In which section of the balance sheet are fixed assets taken into account?

On line 1150

the residual value of fixed assets is reflected:

[Debit balance on account 01 “Fixed assets”] (excluding the analytical account “Young plantings”)

[Credit balance on account 02 “Depreciation of fixed assets”] (excluding depreciation on fixed assets accounted for on account 03)

Concept, classification, assessment

Fixed assets include: buildings, structures, working and power machines and equipment, measuring and control instruments and devices, computer equipment, vehicles, tools, production and household equipment and supplies, working, productive and breeding livestock, perennial plantings, on-farm roads and other relevant objects.

The following are also taken into account as part of fixed assets: capital investments for radical improvement of land (drainage, irrigation and other reclamation works); capital investments in leased fixed assets; land plots, environmental management objects (water, subsoil and other natural resources).

Fixed assets intended exclusively for provision by an organization for a fee for temporary possession and use or for temporary use for the purpose of generating income are reflected in accounting and financial statements as part of profitable investments in tangible assets.

Conditions for accepting assets for accounting as fixed assets

An asset is accepted by an organization for accounting as fixed assets if the following conditions are simultaneously met:

- the object is intended for use in the production of products, when performing work or providing services, for the management needs of the organization, or to be provided by the organization for a fee for temporary possession and use or for temporary use;

- the object is intended to be used for a long time, i.e. a period exceeding 12 months or the normal operating cycle if it exceeds 12 months;

- the organization does not intend the subsequent resale of this object;

- the object is capable of bringing economic benefits (income) to the organization in the future.

The useful life is the period during which the use of an item of fixed assets brings economic benefits (income) to the organization. For certain groups of fixed assets, the useful life is determined based on the quantity of products (volume of work in physical terms) expected to be received as a result of the use of this object.

Valuation of fixed assets

Fixed assets are accepted for accounting at their original cost.

The initial cost of fixed assets acquired for a fee is recognized as the amount of the organization's actual costs for acquisition, construction and production, with the exception of value added tax and other refundable taxes (except for cases provided for by the legislation of the Russian Federation).

The initial cost of fixed assets contributed as a contribution to the authorized (share) capital of an organization is recognized as their monetary value agreed upon by the founders (participants) of the organization, unless otherwise provided by the legislation of the Russian Federation.

The initial cost of fixed assets received by an organization under a gift agreement (free of charge) is recognized as their current market value on the date of acceptance for accounting as investments in non-current assets.

The initial cost of fixed assets received under contracts providing for the fulfillment of obligations (payment) in non-monetary means is recognized as the value of the assets transferred or to be transferred by the organization. The value of assets transferred or to be transferred by an organization is established based on the price at which, in comparable circumstances, the organization usually determines the value of similar assets.

The cost of fixed assets in which they are accepted for accounting is not subject to change, except in cases established by this and other provisions (standards) for accounting.

Changes in the initial cost of fixed assets, in which they are accepted for accounting, are allowed in cases of completion, additional equipment, reconstruction, modernization, partial liquidation and revaluation of fixed assets.

The actual costs for the acquisition, construction and production of fixed assets are:

- amounts paid in accordance with the contract to the supplier (seller), as well as amounts paid for delivering the object and bringing it into a condition suitable for use;

- amounts paid to organizations for carrying out work under construction contracts and other contracts;

- amounts paid to organizations for information and consulting services related to the acquisition of fixed assets;

- customs duties and customs fees;

- non-refundable taxes, state duties paid in connection with the acquisition of fixed assets;

- remunerations paid to the intermediary organization through which the fixed asset was acquired;

- other costs directly related to the acquisition, construction and production of fixed assets.

Actual expenses for the purchase, manufacture, construction of fixed assets

In order to form the initial cost of a fixed asset, at which it will subsequently be accepted for accounting, it is necessary to sum up the expenses actually incurred by the company for the purchase (construction, production) of a fixed asset item. Such costs may include:

- non-refundable tax amounts;

- state fees for the right to purchase fixed assets;

- the cost of the purchased fixed asset (specified in the purchase and sale agreement);

- the amount of payment for setting up the property, bringing it into a condition suitable for use;

- the amount of payment for the service of delivering a fixed asset to the place of its use;

- duties and fees collected by customs;

- amounts of payment to construction contractor companies under the contract for the construction of an environmental facility;

- remuneration for the services of intermediaries in transactions related to the acquisition of an asset;

- fees for specialist consultations, legal advice, information support, etc.;

- other expenses, if they are directly related to the acquisition (independent production) of an OS item.

What is considered a fixed asset?

Fixed assets include property assets that can be used as production assets necessary for the manufacture of products (providing services, carrying out work), as well as property used to manage the company. Currently, the rules for accounting for fixed assets are established by PBU 6/01 (approved by order of the Ministry of Finance dated March 30, 2001 No. 26n).

Important! From 2022, fixed assets accounting will be regulated by new accounting standards 6/2020 and 26/2020, and PBU 6/01 will no longer be in force. The new FSBUs will become mandatory from January 1, 2022, but you can start applying them earlier. You can find out what will change in accounting from the Review from ConsultantPlus. You can get a trial full access to K+ for free.

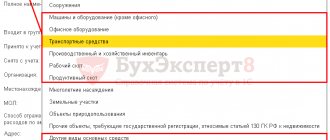

The fixed assets include:

- buildings and constructions;

- land;

- equipment;

- auto, motorcycle and other equipment;

- computing devices;

- measuring instruments;

- household equipment;

- farm livestock;

- perennial plantings;

- on-farm, logistics roads and railways, as well as other similar assets.

Fixed assets also include capital investments in the land fund (carrying out work that significantly improves the quality of agricultural land), environmental management facilities, as well as completed capital investments in leased property.

The cost of registered fixed assets consists of all costs associated with their acquisition and is repaid through depreciation. Depreciation charges are made using one of the methods chosen by the enterprise:

- linear;

- reduction of balance;

- by the sum of the numbers of years of useful life;

- in proportion to the volume of production.

NPO property is not depreciated.

The cost of land and mining facilities, water and other subsoil is not repaid. To learn about the similarities and differences between depreciation charged in accounting and tax accounting, read the article “Depreciation bonus in accounting and tax accounting.”

Cost of fixed assets on the balance sheet: line 1150

In accounting, fixed assets include assets worth more than 40,000 rubles. with a service life of more than a year.

Expert recommendations for accounting for objects costing less than RUB 40,000. you will find in ConsultantPlus:

If you don't already have legal access, a full access trial is available for free.

In the balance sheet, fixed assets are reflected in the amount of their value reduced by the amount of depreciation (i.e., at the residual value).

To learn how the residual value of fixed assets is determined, read the material “How to determine the residual value of fixed assets .

The cost of fixed assets on the balance sheet - line 1150 - is taken as the difference between the balance existing at the end of the reporting period on the debit of account 01 and the balance on the credit of account 02.

You can see an example of filling out line 1150 of the balance in ConsultantPlus, having received free trial access to the system.

In the case of additional equipment (reconstruction, partial write-off) of fixed assets, leading to a change in the initial cost, this information is reflected in the appendices to the balance sheet. The same applies to the case of revaluation of property, carried out by indexing the replacement cost of assets or by direct recalculation to the actual market value. Any differences that arise are credited to additional capital.

Basic accounting entries for fixed assets

The following accounting entries are most often found in financial statements when it comes to fixed assets:

| Operation | DEBIT | CREDIT |

| The initial cost has been formed, the OS has been put into operation | 01 | 08 |

| The residual value was written off upon disposal of fixed assets | 91 | 01 |

| Depreciation accrued | 20, 23, 25, 26, 29 (depending on production) | 02 |

| Accumulated depreciation was written off due to disposal of property | 02 | 01 |

| Depreciation was accrued due to the revaluation of fixed assets | 83 | 02 |

| Depreciation has been accrued on an object transferred to third parties under a temporary use agreement | 91 | 02 |

Results

To reflect fixed assets in the balance sheet, a specific line (1150) is allocated in the section devoted to non-current assets. This property includes objects of a certain value (above 40,000 rubles) and service life (over 1 year). On the balance sheet, this cost is shown reduced by the amount of depreciation. Situations of changes in value associated with additional equipment (reconstruction, partial write-off) and revaluation are disclosed in the appendices to the balance sheet.

Source

osnovnye_sredstva.jpg

Related publications

The balance sheet of an enterprise accumulates all information about the availability of property (assets) and the sources of its receipt (liabilities) as of a certain date, i.e., it reflects the financial condition and demonstrates this information to users. The first section of the balance sheet is devoted to non-current assets, a significant proportion of which are fixed assets. Let us recall how fixed assets are reflected in the balance sheet by looking at a specific example.

What applies to fixed assets

These assets include property that supports the production and management process of the company - buildings, structures, plots of land, perennial plantings, machine tools, equipment, power machines, vehicles, etc. The cost of recorded fixed assets is formed from the costs aimed at their acquisition (manufacturing), and is gradually repaid by monthly depreciation. This is carried out using one of the methods chosen by the company and enshrined in the accounting policy (clause 48 of PBU dated July 29, 1998 No. 34n):

by the sum of numbers of years of SPI (useful life);

in proportion to the volume of output (work, services).

Please note that not all fixed assets are depreciated. For example, land, environmental management facilities, road facilities, museum exhibits, housing stock, mobilization funds in conservation, as well as property owned by non-profit organizations are not subject to traditional depreciation charges.

In terms of liquidity, fixed assets are considered low-liquidity assets, since it is often impossible to immediately turn them into means of payment and quickly sell them if necessary.

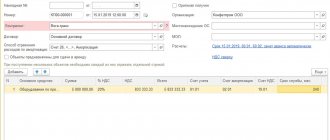

Capitalization of a fixed asset (example, calculation, postings)

The hypothetical enterprise Rabotyaga LLC buys new equipment for production to replace completely worn-out equipment. Its price is 310,000 rubles, including the company’s expenses for delivering the fixed asset to the workshop and for bringing it into working condition by a specialist. VAT on the cost of equipment is 42,155 rubles. When new equipment is put into operation, the accountant will make the following entries:

| Operation | Amount (rubles) | DEBIT | CREDIT |

| The costs of purchasing equipment are taken into account (the price includes delivery and setup services) | 267 845 | 08 | 60 |

| Input VAT reflected | 42 155 | 19 | 60 |

| The initial cost of the equipment was formed, the facility was put into operation | 267 845 | 01 | 08 |

| Submitted for deduction of input VAT | 42 155 | 68 | 19 |

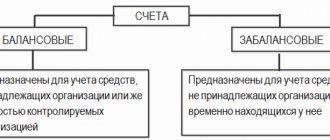

Fixed assets on the balance sheet and their valuation

Since fixed assets are a long-term asset (with a service life of more than a year) and tend to gradually wear out during operation, its value changes at each reporting date, that is, the assessment of the recorded fixed assets changes depending on revaluations or due to depreciation charges, unless, of course, it relates to depreciable property. Depreciation is a regulatory indicator that affects the value of fixed assets.

Fixed assets are reflected in the balance sheet at cost reduced by the amount of accrued depreciation (clause 35 of PBU 4/99), i.e. at residual value. In the company's balance sheet, the valuation of fixed assets is indicated at the residual value: the original value minus depreciation.

In accounting, the initial (or replacement after revaluation) cost of fixed assets is taken into account as the debit of account 01 “Fixed assets”, and the amount of accrued depreciation is recorded as a credit of account 02 “Depreciation of fixed assets”. Accordingly, the residual value is calculated as the difference between the amounts of initial cost and depreciation (D/t 01 minus K/t 02).

In the form of the balance sheet, a separate line 1150 “Fixed assets” is provided to reflect the amount of fixed assets valuation as of the reporting date.

Leased fixed assets are subject to separate accounting in account 03 “Income-generating investments in tangible assets”. Depreciation on them is calculated in the same way as on all fixed assets on the account. 02, recorded in the analytical accounting registers, and the residual value of such property occupies line 1160 “Profitable investments in materiel” in the balance sheet.

What information on fixed assets must be disclosed in the financial statements?

The minimum set of information about the fixed assets of an enterprise that must be disclosed in the financial statements includes the following points:

- initial cost, the amount of accumulated depreciation for the main groups of fixed assets (as of the beginning and end of the period);

- a list of real estate that is already in use and in relation to which the state is in charge. registration;

- movement of fixed assets during the reporting period by main groups (acceptance to the enterprise, retirement, etc.);

- methods for calculating depreciation for each group of fixed assets;

- rules for assessing the cost of fixed assets that were received by an enterprise under an agreement that does not provide for payment in money;

- property that is taken into account as profitable investments in the MC;

- a list of objects that are provided for use for a fee or, conversely, are issued under a lease agreement;

- cases of adjustment of the initial cost of fixed assets due to revaluation, partial liquidation, reconstruction, additional equipment, completion;

- about the property of fixed assets, the value of which is not subject to repayment through depreciation;

- the procedure for determining the useful life of property objects.