Home / Bankruptcy / Bankruptcy of legal entities

Back

Published: 09/06/2019

Reading time: 4 min

0

406

In financial relations between various types of legal entities and individual entrepreneurs, there are mutual obligations of debtors and creditors. They all boil down to the emergence of receivables and payables.

- Limitation period for accounts receivable Moment of occurrence, taking into account weekends and holidays

- Determining the beginning of the limitation period for late obligations

- How to determine the beginning of the statute of limitations if the deadline for fulfilling the obligation is not determined

Accounts receivable is a type of debt when a company does not receive payment for services provided to it or goods supplied. That is, in this case, the company acts as a creditor to whom its counterparties have debts.

Accounts payable are debts that a company has to its counterparties.

One company simultaneously has both receivables and payables. Repayment of these types of debts must occur in accordance with the conditions formulated in the concluded agreement. At the same time, the use of the word “debt” cannot always be interpreted as a delay in fulfilling a financial obligation - in financial and economic relations, this term is used to determine mutual settlements with counterparties. The use of the term “debt” lasts until all calculations are fully completed.

The essence of receivables

So, this is the payment of the amount due on due date to the debtors. Such debt is divided into two types;

- current;

- long-term.

The first option represents the amount of receivables that must be paid within one year after signing the contract. It does not occur during an operational type cycle if it proceeds normally. The second option is the amount of monetary obligations of the receivable type, which arises during the previously considered cycle; the debt is repaid within a similar time frame (the period in this case is the time allotted for repaying the loan)

Long-term debt is also called doubtful, because one cannot be completely sure of it, or rather, of the repayment of the debt for the elapsed periods specified in the contract. If confidence is completely absent, such debt is called bad debt.

Writing off expired debts

Accounting statements today are under capital control; the requirements for their reliability and specificity are very high. Now there are no longer such complaints about assessment-type obligations, as well as about the preparation of documentation on expenses. The indicators in the reports are now subject to capital attention; the amounts of accounts payable and receivable are now carefully checked (limiting the compilation of all documentation by the time of limitation).

From now on, all organizations must carefully monitor the amounts of receivables and payables, and also monitor their statute of limitations. You should also not forget about keeping records such as: writing off a non-cash debt after the statute of limitations has expired and recognizing it as a tax expense.

In the case under consideration, there are a lot of different nuances that must be taken into account in the process of maintaining such reports; accounting for the duration of any process carried out, such as debt write-off, must be accurate. The process of writing off accounts receivable (in this case, bad debt) is quite complex with many pitfalls, and therefore requires careful consideration.

Debts subject to write-off

If we consider the write-off of past debts from all sides, to fully understand this process, it is necessary to pay attention to the following facts prescribed in the tax code:

- accounts payable debts must be included in the list of unrealized income due to the expiration of the statute of limitations, that is, a write-off process has been carried out. It should be noted that amounts that are debt to extra-budgetary funds are not written off completely, depending on the size and type, they can be reduced in size;

- the debtor's debt is subject to the write-off process if it is recognized as a bad debt (which was already mentioned above). If the statute of limitations for the type of debt in question has expired, it means that it automatically becomes hopeless;

- in the event that the statute of limitations for the debtor's debt has expired, they must also be written off, moreover, for each individual obligation. Inventory data is the basis for the above process;

Note:

Writing off debts due to the debtor's insolvency does not mean complete cancellation of his debt. Such debt should be reflected in the reports within 5-6 years after it is written off, in order to, if possible, get the amount of the debt back if the debtor’s financial position changes during this period.

- the amount of receivables, if their statute of limitations has expired, as well as the previous ones, must be written off under certain circumstances. The basis for such a process is the order of higher management, as well as the results of the inventory.

Statute of limitations

The concept of the limitation period is given in subsection 5 “Time limits.

Limitation period" of part one of the Civil Code. The limitation period is the period for protecting the right under the claim of a person whose right has been violated (Article 195 of the Civil Code of the Russian Federation). The general limitation period is set at three years (Article 196 of the Civil Code of the Russian Federation). Its course begins from the day when the person learned or should have learned about the violation of his right and who is the proper defendant in the claim for the protection of this right (clause 1 of Article 200 of the Civil Code of the Russian Federation), and ends on the corresponding month and date of the last year term (clause 1 of article 192 of the Civil Code of the Russian Federation).

Therefore, for tax purposes, it is necessary to document the occurrence of debt, as well as the expiration of the specified period. These can be any primary documents indicating the completion of a business transaction that resulted in the formation of a debt:

- invoices, acceptance certificates for work (services), payment documents;

- an agreement that specifies the due date for payment;

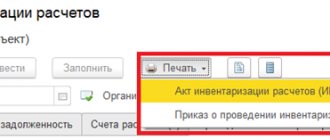

- act of inventory of receivables at the end of the reporting (tax) period;

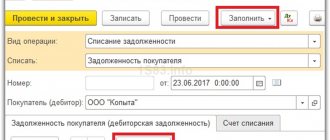

- an order from the manager to write off accounts receivable as a bad debt.

The creditor company does not have the right to write off a bad debt arising as a result of the expiration of the statute of limitations in the period at its discretion. It can be taken into account in expenses on the last day of the reporting period in which the statute of limitations expires (clause 7 of Article 272 of the Tax Code of the Russian Federation).

A debt is recognized as uncollectible due to the expiration of the established limitation period regardless of the measures taken by the taxpayer to forcibly collect such debt. The Ministry of Finance of Russia reminds us of this dated June 9, 2021 No. 03-03-06/1/49480.

Read in the berator “Practical Encyclopedia of an Accountant”

Creation of a reserve for doubtful debts

Main criteria for the write-off process

All of the above can be generalized and an appropriate conclusion can be drawn; in this case, this is the selection from the information verbosity of just a few criteria that precede write-off:

- Collection is unrealistic

- The stated payment deadline has already expired

Typically, this period is three years, as stated in the civil code. The countdown of this period will begin only when the creditor company learns of violations of the contract. This may be the day when the organization was obliged to pay a certain amount, and did not do so, which was reflected for the first time in the documentation, accounting report, etc.

This countdown period may be interrupted if the receivables are recognized by the debtor (documentary evidence is required for this). If necessary, the interrupted period will be counted again; the time that expired last time is not taken into account in the next time period report.

Important!

If the established period for paying off debts has expired, then it has also expired for additional obligations, not only for the main ones, if any existed at the time of signing all the documents. Even if the persons participating in this process are replaced, this fact will in no way affect the expiration date of the established time.

Fulfillment of all prescribed obligations will be considered impossible if an act certified by a government agency is presented. In this case, the complexity of the write-off process becomes more serious, because to this day tax authorities continue to challenge the legality of writing off receivables. The basis for such disagreement is an act certified by the bailiff, which declares the impossibility of collecting the required amount of money. But with all this, there is serious support from taxpayers from the Ministry of Finance, and YOU are also on their side, in the end - you should not give up in the face of difficulties.

INTERNATIONAL FACULTY

There is a debt to the buyer. No one is asking for a refund. Moreover.. they disappeared somewhere...

If the buyer does not return within 3 years, feel free to put it on non-real income.

and now wait until they come with an order from the manager to write off receivables as a bad debt. Even if you missed the deadline for writing off the debt, Article 54 of the Tax Code of the Russian Federation gives you the right not to submit an updated declaration for the period when the statute of limitations has expired...

If you are talking about legal entities, then you will receive a reconciliation report and settle the problem. If the company was liquidated, then that’s their problem.

D62 K91 - unclaimed advances received from buyers and customers (after the expiration of the statute of limitations) are included in the organization’s income.

The debt cannot be written off. Bet on your income and pay VAT on this amount + income tax.

After the expiration of the limitation period, i.e. after 3 years (Article 196 of the Civil Code) from the moment of the last transaction (receipt of an advance payment, shipment or signing of a reconciliation report), it is attributed to non-operating income: D62/2 K91.2

Write-off by a creditor upon expiration of the statute of limitations:...

If you run into an audit, there will be fines and additional charges, and since they don’t check so often now, a partial write-off may go unnoticed))))

Problem loan, loan debt, statute of limitations on loans, debt write-off. In my opinion, the answer is obvious. No one ever wants to lose money and write off debts.

The statute of limitations is 3 years, accounts payable are written off in accordance with paragraph 78 of the Regulations, approved by order of the Ministry of Finance dated July 29, 1998. No. 34N (as amended on March 26, 2007). 78. Amounts of accounts payable and depositors for which the statute of limitations has expired are written off for each obligation based on the inventory data, written justification and order (instruction) of the head of the organization and are included in the financial results of the commercial organization. The main thing when writing off accounts payable is the order of the manager. Even if an organization missed the statute of limitations, if there is no order from the manager, it cannot be written off, if the tax office charges income tax, penalties and fines for not writing off accounts payable, you can challenge this. (Look at the Resolution of the Prisidium of the Supreme Arbitration Court dated July 15, 2008. No. 3598/08)

Help!? MTS is suing me because I owe them money.

Well pay

What documents should I use to formalize the write-off? So, if the statute of limitations on accounts payable has expired, it should be written off. If you missed the statute of limitations, then you can take into account the overdue debt on the day you took the inventory, then...

TO PAY

To pay. You don't deny the fact of the calls, do you? and when did they find out? What do you owe 90 dollars, did you immediately buy a new SIM card? Right? pay. otherwise the bailiffs will come and seize your property to settle the debt.

So what? pay this court decision and you no longer have any options, especially since you do not deny the fact of the debt, there is no problem here, just go right away, otherwise in a couple of days the enforcement fee will be imposed in your case, another 500 rubles.

Within 10 days from the date of the decision of the judge (magistrate), you had to file a refusal of the court order. And insist on your version. It is unlikely that MTS will go further.

The fact is that in all these quizzes at the bottom of the screen there is a creeping line of information that states that by calling this number you automatically agree to the terms of the contract. So you can only hope for the expiration of the statute of limitations, which, according to Art. 196 of the Civil Code of the Russian Federation is established at 3 years

If the deadline is missed for a good reason, then the court can reinstate it. As for the position of the tax authorities in this matter, the expiration of the statute of limitations on However, the Tax Code of the Russian Federation in Article 59 provides for the possibility of writing off tax debt, the deadline...

You need to go to the bailiffs, get a court decision from them (a copy of the court order, the bailiffs need to indicate on the copy when they gave it to you). Then write an objection to the order and submit it to the magistrate who issued the order. Articles: (Civil Procedure Code of the Russian Federation) Article 128. Notification of the debtor about the issuance of a court order The judge sends a copy of the court order to the debtor, who, within ten days from the date of receipt of the order, has the right to submit objections regarding its execution. Article 129. Cancellation of a court order The judge cancels the court order if the debtor raises objections regarding its execution within the prescribed period. In the ruling on the cancellation of the court order, the judge explains to the claimant that the stated claim can be presented by him in the manner of claim proceedings. Copies of the court ruling to cancel the court order are sent to the parties no later than three days after the day it was issued.

You didn’t challenge your debits from your account within the limitation period, and MTS is unlikely to have missed the limitation period (3 years), considering. that there is already enforcement proceedings, but check, maybe you can declare the application. And so - you have to pay.

Is there a statute of limitations for tax debt?

5 years!

Write-off of accounts payable due to the expiration of the statute of limitations. In other words, if during the consideration of the case it turns out that the plaintiff missed the statute of limitations, then the court must reject the claim, although it follows from the circumstances of the case that the plaintiff...

About 5 years, but if you don’t pay on time, they charge penalties that can exceed the debt itself. It’s better not to joke with the tax office

For 4 years. You are required to keep documents for an on-site tax audit. And additional accruals are made for the last three years. Then it's not scary.

The statute of limitations is 3 years! Exactly!! But only if you have not been issued an invoice for payment and you have not received it. No write-off is provided.

1. Tax authorities may file a claim in court to collect a tax sanction no later than six months from the date of discovery of the tax offense and the drawing up of the corresponding act (the statute of limitations for collecting the sanction). 2. In case of refusal to initiate or terminate a criminal case, but in the presence of a tax offense, the period for filing a statement of claim is calculated from the date the tax authority receives the decision to refuse to initiate or terminate the criminal case.

Art. 115 NK

This is probably the deadline. missed, the deadline cannot be restored, the court will not recover

Is it possible to file a lawsuit to cancel paternity, a DNA test has been done.

Bring it on, you bastard. . .nobody thinks about the child! Rada Rada, you shouldn’t have gotten married... and if you gave birth, then raise them.

The procedure for writing off amounts of accounts payable for which the statute of limitations has expired is determined by paragraph 78 of the Regulations on Accounting and Financial Reporting in the Russian Federation, approved. by order of the Ministry of Finance of Russia dated July 29, 1998 34n.

It’s possible!)) ) If anything is sent again for DNA.

Bastard, it’s people like you, Irima, who wandered around and spoiled a child, it’s not clear from whom, and then pinned it on her husband, and there’s no point in opening your mouth here. IRIMA, Have you given birth? who gave birth and from whom, that is the question. . .You are probably also in the same position, since you defend women who, while married, take care of children on the side. Once you’ve had a good time, act honestly, tell the truth, or do we not have the courage to tell the truth? Do you think it’s fair to cheat?

File a claim to challenge paternity, after the court’s decision, file a claim to cancel alimony and, if you wish, file a claim to recover unjust enrichment for the entire period of collection of alimony

The court is obliged to take this document into account. You can only return alimony for the last three years (the general statute of limitations), and you can also recover moral damages, because your rights were violated due to the deception of your ex-wife and you were forced to support someone else’s child.

Your statute of limitations has passed. This time. Even if the court accepts your application, you will have to do the analysis again.

Let's consider how the limitation period is calculated for obligations arising from business contracts, as well as how to document the write-off of overdue debts and what accounting entries need to be made in accounting.

Inga! How many times am I convinced that you are giving illiterate legal comments! ! Since the law does not establish a statute of limitations for cases in this category, paternity can be established by the court at any time after the birth of the child. It is necessary to take into account that, by virtue of clause 5 of Art. 48 of the RF IC, establishing paternity in relation to a person who has reached the age of 18 is allowed only with his consent, and if he is declared incompetent, with the consent of his guardian or guardianship authority. (Resolution of the Plenum of the Supreme Court of the Russian Federation dated October 25, 1996 N 9). And even if they force you to do a second examination, ordered by the court, you will then recover all the expenses for it from your wife!

Yes, you have the right to file a claim to challenge the entry on the child’s birth certificate. Whether the court accepts this examination or appoints another is at the discretion of the court. A claim for unjust enrichment and moral damage will not work - legally, until the court’s decision, you will be listed as the father of the child with the ensuing responsibilities, including maintenance, and the mother will declare that she sincerely considered YOU to be the father of the child. The only thing you can ask for is a suspension of the withholding of alimony until a court decision is made.

Natalya Raskova, everything is correct on the topic and about Inga. And Inge better get out of this category of questions and not mislead people.

A citizen of the Russian Federation has the right to do a DNA test, regardless of the child’s age! This is stated in the law, and there is no statute of limitations in this matter, and there is also a statute of limitations for writing off alimony debt.

Help with advice! In 2013, I took out a loan from Home Credit in the amount of 500,000 rubles at 40%. I paid 17 thousand per month. In this mc

They CAN take away your home for non-payment and any equipment from your home. but collectors are not bailiffs, they are not polite

After a break, the limitation period begins anew, and the time elapsed before the break is not counted in the new period of Art. 203 of the Civil Code of the Russian Federation .- by orders of the head of the organization to write off receivables as bad debts, a letter...

They can’t take the apartment (unless, of course, it’s on a mortgage), first they’ll bother you with calls, and then they’ll go to court where the court will oblige you to repay the loan

1. Collectors will call and come to the place of registration. 2. They will sell the debt to collectors or the court 3. The statute of limitations will expire (in your case it is 3 years from the end of the contract), if a credit card, then from the moment of the last payment. In this case, it will be necessary to be careful and not to miss the summons to the court, to which you come and declare the end of the LID; if this is not done, the court will rule in favor of the bank. In fact, it is difficult to simply guess which path the bank will take. In any case, if there is only one housing, they will not take it away.

I don’t know... but some kind of law has been passed on debt restructuring...

I'm not special. on these matters and came to look at the answers. :))

They can take away the housing and also seize wages and any payments. Although a woman worked at our place of work, it so happened that she took out a loan of 200,000 and her ex-husband stole the money and ran away. She fell ill, her legs gave out and she was treated for more than a year. And the bank calculated such interest for her at more than 1,500,000, she went to a lawyer, he advised her to pay 500 rubles a month for housing, she doesn’t have her own, nothing to take before retirement. It’s like walking to the moon and the bank doesn’t particularly care

A selection of the most important documents on the issue of Write-off of accounts payable with an expired statute of limitations, regulations, forms, articles, expert consultations and much more.

You need to hit your head against the wall and don’t take money for which you can’t irresponsibly get angry, and don’t think about the laws in Russia, wait for collectors, bandits and so on, they’ll knock out the money in any way, don’t worry, they’ll make you want to sell the apartment , my advice is to look for a job for 30k a month 6/7, work hard, pay off, or whatever you spent 500k on, sell it. Come to your senses, get away from the bottle, otherwise you will turn into a homeless person. I didn’t want to scare you, but I kept waking you up, FOREWARE is ARMED. Take action!

Did you take it for 10 years? And at 40% per annum? ! You're a complete idiot! One percent more than 1.5 million will come... And “happened” - from the word “mating”? Or how?!

Are you temporarily unable to repay your loan? If so, you can explain to the bank a good reason (for example, loss of work or treatment) and agree with the bank on a deferment of payments or restructuring of the remaining payments (for example, for a longer period in smaller payments). If you decide not to pay at all, I strongly advise against it! This is fraught with big problems. The smallest of them is that you will not be allowed to travel abroad.

Contact the bank and they will recalculate you for a longer period with a smaller payment

Go to the bank and make a resta…. in short, let them reconsider the payment and they will cancel the fines, if they don’t agree to this, then don’t pay at all three years after the last payment, everything will be cancelled, but the bank will be a pain in the ass, they won’t give you any more credit, although I took out a trade loan at home, there was an amnesty and that was a long time ago 10 years ago but the bank stores my data and refused, but others gave it

Regulatory documents do not provide for any other procedure for writing off accounts payable in accounting. However, in the situation under consideration, income in the form of accounts payable for which the statute of limitations has expired is not associated with...

Contact the bank... maybe they will count it for you..

There is material on how to legally not pay a loan. How to communicate with banks and debt collectors. The price is minimal, I highly recommend it, write me an email and I’ll send you a link, they won’t let you through here. The main thing is not to lose heart, you are not the first, and you are not the last. The apartment will not be taken away, after the trial you will talk to the bailiffs, they will write a document stating that you have nothing to take.

“The statute of limitations will expire (in your case it is 3 years from the date of expiration of the contract)” Well, I’m not sure that this is so. Firstly, the limitation period must end BEFORE filing the claim, and if the claim is filed within the limitation period, it will not end until the claim is considered. I could be wrong, but it seems to me that this is so. Secondly, “from the moment the contract ends” - when does this moment come? It may be written there - until the Parties fulfill their obligations under the agreement. That is, until you pay, the contract will not end. In general, banks, of course, are bitches, but how many scoundrels are there...

1. You can refinance with another bank at a lower rate. 2. Contact the bank and tell them your situation honestly. Ask for a deferment, revision of the loan agreement. In any case, it is better for the bank that you repay the loan, even if not on time, than not repay at all. From the 1st day of delay, the bank will still call you and your guarantors and you will have to make excuses.

Why did you take it at 40%?!

Thus, when writing off a debt with an expired statute of limitations or for other reasons that make collection impracticable, the enterprise recognizes...

Crazy interest rates. This doesn't happen.

I don’t know exactly what the article is, but they can put you in a colony for a certain period of time and the state will pay off the loan for you, but you will work it off in prison, this is the last resort if you run and resist to the last... playing with fire

1 - if the housing is not yours, then the housing will not be deprived 2 - the statute of limitations is 3 years. If you are as naked as a falcon, then in 3 years everything may end 3 - I can’t or don’t want to pay the loan? 4 - Collectors earn about 30-50% of the collected debt amount. Calculate what they will do if there is an order to take this money from you? 5 - You can refinance with another bank at lower interest rates. 40% per annum is robbery 6 - You can restructure the debt - come to the bank and say how we can resolve this issue with you. It often happens that the bank cancels fines/interest/penalties - as long as you pay at least some money. 7 - What to do in your specific case - repay the debt. By any means. Otherwise, you will suspect karma. If you don’t return the money, this debt will come back to you with a big kick in the ass, most likely several times more expensive than the cost of the loan.

You can wait for the bank to file a claim in court and in court make a counterclaim for the termination of the enslaving contract or for the abuse of the bank’s rights (Article 10 of the Civil Code) and try to reduce the interest. Interest that is a penalty, and not those that are payment for the use of borrowed funds, can be reduced under Article 333 of the Civil Code of the Russian Federation (obvious disproportionality) by also declaring this in court. You can also tighten up the law on consumer protection if you dig deeper. Study carefully the contract, what formed such a rate; some charges may be prohibited by law and instructions of the Central Bank. You will have to return the money and some interest. There is more talk about debt restructuring on TV than banks actually do (they don’t care about your problems, to be honest, they will take the last piece of bread from the child). The option to refinance with another bank and repay Houma ahead of schedule is more correct. The statute of limitations, as some “smart” ones write, not a single bank will miss, don’t even hope))) They won’t take away your only apartment, if it’s privatized, they can move you to a smaller and worse one if you still have a municipal one. But some of the negative consequences may include: removal of household appliances and furniture, transfer of part of your salary directly to the bank, bypassing your hands, debiting money from your cell phone account! , confiscation of a car (this is one of the new measures), a ban on traveling abroad, a bad credit history (now perhaps this is not a problem for you, but then you will want a loan for a refrigerator, but they will not allow you to go to Thailand on New Year’s Eve). It is better to resolve the issue somehow, rather than wait passively.

Credit in Khomyak, this is fucked up, such an ambush.

Rossovet.ru Statute of limitations Write-off of rent arrears. There is no such law. But if the statute of limitations of 3 years has expired, then it will hardly be possible to recover the amount in court.

Consequences - the bank goes to court to collect the loan debt. bailiffs will make inquiries about property, come home to take an inventory and will withhold up to 50% of wages or pensions. If there is no property, then there is nothing to recover; after some time, the writ of execution may be returned due to the impossibility of execution. But the bank can submit it again within 3 years from the date of receipt. Check the loan agreement for insurance and commissions; they may be considered illegal in court and will be counted against the debt. Read the contract. The bank can go to court to terminate the contract and collect the amount, including interest, or it can only collect interest from you, which in the end can take a long time and amount to a significant amount. The bailiffs will search for the property, if there is nothing to take, they will issue a ruling that it is impossible to recover and return it to the owner. sheet to the claimant. However, the claimant may file a claim multiple times. execution sheet. The limitation period for each presentation of the claim. leaf - three years.

You'll be patient for 3 years and they'll forgive you...

All answers to your question that promise problems with bandits, unbearable moral torment, curses on your entire family up to the 7th generation and other Egyptian executions are misinformation from debt collectors. The bank and collector can either restructure the debt or go to court. If collectors or banks organize unbearable moral pressure, then you can contact law enforcement agencies. To understand all your risks, it is better for you to contact a lawyer. For example, you were “advised” incorrectly regarding the statute of limitations.

Google to the rescue

Take a loan at 17% and close it at 40% and try to pay off the loan and don’t take out a loan at all, etc. , better get a job and save up, invest in the bank and be sure to learn business, read books, for example (Me and Money, Rich Poor Dad, watch YouTube Business Youth, learn to manage money, and spend correctly, build a business) and you will definitely succeed….

As for the proposal to write off restructured debt for penalties and fines without the organization fulfilling the conditions, the demand will be sent several years after the deadline for paying the tax, and the statute of limitations will not be considered missed.

Under what circumstances is loan write-off possible? There are several of them in different banks and the total amount is 2.5 million.

Under no circumstances. well, except in the event of the death of the borrower - and if the relatives did not enter into the inheritance.

It has a statute of limitations for collection of 3 years, alimony does not have a repayment period, but interestingly for tax debts there is a statute of limitations for writing off debts. Thus, even if the deadline for forced collection of the debt is missed, it will not be automatically written off.

I was daydreaming... They weren’t given to you to write them off. They write it off only with death when they are taken to the forest.

There are no miracles. Only if the bank misses the deadline for the claim and does not go to court.

I wonder if this were possible, would there be people who are NOT debtors? :))))

If the statute of limitations has expired.

Loans are NOT written off at all - this is a myth. If the bank does not sue the borrower within the statute of limitations, the bank simply will not be able to reclaim it legally in the future, but formally the debt will remain a debt, you never know, the borrower is stupid and illiterate and will be afraid of tales about debt collectors. With such an amount, it makes sense for the borrower to familiarize himself with the bankruptcy bill - maybe as an option.

Thus, in fact, only missing the statute of limitations and bankruptcy of the debtor are grounds for writing off the debt as non-operating expenses. Moreover, if the debt was collected by the court...

Nothing is ever written off. even if the borrower dies, the heirs must pay the debt within the value of the inheritance received. Or the insurance company pays if the loan is insured. The statute of limitations expires after 3 years, but not after receiving the loan, but from the date of final repayment of the loan, which is provided for in the agreement, and this period can be interrupted. Look at the Civil Code of the Russian Federation, and don’t fantasize.

They take 3 percent from each poor fellow for banking risk, on the basis of which the bank can be allowed a discount, and the bankrupt is blacklisted for 5 years! You just need to open the door to the bailiffs and show the empty hut and the inventory report will be presented by the bailiff to the bank!

What can be done in this situation

If the court decides that the debt is not joint and several, but is assigned to each defendant in equal shares, you only pay your share. If the debt is joint, they collect it from anyone. We need to challenge the court's decision, not sit down.

Writing off bad debts. Doing business involves risks. Bad debts are recognized as debts to the taxpayer for which the established statute of limitations has expired - debts for which, in accordance with civil...

The Criminal Code makes no difference who pays the debts to the municipal apartment .. you have the right to sue the defaulters and demand repayment of the debt from them

Execution cannot be pardoned!!!! Apparently, no one went to the bailiff service with the Court's decision to determine the order of payments! You cannot sell a non-privatized apartment, and you also have no right to force anyone living in the apartment to work through the Court! Refunds are unlikely! You can't do without a good lawyer!

Yes.. Bailiffs have FINALLY found a way to write off utility debts. . Here the limitation period of 3 years is “swallowed”... They collect in full from at least one registered person! ! They are caught on the hook with debts of 200 thousand. per apartment for a decade. . But this is a signal to everyone who has at least some kind of debt.. They collect it by court order of the Magistrate without even informing them??.. even for the first time??

Your husband has only one choice: either deregister or not have money on the card. Otherwise this “bad thing” will last forever

Is there any law on writing off rent debts?

The limitation period is 3 years. The court can recover funds only for the last 3 years, and not since 2001. Age of majority does not matter when calculating payments for utility services. If there were benefits, they had to be presented on time. Dispute the amount of the debt based on the statute of limitations. The housing department is obliged to provide documents confirming the price of the claim, and you challenge it (do not agree).

After how many years are accounts payable to suppliers. for which the statute of limitations has expired must be written off. Just don’t miss the deadline! further . I was in shock, the traffic police inspector ran me through the database and found out all the information about unpaid fines, which...

This housing could not be inherited, since the apartment is not owned by the deceased. The debt can only be paid by adult (emancipated) children; if they do not live there, then their guardians will pay. Payment is made for the last three years. Good luck!!!

Three years, but you need to say this in court that DEZ missed the statute of limitations.

They can only recover for the last three years - the statute of limitations. There is no law on debt forgiveness.

What should I do?

In fact, you described the write-off tool - the court. A statute of limitations missed for a valid reason may be reinstated.

In life, the statute of limitations is ephemeral. A debt is a debt, and the bank will never forget it, even if it pays it off. In other words, if the Bank has missed the statute of limitations, it cannot be restored.3 As for writing off the debt, it is clear that there can only be an appeal from the bank.

See articles 78, 79 of the Tax Code of the Russian Federation. Missed 3 years? Who are you? IP? Entity? Individual?

Is the inventory of receivables and payables carried out twice a year?

Having carried out an inventory of receivables and payables in the annual report, the accountant draws up a write-off plan for the next year. This will allow you to more quickly monitor the statute of limitations on debt when working with debtors and creditors. And you will waste less time identifying debt terms.

The state takes a similar position and, in accordance with accounting rules, allows the write-off of receivables, but we also offer collection of debts with expired statutes of limitations on partnership terms with the transfer of part of the debt...

If the statute of limitations has expired, how can it be annulled?

The deadlines for filing claims are regulated by civil codes. If the deadline for filing an application is missed, but the plaintiff intends to seek satisfaction, he must present to the court a very serious justification for missing the deadline (for example, he was in the hospital, was on a business trip abroad, etc.). In other cases, after the statute of limitations has passed, the courts will not accept claims for consideration. You can find out the limitation periods for various cases by looking at the Civil Code of the Russian Federation

Does it matter whether they went to court to collect the debt when the debt is written off as hopeless due to the expiration of the statute of limitations? If there are no legal grounds for restoring the missed statute of limitations, this debt is lost, and in...

The court is obliged to accept the claim for consideration regardless of whether the statute of limitations has been missed or not. Limitation periods apply only upon application by the interested party. If it is stated that the plaintiff has missed the limitation period, the court is obliged to make a decision to deny the plaintiff’s claims. In practice, creditors themselves write off overdue receivables as losses. For example, the Moscow Government issued decisions to write off debts of individuals with an expired statute of limitations for losses. It is impossible to cancel a debt without the creditor performing legally significant actions.

How to challenge illegal harassment of the tax authorities regarding transport tax for 2003-2005 in light of Putin’s tax amnesty

Send them far, far away! According to the law, the tax office can only demand taxes for the last 3 years. After three years they cannot collect from you. You can look at the Tax Code for yourself, Article 113. “Limitation period for holding accountable for committing a tax offense” “A person cannot be held accountable for committing a tax offense if from the date of its commission or from the next day after the end of the tax period, during which this offense was committed, and three years (the statute of limitations) had expired before the decision to prosecute was made. "

In addition, the plaintiff missed the statute of limitations. The statute of limitations on claims for overdue time-based interest payments assumes that the bank’s actions to write off the above commissions. An account for recording loan debt, a loan account is opened...

Please help me with the wiring, urgently????

There are too many questions to answer on the site, thanks.

The statute of limitations for the loan. It often happens that the bank makes demands on the borrower to repay the loan debt several years after the expiration of the agreement. In practice, this raises the question of...

1. 62 K90 2. 90 K 43,41,20 3.D90 K68, etc.

What is the claim period for tax debts?

For 3 years, the organization was supposed to be liquidated back in 2008. but the tax office doesn’t have enough hands for everyone

The statute of limitations for debt collection by the bank has been missed! What accounting entry is used to write off accounts payable for which the statute of limitations has expired Write-off of accounts payable The procedure for writing off accounts payable...

In what time frame must bailiffs collect my wages from my former employer?

As I understand it, the bailiff received the writ of execution and initiated enforcement proceedings on it. Since three months have already passed, the bailiff was long ago obliged to take actions to collect the debt (since the period for voluntary execution of the court decision has clearly expired) - for example, send instructions to write off the debt to the bank accounts of your former employer, send requests to the property account ( and even get answers to them), seize this very property, etc. All these actions are recorded in documents and you, by the way, as a claimant, have every right to familiarize yourself with these documents, including demanding a written report from the bailiff about that , what actions he took in your case (these are the provisions of the law on enforcement proceedings). Accordingly, you have every right to complain about the actions (inaction) of the bailiff - first to the senior bailiff, then to the Service Department for your region, etc. Use these rights. Second. The fact that your former employer is “going to file an appeal” does not at all prevent the bailiff from taking actions to collect the debt. The only thing that can interfere with the bailiff is that the appeal actually exists (not “will be filed”, but has already been filed, but then a copy of this complaint should be sent to you - this concerns you!), and the complaint is already in court and there is a court decision on the application of interim measures. In other words, if the bailiff refers to the fact that he is not collecting anything because your former employer filed an appeal, he must confirm the legality of his inaction by a court decision to apply interim measures in the form of a ban on collection or to suspend enforcement proceedings until the complaint is considered. In this case, the bailiff was obliged to issue a resolution to suspend enforcement proceedings and indicate the reason therein. If nothing like this happened and you are not provided with such documents, this is illegal. Again, you can (and should) fight with complaints. Now about the timing. The writ of execution is valid for three years. This means that within three years you must PROVIDE a form for collection, i.e., in your case, send it to the bailiff service. If enforcement proceedings have already begun, they continue, as they say, “until victory” - until the debt is collected. The proceedings are terminated not because three years have passed, but because the bailiff proves that collection is impossible (if you presented the sheet to a person, he has died or it is absolutely impossible to find him; if to an enterprise, he has no property or it has been liquidated). There are no other options. In addition, if the bailiff began enforcement proceedings (suspended it) - the course of the period is interrupted, i.e. if the bailiffs suddenly finish the case without collecting the debt and return the writ of execution to you, you have the right to present it again - you again have the right to do so three years (now from the moment the enforcement proceedings are completed).

And it is recommended to carry out accounts payable regularly, but at least twice a year, so as not to miss the statute of limitations. Write-off of receivables for which the statute of limitations has expired is provided for in clause 77 of the Regulations on accounting and...

Guys, what the hell did you write? I almost peed myself from the answer. The employer missed the deadline for appeal, he had 10 days (appeal) And regarding the collection of wages. payment, then the court decision is immediately executed. I’m more than sure that the bailiff and your former employer know each other, so they’re sending you a blizzard (bailiff). A complaint to the senior bailiff, or better yet, immediately to the prosecutor's office about the inaction of the bailiff.

The write-off of accounts receivable to reduce profits in accounting is documented by the following entries:...

Dt 91.2 Kt 62 (subject to expiration of the statute of limitations - 3 years (from the last movement - reconciliation act, receipt of money, correspondence about the timing of transfer of payment....) Reduces the tax base for profits. Just don’t miss the deadline!

Just don't miss the deadline! !!! b 63 Provisions for doubtful debts... What to do with VAT when writing off overdue receivables? If the statute of limitations for receivables has expired, then you write them off by posting D-t 91.2 K-t 62.

Payment of transport tax and statute of limitations or tax amnesty. Someone please explain it popularly)))

Forget…. I was sent a similar piece of paper, our federal law can be crossed out by local deputies

Meanwhile, the statute of limitations for paying this fine is three years. The judges of the Supreme Arbitration Court pointed out to the tax authorities that they missed the deadline for collecting sanctions as in Although the Tax Code provides for the write-off of debts that are unrealistic for collection for reasons...

The owner of the car is required to pay transport tax. moving and other rubbish is a kindergarten. pay the tax and penalties - and calm down

Does the tax office have the right to demand payment of UTII tax after 2 years?

Maybe.

Which article of the law can you refer to if there is a statute of limitations on debt for housing and communal services? How to draw up a statement of claim for writing off a debt for housing and communal services due to the statute of limitations. Yes, because it is not known whether the ID period has been missed or not... Maybe the debts were partially repaid...

Taxpayer support from the Ministry of Finance

The Ministry of Finance, as mentioned earlier, supports its taxpayers, it is for this reason that a decree was issued, which states that the issue of non-recognition, or, conversely, recognition of the impossibility of collecting receivables from the debtor, should be discussed individually, in a separate manner , with mandatory consideration of all circumstances that may affect the final outcome of the trial. One of the letters from the Ministry of Finance indicates that the debtor’s debt, which is even disputed by bailiffs, may be considered hopeless. The liquidation of the organization in question will be considered completed after the entry is made in the Unified State Register of Legal Entities.

Doubtful and bad debts

Accounts receivable may be normal or they may be bad. However, there is also the concept of dubious “receivables”. The criteria for classifying funds diverted from a company's turnover into this category are defined in tax and accounting legislation.

Question: Is it necessary to reflect in income for calculating income tax debt repaid in the current period, part of which was previously written off as expenses as bad receivables due to the expiration of the statute of limitations, and part of which was not taken into account in expenses? View answer

Tax accounting

Debt may arise:

- In connection with the sale of goods (services, works). The Ministry of Finance believes that the following cannot be classified as doubtful debt: for advances to suppliers; on fines for violation of the contract; on the amount of interest for the use of other people's money, collected in court; loans (letters No. 03-03-06/1/816 dated 08/12/11, No. 03-03-06/1/308 dated 15/06/12, No. 03-03-06/1/ 29315 dated 07/24/13, No. 03-03-06/1/70 dated 02/04/11).

- If the repayment period under the contract has expired. If the contract does not indicate a period or the contract was not concluded in writing, the date is determined on the basis of legislation, the regulatory framework, customs of business life, the essence of the obligations, and other conditions (Civil Code of the Russian Federation, Articles 486-1, 314-2).

- The “receivable” has no security (bank guarantee, surety, pledge).

Question: In what period are bad receivables taken into account for income tax purposes upon liquidation of the debtor (clause 1 of Article 272 of the Tax Code of the Russian Federation)? View answer

Question: In what period are bad receivables with an expired statute of limitations taken into account for income tax purposes (clause 1 of Article 272 of the Tax Code of the Russian Federation)? View answer

Accounting

According to Order No. 34n (Regulations on accounting and reporting dated 07/29/98), any unsecured debt can be considered doubtful, regardless of its nature, if its repayment period has expired or is close to expiration.

Doubtful and hopeless

It is a mistake to equate between doubtful and hopeless “debts”. In the first case, as follows from the listed conditions, the debt can still be returned to the company’s turnover. If the deadline is missed, the debt becomes uncollectible or hopeless.

According to the Tax Code of the Russian Federation, receivables are recognized as uncollectible if at least one of the following conditions is met (Tax Code of the Russian Federation, Article 266-2):

- the statute of limitations on this debt has expired;

- the debtor organization is liquidated or, according to an act of a government agency, cannot fulfill its obligations;

- bankruptcy of a debtor-individual (in accordance with the norms of Federal Law No. 127 of 10/26/02 “On Bankruptcy”, valid from 01/01/18);

- The bailiffs returned the writ of execution to the debtor, unable to collect the debt.

The latter may occur if the location of the debtor is not established by the bailiffs or they do not have information about the amount of property with which the debt can be repaid, or the debtor does not have property that can be foreclosed on.

A debt that is unrealistic for collection on several grounds at once will be considered as such already in the period when the first of them arises (Ministry of Finance, letter No. 03-03-06/1/373 dated 22/06/11).

The most common reasons for bad accounts receivable are liquidation of the debtor and the expiration of the statute of limitations. An organization is considered liquidated if it is excluded from the Unified State Register of Legal Entities. The limitation period is generally determined as three years (under Article 196 of the Civil Code of the Russian Federation).

On a note! If it follows from the terms of the contract that payment must be made in installments, the deadline is set for each installment separately.