Operations related to the accounting of non-exclusive rights, in practice, are most often encountered when purchasing software products. In most cases, the developer reserves exclusive rights. The company only gets the opportunity to use the program in its activities, that is, it acquires non-exclusive rights.

By purchasing a non-exclusive right to use the software, an organization may incur expenses in the form of payment:

- costs for acquiring a non-exclusive right;

- other costs associated with payment for services for the implementation of a software product and modification of its standard version taking into account the requirements of the company.

How to correctly account for such expenses for accounting and tax purposes?

Documents for processing receipts and debits from 01 software product accounts

In this case, indicate in the certificate: the name of the primary document, the basis, number, date and name of the business transaction; if it is not possible to fill out the section “Note on acceptance for accounting” in the primary document - when transferring the authority to maintain accounting to centralized accounting (Guidelines approved by order of the Ministry of Finance of Russia dated March 30, 2015 No. 52n). In this case, indicate in the certificate: the name of the primary document, the basis, number, date and name of the business transaction; operations to fulfill, withhold or pay off obligations, accrual of taxes, fees, insurance premiums and other obligatory payments (clauses 129, 131 of Instruction No. 174n, clauses 157, 159 of Instruction No. 183n); writing off unrecoverable accounts receivable and unclaimed accounts payable and accruing income from the rental of property (clause

98, 150 Instructions No. 174n, paragraph 101, 178 Instructions No. 183n)

The procedure for writing off inventory items from an off-balance sheet account

Inventory and inventory items are recorded on off-balance sheet accounts in the following cases:

- Acceptance of materials from other companies for processing - records of these operations are kept on the account. 003 “Materials accepted for processing.”

- Commission agents account for goods for resale on the account. 004 “Goods accepted for commission.”

- Acceptance for storage - this is what the account is intended for. 002 “Inventory and materials accepted for safekeeping” of the Chart of Accounts (approved by order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n).

Let's take a closer look at the procedure for writing off materials from these off-balance sheet accounts. Postings for capitalization and write-off from the account. 002 look like this: Debit Credit Contents of transaction 002 Acceptance of inventory items for secondary storage 002 Disposal of inventory items accepted for secondary storage Write-off of inventory items from the account.

002 is carried out on the basis of:

- form or similar document developed by the organization (taking into account the requirements of paragraph 2 of Article 9 of Law No. 402-FZ)

How software accounting is carried out

:

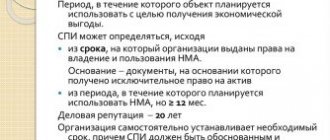

- duration of use exceeds the threshold of 12 months.

- availability of documentation confirming the right to own and use the object;

- the prerequisites have been created for obtaining financial benefits from the operation of the asset;

The software is placed on the balance sheet at its original cost, which includes the costs incurred to purchase the licensed product. If the cost of the program does not exceed 100 thousand rubles, then, according to tax accounting rules, the asset may be considered non-depreciable. In accounting, the threshold for classifying objects as depreciable is at around 40 thousand rubles.

When a decision is made to charge depreciation on the purchased software, the service life is determined according to the technical documentation and is correlated with the standards of Art. 258 Tax Code of the Russian Federation. This rule is fixed for tax accounting; in accounting, depreciation may not be charged if the service life of the intangible asset is unknown.

How much to take into account software (Kosheleva Yu.A.)

As a primary document, we can recommend issuing a certificate (f.

Software products acquired on the basis of a non-exclusive right cannot be depreciated.

0504833). In addition, according to clause 334 of Instruction No. 157n, a card for quantitative and total accounting of material assets is opened for each software product (f. 0504041). However, natural questions arise: for how long should it be taken into account there and how can it be written off. And about what she is silent. From the above provisions of Instruction No. 157n we can conclude that the starting point for accounting for the receipt and disposal of software on off-balance sheet account 01 is the license agreement.

Relations under such an agreement are regulated by civil law, in particular Art.

We recommend reading: Check passports for validity on the FMS website

1235 of the Civil Code of the Russian Federation. According to paragraph 2 of Art. 1235 of the Civil Code of the Russian Federation, a license agreement is concluded in writing. If the contract specifies its validity period, the software products are written off at the end of this period. In the case where the license

spisanie_po.jpg

A company operating on OSNO, in August 2021, under an alienation agreement, acquired exclusive rights to accounting software worth 420,210 rubles, while paying a state fee for registering rights to the software in the amount of 20,210 rubles. The validity period of the exclusive right is 5 years. The method for calculating depreciation of intangible assets is linear.

Example

Non-exclusive rights acquired under a license agreement are not recognized as intangible assets, and the costs incurred are taken into account in expenses for ordinary activities. The license to use the software is reflected on the balance sheet of the acquirer (for example, on account 012) in the valuation specified in the license agreement. After putting the software into operation, the costs of its acquisition are subject to write-off, the procedure for which is established by the company and enshrined in the accounting policy for accounting purposes. For example, the cost of purchasing software is reflected in the structure:

*(4) Also, as part of other expenses, the taxpayer has the right to take into account the costs associated with preparing the software for use, including adapting the software, setting up the program, provided that these costs meet the criteria established in paragraph 1 of Art. 252 of the Tax Code of the Russian Federation (letter of the Federal Tax Service of Russia for Moscow dated August 22, 2021 N 20-12/079908).

— Question: On accounting account 97 “Deferred expenses”, the organization takes into account acquired non-exclusive rights to software, in particular server licenses, program licenses. The period of use of the software is not specified in the documents. The organization's accounting policy sets the software use period at five years. How to correctly reflect license costs in accounting and tax accounting? (response from the Legal Consulting Service GARANT, May 2021)

Tax accounting

In order to avoid claims from the tax authorities, it is advisable to establish the expected period of use of computer programs, taking into account the period established by the Civil Code of the Russian Federation (at least five years - clause 4 of Article 1235 of the Civil Code of the Russian Federation), and take into account evenly the costs of acquiring the right to use them during this term, establishing such a procedure for recognizing expenses in the accounting policy for tax accounting purposes.

For example, in its accounting policy, an organization may stipulate a cost criterion for classifying such assets as fixed assets or inventories. However, the legislation does not contain any restrictions regarding the value of this criterion. It can be equal to 30 basic values, or have a different value (20 basic values, 40 basic values, be equal to a certain amount, etc.). An organization may also provide in its accounting policies a list of relevant assets related to fixed assets or inventories.

In which off-balance sheet account should the software in use be accounted for?

This procedure follows from paragraphs 66 and 302 of the Instructions to the Unified Chart of Accounts No. 157n.

After putting the computer program into operation, the costs of its acquisition, accounted for as deferred expenses, are subject to write-off to the financial result of the current financial year. The procedure for writing off expenses that relate to several reporting periods is established by the institution independently. For example, an institution can write off a one-time one-time payment for the use of a computer program evenly over the period established by order of the head of the institution.

Fix the applied option for writing off deferred expenses in the accounting policy for accounting purposes.

Nuances of software accounting in budgetary organizations

In budget-type organizations, software products are accounted for separately by type of expense in accordance with the norms of Order of the Ministry of Finance dated July 1, 2013 No. 65n:

- Code 242 is used in situations where software is purchased to satisfy requests from federal government agencies and organizations under their control.

- Code 244 is used when receiving software by subjects of the Russian Federation for which it is impossible to assign expense transactions to code 242.

- Article 226 is necessary if non-exclusive rights to use the program are acquired when updating reference and information systems.

The reasoning for the attribution of costs for the purchase of software to code 226 is given in the text of the Letter of the Ministry of Finance dated March 18, 2021, registered under No. 02-07-10/15362. The clarification clarifies that when determining accounting accounts, it is necessary to be guided by Instruction No. 157n. It implies the assignment of intangible assets in the form of software to off-balance sheet account 01. The cost in accounting is reflected equal to the amount of remuneration that is specified in the contract. The rule also applies to programs received under the right of non-exclusive use.

If an object recognized as an intangible asset was purchased with the receipt of non-exclusive rights to it with the condition of using the program for several reporting years, then:

- the amounts of costs are subject to inclusion in accounting in the current period;

- expenses will be considered expenses of future years;

- In accounting transactions, account 401 50 is used.

If the asset will be used for several years in a row, and the agreement for its transfer provides for phased payment on the terms of monthly transfer of fixed amounts, then the payments made are considered expenses of the current period.

Typical corresponding records for budgetary organizations are represented by the following options:

- if the organization incurs expenses in the current year, which are considered expenses of the coming years, they will be written off against the financial results of the future period when debiting 0 401 50 226 and crediting 0 302 00 000;

- if expenses were incurred in one of the previous years and were recognized by the organization as deferred expenses, then in each new reporting year their attribution to the financial result is accompanied by a debit turnover of 0 401 20 226 and a credit value of the amount of 0 401 50 226.

The scheme according to which the amounts of expenses for software with a long operating time will be divided and transferred to financial results is provided for in clause 302 of Instruction No. 157n. The regulatory document provides the opportunity for institutions to independently determine the procedure for transferring part of the costs to the results of financial activities. This can be done in uniform fixed amounts, by calculating a given proportion that takes into account the volume of services provided.

NOTE! The Letter of the Ministry of Finance No. 02-07-10/15362 clarifies that the period of use of a software product in the absence of information about this in the licensing documentation should be determined by the commission body.

Software and database updates must be implemented on the basis of a separate agreement. The frequency of updates can be set individually for each software product. When charging a monthly subscription fee for services to maintain the relevance of the information component in the program, expenses are included in the financial result of the current year. Costs are reflected in accounting transactions through debiting 1,401 20,226 and crediting 1,302 26,730.

Accounting for fixed assets on off-balance sheet accounts in 1C: BGU 8

I will structure the article as follows: I will draw your attention to how accounting was previously carried out on off-balance sheet accounts, and how it is now necessary to maintain it.

Expenditures on the program that will not be included in the intangible assets are carried out under subarticle KOSGU 226 “Other work, services.” Reflect them on accounts that are linked to this code: 302.26, 401.20.226.2 If the institution received a computer program for use, reflect it on off-balance sheet account 01.

In general, off-balance sheet accounts are necessary for full accounting of fixed assets, since these fixed assets do not play a role in the balance sheet of the institution, but they still require control.

There is also special reporting for government agencies on values in off-balance sheet accounts. As we all remember, accounting for off-balance sheet accounts is carried out according to a simplified scheme: the principle of double entry may not be used (in postings with off-balance sheet accounts there may be no corresponding account).

The lack of rigor in recording transactions with off-balance sheet accounts is explained by the fact that they do not participate in the formation of the balance, for which double correspondence must be observed. Let's summarize: - accounting on off-balance sheet accounts is important for control;

The work of the commission conducting write-offs

An act is a document that cannot be created by one person. A commission is needed to form it. That is, the manager must definitely create it. Tasks set before the commission:

- Inspection of valuables for write-off.

- Determining the reasons why assets fell into disrepair.

- Identification of persons who are to blame for the unusable condition of valuables (for example, an employee broke a product).

- Establishing the order of next actions.

- Formation of the act.

- Approval of the act by a person with appropriate authority.

- Valuation of assets.

- Control over destruction.

It is the commission that determines what valuables need to be written off.

Accounting on off-balance sheet accounts in 1C.

Budget accounting

Recording on accounts, unlike balance sheet accounts, is simple; a corresponding account is not needed to generate postings.

The main business situations in which an institution, in accordance with current legislation, needs to make entries on off-balance sheet accounts.

Before the entry into force of the amendment to Instruction 157n dated March 31, 2018, accounting for both rented property and property received for free use was kept in account 01 “Property received for use.”

In the latest edition of Instruction 157n, the purpose of account 01 is interpreted differently:

“The account is intended to account for property received by an institution for use that is not leased”

.

These changes are associated with the introduction of account 111.40 “Rights to use non-financial assets”, which currently accounts for the rights to use non-financial assets in accordance with the terms of lease agreements.

Important to consider

Accounting for fixed assets on off-balance sheet accounts in 1C: BGU 8

I will structure the article as follows: I will draw your attention to how accounting was previously carried out on off-balance sheet accounts, and how it is now necessary to maintain it. In general, off-balance sheet accounts are necessary for full accounting of fixed assets, since these fixed assets do not play a role in the balance sheet of the institution, but they still require control. There is also special reporting for government agencies on values in off-balance sheet accounts.

As we all remember, accounting for off-balance sheet accounts is carried out according to a simplified scheme: the principle of double entry may not be used (in postings with off-balance sheet accounts there may be no corresponding account). The lack of rigor in recording transactions with off-balance sheet accounts is explained by the fact that they do not participate in the formation of the balance, for which double correspondence must be observed.

Let's summarize: - accounting on off-balance sheet accounts is important for control;

Is it necessary to account for this software in off-balance sheet account 01?

In accordance with paragraphs. 66 and 333

“Instructions for the use of the Unified Chart of Accounts.”

, approved by Order of the Ministry of Finance of Russia dated December 1, 2010 N 157n (hereinafter referred to as Instruction N 157n), intangible assets received for use by an institution (licensee) are accounted for in off-balance sheet account 01 “Property received for use” at a cost determined based on the amount of remuneration established in the contract for the entire period of use.

66 Instructions No. 157n are also indicated by the judicial authorities (see, for example, the decision of the Twelfth Arbitration Court of Appeal dated October 23, 2014 No. 12AP-6735/14,

Error 1: lack of materials in the warehouse and invoice time

When posting a document, a message appears about the absence (shortage) of materials in the warehouse. And if we are sure of the opposite, then we go in search of errors in the program: in this article we will look at the three most common of them.

But first of all, I would like to draw attention to one important nuance for those who follow our example: the program can have settings that do not allow materials to be written off if they are not in stock. And therefore the program does not process this document and displays errors!

However, another option is also possible. If we go to the “Administration” - “Post Documents” section, then we can set the setting “Allow inventory write-off if there are no balances according to accounting data.”

After changing this setting, the document will be processed by us - and this situation will be one of the most dangerous. With these settings, the program will not report a single error, but if we go into the postings, we will see that the movements are generated without a total estimate. Please note this before deciding which setting is most convenient for you.

Next, I propose to figure out why it is not possible to post the “Demand-invoice” document. For convenience, we will use the “Subconto Analysis” report.

Let’s generate this report and indicate the “Nomenclature” subaccount. Next, click “Show settings” and on the “Selection” tab select the item that interests us.

It would seem that everything is fine. We have the quantity, the cost too, but the write-off occurs without the amount.

If we expand this report by double-clicking on the “Turnover” resource field, we will see that the time specified for the “Request-invoice” document is earlier than the time of the “Receipt (act, invoice)” document.

Let's set the time of the “Demand-invoice” document to the end of the day and resend it. We go into the document postings and see that the amount of the item has been written off.

When setting the time, pay attention to the following setting. Let's go to the section "Administration" - "Posting documents". Here we see the “Set document times automatically” setting. If you install it, the program will automatically distribute all documents throughout the day in the most optimal way. For example, all “Receipts (acts, invoices)” documents are set to 07:00, and all write-off documents will be posted at a later time. Please note that the time of documents that were created before setting this setting will not be changed.

The procedure for recording a computer program and the procedure for writing off from an off-balance sheet account

However, it should be taken into account that maintaining a journal of transactions No. 99 for off-balance sheet accounts is not provided for by Instruction No. 157n.

Similar explanations are given in letters of the Ministry of Finance of the Russian Federation dated October 2, 2013 N 02-06-10/40915, dated August 29, 2013 N 02-06-10/35603. The institution is required to account for intangible assets received for use by the institution (licensee) in off-balance sheet account 01 in accordance with the requirements of paragraph.

Therefore, develop the procedure for recording and storing documents on movements on off-balance sheet accounts, the procedure for creating a journal, and the procedure for filing documents with the journal yourself and approve it in the accounting policy of the institution.

Rationale From the recommendation of Sergei Razgulin, Actual State Advisor of the Russian Federation, 3rd class. How to formalize and reflect in accounting and taxation the acquisition of a computer program. An institution can not only create a computer program on its own, but also buy it.

By purchasing a computer program, an institution acquires:

- exclusive rights to it under an alienation agreement;

- rights to use it (non-exclusive right, license) under a license agreement.

This procedure is established by paragraph 1 of Article 1233, paragraph 1 of Article 1235 and Article 1236 of the Civil Code of the Russian Federation.

1. Accounting and depreciation of long-term assets

When classifying fixed assets, it is necessary to be guided by the standard service life of fixed assets, approved by Resolution of the Ministry of Economy of the Republic of Belarus dated September 30, 2021 No. 161 (hereinafter referred to as the Standard Service Life).

1.1. Attribution of assets to fixed assets or to individual items as part of funds in circulation.

Such fixed assets as buildings, structures, transfer devices, machinery and equipment, vehicles cannot be classified as inventories (individual items as part of funds in circulation), even if this is stipulated in the accounting policy, since the corresponding entry in the accounting policy will contradict legislation They should be classified as fixed assets if the recognition conditions provided for in clause 4 of Instruction No. 26 are met.

As a rule, institutions do not have the ability to independently dispose of office equipment and remove parts containing precious metals. In addition, in some cases, their independent withdrawal is impossible. This is due to the fact that in addition to precious metals, computer equipment often contains substances harmful to human life and health (for example, mercury, lead, etc.). And monitors can be classified as hazardous waste, since radiation accumulates in the displays over the years of operation. In these cases, the law prohibits the disposal of such waste on your own. This can only be done by specialized licensed organizations (Resolution of the Government of the Russian Federation of August 26, 2021 No. 524). Therefore, institutions should plan expenses taking into account the disposal of office equipment with the help of specialized organizations.

- name, weight and quantity of precious metals contained in the transferred parts and assemblies;

- the method by which the content of precious metals was determined (for example, on the basis of a passport for equipment or according to technical documents for similar models (passports, forms, labels, operating manuals, reference books), or in the absence of this information (imported, outdated domestic equipment, etc.) etc.) - according to data from development organizations, manufacturers or commission based on analogues, calculations).

We determine the technical condition

Reversal:

Debit 2 105 06 340 “Increase in the cost of other material inventories” Credit 2 401 01 172 “Income from the sale of assets”

- 500 rubles. — a correction was made for the content of precious metals in parts using the “red reversal” method;

The conclusion of a license agreement does not entail the transfer of exclusive rights to the licensee. An agreement that does not directly indicate that the exclusive right of RIA is transferred in full is considered a license agreement (Article 1233 of the Civil Code of the Russian Federation). The license agreement is concluded in writing, unless otherwise provided by the Civil Code of the Russian Federation. Failure to comply with the written form entails the invalidity of the license agreement. Under a licensing agreement, the licensee, as a rule, undertakes to pay the licensor the remuneration stipulated by the agreement. If there is no provision in the paid license agreement regarding the amount of remuneration or the procedure for determining it, the agreement is considered not concluded (Part 5 of Article 1233 of the Civil Code of the Russian Federation). The license agreement may provide for:

Accounting for software on an off-balance sheet account

What documents, in addition to the contract and act, should the developer (if he is one, and not an intermediary) of software, domains and Internet versions submit to the accounting department? Answered by Olga Troshina, senior expert You must reflect on off-balance sheet account 01: the right to use a computer program, the right to access electronic versions. 2. If the license is unlimited, and the program is updated over time, then these changes do not need to be reflected on the 01 balance sheet.

if an institution has been transferred the rights to a computer program under a license agreement, it will be an intangible asset received for use. Such a computer program should be recorded at a cost determined based on the amount of remuneration under the contract. This is stated in the Instructions to the Unified Chart of Accounts No. 157n.

3. When purchasing a computer program (use right), the institution enters into a license agreement with. An acceptance certificate is attached to it.

Form of the act

Even if the faulty equipment can be repaired, the service company must provide a full estimate to fix the problem. This will allow you to determine the economic benefit of the repair. If repair is not practical, the equipment is subject to write-off. Thus, it is the expert’s opinion that allows you to determine whether faulty OS can be written off.

Instructions for filling out an act for write-off of fixed assets

The form has three sections. Each of them is designed to display specific information. An accounting employee is responsible for filling out the document. This can also be done by an employee who is responsible for the safety of fixed assets. In addition, a special commission is created that is directly involved in drawing up the act. Filling is carried out in four stages:

Purchasing the necessary software for a company’s operation is a reality of our day. Often, a company incurs significant costs for the purchase and maintenance of computer programs. Their value is written off depending on how the rights to use them were reflected in accounting. Let's consider how these operations are carried out in each situation.