not submit a notification to the Tax Service (he fills out form P26001). So, if you fail to complete the report by the 25th of the next month, the Federal Tax Service will not impose a fine.

Why is the use of UTII stopped?

The Tax Code specifies one reason: termination of a type of business subject to single taxation. Closing an enterprise completely is not the only reason for filing an application for deregistration based on imputation. It is possible to terminate activities under UTII without closing the LLC or in parallel with the liquidation of the enterprise. Typically, enterprises simply move to other markets, begin to explore other areas of the economy, expand their business and go beyond the framework of this system. The law obliges to switch to another regime if the enterprise ceases to meet the criteria of imputation (100 employees, etc.). Often, activities under UTII are terminated without closing the individual entrepreneur; an individual entrepreneur simply begins to conduct another business, in which the use of UTII is prohibited (the list of permitted activities is established by Article 346.26 of the Tax Code of the Russian Federation).

Thus, the cessation of use of the mode is due to the following reasons:

- carrying out other activities, changing business orientation;

- closure of an enterprise;

- choosing a different tax system;

- mandatory transition to another regime according to the norms of the Tax Code of the Russian Federation.

In addition, starting from 2021, imputation will be canceled for all subjects. In accordance with the norms of Federal Law No. 97-FZ dated June 29, 2012, Chapter 26.3 of the Tax Code of the Russian Federation is valid only until 2021, and the Government has already announced that it does not intend to extend it.

And in connection with the introduction of mandatory labeling of goods (medicines, shoes, clothing and other products made from natural fur) from 01/01/202, retail sellers of these goods are prohibited from using the single tax regime on imputed income. Amendments were made to the Tax Code of the Russian Federation FZ-325 dated September 29, 2019, which was adopted by the State Duma of the Russian Federation and signed by the President.

Declaration when closing an individual entrepreneur on the simplified tax system

But there is no need to wait until the end of the current year. In accordance with paragraph 3 of Article 55 of the Tax Code of the Russian Federation, the last tax period at closing will be considered the year from January 1 to the date of deregistration. Thus, a declaration of the simplified tax system when closing an individual entrepreneur in 2020 can be submitted immediately after making an entry in the register about the deregistration of the entrepreneur and up to April 30, 2021. At the same time, it is necessary to pay tax for the year (clause 7 of Article 346.21 of the Tax Code of the Russian Federation).

When to pay pension contributions

The deadline for paying these contributions is specified in paragraph 5 of Article 432 of the Tax Code of the Russian Federation - no later than 15 days (calendar) from the date of deregistration. From the next day, penalties will be charged. However, there is an important nuance. You can claim a deduction only for the amount of deductions that were paid before the day of deregistration (letter of the Ministry of Finance of Russia dated August 27, 2015 No. 03-11-11/49540).

The order in which you fill it out is also important. Since the total number of sheets is indicated on the “title sheet”, it is filled out as a final sheet. You should start with the second section, then move on to the third, and only then to the first .

- Two or more points on UTII + 1 type of activity + the same OKTMO = submit 1 declaration, and sum up the physical indicators.

- 2 or more points on UTII + 1 type of activity + different OKTMO = submit the declaration to separate inspectorates for each education.

- 2 or more points + 1 subordinate inspection + different types of activities = 1 declaration with several third sections.

- Several types of work + different subordinate inspections = a declaration for each.

Second section

The last 2 points are closely related to the innovations that the tax system itself has undergone. The wish of all individual entrepreneurs who worked without staff has been fulfilled - now they are allowed to reduce the tax on contributions for themselves. And the contributions themselves have been transferred under the jurisdiction of the FSN : the Pension Fund and the Compulsory Medical Insurance Fund no longer have anything to do with them.

The individual entrepreneur brings the desired results, and then the individual decides to stop running the business. If for some reason an individual entrepreneur has decided to liquidate, in order to completely close it he must go through the appropriate procedure, in accordance with the Federal Law “On State Registration of Legal Entities and Individual Entrepreneurs” and the Civil Code of the Russian Federation.

Closing without employees

Closing a business without employees is much easier than with staff: the entrepreneur does not need to warn anyone and submit numerous certificates related to employees.

The procedure is the same as for standard closing. The only difference is that the decision to liquidate can be implemented immediately, rather than waiting for the 2 months allotted to warn employees about imminent dismissal.

Example of UTII declaration 2021 closing individual entrepreneur

Page 040 is calculated by subtracting line 030 from line 010, i.e. line 040 = line 010 - line 030. For our example - 20,389 - 21,000 = 0. Thus, we see that the amount of tax paid is equal to zero, and only contributions to the PRF are paid for the period.

Rules for filling out the UTII declaration in 2021 for individual entrepreneurs

- Correction number – when submitting the primary declaration, indicate 0; if an updated declaration is submitted, then corrective number 1, 2, etc.;

- Tax period – code of the tax period for which the declaration is submitted:

- 21 - for the first quarter;

- 22 - for the second quarter;

- 23 - for the third quarter;

- 24 - for the fourth quarter.

- Reporting year – indicates the year for which the declaration is submitted;

- INFS code at the place of registration as a UTII payer;

- Code by place of registration - the value is selected depending on the place of registration as a UTII payer. If this is the Federal Tax Service Inspectorate at the place of business, then LLCs choose code 310, individual entrepreneurs - 320.

The deadline for submission is the 20th. For 2021 this is: Quarter number Deadline date First April 20 Second July 20 Third October 20 Fourth (annual reporting) January 20, 2021 If you have a small staff, no more than 25 people, submit the declaration in any way convenient for you:

The article will be of interest to entrepreneurs “on income” and “income minus expenses”. When filling out the form by hand, use only blue, purple or black ink; cost indicators must be indicated in full rubles; text and numeric fields are filled in from left to right in capital block letters; put dashes in empty cells; sheets must be numbered, starting with the title page;

Declaration of UTII when closing an individual entrepreneur in 2021 sample

In any case, it is necessary to responsibly approach the issue of closing your own individual entrepreneur. This process is accompanied by the submission of reports to the tax office and the repayment of existing debt. You need to pay off your debts with: The Tax Service (for unpaid UTII); Off-budget funds (pension and health insurance); Banks (for existing loans);

How to fill out a UTII declaration, sample form for individual entrepreneurs and LLCs in 2021

A simplified liquidation declaration is submitted to the Federal Tax Service no later than the 25th day of the month following the month in which information about the termination of the activities of an individual entrepreneur was entered into the Unified State Register of Individual Entrepreneurs (). The tax return form for taxes paid under the simplified tax system, as well as the procedure for filling it out, have been approved.

When carrying out such types of activities, organizations report on UTII to the Federal Tax Service at their location, and individual entrepreneurs - at their place of residence. If a businessman has several points and/or types of activities on UTII, then the declaration is submitted according to the following rules:

This may happen due to further reluctance to engage in business and joining the ranks of hired workers. You need to pay off your debts with: The Tax Service (for unpaid UTII); Off-budget funds (pension and health insurance); Banks (for existing loans);

Tax return for UTII in 2020-2020, detailed instructions for filling out

Since 2021, entrepreneurs have been faced with a choice - do not change anything or register as self-employed (if the law allows) and pay tax on professional income. In the second case, it is not necessary to close the individual entrepreneur itself, but many businessmen still chose to fill out a simplified taxation system declaration when closing the individual entrepreneur. We tell you how to do this, since the Tax Code of the Russian Federation only partially regulates this issue.

The title page of the “liquidation” declaration of an individual entrepreneur on the simplified tax system. For entrepreneurs, the legislation does not provide for separate deadlines for submitting a declaration upon deregistration, as, for example, for simplifiers. Depending on the quarter for which the “liquidation” declaration is submitted, the following tax period codes are indicated on the Title Page: 51 – when

UTII declaration calculator when closing IP 2021

According to it, it must be submitted before the 25th day of the month following the month in which the entrepreneur’s activities ceased. For example, if the Unified State Register of Entrepreneurs contains information about the termination of the entrepreneur’s activities from 06/05/2017, then the last declaration must be submitted on July 25, 2021.

Liquidation declaration when closing an individual entrepreneur

The declaration is submitted at the actual place of business activity. The UTII declaration in 2021 for individual entrepreneurs must be submitted within the following deadlines: before January 20, 2021 - for the fourth quarter of 2021; until April 20, 2021 - for the first quarter of 2021; until July 20, 2021 - for the second quarter of 2021; until October 20, 2020 - for III

Rules for filling out a declaration when closing an individual entrepreneur. or fill out online

In this article we will talk about the features of filling out a declaration by an individual entrepreneur who has expanded his activities.

A declaration under the simplified tax system upon termination of activity is submitted no later than the 25th day of the month following the month in which the activity was terminated. That is, if the activity was completed in September 2021 (no matter what date), then reporting must be submitted by October 25, 2021. This is stated in paragraph 2 of Art. 346.23 Tax Code of the Russian Federation. Please note that the Code states that the date is determined by notification (clause 8 of Article 346.13 of the Tax Code of the Russian Federation).

But when an organization is liquidated or an individual entrepreneur is closed, this notification is not issued. This is confirmed by letter No. GD-4-3/ [email protected] dated August 4, 2014, which states that the exclusion of a taxpayer from the Unified State Register of Individual Entrepreneurs or the Unified State Register of Legal Entities automatically terminates the special regime. Based on this document, we can conclude that the deadline for filing the declaration is determined by the established date for current activities - April 30 (this is stated in the letter of the Ministry of Finance of the Russian Federation dated No. SD-3-3/1530 on April 8, 2021).

The legislation has not yet regulated the issue of when reporting must be submitted - before April 30 or before the 25th day of the month following the termination of activity. Therefore, to avoid penalties, we advise you to use the shortest possible period.

In case of closure of an individual entrepreneur, the same declaration is submitted as for annual reporting - forms according to KND 1152017. The form of the declaration, as well as the procedure for filling it out, is regulated in the order of the Federal Tax Service No. ММВ-7-3 / [email protected] dated February 26, 2021 . Over the subsequent years, the procedure for filling out and the declaration form have not changed, so reporting must be submitted in accordance with this document.

The rules for filling out a document in the event of termination of activity are similar to the rules used when preparing annual reports. But there are several differences:

- The tax period code is not 34, as in annual reporting, but 50;

- since the individual entrepreneur ceased operations before the end of the year, there will be dashes in those reporting periods that were not completed.

- Insurance premiums paid after the date of termination of activity are not taken into account.

Let's consider filling out a declaration on the occasion of termination of the activities of an individual entrepreneur. This sample was generated automatically using the form located in the left column of the site.

Initial data to fill:

IP Vosmerkin Nikodim Panteleevich.

The date of entry into the Unified State Register of Entrepreneurs about the termination of activities is 08/13/2019.

Income received in the 1st quarter - 454,551 rubles, in the 2nd quarter - 333,211 rubles, in the 3rd quarter - 123,041 rubles. Nikodim Panteleevich received income in the 3rd quarter before the closing date of the individual entrepreneur. They will not be reflected in the line of the reporting period “9 months”, but will be transferred to the line “Tax period”.

Contributions to the Pension Fund and the Federal Compulsory Medical Insurance Fund in the 1st quarter - 9059.5 rubles, in the 2nd quarter - 9059.5 rubles. The entrepreneur paid the remaining amount in the 3rd quarter (you can calculate it using our individual entrepreneur insurance premium calculator), but since this amount was paid after the date of termination of activity, it is not taken into account in the calculations.

Individual entrepreneur is a payer of trade tax, paid in the 1st quarter - 3433 rubles, in the 2nd quarter - 3323 rubles. In the 3rd quarter, the trade tax debt was paid, but since this amount was paid after the date of termination of activity, it is not taken into account in the declaration.

We fill out the form fields using the original data, check the “Generate declaration for printing” checkbox, and fill out “Data for the title page”.

Click the “Calculate” button and download the finished declaration using the link that appears. Despite the fact that the entrepreneur “closed” in August, there were dashes in the lines of the document for the reporting period of 9 months.

As already mentioned, when terminating the activities of an individual entrepreneur, the tax period is considered to be the period from January 1 to the date of closure of the individual entrepreneur, so there is simply no reporting period of 9 months in our example.

You can download this sample declaration when closing an individual entrepreneur in PDF format with calculations and explanations.

Tax payable

The tax is calculated by multiplying the base for the quarter by a rate of 15%. The amount to be transferred to the budget is reduced to 50% by the amount of insurance premiums (paid in the tax period), contributions under DLS (voluntary personal insurance) agreements in favor of employees and sick leave paid from the entrepreneur’s funds. Individual entrepreneurs without employees can completely reduce the tax on the amount of insurance premiums paid “for themselves.” This information is reflected in Section 3 of the declaration.

The total amount to be paid is transferred to Section 1 of the report.

Reasons for closing an individual entrepreneur on UTII

The legislation regulates the probable reasons for the closure of individual entrepreneurs, defining separate codes for the grounds for terminating the functioning of a business. To terminate a business, you will need to indicate what caused such a decision. This may be the end of the entrepreneur’s activities or a transition to another area of business or the formation of a legal entity and so on.

Regardless of the chosen reason for liquidation, you will have to interact with the tax service. One of the reporting methods is a declaration, which may change in case of closure.

What to do after liquidation

Any individual must remember that even after the closure of an individual entrepreneur, a person is not exempt from paying all taxes, insurance premiums and debt obligations that arose while running a business.

If the individual entrepreneur had a seal, then it is not subject to mandatory destruction. After all, you can use it when opening a new individual entrepreneur. And you can open a new business the next day after closing. Documents that were generated during the activities of the individual entrepreneur must be stored for 4 years.

What documents need to be provided to the tax authorities?

An entrepreneur must approach this issue carefully, since contacting the wrong tax service leads to problems, since the authority has not received the necessary papers. The requirements for an entrepreneur during liquidation establish that documentation can only be submitted to the governing body that opened the registration.

Important! You can close an individual entrepreneur only where it was opened. If you send the documentation to the wrong department, the procedure will not be completed.

Upon closing, the entrepreneur must send to the tax office a package of the following documents:

- application requesting closure;

- liquidation declaration;

- confirmation of absence of debts to funds;

- check or receipt confirming payment of state duty.

There are four ways to submit documents:

- in person - the entrepreneur contacts the tax office, hands over a package of documents to the inspector, who accepts it exclusively against his signature, after which the official must wait within 5 days to receive a response letter indicating confirmation of the closure of the individual entrepreneur;

- online - for this you need to visit the official website of the Federal Tax Service, where all the necessary papers are uploaded through a special form, certification is carried out using an electronic signature;

- by mail - the tax service only accepts for processing documents sent by registered mail with notification, and for the sender there is an additional important nuance - all papers must be certified by a notary, after which an inventory is drawn up;

- through a proxy - a notarized power of attorney and a representative’s passport are added to the list of documents.

Important! If the package of papers was sent by mail, the day of submission will be the date the letter was accepted by the tax service.

How to fill out a declaration when closing an individual entrepreneur on UTII

When preparing a report, all data must be entered from right to left. If a cell does not need to be filled in, a dash must be placed to mark the absence of information. If the indicator is not an integer, it must be rounded to a whole number in accordance with mathematical rules (if the remainder is 4 or less, one is not added, if the remainder is 5 or more, one is added). Each report has a number of requirements:

- pen color - black or blue;

- The tax period code must be specified accurately;

- filled in block letters;

- Only capital letters are used;

- pages are numbered as 001, 002, …;

- the first page must contain the date and signature of the entrepreneur;

- a seal impression is required only if it is on the title page.

The report is drawn up strictly on A4 sheets, on which only one side is filled out. The declaration does not convey information regarding fines and penalties. If an error was made, the sheet must be completely rewritten, since the report will not be accepted with corrections or erasures.

Example of filling out a form

Filling out the form when closing an individual entrepreneur is no different from other cases. It is only necessary to take into account the need to specify a special code for transmitting information about the termination of activities.

Declaration of UTII upon liquidation of an individual entrepreneur, example of filling:

For all forms of taxation, a single form is used, on which the necessary information for the Federal Tax Service will be indicated.

Penalties

Even when liquidating an individual entrepreneur, do not forget that there are penalties for failure to submit reports.

| Violation | Amount of sanctions |

| In case of late submission of reports but payment of UTII | 1 thousand rubles |

| In the absence of a report and non-payment of tax | 5% of the tax amount, and for each month of delay, even if it is incomplete. Penalties are accrued from the time required for submitting the report, but cannot exceed 30% and cannot be less than 1 thousand rubles. |

What tax period should I indicate?

The tax office divides the entire year into four equal quarters. For each of them, the entrepreneur is required to prepare and send reports. The code must be indicated in all declarations.

Note! The exact figures for each period are determined by order of the Federal Tax Service of the Russian Federation No. ММВ-703/353.

The individual entrepreneur liquidation code in the UTII declaration can be determined in accordance with this table:

| Code | Quarter |

| 21 | 1 |

| 22 | 2 |

| 23 | 3 |

| 24 | 4 |

| 51 | 1 upon liquidation |

| 52 | 2 upon liquidation |

| 53 | 3 upon liquidation |

| 54 | 4 upon liquidation |

The tax period when closing an individual entrepreneur's UTII is an important condition when filing a declaration. There are two reasons for this:

- The tax period is the start of the countdown for the need to send a declaration.

- Necessary for organizing reporting in accordance with strict tax filing and payment deadlines. If the closure of an enterprise occurs during the tax period, then only those months when the individual entrepreneur worked will be taken into account.

It is also necessary to indicate the code when deregistering a company. It depends on the reason for closing the individual entrepreneur:

- 0—liquidation;

- 1 - transformation;

- 2 - merger;

- 3 - separation;

- 5 - connection;

- 6 - simultaneous division and accession.

Zero declaration

Many businessmen are interested in the question of whether it is possible to submit a UTII declaration when closing an individual entrepreneur with a liquidation code and a zero result. No, you can't do that. Do not forget that the amount of imputed tax is calculated by the state and in no way depends on the income that the entrepreneur actually received during the reporting period. Therefore, even if there was no profit, you will have to pay tax. Even if the entrepreneur has truly exculpatory factors, a fire occurred or the store was robbed, it is impossible to submit a zero declaration. Simply put, there is only one point of view of the regulatory authorities: if you run a business, pay tax; if you don’t, get deregistered.

Closing an individual entrepreneur on UTII before the end of the reporting period

An individual entrepreneur has no obstacles to complete his activities before filing a tax return. Problems can only arise due to issues related to the amount of funds paid to the Federal Tax Service. After all, if liquidation occurs after 20 days, there is no reason to pay the full tax quarter of 90 days.

In order to preserve entrepreneurs' funds, a special mechanism was created that is used when submitting final reports. UTII is a form of taxation when the amount of tax is determined not depending on income and expenses. The amount is fixed in advance and sent to the Federal Tax Service on time. Therefore, the fact of work will not matter when drawing up the last declaration. The basis for charging a fixed amount is the status of an individual entrepreneur.

The tax amount is determined on the basis of several indicators and coefficients fixed at the state or municipal level. To more correctly determine the amount of tax, there are physical indicators for determining the size of a business in numbers. Depends on the number of employees, area in sq.m. and other indicators. When an employer lets go of all employees, sells equipment and premises, then its physical indicator will be 0. This figure must be indicated in the declaration in the appropriate field.