Companies can pay for travel for their employees. However, according to general rules, such a benefit does not affect the tax expenses of the company. However, there is an alternative option, according to which both the “wolves” will be well-fed and the “sheep” will be safe.

Many companies partially or fully pay for trips to various sanatoriums for their employees at the expense of the company. At the same time, vouchers are purchased not only for employees, but also for members of their families.

All this undoubtedly has a positive effect and strengthens the atmosphere within the company. But this coin also has a flip side - accounting and tax accounting of such transactions. After all, it is unacceptable for an employer’s good intentions to be spoiled by problems with controllers. And for this, the accountant needs to correctly reflect all transactions in accounting, pay the appropriate taxes, and preferably as little as possible.

Let's look at the tax consequences of paying for vacations for organizations. In addition, we will try to understand accounting and insurance contributions to extra-budgetary funds.

New in the Tax Code of the Russian Federation

From January 1, 2021, Law No. 113-FZ supplemented Article 255 of the Tax Code of the Russian Federation with a new clause 24.2. Labor costs may include funds spent on vacations for employees and their family members. To do this, the following conditions must be met: the employee and his family members must rest; Tourist services must be obtained from a tour operator or travel agency. The contract must be concluded by the employer himself (see letter of the Ministry of Finance of Russia dated May 23, 2018 No. 03-03-05/34637); the vacation must be organized on the territory of the Russian Federation; the cost of vacation for each person (the employee himself and each member of his family) should be no more than 50,000 rubles per year. In addition, the total amount of expenses for vacation pay together with expenses for voluntary personal insurance and for payment of medical services for employees should not exceed 6 percent of the organization’s payroll (clause 16 of Article 255 of the Tax Code of the Russian Federation).

At the same time, paragraph 29 of Article 270 of the Tax Code of the Russian Federation on expenses not taken into account when taxing profits was amended. In general, payment for vouchers for treatment or vacation, excursions or travel cannot be taken into account as expenses. And even the presence in an employment or collective agreement of a condition providing employees with the opportunity to “rest at the expense of the employer” does not change the situation. But from January 1, 2021, tourist services that meet the listed requirements of the new paragraph 24.2 of Article 255 of the Tax Code of the Russian Federation are excluded from non-taxable ones. Only those who meet the standard will be able to completely reduce the tax base for these expenses. These will most likely be large companies with a large payroll. And if they deem it necessary to pay for the vacation.

Calculation of insurance premiums

When deciding the issue of charging insurance premiums for the cost of a voucher, it is necessary to take into account whether the recipient of the voucher has an employment relationship with the organization and how its provision is formalized.

The object of taxation of insurance premiums is payments and other remunerations accrued within the framework of labor relations. Thus, if the person for whom the voucher was purchased does not work for the company, then insurance premiums do not need to be charged. Accordingly, fees are not charged for vouchers purchased for:

- former employees;

- children of employees and other family members who do not work for the company;

- disabled people and children under 16 years of age who are not employees of the organization.

In the case where the voucher is provided to a company employee, contributions must be calculated. Since such an operation was carried out within the framework of an employment relationship and such remuneration in favor of the employee is not mentioned in the list of contributions excluded from the calculation base. Consequently, the employee receives remuneration in kind, for which contributions must be calculated.

But when the transfer of a voucher is formalized under a gift agreement, then the obligation to charge contributions does not arise. This was stated in the letter of the Ministry of Health and Social Development of Russia dated February 27, 2010 No. 406-19.

Who can pay for trips?

Who can pay for vouchers is described in detail in the new paragraph 24.2 of Article 255 of the Tax Code of the Russian Federation. A company can pay for spa treatment or vacation for its employees, their spouses, parents, children and wards. In this case, the child, including the adopted one, must be either under the age of 18 years, or between the ages of 18 and 24 years old and at the same time a full-time student of an educational organization.

Similar rules are provided for the ward. He must also not yet be 18 years old or, if he is between 18 and 24 years old and guardianship or trusteeship has been terminated, he must be a full-time student in an educational institution.

What can be included in costs

The composition of costs that are included in the tax benefit is limited. But in addition to treatment, additional services can be included in the package.

Expenses taken into account for tax purposes:

- Treatment and wellness services.

- Accommodation, food, recreation.

- Travel to and from the place of health improvement, recreation or tourism.

- Excursion programs and services.

IMPORTANT!

All types of expenses must be clearly specified in the contract with the tour operator. Otherwise, it will not be possible to offset the costs. For example, if an employee purchased excursions on his own, then no one is obliged to compensate him for these amounts.

What services can be paid for and recognized as expenses?

The company can pay and take into account the cost of such services for tourists:

- travel across the territory of the Russian Federation by train, plane, water or road transport to a vacation spot and back;

- accommodation in a hotel, sanatorium-resort organization or other vacation spot in the Russian Federation;

- food, if it is included in the accommodation services;

- sanatorium and resort services;

- excursion services.

The contract must be concluded by the company directly with the travel agent or tour operator. If the contract is concluded directly with service providers (hotels, carriers, excursion guides (guides) and others), expenses cannot be taken into account.

Terms of payment for health improvement at the expense of the employer

Lawmakers have identified several important requirements that must be met in order to receive tax benefits. These include the following.

- Benefits for paying for sanatorium and resort treatment are provided only for Russian tourism and health improvement. It is permissible to conclude an agreement for sanatorium-resort treatment outside the Russian Federation, but in this case the right to taxation privileges is lost.

- You can receive a tax benefit only if the costs are paid by the employer himself. For example, if an employee purchased a trip on his own and then demands compensation for expenses, then the company will not take these expenses into account for tax purposes. Although compensation for spa treatment by the employer is possible, for example, at the expense of the company’s net profit.

- The benefit has an amount limit. No more than 50,000 rubles are allowed per employee per year. And this is not the only limitation. In total, the costs of employee health, together with expenses for voluntary health insurance, cannot exceed 6% of the wage fund. If the amount exceeds the permissible 6%, then expenses cannot be counted for tax purposes.

- Innovations apply not only to sanatorium and resort treatment for employees, but also to the organization of recreation for subordinates, as well as to tourism services. It is important to correctly draw up an agreement between the employer and the travel agent or tour operator.

Memo for employers

| Action | Result |

| The employer entered into an agreement with the tour operator to pay for the health of his subordinates. | Payment costs can be taken into account when taxed under OSNO and simplified taxation system 15% in the maximum permissible values. |

| The employee purchased the trip on his own, and the employer reimbursed the costs. | Company expenses cannot be taken into account for tax purposes. In addition, such costs are subject to additional tax obligations in the form of insurance premiums paid at the expense of the employer. |

| The company allocated funds to the employee to purchase a voucher. | The type of financial incentives for the employee is important. For example, if this is financial assistance, then only 4,000 rubles of the entire amount are considered non-taxable. The rest of the money will have to withhold personal income tax and pay insurance premiums. Bonuses and other remunerations for paying for sanatorium-resort treatment of subordinates cannot be taken into account as benefits and are subject to full taxation. |

Personal income tax

The cost of a sanatorium-resort package purchased by an employer for its employees and (or) members of their families is exempt from personal income tax if these costs are not included in the expenses taken into account when determining the tax base for income tax. This is not a new norm (clause 9 of Article 219 of the Tax Code of the Russian Federation). Another requirement is that the sanatorium-resort or health-improving organization where the employee and his family are going must be located on the territory of the Russian Federation. Such organizations mean sanatoriums and dispensaries, recreation centers, boarding houses, health or sports camps for children.

At first glance, this rule is suitable for avoiding paying personal income tax on company expenses for employee vacations permitted by Law No. 113-FZ. But that's not true. Tax exemptions do not apply to tour packages. Paragraph 9 of Article 217 of the Tax Code of the Russian Federation directly states that the cost of vouchers, on the basis of which sanatorium-resort and health-improving organizations, with the exception of tourist ones, provide services to individuals, is exempt from personal income tax. That is, when paying for a tour package to employees, the employer will have to withhold personal income tax.

VAT issues

Value added tax provides a benefit for sanatorium and resort vouchers issued on the established strict reporting form.

However, there is some uncertainty in the application of this benefit. In particular, there is no consensus on whether it can be used not by the organization that directly provides health services, but by the employer company that provides vouchers.

This is interesting

Personal income tax from the cost of the voucher is not withheld from retired employees, regardless of whether they got a job somewhere else in another company or not (letter of the Ministry of Finance of Russia dated February 19, 2009 No. 03-04-06-01/36).

The Financial Department is of the opinion that employers in this situation can take advantage of the benefit (letter of the Ministry of Finance of Russia dated March 16, 2006 No. 0305-01-04/68). But the judges have the opposite opinion on this matter. They pointed out that the benefit can only be applied by organizations that are directly involved in health resort and health activities (Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated May 3, 2006 No. 15664/05 in case No. A27-31250/2004-6). Although the arbitrators noted that there is no need to impose VAT on these amounts, since in this case added value is not created, therefore, there is no object of taxation.

Conditions for tax accounting of expenses

Mandatory criteria that allow the employer’s accounting department to reduce income tax at the expense of vouchers purchased for employees are as follows:

- The place of recreation/tourism is the territory of Russia.

- Signing one or more agreements on the sale of a tourism product with a tour operator or travel agent.

Tourist product - a set of transportation and accommodation services provided for a total price (regardless of the inclusion in the total price of the cost of excursion services and/or other services) under an agreement on the sale of a tourist product (Article 1 of the Law of November 24, 1996 No. 132-FZ " On the basics of tourism activities in the Russian Federation").

simplified tax system

Organizations with the object of taxation “income reduced by the amount of expenses” do not take into account the cost of vouchers paid from the organization’s funds when calculating the single tax. After all, such expenses are not included in the closed list of expenses given in paragraph 1 of Article 346.16 of the Tax Code of the Russian Federation. At the same time, organizations that pay a single tax on the difference between income and expenses include in expenses the amounts of insurance premiums accrued on the cost of vouchers (subclause 7, clause 1, article 346.16 of the Tax Code of the Russian Federation).

Organizations that pay a single tax on income do not take into account any expenses when calculating the tax (Clause 1, Article 346.18 of the Tax Code of the Russian Federation).

However, the single tax (advance payment) can be reduced by the amount of contributions to compulsory pension (social, medical) insurance and contributions to insurance against accidents and occupational diseases actually paid (within the limits of accrued amounts) in the period for which the single tax was assessed. In this case, the total amount of the deduction should not exceed 50 percent of the amount of the single tax (advance payment). This is stated in paragraph 3.1 of Article 346.21 of the Tax Code of the Russian Federation. For more information about what amounts are included in the tax deduction when calculating the single tax, see How to calculate the single income tax using the simplified tax system.

Is there enough money?

Is 50,000 rubles enough to relax? It is quite possible to purchase a tourist package for this amount. Analysis of prices for package tours showed that you can relax in Crimea, Sochi and Anapa.

So, the average cost for two people is approximately 37-38 thousand rubles for seven nights. A week in Sochi for two people costs about 43 thousand, and a trip to Anapa for a couple will cost 53-54 thousand.

Fifty thousand rubles is enough for a vacation. However, it is more likely for those who live in resort areas. Others may have difficulties with the cost of tickets.

UTII

The object of UTII taxation is imputed income (clause 1 of Article 346.29 of the Tax Code of the Russian Federation). Therefore, expenses associated with paying for travel packages for employees do not affect the calculation of the tax base.

Insurance premiums accrued from the cost of the trip and actually paid (within the accrued amounts) in the period for which the single tax is calculated can be deducted from the amount of the single tax. In this case, the total amount of the deduction should not exceed 50 percent of the UTII amount. This is stated in paragraphs 2 and 2.1 of Article 346.32 of the Tax Code of the Russian Federation. For more information about what amounts are included in the tax deduction when calculating UTII, see How to calculate UTII.

Accounting: issuing vouchers

The procedure for accounting for the issuance of vouchers purchased (received) by an organization depends on the sources of their payment:

- at the expense of the employee;

- at the expense of the organization;

- through contributions for insurance against accidents and occupational diseases.

The cost of vouchers purchased by the organization independently can be written off either at the expense of the employee or at the expense of the organization’s own funds. In addition, the cost (part of the cost) of vouchers purchased for the children of employees can be compensated from the regional budget.

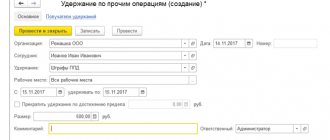

If the cost of the trip (part of it) is paid by an employee of the organization, make the following entries in your accounting:

Debit 73 Credit 50-3

– the cost of the trip is reflected, subject to reimbursement at the expense of the employee;

Debit 50 (70) Credit 73

– the cost of the voucher is paid into the cash register (deducted from the salary).

If an organization purchases a voucher at its own expense, there are two options. You can use the retained earnings of the current year or the retained earnings of previous years to pay for the trip. Include the cost of the trip among other expenses:

Debit 73 Credit 50-3

– reflects the cost of the voucher issued to the employee;

Debit 91-2 Credit 73

– the cost of the trip is written off from the current year’s profit.

Such entries must be made regardless of whether the retained earnings of previous years or the current year are used to pay for the trip (including profits based on the results of a quarter, half a year, or nine months). The fact is that such expenses cannot be reflected using account 84. These will be other expenses that also affect the financial result of the organization. Accordingly, such expenses must be reflected in the debit of account 91-2. Similar explanations are given in letters of the Ministry of Finance of Russia dated December 19, 2008 No. 07-05-06/260 and dated June 19, 2008 No. 07-05-06/138.

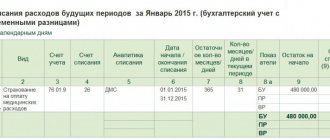

An example of how transactions related to the purchase and issuance of a voucher are reflected in accounting. The organization purchased the ticket independently. The cost of the trip is reimbursed from retained earnings

When distributing net profit for 2014, at the general meeting of shareholders of Alpha LLC, it was decided to reserve 80,000 rubles. to pay for travel vouchers for employees in 2015. On May 18, 2015, “Alpha” purchased a ticket to a year-round children’s health camp for the child of the organization’s manager A.S. Kondratieva. The cost of the tour is 18,400 rubles, the duration of the holiday is 21 days.

On May 22, 2015, the permit was issued to Kondratiev. The calculation of the cost of a trip paid from retained earnings is documented in an accounting certificate.

The following entries were made in the organization's records.

May 18, 2015 (receiving a voucher from the seller):

Debit 50-3 Credit 76 – 18,400 rub. – a voucher was purchased for the child of an employee of the organization;

Debit 76 Credit 51 – 18,400 rub. – the cost of the tour has been paid to the seller.

May 23 (issuance of a voucher to an employee):

Debit 73 Credit 50-3 – 18,400 rub. – reflects the cost of the voucher issued to the employee;

Debit 91-2 Credit 73 – 18,400 rub. – the cost of the trip was written off from retained earnings from previous years.