Work experience refers to the total period of official employment of a citizen. Duration gives a person a certain set of guarantees and privileges from both the state and the employer. It is the length of service that is one of the criteria for assigning an insurance pension, along with individual points, which are gained through wages, and reaching the appropriate age. Managers also reward people who have been busy for a long time, as this fact is reflected in experience.

What does continuous experience provide?

In modern Russia, continuous work experience is important only for a few professional areas. In Soviet times, all citizens who had permanent employment were guaranteed certain benefits and privileges.

Today it is advisable to talk about the benefits for:

- medical workers - they are assigned a bonus;

- residents of the Far North - benefits and compensation;

- employees of some institutions, where management, at its discretion, assigns bonuses and privileges to those who have been employed for a long time and consistently at a particular enterprise.

In general, the concept of continuous service, preserved from the times of the USSR, no longer plays a significant role, at least to the extent that it was before.

Let's look at what influences continuous work experience.

The following preferences are introduced within the enterprise to promote stability:

- salary supplements or bonuses;

- a one-time remuneration at the time of reaching seniority;

- exclusive right to additional days of rest, including paid ones.

Also at the departmental level, since there is no legislative definition, one has the right to clarify one’s own understanding of continuity, for example, activities at one enterprise (most often), in a certain specialty or in special working conditions, as well as within a region. The latter is often applied either to people employed in closed, remote areas, or to those who live in areas of the North.

Continuous work experience is not as important as total insurance coverage. It is on the size of the second and the volume of payments to the Pension Fund that the future pension depends.

Does continuous work experience matter?

Some workers are afraid of breaks between leaving one job and starting another, believing that this will interrupt their continuous service and this will somehow affect the size of their future pension, sick leave, bonuses, etc. Is this really so?

Buxgalter . uz explains:

There is currently no definition of the term “continuous work experience” in legislation. It was important during the times of the USSR and represented the time during which a person constantly worked, and the periods between layoffs and new employment did not exceed certain periods.

However, even now its mention among personnel officers is not uncommon. The fact is that continuous work experience is taken into account when assigning bonuses in certain professional fields. For example, bonuses for continuous work experience are guaranteed to medical and pharmaceutical employees of government institutions. The procedure for their payment and calculation of continuous length of service is regulated by the procedure and conditions for remuneration of medical and pharmaceutical workers of state institutions of the Republic of Uzbekistan.

Work experience in private enterprises

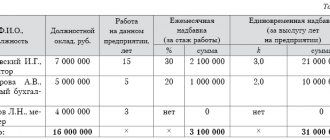

Companies also have the right to independently, locally, establish additional benefits for their employees for continuous work experience with a given specific employer or in a specific industry. The procedure for providing such guarantees is fixed in separate local regulations of the organization. For example, in a collective agreement, provisions on wages, material incentives, etc.

These can be monthly or annual salary supplements, the amount of which varies depending on the period worked. In addition to cash payments for continuous service, employees can be provided with additional paid vacations, trips to a sanatorium, etc. Moreover, the organization has the right to consolidate its interpretation of “continuity” in a local act:

- continuous work in one company or industry;

- continuous work in the same specialty or under the same working conditions.

If the internship is interrupted

If an employee decides to resign or change career field or specialty, he may lose the right to benefits established by the organization, even if he later returns to his previous position. At the same time, nothing prevents the company from prescribing a rule for maintaining all guarantees for the employee upon his return no later than a certain amount of time. For example, if no more than 3 months have passed between dismissal and the conclusion of a new employment contract, etc.

Thus, continuous work experience can influence the amount of remuneration of an employee if he is entitled to bonuses for continuous work experience established at the legislative level or locally from the enterprise’s own funds.

Is continuous work experience necessary to calculate pensions and sick leave?

For the calculation of pensions and temporary disability benefits, continuity of work experience does not matter.

When calculating length of service for assigning a pension, as a general rule, the following are taken into account:

- for the period before January 1, 2021 - any job in which the employee was subject to state social insurance, regardless of the type of activity, form of ownership and management - subject to payment of insurance contributions to the extra-budgetary Pension Fund (i.e. the so-called "insurance" is taken into account » experience);

- for the period after January 1, 2021 - any work performed by the employee, subject to the accrual of income in the form of wages.

In this case, earnings for calculating the pension are taken for any 5 consecutive years (at the choice of the person applying for the pension) during the last 10 years of work, regardless of any breaks in work.

Continuous service can affect the size of the pension, for example, in the case when a company locally establishes pension supplements from its own funds for “its” pensioners, i.e. former employees who left this organization and worked there or in a certain area for a continuously determined number of years.

When determining the amount of temporary disability benefits, the total length of service is also taken into account:

- employees with a total work experience of 8 years or more, as well as orphans under the age of 21, are paid benefits in the amount of 80% of wages;

- employees with a total work experience of up to 8 years – 60% of salary. An exception is certain categories of employees who have more preferential conditions for payment of benefits.

Lenara KHIKMATOVA,

"Norma" expert on labor law

Experts' explanations reflect their opinions and create an information basis for you to make independent decisions.

What is included in the experience

In general, the word continuous indicates that we are talking about employment without breaks or changes in professional sphere. By internal regulations, any enterprise has the right to establish its own criteria, for example, that a person is obliged to work in a specific company. In most cases, benefits are based on benefits, allowances or special working conditions.

According to Russian legislation, there is a list of periods in a person’s life that are not grounds for interrupting service.

These include:

- Official status of unemployed with payment of appropriate benefits.

- Completion of training at a higher educational institution, accompanied by a scholarship.

- Paid community service.

- The process of moving in the direction of an official body - the employment center.

- Documented temporary disability, usually your own sick leave or a child’s.

- Maternity leave, including maternity leave and childcare for up to one and a half years.

- Being at military training camps upon conscription.

- Fulfillment of other obligations to the state.

All of the above periods do not constitute an interruption of work experience, however, due to the ambiguity of the legislation, the company’s management has the right to define its own criteria, including excluding certain periods from continuous service.

We recommend you study! Follow the link:

Does the period of military service count towards length of service?

The length of service does not equal the insurance period; therefore, if we are talking about a particular period, then it is worth paying attention to whether payments will be made to the pension fund during it.

Experience has nothing to do with it

The maximum amount of sick leave payment increased by 1 thousand 125 rubles and thus amounted to 16 thousand 125 rubles. This applies equally to both those who have temporarily lost their ability to work due to the common flu, and those who have gone on maternity leave. Another revolutionary measure: if previously a person could receive sick leave only at his main place of work, part-time work was not taken into account, now the practice of paying sick leave extends to all places of employment of a citizen.

And finally, the third fundamental point is the rejection of the concept of “continuous service”, which has been in effect since Soviet times. Let us remember that previously the procedure was as follows: an employee who worked continuously for 8 or more years received 100 percent of average earnings. Those with 5 to 8 years of experience received 80 percent. Finally, those who worked less than five years were entitled to only 60 percent of average earnings.

If a person for some reason interrupted work for more than two months (this often happened when changing jobs), the length of service was interrupted and the countdown for calculating sick leave began anew. There was a certain injustice in this: a person has a total length of service of, say, a quarter of a century, but continuous work experience is only two years, which means that he receives the minimum amount of sick leave. Now the concept of “continuous service” does not exist at all. Instead, something else appeared - “insurance experience”. That is, even having a significant break in work experience, but having worked for a total of 8 years, a person has the right to be paid 100 percent of average earnings during sick leave.

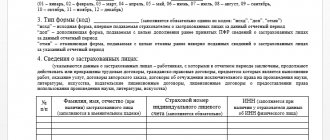

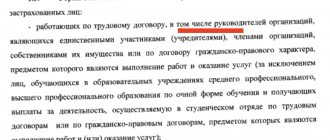

The Ministry of Health and Social Development has developed Rules for calculating and confirming the insurance period to determine the amount of benefits for temporary disability and pregnancy and childbirth. According to the Rules, “insurance period” includes work under an employment contract, state civil or municipal services, periods of activity as an individual entrepreneur, a member of a farm, a clergyman, as well as paid work of prisoners. Documents confirming insurance experience include a work book or, in the absence of one, written employment contracts, certificates from the employer or state (municipal) body, extracts from orders, pay slips and other documents.

The length of service is calculated on a calendar basis based on full months (30 days) and a full year (12 months). If two places of work coincide, only one of the periods at the choice of the insured is taken into account.

How to calculate continuity

It is important to clarify how continuous work experience is considered; the length of service and specifically the period of continuity are calculated using the citizen’s personal materials.

In particular these include:

- work book, as well as agreements on the existence of relations with the employer;

- information from the labor exchange and employment center;

- military ID in the form of a ticket;

- an agreement with the university reflecting the fact of payment of the scholarship;

- other materials from archives.

So, continuous work experience is the addition of time at a particular enterprise and the periods that are counted towards it. There is an exception for doctors - it is permissible to work in different organizations, but with a similar focus and in a similar position.

The following work is counted as a continuous period:

- part-time job;

- part-time employment.

These conditions are often used by citizens seeking to maintain their seniority, even under changing life circumstances, for example, upon the birth of a child. So, speaking about why continuous work experience and the overall period of service are needed, it is worth focusing not only on local privileges, but also on the long term in the form of pensions.

You can calculate your length of service yourself, either manually or using online calculators. Problems arise if the work record book is lost, since it is necessary to search for materials reflecting the duration of employment. In most cases, they are approached by the employer. Recently, information has also been received by the Pension Fund. Since there is data regarding deductions.

Let us note some periods of time when the length of service is not interrupted, but the activity does not count towards labor:

- Obtaining medical education, as well as another focus, if the period of unemployment does not exceed three months.

- Rest between seasonal jobs, but for this an employment contract is concluded and the employee must return within the time period specified in it. Otherwise, the agreement is terminated.

- Participation in correctional labor assigned to the place of service. The court decision does not provide for imprisonment.

In many industries, the process of calculating length of service and its continuity has been simplified, simply because it does not play a significant role. At the same time, in some areas, enterprises are guided by old rules and procedures. Interruption of work experience terms require provision of sufficient time to find a new place and for official registration.

To calculate continuity, it is recommended to refer to the employee’s official papers, as well as specialized resources of government authorities. Changing jobs does not always interrupt the length of service; the period for finding a new one and the grounds for dismissal are taken into account.

How to calculate continuous work experience upon dismissal?

To determine continuous length of service, a number of documents are used, on the basis of which it is calculated:

- Employment contract and book

- Military ID.

- Salary sheet.

- Certificate from the place of work.

In some cases, statements from archival organizations may also be used. In addition to the main job, work where the employee worked part-time is also taken into account, and calculations are made on calendar days. Also, the length of service of women with children under 14 years of age includes periods when they worked part-time.

Since the procedure for calculating length of service has changed dramatically since 2007, to calculate compensation, accountants have to recalculate continuous and insurance length of service before 2007 and after. If the duration of the insurance period is shorter, then the old rules apply, and only continuous is taken into account.

Accountants definitely need to know how many days after dismissal the length of service is interrupted, otherwise it will be impossible to calculate the amount of various compensations, and in case of incorrect calculation, the dismissed employee may require clarification from the Federal Social Insurance Fund of the Russian Federation or the Ministry of Labor.

Despite the fact that since 2007 the calculation procedure has been significantly simplified and the length of service is interrupted from the moment of dismissal, there are still a number of nuances in which such interruption can be avoided:

- If you need to quit voluntarily in order to find a more profitable job, it is best to take a vacation followed by dismissal. Thus, a citizen has the right to begin performing work duties in another organization the very next day after the end of the vacation, however, if he has already quit more than once in 12 months, the length of service will be considered interrupted.

- If a woman is on maternity leave for a child under 3 years of age and wants to go back to work, her husband can take this leave in order to receive benefits. If the employment contract expired while the employee was pregnant, the employer must renew it, because Dismissal in this case is allowed only upon liquidation of the organization.

- If the enterprise is liquidated, then while on maternity leave, the length of service will include a period of up to 3 years, provided that the employee was registered with the Employment Center, but could not get a suitable job.

- If an employee resigns due to transfer to another organization, the new employer is obliged to employ him within a month: this is the period of continuity.

Despite the fact that now the procedure for calculating seniority has been significantly simplified, there are still some areas in which it is carried out according to the old rules established by the regulations of organizations.

It is also important to know certain cases when the length of service is considered continuous, but they are not counted towards it:

- Studying in graduate school, clinical residency, university and secondary educational institution, if the intervals between their completion and employment do not exceed three months.

- Sending family members of military personnel to work or study at enterprises in the USSR or abroad, if two months have not passed from the moment of completion of studies to entering work.

- A break from seasonal work, provided that an employment contract was concluded and the employee worked the entire last season and returned to work within the agreed time frame.

- If the employee was involved in correctional work at the main place of employment without imprisonment.

What kind of break will not disrupt continuous service?

Continuous service after dismissal at one's own request will not be interrupted if the dismissed person can find a job again within 1 month.

ATTENTION: FOR RESIDENTS OF THE FAR NORTH, THE PERIOD BETWEEN EMPLOYMENT, WITHOUT INTERRUPTION OF WORKSHOP, IS EQUAL TO 2 MONTHS.

There is an exception to this rule: continuity of service will be maintained if the reason for the loss of work was:

- Reorganization of a company with reduction of positions/staff

- Complete liquidation of the enterprise and all jobs

- Period of temporary incapacity for work

Cases of maintaining continuity of service regardless of a break

The employer also provided the opportunity to maintain length of service without taking into account the break between successive jobs. Even with a long break between two jobs, the length of service will be maintained as continuous if:

- The employee was forced to resign from his previous place of work due to the transfer of his spouse to another location

- The employee resigned from his previous job due to the onset of the regulated retirement period.

Pension

According to current legislation, continuity of employment does not affect the size of a future pension. It is impossible to receive any additional payments for loyalty to the enterprise after retirement. The key factors influencing old age benefits are:

- Total duration of employment. For insurance payments, the minimum in 2021 is nine full years.

- Individual pension points. Calculated annually based on wages. The basic minimum is thirteen point nine.

- Age. Reaching the bar when the right to old age benefits arises at the state level.

Thus, the size of the future pension is decisively influenced by the payments made by the employer for its employees.

The higher the official salary, the larger sums a person will receive when going on vacation. What breaks in your work experience do affect is overall employment, which is decisive for your future pension. The Labor Code of the Russian Federation, indicating the procedure for calculating benefits, does not consider the concept of continuity either as basic or as additional. Length of service has an impact on military personnel; their years must be counted as several for the purpose of granting a pension; this is also indicated by the Labor Code. Currently, pension payments are entirely influenced by how much a person worked and earned. Moreover, whether he did this in one place or changed more than a dozen is not important. If there were payments to the Pension Fund, there will be a decent pension.

We recommend you study! Follow the link:

What is included in work experience and why is it needed?

Interruption of service due to voluntary dismissal

Normative acts providing for the conditions for the continuity of labor activity of working people do not yet exist in the legislation of the Russian Federation.

Not so long ago, this issue was spelled out in the Rules, according to which the continuous work experience of an employee resigning on his own initiative was interrupted in the following situations:

- the former employee did not find a new job within three weeks from the date of dismissal from the previous one;

- there is no compelling reason to miss work.

The following situations did not affect continuity in any way:

- the employee had to leave work due to the transfer of his spouse to a workplace in another city, town, etc.;

- The employee left due to retirement.

How to calculate continuous work experience using a work book?

You can calculate the continuous work experience from your work book using a calculator. This can be an online program or a simple regular calculator with which you can manually perform the calculation. It is quite obvious that it is much easier to calculate the duration of work using an online calculator. The numbers from the work book are simply entered into it, indicating the dates of hiring and dismissal. The calculation is performed automatically by clicking the “Calculate” button.

In this case, during the calculation it is necessary to take into account certain values based on clause 1 of Article 13 of the current Labor Code of the Russian Federation. To calculate length of service, you need to use the dates from the book. The number of days in a month is 30, and the number of months in a year is 12.

First you need to calculate how many years, months and days correspond to a certain place of work. Next, you need to pay attention to the period that was in between and take into account the reasons and conditions for dismissal. If the duration of the break is longer than the period established by the code, then the chain is interrupted and the further period of work is not added to the previous one.

Continuous work experience for calculating sick leave in 2019

The period of work for calculating sick leave affects the amount of benefits that are provided for temporary disability. At the same time, in 2021, the calculation is carried out according to the length of insurance; continuous coverage is not important when determining the amount of sick leave.

The main point is that to calculate this amount, the employee’s periods of work are taken for which payments were made to insurance funds. In addition, this does not include contract service in the army and compulsory military service. Therefore, when calculating sick leave, it is important to take into account such nuances.

Temporary disability

Periods of temporary disability, as a rule, are associated with illness and in everyday speech are called sick leave. If continuous service does not have any effect on pension payments, then such intervals do.

It looks like this:

- with experience from one to five years - sixty percent of wages;

- up to eight years - eighty;

- If a person works in a company for more than eight years, then during periods of incapacity for work he is paid his full salary.

In many ways, this is one of the key aspects that really relies on continuity. Along with this, it is important to note that the difference is not so great, although noticeable. According to the Labor Code, the duration of sick leave is not regulated, the main thing is the presence of grounds for temporary inability to perform work, and a doctor’s conclusion about this. In the Russian Federation, the maximum insurance period is not specified in any regulation or legal opinion, but the employee is obliged to leave the place if there is a medical expert opinion regarding the inability to continue activities.

Sick leave is calculated on a daily basis. If it so happens that the limit of length of service, which affects the amount of benefits, fell during a period of temporary incapacity for work, then part of it will be paid like that, and the other with a higher percentage.