Many companies accept cash from customers through structural divisions located outside the place of their state registration. This could be a retail chain or points of provision of services to the public. Often, each such “point” is served by a single employee. Should a separate cash book be maintained in such a department?

Unfortunately, we will not find a simple and clear answer to this purely practical question in the basic regulatory document - the Regulations on the procedure for conducting cash transactions with banknotes and coins of the Bank of Russia on the territory of the Russian Federation, approved by the Bank of Russia on October 12, 2011 No. 373- P (hereinafter referred to as the Regulations), nor in official explanations of the Bank of Russia, the Ministry of Finance of Russia or the Federal Tax Service.

Let's try to figure it out on our own.

Reading the regulatory document

The regulation (paragraph 2, clause 1.2) literally establishes the following: a separate division (branch, representative office) of a legal entity, for the purposes of which the legal entity has opened a bank account, sets a limit on the cash balance. But since there must be a limit, there is also a cash register (paragraph 1, clause 1.2 of the Regulations). Cash transactions are subject to reflection in the cash book (paragraph 9, clause 2.6 of the Regulations). What if a separate unit does not conduct it?

Failure to make entries in the cash book is considered as non-receipt of cash to the cash register (paragraph 2, clause 6.1 of the Regulations). It is regarded as an administrative offense and entails very impressive fines (Clause 1 of Article 15.1 of the Code of Administrative Offenses of the Russian Federation). Control over the completeness of accounting for cash proceeds is carried out by territorial tax inspectorates (clause 5 of the Administrative Regulations for the execution by the Federal Tax Service of the state function of monitoring and supervising the completeness of accounting for cash proceeds in organizations and individual entrepreneurs, approved by order of the Ministry of Finance of Russia dated October 17, 2011 No. 133n). Therefore, it is important for every company that works with cash outside its location to determine the “cash” responsibilities of employees of its departments.

So in what sense is the concept of “separate division” used in the Regulations?

Changes in the rules for accepting and issuing funds

According to the new edition of paragraphs. 5.1 clause 5 of Directive No. 3210-U now, when accepting banknotes, the cashier is obliged to verify their solvency.

Signs of the solvency of banknotes (coins) are given in the Directive of the Central Bank of the Russian Federation dated December 26, 2006 No. 1778-U. According to this document, banknotes and coins of the Central Bank of the Russian Federation are recognized as solvent, having the force of a legal means of cash payment in the territory of the Russian Federation (including those withdrawn from circulation), not containing signs of counterfeiting, without damage or with damage of the following nature:

- banknotes are dirty, worn, torn, have abrasions, small holes, punctures, extraneous inscriptions, stains, stamp impressions, lost corners, edges;

- The coin has minor mechanical damage.

In other words, the cashier can only accept banknotes that have minor damage. For example, a cashier does not have the right to refuse to accept a torn banknote, since, due to the above-mentioned signs, it is not considered damaged.

In addition, Directive of the Central Bank of the Russian Federation No. 5587-U introduced a ban on the issuance by cashiers of banknotes that have one or more damages specified in clause 2.9 of Regulations of the Central Bank of the Russian Federation dated January 29, 2018 No. 630-P (hereinafter referred to as Regulation No. 630-P). In this regard, paragraphs. 6.2 clause 6 of Directive No. 3210-U is supplemented with the corresponding provision.

In accordance with clause 2.9 of Regulation No. 630-P, the cashier must not issue from the cash register solvent coins that have damage of a mechanical, chemical or thermal nature (they are considered defective), and solvent banknotes that have one or more of the following damages (they are recognized as old) :

- contamination of the surface of the front or back side, leading to a decrease in image brightness by 8% or more;

- extraneous inscription consisting of two or more characters;

- extraneous drawing, stamp impression;

- contrast spot with a diameter of 5 mm or more;

- tear(s) of the edge of the banknote with a length of 7 mm or more;

- through hole, puncture with a diameter of 4 mm or more;

- violation of the integrity of the banknote, sealed with adhesive tape.

Banknotes (coins) that have one or more of the listed damages must be returned to the bank.

Linguistic analysis

First, let’s look at the construction of “a separate division (branch, representative office) of a legal entity (hereinafter referred to as a separate division)” used in the Regulations. When listing, brackets are used not for the purpose of clarifying (specifying, narrowing) the first of the listed terms, but to designate alternative or additional options to it. This is evidenced by numerous examples from the text:

- bank payment agent (subagent);

- seal (stamp);

- cash book (book of accounting of funds accepted and given by the cashier);

- payroll (payroll);

- expense cash order (settlement and payroll sheet, payroll);

- name (company name);

- incoming cash order (outgoing cash order);

- cash received (issued).

This means that “branch” and “representative office” are not decodings or explanations for “separate division”, especially since any object from the list of interest to us - “separate division”, “branch” and “representative office” - for the purpose of applying the Regulations is generally referred to as a separate division (using the clause “further”). It would seem that a separate division in the “cash” sense is not reducible to the generally established meaning of the term “separate division.”

For information

A separate division of a legal entity is necessarily characterized by its location outside its location.

Formal linguistic analysis forces us to admit that a separate division, branch and representative office are equivalent concepts from the point of view of the Regulation. Therefore, it is impossible to agree with the opinion that only branches and representative offices are considered separate divisions in the Regulations.

Changes to Salary Deposit

Unpaid wages to the employee must be deposited. Therefore, on the last day of issuing cash intended for payment of wages, the cashier in the payroll sheet must make the entry “Deposited” opposite the names and initials of the employees who were not issued cash. He must also calculate and record in the final line the amount of cash actually issued and the amount to be deposited. These requirements were established by paragraphs. 6.5 clause 6 of Directive No. 3210-U.

The deposited amounts had to be handed over to the bank, although the provisions of Directive No. 3210-U did not prohibit storing them in the institution’s cash desk. In this regard, the institution could not hand over the deposited funds to the bank, of course observing the limit on the balance of funds in the institution’s cash desk.

Now there is no longer a need to deposit unpaid wages to the institution, since paragraph. 3 pp. 6.5 clause 6 of Directive 3210-U is no longer in force.

The requirement to make a note in the payroll slip regarding the deposit of wages has been abolished, but there is no prohibition on this. You can continue making this entry. Wages not paid on time must be submitted to the bank.

List of objects

The next step is to understand the meaning of each of the independent objects - “separate division”, “branch”, “representative office”.

At first glance, we are talking about territorial isolation, which is characterized by an address different from the state registration address of the company.

Accountants tend to view a separate division in the special meaning given to this term by tax law. The main feature of such a separate unit is the period for which workplaces are equipped in it. And if a workplace exists for less than a month, then it does not generate a separate division. However, we should not forget about the limited application of this criterion. Such a sign of a separate division as a term “works” only in acts of legislation on taxes and fees. This is directly stated in paragraph 1 of paragraph 2 of Article 11 of the Tax Code. The regulation adopted by the Bank of Russia does not apply to such acts (Clause 1, Article 4 of the Tax Code of the Russian Federation). It is intended to organize cash circulation (Article 34 of the Law of July 10, 2002 No. 86-FZ “On the Central Bank of the Russian Federation (Bank of Russia)”).

Let us explain this with a specific example. Let's assume that a company has opened a retail outlet without defining a period and it has been operating for less than a month. From the point of view of tax legislation, it does not have a separate division. But this does not mean that there is none for the purpose of maintaining cash discipline. This position is supported by the letter of the Ministry of Finance of Russia dated October 8, 2012 No. 03-02-07/1-242. It emphasizes that an organization that has a separate “tax” division is subject to registration with the tax authority at the location of such division. But the fact of such accounting cannot influence the procedure for conducting cash transactions.

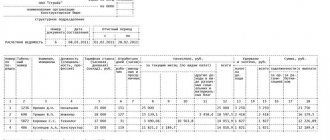

The organization has separate divisions. How to keep a cash book

The organization is engaged in retail trade (medicines). The legal entity includes 2 pharmacies (one of them is located at the location of the legal entity, the second is in another area of the city). Pharmacies are also located in different areas of the city, but in the same municipality. Each entity has its own bank account, but does not maintain an independent balance sheet. There is only one accounting department, at the location of the legal entity.

How should the cash book be maintained in accordance with the new Regulations on the procedure for conducting cash transactions? One for a legal entity or for each division separately? I tend to keep one cash book.

In accordance with paragraph 2 of Art. 11 of the Tax Code of the Russian Federation, a separate division of the organization

- this is any division territorially isolated from it, at the location of which stationary workplaces are equipped.

Recognition of a separate division of an organization as such is carried out independently

on whether its creation is reflected or not reflected in the constituent or other organizational and administrative documents of the organization, and on the powers vested in the specified unit.

In this case, the workplace is considered stationary

, if it is created

for a period of more than one month

.

Taxpayers - organizations are required to report to the tax authority at the location of the organization within one month from the date of creation of a separate division

a Russian organization about all separate divisions of a Russian organization created on the territory of the Russian Federation (with the exception of branches and representative offices), and changes to information about such separate divisions previously reported to the tax authority (

clause 3, clause 2, article 23 of the Tax Code of the Russian Federation

).

According to paragraph 4 of Art.

83 of the Tax Code of the Russian Federation, registration

with the tax authorities of a Russian organization

at the location of its separate divisions

(with the exception of a branch, representative office) is carried out by tax authorities

on the basis of messages

submitted (sent) by this organization

in form No. S-09-3-1

, recommended by letter Federal Tax Service of the Russian Federation dated 09/03/2010 No. МН-37-6/ [email protected]

If several separate divisions of the organization are located in the same municipality in territories under the jurisdiction of different tax authorities

, registration of an organization can be carried out by the tax authority at the location of one of its separate divisions, determined by this organization independently.

The organization indicates information about the choice of tax authority in the notification on form No. 1-6-Accounting

, approved by order of the Federal Tax Service of the Russian Federation dated August 11, 2011 No. YAK-7-6/ [email protected] , submitted (sent) by the Russian organization to the tax authority at its location.

Until 2012

The procedure for conducting cash transactions in the Russian Federation established that each enterprise maintains

only one cash book

.

In connection with this, the Central Bank of the Russian Federation, in a letter dated December 11, 2008 No. 29-1-1-11/7735, reported that the separate structural divisions of the organization

located outside its location,

keep a cashier's report in two copies containing all the details of the cash book

. The first copy of the cashier's report remains in a separate unit. The second copy of the cashier's report, together with the cash and supporting documents attached to it, is transferred to the organization.

In the organization, for the total amounts of cash contained in the second copy of the report of the cashier of a separate division, cash receipt and expenditure orders were issued and entries were made in the cash book.

From January 1, 2012

The Regulations on the procedure for conducting cash transactions with banknotes and coins of the Bank of Russia on the territory of the Russian Federation

, approved by the Central Bank of the Russian Federation on October 12, 2011 No. 373-P, came into force

Regulation No. 373-P does not require organizations to have only one cash book

.

In addition, a separate division

a legal entity for whose transactions a legal entity

has opened a bank account with a credit institution, independently sets the cash balance limit in the manner

prescribed by Regulation No. 373-P for a legal entity (clause 1.2 of the Regulations).

That is, a separate division with a separate current account has its own cash desk and its own cash balance limit

.

Also an authorized representative of a separate unit

may, in the manner established by a legal entity,

deposit cash into the bank

(clause 1.5 of the Regulations).

A separate division maintains its own cash book

.

The separate division displays in the cash book

(form No. 0310004, approved by Decree of the State Statistics Committee of the Russian Federation dated August 18, 1998 No. 88)

the amount of cash balance at the end of the working day

(clause 5.6 of the Regulations).

After this, the separate division transfers the cash book sheet for this working day to the legal entity no later than the next working day

.

In the case of registering a cash book on paper

a separate division

transfers a tear-off second copy of the cash book sheet

.

In the case of registering a cash book using technical means, a printed copy is transmitted

on paper,

a second copy of the cash book sheet

.

The transfer of a cash book sheet by a separate division to a legal entity can be carried out electronically

in accordance with the legislation of the Russian Federation.

In this case, the transfer of the cash book sheet on paper is carried out in accordance with the document flow rules approved by the legal entity (clause 5.6 of the Regulations).

Definitions of terms

We will find the characteristics of the terms that interest us in Article 55 of the Civil Code. And an amazing surprise awaits us in it. It does not follow from the wording of the article that a separate division of a legal entity is necessarily characterized by its location outside its location, which is determined by the place of its state registration (clause 2 of Article 54 of the Civil Code of the Russian Federation). This territorial isolation is specially stipulated in tax legal relations, that is, it is of fundamental importance.

It is not difficult to imagine separate divisions located at the “legal” address of the company. For example, in one task owned by her, several stores of different profiles (for example, selling food and sporting goods), a restaurant, etc. can be located. A separate room is allocated for each type of activity, but this fact is not reflected in the Unified State Register of Legal Entities.

Branch and representative office are special types of separate divisions. They must, firstly, be located outside the location of the legal entity, and secondly, they must certainly be indicated in its constituent documents.

As a result, we identified the source of difficulties in understanding the requirements of the Regulations. And they came to the conclusion: the territorial address feature is not a mandatory criterion for isolation.

According to the author, branches and representative offices are highlighted in the Regulations in order to emphasize the civil legal status of separate units. But it wasn’t even necessary to do this. After all, branches and representative offices are also separate divisions. But the opinion of some experts that the Regulations define separate divisions as branches and representative offices is a misconception.

Attention

If a department conducts cash transactions, it is required to maintain a cash book. Moreover, it is not at all necessary to use a bank account.

The role of the bank account

The Regulations say that the limit is set by separate divisions for the purposes of which a legal entity has opened a bank account. This formulation was another source of controversy. It would seem that if an account was not specifically opened to service the unit, then there is no reason to set a limit. And, accordingly, keep a cash book.

But the Bank of Russia objects to such an interpretation. In letter dated May 4, 2012 No. 29-1-1-6/3255, he explains that the requirement to maintain a cash book must be observed by each separate division conducting cash transactions, regardless of the presence of a bank account of a legal entity opened for carrying out separate transactions division. This position was adopted by the tax authorities (clause 1 of the letter of the Federal Tax Service of Russia dated September 12, 2012 No. AS-4-2/15195).

It is difficult to argue with this point of view, since the owner of the account is not a separate division, but a legal entity. The possibility of using the account by employees of the unit is established by the company and is not limited externally, by the bank.

If a department conducts cash transactions, it is required to maintain a cash book. Moreover, the division does not have to use a bank account to comply with the limit. Over-limit cash can also be deposited at the head office (paragraph 2, clause 1.5 of the Regulations).

conclusions

As a result, the only criterion for the presence of a cash register remains – the execution of cash transactions by the department. Well, cash transactions are operations for accepting cash, including their recalculation, and issuing cash (paragraph 2, clause 1.1 of the Regulations). And if such actions are carried out directly in a separate room, and responsible persons are appointed for this, then the department is obliged to maintain a cash book.

We have to admit that the main sign of isolation is organizational. After all, a cash desk is a place for conducting cash transactions, determined by the head of a legal entity (paragraph 1, clause 1.2 of the Regulations). According to the author, tax disputes over the failure to maintain a cash book by a separate division have no prospects. The only good news is that the responsibilities for special equipment and strengthening cash registers are a thing of the past.

E.Yu. Dirkova

Cash limit calculation has become more profitable

Previously, the institution calculated the cash limit in two ways:

- based on cash proceeds,

- based on the volume of cash disbursed.

With the first method, it was necessary to determine the period between the days of receiving cash on a cash check. If cash was withdrawn not by check, but from a card, it turned out that the limit was zero.

In the second method of calculating the limit, the institution determined the period between days of receiving cash. The clarification that cash is received by cash check was removed from clause 2 of the appendix to the Central Bank Directive No. 3210-U dated March 11, 2014. Based on this, if cash is withdrawn from the card, the limit will be non-zero.