Introductory information

One of the conditions that the legislator requires to be included in the accounting policy for income tax purposes is the procedure for classifying expenses as direct and indirect (Article 318 of the Tax Code of the Russian Federation). And there is no need to treat this requirement formally. Correctly consolidating this procedure is important because it directly affects the amount of tax paid. After all, indirect costs can be taken into account in full during the period of their implementation. Direct payments are recognized as products, works, and services are sold, in the cost of which they are taken into account. It is clear that tax officials are closely monitoring this distribution in order to prevent an arbitrary reduction in the amount of tax transferred to the budget (by overestimating indirect costs). Therefore, the taxpayer must clearly understand which expenses (and, most importantly, why) he classified as indirect and which as direct. You can clearly state your position on this issue in your accounting policy.

Who splits the costs?

First, let’s decide who should think about allocating expenses. Here we can immediately distinguish two categories of taxpayers for whom this section in the accounting policy is not relevant.

Firstly, the rules for allocating expenses into direct and indirect can only be used by those organizations that operate on the accrual basis. For taxpayers who determine income and expenses on a cash basis, expenses are not divided into direct and indirect, so the corresponding section in the accounting policy is simply not needed.

Secondly, such a division is not relevant for organizations that provide services. They have the right to take into account all expenses during the period of their incurrence (clause 2 of Article 318 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated June 15, 2011 No. 03-03-06/1/348). That is, such taxpayers, in fact, have nothing to share - in fact, all their expenses are indirect.

All other taxpayers must distribute expenses into direct and indirect, fixing the procedure for such distribution in the accounting policy for income tax purposes. How to do this?

The Tax Code of the Russian Federation is not rules, but guidelines

Article 318 of the Tax Code of the Russian Federation lists the types of expenses that the legislator considers possible to be classified as direct.

According to Article 318 of the Tax Code of the Russian Federation, direct expenses may include, in particular:

- material expenses for the acquisition of raw materials, materials used in production or serving as a necessary component in the production of goods (works, services), as well as for the acquisition of components undergoing installation, semi-finished products undergoing additional processing in the organization.

- expenses for remuneration of personnel involved in the production of goods, performance of work, provision of services, as well as insurance payments accrued on such amounts;

- depreciation of fixed assets used in the production of goods, works, and services.

However, it is important for an accountant to know that this list is only a guideline. After all, the Code directly states “may be attributed, in particular.” Simply put, the taxpayer has the right to classify even the costs directly named in this list as indirect in his accounting policy. Conversely, any other costs not directly named in Article 318 of the Tax Code of the Russian Federation can be included in direct costs.

However, such “transfers” cannot be made arbitrarily. The classification of expenses as direct or indirect must be justified. This requirement is made by both the tax authorities (letter of the Federal Tax Service of Russia dated February 24, 2011 No. KE-4-3 / [email protected] ; see “Federal Tax Service: the distribution of direct and indirect expenses must be justified”), and the courts (see the definition of the Supreme Arbitration Court RF dated June 22, 2012 No. VAS-7511/12).

Solution

Significant costs for repairs and maintenance of fixed assets, carried out with a frequency exceeding 12 months (or the normal operating cycle, if it exceeds 12 months), are recognized in the accounting (financial) statements as part of non-current assets, as part of the indicator detailing the line “Fixed assets ", for example, "Long-term costs of repair and maintenance of fixed assets" (see Illustrative Example No. 1).

This norm applies to costs not associated with replacing parts of fixed assets (clause 8 of this Recommendation). In the case when parts are replaced during repair and maintenance, it is recommended to use a scheme for accounting for the partial liquidation of a fixed asset item. In particular, it is necessary to reduce the value of the fixed asset by the amount of the residual value of the retiring part and increase the value of the fixed asset by the amount of the costs of acquiring a new part, as well as by the amount of other associated costs (for example, the cost of installing this part) (see Illustrative example No. 3). The costs of replacing parts of fixed assets are included in the cost of fixed assets.

Costs for repairs and maintenance of fixed assets, carried out with the aim of restoring their useful properties and extending the possibilities of their operation in the future, carried out with a frequency of less than 12 months (or the normal operating cycle, if it exceeds 12 months), are recognized as current expenses of the period in which they were incurred.

Repair and maintenance costs, if they are insignificant individually or in aggregate, are recommended to be taken into account in the manner provided for in paragraph 9 of this Recommendation.

The procedure for reflecting the costs of repair and maintenance of fixed assets on accounting accounts is established by the economic entity independently.

How to justify indirect expenses

The letter from the Federal Tax Service of Russia mentioned above says: although Chapter 25 of the Tax Code of the Russian Federation does not limit the organization in classifying certain expenses as direct or indirect, from the provisions of Art. 252, 318 and 319 of the Tax Code of the Russian Federation it follows that this choice must be justified. The justification must be that indirect costs cannot be those associated with the production of goods (performance of work, provision of services).

In other words, the cost distribution mechanism must contain economically sound indicators determined by the technological process. It is possible to classify individual costs associated with the production of goods (works, services) as indirect only if there is no real possibility of classifying them as direct costs using economically sound indicators.

Representatives of the judiciary echo the tax authorities: by giving the taxpayer the opportunity to independently determine accounting policies, including the formation of the composition of direct expenses, Chapter 25 of the Tax Code of the Russian Federation does not consider this process as depending solely on the will of the organization. On the contrary, Art. 318 and art. 319 of the Tax Code of the Russian Federation classifies as direct costs only those costs that are directly related to the production of goods (performance of work, provision of services). Therefore, if it is impossible to attribute direct costs to a specific production process for the manufacture of a given type of product (work, service), then in the accounting policy it is necessary to determine the mechanism for their distribution using economically feasible indicators (see the definition of the Supreme Arbitration Court of the Russian Federation dated June 22, 2012 No. VAS-7511/12 ).

Amazing unanimity! But, unfortunately, no specifics. Therefore, let's look at specific examples of what the use of such “economically justified indicators” should look like in an accounting policy.

How to close account 20 in 1C 8.3

Let's consider whether in 1C 8.3 it is possible to implement automatic write-off of expenses from account 20 without taking into account revenue by item group.

A nomenclature group is a type of goods, works and services in 1C 8.3.

In the 1C 8.3 database there is a directory Nomenclature, where there is a group Products - these are the final products of the organization:

Or there is such a group as Services, which has its own services, that is, those services that are provided directly to customers:

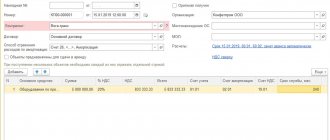

In 1C 8.3 there is a directory Nomenclature groups. Many 1C 8.3 users are confused about what they are needed for. It seems that there is a nomenclature that is inserted into the documents for implementation. But in 1C 8.3 there are item groups for which analytical accounting is maintained on account credit 90, that is, both the item and the item group are added to revenue. The debit of account 20 is accumulated specifically according to the item group:

In the previous version of the 1C 8.2 program, until the revenue passes through the item group, account 20 will not be closed. For this reason, problems arose with closing account 20 in 1C, because for some services there could either be no revenue or, for example, sales are carried out according to one item group, and costs are reflected on two lines.

In order to avoid difficulties with closing account 20, 1C developers introduced a parameter in the Accounting Policy settings to close account 20 without taking into account revenue. This setting must be used for work or services:

Thus, in 1C 8.3 the Accounting Policy provides options for closing account 20 for works and services at the end of the month:

- Excluding revenue;

- Including revenue;

- Including revenue from production services only.

Method of closing account 20 “Excluding proceeds from work” in 1C 8.3

In 1C 8.3, this method makes it easier to work with 20 counts. If in 1C 8.3 it is difficult to maintain the dependence of account 20 on the credit of account 90 and item groups, then this method is the most acceptable, and account 20 will be closed monthly.

According to this method, the debit of account 20 will be closed if there is no revenue on the credit of account 90 or the revenue comes from another item group, provided that the Accounting Policy specifies the method of closing account 20 - “Without taking into account revenue from work.”

Thus, all costs recorded on account 20 for work and services will be written off automatically in full in Dt 90 always at the end of the month. Regardless of whether the proceeds from loan 90 are reflected or not reflected.

In order to reflect “work in progress” using this method, in 1C 8.3 you need to enter the document “Inventory of work in progress”, then the debit of account 20 will be closed minus the amount of “work in progress”:

Method of closing account 20 “Taking into account proceeds from work” in 1C 8.3

If in 1C 8.3 the option for setting up the Accounting Policy “Taking into account revenue from work” is selected, then

- If revenue is reflected for a product group, then the costs recorded on account 20 for the same product group will be written off automatically for the entire amount in DT 90 when closing the month.

- If there was no revenue for the product group, then the costs will not be written off, but will remain as work in progress in the debit of account 20.

Thus, strict compliance is necessary so that the debit of account 20 reflects the costs of one item group and the revenue necessarily goes through this item group. If there is no revenue for the item group in the current month, then account 20 will not be closed and will be transferred as “unfinished” to the next month.

Method of closing account 20 “Taking into account revenue only from production services” in 1C 8.3

Production services in 1C 8.3 are introduced using the document “Provision of production services”. In this method:

- Revenue from works and services should be reflected only using the document “Provision of production services”.

- If revenue is reflected by product group using this document, then the costs recorded on account 20 for the same product group will be written off automatically for the entire amount in DT 90.02 at the end of the month.

- If there was no revenue for the item group or it was entered in the document “Sales of goods and services,” then the costs will not be written off, but will remain in the form of work in progress in the debit of account 20.

Thus, if there is a debit to account 20 for a certain item group, then in order for it to be closed, revenue must be reflected for the same item group on the credit of account 90.01 using the document “Provision of production services.” You cannot use other documents for the sale of goods and services, otherwise the account will not be closed.

Setting up accounting policy parameters for direct expenses in 1C is discussed in more detail in the course on working in 1C 8.3 Accounting ed. 3.0.

Give your rating to this article: (

17 ratings, average: 3.76 out of 5)

Registered users have access to more than 300 video lessons on working in 1C: Accounting 8, 1C: ZUP

Registered users have access to more than 300 video lessons on working in 1C: Accounting 8, 1C: ZUP

I am already registered

After registering, you will receive a link to the specified address to watch more than 300 video lessons on working in 1C: Accounting 8, 1C: ZUP 8 (free)

By submitting this form, you agree to the Privacy Policy and consent to the processing of personal data

Login to your account

Forgot your password?

Depreciation on real estate

The situation with premises is somewhat more complicated. After all, often both production and non-production facilities are located in the same building. The Tax Code does not allow dividing the depreciation of a single object. This means that the company needs to clearly decide whether such costs are classified as direct or indirect.

This can be done through economic analysis. It is necessary to look at how much (as a percentage) of the area is occupied by production facilities, and how much by non-production facilities. If it turns out that the production space clearly takes up less than half, then the amount of depreciation for the entire premises can be considered indirect costs (see the decision of the Supreme Arbitration Court of the Russian Federation dated 08.16.12 No. VAS-9792/12, where the judges recognized the inclusion of depreciation for the building in indirect costs as legal , where production equipment occupied no more than 30-50% of the premises area).

At the same time, we recommend that in the accounting policy not only the fact that these costs are classified as indirect, but also the main points of the calculations. This can be done, for example, in an annex to the accounting policy. In the event of a dispute, the accountant will not have to re-prepare the evidence - it will always be at hand.

Salary

As already mentioned, in any organization there are personnel who are not directly involved in the production of products. At the same time, Article 318 of the Tax Code of the Russian Federation lists labor costs and the amount of insurance premiums for compulsory insurance as direct expenses. But in relation to management personnel, the taxpayer has the right to recognize such costs as indirect (see letter of the Ministry of Finance of Russia dated September 20, 2011 No. 03-03-06/1/578). In particular, indirect costs may include the cost of remuneration for the manager, employees of the accounting department, financial and personnel services. Thus, the cost of paying non-production personnel, including the amount of insurance premiums, can be taken into account as expenses at a time. The only condition for this is the inclusion of the corresponding clause (on classifying these expenses as indirect) in the accounting policy of the organization.

Basis for conclusions

Paragraph 27 of PBU 6/01, establishing the need to reflect the costs of restoring fixed assets in the reporting period to which they relate, does not disclose the procedure for such reflection (with the exception of reconstruction and modernization).

Clause 14 of PBU 6/01 provides that “the cost of fixed assets in which they are accepted for accounting is not subject to change, except in cases established by this and other accounting provisions (standards).

Changes in the initial cost of fixed assets, in which they are accepted for accounting, are allowed in cases of completion, additional equipment, reconstruction, modernization, partial liquidation and revaluation of fixed assets.”

Article 3 of Law 402-FZ establishes definitions of standards and international accounting standards:

“an accounting standard is a document that establishes the minimum necessary requirements for accounting, as well as acceptable methods of accounting;

international standard is an accounting standard, the application of which is customary in international business, regardless of the specific name of such standard.”

Paragraph 7 of PBU 1/08 states that: “...If the regulatory legal acts do not establish accounting methods for a specific issue, then when forming an accounting policy, the organization develops an appropriate method, based on this and other accounting provisions, and also International Financial Reporting Standards...” Thus, the procedure for accounting for the costs of repair and maintenance of fixed assets is an issue that requires detail in the accounting policy of the organization on the basis of IFRS.

According to paragraph 1 of IAS 16, “the purpose of this standard is to specify the accounting treatment of property, plant and equipment so that users of financial statements can obtain information about an entity's investments in property, plant and equipment and changes in the composition of such investments. The main aspects of property, plant and equipment accounting are the recognition of assets, the determination of their carrying amounts, and the associated depreciation and amortization charges to be recognized.” Book value (as interpreted in clause 6 of IAS 16) is the value at which the asset is recognized in the financial statements.

This international standard regulates the procedure for generating reports of an economic entity. From Art. 3 of Law 402-FZ it follows that the cases “established by this and other accounting provisions (standards)” mean:

- completion, additional equipment, reconstruction, modernization, partial liquidation and revaluation of fixed assets (clause 14 of PBU 6/01);

- replacement of parts (clause 13 of IAS 16);

- technical inspection (clause 14 of IAS 16), etc.

At the same time, the applicability of RAS standards (PBU 6/01) extends to the formation of the initial cost of inventory fixed assets, and the applicability of IFRS standards (IAS 16) extends to the book value (reflected in the accounting (financial) statements), reflected in the line “ Fixed assets".

Paragraphs 13, 70 of IAS 16 provide for the inclusion of costs for the regular replacement of parts of an item of fixed assets in the book value of the specified item, and the cost of the replaced parts is subject to write-off. If it is “practicable” for an entity to calculate the cost of the replacement part, then it may use the original cost of the replacement part as the cost of the replacement part at the time of purchase.

These provisions correspond to a similar norm, paragraph 29 of PBU 6/01, according to which the disposal of a fixed asset may occur in the event of “partial liquidation during reconstruction work.” This formulation implies the disposal of the partially liquidated part and an increase in the value of the fixed asset by the amount of costs for its reconstruction. When correlating this norm with IFRS, it corresponds to that part of the norm of the previous paragraph, according to which, when parts of a fixed asset are regularly replaced, the amount of replacement costs (for example, the cost of the part itself and installation costs) is included in the cost of the fixed asset, and the cost of the replaced parts subject to write-off.

Thus, in all cases:

- partial liquidation during reconstruction work,

- replacement of parts when performing repair work,

- replacement of parts when performing reconstruction work

It would be correct to use a unified approach, within which the cost of retired parts is written off, and new parts and the cost of work on their installation (installation work, reconstruction, and, if the conditions of clause 7 of this Interpretation are met, repair work) are capitalized.

Clause 14 of IAS 16 provides that “a condition for the continued operation of an item of fixed assets may be regular large-scale technical inspections for defects, regardless of whether elements of the item are replaced.

When each major technical inspection is performed, the associated costs are recognized in the carrying amount of the item of property, plant and equipment as a replacement, subject to the recognition criteria being met. Any cost remaining in the carrying amount for the previous technical inspection is subject to derecognition. This occurs regardless of whether or not the costs associated with the previous technical inspection were indicated in the acquisition or construction transaction. If necessary, the amount of a preliminary estimate of the costs for an upcoming similar technical inspection can serve as an indicator of the amount of technical inspection costs included in the book value of the object at the time of its acquisition or construction.” From an economic point of view, the costs of restoring the useful properties of fixed assets (repairs and maintenance) are aimed at extending their service life and ensuring the flow of economic benefits from such costs in the future. In cases where such costs are incurred over a period of more than 12 months (or the normal operating cycle, if it exceeds 12 months), the economic benefits from their implementation will flow to the organization over several reporting periods. In this regard, a justified methodological approach seems to be the recognition in accounting of a non-current asset in the amount of costs incurred, with the subsequent write-off of such an asset as an expense during the period of receipt of benefits, that is, until the next similar event is carried out.

Clause 19. PBU 10/99 provides that expenses are recognized in the income statement, including “through their reasonable distribution between reporting periods, when expenses determine the receipt of income over several reporting periods and when the connection between income and expenses cannot be clearly defined or determined indirectly.”

In accordance with clause 65 of PVBU No. 34n: “Costs incurred by the organization in the reporting period, but relating to the following reporting periods, are reflected in the balance sheet in accordance with the conditions for recognition of assets established by regulatory legal acts on accounting, and are subject to write-off in accordance with the procedure established for writing off the value of assets of this type.”

Assets are recognized as resources controlled[1] by an economic entity as a result of past events, capable of bringing economic benefits to it in the future, the value of which can be reliably estimated.

Thus, since the costs of repairs and maintenance generally satisfy the criteria for recognition of an asset, and also taking into account paragraphs 17-18 of this Interpretation, they must be taken into account as part of non-current assets, and not in current expenses.

Paragraph 6 of PBU 1/08 stipulates that the accounting of an organization must meet the requirements of rationality.

In this regard, recognizing non-current assets as an object seems appropriate only for significant repair and maintenance costs. It is recommended to write off non-essential costs for repairs and maintenance (including those carried out at intervals of more than 12 months) as expenses of the current reporting period. In accordance with PBU 4/99, indicators about individual assets must be presented separately in the financial statements if they are significant, and if without knowledge of them by interested users it is impossible to assess the financial position of the organization or the financial results of its activities. In accordance with clause 3 of Order No. 66n: “...organizations independently determine the detail of indicators for reporting items...”.

In this case, when isolating the costs under consideration if they are significant in the balance sheet, the meaning of the name of the indicator should reflect the essence of this asset, that is, the meaning of the name should be clear to the user of the financial statements. The recommended name of the indicator is “Long-term costs of repair and maintenance of fixed assets.” Since, according to IFRS standards, the costs in question are capitalized as part of fixed assets, this indicator deciphers the group of items “Fixed assets” (see Illustrative example No. 1).

According to the Recommendations to auditors, “regular large expenses that arise at certain long time intervals (more than 12 months) during the life of the fixed asset, for its repair and for other similar activities (for example, checking the technical condition), are reflected in the balance sheet in the section I “Non-current assets” as an indicator detailing the data reflected in the group of articles “Fixed assets”. Taking into account paragraph 7 of PBU 1/2008, such costs are repaid during the specified time interval.”

Thus, the procedure for recognizing repair and maintenance costs set out above corresponds to the approach of the Ministry of Finance of the Russian Federation to reflecting the business transactions under consideration in accounting (financial) statements.

Rental payments

Whether rental payments are classified as direct or indirect expenses directly depends on what exactly is being rented and how the leased item is used by the company. It is clear that rental payments for machines or computers that are used to produce products cannot be classified as other than direct expenses. But the office rental fee can already be considered from the point of view of the share that the “production part” occupies in this office (see resolution of the Moscow District AS of September 30, 2014 No. F05-10544/14). And since these ratios can change from year to year, this is another reason to audit accounting policies and bring them into line with reality, so as not to overpay taxes and avoid conflicts with inspectors.

Direct and indirect costs in accounting

Of all the costs of manufacturing a product, its cost is added up. Account 20 contains almost all production costs that can be classified as direct. The main production account on debit corresponds with accounts 02, 10, 23, 25, 26, 60, 69, 70 on credit. To determine the cost of a product of a certain type, open analytical accounts for individual types of products and costs for account 20. This will simplify the procedure for generating cost by type.

Indirect costs are contained in accounts 25 and 26. To prepare loan entries, the same correspondence is used as for direct costs. Do not forget that indirect costs cannot be attributed directly to the cost of one product. Select a reasonable allocation basis and note your choice in the accounting policy.