We work with cash

Handling cash always comes with great responsibility.

The cashier needs to be able not only to correctly draw up all cash documents, but also to comply with legal requirements. IMPORTANT! The main points that a cashier should know when working with cash are indicated in the law “On the use of cash register systems” dated May 22, 2003 No. 54-FZ and the instruction of the Central Bank of the Russian Federation on cash transactions dated March 11, 2014 No. 3210-U.

To learn how cash discipline is checked and what the consequences of violating it may be, read the material “Cash Discipline and Responsibility for Its Violation.”

But that's not all: the cashier has many other responsibilities. One of them, the implementation of which is necessary when working on a cash register with an EKLZ, is filling out the report “Cashier-operator’s certificate-report” about the readings of the cash register counters and the revenue for the working day (or cash register shift). Based on this report, the revenue received for the shift is credited to the operating cash desk.

It is done either on a form of the unified form KM-6, approved by Decree of the State Statistics Committee of December 25, 1998 No. 132, or on a form of similar content, developed independently. The latter became possible from mid-2021 after the amendments made to Law No. 54-FZ came into force.

With the introduction of online cash registers on July 1, 2017, the need to prepare such a report disappears, since all necessary reporting can be generated based on the revenue data that went into the fiscal storage of the online cash register during the shift (see letter from the Ministry of Finance dated June 16, 2017 No. 03-01-15/37692).

Read more about the technical side of online cash registers in the article “Procedure for switching to online cash registers from 2021.”

Why is the KM-6 form needed?

Certificate form KM-6 is the main reporting document of the cashier. It indicates the revenue received and is handed over to the manager along with the revenue. If the proceeds are given to collectors, then a corresponding note is required in the certificate-report.

In the work of inspection bodies, such certificates play a very important role. It is on their basis that a conclusion is made about the completeness of revenue reflection. In addition, information from the KM-6 certificate is used to fill out a summary report. This report includes data on the status of cash register meters and the income of the enterprise.

Sample certificate. Filling example

To learn more about the KM-6 form, download a free sample. It is in *.doc format and contains the correct form of help without factual errors or inaccuracies. This sample can be used not only to study the features of the certificate report, but also for the specific work of a cashier.

The cashier-operator's certificate-report is divided into 3 parts - line, tabular and final. For convenience, we will divide it into 3 parts and an example of filling it out so that the reader can quickly find exactly what interests him.

So, an example of entering information into the line part of KM-6:

- In the “Organization” field enter the name of the enterprise, its address, and contact telephone number.

- The identification number of the enterprise where the cashier works is entered in the TIN field.

- The “Structural division” field does not need to be touched if this division does not exist in the company.

- In the “Cash register equipment” field, information about cash register models is entered.

- In the “Number” field – the number of the cash register. This information, as well as the information for point 3, can be obtained from the senior cashier or read in the cash register documentation.

- The “Application program” field remains empty if such a program is not used.

- In the “Cashier” field, enter the cashier’s last name and initials. If a certificate is created for 2 or more sectors that have several cashiers, then the field remains empty.

- The number of the current Z-report is entered in the “Change” field. This is not shown in the sample, but it typically starts with the letter "Z". For example, "Z 0040".

Important! Next comes an intermediate field in which you need to enter the serial number of the reference report, the date of preparation, the start time of work on the report and the end time of work. These data cannot be ignored.

The tabular part of the certificate must be filled out as follows:

- Column 4 should also be left blank if modern cash register technology is used (since 2004).

- In column 5 enter the amount at the beginning of the day or shift. This amount can be found in the cashier-operator’s journal, in column 9. It was left there by the cashier who worked the previous shift. This amount is also in the morning X-report, in the GROSS TOTAL line.

- In column 6 enter the amount from the GROSS TOTAL line of the Z-report.

- In column 7 - the amount from the “Shift Total” line of the Z-report. If returns occurred during the day/shift, then you need to enter the shift total minus the returns.

- Column 8 should be left blank if there were no returns. If they were, then you need to enter the amount from the “Returns” line of the Z-report.

- In column 9, the cashier enters his last name.

- The cashier signs in column 10.

The sums of columns 7 and 8 are entered in the “Total” field.

Important! Empty columns can be crossed out. Cashiers often cross them out so that the inspection authorities know for sure that the document is completed completely and the cashier has not forgotten anything.

The final part of the certificate is completed as follows:

- The line “Total...” requires you to enter the proceeds in words.

- The line “Accepted...” should be left blank. It is necessary when a receipt order is issued for a report. In practice this rarely happens.

- The line “Delivered to the bank” contains information about the bank only if the report is handed over to the collector. If the proceeds and certificate are given to the chief cashier, then this line should be left blank.

- There is also no particular point in filling out the “Receipt No.” line, because it refers to the “Accepted...” line.

Next, you need to leave signatures and transcripts of the signatures of the operator, senior cashier and head of the enterprise.

Features of the help report

The cashier-operator's certificate-report has several characteristic features:

- the KM-6 form, approved by the State Statistics Committee of the Russian Federation in 1998, is unified;

- errors when filling out, as well as deviations from the generally accepted format, may result in a fine during the work of inspection bodies;

- KM-6 must be filled out daily (or at the end of each shift), and simultaneous filling out of certificates for 2 or more days/shifts is not allowed;

- The document must be submitted simultaneously with the proceeds - either to the chief cashier of the company or to the bank;

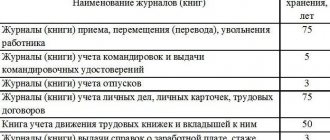

- The certificate must be kept for exactly 5 years, after which it loses its value.

Important! Column 4 is filled in only when using outdated cash register equipment. If modern devices have been installed in the organization over the past 12 years, then this section should be left blank.

Cashier's report

The movement of an organization's money must always be recorded and properly documented. The report compiled by the cashier is sent to the accounting department. Some organizations prefer to entrust all calculations to the chief accountant, so it is he who prepares the cashier’s report. Cash discipline requires the correct execution of all calculations and documents.

The cashier's report is generated for any movement at the cash register: payment of salaries, payment of travel allowances, payment of bills, etc. The report and the contents on the loose sheets of the cash book must be identical. Often accounting programs contain forms that are automatically generated when you enter data. With manual accounting, the cashier-operator's report is also a copy of the loose-leaf sheets. The required information includes the document number, the amount of the transaction, its name, and the date of the transaction. All documents indicating the movement of money are attached. When issuing cash orders (F No. KO-2) are attached to the report. When cash is received, cash orders are attached (F No. KO-1). The issuance of salaries is recorded by attaching pay slips (F No. T-53).

It is advisable to keep the cashier's report in a separate journal or in a folder. Information is added in chronological order. At each end of the period (year, month, quarter), the sheets are numbered, stitched and signed. The number of sheets is indicated, incl. all statements, certificates, orders.

The cashier's report is a “mirror” of the loose-leaf sheet, but with deeper, expanded information. The cashier signs the report, and the director (manager) or chief accountant signs the cash book.

The cashier-operator is required to generate reports F KM-6, indicating the readings of cash register counters, the amount of revenue per shift (working day).

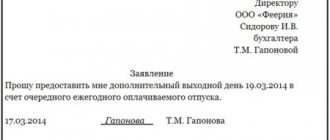

How should the cashier-operator’s certificate-report be filled out? First, specify the details:

1) name;

2) identification number (TIN);

3) name and address of the structural unit;

4) cash register (model, number (registration, factory)).

Next, the program that connects the cash register with the computer (if any) is indicated. The serial numbers of the certificates must match the numbers of the Z-reports.

The first column contains the numbers of Z-reports (at the end of the shift or working day). When taking several Z-reports per day (or per shift), entries are made in order.

In the second column the department numbers are entered, then the sections. The fourth column remains empty. The fifth column should reflect the readings of cash counters (summing), the sixth - the readings at the end of the shift (working day).

Write down in the seventh column the amount that the counter reflects (rubles, kopecks). This indicator should correspond to the difference between 6 and 5 columns. This includes returns (erroneous checks), separately indicated in column eight (if there are no returns, dashes are added).

The ninth and tenth columns are provided for the name of the head of the department and his signature. If there is no cashier on staff, the cashier handing over the proceeds must sign.

The “total” column must duplicate the information indicated in the seventh and eighth columns. Next, indicate (in words only) the actual amount of revenue (represents the difference between the indicators from the seventh and eighth columns). Afterwards, the data of the cash order (receipt) issued on the day of delivery of the proceeds (number, date) is entered into the certificate. Then indicate the number of the receipt issued by the bank (after receiving the money).

The F KM-6 certificate must be certified by the signatures of the manager, the chief cashier, and the operator.

The bank servicing the enterprise can check the maintenance of cash accounting at any time by requesting a package of documents for verification. The bank is provided with a cash book with a cashier's report.

General filling rules

In order to avoid mistakes when entering information into the KM-6 form, you must follow the general rules:

The first line of the report should contain the name, address (legal or actual - it doesn’t matter, the main thing is that it is the same in all reports) and telephone number of the enterprise. If there is a separate division, then its name must also be indicated.

If the KM-6 form is filled out by an individual entrepreneur, then he must indicate all the necessary information in the same order. This is a common mistake - many individual entrepreneurs believe that they can deviate from the unified form, because they work for themselves. The document must indicate the name, registration number and number of the CCP manufacturer. You must indicate the exact date of completion and certificate number. Revenue must be reported in numerical form and in words. The signature of the author of the certificate report is a required element.

Important! If the proceeds are not handed over to the company’s chief cashier, but to the bank, then this must be noted in the report.

Procedure for maintaining a cash book

The cash book is an important document for LLCs and individual entrepreneurs, who in their work deal with the receipt of cash. When conducting it, you must be guided by the following basic rules:

- The book is started and used in the activities of the enterprise for one calendar year.

- The book is maintained either by the chief accountant or by the person who replaces him (most often this is the cashier).

- One organization can maintain only one cash book, regardless of how many types of activities and taxation systems it uses. An exception is the situation with subsidiaries - they maintain their own separate book, a copy of the sheets of which is transferred to the company's head office at the end of the year.

- The cash book displays all transactions of the enterprise - both incoming and outgoing. The basis for entering data is PKO and RKO (receipt and expense cash orders, respectively).

- If on a certain day no operations were performed at the enterprise, then the sheet of the ledger remains blank.

- There are two forms of maintaining a cash book - electronic and paper. The rules for filling it out directly depend on the chosen form.

- Data is entered into the book immediately after the actual receipt or expenditure of funds.

- The cash book has a legally approved form KO-4.

- At the end of each day in which cash transactions were carried out, all data entered in the book is verified with the indicators of cash orders. Afterwards, the final cash balance is displayed, which is checked against the amount of cash in the cash register.

The total amount is signed by the cashier or other person responsible for maintaining the book. Also, the calculated indicators for each day are checked by the chief accountant of the enterprise, which is confirmed by his signature at the end of the sheet.

The listed rules relate rather to organizational issues related to maintaining a book. Next, it is worth considering in more detail the order of its registration.

Rules for registering a cash book

When maintaining a cash book in electronic form, all data is entered into it on a computer; there is no need to print the book at the end of the reporting period. There are no particular difficulties in filling out such a book, so it is worth considering the paper version in more detail.

There are two ways to maintain a cash book in this format:

1. A ready-made book is purchased (for example, printed in a printing house). A standard book of this kind is made in the form of a magazine and usually has 50 or 100 sheets.

If one book is not enough for the current calendar year, you need to create a new one and continue recording transactions in it. In this case, on the title page of the new book you need to indicate the period of time for which transactions are entered into the book. After the end of the year, you need to start a new book, even if there are still leaves in the old one.

All sheets in the journal are divided into two types:

- loose-leaf - filled with a ballpoint pen;

- tear-off documents are kept as carbon copies, that is, they completely duplicate the information entered on the loose leaf.

Both types of sheets must have the same numbering and contain identical data. After filling out, the loose leaf remains in the book, and the tear-off sheet is handed over to the accounting department by the cashier. This sheet is his reporting and must be submitted along with other documents: PKO, RKO, payment statements, etc.

2. Electronic sheets of the book are prepared, then they are printed and filled out by the responsible person. These sheets can be filled out either by hand or on a computer (in the latter case, they are printed after completion).

The numbering of the sheets is continuous; they are numbered from the beginning of the year in ascending order. It is also necessary to indicate the total number of sheets for each month and the total annual value.

What is a cash register?

What is a cash book - a necessary accounting document, the form of which is made in the form of a specialized journal. It records information related exclusively to the movement of cash. The magazine has 50 or 100 pages. The sheet of the cash book must be numbered separately, the book is completely stitched and sealed on the reverse side with the signature of the entrepreneur, which is certified by a seal. However, according to the instructions of the Central Bank of Russia 3210-U, if you do not adhere to these rules in 2021, this will not be regarded as a violation of maintaining a cash book. However, the established form of the document must be maintained by the individual entrepreneur. Those who will be on the so-called simplified system in 2021 are no exception. The cash book is approved by the State Statistics Committee as form KO-4. In other words, this is a new form of the operator’s book, which must be maintained in 2021.

An important point in maintaining accounting records for individual entrepreneurs in 2021. is the correct and competent design - that is, the essence and form. When conducting an inspection, state control authorities will first of all check this document. Incorrect maintenance or absence of a book can result in significant fines. But for ignorance or absence of a cash book, when salary payments are made to bank cards, individual entrepreneurs in 2021. does not bear any legal liability. However, if an entrepreneur keeps a cash register, he must fill it out in accordance with the established template and the existing requirements of current legislation. It is important to receive reliable and timely information from the operator in certain documents.

Corrections in the cash book

Regardless of the method of keeping the book, no blots or corrections are allowed. If a mistake was made when filling out the book, there are two ways to make changes:

- In the event that the error does not affect the final amount of cash balances, the incorrect value is crossed out with one line, and the correct data is placed above or below it. The correction made is certified by the signatures of the responsible persons - the cashier and the chief accountant.

- If, due to an error, changes occur in the reflection of balance amounts, it is necessary to completely cancel the page and draw up new cash sheets, with the correct data entered. Erroneous sheets are crossed out.

In the latter case, the person who made the mistake (cashier) draws up a report addressed to the chief accountant or director. Next, a special commission is appointed, responsible for making corrections to the cash book. After the adjustments are made, the cashier draws up a corresponding certificate indicating the errors made and the corrections made.

When changing data in the cash book, you must strictly comply with all established requirements. Otherwise, during the audit, tax inspectors may discover existing violations and fine the company. However, it should be taken into account that the right to a fine is only in the case when the detected violation and the date of inspection have a time difference of no more than two months.

How to stitch a cash book?

When maintaining a cash book, an important point is not only its correct filling, but also compliance with all requirements for registration of accounting documentation. First of all, this concerns stitching sheets and fastening them.

The order of stitching the sheets of the cash book also depends on how it is maintained:

1. A book purchased from a printing house is bound immediately. Before you start filling it out you must:

- number all sheets;

- sew all sheets;

- on the last page indicate the total number of sheets;

- put a seal (wax or mastic);

- sign (this must be done by the head of the enterprise and the chief accountant).

2. The book, printed on a computer, is stitched at the end of the year. During the year, the cashier or accountant fills out the printed sheets and stores them in a separate folder, and then staples them according to the same rules as the finished book (indicating the number of pages, the seal and signatures of the manager and chief accountant).

When maintaining and registering a cash book, it is worth remembering several important points:

- Having a book is necessary for those organizations and entrepreneurs who deal with cash in their activities.

- For use, you can either buy a ready-made cash book or print it yourself on your computer.

- A special responsible person is responsible for maintaining the cash book: the chief accountant or cashier.

- In the paper version, the book can be kept either by hand or using technical means (that is, filled out on a computer and printed).

Watch also the video on how to fill out the cash book correctly:

How to properly maintain a cash book in 2019

At each enterprise, by order of the manager, a special employee must be appointed responsible for the cash register. If the state allows, then this is a separate cashier; if not, then, as a rule, this is the chief accountant. It is this person who must keep records of all transactions and the cash book. In any case, the chief accountant controls the process. The cash book itself is a journal if maintained in paper form, or a separate section of the accounting program if maintained electronically. Both methods are allowed, so let’s look at each method of maintaining a cash book in more detail.

First, let's look at the responsibilities of a cashier, since they do not depend on the method of maintaining the cash book and have a certain algorithm that looks like this:

- At the beginning of a new shift, the cashier must open the day, that is, make an entry with the date and amount of the balance in the cash register. This amount should always be equal to the balance at the end of the previous working day. Such operations may not be daily, so it is necessary to open a shift and make an entry in the cash book only on the day on which the movement of funds occurred. On other days, the balance is simply transferred.

- Each operation for issuing or receiving cash must be formalized by a cash receipt order (PKO) or an expenditure cash order (RKO). The cashier prepares these documents, assigns them numbers and makes a record of each of them.

- At the end of the shift, the cashier sums up the day's income and expenses, makes appropriate entries in the cash book and displays the balance. The recordings made during the day are certified by the signature of the performer with a decoding of the last name, first name and patronymic. After which the cash book is submitted to the chief accountant for verification and approval.

This procedure is provided for each shift. These are only general requirements for maintaining a book; the basic procedure is slightly different, depending on the organization of the process.

Separately, it is necessary to note the requirements for storing the cash book. All cash registers, cash registers, tear sheets, various checks and the magazine itself must be kept in the company for 5 years. After the expiration of this period, the documentation should be destroyed in accordance with the established procedure.

Are there penalties for failure to comply with storage deadlines?

Tax and administrative liability is provided for violation of the safety of primary operating documentation. Legislative regulations stipulate how long cash documents of LLCs, non-profit organizations and budgetary institutions should be kept. The shelf life is 5 years. If the company violates the statutory period, it will have to pay:

- from 5,000 to 10,000 rubles per official - for the first violation (Part 1 of Article 15.11 of the Code of Administrative Offenses of the Russian Federation);

- from 10,000 to 20,000 rubles per official or disqualification for a period of 1 to 2 years - for a repeated violation (Part 2 of Article 15.11 of the Code of Administrative Offenses of the Russian Federation).

For violation of the rules for storing and compiling archival documents, the fine is (Article 13.20 of the Code of Administrative Offenses of the Russian Federation):

- from 1000 to 3000 rubles - for individuals;

- from 3000 to 5000 rubles - for officials;

- from 5,000 to 10,000 rubles - for organizations.

Tax liability is also provided. For a gross violation of the rules for accounting for income and expenses, the company will pay from 10,000 to 30,000 rubles (clauses 1, 2 of Article 120 of the Tax Code of the Russian Federation).

The instructions of the Central Bank of the Russian Federation No. 3210-U separately explain how long to keep cash documents of individual entrepreneurs - for 5 years, but only if entrepreneurs decide to keep cash documentation (clauses 4.1, 4.6 of instructions No. 3210-U). An individual entrepreneur has the right not to keep accounting records, not to draw up a cash book and receipt and expense documentation.

How to fill out a cash book: sample electronic form

The easiest way is to organize the maintenance of a cash book in an accounting program, which reflects all accounting in the organization. This function, for example, is available in 1C and other programs. In this case, the form is generated and filled out directly on the computer, the order of making entries does not change: it is necessary to enter information about each PKO or RKO. At the end of the day, the cashier must summarize, display the account balance and print out the sheets of the cash book for the day in two copies. All documents must be submitted for verification by the chief accountant, who verifies the data in the primary documents with the data in the registers and certifies them with his signature. Corrections and edits are not permitted.

Every year, and if the cash register turnover in the organization is daily, then quarterly, the printed sheets of the cash book must be formed into a journal and stitched. The last page must indicate the total number of sheets and bear the signature of the head of the organization, the chief accountant and an imprint of the company’s round seal, if any. In addition, you can maintain a cash book entirely electronically. In this case, all records must be certified by electronic signatures of authorized persons, and information and its editing must be protected from unauthorized access using additional technical means

Cash book: sample manual filling and filling requirements

Maintaining a cash book in 2021 begins with numbering and stitching its sheets. The ends of the lacing at the back of the journal must be sealed with a paper strip on which you must indicate the number of sheets, the start date of maintaining the cash book and the end date. To certify the record, the chief accountant and the head of the organization must sign, and a seal, if available, must be affixed. It should look like this:

On the title page of the cash book you must indicate the name of the organization and the period for which the document was opened. All entries must be made only with blue or black ballpoint pen or ink.

Each sheet is divided into two parts:

- one remains in the book;

- the second is detachable and is stored together with the RKO and PKO registers.

To fill out the sheet, the cashier places carbon paper so that the entry in pen is on the sheet that remains in the document. The entries must be completely identical, but you cannot sign a carbon copy. Therefore, at the end of the day, the cashier must sign on each copy of the cash book. All records about cash settlements and cash settlements are entered line by line in the appropriate columns, indicating the details of the person who deposited or received the money. Income and expense are entered in different columns. If one sheet is not enough to reflect all transactions for one day, the cashier must fill out the “transfer” line, which records the total amount of money received and spent at that moment. The next sheet of the cash book begins with the same amounts.

At the end of the day, you should sum up the results and indicate the total turnover at the cash register for the day and withdraw the remaining cash at the end of the day. If the cash register included amounts intended for the payment of wages or benefits according to the payroll or payroll, the cashier must allocate them in the line “including wages, social payments and scholarships.” After all the entries have been made, they are checked against the primary documents and certified by the chief accountant.

A correctly completed cash book sheet for the day looks like this:

What is a fiscal report

Fiscal report is a report from the fiscal memory of a cash register, in which all sales results are saved.

Access to it is limited and protected by a password, which is entered by the tax inspector when the cash register is registered with the tax authority. Based on data from fiscal reports (FR), tax authorities conduct audits and receive complete information about the organization’s revenue.

What is needed to create a fiscal report

The procedure for withdrawing financial statements is regulated by documents of tax services and is carried out in certain situations:

- conducting tax inspections,

- replacing the fiscal memory block,

- deregistration of cash register,

- KKM repair,

- replacement of cash ledger

Stages of generating a fiscal report

- At the central service center, with which the cash register service agreement has been concluded, a corresponding statement is drawn up regarding the need to remove the financial statements.

- An application is made to the tax office

- The following are submitted to the tax authority along with the applications:

- cash accounting book, pre-laced, numbered and signed by the manager and chief accountant;

- last day budget reports;

- withdrawal act;

- cash machine.

Before removing the FO, a control check is punched. It must contain the following information: name of the organization, INN code, cash register number (factory and registration), check number, date and time of entry, as well as fiscal attribute.

Fiscal memory of cash register and fiscal reports

- EKLZ reports

- Fiscal reports

- Z-report

- X-report

Fiscal memory (FM) is a memory in a cash register in which information on revenue entered on the cash register is stored.

Fiscal memory (FM) is usually a microcircuit or a separate block in a cash register, onto which information about each Z-report is recorded. This block or microcircuit must be sealed at the central control center.

FP in the picture from left to right: Mercury 180K, Kasbi 02K, AMC 100K (version 18), Kasbi 03K

Tax office and fiscal reports

Fiscal memory and fiscal reports are needed so that an entrepreneur cannot hide his revenue.

When the tax office comes with an audit, inspectors must take down fiscal reports for the last 2 months of work on the cash register. Usually they do not know how to do this and ask cash register mechanics to produce a brief fiscal report by date.

Types of fiscal reports

There are several types of fiscal reports:

- Main X - report - a general report on revenue for the current shift (unlike the Z - report, it does not reset revenue)

- Control tape or hourly report - shows all purchases that were made during the current shift

- Z - report by department - shows revenue by department

- Z - report on cashiers - shows the amounts that each cashier has entered

- Z - report on goods - shows how many and what goods were checked out at the checkout

What information is stored in fiscal memory

The following information is stored in fiscal memory:

- cash register number

- TIN of the enterprise

- registration number

- cash register registration date

- ECLZ number

- information on Z reports: date of Z report

- Z report number

- total revenue per shift

- total amount of returns per shift

- check number

The difference between fiscal memory and ECLZ

Only the total amount for the working day is recorded in the fiscal memory, and each punched check is recorded in the ECLZ.

Common mistakes when filling out

Newbie cashiers sometimes make the ridiculous mistake of entering their own TIN instead of the company’s TIN. Of course this is wrong. The identification number must always belong to the company.

Columns 5 and 6 of the main table should not be confused. Column 5 contains the GROSS TOTAL of the X-report, and column 6 - the GROSS TOTAL of the Z-report. It can't be the other way around. This mistake is often made due to inattention.

Other errors are due to inattention when entering numerical values. For example, you can confuse the date or make a mistake when entering the amount. Such errors are unacceptable, so the cashier should check everything properly.

Important! If there are typos in the KM-6 form itself, then no one will punish the cashier for them. A fine can only be issued for errors in the information that the cashier-operator personally entered.