Inventory transactions

At least once a year, every organization, regardless of its form of ownership and legal status, must conduct an inventory. The accountant must reflect its results in accounting. This article will tell you how to do this correctly and what inventory transactions are usually used.

The mandatory conduct of a complete inventory of all company assets is provided for by Federal Law No. 402 of December 6, 2011 “On Accounting”.

It must be carried out at least once a year, usually in the last month before summing up the results and drawing up annual reports.

The procedure for conducting an inventory must be prescribed in the accounting policy of the organization, and its main goal is to identify the actual presence and quality condition of all assets of the organization:

- fixed assets;

- materials and raw materials;

- goods in warehouses and for sale;

- other tangible and intangible assets;

- settlements with counterparties;

- documentation;

- cash and securities.

After the inventory, it is necessary to clarify the accounting data and bring them into line with the actual state of affairs. After all, the inventory process consists precisely in comparing accounting data with the actual presence of valuables and balances. Let's take a closer look at accounting for inventory results and the postings used in different situations.

Accounting for inventory results

The results of a comprehensive audit of an organization’s assets may be different, in particular, in relation to material assets, these may be:

- shortage - when accounting balances are greater than actual ones;

- surplus - when excess goods or materials are identified that are not in the accounting data;

- re-sorting - when some material assets are missing, but there are extra values under other items.

In addition, there is also an audit of mutual settlements, the results of which the accountant must also display in accounting. Therefore, it is necessary to deal with each specific case separately.

But it should be remembered that the main document in any situation is the collation sheet of inventory results of inventory items, form No. INV-19; it is on its basis that the accountant makes all entries.

The matching statement may be of a different form if this is specified in the accounting policy.

Shortage: wiring

Shortage, unfortunately, is the most common result of inventory, especially in trading companies and warehouses. This is due to various factors:

- careless storage;

- theft by employees or clients;

- natural decline (so-called “shrinkage”, “decay”, etc.);

- other factors.

Only shortfalls within the limits of natural loss can be written off painlessly.

Such standards are established for each type of product, material and raw material and must be officially enshrined in the accounting policy.

The rest of the shortage should be written off to the perpetrators, and only if they could not be identified can it be written off. A step-by-step algorithm for accounting for identified shortages by an accountant.

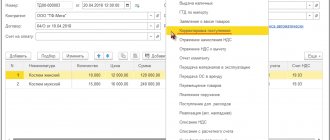

Step 1. First, you need to attribute the cost of all missing assets to account 94 “Shortages and losses from damage to valuables” using the following entries:

- Dt 94 Kt 10 (07, 08, 41, 43) - shortage of materials (equipment, investments in non-current assets, goods);

- Dt 94 Kt 50 - lack of money in the cash register.

If there is a shortage of fixed assets or intangible assets, several entries will have to be made, since it is necessary to take into account not only the residual value, but also the depreciation accrued over the period of their operation. They will look like this:

- Dt 02 Kt 01 - depreciation of missing fixed assets;

- Dt 05 Kt 04 - depreciation of missing intangible assets;

- Dt 94 Kt 01 (04) - residual value of missing fixed assets or intangible assets.

Step 2. If there are not enough materials or raw materials within the limits of natural loss, then they can be immediately written off to expense accounts. In order for the accountant to have the right to make such entries, the head of the company must issue an appropriate order based on the results of the inventory. When all formalities are completed, the postings will look like this:

Dt 20 (44) Kt 94.

Step 3. If there is a shortage of more valuables than the established standards, the shortage must be attributed to the persons responsible for it. To do this, there must be a corresponding conclusion of the commission and an order from management. After completing all these documents, you need to make the following entry in the accounting registers:

Dt 73 Kt 94.

For account 73, analytical accounting is required in the context of all culprits with the corresponding entries.

Step 4. If the perpetrators could not be identified or they were able to defend in court the impossibility of compensating the company for losses, the amount of the shortfall must be included in other expenses. The wiring looks like this:

Dt 91-2 Kt 94.

Inventory surplus: postings

If during the audit, unaccounted for material assets, which are usually called surplus, were identified, they must be registered or capitalized. The accountant must do this at the market value on the date of the inventory.

Commercial organizations include this amount in their financial results, and non-profit organizations increase their income with it. For these purposes, passive synthetic account 91-1 “Other income” is used.

In order to correctly display surpluses in accounting, we have collected the transactions in one table.

| Type of assets being capitalized | Debit | Credit |

| Cash in the cash register | 50 "Cashier" | 91-1 “Other income” |

| Fixed assets | 08 “Investments in non-current assets” | 91-1 “Other income” |

| Materials | 10 "Materials" | 91-1 “Other income” |

| Goods | 41 "Products" | 91-1 “Other income” |

Sub-accounts, accounting statements and other documents are used for analytics. Fixed assets registered in this way are subject to depreciation in the usual manner.

Re-grading: postings

Sometimes it happens that during the inspection, both surplus and missing goods or materials were identified.

This is called re-sorting, but only if the material assets are of the same type or they were in the custody of one person.

In this case, it is allowed to carry out the so-called re-offset in accounting. That is, to cover the shortage with surpluses. There are different wiring for this.

Example 1. The cost of missing assets turned out to be higher than the cost of unaccounted for assets that were in surplus. For example, during a warehouse audit, 100 kg of rice were found instead of 150 kg and 200 kg of millet instead of 175 kg. Rice is more expensive than millet and its deficiency in weight is greater than the excess of millet. The accountant made the following entries based on the inventory results:

- Dt 94 Kt 41 subaccount “Rice” - the cost of the missing 50 kg of rice;

- Dt 41 subaccount “Millet” Kt 94 - the cost of an extra 25 kg of millet;

- Dt 41 subaccount “Rice” Kt 41 subaccount “Millet” - offset cost (the difference between the cost of credited millet and the missing rice);

- Dt 94 Kt 41 - the amount of excess of the shortage over the surplus is written off.

In the situation under consideration, the storekeeper turned out to be the culprit for the shortage that arose as a result of offset. Therefore, the following entry was made for the amount that should be collected from him:

Dt 73 Kt 94.

If it is not possible to recover the loss or the court finds the storekeeper not guilty, the accountant will have to write off the difference as distribution and production costs.

Example 2. Let's consider the same situation, but swap rice and millet, as a result of which we will find that the amount of goods that should be capitalized is greater than what is missing in the warehouse. Postings based on inventory results will look like this:

- Dt 41 sub-account “Millet” Kt 41 sub-account “Rice” - offset cost;

- Dt 41 subaccount “Rice” Kt 94 - cost of extra 50 kg of rice;

- Dt 94 Kt 41 subaccount “Millet” - the cost of the missing 25 kg of millet;

- Dt 41 Kt 91-1 - the remainder of surplus rice.

Source: //ppt.ru/art/provodki/inventarizaciya

What to do if the inventory reveals unaccounted assets?

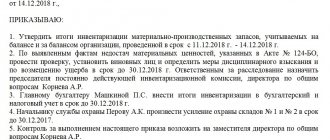

When the inventory commission has completely completed the comparison (comparison) of factual information with accounting information, the head of the organization approves the results of the inspection by issuing an appropriate order.

A natural consequence of the execution of this administrative act will be the introduction of the necessary changes into the accounting (accounting) registers, determined by the results of the inventory.

Thus, identified shortages are correctly written off, and surpluses found are correctly accounted for and are registered.

An important clarification is that the inventory should be completely completed by the time the head of the company must sign the prepared reports.

The necessary adjustments to the accounting registers are carried out by specialists on the date of the inventory procedure.

Thus, the manager’s order ordering the capitalization of found surpluses is the legal basis for the proper correction of detected errors in accounting.

An administrative act can be drawn up according to a template adopted in a particular organization.

How to capitalize identified objects?

Unaccounted for fixed assets discovered during a scheduled inspection are accounted for, as required by current standards, at market value.

It should also be clarified that the surplus found must be received exclusively on the date of the inventory.

Accounting rules provide for several options for crediting surplus fixed assets to income.

The choice of a specific approach is determined by the specifics of the situation in which a specialist needs to capitalize a specific object discovered during the inventory process.

Inventory of feed postings

They are accounted for at market value, which must be confirmed in one of the following ways:

- A company certificate compiled on the basis of an analysis of prices for similar property (invoices from suppliers, advertisements for the sale of similar objects in the media, a certificate from statistical authorities, etc.);

- A certificate prepared by an independent appraiser (more preferable).

Excess valuables at market prices are included in other income and capitalized using the following entry:

Re-grading If the audit reveals a shortage of one value and a surplus of another, this fact must also be reflected in accounting. Situation: During an inventory of the spare parts warehouse, a shortage of three bushings costing 4,500 rubles per piece was revealed, and a surplus in the form of three injectors costing 6,700 rubles per piece.

Inventory of property and liabilities" of the Law of the Republic of Belarus "On Accounting and Reporting" inventory is mandatory: - when transferring the property of a state unitary enterprise for rent, its purchase and sale; — during reorganization or liquidation (abolition) of the organization; — before preparing annual financial statements; — when changing the head of an organization (institution) or a financially responsible person; — upon detection of facts of theft and (or) damage to property; - in the event of force majeure, that is, extraordinary and unavoidable circumstances under the given conditions; — in other cases provided for by the legislation of the Republic of Belarus. In the process of conducting an inventory, the following tasks are solved: - identifying the actual availability of inventory items, incl.

Literally:

If the actual cost is lower than the planned cost, then a reversing entry is made (an entry with a negative amount).

The cost of weight gain of animals, animals, poultry is formed from the costs incurred, which include the following main items: remuneration of personnel providing care for animals, animals, poultry; contributions to social funds from staff salaries; means of protecting animals, animals, birds; maintenance of fixed assets; costs of managing the growing and fattening process; insurance payments; other costs; losses from mortality. Issues of calculating product costs are presented in Chapter 8. The difficulties of accounting for weight gain are due to a number of circumstances.

Postings for surpluses and shortages during inventory

Registration and approval of results Accounting reference Bringing accounting data into compliance with actual availability. Writing off shortages or capitalizing surpluses Reasons for conducting an inventory, in addition to the annual obligation, may be:

- Change of financially responsible person;

- Fact of theft or damage;

- Disaster;

- Organizational reasons (change of manager, reorganization, etc.):

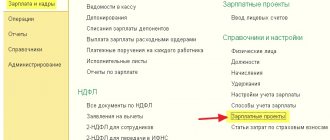

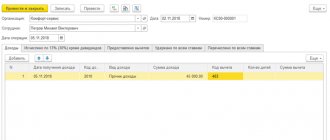

Get 267 video lessons on 1C for free:

- Free video tutorial on 1C Accounting 8.3 and 8.2;

- Tutorial on the new version of 1C ZUP 3.0;

- Good course on 1C Trade Management 11.

The results of the inventory can be: To carry out the inventory, a commission consisting of at least three people is formed at the enterprise.

Inventory of seeds, feed, reflection of results in accounting

Accounting for the economic activities of enterprises and organizations in various sectors of the economy has much in common. At the same time, they clearly demonstrate the specifics of production and sales of products, the reflection of which requires additional knowledge and experience.

The most peculiar industry is agricultural production, to take into account some of the features of which it was necessary to introduce a separate account 11 “Animals for growing and fattening”.

Animals in agriculture are divided into two economic categories: fixed assets (productive and draft livestock) and means of labor (young productive and draft livestock, animals culled from the main herd and transferred to fattening, as well as poultry, animals, rabbits, bee families). Productive livestock (used to produce products) include: cattle, pigs, sheep, goats, deer and deer.

Chapter 7. accounting of animals being raised and fattened

D 01 - K 08 - the animal is capitalized as part of fixed assets, where: account 08 “Investments in non-current assets”. Young and adult fattening animals can be sold externally.

The process of their sale in the form of accounting records is no different from the sale of main products: D 90-2 - K 11 - the book value of animals is written off; D 90-2 - K 44 - commercial expenses written off for sales; D 90-3 - K 68 - VAT accrued on the sale of animals; D 62 - K 90-1 - an invoice was presented to the buyer of animals; D 90-9 - K 99 - when summing up the monthly results, the amount of profit from the sale was revealed; D 51 - K 62 - proceeds from the sale were received; D 68 - K 51 - the amount of VAT due to the budget has been paid, where: account 44 “Sale expenses”, account 51 “Settlement accounts”, account 62 “Settlements with buyers and customers”, account 68 “Calculations for taxes and fees”, account 90 “Sales”, account 99 “Profits and losses”.

Surplus in inventory transactions

Attention

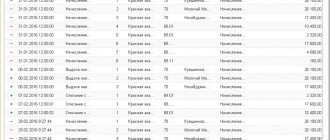

The results of the inventory are reflected in the accounting and reporting of the month in which the inventory was completed, and for the annual inventory - in the annual financial statements.

In order to strengthen the responsibility of individuals for the safety of material assets entrusted to them, the administration of the organization enters into written agreements on material liability with employees who have reached the age of 18, occupy positions or perform work directly related to storage, processing, sale (release), transportation or use in process of production of the values transferred to them. The agreement is drawn up in the prescribed form in two copies, signed by the head of the organization, the financially responsible person, and sealed.

The first copy of the agreement is with the administration, the second - with the employee.

Carrying out an inventory: receipt of surpluses and write-off of shortages

The type of feeding was established taking into account the capabilities of feed production and the efficiency of crop cultivation on the farm. Thus, on the farm’s pig farm, a concentrated type of feeding is used; concentrates occupy 51% of the diet structure.

Shortage during wiring inventory:

- Dt 20 (23,25,26,44) Kt 94

If natural loss rates for certain types of property are not established or the shortage exceeds them, then it is charged to other expenses and reflected by posting:

It is important to remember that in tax accounting it is impossible to recognize expenses in excess of the norms of natural loss (Article 254 of the Tax Code of the Russian Federation). 2) The perpetrators are identified, the damage is compensated at their expense.

In this situation, an important role is played by the presence and content of an agreement on financial liability, as well as the norms of the Labor Code of the Russian Federation, which contain instructions on the maximum amount and procedure for deducting amounts from employees’ wages.

If the guilty person is not an employee of the organization and agrees to compensate for the damage (it is better to draw up an agreement on voluntary compensation for damage), then you can deposit the money into the cash register or into a current account.

V = (0.52P - 0.46B) x B x L V = (0.56P - 0.55B) x B x L V = (P x B) / 4 x L P—phase, P; B — ¯ËË̇ ÒÍˉ˚, Ï; L — ‰ÎË̇ ÒÍˉ˚, P; V = (0.4 P - 0.12 L) x L2 - ‰Îˇ ÒÚÓ„‡, „‰Â V - Ó·˙ÂÏ ÒÚÓ„‡, ÍÛ·.

Ï; P — ‰ÎË̇ ÔÂÂÍˉÍË, Ï; L — ‰ÎË̇ ÓÍÊÊÌÓÒÚË ÒÚÓ„‡, P. “The price of 20 ‰M in the world ‰ÌÂÂ30‰ÌÂÈ ÔÓÒΠÓÍÓ̘‡Ìˡ Á‡„ , , , , , , , , , TERMINAL RESEARCH ˚.—ËÎÓÒÛ˜ËÚ˚‡˛ÒÔÓÓ‰‡Á‰VOLÌÂÏ ÒËÎÓÒ ÍÛÍÛÛLAÌ˚ÈËËLA‰Û„ ËıÍÛθÚÔÓ Ï‡ÒÒ ‚ ÍÓÏÓ‚˚ı ‰ËÌˈ‡ı Ë ‚ FAQ VTOL (FA) MEASUREMENT OF TERMS AND CONDITIONS ‰ËÌ˚ÏË ÒÔ‡‚ Ó˜Ì˚ÏË Ú‡Îˈ‡ÏË

Losses from epidemics and natural disasters are written off either as losses of the enterprise or as insurance compensation: D 99 - K 11 - losses of animals are reflected if the herd is not insured; D 76 - K 11 - animal losses are written off if the herd is insured, where: account 76 “Settlements with various debtors and creditors”, account 99 “Profits and losses”.

If the bee colony is completely destroyed, the hive is released, which is returned to fixed assets: D 99 - K 11-P - the book value of the dead bee colony is written off; D 01 - K 11-U - the vacated hive was returned to the fixed assets.

In addition to its book value, such a hive is also characterized by the amount of depreciation in account 02 “Depreciation of fixed assets” accumulated during its operation.

Control questions on the topic 1. In which account are productive and working livestock taken into account, and in which account are their young animals taken into account? 2. This difference is recorded as future income of the enterprise, which is realized only upon the next deduction of amounts from the salary of the guilty employee.

If the culprit for the death of animals is not identified, then their book value is written off as an increase in the cost of maintaining the corresponding group of animals.

If at the same time some products are obtained from dead animals (skins, horns, hooves), then they are accounted for at the prices of possible sales, reducing the amount of losses received: D 94 - K 11 - the book value of dead animals is written off; D 20 - K 94 - costs for keeping animals increased due to the amount of losses; D 43 - K 20 - the amount of losses has been reduced due to products obtained from dead animals, where: account 20 “Main production”, account 43 “Finished products”, account 94 “Shortages and losses from damage to valuables”.

Source: //prodhelp.ru/inventarizatsiya-po-kormam-provodki/

We prepare and carry out inventory

The obligation to conduct an annual inventory of property and financial obligations is established by the Regulations on accounting, approved by the Ministry of Finance on July 29, 1998. No. 34n. The rules and procedure for carrying out this procedure are established by the Methodological Instructions (Order of the Ministry of Finance No. 49 of June 13, 1995), they list the composition of property and liabilities subject to audit, and the forms of documents that can be used to document the results.

The main stages of inventory are shown in the table:

| Stage | Document | Explanation |

| Preparation | Manager's order to conduct an inventory | The order indicates: the timing of the inventory, the reason for the inventory, the list of inventory property, the list of financially responsible persons and the composition of the commission |

| Carrying out | Inventory list | Members of the commission maintain an inventory (count) of property and its condition |

| Data Mapping | Collation statement | Reconciliation of the data presented in the inventory with the data in accounting. Drawing up comparison sheets to identify discrepancies. |

| Registration and approval of results | Accounting certificate | Bringing accounting data into correspondence with actual availability. Write-off of shortages or capitalization of surpluses |

Reasons for conducting an inventory, in addition to the annual obligation, may be:

- Change of financially responsible person;

- Fact of theft or damage;

- Disaster;

- Organizational reasons (change of manager, reorganization, etc.):

The results of the inventory can be:

To carry out an inventory at the enterprise, a commission consisting of at least three people is formed. Based on the results of the inventory, the commission draws up matching statements, inventory lists, acts:

Accounting entries based on the results of the inventory of fixed assets

Add to favoritesSend by email Reflection of inventory results in accounting is the final stage of verification of the company's assets and liabilities. What is an inventory, in what cases is it mandatory and what documents must an accountant prepare - read the material below.

Inventory as an accounting method Documentation in inventory accounting Accounting for inventory results: postings Results Inventory as an accounting method According to clause 6 of PBU 4/99 (approved by order of the Ministry of Finance of the Russian Federation dated 06.07.

1999 No. 43n) accounting should give a complete and reliable picture of the financial condition of the company. To comply with this requirement, accounting uses a control method - inventory.

Inventory is a procedure for comparing the actual availability of a company’s assets and its obligations with accounting data.

Inventory of fixed assets (surpluses and shortages)

Next, either the guilty persons return the cost of the shortage to the cash desk (posting D50 K73/2), or the amount of the shortage is taken into account from wages with posting D70 K73/2.

If the perpetrators are not identified, then the shortage identified during the inventory of fixed assets is written off as a loss using posting D91/2 K94.

Inventory of fixed assets (postings) Debit Credit Name of transaction 01 91/1 The surplus identified during the inventory is capitalized 94 01 The shortage identified during the inventory is reflected 73/2 94 The shortage is written off to the guilty person 50 73/2 Payment of the shortage by the guilty person to the cash desk 70 73/ 2 The shortfall is withheld from the wages of the guilty person 91/2 94 The shortfall is written off as expenses (if the guilty person is not identified) Conservation of fixed assets If the equipment is not used for any reason, the manager may decide to preserve fixed assets.

Accounting for the results of inventory of fixed assets

What needs to be done from April 16 to 20 Every day spring comes into its own more and more confidently. The bright sun, blue sky and birdsong can make anyone forget about worries and plunge into sweet dreams.

So that while you indulge in your dreams, you do not miss any important accounting dates, we present to your attention our weekly reminders.

It is impossible to give a resigning employee a copy of SZV-M. According to the law on personal accounting, when dismissing an employee, the employer is obliged to give him copies of personalized reports (in particular, SZV-M and SZV-STAZH). However, these reporting forms are list-based, i.e.

contain information about all employees. This means transferring a copy of such a report to one employee means disclosing the personal data of other employees.

Reflection of inventory results in accounting

Accounting regulations require an inventory in the following cases:

- before preparing annual accounting reports - with the exception of property that has already been inspected after October 1 of the current reporting year;

- when changing matrially responsible persons;

- upon detection of theft, abuse and damaged property;

- when transferring assets for sale, lease or redemption;

- during the transformation of the company, as well as during its liquidation - before the formation of the liquidation balance sheet;

- in the event of emergency situations.

If the financial responsibility is collective, then the inventory is carried out when the team leader changes, more than 50% of the participants leave the team, or at the request of one or more team members. So, as a general rule, an inventory of a company’s assets and liabilities is carried out at least once a year.

Postings for surpluses and shortages during inventory

The accountant must write off shortages or damage to valuables in excess of the norms on the basis of a court decision (in the absence of the perpetrators or refusal to recover from the guilty person) or a conclusion on damage to property issued by a specialized organization (clause 5.

2 Guidelines for inventory of property and financial obligations). During inventory, misgrading may be detected.

Then the surpluses and shortages are counted against each other, and the responsible persons provide the commission with written explanations.

The offset can be carried out only for the same audited period from the same financially responsible person for the same values (clause 5.3 of the Methodological Instructions for Inventory of Property and Financial Liabilities). If the surplus is not enough to cover the shortage, then the procedure is similar to that when a shortage is detected.

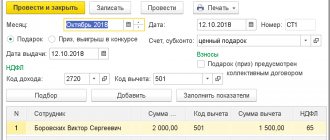

Reflection of surplus

The discovery of surpluses based on the results of a cash register inventory does not have any consequences for the financially responsible person.

Example

In Margaritka LLC, as a result of a cash inventory, a surplus in the amount of 1,050 rubles was discovered.

The accountant makes entries according to the identified surpluses:

| Dt | CT | Operation description | Amount, rub. | Document |

| 50 | 91.1 | Reflection of surplus DS at the cash desk | 1 050 | Accounting information |

That is, the detected surplus amounts are included in non-operating income.