Income tax: OSAGO

Expenses for compulsory motor liability insurance when calculating income tax are included in other expenses associated with production and sales (clause 2 of article 263 of the Tax Code of the Russian Federation).

Situation: is it necessary to include the costs of compulsory motor liability insurance in accounting and taxation in the initial cost of a car?

No no need.

The costs of compulsory motor third party liability insurance are not included in the initial cost of the car. They should be written off as current expenses. The basis is clause 11 of PBU 10/99 and article 263 of the Tax Code of the Russian Federation.

It does not matter that a car without an MTPL policy will not be registered with the traffic police and it will not be able to pass technical inspection (clause 2 of article 4, clause 1 of article 32 of the Law of April 25, 2002 No. 40-FZ). This does not change the essence of insurance costs. After all, in the future you will still need to obtain an MTPL policy every year and pay insurance premiums. And this has nothing to do with car registration. Thus, the costs of compulsory motor liability insurance are not directly related to the purchase of a car. Therefore, they do not need to be included in its initial cost.

A similar point of view is reflected in the letter of the Federal Tax Service of Russia for Moscow dated March 2, 2006 No. 20-12/16322.

Recognition of VHI expenses in accounting and tax accounting

Voluntary health insurance for employees is not only part of the so-called “social package”, which indirectly indicates the well-being of the employer, but also one of the components of labor costs.

Subclause 16 of Article 255 of the Tax Code of the Russian Federation provides for certain conditions under which VHI insurance premiums are recognized as expenses:

- a contract of voluntary personal insurance for employees, providing for payment by insurers of medical expenses of insured employees, must be concluded for a period of at least one year;

- the insurance organization must have a license issued in accordance with the legislation of the Russian Federation to conduct the relevant type of activity;

- expenses for voluntary health insurance are recognized within a standard not exceeding 6 percent of the amount of labor costs. When calculating the standard, labor costs do not include the amounts of payments (contributions) provided for in subparagraph 16 of Article 255 of the Tax Code of the Russian Federation.

It does not matter whether the employee has one or more insurance policies from different companies covering different types of services.

The main thing is to take into account the maximum threshold for labor costs (letter of the Ministry of Finance of Russia dated July 29, 2013 No. 03-03-06/1/30023). The calculation of the standard also includes the expenses of employers under contracts for the provision of medical services concluded in favor of employees for a period of at least one year with medical organizations that have appropriate licenses to carry out medical activities.

The standard should be calculated based on the amount of labor costs for all employees of the organization, and not just the insured persons. The calculation also includes remuneration to individuals working under civil contracts (clause 21 of Article 255 of the Tax Code of the Russian Federation, letters of the Ministry of Finance of Russia dated 04.06.2008 No. 03-03-06/2–65, Federal Tax Service for Moscow dated 28.02 .2007 No. 28–11/018463.2). The basis for calculating the maximum amount of expenses for voluntary health insurance is determined by the cumulative total from the beginning of the tax period (clause 3 of article 318 of the Tax Code of the Russian Federation). If the insurance contract covers several tax periods, then the base is determined (letters from the Federal Tax Service in Moscow dated 05/06/2010 No. 16-15-/ [email protected] and dated 08/22/2008 No. 21–11/ [email protected] ):

- on a cumulative basis starting from the date of entry into force of the insurance contract within the tax period to which it relates;

- from the next tax period until the end of the insurance contract.

VHI expenses are recognized in tax accounting no earlier than the reporting (tax) period in which the insurance premium is transferred under the terms of the contract.

Expenses are recognized evenly over the term of the agreement in proportion to the number of calendar days of the agreement in the corresponding reporting (tax) period (clause 6 of Article 272 of the Tax Code of the Russian Federation, letters of the Ministry of Finance of Russia dated May 14, 2012 No. 03-03-06/1/244 and No. 03-03-06/1/245). Amounts transferred under voluntary health insurance agreements are not subject to personal income tax (clause 3 of article 213 of the Tax Code of the Russian Federation), and are also not subject to insurance premiums for a contract period of at least a year (clause 5 of part 1 of article 9 of the Federal Law of July 24, 2009 No. 212-FZ, paragraph 5, clause 1, article 20.2 of the Federal Law of July 24, 1998 No. 125-FZ).

In accounting, expenses for voluntary medical insurance of employees are included in expenses during the period to which they relate (clause 65 of the Regulations on accounting and financial reporting in the Russian Federation, approved by order of the Ministry of Finance of Russia dated July 29, 1998 No. 34n; clause. 18 Accounting Regulations “Organization Expenses” PBU 10/99, approved by order of the Ministry of Finance of Russia dated 05/06/1999 No. 33n, hereinafter referred to as PBU 10/99; clause 5 Accounting Regulations “Accounting Policy” PBU 1/2008, approved by order of the Ministry of Finance of Russia dated October 6, 2008 No. 106n, hereinafter referred to as PBU 1/2008).

VHI payments are reflected in the debit of cost accounts (for example, account 20 “Main production”, account 26 “General business expenses”, 44 “Sales expenses”). If an organization transferred insurance premiums for persons who are not in an employment relationship with it, then in this case the expenses are recognized as other for the organization and are reflected in the debit of subaccount 91.02 “Other expenses” (clause 11 of PBU 10/99).

Unlike tax accounting, in which expenses for voluntary health insurance are standardized, in accounting such expenses are recognized without restrictions. If differences arise, they should be reflected in accounting in accordance with the Accounting Regulations “Accounting for income tax calculations” PBU 18/02, approved. by order of the Ministry of Finance of Russia dated November 19, 2002 No. 114n (hereinafter referred to as PBU 18/02).

In “1C: Accounting 8” edition 3.0, to reflect settlements for property and personnel insurance (except for settlements for social insurance and compulsory medical insurance), in relation to which the organization acts as an insurer, account 76.01 “Settlements for property, personal and voluntary insurance” is intended. . Second level subaccounts have been opened to the account:

- 76.01.1 “Calculations for property and personal insurance”;

- 76.01.2 “Payments (contributions) for voluntary insurance in case of death and personal injury”;

- 76.01.9 “Payments (contributions) for other types of insurance.”

Transport tax and declaration

At the end of the year, at the close of the month, the transport tax will be automatically calculated.

The posting Dt 26 Kt 68.07 will be created.

Transport tax is calculated as follows: Number of horsepower * Tax rate = 97 hp. * 12 rub. = 1164 rub.

Next you need to submit a Transport Tax Declaration.

To do this, in the list of regulated reports, we will create the report “Declaration of transport tax (annual)”.

The report is filled out automatically by clicking the “Fill” button.

In section 1, the total tax amount for all vehicles is filled in.

Section 2 provides a breakdown for each car.

One-time payment of insurance premium

Let's consider an example in which an organization transfers a one-time insurance premium to the insurer in favor of employees, after which insurance premiums for VHI are taken into account automatically in accordance with the requirements of PBU 10/99 and Article 272 of the Tax Code of the Russian Federation. Example 1

The organization Andromeda LLC (applies the general taxation system, provisions of PBU 18/02) entered into a voluntary health insurance agreement for the provision of medical services in favor of its employees with an insurance company licensed to conduct the corresponding type of activity in the Russian Federation. The agreement was concluded for a period of 1 year - from 01/01/2015 to 12/31/2015 and came into force on 01/01/2015. The amount of the insurance premium is RUB 480,000.00. The insurance premium was paid in a lump sum in December 2014. During the year, the number of insured persons specified in the contract does not change. In accordance with the accounting policy of Andromeda LLC, expenses for voluntary health insurance are fully classified as indirect expenses. General operating expenses are included in cost of sales (“direct costing”). Labor costs for calculating the standard for the purpose of recognizing VHI expenses are presented in Table 1.

Table 1 Labor costs for 2015

| No. | Month of 2015 | Labor costs for the period, thousand rubles. | Cumulative labor costs from the beginning of the tax period, thousand rubles. |

| 1 | January | 300 | 300 |

| 2 | February | 297 | 597 |

| 3 | March | 300 | 897 |

| 4 | April | 686 | 1 583 |

| 5 | May | 555 | 2 138 |

| 6 | June | 670 | 2 808 |

| 7 | July | 710 | 3 518 |

| 8 | August | 710 | 4 228 |

| 9 | September | 790 | 5 018 |

| 10 | October | 790 | 5 808 |

| 11 | November | 730 | 6 538 |

| 12 | December | 730 | 7 268 |

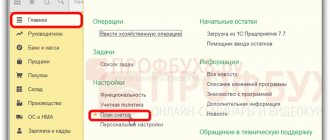

To register a one-time payment of an insurance premium under a VHI agreement in “1C: Accounting 8” edition 3.0, you need to create a standard accounting system document Write-off from a current account (section Bank and cash desk -> Bank statements). The document can be generated manually or based on the Payment order document. When using the 1C: DirectBank service, the document is downloaded automatically. Let us remind you that this service allows you to exchange documents with banks directly, without the Client-Bank program.*

Note:

In the 1C: Accounting 8 program, edition 3.0, you can connect the 1C: DirectBank service using an electronic signature (ES); without using an electronic signature, using a login and password; for an external component, as well as send a payment order to the bank and receive an electronic statement in each case. All information is available under the DirectBank tag. 1C experts' answers to questions include videos with a step-by-step description of the sequence of actions.

In order for the amounts paid to be recognized evenly in accordance with paragraph 6 of Article 272 of the Tax Code of the Russian Federation, the program should use the mechanism of deferred expenses. This mechanism is supported both on account 97 “Deferred Expenses” and on subaccounts 76.01.2 and 76.01.9 using the subaccount Deferred Expenses.

If the user wants to keep additional analytical records for insured employees, then account 76.01.2 can be used. In this case, the amount of the insurance premium must be indicated for each employee in accordance with the list attached to the VHI agreement, and the number of documents Write-off from the current account must correspond to the number of insured employees - one document for each employee. We indicate in the document Write-off from the current account the following details (Fig. 1):

Rice. 1. Payment of insurance premium

| Field | Data |

| "Type of operation" | Other write-offs |

| "Debit account" | Account 76.01.9 |

| "Recipient" and "Counterparties" | Name of the insurance company from the Contractors directory |

| "Future expenses" | You need to go to the directory of the same name and enter information on the corresponding type of expense (Fig. 2). The Amount field can be left blank, since the sum of balances according to accounting and tax accounting data is used to write off future expenses. In the Cost Items field, you must indicate the corresponding item from the directory. In the form of the directory element Expense Items, the Expense Type attribute must take the value Voluntary personal insurance, which provides for the payment of medical expenses by insurers |

| "Subdivision" | The corresponding division from the directory of the same name. If accounting for VHI expenses is kept by department, then you need to create several documents Write-off from the current account indicating the relevant departments |

Rice. 2. Form of the directory element “Future expenses” After posting the document Write-off from the current account, the following posting will be generated:

Debit 76.01.9 Credit 51

- the amount of the lump sum insurance premium paid to the insurer.

For tax accounting purposes for income tax, the corresponding amount is also recorded in the resource Amount NU Dt 76.01.9 .

Thus, the lump sum paid to the insurer is taken into account as part of the receivables of Andromeda LLC, and the insurance premium will be included in expenses for accounting and tax purposes during the term of the insurance contract.

In “1C: Accounting 8”, automatic calculation of VHI expenses is carried out in three stages during the monthly processing process. Closing the month:

- at the first stage - when performing the routine operation Write-off of deferred expenses, part of the insurance premium is written off to cost accounts in accordance with the write-off parameters established in the form of the directory element Deferred expenses;

- at the second stage - when performing a regulatory operation Calculation of shares of write-off of indirect expenses, the maximum amount of expenses for voluntary health insurance to be included in expenses is calculated;

- at the third stage - when performing the routine operation Closing accounts 20, 23, 25, 26 or Closing account 44 “Distribution costs”, the costs of voluntary health insurance reflected in the cost accounts are written off in accordance with the accounting policies of the organization. At the same time, expenses related to the current month for voluntary medical insurance are recognized in full in accounting, and in tax accounting - within the limits of the standard calculated in accordance with paragraph 3 of Article 318 of the Tax Code of the Russian Federation.

Let's consider all the stages of automatic calculation of VHI expenses for Example 1, completed in January 2015.

The regulatory operation Write-off of deferred expenses determines the part of the insurance premium that could potentially be recognized as expenses: RUB 480,000.00. / 365 days x 31 days = RUB 40,767.12

It is this amount that is entered into the accounting register entry by posting:

Debit 26 Credit 76.01.9.

Also, for income tax purposes, an entry is entered in the resources Amount of NU Dt and Amount of NU Kt .

Figure 3 shows the Certificate of calculation of write-off of deferred expenses for January 2015.

Rice. 3. Certificate-calculation of write-off of deferred expenses

Using the routine operation Calculation of shares of write-off of indirect expenses, the standard for expenses on voluntary health insurance is calculated:

RUB 300,000.00 x 6% = RUB 18,000.00

The document does not generate accounting entries, but the corresponding entries are entered into the information registers Shares of write-off of indirect expenses and Calculation of standardization of expenses. Figure 4 shows the Help-calculation of cost rationing for January 2015.

Rice. 4. Certificate-calculation of rationing costs for VHI for January 2015

By routine operation Closing accounts 20, 23, 25, 26, VHI expenses are written off by posting:

Debit 90.08.1 Credit 26

— in the amount of 40,767.12 rubles.

Amounts are also entered into special resources of the accounting register intended for income tax accounting:

Amount NU Dt 90.08.1 and Amount NU Kt 26

— for the amount of expenses within the standard (RUB 18,000);

Amount PR Dt 90.08.1 and Amount PR Kt 26

- for a permanent difference (RUB 22,767.12).

After completing the regulatory operation Calculation of income tax, a permanent tax liability (PNO) in the amount of RUB 4,553.42 will be recognized. Also, VHI expenses will be calculated monthly until the end of the contract. So, in February 2015:

- part of the insurance premium written off from the account on 01/76/9—RUB 36,821.92. (RUB 439,232.88 / 334 days x 28 days);

- the standard cost for voluntary health insurance is RUB 17,820.00. (RUB 597,000.00 x 6% - RUB 18,000.00);

- expenses for voluntary health insurance in tax accounting amount to 17,820.00 rubles, which creates a constant difference in the amount of 19,001.92 rubles.

In December 2015, the lump sum of the insurance premium paid is completely written off from account 76.01.9, and the maximum amount of expenses for voluntary health insurance for the tax period (for 2015) is determined as 436,080.00 rubles. (RUB 7,268,000.00 x 6%). It is this amount that will be included in the indirect expenses reflected in line 040 of Appendix No. 2 to Sheet 02 of the income tax return (approved by order of the Federal Tax Service of Russia dated November 26, 2014 No. ММВ-7-3 / [ email protected] ). IS 1C: ITS For more information on accounting for VHI expenses in the 1C: Accounting 8 program (rev. 3.0), see the Directory of Business Transactions. 1C: Accounting 8" in the section "Accounting and tax accounting" - without exceeding the standard and with exceeding the standard of expenses.

Buying a car

To reflect the purchase of a car, we will create a document “Receipts (acts, invoices)”, type of operation “Equipment”.

On the “Equipment” tab we will indicate the Renault Logan car and its cost of 500,000 rubles.

We will also register an invoice.

Let's look at the document postings.

The cost of the car is collected on the account on 08.04.1.

Accounting for civil liability insurance (CLI)

SGO provides for one of the types of insurance of property interests under Article 929 of the Civil Code of the Russian Federation, and implies:

- Liability insurance for damage caused;

- Liability insurance according to contract. insurance.

Costs for OSI and DSI must be recorded in expenses for R&D or other expenses, but within the limits of ST (insurance tariffs) approved by law. If they are not approved, then the funds spent on the OSI must be included as actual costs (FZ) in the PR.

Accounting for construction and installation risks

Violations, even minor ones, in the construction industry can cause the collapse of elements and even the entire building. To reduce the cost of their restoration, contract agreements are being built. installation risks (DS, construction and installation works). For the contracting firm, costs are the costs of the work performed under the agreement. Construction and installation work insurance is carried out as a police department.

Example 3. An enterprise transfers money to the insurer under an agreement drawn up for a year, then the funds are included in the RBP, and then for the period of validity of the insurance policy they must be written off as expenses.