Deadline for payment of UTII in 2017

Transfer the calculated amount of UTII to the budget in 2021 no later than the 25th day of the first month following the expired tax period (quarter). This is provided for in paragraph 1 of Article 346.32 of the Tax Code of the Russian Federation. Therefore, the deadlines for paying UTII in 2021 are as follows:

| Tax period 2021 | Payment deadline |

| 1st quarter | No later than April 25, 2021 |

| 2nd quarter | No later than July 25, 2021 |

| 3rd quarter | No later than October 25, 2021 |

| 4th quarter | No later than January 25, 2021 |

When the obligation to pay tax arises

To stop paying tax, you must submit an application for deregistration to the tax office. From this moment, the individual entrepreneur or organization ceases to fulfill the duties of the payer.

But if you do not engage in the declared business and do not declare it, then the tax will have to be paid to the treasury. The fact is that the single tax is tied to physical indicators, for example, to retail space, and does not depend on the amount of turnover. This is confirmed by the information letter of the Supreme Arbitration Court of the Russian Federation dated March 5, 2013 No. 157.

UTII should be paid immediately after the end of the next quarter - before the 25th of the next month. Reporting is submitted a little earlier - before the 20th, since the corresponding declaration provides a calculation of the amounts payable.

Settlement transactions for payment of UTII

The application of the UTII regime involves the payment of estimated income, the amount of which is established by the state and does not depend in any way on the actual income received by the entrepreneur. The amount of accrued UTII is paid quarterly by the 25th day of the month following the expiring quarter.

Special regime employees of UTII are exempt from paying the main taxes that are inherent in the OSN (clause 4, Article 346.26 of the Tax Code), but no one has exempted them from paying insurance premiums for hired employees.

Correct application of the BCC allows for the correct transfer of contributions to the appropriate budgets:

KBS simplified tax system 6 percent 2021 for individual entrepreneurs without employees

The Federal Tax Service is the body that is responsible for tax control. The service has divisions in populated areas. The choice of branch for payment is carried out on a territorial basis using UTII KBK. A general rule has been established: tax is paid at the place of activity.

Exceptions to the rule:

- cargo transportation;

- transportation of passengers;

- advertising placed on vehicles;

- delivery trade;

- payment of insurance premiums for employees.

Both categories are paid at the place of registration of the individual entrepreneur. Other types of activities, from household and veterinary services to the lease of a retail outlet, are subject to the main norm.

According to the law, the payer is obliged to timely repay tax debts to the state. UTII is no exception. Specific payment deadlines are set out in the Tax Code of the Russian Federation (Article 346.32). A quarter is recognized as a period. The deadline is the 25th day of the month following the last tax period.

The rules haven't changed. There have been no changes to the timing. There are 4 quarters provided. At the end of each quarter, the merchant is obliged to pay UTII.

The following dates were in effect:

| Fourth quarter 2021 | Until January 25, 2021 |

| First quarter of 2021 | Until April 25, 2021 |

| Second quarter 2021 | Until July 25, 2021 |

| Third quarter 2021 | Until October 25, 2021 |

The last day of payment did not fall on a working day. Entrepreneurs paid according to the standard scheme, without transfer to working days

Pay attention to the time of filing the declaration. The deadline differs from the direct payment of tax - until the 20th of the corresponding month

In other words, the act is submitted earlier than the payment of the obligation.

The norms will remain. Moreover, not a single day will be a holiday - merchants pay according to the standard scheme in accordance with the KBK for paying UTII in 2021. The quarters end in a similar manner - in January, April, July and October, respectively. The deadline for filing the declaration has also not changed.

| Fourth quarter 2021 | Until January 25, 2021 |

| First quarter of 2021 | Until April 25, 2021 |

| Second quarter 2021 | Until July 25, 2021 |

| Third quarter 2021 | Until October 25, 2021 |

The budget organization code depends on the purpose of payment. The data is presented in the following table:

| UTII in 2021 for individual entrepreneur KBK (tax code itself) | 182 1 0500 110 |

| Penalty code | 182 1 0500 110 |

| KBK penalty UTII | 182 1 0500 110 |

Penalty is a sanction that is accrued daily for late payment of an obligation. Unlike a penalty, a fine is imposed for a specific violation. Despite the direct relationship of sanctions to “imputation”, the Code of Criminal Code of fines and penalties differs from the code of the tax itself. It is recommended to save the data so as not to confuse the direction of the money.

Features of payment in 2017

In 2021, pay UTII according to the details of the Federal Tax Service, which has jurisdiction over the territory where the “imputed” activity is carried out. In this case, the organization must be registered by the Federal Tax Service as a payer of UTII (clause 2 of Article 346.28, clause 3 of Article 346.32 of the Tax Code of the Russian Federation). However, if there are certain types of business that these rules do not apply to, namely:

- delivery and distribution trade;

- advertising on vehicles;

- provision of services for the transportation of passengers and cargo.

For these types of businesses, organizations do not register as UTII payers at the place where they conduct their activities. Therefore, they pay UTII at the location of the head office. Also see “Insurance premiums of individual entrepreneurs for UTII in 2021: what has changed.”

Features of UTII

First, let's look at what UTII is. The single tax on imputed income is a special tax regime in which it does not matter what income an organization or individual entrepreneur receives; For tax purposes, only the income imputed to them by the Tax Code of the Russian Federation matters.

This mode is optional for everyone; you can switch to it at will if certain conditions are met. So, firstly, it must operate in the area in which the entrepreneur or organization operates, and secondly, there must be an act on this tax regime, in which there is a type of activity carried out. Only if all these conditions are met can you switch to this taxation regime, and the BCC for UTII in 2021 will become relevant for you.

KBC for insurance premiums for 2021

There are, however, cases in which legal entities and entrepreneurs cannot use UTII. For example, this is not possible when the average number of employees is more than 100 people, or when the share of other legal entities participating in them is more than twenty-five percent.

Settlement transactions for payment of pension and health insurance contributions

Entrepreneurs on UTII are required to pay pension and health insurance contributions not only for their employees, but also for themselves.

The amount of pension payments for yourself depends on two factors:

- From the minimum wage established for the current year;

- If income exceeds RUB 300,000, then 1% of the income received. This requirement applies only to contributions to a pension fund.

According to Art. 346.32 Tax Code, an entrepreneur on UTII has the opportunity to:

Get 267 video lessons on 1C for free:

- Free video tutorial on 1C Accounting 8.3 and 8.2;

- Tutorial on the new version of 1C ZUP 3.0;

- Good course on 1C Trade Management 11.

- Reduce the amount of UTII by the amount of insurance premiums that he pays for himself, but provided that this entrepreneur does not have hired employees (the tax base is reduced by the amount of the minimum payment, which depends on the size of the minimum wage);

- Reduce the amount of UTII to 50% of the level payable, but subject to the presence of hired employees. That is, the UTII base is reduced by the amount of insurance premiums that the employer pays for its employees.

Please note that the amount of fines and penalties paid on insurance premiums does not affect the amount of the “imputed” tax.

In addition, in order to use these “deductions” of insurance premiums, you must pay them correctly, that is, correctly indicate the BCC.

Important! In 2021, the BCC for the pension fund and the Compulsory Medical Insurance Fund were changed, which is due to the transfer of insurance premiums under the jurisdiction of the tax services.

This might also be useful:

- Retail trade on UTII in 2021

- Calculation of UTII for less than a month in 2021

- UTII for individual entrepreneurs in 2021

- UTII changes in 2021

- Basic UTII yield in 2021

- Codes of types of entrepreneurial activity UTII

Is the information useful? Tell your friends and colleagues

Dear readers! The materials on the TBis.ru website are devoted to typical ways to resolve tax and legal issues, but each case is unique.

If you want to find out how to solve your specific issue, please contact the online consultant form. It's fast and free!

KBC for 2021

In connection with the publication of Order No. 230n of the Ministry of Finance of Russia dated December 7, 2016, some BCCs changed in 2017. So, for example, the BCC for insurance premiums has changed. See “KBK for insurance premiums in 2021: table with explanation.”

However, the budget classification codes (BCC) for UTII for 2021 have not changed. When paying “imputed” tax and related payments, use the BCC indicated in the table below:

| Payment type | KBK for UTII in 2021 |

| Imputed tax | 182 1 0500 110 |

| Penalty | 182 1 0500 110 |

| Fines | 182 1 0500 110 |

Where to get a receipt for payment of UTII

Tax authorities can help in providing details, but it is up to economic entities themselves to generate a payment document (in electronic or paper form). There are resources on the Internet that can help you create a receipt for paying UTII.

The technology for transferring money to the budget is varied, and the transfer can be done in several ways, such as:

- transfer from a bank account (available for individual entrepreneurs and companies);

- through the bank's cash desk in cash (only available to individual entrepreneurs);

- using Internet resources such as online banking (available to individual entrepreneurs and organizations that have the appropriate capabilities);

- on the Federal Tax Service portal, where you can first prepare a payment document and then make a transfer (available to individual entrepreneurs);

Separately, we note the method in which a payment receipt is created on the Federal Tax Service portal. There is appropriate software here that will allow you to enter all the data correctly and avoid errors. The taxpayer, by entering, for example, data on tax address, automatically fills in the fields where OKTMO is indicated, and also enters other details.

NOTE! In order for the payment to go through, it is necessary to indicate the TIN.

***

To pay UTII, you must enter the details in the receipt or payment slip. KBK occupies a special place in their composition, since it allows you to direct money exactly to the desired treasury account. To avoid mistakes, it is recommended to issue a payment document on the Federal Tax Service portal or by printing out the receipt offered by the tax authorities at bank cash desks.

Similar articles

- Latest changes in the Tax Code of the Russian Federation on UTII

- KBK for UTII in 2016-2017 for individual entrepreneurs

- Application form for termination of activities under UTII

- How is UTII calculated for passenger transportation?

- How to switch to UTII in 2021

KBK UTII-2017: if there is an error in the payment when indicating the budget classification code

If you make a mistake when indicating the KBK in the payment slip for UTII payment, it can be corrected quite easily. To do this, you need to submit an application to the Federal Tax Service to clarify the payment (Clause 7, Article 45 of the Tax Code of the Russian Federation). The form of such an application is not approved - it is written in any form.

A sample application for payment clarification can be found here.

Be sure to attach a copy of the payment order in which you made a mistake to your application for payment clarification.

By the way, if you are charged penalties (before the day when the tax authorities make a decision on your application to clarify the payment), immediately after a positive decision is made, they will be reversed (clause 7 of Article 45 of the Tax Code of the Russian Federation).

But keep in mind that if you make a mistake not only when specifying the KBK, but also when specifying the account number of the recipient and/or the recipient's bank, then you will not be able to clarify the payment. Indeed, if these details are incorrectly indicated, the obligation to pay tax is considered unfulfilled (clause 4, clause 4, article 45 of the Tax Code of the Russian Federation). In this case, you will have to re-transmit the UTII budget, as well as pay the amount of “accumulated” penalties. You can calculate it using our Calculator.

And the amount transferred on a payment slip with errors can be returned from the budget.

You can find more complete information on the topic in ConsultantPlus.

Free access to the system for 2 days.

Accountant forum:

Form and sample receipt for UTII for the 4th quarter of 2019

When preparing a payment order for the payment of UTII for the 4th quarter of 2021, you need to focus on two documents:

- Appendices 1 and 2 to the order of the Russian Ministry of Finance No. 107n dated November 12, 2013.

- Regulation of the Bank of the Russian Federation No. 383-P dated June 19. 2012.

If an individual entrepreneur has a current account with a bank, then he fills out a payment order. If a current account is not open, then fill out a receipt and pay at any bank.

The details of the payee must be clarified at the Federal Tax Service at the place of registration of the UTII payer.

When filling out field 101 “Payer status” of the payment order, organizations must enter the value “01”, and individual entrepreneurs - “09”.

and a sample receipt for payment of UTII for the 4th quarter of 2021 can be found using the buttons below:

Sample payment form for UTII in 2021

The BCC for payment of UTII in the payment order must be indicated in field 104.

As for the other fields of the payment order for the payment of current UTII payments in 2021, pay attention to the following:

- in field 105 “OKTMO” - OKTMO of the municipality in which the company or entrepreneur is registered as a payer of “imputed” tax;

- in field 106 “Basis of payment” - for current “imputed” payments - “TP”;

- in field 107 “Tax period indicator” - the number of the quarter for which UTII is transferred. Let’s say “KV.01.2017”;

- in field 108 “Document number” – for current payments “0”;

- in field 109 “Date of payment basis document” - for current payments - the date of signing the UTII declaration;

- Field 22 “UIN” – is filled in if the company (IP) pays imputed tax at the request of the Federal Tax Service. Then this detail will be required by the tax authorities. Otherwise, field 22 is “0”.

- field 110 “Payment type” is not filled in.

KBK UTII for individual entrepreneurs in 2021

Profit tax of organizations credited to federal budget funds 182 10101011011000 110

Penalties on income tax of organizations transferred to federal budget funds 182 10101011012100 110

Penalty for income tax of organizations transferred to federal budget funds 182 10101011013000 110

Profit tax of organizations credited to the budget funds of constituent entities of Russia 18200 110

Penalties for income tax of organizations credited to the budget funds of constituent entities of the Russian Federation 18200 110

Penalty for income tax of organizations credited to the budget funds of constituent entities of the Russian Federation 18200 110

Budget classification codes TAX ON INCOME RECEIPTS OF INDIVIDUALS for 2015 – Federal Tax Service of the Russian Federation.

Tax on personal income. The source of income is the tax agent (Code KBK INCOME TAX OF INDIVIDUALS 2015 for employees and employees), with the exception of Income under Art. 227, 227.1, 228 Tax Code of the Russian Federation 182 10102010 011000 110

Penalties for INCOME TAX FOR INDIVIDUALS. The source of income is a tax agent, with the exception of Income under Art. 227, 227.1, 228 Tax Code of the Russian Federation 182 10102010 012100 110

Penalty for INCOME TAX FOR INDIVIDUALS. The source of income is a tax agent, with the exception of Income under Art. 227, 227.1, 228 Tax Code of the Russian Federation 182 10102010 013000 110

Tax on income receipts of individuals (individual entrepreneurs, notaries, lawyers, etc., engaged in private practice in accordance with Article 227 of the Tax Code of the Russian Federation) 182 10102020 011000 110

Penalties INCOME TAX FOR INDIVIDUALS (individual entrepreneurs, notaries, lawyers, etc., engaged in private practice in accordance with Article 227 of the Tax Code of the Russian Federation) 182 10102020 012100 110

Fine INCOME TAX FOR INDIVIDUALS (individual entrepreneurs, notaries, lawyers, etc., engaged in private practice in accordance with Article 227 of the Tax Code of the Russian Federation) 182 10102020 013000 110

Tax on Income Receipts of Individuals on income received by individuals in accordance with Article 228 of the Tax Code of the Russian Federation (kbk Tax on Income Receipts of Individuals in 2015) 18210102030 011000 110

Penalties on INCOME TAX FOR INDIVIDUALS received by individuals in accordance with Article 228 of the Tax Code of the Russian Federation 182 10102030 012100 110

Fine on income received by individuals in accordance with Article 228 of the Tax Code of the Russian Federation 18210102030 013000 110

INCOME TAX FOR INDIVIDUALS in the form of fixed advance payments on income received by non-residents employed by citizens on the basis of a patent, respectively. With Article 227.1 of the Tax Code of the Russian Federation 182 10102040 011000 110

Value added tax on goods (work, services) sold in Russia (KBK VAT code for 2015) 182 103 01000 011000 110

VAT penalties on goods, works, services sold on the territory of the Russian Federation 182 103 01000 012100 110

VAT penalty on goods, works, services sold on the territory of the Russian Federation 182 103 01000 013000 110

Value added tax on goods imported into Russia (from the Republics of Kazakhstan and Belarus) 182 104 01000 011000 110

Tax levied in connection with the application of the simplified taxation system (Code KBK USN for 2015) - Income receipts - object of taxation 182 105 01011011000 110

Penalties levied in connection with the application of the simplified tax system - object of taxation - Income receipts 182105 01011012100 110

Fine levied in connection with the application of the simplified tax system - object of taxation - Income receipts 182105 01011013000 110

Tax levied in connection with the application of the simplified taxation system (Code KBK USN for 2015) - Income receipts minus Expenses - object of taxation 182105 01021011000 110

Penalties levied in connection with the use of “simplified taxation” - object of taxation - Income receipts minus Expenses 182 105 01021012100 110

Fine levied in connection with the use of "simplified taxation" - object of taxation - Income receipts minus Expenses 182 105 01021013000 110

Minimum tax under the simplified tax system 182105 01050 011000 110

Minimum tax penalty for “simplified” 182 105 01050 012100 110

Minimum tax penalty for “simplified” 182 105 01050 013000 110

Unified tax on imputed income for certain types of activities (code kbk UTII 2019) 182 10500 110

Penalties on the Unified tax on imputed income for certain types of activities (code kbk UTII 2019) 182 10500 110

Fine Single tax on imputed income for certain types of activities (code kbk UTII 2019) 182 10500 110

Unified agricultural tax (Code KBK Unified Agricultural Tax 2015) 182 105 03000 011000 110

Unified agricultural tax penalty 182 105 03000 012100 110

Unified agricultural tax fine 182 105 03000 013000 110

Tax levied in connection with the application of the patent taxation system 182 10500 110

Property tax for individuals 182 10600 110

Property tax for organizations not included in the unified gas supply system 182 10600 110

Penalties for the Property Tax of organizations not included in the unified gas supply system 182 10600 110

Fine for Property Tax of organizations not included in the unified gas supply system 18210600 110

Property tax of organizations included in the unified gas supply system 182 10600 110

Penalties for the Property Tax of organizations included in the unified gas supply system 182 10600 110

Penalty for Property Tax of organizations included in the unified gas supply system 182 10600 110

Transport tax from organizations 182 106 0401102 1000 110

Below you will find tables with the BCC for 2021 for basic taxes and insurance premiums.

KBK for paying taxes for organizations and individual entrepreneurs on OSN

| Name of tax, fee, payment | KBK |

| Corporate income tax (except for corporate tax), including: | |

| — to the federal budget (rate — 3%) | 182 1 0100 110 |

| — to the regional budget (rate from 12.5% to 17%) | 182 1 0100 110 |

| VAT | 182 1 0300 110 |

| Property tax: | |

| - for any property, with the exception of those included in the Unified Gas Supply System (USGS) | 182 1 0600 110 |

| - for property included in the Unified State Social System | 182 1 0600 110 |

| Personal income tax (individual entrepreneur “for yourself”) | 182 1 0100 110 |

| Name of tax, fee, payment | KBK |

| Tax under the simplified tax system, when the object of taxation is applied: | |

| - “income” | 182 1 0500 110 |

| — “income minus expenses” (tax paid in the general order, as well as the minimum tax) | 182 1 0500 110 |

| UTII | 182 1 0500 110 |

| Unified agricultural tax | 182 1 0500 110 |

| Name of tax, fee, payment | KBK |

| Personal income tax on income the source of which is a tax agent | 182 1 0100 110 |

| VAT (as tax agent) | 182 1 0300 110 |

| VAT on imports from Belarus and Kazakhstan | 182 1 0400 110 |

| Income tax on dividend payments: | |

| — Russian organizations | 182 1 0100 110 |

| - foreign organizations | 182 1 0100 110 |

| Income tax on the payment of income to foreign organizations (except for dividends and interest on state and municipal securities) | 182 1 0100 110 |

| Income tax on income from state and municipal securities | 182 1 0100 110 |

| Income tax on dividends received from foreign organizations | 182 1 0100 110 |

| Transport tax | 182 1 0600 110 |

| Land tax | 182 1 06 0603х хх 1000 110 where xxx depends on the location of the land plot |

| Water tax | 182 1 0700 110 |

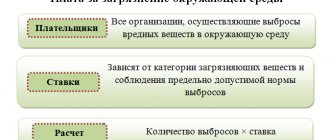

| Payment for negative impact on the environment | 048 1 12 010x0 01 6000 120 where x depends on the type of environmental pollution |

| MET | 182 1 07 010хх 01 1000 110 where хх depends on the type of mineral being mined |

| Corporate income tax on income in the form of profits of controlled foreign companies | 182 1 0100 110 |

In practice, other payment details may be no less important for the UTII payer. Despite the fact that their incorrect indication, as in the case of the KBK, cannot be a basis for the Federal Tax Service to refuse to offset the payment, they should be known and applied correctly - in order to avoid any difficulties with the processing of the payment by the bank, as well as to quickly detect the payment Federal Tax Service upon receipt of funds into treasury accounts.

There are details that are quite difficult to make a mistake (for example, in the name of the payer). There are those that in many cases are filled in automatically (for example, the details of the payer’s bank - by a banking program). But there are also those that may be difficult to fill out. Such details include:

- OKTMO code;

- document number and date;

- priority, basis and purpose of payment;

- UIN code;

- taxable period.

Let's consider how to correctly determine the specified details, as well as where to get and how to fill out a receipt for UTII.

This article reveals the features of payment for the KBK UTII 2021 for individual entrepreneurs. The deadlines and codes of the budget organization for sending the payment are indicated.

A single imputed tax replaces standard scattered payments and eases the burden on small businesses. To avoid making a mistake when paying, you must use the KBK UTII 2021 for individual entrepreneurs - the digital designation of a budgetary institution.

Details for filling out a payment order

(general information)

Paragraph 1. When starting to fill out the payment order, you must enter the serial number and, accordingly, the date of generation of the payment order.

The payment order number is assigned chronologically, consisting of 6 digits (the number cannot be zero). The date format is “day month year”. In electronic form, the date is entered according to the format established by the bank.

Point 2. The “type of payment” is designated, the code of which is set by the bank.

Clause-3 . The status of the payer is indicated

| The list of status codes is given in Appendix 5 to the order of the Ministry of Finance of Russia dated November 12, 2013 No. 107n: |

• 01 - taxpayer (payer of fees) - legal entity;

• 02 – tax agent;

• 06 - participant in foreign economic activity - legal entity;

• 08 - payer - a legal entity (individual entrepreneur) transferring funds to pay insurance premiums and other payments to the budget system of the Russian Federation;

• 09 - taxpayer (payer of fees) - individual entrepreneur;

• 10 - taxpayer (payer of fees) - a notary engaged in private practice;

• 11 - taxpayer (payer of fees) - lawyer who established a law office;

• 12 - taxpayer (payer of fees) - head of a peasant (farm) enterprise;

• 13 - taxpayer (payer of fees) - another individual (bank client (account holder));

• 14 – taxpayer making payments to individuals;

• 16 - participant in foreign economic activity - individual;

• 17 - participant in foreign economic activity - individual entrepreneur;

• 18 - a payer of customs duties who is not a declarant, who is obligated by the legislation of the Russian Federation to pay customs duties;

• 19 - organizations and their branches (hereinafter referred to as organizations) that issued an order for the transfer of funds....;

• 21 - responsible participant in the consolidated group of taxpayers;

• 22 – participant of a consolidated group of taxpayers;

How budget qualification codes have changed

The beginning of the year is a time of legislative innovations. Our portal wrote about the most pressing ones earlier, now it’s time to find out new budget qualification codes for paying taxes and contributions. Since January, 12 new CBCs have already been operating. By order of the Ministry of Finance, a different code for income tax is introduced, the code for the minimum tax is canceled and updated codes for insurance premiums are introduced. In addition, from now on there will be no separate code for the minimum tax. Information agency vRossii.ru publishes a complete list of KBK for 2021.

Income tax:

— to the federal budget — 182 1 0100 110;