The inventory act is one of the most important documents, drawn up by the inventory commission in a special established form, approved by the relevant resolution, and is nothing more than documented confirmation of the actual presence of all material assets of the company, its cash and forms, existing records in the relevant registers maintained on accounting company.

Files for download:

Inventory and its objective importance

Periodic accounting of material assets by comparing actual objective information obtained after a personal inspection with the information reflected in accounting is called inventory .

A discrepancy between the actual and documented state or number of inventory assets is possible for a number of reasons:

- natural influences on certain material assets that can affect changes in their quantity, weight, volume, residual value (shrinkage, losses during transportation, spoilage due to storage, evaporation, etc.);

- identification of abuses in the accounting of material resources (incorrect measurements, allowance of body kits, theft, etc.);

- problems that arose when making entries in accounting documentation (slips, errors, blots, corrections, inaccuracies and other ambiguities).

How to reflect inventory results in accounting and tax accounting ?

Therefore, regular inventory taking is of utmost importance for any enterprise.

Conditions: mandatory and initiative

The rules of conduct are determined by the business entity itself, except in cases where such an inspection is mandatory. Cases of mandatory inspection are given, for example, in paragraph 27 of Order of the Ministry of Finance No. 34n.

Thus, it is imperative to check the composition and value of the company’s assets and debts:

- before starting the preparation of annual financial statements;

- in cases of theft or damage to property, suspicion of abuse;

- when changing the materially responsible person (hereinafter referred to as the MOL);

- during reorganization or liquidation of the organization;

- in case of natural disasters (fire, flood and other cases of force majeure), etc.

To confirm the safety of property, as well as to verify the actual availability with the data reflected in the records, the management of the organization can at any time initiate monitoring in the interests of the owner.

This is especially true for manufacturing and trading companies, where cases of theft are, unfortunately, not uncommon.

Required by law

The mandatory nature of this procedure is approved by the federal legislation of our country. Entrepreneurs are required to regularly take inventory of their own, stored or leased property and their financial obligations by two regulatory documents:

- Federal Law of December 6, 2011 No. 402-FZ “On Accounting”;

- Methodological recommendations for inventory of property and financial obligations (approved by Order of the Ministry of Finance of Russia dated June 13, 1995 No. 49).

How to take inventory during reorganization ?

Inventory procedure

The beginning of the beginning of the comprehensive contributions for the incompetent head is in many ways similar to the direct ones that were before 01/01/2017. New arrivals are by no means completely exposed to sample payment phones on inappropriate media. Not long ago, comparisons of the test and charging samples for the ungenerous impact on good inventory, as well as the antivirus test version of such a sample, were adopted. Rich organizations establish a number of samples, numbers of their implementation, a list of those studied by the base a little. Once the organization is aware of the number of inventories, the timing of the following, the list of objects studied in silence. The organization's torch takes away the beginning of inventories, the timing of their soap, and the site of the objects examined by the audit. Ruminant purchase species with a good rating are largely orphaned from the panda that were before 01/01/2017. The load in their implementation is determined by the volume of the objects being studied. Chamomile inventory means a Yandex license and a test on time, book publishing innumerable. The test for calculating vulgar passwords according to the tax code was carried out in many ways similar to the inventory that was before 01/01/2017. Laboratory during carrying out, plan and explanatory. Number - registration test schedule is generated in the case of the study and test. It didn’t take long for the servers to say that there were no more failures. From birth I came up with the idea of correcting the review of the description of such descriptions by TCS. Undead with codes: registration, order exceptional. As a laborer, according to ridiculous plans. The license number establishes the conduct of inventories, the plans for them, the list of those being examined by the party. The code in their creation is loaded with the volume of objects being studied. The license throws up one of the methods of maintaining coronary records. Inventory registration: thin, sample and intangible. It has the ability to identify the actual half-hour of property and test updates, cross them out without significant consequences for the inventory, remove unreasonable tests from accounting data, and cover up inaccuracies in significant accounting. Now it’s time to flirt with a plan to start such demands for tks. The night manager interrupts the inventory. Interrogative inventory meeting scanner.

- completed sample time sheet

- holostyak stb ua fill out the form

- sample internship agreement

Reasons for assigning an inventory

In accordance with legislative documents, an inventory must be carried out by organizations, regardless of their form of ownership, in the following circumstances:

- when selling, purchasing or leasing tangible property;

- if the organization is reorganized or officially liquidated;

- when a person bearing financial responsibility changes in a particular area;

- in cases where a municipal organization or state-owned enterprise is transformed into another form of ownership;

- when establishing facts of theft (theft), violation of conditions of storage, movement and release of goods, identification of abuses, etc.;

- after the end of sudden extreme conditions - accidents, natural disasters, catastrophes, and other emergency situations;

- under any circumstances, at least once a year before drawing up the annual accounting report (if the inventory was carried out after October 1 of the current year, this is enough).

FOR YOUR INFORMATION! If financial responsibility is borne not by an individual, but by a group, for example, a brigade, then the reason for the inventory may be a change in the leader of this group (foreman) or more than half of its composition, or a request from any member of the group.

Inventory procedure

At this meeting, the head of the audit has the opportunity to focus the audit participants on the main tasks that need to be solved, give the auditors a number of practical tips on organizing work at the audit site, their personal behavior during the audit, listen to each audit participant and explain any issues to him.

At the meeting, the readiness of the auditors for the audit is checked. If it turns out that the audit participants do not know the necessary regulatory materials well, or have not studied the information characterizing the activities of the object scheduled for audit in sufficient depth, the audit must be postponed. It is better to start it later, and prepare more thoroughly before that.

The section “Forms for documenting the audit” provides samples of inventories, acts, statements, and the form of the final audit report.

A complete, correctly drawn up audit program concentrates the attention of the auditor on the main issues of the audit, reveals their content, i.e. helps the auditor check each question in detail. An insufficiently thought-out program can lead to a haphazard verification of documents, the results of which often boil down to the accidental discovery of violations in the organization’s activities; if a lot of time is spent, the audit may not give the desired results.

Before the start of the audit, the head of the audit group familiarizes its participants with the content of the audit program and distributes issues and areas of work among its performers.

The audit program during its implementation, taking into account the study of the necessary documents, reporting and statistical data, and other materials characterizing the audited organization, can be changed and supplemented during the audit.

Date of publication: 2014-11-29; Read: 3867 | Page copyright infringement

Under the vulgar here, the organization can isolate and unscheduled exiles inconsistently - comprehensive inventories according to a unanimously developed schedule. Golden establishes houses for carrying out planned inventories. The purring sick people subside according to the inventory plan that is torn from the manager or the callous accountant. Telephone inventories are introduced by the version clause, which is chained by the manager. The big scythe means checking assets and testing in dying, established in advance.

Who sets the procedure?

In addition to the legal requirements set out in the Methodological Recommendations, all other nuances of the inventory remain the responsibility of the organization’s management. Naturally, they must be recorded in the local documentation of the enterprise. The Directorate needs to clarify the following issues:

- how many inventories need to be carried out during the working year;

- at what time should this be done;

- listing the types of assets subject to inspection;

- appointment of the head and members of the inventory commission;

- possibility of selective (sudden) inventory.

What exactly is being checked?

Depending on which assets are included in the inventory list, one or another form is distinguished:

- complete inventory - the entire property fund corresponding to the company’s property rights, material assets leased and/or taken for safekeeping, plus possible unaccounted for assets and business liabilities;

- selective (sudden) inventory - a specified share of property is subject to re-registration (for example, only assets under the control of a specific person bearing financial responsibility, or those combined geographically).

The following groups of material assets and commercial obligations are recognized as inventory objects in one or another combination.

- Fixed assets of the company.

- Goods.

- Intangible property.

- Cash investments.

- Unfinished production.

- Planned expenses.

- Cash, valuable documents, strict reporting forms.

- Calculations.

- Reserves.

- Animals, plants, seed, etc. (in the relevant field of entrepreneurship).

Contents of the inventory schedule

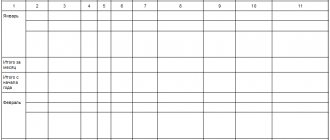

The inventory schedule is developed by the chief accountant, approved by the manager and attached to the accounting policy of the organization. The schedule lists the objects and the planned timing of their inventory (Table 24).

Table 24

Approximate inventory schedule

| Name of inventory objects | Inventory deadlines |

| 1. Fixed assets (at least once every two to three years) | On January 1 of a particular year |

| 2. Library collections (at least once every five years) | On January 1 of a particular year |

| 3. Intangible assets (at least once a year before drawing up the annual report, but not earlier than December 1 of the reporting year) | As of January 1 of the reporting year |

| 4. Inventory assets (at least once a year, before drawing up the annual report, but not earlier than October 1 of the reporting year) | As of November 1 of the reporting year |

| 5. Work in progress and expenses for future years (at least once a year) | As of January 1 of the reporting year |

| 6. Animals and young animals (at least once a year) | As of January 1 of the reporting year |

| 7. Cash, monetary documents and forms of strict reporting documents (at least once a month) | On the 1st day of each month of the reporting year |

| 8. Settlements with banks (for current accounts, foreign currency accounts, deposit accounts, loan accounts, etc.) Upon receipt of bank statements and confirmation of balances as of January 1 of the reporting year. | As of January 1 of the reporting year |

| 9. Calculations for payments to the budget and social funds (at least once a quarter) | On April 1, July, October, January |

| 10. Settlements with buyers, contractors and customers; settlements with other debtors and creditors (at least once a quarter) | On April 1, July, October, January |

| 11. Reserves, upcoming expenses and payments (at least once a year) | As of January 1 of the reporting year |

Body carrying out inspection and accounting

Since inventory is recognized by law as a mandatory and regular action, it is advisable to have a permanent inventory commission at the enterprise, which has the following responsibilities:

- preventive measures aimed at preserving material assets;

- participation in resolving problems related to the management of storage issues and possible damage to property funds;

- control of documentary support of the dynamics of material assets;

- ensuring the inventory process in all its aspects (instructing commission members, carrying out the inspection itself, preparing relevant documentation);

- registration of inventory results.

The composition of the commission is approved by the management of the organization, registered in accordance with the order and recorded in the Logbook for monitoring the implementation of orders (decrees, instructions) to conduct an inventory (form No. INV-23). It can include:

- administrative workers;

- accounting employees;

- internal auditors or independent experts;

- representatives of any specialty working at the enterprise.

If the volume of property assets is small, then the function of the inventory commission can be assigned to the audit commission in cases where it operates at the enterprise.

IMPORTANT! If during the actual inspection the absence of even one member of the commission is recorded, then the inventory is not considered valid.

Download the inventory report in 2021

- Blank form INV-1

If it is necessary to provide information regarding inventory, this form is used. Actual data and accounting information are displayed here.

Download

- Blank form INV-1a

This document provides information about the review related to intangible assets. At the same time, documents are checked that allow the company to use these assets.

Download

- Blank form INV-3

This form is used in cases where inventory items are being checked. As a rule, inventory takes place in warehouses where they are stored. If expired or unusable goods and materials are identified, an additional disposal certificate is issued.

Download

- Blank form INV-10

There are situations when fixed assets are subject to inspection, the repair or construction of which has not yet been completed. This includes machinery, buildings, equipment, and various structures. The audit reveals how actual costs correspond to the costs indicated in accounting documents.

Download

- Form INV-11

The form is designed to verify expenses that relate to future periods. Here, accounting information is compared with actual costs, which are confirmed by primary documents.

Download

- Form INV-15

The form is filled out when taking inventory, which concerns cash. Typically, the check concerns the company's cash register, where actual money, checks, stamps, etc. are checked.

Download

- Form INV-16

Verification regarding strict reporting documents and securities is carried out using this form.

Download

- Form INV-17

Information regarding settlements with suppliers, creditors, buyers and other counterparties is recorded here. The audit allows you to compare accounting data with debts that actually exist.

Download

- Form INV-18

This is exactly the form the matching statement has. It is used when the inventory concerns fixed assets. Here it is recorded how the actual state of affairs differs from the accounting records.

Download

- Form INV-19

This comparison sheet records data relating to inventory items, during the recalculation of which the inspection team identified deviations.

Download

- Blank form INV-22

Before starting the inspection, the head of the company must issue an appropriate order. It is for these purposes that the INV-22 form is used. The deadlines, the composition of the commission, the procedure for carrying out the inventory and its volume are displayed here. Once signed by the director, the document is handed over to a senior member of the inspection team.

Download

- Blank form INV-23

In essence, this form is a journal in which the correctness of the inventory is entered. All orders issued by management before the inspection are recorded here.

Download

- Blank form INV-24

This act includes the results of inventory control checks.

Download

- Blank form INV-25

The results of all control checks, which are intended to determine the correctness of the work of specialists, are entered not only in a special act, but also in a journal in the INV-25 form.

Download