Tax deductions for life insurance are becoming as popular as, for example, for treatment or education. Often people themselves seek to voluntarily insure their own life or health, and some are forced to take such a step.

For example, for a loan, or rather for its approval in the provision or not to increase the loan rate, a person takes out insurance for his life. Thus, the banking organization provides itself with a guarantee of the return of funds.

Citizens in the modern period are interested in accumulative types of insurance, namely, payment by the insurer not only upon death, but also in the presence of other reasons - the fulfillment of certain years and others. The article will tell you how to get a tax deduction for life insurance, what is necessary, and what is the largest amount of funds you should expect.

Under what conditions can you apply?

After the start of the 2015 transformations, it is allowed to receive benefits from the state through reimbursement when paying taxes on life insurance. This provision is fixed in Art. 219 of the Tax Code of the Russian Federation.

Compensation is considered socially oriented and is provided if the following factors are present:

- a voluntary insurance agreement has been concluded with the insurer for a period of at least 5 years. In 2021 Komkova E.G. signed an agreement with the insurer for a period of 2 years. That is, the woman does not have the right to subsequently use the prerogative to receive a refund on payments, since the duration of the action does not correspond to that established by law;

- the agreement was concluded for the personal benefit or for the benefit of the spouse, parents, children. Compensation applies to both adopted and natural children. An important point here is the absence of an age limit for children. That is, it is possible to issue compensation for an adult offspring. For example, Sidorov made contributions for his 20-year-old son, and then submitted a package of documentation with an application to the tax office. He received the deduction.

Only officially employed persons who contribute tax funds to the state treasury have the right to apply for benefits.

The following applicants will be denied a refund of part of their expenses:

- For students receiving only scholarship payments.

- Pensioners living solely on pension benefits.

- Unemployed women on maternity leave.

- If all costs were borne by the employer and not by the employee himself.

- An individual who used only maternity capital for payment.

Summarize

Taxpayers of the Russian Federation have every right to receive part of the funds collected by the state as income tax. One way is to take out life insurance. The main features of the contract include a validity period of 5 years and a certain circle of persons as the insured and beneficiary. You can receive funds through the tax office by preparing a complete package of documents. The second way is through the employer, having received the necessary notification from the tax service. The last way is to exclude personal income tax from your earnings. There is no tax deduction for life and health insurance. The amounts are relatively small, but in the long run they will help save your budget.

Subtleties of calculating the payment volume

When calculating the expected amount of payments, the following factors should be taken into account:

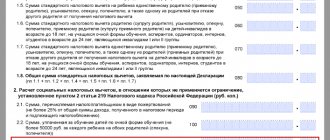

- no more than 15,600 rubles can be refunded. Since the maximum cost should not exceed 120 thousand. In fact, the individual will receive 13% of them. So, in 2021, Simonova signed an agreement with the insurer for a 6-year period. In the same year, the volume of payments reached 89,000 rubles. She transferred 52 thousand to the state treasury in a year. She will be able to receive 89,000 × 13/100 = 11,570;

- the maximum volume covers not only the possibility of receiving a refund from insurance, but also other social deductions - treatment, training and others. That is, in total for all 120 thousand. Even if you spent more than the indicated threshold, you will only be able to return 15,600 for all types of compensation combined. Belyakov paid for his studies at a driving school in 2021 in the amount of 52 thousand and insurance payments amounted to 100 thousand. But he can only claim 120 thousand for reimbursement;

- It is impossible to return more funds than transferred to the budget. Stroganova paid 78 thousand for insurance in 2021. The woman worked for a month and went on maternity leave. 5200 rub. transferred from her monthly salary for tax. She will be able to submit this amount to the inspectorate, but she will not be able to receive the rest. Because amounts for social deductions are not carried forward to a future period.

Refund amount

For a year, you can receive a maximum tax deduction for life insurance in the amount of 120,000 rubles and compensate personal income tax for no more than 15,600 rubles (120,000X13%). At the same time, the taxpayer can receive a personal income tax refund in subsequent periods until the expiration of the insurance contract, if at that time he receives income and pays contributions at a rate of 13%.

The amount of tax deduction is the same for all social tax refunds and does not exceed 16,500 rubles per year.

According to the Tax Code of the Russian Federation, 13% can only be returned from the total amount of costs for social issues (treatment, training, mortgage insurance) of 120,000 rubles per year (Article 219 of the Tax Code of the Russian Federation), and this is 16,500 rubles, that is, returned for the tax period, you can either have a smaller amount or equal to it, but not more.

The exception is tax refunds for expensive dental treatment; read about this in our article. But you can receive a deduction for life insurance at least every year in a row.

For example, in 2021, you spent 200,000 rubles on the education of your child and on the treatment of your father, and insured your life for another 200,000 rubles, so that in the event of your death, both the father and the child would not have to answer for your obligations.

The total cost was 400,000 rubles.

Considering that the tax benefit is allowed for a maximum amount of 120,000 rubles, it will not be possible to return money from 400 thousand rubles.

And it turns out that 400,000 – 120,000 = 280,000 rubles. With 280 thousand rubles, you will still have to pay 13% personal income tax to the state budget. But the tax code does not prohibit transferring to the next year funds not paid in the previous year.

The final tax compensation depends on the cost of life insurance and the income tax paid by the employer, but should not exceed 13% of the insurance amount. However, a citizen cannot receive more than 120 thousand rubles for personal income tax return from life insurance.

Calculation example: 120,000 – 13% = 15,600 rubles. It turns out that the maximum citizens of the Russian Federation can return for insurance is 15 thousand 600 rubles per year.

When using a deduction, a citizen of the Russian Federation must use the policy in the future. If this requirement is not met, a reverse calculation will be carried out, unless the contract is terminated for reasons that could not be influenced by the will and desire of the parties. It turns out that in order to receive a tax refund for life insurance, it is necessary to comply with the initial conditions and renew the contract in a timely manner.

If the contract is combined

Often the agreement is concluded not only regarding life, but also insures the person against threatening incidents or illnesses. According to paragraph 4, paragraph 1. Article 219 of the Tax Code of the Russian Federation is allowed to issue a deduction solely on the fact of life insurance. The Ministry of Finance of the Russian Federation adheres to a similar position.

If a person has a similar agreement, then to determine the amount of premiums for life insurance, you need to contact the insurance company for a statement. It indicates the entire volume of payments and is divided into categories.

For example, Savelyev also entered into a combined agreement with the insurer when applying for a loan. In 2021, he applied for a deduction and provided an extract from the company, according to which it turned out that the man had paid 30,000 rubles for life insurance throughout the year, and for other types - 13 thousand. The deduction is due - 3900. Other categories are not included in calculation.

Possible difficulties

Forewarned is forearmed. Difficulties do not always arise for clients, but it is better to familiarize yourself with the typical ones in advance.

Delay in payments

Sometimes the tax service delays the process of transferring funds.

In this case, or a phone call may help

It is necessary to clarify at what stage the verification of documents is , and also state your intention to write a complaint if the funds are not transferred.

Lack of a copy of the contract

The insurance company or employer refuses to transfer the contract to third parties because it contains confidential information.

In this case, it is necessary to point this out to tax officials and state that they can receive a copy of the agreement by making an official request.

Is there a mortgage benefit?

The mortgage loan is the longest-term loan available. Accordingly, the banking organization bears a huge risk of non-receipt of issued funds. To exclude such situations, the lender, when applying for a mortgage, sets insurance for the borrower as one of the conditions.

In this case, a mixed type of insurance is used, consisting of both personal and property safety guarantees. To clarify the issues that arise, the Ministry of Finance explains that compensation to a person for insurance premiums in this case is not provided. The position is explained by the fact that under a mortgage and related agreements, the recipient is the bank, but not the citizen.

Sviridov took out a mortgage in 2015, and with it an agreement on life insurance, property, etc. When paying fees, I expected to receive a refund of part of the expenses at the end of the year. But the Federal Tax Service refused him, because the recipient under the agreement is considered a credit institution. A man has the right to receive a deduction for interest and upon repayment of the loan.

Preface

When you take out a mortgage, the bank asks (requires) you to purchase two insurance packages:

- property insurance

- own life insurance

The first package is mandatory on the basis of 102 Federal Law on mortgages, but the second, on the contrary, is contrary to the laws, and the bank has no right to impose it.

However, banks easily circumvent these provisions in the Federal Law, taking advantage of loopholes and contradictions; they do all this in their own personal interests and in order to obtain additional guarantees that they will get their money back. That is, having insured your personal liability to the bank, in the event of non-payment of the loan, this will be the problem of the insurance company, not the bank (since it will receive its due from the insurance company).

If you do take out insurance, you should know that you are entitled to a tax refund for life insurance on a mortgage, and this applies not only to mortgage insurance, but, for example, when buying a car, this refund cannot be issued.

The possibility of a tax refund on life insurance is presented in the Tax Code of the Russian Federation of 2015 and, according to the law, can also be extended in favor of direct relatives. Such conditions apply to agreements concluded for at least 5 years. This applies, as a rule, to loans for apartments, contracts that end after full payment of the mortgage.

Required Documentation

When applying for transfers, you must provide the authorized body with:

- Income declaration 3-NDFL. It contains information about income.

- Identification. First pages and registration.

- Help 2-NDFL. It is taken from the management of the enterprise where the person works. It records information about the employer - the name of the organization, details, information about the employee - personal data, salary amount, how much money is transferred to the budget in total and monthly.

- Application for reimbursement. Indicating the details of the personal account to which you would like the transfer.

- Agreement with the insurer. Duly certified duplicate.

- Permission of the company to conduct activities of this kind. If the license number is specified in the contract, then there is no need to provide additional information.

- Papers confirming payment - checks, receipts, receipts and debit orders, bank statements. Or ask the organization to issue a certificate of contributions made.

It is impossible to unambiguously answer the question of what documents are needed for insurance for 5 years. Since each individual case may require an extended list of documentation. For example, when applying for a benefit based on payment for parents, the applicant’s birth certificate will be added to the above list, for a child – a duplicate of his certificate, for a spouse – a marriage certificate.

As it becomes clear from the list, originals or certified duplicates of documents are submitted to the Federal Tax Service. According to current legislation, certification occurs either through a notary or by the payer himself.

The second certification method involves on each page of paper the presence of the inscription “Copy is correct”, a signature and its decoding, and affixing the date.

How to get a?

To receive a deduction you will need the following package of documents:

- tax return;

- a certificate confirming payment for medical services (if necessary);

- a receipt indicating the transfer of funds to the account of the insurance company/medical institution;

- a copy of the contract for the provision of medical services;

- a copy of the license of the medical institution;

- income certificate;

- stub from a trip to the sanatorium (if necessary);

- a copy of documents confirming the issuance of prescription drugs (if necessary);

- a copy of the document confirming payment of insurance premiums;

- a copy of the certificate confirming the stop for registration with the tax authorities.

In addition to this you will need:

- Certificate from the place of work.

- Application requesting a deduction.

- Copy of passbook sheet/bank account details.

- A copy of the taxpayer's passport (photo + registration).

If information about the accreditation of an insurance company or medical institution is reflected in the service agreement, then you do not need to bring a copy of the license.

Conditions

A deduction can only be granted if the following conditions are met:

- The applicant is officially employed.

- When submitting an application, all necessary documents are provided.

- The information provided in the documents is true.

- The applicant pays taxes at the rate of 3-NDFL.

- VHI is issued to the taxpayer or his family members.

- The insurance company and the medical institution have undergone the licensing procedure in accordance with the law.

- The documents are valid on the territory of the Russian Federation.

If at least one of these conditions is not met, payment will be denied.

If the agreement date is earlier than the specified date

The transformation of legislation took place only in January 2015. However, what about people who signed the agreement earlier?

The opinion of the Federal Tax Service is that people have the right to claim benefits if they have the following grounds:

- the agreement is valid for more than 5 years;

- application is only permitted to payments made since 2015, but not earlier.

Svetlakova entered into a life insurance contract for 8 years in 2013. After the changes were made, she began to apply for a refund of part of the funds and was not refused.

Tax deduction for accident insurance

Insurers offer clients dozens of different services, including accident and illness insurance. they have their pros and cons, but the main disadvantage is that it is impossible to return 13% of personal income tax under such a policy. This also applies to combined policies that provide insurance (including investment) for life and illness and accidents. You will be able to receive a portion of the personal income tax funds only for the amount that appears specifically for life insurance.

When to submit and when to expect transfers

You are allowed to receive a refund only for the time when the costs were directly incurred. It is possible to submit documentation for the next tax period, after the grounds for receipt occur. For example, payment was made in 2021, but accrual will only be made in 2021.

ATTENTION !!! As for the length of time it takes for an authorized institution to make a decision on transferring funds, it is not fast at all. Documentation is checked only within 3 months from the date of submission. And the return is carried out from 2 weeks to 30 days after an affirmative decision is made.

Such a long process of compensation when issued through the Federal Tax Service. Faster deadlines when submitting documentation directly through the employer. The accounting department of the enterprise receives a notice from the tax office containing permission to pay and a completed application for a refund. In the first case, the entire amount will be transferred at once, in the second - partially, every month. That is, you will receive an increased salary without charging an income tax until the entire amount is exhausted.

In any case, it is worth applying for the benefits provided by the state, since, albeit in small amounts, the family budget is gradually replenished. The procedure is not complicated and the list of documentation is quite feasible for self-collection. It is important to fill out the income declaration correctly, but here you can always contact an inspectorate employee for help.