Why do you need a 2-NDFL certificate?

The certificate may be needed by tax agents, individuals, individual entrepreneurs, as well as pensioners.

A tax agent is an entity that pays citizens a certain amount with taxation. Agents are required to submit information about paid taxes to the tax service using Form 2-NDFL.

REFERENCE!

Tax agents are all employers operating in the country. Their responsibilities include calculating, withholding and paying taxes to all employees with reporting.

For individuals, the paper is a reflection of income; accordingly, it is needed in all cases when it needs to be confirmed. These include applying for a loan, paying for vacations, sick leave, days off, calculating pension accruals and processing various benefits.

In the same cases, individual entrepreneurs need a certificate. If the individual entrepreneur is also employed, a certificate can be requested from the employer.

Pensioners require 2-NDFL to apply for a loan or various subsidies. Only those persons who receive payments from the NPF can request a certificate.

Basically, a 2-NDFL certificate is needed in the following cases:

- Registration of loans and mortgages. Most often, banks require proof of income.

- Dismissal. When applying for a new job, the employer may require a declaration from the previous one.

- For deduction. It may be necessary to provide a certificate to the tax office in order to confirm the correctness of the accruals and obtain specific deductions.

- Apparatus employed. 2-NDFL is required by the accounting department so that it can see what deductions the employee had in his previous place. This will affect future deductions from income.

- To social protection. The document is needed to receive various benefits.

- To kindergarten and school. In this case, a certificate is needed so that, with a low income, the child is provided with some benefits, for example, free food.

- To obtain citizenship and visa. The certificate confirms that the applicant will be able to provide for himself and his family members.

- To court. Required for proceedings regarding labor disputes.

- Decree. Before going on maternity leave, a woman is required to provide a certificate for the last two years in order to process and pay benefits.

Why is it needed?

Every person from the working-age population of the country has at least once been faced with the need to obtain this document. And I wondered where to get the 2nd personal income tax certificate? Most often, it is needed to be submitted to credit organizations and banks in order to confirm the fact that a given citizen is able to fully pay off his obligations in the future. Moreover, the interest rate on the loan can significantly depend on the borrower’s provision of 2-NDFL. You will also need to receive it for:

- registration of tax deductions;

- sometimes - upon receipt of a visa;

- for getting a new job and in some other cases.

What kind of certificate is this anyway?

The 2-NDFL certificate form is approved at the legislative level. This document contains all the necessary information regarding the taxpayer and tax agent, the amount of income and the tax withheld. It includes the following sections:

- information about the tax agent;

- information about the individual who receives the income;

- income that is subject to taxation at the tax rate;

- data on standard, social, property tax deductions;

- total profit and tax.

The certificate may be required both for personal purposes and as a form of reporting to tax authorities.

What information is included in the certificate?

Heading: it indicates the name of the document, the period of time for which the income was received, the date of issue, and the tax authority code.

Information about the employer (tax agent) - contact details, name and form of economic activity, OKTMO and KPP codes.

Detailed information about the employee (taxpayer - individual). This is the surname, first name and patronymic, date of birth, TIN, passport data, country code, taxpayer status, citizenship, actual address and place of residence.

Information on income received during the specified period and subject to taxation at a monthly rate of 13%. They should be scheduled by month. It also displays information about tax deductions and notifications, the total amount of income and accrued taxes.

Where can I order and get a 2-NDFL certificate for a working person?

Article 62 of the Labor Code of the Russian Federation states that the employer is obliged to issue information about the income of employees, in particular, 2-NDFL certificates. The obligation to issue certificates rests with the employer, since in accordance with Art. 116 of the Tax Code of the Russian Federation, he is a tax agent.

In view of this, obtaining a certificate for an employed person is very simple. All you have to do is contact your employer. He is obliged to issue a certificate within three days, without specifying why the employee needs it.

IMPORTANT!

If the employer fails to fulfill its obligations regarding the certificate, sanctions may be imposed upon the employee upon complaint. For officials, the fine is up to 5 thousand rubles, for an enterprise – up to 50 thousand. It is even possible to suspend the organization's work.

If there are errors in the document, you need to quickly correct them. Changes must be made both to the certificate of the employee who issued it at his request, and to the certificate that is sent to the tax authority. If a tax error is discovered before correction, the employer may be fined.

Possible problems

Although there is no risk of not receiving a certificate, another problem is possible - the data in the document will not correspond to reality. This applies to cases where the company maintains gray or even black accounting. However, nothing can be done about this: both the employer and the employee are responsible for this. And therefore, unpleasant consequences await both sides when fraud is discovered.

How to get a certificate if the organization is liquidated

There are times when you need to get a certificate from your old place of work, but the company no longer officially exists. You will need to determine the TIN of your former employer. He is registered in the work book.

Then you should contact the tax office directly at the place of registration of the organization. The official website of the Federal Tax Service will help you determine a specific branch. It stores information about taxes and income submitted by the company for various periods. After this, it remains to fill out two copies of the application in free form with a request to issue a certificate.

Illegal transactions

Due to insufficiently high official income, stricter requirements for documents for taking out a loan or mortgage, and the widespread use of gray and black accounting in enterprises, a segment of illegal services is thriving in the market. We are talking about selling fake certificates and statements that can be used in the absence of official work experience or taking out a loan.

How to obtain a 2-NDFL certificate from an employer?

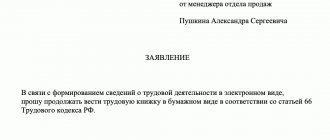

To obtain a certificate of employment, you need to visit the organization’s accounting department and write a free-form application addressed to the director. By law, the employer is required to issue a certificate within three days. If this does not happen, the person has the right to file a complaint with the labor inspectorate, and if this does not help, then with the prosecutor’s office.

IMPORTANT!

Tax documentation must be kept by the company for four years. At the end of this period, the employer may refuse to issue a certificate.

How to apply for a certificate

To obtain a document, you must write a written request in free form with a request to issue a certificate. Thus, two copies are filled out, one should be left with the employer, and the second should be taken away. In some cases, a verbal request will be sufficient.

If the employer refuses to issue a certificate, the applicant has the right to appeal to the court on the basis of Article 237 of the Labor Code of the Russian Federation. And if the court decides in favor of the employee, you can receive compensation for moral damage caused by the refusal or untimely issuance of a certificate. As practice shows, the case rarely goes to court: employers prefer to quickly issue the document.

2-NDFL information can be obtained directly online. Since 2014, every individual can view the data on the official website of the Federal Tax Service.

Help 2-NDFL: how to fill out in 2021

In order to correctly fill out the 2-NDFL certificate and not lose a lot of time, you need to know what the requirements for issuing the certificate are. article will help with this , in which you will find instructions for filling out the form.

Sample of filling out certificate 2-NDFL

Video - How to fill out a 2-NDFL certificate

When is it possible to receive 2-NDFL from the tax office?

Providing 2-NDFL certificates to individuals is not the responsibility of tax employees, as stated in Art. 32 of the Tax Code of the Russian Federation. However, if you need a certificate of income that you received at your previous job in a company that no longer exists, then only tax officials can provide this data.

To do this, an individual must submit a written request to the tax authority in accordance with the place of registration of the former employer. Tax officials must provide information about income based on information that was previously received from the former employer, because he is obliged to annually provide 2-NFDL certificates for each employee no later than April 1 of the year following the current one (clause 2 of Article 230 of the Tax Code of the Russian Federation) . For situations where a company is liquidated, in particular during transformation, the timing may differ, but liquidated organizations are required to submit 2-NDFL before complete closure.

Error while filling

The most common design errors when filling out a form are:

- the date format is not followed;

- incorrect placement of the seal (its place is on the left);

- there is no decoding of the signature (name and position);

- the blue seal and the signature in blue ink merge - take care that the former does not hide the latter.

Marks or corrections on the form are not acceptable. If any inaccuracy is detected in the information, the accounting department must take immediate action. The adjustment is sent to the tax office, and the corrected personal income tax is issued to the applicant.

If the inspection discovers an inaccuracy before the accounting department notices the mistake, then a fine for inaccuracy cannot be avoided (TC Art. 126.1). If you independently identify an error/typo and correct the document, sanctions will not apply.

Where can I get a 2-NDFL certificate for an unemployed person?

If an individual is unemployed, you can obtain a certificate in the following ways:

- Go to the dean's office of your university if you are a student.

- Visit the employment center if you do not work, but are registered with the employment service.

In each case, you must write an application in the form recommended by the authority issuing the certificate. In other cases, due to the absence of a tax agent at the place of request, documents are presented that confirm the impossibility of providing a certificate. Thus, those who do not work, before going somewhere for help, need to understand the sources of their income and whether they are individual entrepreneurs.

Features of filling out the 2-NDFL certificate

Depending on where the certificate will be provided, it can be filled out in various ways. Most often it is prepared by accountants who are either employed in a company that is a tax agent or work with individual entrepreneurs under a contract. In some cases, the certificate can be filled out by the entrepreneur himself or the head of a small organization. There are programs and online resources for this that allow you to save as much time as possible.

Also, 2-NDFL can be filled out independently. This can cause a number of difficulties for a person unfamiliar with all the intricacies, but in fact everything is simple. The declaration form can be downloaded from the official tax website. Let's look at some features of filling out the document.

- You need to start filling out declarations by entering the date. The header also indicates the Federal Tax Service code.

- The first section indicates the name of the legal entity. Enter contact phone number, INN, OKTMO code. There is also a field about the reorganization or liquidation of the company. It is filled out by successor enterprises that prepare reports for tax authorities instead of the liquidated company.

- The second section must contain information about the individual whose income and taxes are reflected in the certificate: full name, citizenship, date of birth, taxpayer code.

- Sections 3 and 4 indicate all sources of income subject to taxation. Here you can also see fields for deductions. Deductions are accompanied by documents certifying their legality.

- Section 5 – final. It contains the calculation of withheld and transferred tax taking into account the total amount of income with deductions.

- The last block must contain information about the person filling out the declaration. If it is the tax agent himself, a one is given, if the representative is a two. You must indicate the full name of the person who prepared the document and its details, and sign it. After this, you can submit the certificate wherever needed.

Possible difficulties

To avoid possible problems when receiving a certificate, be sure to check the following lines:

- Sign. This is a required field that allows you to determine the type of certificate. The number 1 must be included if the certificate displays information about income and the tax levied on it. The number 2 is set if income was received, but the income was not withheld. If the certificate is issued for an employee who received a salary with tax deduction, then, regardless of the purpose of receipt, the number 1 is entered.

- Code of the country. Mandatory column indicating citizenship. The taxation procedure for residents and non-residents of the Russian Federation is different. For Russians, the code in the column is indicated “643”.

- Region code. This indicates the region to whose budget the tax is paid. It corresponds to the registration of an individual. The region code can be found by the first two digits of the TIN.

- Tax deduction code. It may differ, for example, if a person has minor children.

- Section 5. It displays the income and its amount received by an individual during the reporting period. The tax base is indicated as the difference between profit and deductions.

If an error was made in the certificate, for example, a tax return was provided, a 2-NDFL adjustment must be submitted to the tax office. Its form is similar to the standard declaration, only the “adjustment number” field is different. When submitting a certificate for the first time, the number “00” is entered, if an adjustment is submitted for the first time, “01” and so on.

IMPORTANT!

It is better to notice the presence of unreliable information before the tax authorities do it. In this case, you can avoid a fine.

Certificate 2-NDFL is an important document that is required in all cases when confirmation of a citizen’s income is required. In its absence, many services may be unavailable. Obtaining this document is quite simple. This can be done through the employer or the Federal Tax Service website online.

Responsibility for a forged certificate

Quite often, if it is impossible to obtain a Form 2 - Personal Income Tax certificate, citizens falsify this document. Such actions are a criminal offense for which you can get a real prison sentence. Moreover, this offense may fall immediately under two articles of the Criminal Code of the Russian Federation: 292 (official forgery) and 327 (forgery of forms and seals).

Article 292 of the Criminal Code of the Russian Federation when falsifying 2-NDFL will be applied if you want to carry out some kind of operation with the help of a certificate, as well as in some other similar cases. This article is quite short, it only has 2 points:

- Point one. Introduction by officials and civil servants of false information or corrections into documents for personal gain. Punishable by a fine of up to 80,000 rubles, compulsory labor for up to 480 hours, correctional labor for up to 2 years, forced labor for up to 2 years, arrest for 6 months, or imprisonment for 2 years;

- Point two. The same acts as described in paragraph one, but committed with the aim of violating the rights of individuals or legal entities, as well as the state. Punishable by a fine of up to 500,000 rubles, forced labor for up to 4 years, or imprisonment for 4 years.

Article 327 of the Criminal Code of the Russian Federation will be applied for the falsification of the certificate itself, and there is no way to avoid it when considering the case. It consists of three parts:

- Part one. Forgery of documents and stamps that give any rights or remove restrictions, as well as the sale of counterfeit documents. Punishable by imprisonment for 2 years, restriction of freedom for up to 3 years, arrest for 6 months;

- Part two. The same acts as in the first part, but committed in order to hide the crime. Punishable by forced labor for 4 years or imprisonment for up to 4 years;

- Part three. Using a fake document for personal gain. Punishable by a fine of up to 80,000 rubles, compulsory labor for up to 480 hours, correctional labor for up to 2 years, and arrest for 6 months.