Property that the recipient is not obliged to pay for or return is considered to be transferred free of charge (clause 1 of Article 572 of the Civil Code of the Russian Federation).

Transfer property valued over RUB 3,000 free of charge. commercial organizations are prohibited. As for donations to non-profit organizations and citizens, there are no such restrictions. If the transaction amount exceeds 3,000 rubles, draw up a written gift agreement. If it does not exceed, the contract can be concluded orally. This procedure follows from Articles 574 and 575 of the Civil Code of the Russian Federation.

Accounting

Income from the gratuitous transfer of goods (materials) does not arise in accounting (PBU 9/99 and PBU 5/01). Other expenses take into account the cost of transferred goods (materials), as well as expenses associated with their transfer (clause 11 of PBU 10/99).

In this case, make the following entries:

Debit 91-2 Credit 41 (10)

– reflects the cost of goods (materials) donated free of charge;

Debit 91-2 Credit 10 (60, 69, 70, 76...)

– expenses associated with the free transfer of goods (materials), for example, for delivery, are taken into account.

Free transfer of goods between legal entities agreement

A gift agreement for an amount of more than 3 thousand rubles, drawn up between commercial organizations, is a voidable transaction by virtue of clause 1 of Art. 168 of the Code or void if public interests or rights of third parties are violated (clause 2 of Article 168 of the Code).

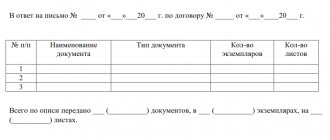

The first copy is transferred to the warehouse as the basis for the release of materials, the second - to the recipient of the materials.

Under an agreement on the gratuitous transfer of property and use of it, one of the parties (the lender) is obliged to transfer the thing for temporary use to the other party (the borrower). And the borrower is obliged to return the relevant item in the same condition in which he received it. For the release of product samples to potential buyers in the situation under consideration, we recommend that you issue an Invoice for the release of materials to the third party (Form N M-15, approved by Resolution of the State Statistics Committee of Russia dated October 30, 1997 N 71a).

BASIC: income tax

The cost of goods (materials) and expenses associated with their gratuitous transfer are not taken into account when calculating income tax (Clause 16, Article 270 of the Tax Code of the Russian Federation). This also applies to accrued VAT.

Due to differences in accounting and tax accounting, a permanent difference is formed, which leads to the emergence of a permanent tax liability (clauses 4 and 7 of PBU 18/02). It must be taken into account simultaneously with the write-off in accounting of the value of property and other expenses associated with the gratuitous transfer (clause 7 of PBU 18/02).

Do the following wiring:

Debit 99 subaccount “Fixed tax liabilities” Credit 68 subaccount “Calculations for income tax”

– a permanent tax liability is reflected.

This procedure follows from the Instructions for the chart of accounts.

Special conditions

When transferring valuables, you need to take into account the financial limit: gifts to the organization should not exceed 3 thousand rubles.

If the value exceeds the limit, a written gift agreement must be drawn up. The transfer is confirmed by an acceptance certificate or a delivery note; in some cases, it may be necessary to draw up an agreement. But there are exceptions: when transferring objects to public and budgetary organizations, religious and charitable organizations and any non-profit foundations, the limit of 3 thousand rubles is removed. Also, a gift can be made to an individual if he is not a state or municipal employee or his substitute, an employee of the Bank of Russia, an employee of an organization that provides social services: educational, medical, etc.

BASIS: VAT

The gratuitous transfer of goods (materials) is recognized as a sale (Clause 1, Article 39 of the Tax Code of the Russian Federation). Therefore, VAT must be charged on it (subclause 1, clause 1, article 146 of the Tax Code of the Russian Federation). However, in some cases, the sale of goods (performance of work, provision of services) is not subject to VAT. For example:

- provision of free assistance in accordance with the Law of May 4, 1999 No. 95-FZ;

- transfer for advertising purposes of goods, the cost of acquisition (creation) of which, taking into account input VAT, does not exceed 100 rubles. for a unit.

For more information about this, see How to calculate VAT for the gratuitous transfer of goods, works, and services.

If the gratuitous transfer of goods (materials) is subject to VAT, make the following entry:

Debit 91-2 Credit 68 subaccount “VAT calculations”

– VAT is charged on the free transfer of goods (materials).

The amount of VAT accrued on the value of property transferred free of charge does not reduce the tax base for income tax (clause 16 of Article 270 of the Tax Code of the Russian Federation).

Input VAT on costs associated with the transfer of goods (materials) should be deducted (clause 1 of Article 171, clause 1 of Article 172 of the Tax Code of the Russian Federation). Along with this, other conditions required for deduction must be met. In this case, do the wiring:

Debit 68 subaccount “VAT calculations” Credit 19

– accepted for deduction of input VAT on costs associated with the free transfer of goods (materials).

How to register the transfer of goods between your own legal entities

Although, this raises a large number of disputes and various issues in the field of taxation, including the collection of VAT.

There is a widespread belief that gifts between legal entities are prohibited. This statement is not entirely correct. Subp. 4 paragraphs 1 art. 575 of the Civil Code of the Russian Federation (hereinafter referred to as the Code) contains a provision that donations between commercial organizations are prohibited.

If the acceptance rules and deadlines are violated, trade organizations are deprived of the opportunity to make claims to suppliers or transport organizations in the event of a shortage or reduction in the quality of goods.

The ban in question is explained by the fact that the main purpose of the activities of commercial organizations in accordance with paragraph 1 of Art. 50 of the Code is profit-making. The gratuitous alienation of the property of a legal entity is directly opposite to this goal and excludes the receipt of any income.

Acceptance of goods at the supplier's warehouse is carried out by the financially responsible person by proxy. If the goods are in undamaged containers, then acceptance can be carried out by the number of pieces, gross weight or by the number of trade units and markings on the container. If the actual presence of the goods in the container is not checked, then it is necessary to make a note about this in the accompanying document.

It is expected that the production of a new type of product will begin. In this regard, it is planned to provide our own customers with samples of new products on a non-refundable basis. VAT is paid on this transaction. The cost of the transferred products can be more than 3,000 rubles.

:

. , . , . ? , :

- ;

- .

( ) ( ), . ?

. . . 1 . 3 . 39 , , ( ), , . 21 .

. .

, , (, ) : “” ? , “” ? , , . .

2. 2010. I 2010. . , “” . II 2010. , . II, 10,000. I II 2010. “” , , 1 000 000 .

II 2010. “” , , , ? ?

, “” :

- -, . 169 ;

- (, ) , , ;

- (, ) .

(. 2 . 171, . 1 . 172 ). , , , “” .

09/21/2009 N 03-07-11/240 ( , , , ). , 30.03.2010 N 03-07-11/79 , , . , . , , 01.10.2009 N 03-07-11/245, . 12/23/2009 N 16-15/135777, 12/09/2009 N 16-15/130771.

. 05/03/2006 N 14996/05, . 21 (, ) , . (, ) , ” “, , ( ) , . , , 01/15/2010 N 19-11758/09, 05/05/2010 N -40/4094-10-2.

, “” , (I 2010.). , .

, “” , (II 2010., “” I 2010.). , .

, , , .

, (22.01.2009 N 03-07-11/16, 10.04.2006 N 03-04-11/64). , .

, , .

(., , 01/19/2010 N 09-10766/09-2 <1>, 06/02/2009 N 62-5424/2008, 03/05/2008 N 19-14863/07-20-02-728/08). , .

<1> 05/14/2010 N -6052/10.

, , 03/05/2008 N 19-14863/07-20-02-728/08. , . 129 – , , , , . . 135 , , , , , , . . 191 , , ( , , , , ). , .

, , , , . , ” , “, . .

, , , – ( ), . , , , , , . . , , :

- 02.06.2009 N 62-5424/2008 , , , , . ;

- 01/19/2010 N 09-10766/09-2 , , , , . . . . , . . 129, 144, , .

, ( ) , , (, , , ). , , , . , , , .

, , , – , , .

, ( ), , , . .

, , ( , ) , :

- , . , , ;

- (, ) (, , );

- ( , ) , , . , , , ..;

- . 3 . 39 .

..

“: “

What can be donated?

Objects for gratuitous transfer may be:

- securities;

- intangible assets of the organization;

- goods;

- finished products;

- materials, raw materials;

- equipment, tools;

- real estate objects or the right to use them;

- vehicles;

- money in cash or non-cash form, as well as repayment of the financial obligations of the recipient.

IMPORTANT! If taking possession of the transferred property involves registration, for example, we are talking about a car or real estate, then the recipient party must register this property for themselves, and only then will a change of owner occur.

PROBLEMS OF REGISTRATION OF EXPERIMENTAL SAMPLES AND MOUNTINGS

Intangible assets are a special type of non-current assets that do not have a tangible form, but are capable of generating income for the owner for a long time, directly participating in the financial and economic activities of an economic entity. The problematic point is the identification of an intangible asset, that is, its separation from other types of assets, a reliable determination of the initial cost.

Despite the certainty of the concept of “intangible assets” in the practical activities of an economic entity and its accounting service, difficulties often arise associated with the identification of the accounting object. The greatest controversy is caused by the results obtained during research and development work (R&D).

Interest in accounting for material objects, namely prototypes and mock-ups created as part of research and development work, is justified by the fact that the costs of their creation can be taken into account as part of a separate material object (fixed assets, equipment, materials ), and as part of the obtained intangible R&D results.

Let's consider the features of legal regulation and problems of accounting and analytical procedures related to the registration of prototypes and mock-ups.

When creating an intangible asset of this kind, in accordance with the rules for forming the initial cost of an object, expenses include amounts paid to third parties for the performance of work or provision of services under contracts for the performance of research, development or technological work. Research and development work involves obtaining a result, which, depending on the nature of this work, will be different.

As part of applied research work (R&D), a specific sample (type of product, type of material) can be created or research into the features of its functioning and application can be carried out [3; clause 1.2.3]. In the process of carrying out research, mock-ups, models, experimental samples (hereinafter referred to as mock-ups) are formed to experimentally test the possibility of creating a product sample and determine its technical characteristics, verify the correctness of the results of theoretical research and select the optimal technical and design-technological solution.

In turn, when carrying out development work (R&D), technical documentation (design and technological) is developed, prototypes are manufactured, tested and accepted [1; clause 4.8]. The result of these works is a prototype product, manufactured according to newly developed working documentation for verification by testing of compliance with its specified technical requirements in order to make a decision on the possibility of putting it into production and (or) use for its intended purpose [2; clause 8].

Depending on the different definition of the result of research and development work, the procedures for registering them as a corresponding object of non-current assets, reflecting them in financial statements, as well as calculating the tax base based on their attribution to a specific type of property of an economic entity will differ. Incorrect calculation of one tax can lead to numerous tax violations.

When registering prototypes and mock-ups, the following most common problems can be identified:

– identification of classification characteristics in order to assign them to one or another group of non-current assets;

– compliance of the work performed with R&D contracts;

– identification of the obtained R&D results;

– correlation of the obtained R&D results with the development of new products or improvement of previously created products.

All doubts regarding the attribution of expenses to R&D must be eliminated, precisely defined in accordance with regulations and documented. However, to date, operations to identify and register prototypes and mock-ups created as part of R&D are not clearly regulated.

Due to the wide range of work performed and the large number of participants using various forms and methods of organizing work at various stages of the life cycle of industrial products, its development and production is carried out on an individual basis.

In practice, it is very difficult to distinguish between work to improve manufactured products (improvement of manufactured products) and work to create new products based on previously created ones (modernization of manufactured products), as well as to determine the future purpose of products for serial production. A specific feature of R&D is that for these types of work there is a high risk of not obtaining, for objective reasons, the result established in the technical specifications. The existing ambiguity is explained by the unknown, the uncertainty of the future use of the result of the work, since it is new.

It is also problematic to determine the fundamental features characteristic of innovations. Difficulties can arise after several years of working documentation for the obtained R&D result, in particular, during inspections by tax authorities and the absence of explanations from the developers that are understandable from an economic point of view.

Due to the ambiguous definition of the results of work performed when registering intangible and tangible objects created within the framework of the same contract, risks arise associated with additional tax assessments during audits of organizations.

Due to the different procedures for recording intangible and tangible objects, when registering, it is necessary to correctly identify the resulting R&D result.

An ambiguous point when reflecting prototypes and mock-ups created in the process of R&D is the purpose of their use. Prototypes and mock-ups serve as a means of testing and testing relevant technologies (projects) and are not initially intended to be used as fixed assets, equipment or inventories. The purpose of creating prototypes and mock-ups is to ensure the achievement of the results of relevant R&D, and not to ensure the current economic activities of the organization. However, in practice, a prototype is used in the activities of an organization as a material object (for example, at exhibitions, in a museum, as a component for other objects), can generate income, and is not intended for sale to third parties.

In addition, R&D expenses are written off without any examination of the efficiency and targeted use of funds in full, while organizations that received a positive R&D result are in a worse position, since they write off expenses evenly, and not at a time (if the result is negative) .

The accounting provisions “Accounting for fixed assets”, “Accounting for expenses for research, development and technological work”, “Accounting for intangible assets” do not disclose an unambiguous position as to what type of asset prototypes and mock-ups should be registered .

The current state of legal regulation allows us to conclude that it is necessary at the level of national standards to regulate methodological approaches to identifying the work performed and the results of R&D and the correct reflection of R&D results in accounting and reporting.

Bibliography

1. State standard of the Russian Federation GOST 15.201-2000 “System for the development and production of products. Products for industrial and technical purposes. The procedure for developing and putting products into production” was put into effect by Decree of the State Standard of Russia dated October 17, 2000 No. 263-Art.

2. State standard of the USSR GOST 16504-81 “Interstate standard. System of state testing of products. Testing and quality control of products. Basic terms and definitions" was put into effect by Decree of the USSR State Standard of 08.12.1981 N 5297.

3. Recommendations R 50-605-80-93 “System for the development and launch of products into production. Terms and definitions”, approved by order of VNIIstandart dated 07/09/1993 No. 18.

Documents required for registration

When going to a notary to conclude one of these types of contracts, representatives of organizations need to prepare the following documents:

ATTENTION! Check the list of documents that will be needed in your particular case: the list may differ from one notary to another, and for some categories of gifts, special papers are sometimes required.