The UTII taxation system is one of the special tax regimes for entrepreneurs working primarily in the field of small retail and is applied only to those types of activities, the list of which is established by local authorities, based on the list approved by the Tax Code of the Russian Federation.

Previously, such a scheme was used compulsorily: individual entrepreneurs who fell under certain parameters had no choice but to work “imputed”. Since 2013, the presence of “imputed” types of activity does not oblige an entrepreneur to switch to UTII if this tax system does not suit him.

The obvious advantages of this regime are minimal reporting and simple calculation of the amount of the single tax. UTII replaces a number of fees required for individual entrepreneurs working on a common system.

The 15% tax is determined by a simple formula, based on the amount of imputed income. In this case, imputed income refers to the conditional income that an entrepreneur can receive for a specific type of activity in a specific region.

This approach is based on the concept of basic profitability - the minimum benefit that, in the opinion of the state, an individual entrepreneur engaged in certain types of trade and services to the population should receive.

UTII for individual entrepreneurs in 2015

Since 2015, the tax system for individual entrepreneurs, whose activities are subject to UTII, come into force . Initially, it was planned to levy this tax on imputed income from individual entrepreneurs who are on a simplified taxation system. But since the beginning of this year, enterprises and organizations began to pay this tax. Moreover, UTII is calculated taking into account the value of movable and immovable property.

Payers of UTII

So, now it’s up to you to decide: do you want to be the payer of the “imputation” or will you still switch to another regime. Those companies and entrepreneurs who “flew” from UTII in 2013 will be able to become a single tax payer again from January 1, 2014. Don’t forget about the limitation: you can switch to the special regime only if the average number of employees does not exceed 100 people. Do not forget to submit an application to the auditors, forms No. UTII-1 “Application for registration of an organization as a single tax payer on imputed income for certain types of activities” and No. UTII-2 “Application for registration of an individual entrepreneur as a single tax payer on imputed income for certain types of activities" approved by Order of the Federal Tax Service of Russia dated December 11, 2012 No. ММВ-7-6/ [email protected]

Payers of UTII have the right to switch to a different taxation regime from the next calendar year (clause 1 of Article 346.28 of the Tax Code of the Russian Federation). Don’t forget, if you violate the requirements established for the use of “imputation”, then the campaign will be considered to have switched to the general regime from the beginning of the quarter in which the mistakes were made (clause 2.3 of Article 346.26 of the Tax Code of the Russian Federation). And lastly: do not forget, if you choose “imputation”, do not commit violations, because recalculating taxes according to the general system is definitely not in your favor.

Optimization of taxes under the simplified tax system and UTII

The e-book “Optimization of taxes under the simplified tax system and UTII” will tell you how to properly use the advantages of these two tax regimes and help reduce the tax burden on business

Who should pay this tax

In the previous year, namely from 07/04/2014, the Federal Tax Service approved the entry into force of a new form of tax return for UTII for organizations and individual entrepreneurs. It is worth noting that it came into force only this year. Entrepreneurs will submit a report on it only based on the results of the third quarter of 2015.

The Ministry of Finance clarified that UTII in 2015 is not provided for individual entrepreneurs and organizations in the case when the seller of a product first shows it to buyers in one place, and issues and carries out all related payments in another. The Ministry regards this type of economic activity as trade by sample. Therefore, for such entrepreneurs the simplified tax system or the general system is used.

Regarding individual entrepreneurs, the tax can be reduced if the individual entrepreneur makes fixed contributions. These changes specifically affect the period of payment of these contributions. Also, tax legislation does not provide for the distribution of the amount paid throughout the year.

What is the basic yield for UTII?

By basic monthly profitability, tax legislation means a monetary amount corresponding to the conditional profitability of a certain type of activity per unit of physical indicator.

This profitability is considered “conditional” because it does not depend on the actual results of the entrepreneur’s work. It is “assigned” by the government for each “imputed” type of goods and services per 1 employee / 1 “square” of retail space / 1 seat of a passenger vehicle fleet and other physical indicators characterizing this type of activity. Accordingly, the physical indicator for UTII will be the totality of these units directly involved in the production and provision of services.

How to calculate the tax amount

The formula for calculating the tax on imputed property has not undergone any changes. It includes the following coefficients :

- K1 - deflator coefficient (for 2015 - 1.798);

- K2 – correction coefficient (set separately in each subject of the federation).

Actually, the formula looks like this: UTII = Basic yield * K1 * K2 * 15%.

Note that the calculation of the basic profitability of an enterprise takes into account the informative value. The latter, in turn, is calculated per month, so it must be multiplied by 3. This happens because for UTII the tax period is a quarter.

Coefficients K1 and K2 were finally approved in December of that year. If K2 has never been established, then instead of it in the formula there will be 1. That is, if an entrepreneur sells goods with different K2, then this case will apply.

The amount of basic income with “imputation”

What are the basic income levels of UTII in 2014? Article 346.29 of the Tax Code of the Russian Federation contains a complete list of “imputed” types of activities with their corresponding profitability coefficients and physical indicators. Here are some of them.

Basic profitability for services

- Household services (according to OKUN - a classifier of services to the population), ranging from cleaning to construction work, private lessons, veterinary medicine, etc. - have a DB equal to 7,500 rubles per employee. The FP is the number of all employees of the enterprise, including the individual entrepreneur himself.

- Car repair, maintenance and car washes provide a conditional income of 12,000 rubles per person, and the physical indicator is similar to the FP of household services.

- From the point of view of tax legislation, paid parking lots generate a conditional income of 50 rubles per “square” of parking area. The physical indicator is the footage of the car area.

- The freight transportation database is calculated for each transport unit in the amount of 6,000 rubles. When calculating imputed income, the number of all vehicles involved in the transportation of goods is taken into account, and there should be no more than 20 of them.

- Passenger transport (taxi, minibuses) has a profitability of 1,500 rubles per seat; accordingly, the physical indicator is the total number of seats in the passenger fleet of an enterprise, not exceeding 20 cars.

Retail profitability base

- Stationary retail facilities with an area of less than 150 sq.m (pavilions, shops) are subject to UTII based on a basic income of 1,800 rubles per unit of area. The calculation includes the footage of the sales area.

- Stationary retail without trading floors with a total area of up to 5 sq.m., that is, stalls, kiosks, tents, has a DB of 9,000 rubles per retail space. FP is equal to the number of such places.

- Stalls and kiosks, non-stationary retail outlets with an area of over 5 square meters. m work with a conditional profitability of 1,800 rubles, which is multiplied by the entire retail space in meters when calculating the tax.

- The database for vending machines selling retail goods is 4,500 rubles. The individual entrepreneur pays tax on all the devices he has.

- For outbound trading, the number of employees is taken into account as the FI, and the DB is 4,500 rubles for each of them.

Catering database

- The profitability of a public catering establishment (canteen, cafe, pizzeria) with a customer service hall of up to 150 sq.m. is 1,000 rubles per unit area. The size of the hall for visitors is taken into account as the FP.

- The DB and FP of catering services outside the stationary premises (lunches to the office, home delivery) are the same as for away trade.

Conditional profitability of advertising services

- An advertising agency that places advertisements for clients on transport pays UTII based on a base of 10,000 rubles for one vehicle involved. The amount of tax depends on the total number of such vehicles.

- Services for placing outdoor advertising on street structures are subject to tax based on the advertising surface area. Conditional income base - from 3000 to 5000 depending on the type of structure.

Rental services and UTII

- An individual entrepreneur engaged in leasing residential real estate (apartments, houses, hotels) uses a database of 1000 rubles per “square” when calculating tax. The total area of housing is taken into account, and it should not exceed 500 sq.m.

- Renting premises larger than 5 sq.m. for stationary trade and public catering is taxed at a base of 1,200 rubles per meter of area. FP – footage of the entire non-residential premises.

- For a taxpayer who owns land transferred for paid use for retail facilities, the size of the plot is important. With an area of up to 10 sq. m will be subject to UTII for the number of leased plots (BD = 10,000 rubles for each), over 10 sq.m - land area based on 1000 per square.

For any of the above types of services, an individual entrepreneur may lose the right to “imputation” if the number of its staff exceeds 100 people.

It is worth noting that certain types of activities fall under UTII, and not the taxpayer himself, registered as an individual entrepreneur. This means that an entrepreneur who has a wide range of services is forced to keep separate records for “imputed” and “non-imputed” types.

If there are several services included in UTII, taxes are calculated for each of them separately, but are entered into one declaration and are also paid in a single amount.

Changes from the previous form

The declaration form has undergone a number of changes; they affected 3 sections. In the first section, line 010 was excluded; it previously indicated the KBK; the line codes that reflect OKTMO and the amount of tax payable for the reporting period were also changed.

There were also changes in Section 2 - the fields in which the OKUN service code was provided were excluded, including the application that contained these codes was excluded. An adjustment has been made to line 100 – the procedure for calculating the tax base.

Section 3 – fields have been introduced in which the taxpayer’s characteristics are indicated; the line in which the tax base subject to exclusion by OKTMO codes was displayed was removed. We also made a correction to display the amounts of insurance premiums to reduce.

Tax return for single tax on imputed income 2015

In 2015, a new UTII declaration was approved by a new order of the Federal Tax Service.

10/29/2015

Transition to UTII in 2015

To make the transition to apply UTII in 2015, you need to follow simple instructions:

- You need to register for tax purposes - Tax Code, Article No. 346.28, paragraph 3. This procedure is carried out within 5 days from the date of commencement of activities that are subject to UTII taxation.

- From this time (from the day that will be indicated in the application requesting registration) you will be considered the official payer of UTII.

- To confirm the fact of registration, you will receive an official notification that you are registered with the tax office as a UTII payer.

All types of activities that involve the introduction of UTII are prescribed in the Tax Code - Article No. 346.26, paragraph 2. And in paragraph 4 of the same article No. 346.26, exceptions are described that do not fall under UTII, since this payment should be understood as the payment of a single tax on exemption of the company from the following taxes:

- on the profit received;

- on property;

- VAT.

At the same time, the tax period for paying UTII is a quarter, but reporting periods are not established at all - Tax Code, article No. 346.30. According to this, transfers to the state budget for UTII are made at the end of the quarterly period.

It should also be taken into account that the object for taxation under UTII is the imputed (potentially possible, which does not depend in any way on the actual profit received) income of the one who pays this tax (Tax Code, Article No. 346.29, paragraph 1).

How is UTII calculated in 2015?

According to the Tax Code (Article No. 346.31), the interest rate of the single tax will be 15% of the amount of imputed income itself. Taxpayers must calculate it themselves. In this case, the transfer to the budget of the amount received in the calculations is made before the 25th day of the month immediately following the previous tax period (this is a quarter) - before 04/25, 07/25, 10/25, 01/25 of the next year - Tax Code, Article No. 346.32, paragraph 1.

Any type of activity that is transferred to UTII has its own individual characteristics - physical indicators (TC, article No. 346.29, paragraph 3):

- Number of workers.

- Trade area.

- Number of retail locations, etc.

When making settlement transactions, you should also take into account such indicators as:

- basic profitability for the month - Tax Code, article No. 346.29, paragraph 3 (the necessary data on the basic profitability corresponding to the desired type of business activity is listed here);

- the concept of the deflator coefficient K1 (annual inflation level) and its numerical value (used in calculations without rounding, does not require multiplication by coefficients of other years) - Tax Code, Article No. 346.29, paragraph 4;

- the concept of the correction coefficient K2 (established by local municipal authorities, taking into account various third-party factors, for example, the operating mode of the company) and its digital value (rounded to the third decimal place - Tax Code, article No. 346.29, paragraph 11) - Tax Code, article No. 346.29, point 4.

The first thing you need to do when calculating the UTII indicator is to decide on the tax base (reporting period - quarter). To do this you need to apply the following formula:

tax base (for the quarter) = basic profitability (for the month) x physical value. indicator (for 1 month of the quarter) + physical value. indicator (for the 2nd month of the quarter) + physical value. indicator (for the 3rd month of the quarter) x K1.

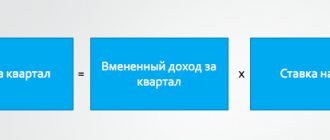

Second step: direct calculation of the UTII amount (for the reporting period - quarter) using the formula:

UTII (for the quarter) = tax base (for the quarter) x15%.

This calculation is provided for by the Procedure (clause 5.2, subclause 10), which was approved by Order No. ММВ-7-3/13 of the Federal Tax Service dated January 23, 2012.

Third step: after all UTII amounts have been calculated for each individual type (location) of business activity, the total amount of the payment should be calculated. But before that, it should be reduced by a certain amount:

- sick leave benefits that were paid to workers during the reporting quarter;

- actually paid insurance premiums (pension, medical, social, accidents and occupational diseases) - within the calculated amounts.

This payment procedure is provided for by the Tax Code (Article No. 346.32, paragraph 2) for firms and entrepreneurs who can quite legally reduce the amount of UTII by the listed amounts, but not exceeding 50%.

An example of mathematical calculations of the amount of UTII (taking into account accrued insurance premiums)

A company operating on a “simplified” basis is constantly engaged in the provision of services, according to which individual retail spaces and plots of land are leased out for organized trade. At the same time, the company carries out these types of business activities in the territory supervised by the local tax office. UTII payments are made for both types of activities. We know that the full amount of UTII for the 2nd quarter is 19 thousand 230 rubles. It includes:

- Tax payments for renting retail space – 7 thousand 210 rubles.

- Tax payments for renting land plots are 12 thousand 20 rubles.

During this reporting quarter, the company made mandatory insurance payments - 30 thousand rubles:

- For March – 9 thousand 500 rubles.

- For April and May – 20 thousand 500 rubles.

- For June, transfers were made on July 28.

- Payments for sick leave were not made.

Taking into account all these conditions, the amount of the tax deduction for UTII will be: 19230x50% = 9 thousand 615 rubles, which will correspond to the actual amount of this deduction (20500 more than 9615).

The transferred amount of UTII to the budget for the reporting 2nd quarter is 9 thousand 615 rubles.

How to refuse UTII in 2015?

Refusal from the so-called “imputation” is carried out on a voluntary basis. This can be done at the beginning of next year (according to the calendar). To do this, you must submit a corresponding application to the tax service within five days (from the moment the entrepreneur ceased to engage in entrepreneurial activity of the imputed type) with a request to waive UTII - Tax Code, Article No. 346.28, paragraph 3, paragraph 3. Specified date of this refusal must correspond to the first day of the coming year - January 1.

Post:

Comments

Basic yield for land lease

- Rent of land plots

rented out for the placement of stationary or non-stationary retail space up to 10 sq.m. The basic income will be 10,000 rubles, and the physical indicator will be the number of land plots for rent. For example: You have 2 land plots with an area of 6 and 9 sq.m., in this case the basic yield will be 10,000 rubles, and the physical indicator will be equal to 2 (based on the number of plots being rented out); - Rent of land plots for trade with

an area of more than 10 sq.m. The basic profitability will be equal to 1000 rubles. per sq.m., and the physical indicator is equal to the area leased. For example: You are renting out a plot of land with an area of 20 sq.m. for a kiosk, in this case the basic profitability is equal to 1000 rubles, and the physical indicator will be equal to 20 (the size of the area of the land plot being rented out in this case).

That's basically all I wanted to write about the basic yield and the physical indicator that is tied to it.

For those who have questions or are simply interested in a business topic, there is my group on the social network VKONTAKTE, all consultations in the group are free.

Good luck in business! Bye!

General rules for filling out the declaration

The declaration can be submitted either on paper or electronically via telecommunication systems.

In paper form, the declaration can be filled out manually, in black, blue or purple ink, or using a computer. When using a computer, both Windows tools (Word, Excel, etc.) and special software can be used. Declarations generated using special software differ from declarations completed without it. Appearance and rules for filling out fields. When printing declarations, you should keep in mind that double-sided printing is not allowed and the sheets cannot be stapled, as this leads to damage to the sheets.

All fields of the declaration are filled in from left to right. If a field is not completely filled in, then dashes are placed in the remaining cells of the field. If there is no data in a certain field, a dash is placed throughout the field. When filling out a declaration through special programs, dashes are not placed in the fields, and the numbers and text are aligned to the right, not the left, edge of the fields.

Appendix 1 “Completed declaration through a special program”

?

Appendix 2 “Completed declaration manually or on a computer without a special program.”

Is it always easy to calculate tax deductions?

The main difficulty may arise for enterprises that operate using different taxation systems. This is based on the fact that the expenses that an organization incurs to conduct its activities are often difficult to clearly take into account in one or another taxation system . For example, salaries of administrative staff and other general business expenses that apply to the entire business as a whole.

In such situations, the Tax Code prescribes the division of expenses in proportion to the amount of income from each specific type of activity. But maintaining separate records in this way is a rather labor-intensive process that requires a lot of time and effort. With income, the situation is simpler, since it is not difficult to determine from which specific type of activity the profit came.