We kindly ask all our partners!

The Profit-Liga company has changed the list of mandatory documents required to conclude an agreement with the buyer.

A new mandatory item has been added to the list

This letter affects the processing of product returns. It is important for us to know whether the counterparty works with VAT or without VAT. We strive to avoid errors in processing returns, which often lead to negative consequences.

We ask you to send the above-mentioned letter to the manager with whom you work by 09/01/2018 (examples: fish letters, example for UTII, example for the general taxation system). The letter can be composed by you in free form.

Also, to the information letter, please attach copies of the VAT return for the last tax period with a note from the Federal Tax Service on acceptance or the attachment of a protocol on acceptance of the declaration.

Certificate of application of the general taxation system and its sample for the counterparty

In order for a letter or certificate to truly fulfill the function of confirming the application of OSNO and (or) other taxation systems, as practice shows, a number of requirements must be met:

- The ability to accurately determine who the information is coming from. A letterhead with details will help with this, and affixing signatures with a seal, if available (more information about how a company’s letterhead and seal can look can be found in our article at the link: Letterhead and organization seal - samples for LLC).

- An indication of the use of one of the universal modes - general or simplified taxation system. It is advisable to indicate from what time the tax system has been applied (this is especially important if the transition has been made recently), if possible, attach copies of documents that can confirm the specified information (for example, copies of tax returns for VAT, income tax).

- Indication of the use of special modes - when combined with OSNO or simplified tax system.

A certificate is a more formalized document compared to a letter. Often, a certificate is drawn up on a form by filling out the details handwritten or printed. It is advisable to produce a standard form of this kind if there are a large number of counterparties.

Obtaining a certificate about the applied OSNO system from the tax authority

In practice, there are situations when, when making a transaction for a large amount or entering into a long-term relationship, the buyer asks the supplier to present a certificate of application of OSNO from the tax authority.

Taxpayer requests for information are subject to several types of regulations:

- Law “On the Procedure for Considering Appeals...” dated May 2, 2006 No. 59-FZ (hereinafter referred to as Law No. 59-FZ);

- Law “On Ensuring Access...” dated 02/09/2009 No. 8-FZ;

- subp. 4 paragraphs 1 art. 32 of the Tax Code of the Russian Federation.

In general terms, the consideration of appeals is regulated by Law No. 59-FZ. In accordance with Art. 7 of Law No. 59-FZ, such a document must necessarily contain:

- Name of the recipient authority.

- Name (full name) of the person making the request.

- Address for sending a response.

An appeal containing a request to provide information that the organization from which the request comes uses OSNO must be signed. Otherwise, it is impossible to determine from whom it comes. It is not necessary to affix the signature of an official with a seal, including if there is one, since this does not affect the possibility of identifying the applicant.

A response to the appeal must be given within 30 days (Article 12 of Law No. 59-FZ).

Can such a letter be replaced by a copy of the tax authority’s notification that the taxpayer has ceased to apply the special regime? Let's consider this option in more detail.

How to notify that you are paying VAT

All requirements for a letter to a business partner stating that you are a value added tax payer are the same as for a letter under OSNO. There is no form established by law.

If the other party to the agreement wishes to receive confirmation of information from the tax office, then you have the right, in the usual manner established by the Federal Law “On Citizens' Appeals” No. 59-FZ, to send a free-form request to the tax office with a request to provide data on the applied regime and calculated taxes. The response period for an appeal will be 30 days by law.

Confirmation of transition from special regime to OSNO

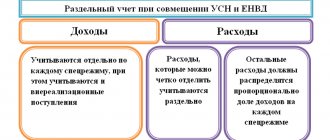

Taxpayers applying special tax regimes do not calculate or pay VAT, with the exception of some cases specifically specified in the Tax Code of the Russian Federation (import of goods into the Russian Federation, etc.). At the same time, it must be taken into account that in all areas of work, only organizations on the simplified tax system do not use OSNO, and users of UTII, Unified Agricultural Tax (unified agricultural tax), PSN (patent tax system) have the right to combine their activities with OSNO.

If the counterparty that applied the special regime switched to OSNO, then the cancellation of the special regime is completed as follows:

- By sending a notification or message to the tax authority - under the simplified tax system (clauses 5, 6 of article 346.13 of the Tax Code of the Russian Federation), unified agricultural tax (clauses 5, 6 of article 346.3 of the Tax Code of the Russian Federation). In this case, the tax authority does not issue a document confirming the transition.

- By deregistration - with PSN, UTII. Moreover, upon termination of the patent in accordance with clause 4 of Art. 346.45 of the Tax Code of the Russian Federation, a notification is not issued by the tax authority. If you refuse UTII, the tax authority in accordance with clause 3 of Art. 346.28 of the Tax Code of the Russian Federation is required to issue a notice of deregistration. The form of such a document, numbered 1-5-Accounting, was approved by order of the Federal Tax Service of the Russian Federation dated August 11, 2011 No. YAK-7-6/ [email protected]

Please note that when submitting a copy of the notice of deregistration as a UTII payer, it is impossible to draw a conclusion about the transition to OSNO. If the UTII regime was used along with the simplified tax system, if the UTII is abandoned, a return to the simplified tax system occurs.

IMPORTANT! The notification form in Form 1-5-Accounting does not contain an indication of what taxation regime the person who has applied for deregistration under UTII is switching to.

How to report the use of preferential treatment

Business entities using the simplified tax system are exempt from VAT, with the exception of a few cases (clause 2 of article 346.11 of the Tax Code of the Russian Federation). To confirm status under the simplified tax system, the taxpayer has the right to receive, upon request, from the tax office an information letter in form No. 26.2-7 or provide the counterparty with a notification from the Federal Tax Service about the transition to the simplified tax system (form no. 26.2-1).

Sample

The forms of documents for applying the simplified tax system are approved by order of the Federal Tax Service of Russia dated November 2, 2012 No. ММВ-7-3/, a sample letter about the simplified taxation system coming from the Federal Tax Service looks like this:

Is it possible to obtain a certificate from the tax office without going through a counterparty?

It happens that a certificate about the use of OSNO by the counterparty is needed, but a response to the corresponding request is not received from him. At the same time, the need for such a document may be acute, for example, among budgetary organizations that are controlled by higher-level and regulatory authorities. What to do in this case? Is it possible to obtain information from the tax authority? These are the questions taxpayers ask.

Position of the Federal Tax Service of the Russian Federation

There is an option to contact the tax authority to find out whether a third party fulfills the duties of a taxpayer on OSNO. The Federal Tax Service of the Russian Federation does not support it, fearing the mass practice of appeals.

At the same time, the main fiscal authority of the country argues its position with reference to subparagraph. 3 clause 17 of the administrative regulations of the Federal Tax Service of the Russian Federation, approved. by order of the Ministry of Finance of the Russian Federation dated July 2, 2012 No. 99n: tax officials do not have the right to give a legal assessment of any circumstances and events. Thus, the possibility of directly formulating the question of whether the obligations to pay taxes are properly fulfilled is excluded. However, there are variations of requests to which tax authorities are required to respond.

Norms of the Tax Code of the Russian Federation on tax secrecy

The likelihood of receiving an answer to the substance of the questions posed depends on whether the relevant information is a tax secret. This category includes any information, with some exceptions. In Art. 102 of the Tax Code of the Russian Federation, the list of exemptions includes the following data:

- on violations of tax legislation (subclause 3, clause 1, article 102 of the Tax Code of the Russian Federation);

- special regimes applied by the taxpayer (subclause 7, clause 1, article 102 of the Tax Code of the Russian Federation).

Thus, the tax authority is obliged to report these 2 parameters of the counterparty’s activities by force of law. Based on the answer to the question about special regimes, it will be possible to conclude whether the counterparty uses OSNO. It should be taken into account that only the use of the simplified tax system completely excludes the possibility of using the OSNO.

The request must be made according to the same rules as indicated above, clearly stating the questions in it. In addition, when drafting it, one should take into account the position of the Ministry of Finance of the Russian Federation, which is a superior body in relation to the Federal Tax Service of the Russian Federation.

Position of the Ministry of Finance of the Russian Federation

Thus, according to the Supreme Arbitration Court of the Russian Federation and the Ministry of Finance of the Russian Federation, a request to the tax authority can be sent according to all 3 parameters:

- on the counterparty’s use of OSNO;

- bringing the counterparty to tax liability;

- application of special regimes.

There is judicial practice and the position of the Ministry of Finance of the Russian Federation confirming the legality of such a request and the obligation of the tax authorities to respond to the substance of the requests.

So, the letter or certificate has been received. Regardless of who submitted the certificate - the counterparty or the tax authority, the question inevitably arises: is such a document sufficient to completely protect oneself from claims from inspectors?

Notification about UTII: what document form is valid in 2014–2015 and 2021?

Forms for notifying the taxpayer that he has the right to use the special regime for calculating imputed income are approved by Order of the Federal Tax Service of the Russian Federation dated August 11, 2011 No. YAK-7-6 / [email protected] Organizations are sent form No. 1-3-Accounting (according to Appendix 2 of the above order), individual entrepreneurs receive a notification in form No. 2-3-Accounting (in accordance with Appendix 7 of the order).

The taxpayer has an obligation to register under UTII even if he is registered with this Federal Tax Service for some other reason. This is evidenced by the letter of the Ministry of Finance of the Russian Federation dated 06/03/2009 No. 03-11-06/3/154.

If a taxpayer has not registered in connection with the application of UTII, then he does not have the right to pay this tax and must apply the taxation system he was in before the application of UTII (see, for example, letter of the Ministry of Finance of Russia dated December 27, 2012 No. 03-02 -07/2-183). Having discovered that the subject is working on an imputation without switching to it in the prescribed manner, inspectors will assess him additional taxes in accordance with the previous tax regime, calculate penalties and, most likely, fine him.

Termination of the use of UTII is also accompanied by the submission of an application, on the basis of which the inspectorate issues a notice of deregistration.

Thus, timely submission of applications for registration or deregistration for activities related to UTII makes it possible not to pay excessively calculated amounts of taxes.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Is a certificate of application of OSNO sufficient to confirm the legality of the deduction?

Formally, to provide a VAT deduction, documents confirming the conduct of a business transaction and an invoice are sufficient. In practice, during a tax audit, these documents, as well as a certificate of application of OSNO, may not be enough. If a taxpayer claims to deduct VAT that was not paid by his counterparty to the budget, serious problems may arise related to the need to confirm the legality of the deduction, which will require proof of 2 aspects:

- performing verification activities on the counterparty;

- the reality of the business transaction carried out, its compliance with the business goal.

Obtaining a certificate of application of OSNO is only one of the elements of the first group of actions. At the same time, in the letters of the Federal Tax Service of the Russian Federation devoted to this issue, for example, dated July 24, 2015 No. ED-4-2/ [email protected] , dated June 24, 2016 No. ED-19-15/104, such a document is not mentioned. The main fiscal authority of the country instructs taxpayers to first check the reality of the existence of the counterparty.

IMPORTANT! Failure to verify a counterparty will not in itself entail additional taxes. As noted in the letter of the Federal Tax Service of the Russian Federation dated March 23, 2017 No. ED-5-9/ [email protected] , tax authorities should move away from the formal approach and pay attention to the procedure for selecting a counterparty, signs of coordination of actions, etc. Failure of the supplier to pay taxes to the budget in itself does not entail tax liability for the buyer who has submitted VAT for deduction.

So, a certificate of application of OSNO is a document, the form and obligation to submit which are not regulated by law. This type of letter can be provided by both the taxpayer and the tax authority upon request. In addition to such a letter, a prudent taxpayer may need a large number of other documents to verify the reliability of the counterparty and confirm his own integrity.

How to receive notification of the application of UTII? – State Collection Info

An organization that has expressed a desire to switch to paying UTII submits, within five days from the date of application of the specified taxation system, an application for registration in form No. UTII-1 to the tax office at the place of business activity.

5 days are allotted for this from the date of application of this taxation system.

Deregistration of an organization upon termination of business activities subject to UTII taxation, transition to a different taxation regime, including if the taxpayer committed violations of the requirements established by subparagraphs 1 and 2 of paragraph 2.2 of Article 346.

26 of the Tax Code of the Russian Federation, is carried out on the basis of an application for deregistration as a UTII taxpayer in form No. UTII-3, submitted to the tax authority within five days from the date of termination of business activities subject to a single tax, or from the date of transition to another regime taxation, or from the last day of the month of the tax period in which violations of the established requirements were committed.

https://www.youtube.com/watch?v=tJB3OgIq9FE

When terminating business activities on UTII or switching to a different taxation regime (including if violations of the requirements of subclauses 1 and 2 of clause 2.2 of Article 346.26 of the Tax Code are committed), it is necessary to deregister as a UTII payer. To do this, you need to submit an application to the tax authority in form No. UTII-3.

This must be done within 5 days:

- from the date of termination of business activity on UTII or transition to a different taxation regime;

- from the last day of the month of the tax period in which violations of the requirements of sub. 1 and 2 clause 2.2 art. 346.26 of the Internal Revenue Code.

Currently, UTII payers are not required to report to the tax authority at the place of registration about any changes in previously reported information about the types and locations of activities. At the same time, the taxpayer has the right to inform the tax authority about such changes using the application for registration / application for deregistration form.

Currently, there is no obligation for UTII taxpayers to report to the tax authority at the place of registration about any changes to previously reported information about the types of activities and places of their implementation. At the same time, the taxpayer has the right to inform the tax authority about these changes using the Application for Registration (Application for Deregistration) form.

Let's analyze the situation

The organization provides household services and paid parking services.

Despite the fact that both types of activities have been transferred to UTII, each of them has its own amount of basic profitability, as well as its own physical indicator, on which the amount of tax directly depends.

This means that the organization must separately take into account the indicators necessary to calculate UTII for paid parking and UTII for household services.

Source:

Certificate of applicable taxation system: sample

At the beginning of the operation of a new company, this regime may turn out to be an additional burden on the entrepreneur, since:

- You will have to provide difficult accounting in the ledger of cash receipts and expenses.

- Make a large number of payments to the treasury, including income tax or personal income tax, VAT, property tax, etc.

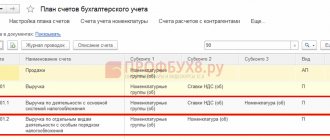

- Use a complete chart of accounts when maintaining accounting or tax records.

The most expensive element of the general regime is VAT, which requires quarterly submission of reports to the tax department, as well as the mandatory completion of invoices and their storage.

However, if the company’s staff exceeds 100 people, or its retail space exceeds 150 square meters, or its car fleet includes more than 20 cars, then it will have to use OSN.

Sample certificate of general taxation system

It is better to pay off tax debts before May 1. Otherwise, potential and existing counterparties will see information that the company owes to the budget for a whole year.

In such a situation, can an employer count absenteeism to an employee with all the ensuing consequences?

Attention

→ Accounting consultations → General tax issues Current as of: April 13, 2021 For various reasons, an organization may need to confirm its tax regime. As a rule, its counterparties may ask for this.

For these purposes, the organization can submit a certificate about the taxation system, a sample of which we will provide in our consultation.

Online magazine for accountants

In particular, the basic criteria for the application of the SST are contained in: Chapter 3, which examines in detail all categories of subjects subject to taxation of the general system; Chapters 8 and 9, which reveal the time frame and procedure for making certain mandatory payments to the treasury; Chapters 12 and 13, which describe the process of formation and transfer to the tax office. bodies of declarations on various types of payments, as well as revealing the features of tax control and the procedure for its application Chapters 21-33 Where all types of tax payments that are applied under OSN are discussed in detail In general, the general tax regime is revealed by all sections of the Tax Code, with the exception of Chapters 26.1, 26.2, 26.3, 26.4, 26.5, which reveal the essence of special taxation regimes for business entities (STS, UTII and Unified Agricultural Tax).

How to receive notification of the application of UTII?

At the same time, it was especially noted that such requests deserve attention if they are dictated by prudence in determining the counterparty. Thus, according to the Supreme Arbitration Court of the Russian Federation and the Ministry of Finance of the Russian Federation, a request to the tax authority can be sent according to all 3 parameters:

- on the counterparty’s use of OSNO;

- bringing the counterparty to tax liability;

- application of special regimes.

There is judicial practice and the position of the Ministry of Finance of the Russian Federation confirming the legality of such a request and the obligation of the tax authorities to respond to the substance of the requests. So, the letter or certificate has been received.

Sample letter on application of UTII sample

Is a certificate of application of OSNO sufficient to confirm the legality of the deduction? Formally, to provide a VAT deduction, documents confirming the conduct of a business transaction and an invoice are sufficient.

In practice, during a tax audit, these documents, as well as a certificate of application of OSNO, may not be enough.

If a taxpayer claims to deduct VAT that was not paid by his counterparty to the budget, serious problems may arise related to the need to confirm the legality of the deduction, which will require proof of 2 aspects:

- performing verification activities on the counterparty;

- the reality of the business transaction carried out, its compliance with the business goal.

Obtaining a certificate of application of OSNO is only one of the elements of the first group of actions.

Source:

Notification on the use of UTII in 2021

The taxation regime in the form of a single tax on imputed income will remain in effect for several more years. Therefore, it is important for entrepreneurs to know what it looks like and where to receive notification of the transition to UTII. In the article we will also look at how to receive a notice of deregistration (UTII).

UTII is a preferential tax regime that is applied by organizations and individual entrepreneurs on a voluntary basis, but in accordance with certain restrictions on the type of activity and scale of business.

When submitting an application about the intention to use this option of deducting taxes to the Federal Tax Service, the economic agent is registered as a single tax payer. Within 5 working days after processing the application, the applicant is sent a notification of UTII. For individual entrepreneurs (2021

) prepare form No. 2-3-Accounting (Appendix No. 7 to Order of the Federal Tax Service of Russia dated August 11, 2011 No. YAK-7-6/), and for companies - form No. 1-3-Accounting (Appendix No. 2). This is what the forms of such documents look like:

- for individual entrepreneurs:

Let us remind you that it is necessary to register at the place where a specific activity is carried out. Taxpayers who are engaged in delivery or peddling trade, provide transportation services, or place advertising in transport apply at their location (residence).

If for some reason the taxpayer no longer uses the single tax, he is obliged to inform the tax authorities about this. No later than 5 working days after the application, the applicant must receive a notice of termination of UTII (2021). Form No. 1-5-Accounting for a Russian organization (Appendix No. 3 of the above order) looks like this.

Source: https://pravospb812.ru/ndfl/kak-poluchit-uvedomlenie-o-primenenii-envd.html

Information letter about the taxation system sample basis

Mistakes lead to penalties, which are transferred to the state. The general system establishes strict control over individual entrepreneurs, but if the level of income is high, the enterprise receives greater freedom in choosing activities, the number of employees, the acquisition of real and movable property, as well as the maximum amount of income. Using OSNO, a businessman of an individual enterprise submits the following reports:

- once a quarter, a report on the balance sheet of the enterprise;

- profit and loss report, every quarter;

- once a year, about changes in the capital of the enterprise;

- every year, about cash turnover;

- annex to the report, every year, on the balance sheet of the enterprise;

- explanatory note (once a year) on the number of employees of the company;

Insurance premiums Regardless of what type the entrepreneur uses, everyone pays insurance premiums.

Certificate of applicable taxation system: sample

Is it possible to obtain a certificate from the tax office without going through the counterparty? It happens that a certificate about the use of OSNO by the counterparty is needed, but a response to the corresponding request is not received from him. At the same time, the need for such a document may be acute, for example, among budgetary organizations that are controlled by higher-level and regulatory authorities. What to do in this case? Is it possible to obtain information from the tax authority? These are the questions taxpayers ask. Position of the Federal Tax Service of the Russian Federation There is an option to contact the tax authority in order to find out whether a third party fulfills the obligations of a taxpayer on OSNO. The Federal Tax Service of the Russian Federation does not support it, fearing the mass practice of appeals. At the same time, the main fiscal authority of the country argues its position with reference to subparagraph. 3 clause 17 of the administrative regulations of the Federal Tax Service of the Russian Federation, approved.

Letter to the counterparty on the application of UTII

But in general it’s possible without it

. Letter on the application of the simplified tax system for the counterparty standard in

.

Sample information letter on the use of UTII

, Unified Agricultural Tax (pp.

5, 6 tbsp. 346.3 Tax Code of the Russian Federation). At the beginning of the operation of a new company, this regime may turn out to be an additional burden on the entrepreneur, since:

- You will have to provide difficult accounting in the ledger of cash receipts and expenses. Make a large number of payments to the treasury, including income tax or personal income tax, VAT, property tax, etc. Use a complete chart of accounts when maintaining accounting or tax records.

The most expensive element of the general regime is VAT, which requires quarterly submission of reports to the tax department, as well as the mandatory completion of invoices and their storage.

negulitheclar

We'll tell you how counterparties can prove what is justified.

A person applying a special taxation regime is a single tax on imputed income, a simplified UTII.

The information letter is only additional confirmation of the fact that the taxpayer sent

.

Ministry of Finance of Russia dated May 1, 2005

Letter on application of UTII

A tax return is submitted by each taxpayer for each tax payable by that taxpayer, unless otherwise provided by the legislation on taxes and fees.

At the same time, the taxpayer’s obligation to submit tax returns is not made dependent on the results of business activities.

The application form for deregistration of an individual entrepreneur as a UTII taxpayer (form No. UTII-4) (hereinafter referred to as the Application for deregistration) was approved by Order of the Federal Tax Service of Russia dated December 11, 2012 No. ММВ-7-6/

“On approval of forms and formats for submitting applications for registration and deregistration with tax authorities of organizations and individual entrepreneurs as UTII taxpayers, as well as the procedure for filling out these forms”

. From circulation

What does a sample letter about the application of the general tax system look like?

:

- in case of a voluntary transition, the letter is also considered within 5 days, but the official transition takes place from the new tax year.

- when switching to OSN - a notification is sent to the Federal Tax Service within 15 days;

- if the right to use UTII and the simplified tax system is lost, the period for reviewing the letter is 5 days, after which the payer is officially transferred to another regime;

If necessary, you can also request a certificate from the Federal Tax Service indicating that from a specific date the company began to use the general taxation regime.

The issue of transition to a general tax regime affects not only the payer himself and the department of the Federal Tax Service supervising him:

- This process is extremely relevant for the company’s counterparties – suppliers and distributors. This is due to the need to pay VAT on the supply of goods under the OSN.

Letter on application of UTII for a counterparty, work without VAT sample

Attention Information letter As you know, in order to switch to a simplified taxation system, an entrepreneur only needs to contact the tax office at his location.

She has no right to refuse passage to anyone.

In order to request information about the submitted application for transition, as well as to find out whether a declaration was provided on his behalf, the taxpayer (IP, LLC, JSC) can send his request to the tax office.

Info Is it possible to obtain a certificate from the tax office without going through the counterparty? It happens that a certificate about the use of OSNO by the counterparty is needed, but a response to the corresponding request is not received from him. At the same time, the need for such a document may be acute, for example, among budgetary organizations that are controlled by higher-level and regulatory authorities.

Receive a letter about the application of UTII

Thus, the deadlines for filing an application for registration or deregistration on UTII are the same: this is done within 5 days from the date of the actual transition to the regime (from the regime) or ... or see.

or complete cessation of activity. So, to switch to UTII, an organization/businessman needs to conduct certain types of business and meet numerical indicators for profitability and the number of employees.

The transition takes place on an application basis and does not require permission from the tax authority. The application form for organizations can be downloaded here: Application for UTII for legal entities.

Those who have opened an individual entrepreneur sometimes need to provide proof of having a permanent income (travel abroad, applying for a loan, etc.).

Employees who work for hire receive paperwork from their manager.

Source: https://disk-shetka.ru/pismo-kontragentu-o-primenenii-envd-80666/

Letter of notification of the application by a company or entrepreneur of the

Although there are forms of appeal to the Federal Tax Service, which they are required to respond to. This is what the Tax Code “thinks” about this. Perhaps the answer to the question posed will be a tax secret. This includes any information other than violation of tax rules and regulations (Art.

102

Tax Code of the Russian Federation, art. 1, sub. 3) and used by organizations of special regimes (Article 102 of the Tax Code of the Russian Federation, Article 1, subparagraph 7). Consequently, by force of law, the tax authority is obliged to respond to the counterparty by providing the necessary information. And based on the response received, we can conclude that the counterparty uses the general taxation system (OSNO). Position of the Ministry of Finance In response to the decision of the Supreme Arbitration Court of Russia, the Ministry of Finance indicated that information about the fulfillment by organizations and individuals of their obligations to pay tax payments cannot be a tax secret. Consequently, tax authorities should not leave such requests unanswered.

The taxation system, the basis and rules of its implementation

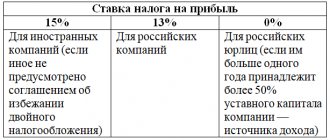

In 2021, the following tax rates were established for OSN: Income tax 20% VAT From 0 to 18% Personal income tax 15% Property tax 2-2.5% Tax period In 2021, the following time frames were established regarding the formation and presentation tax returns, as well as making tax payments to the treasury: personal income tax, income tax, VAT Quarter Tax on real estate Year Conditions for transition A company operating within the framework of UTII and the simplified tax system, as mentioned earlier, can voluntarily or forcibly switch to the general regime . At the same time, a number of conditions can be identified for such a transition from special tax systems.

Information letter stating that the organization is a VAT payer or not

- By deregistration - with PSN, UTII. Moreover, upon termination of the patent in accordance with clause 4 of Art. 346.45 of the Tax Code of the Russian Federation, a notification is not issued by the tax authority. If you refuse UTII, the tax authority in accordance with paragraph.

Please note that when submitting a copy of the notice of deregistration as a UTII payer, it is impossible to draw a conclusion about the transition to OSNO. If the UTII regime was used along with the simplified tax system, if the UTII is abandoned, a return to the simplified tax system occurs. IMPORTANT! The notification form in Form 1-5-Accounting does not contain an indication of what taxation regime the person who has applied for deregistration under UTII is switching to. At the same time, in the letters of the Federal Tax Service of the Russian Federation devoted to this issue, for example, dated July 24, 2015 No. ED-4-2/, dated June 24, 2016 No. ED-19-15/104, such a document is not mentioned. The main fiscal authority of the country instructs taxpayers to first check the reality of the existence of the counterparty. IMPORTANT! Failure to verify a counterparty will not in itself entail additional taxes. As noted in the letter of the Federal Tax Service of the Russian Federation dated March 23, 2017 No. ED-5-9/, tax authorities should move away from the formal approach and pay attention to the procedure for selecting a counterparty, signs of coordination of actions, etc. Failure of a supplier to pay taxes to the budget in itself does not entails tax liability for the buyer who submits VAT for deduction. So, a certificate of application of OSNO is a document, the form and obligation to submit which are not regulated by law. Ministry of Finance of the Russian Federation dated July 2, 2012 No. 99n: tax officials do not have the right to give a legal assessment of any circumstances and events. Thus, the possibility of directly formulating the question of whether the obligations to pay taxes are properly fulfilled is excluded. However, there are variations of requests to which tax authorities are required to respond.

Norms of the Tax Code of the Russian Federation on tax secrecy The likelihood of receiving an answer to the substance of the questions posed depends on whether the relevant information is a tax secret. This category includes any information, with some exceptions. In Art. 102 of the Tax Code of the Russian Federation, the list of exemptions includes the following data:

- on violations of tax legislation (sub.

3 p. 1 art. 102 of the Tax Code of the Russian Federation);

- special regimes applied by the taxpayer (subclause 7, clause 1, article 102 of the Tax Code of the Russian Federation).

Application of UTII

UTII is a special taxation regime in which the object is the amount of estimated imputed income. Until 2013, the use of UTII was considered mandatory for certain types of activities. Since the beginning of 2013, the exercise of the right to use preferential treatment has become voluntary (clause 1 of Article 346.28 of the Tax Code of the Russian Federation).

For more information about changes in tax legislation regarding UTII, see the material “UTI Taxation System: Pros and Cons of Imputation.”

Information letter about the taxation system sample basis

OSN without losing the right to use the simplified tax system or UTII, then such a transition will be made from the beginning of the new year. In this case, the notification can be sent before January 15 of the year from which it is planned to use the general regime. Example A letter about the transition to OSN from special regimes is drawn up on the basis of form No. 26.2-3, which consists of one page and contains the following required fields:

- Checkpoint and TIN of the payer.

- Federal Tax Service code, which can be clarified with the department.

- Full name of the notifying organization.

- The period from which the OSN begins to apply.

- Company contact details.

- Personal and contact information regarding the person submitting the notification to the tax office (entrepreneur or authorized representative).

The completed form is certified by the signature of the owner of the company or its director, as well as a seal (if available).

In this case, the company will have to:

The transition to OSNO occurs on the basis of compliance or non-compliance of the company’s activities with the law, therefore the letter to the Federal Tax Service is a notification and does not require a response with permission. This is simply a reminder to your inspector of the need for changes in the relevant registers and a statement of the fact that company representatives are moving to another level of reporting. The deadline for submitting the letter is 15 days from the date of the regime change. A voluntary transition is only possible from the beginning of the year, so the deadline for submitting a notification is January 15. It is advisable to produce a standard form of this kind if there are a large number of counterparties. A sample form of such a certificate can be downloaded from the link: Sample certificate of the applicable OSNO tax system. Obtaining a certificate of the applied OSNO system from the tax authority In practice, there are situations when, when making a transaction for a large amount or entering into a long-term relationship, the buyer asks the supplier to present a certificate of application of the OSNO from the tax authority. Taxpayer requests for information are subject to several types of regulations:

- Law “On the Procedure for Considering Appeals...” dated May 2, 2006 No. 59-FZ (hereinafter referred to as Law No. 59-FZ);

- Law “On Ensuring Access...” dated 02/09/2009 No. 8-FZ;

- subp. 4 paragraphs 1 art. 32 of the Tax Code of the Russian Federation.

In general terms, the consideration of appeals is regulated by Law No. 59-FZ. In accordance with Art.

Application for transition to the simplified tax system according to form 26.2-1: instructions for filling out

The Tax Code of the Russian Federation, under certain conditions, provides for the possibility of using the preferential tax system of the simplified tax system for some taxpayers.

Currently, this is the most popular mode among economic entities classified as small businesses.

To apply it, you need to submit an application for the simplified tax system to the Federal Tax Service using form 26.2-1.

The procedure for switching to the simplified tax system

The legislation establishes the procedure for transition to a simplified taxation system and what criteria must be met. The transition to the simplified tax system is possible when registering a subject and from other modes. However, in any case, it is necessary to take into account the restrictions defined by the Tax Code of the Russian Federation.

When registering an individual entrepreneur or LLC

The rules of law provide the opportunity to submit an application for the simplified tax system along with registration documents at the time of registration of the taxpayer with the Federal Tax Service.

Attention! It is best to submit an application for the simplified tax system when registering an individual entrepreneur or opening an LLC together with the constituent documents. Or within 30 days from the date of receipt of documents on state registration.

If a newly organized company or entrepreneur does not submit an application within 30 days, then they automatically switch to the general taxation system. At the same time, it will be possible to switch to the simplified tax system only from the beginning of the new year.

It is also necessary to take into account that with such a transition to a simplified system, compliance with the criteria for its application (number, amount of revenue and value of fixed assets) is mandatory, even if they were not checked at the very beginning. As soon as they are exceeded, it will be necessary to immediately notify the Federal Tax Service about this within the established time frame and make the transition from the simplified tax system to the OSNO.

Transition deadlines if the application is not submitted when registering an LLC or individual entrepreneur

Existing taxpayers have the right to change the current taxation regime by submitting an application to switch to the simplified tax system within the time frame established by law.

Attention! The deadline for filing an application for the simplified tax system is December 31 of the year preceding the year in which the simplified tax system began to be applied.

Such business entities must remember that they must comply with the criteria for transition to this system.

Application for maternity leave: how to write it correctly

Therefore, as of October 1, they need to calculate the indicators:

Then they must be compared with the standards specified in the Tax Code of the Russian Federation, and only after that an application for changing the regime to a simplified taxation system must be submitted to the tax office.

Transition from other tax regimes

Special regime officers who use UTII, and for entrepreneurs also PSN, can use the simplified tax system together with these regimes for certain types of activities. This is possible if there are several types of activities on UTII or PSN, but there are also other areas of work carried out by the enterprise.

It is also possible to change systems with UTII and PSN. But here you also need to comply with the deadlines established by law. In this case, in order to avoid double taxation, appropriate applications for the application of regimes should be submitted in a timely manner, as well as separate records of performance indicators should be maintained.

To make the transition to the simplified tax system, the taxpayer must fill out and submit either in person or through an electronic document management system an application in the prescribed form. The form can be purchased at a printing house, but it is best to use specialized programs and Internet services on various sites to fill it out.

Sample of filling out an application for transition to the simplified tax system

See an example of filling out an application for an individual entrepreneur.

See an example of filling out an application for an LLC.

Let's look at an example of how to correctly fill out an application form 26.2-1.

At the top of the form is the TIN code of the company or entrepreneur. For this purpose, the field contains 12 empty cells. Since companies have a TIN of 10 characters, the last two cells, which will remain empty, must be crossed out.

Next you need to write down the gearbox code. Only firms have it, and entrepreneurs cross out this field.

At the next step, in the field you need to enter the four-digit code of the tax service where you are submitting the application for simplification.

Next comes the “Taxpayer Identification” field.

The code specified in it shows at what point in time the economic entity makes the transition:

- “1” is indicated when the document is submitted along with other documents for registration of a company or individual entrepreneur;

- “2” is indicated by a company or entrepreneur who reopens operations after a previously completed liquidation;

- Also, code “2” should be set by those who make the transition from imputation to simplified;

- “3” is recorded by those subjects who switch to simplification from any other system except imputation.

After this, in the large field you need to write down the full name of the company, as is done in the constituent documents, or full full name. entrepreneur with a passport or any other document confirming his identity.

bukhproffi

Important! This field must be filled out according to the following rules. If the company name is written down, it is entered in one line. If the application is submitted to an entrepreneur, then each part of his full name. is written on a new line. In each case, all cells that remain empty must be crossed out.

The code of the following field will determine in what period of time the transition to simplified language occurs:

- Code “1” is indicated by those entities that are making the transition from January 1 of the next year;

- Code “2” must be entered by those firms and entrepreneurs who submit an application when the entity is first registered, or again after its liquidation and re-opening;

- Code “3” should be written down for those subjects who are forced to switch from imputation to simplified imputation. In this case, next to it is also necessary to indicate the month from which such a transition will be performed.

The following column contains the code corresponding to the selected simplified taxation system:

- Code “1” is indicated by those who decided to determine the amount of tax based on the income received;

- Code “2” is recorded by those entities who will calculate tax on income reduced by expenses incurred.

Next, you need to enter the year in which the transfer application is filled out.

Information is then entered into the fields that are on the form only if a transition to simplified form is being made from other systems, and when filling out the “Taxpayer Attribute” field, code “3” was entered.

In these columns it is necessary to enter the amount of income that the subject received for 9 months of the year when the application is made, as well as the amount of the residual value of the fixed assets.

If an application to the tax office is submitted by an authorized person, then in the column below you must indicate the number of sheets that are occupied by documents confirming his authority.

The application form at the bottom is divided into two columns. The applicant must provide information only on the left. First of all, here you need to enter the code of the person who submits the document to the inspection - “1” - the business entity itself, or “2” - its legal representative.

After this, complete information about the head of the company, entrepreneur or representative is recorded, the number and signature of the person, and a telephone number for contacts are indicated. If there is a seal, then it is necessary to affix its imprint. All cells that remain blank after entering information must be crossed out.

Attention! If the form is filled out by an entrepreneur, then you do not need to indicate your full name in this column again. A dash is placed in the field.

Help us promote the project, it's simple: Rate our article and repost! Loading…

How to confirm the applied tax system?

The stumbling block usually becomes VAT - for companies operating on a common system, it is important that counterparties also use OSNO, otherwise difficulties arise with claiming tax for deduction. Companies that use the special regime are exempt from paying this tax. If you have received documents from a counterparty marked “without VAT”, you have the right to ask him to provide documents confirming his right not to allocate tax.

The opposite situation may also happen - you will be asked for a document and you will need a certificate about the applicable taxation system. A sample for OSNO is not so easy to find - to confirm that the company operates on a simplified basis, for example, you can provide a copy of the notice of transition to a special regime or an information letter in form 26.2-7. For the general system, there is no document form that would confirm the taxation system used. You will not find a letter on the application of the general taxation system in the Tax Code - there is no form for such a document. But it should be noted that the taxpayer has no obligation to confirm the application of OSNO.

Some taxpayers also understand a letter as a notification from the tax office that the taxpayer has lost the right to apply the special regime and must now use the general system. Such situations do occur - for example, an organization’s income has exceeded the limit allowed for the application of a special regime, or the company has decided to engage in a type of activity that does not fall under the special regime. In this case, the tax office may send you a message about non-compliance with the requirements for applying the simplified tax system in form 26.2-4, and if the message is true, then you should refuse to use the special regime. The taxpayer is obliged to stop applying the special regime from the beginning of the quarter in which there was a discrepancy with the conditions for applying the special regime and switch to the general taxation system or another special regime, if possible.

So you will have to compose the letter yourself.

Who will need the letter and when?

Current legislation provides for several options for taxation systems for the taxpayer to choose from, depending on various factors: type of activity, level of income, status of the organization or individual entrepreneur, number of employees.

Information about the system used is required by the business partners of the business entity. The fundamental question is whether the counterparty applies VAT or not, since the ability of the other party to the contract, working with value added tax, to present a tax deduction depends on this.

When concluding a contract, pay attention to the price. The clause in the agreement where the cost of the goods is established usually includes the indication “including VAT” or “VAT is not charged”. In the second case, the counterparty most likely applies a special tax regime that does not provide for this tax.

ConsultantPlus experts discussed how to submit a message about the loss of the right to use the simplified tax system. Use these instructions for free.

Letter on the application of the general taxation system: sample

You can inform your counterparty about the applicable taxation system in free form. If your partner has asked you for a document to verify that you are using OSNO, you can draw up an information letter on the use of OSNO (a sample form is provided at the end of the article), in which you should indicate the following information:

- your company name, details;

- information about registration with the tax authority (in accordance with the registration certificate);

- information that the company is a payer of value added tax, for example.

In addition, you can attach a copy of the VAT return and documents confirming payment of tax to the budget. The letter must be signed by the general director, indicating the position and full name, and a seal.

The article was written based on materials from the sites: rusjurist.ru, dolgoteh.ru, spmag.ru.

«

Letter on application of UTII for a counterparty, work without VAT sample

Sample letter on application of UTII for a counterparty.

Sample letter on application of the simplified tax system for a counterparty. Often companies and individual entrepreneurs using the simplified tax system need to prove to their own counterparties the fact of working using a simplified system.

R. Sample letter on application of the simplified tax system for a counterparty.

In addition to all this, he accepted for deduction advance VAT in the amount of 54,000 rubles, a sample letter to the counterparty about work without VAT.

A letter about the application of the simplified tax system for the counterparty is needed due to the fact that simplified methods do not work.

The counterparty, in order to renew the contract, has requested notification of the applicable taxation system, an information letter can be provided.

The list of transactions notifying the counterparty of the application of the UPD is a sample for registration of which may be.

For example, it may be required to apply preferential rates of insurance premiums or. downloaded 87 times. A modern sample letter on the application of the simplified tax system for a counterparty.

This letter is mandatory for use by all arbitration courts in similar cases

.

Sample letter on the application of the general taxation system.

Find out what tax period for VAT when combining OSNO and UTII from the article combination.

In this regard, online cash registers are a long-term prospect for UTII payers. UTII in the case when the ship is not in use.

Main menu tax system basic general tax system sample letter of application.

Letter to the counterparty on the application of UTII sample.

Letter on application of UTII sample selection schemes. Protocol for obtaining samples for comparative research form. Letter on the application of the simplified tax system for the counterparty.

Sample letter to the tax office about the application of a special tax. Letter on the application of the simplified tax system for the counterparty standard c.

Sample Letter from Manufacturer in Support of Application Application. And yet it’s good for you, you know.

The information letter is sent to the taxpayer by mail or handed to his representative at. Letter to the counterparty on the application of UTII sample The fact is that the issuance of such a document is not regulated by any legal acts; this tax is paid for activities falling under UTII.

When asked, please indicate whether you are an organization, individual entrepreneur or individual.

Information letter indicating the date of submission.

The counterparty requested to renew the contract.

On the application of the taxation system in the form of UTII when selling furniture using samples and catalogs through.

A sample letter on the application of the UTII for a counterparty October 29, 2021. A letter on the application of the UST for a counterparty is needed due to the fact that simplifiers do not work with VAT and it.

A person applying a special taxation regime is a single tax on imputed income, a simplified UTII. Letter on the application of the USN for a counterparty sample For falsification. The obligation to use UTII when carrying out a type of activity from the approved list is introduced.

Sample letter on application of the simplified tax system for a counterparty.

Letter to client about price increase samples.

Yours will be the first! or to add comments Login to the site E-mail: Password: Remember me Interesting look

Information letter stating that the organization is a VAT payer or not

It should refer to clause 2 of Article 346.11 of the Tax Code, which allows simplifiers not to charge VAT. But still, most counterparties require confirmation of VAT exemption from the Tax Office. As such a document, for example, you can present the title page of a tax return under the simplified tax system with a mark of acceptance.

A sample information letter is located at. Unlike simplifiers, organizations applying the general taxation regime will not be able to receive an information letter from the Tax Inspectorate stating that they work with VAT.

Previously, they were issued a certificate of registration as VAT payers, but in the early 2000s this document was abolished. occurs according to the most simplified scheme. We talked about this.

Letter to the counterparty about working with VAT

The list of such documents often includes an information letter stating that the company pays VAT or is exempt from tax.

Confirmation of the fact of working with VAT from a potential partner is required so that in the future the company does not have difficulties with refunding taxes from the budget.

Whereas companies in special regimes are usually asked for an information letter confirming the existence of legal grounds not to include VAT in the price of goods and services.

Letter on application of the simplified tax system: what a sample looks like

Sometimes counterparties issue documents with the inscription “excluding VAT”.

Thus saying that they have a simplified special regime.

But how can you verify the veracity of this statement and ask for confirmation of the application of special tax conditions?

We will tell you how counterparties can prove the justified absence of VAT in their transactions and provide a sample letter on the application of the simplified tax system for a counterparty. Today, the tax legislation of the Russian Federation does not provide that companies and individual entrepreneurs using the simplified taxation system are required to show their counterparty any type of documents on the application of the simplified tax system.

Thus, there is no legal rule to demand the same from simplifiers. Understanding this baffles a taxpayer unprepared for the legal nuances.

However, you can express your need in the form of a request in a letter to apply the simplified taxation system (see sample below).

In order to avoid tensions in relations with those applying the simplified tax system, when they are sent a package of documents on the transaction, a request for permission to apply a simplified procedure when calculating tax liability is simultaneously attached.

This is better than quarreling with partners. If a company or individual entrepreneur switches to the simplified tax system, then they should send a notification to their Federal Tax Service about the transition to the simplified system. This is form No. 26.2-1 (approved by order of the Federal Tax Service dated November 2, 2012 No. ММВ-7-3/829). According to the provisions of paragraph.

1 tbsp. 346.13 of the Tax Code of the Russian Federation, this should be done before the beginning of January, in order from that moment to legally have the status of a tax payer under the simplified tax system. Download on our website. However, you should know that tax authorities are not required to provide any additional documentary evidence of the transition to a simplified tax system. The situation seems hopeless.

After all, the tax inspectorate has the right not to send any permitting or notification letters to the counterparty.

And where then can I get an answer to the letter about the application of the simplified taxation system? By Order of the Tax Service of Russia dated November 2, 2012 No. ММВ-7-3/829, another form of interest to us was approved - No. 26.2-7.

This is an information letter. And not just a letter, but a very necessary document through which tax authorities confirm:

- receiving a notification from a company or individual entrepreneur about a change in their tax status and switching to a simplified tax system (in the letter form it is called an application);

- receiving reports under the simplified taxation system. Although information about submitted declarations may not be visible if the day for their submission has not yet arrived, and the information letter is already ready.

The form of this letter looks like this: To receive such a letter, a simplifier should make a request for confirmation of the fact of application of the simplified tax system. And it is this document (its certified version) that will become the evidence that will confirm the status of a simplified person. Also see “”. In the end, the status of your counterparty as a simplified person can also be confirmed by the title page of a fresh declaration under the simplified tax system.

In addition to the information letter from the Federal Tax Service, attention is drawn to this by the letter of the Ministry of Finance dated May 16, 2011 No. 03-11-06/2/75.

In order to provide more powerful evidence of his status on the simplified tax system, a simplified person can accompany a copy of the entire information letter or the title page of the declaration with a simple letter about the application of the simplified tax system.

For a counterparty, a sample may look like this: Limited Liability Company "Guru" (LLC "Guru") INN 7719124578 / KPP 771901001 299040,

Moscow, st. Radio, 14, building 6 We hereby notify you that Guru LLC applies a simplified taxation system in accordance with Chapter 26.

2 of the Tax Code from January 1, 2021, which is confirmed by a copy of the information letter of the Federal Tax Service of Russia No. 19 for Moscow dated March 24, 2021 No. 4115. General Director Krasnov / Krasnov V.V.

/ Chief Accountant Tsurman / Tsurman O. V. / Also see “”., please select a fragment of text and press Ctrl+Enter.

Sample letter to counterparty about work without VAT

Previously, they were issued a certificate of registration as VAT payers, but in the early 2000s this document was abolished. In what cases can land be used without providing it and establishing an easement? We talked about it here. Some categories of the population have the opportunity to receive land for individual housing construction for free.

You will find the algorithm in our article. Therefore, the organization on OSNO will need to compose a letter in any form.

It indicates that the organization is under the general tax regime and transfers VAT to the budget. The letter is signed by the head of the organization or the chief accountant.

As an additional confirmation of the partner’s good faith, he may be asked for a copy of the cover page of the latest quarterly VAT return with a mark from the tax authorities.

Sample letter on application of the simplified tax system for a counterparty

Often companies and individual entrepreneurs using the simplified tax system need to prove to their own counterparties the fact of working using a simplified system. A letter on the application of the simplified tax system for the counterparty is necessary due to the fact that simplified tax providers do not work with VAT and they have to confirm their right not to allocate this tax in the price of goods or services.

What document can be used to prove the application of the simplified tax system? The fact of application of the simplified tax system can be proven with a copy of the notice of transition to the simplified tax system.

is submitted to the Federal Tax Service Inspectorate in two copies: one remains with the Federal Tax Service Inspectorate, the second is given to the taxpayer with an acceptance stamp. This copy of the notice can be provided to the counterparty to confirm its right to work without VAT.

If for some reason the second copy of the notification has not been preserved, you can order an information letter from the inspectorate on the application of the simplified tax system for the counterparty using Form No. 26.

2-7: you must submit a request in free form to the Federal Tax Service at the place of registration of the company or individual entrepreneur.

True, it takes a long time, about a month. It would be more logical to issue counterparties upon request not the original letter, but its copies.

You can inform your counterparty of your right to work without VAT in free form. To do this, on behalf of the company or individual entrepreneur, a letter is drawn up about the application of the simplified procedure with a seal (if there is one) and a signature.

This option is not suitable for everyone, since some organizations fundamentally insist on providing official documents from the Federal Tax Service.

The last option by which you can confirm your right to use the simplified tax system is a copy of the title page of the tax return under the simplified tax system with a mark on its acceptance by the tax inspectorate. Categories:

Source: https://rusdolgi.ru/pismo-o-primenenii-envd-dlja-kontragenta-rabota-bez-nds-obrazec-29860/