IFRS Magazine, No. 6, 2006

Until recently, the concept of “intangible assets” was not given due attention. Now a trademark, copyright, information systems, and intellectual property have become an integral part of the property of almost every organization. The specific nature of intangible assets gives rise to problems associated with their accounting, namely the difficulty of identification and valuation.

Accounting for intangible assets (IIA) is regulated by IAS 38 “Intangible Assets”. An intangible asset is an identifiable non-monetary asset that has no physical form. These may include trademarks, trade names, software, licenses, copyrights, patents, exploitation rights, recipes, formulas, designs, designs, intellectual property and other similar objects.

However, to be recognized in the financial statements, an intangible asset must satisfy the definitions and recognition criteria established by international standards.

First of all, these are the criteria common to all assets:

· controllability of the organization. Controllability of an asset implies that an entity has the right to receive the economic benefits associated with it and can restrict access to those benefits by other entities. Most often, this is evidenced by ownership, however, even the absence of such a legal right is not an obstacle to the organization exercising control over the asset. For example, an object leased must be accounted for on the balance sheet of the lessee, since it is he who uses the asset in his activities and at his own discretion, that is, he controls the asset. At the same time, the knowledge and experience of the company’s employees cannot be considered an intangible asset, since the organization is not able to fully control the future benefits associated with them;

· ability to bring economic benefits in the future. Future economic benefits associated with the use of intangible assets are expressed in increased revenue from the sale of goods (services) or reduced costs;

· high probability of obtaining such benefits. The likelihood of future benefits flowing is assessed using professional judgment based on available initial data and reasonable assumptions regarding the future use of intangible assets;

· the ability to reliably evaluate an asset. The value of an asset is not always a certain value. In many cases, estimates are used. This fully applies to intangible assets. The estimate must be reasonable and prudent. If a reasonable estimate cannot be made, the asset is not recognized in the financial statements.

The following features are specific to intangible assets:

· Lack of physical fitness. Often, assets accounted for as intangible assets exist in some tangible form (for example, a license in the form of a document, software on a CD), but in all cases the tangible element of the asset must be secondary to its intangible element . An asset that combines tangible and intangible elements can be accounted for under both IAS 16 Property, Plant and Equipment and IAS 38 Intangible Assets, depending on which of the components is more important for operation, tangible or intangible. For example, the operating system of a computer is taken into account as part of the computer itself (fixed asset), since it cannot function separately from it;

· identifiability. By identifiability in IFRS it is meant that an intangible asset is a separate accounting object, that is, the asset is separable and can be realized as an independent unit, for example, sold or exchanged. In addition, intangible assets are also identifiable if they arise from contractual or other legal rights, and the transferability and alienability of these rights does not matter. For example, a license issued by a government agency cannot be transferred to another company, but gives the organization the legal right to carry out a certain activity.

So, in order to be recognized in reporting as intangible assets, an object must meet both general and specific criteria. Items that do not meet at least one of the listed requirements must be recognized as expenses as they are incurred, or included in the amount of goodwill (in case of a business combination).

Reference

IAS 38 Intangible Assets was first adopted in 1998. The current edition of the standard appeared in 2004 and applies to annual periods beginning on or after 31 March 2004. A separate standard, IAS 9, Research and Development Costs, has existed since 1974 (as amended in 1993). With the adoption of IAS 38 Intangible Assets, this standard was withdrawn.

Expert opinion

Manets Tatyana , head of the international reporting department of the Federal State Unitary Enterprise "Russian Television and Radio Broadcasting Network" (Moscow)

According to Russian legislation, accounting for intangible assets is regulated by PBU 14/20001, research, development and technological work - PBU 17/022. Differences are revealed already at the stage of recognition of objects as intangible assets. PBU 14/2000 requires the availability of “duly executed documents confirming the existence of the asset and exclusive rights to the results of intellectual activity.” This reduces to nothing the principle of the predominance of economic substance over legal form. In practice, this is expressed in the fact that such widely used items as licenses or purchased computer programs cannot be accounted for as intangible assets, but are reflected as deferred expenses. In contrast, organizational expenses related to intangible assets do not meet the IFRS criteria. Moreover, before the adoption of PBU 14/2000, there was no such requirement, which means that such a contradiction did not arise. There are other differences: in domestic accounting there is no need to revise the useful life and depreciation method, intangible assets are not revalued, and there are no intangible assets with an indefinite service life.

I have come across quite reasonable, in my opinion, statements from consultants that these Russian accounting standards, when interpreted accordingly, do not contradict IAS 38. However, regrettably, our accounting still has a tax focus. If the question concerns the recognition of assets and expenses, then it concerns taxes. There is a possibility that the opinion of the specialist preparing the reports may not correspond to the position of the tax authorities. In such a situation, each organization decides for itself what position to take.

Initial assessment of intangible assets

The initial valuation of an intangible asset depends on how it was acquired by the company (see table).

Table: Valuation of intangible assets depending on the method of acquisition

| Method of receipt of intangible assets into the organization | Initial assessment of intangible assets |

| Separate purchase | Cost price |

| Exchange | Fair value or carrying amount of the asset given up |

| Government subsidy | Fair value or par value plus costs |

| Merger of companies | fair value |

| Creation in-house | Cost calculated from the moment the required criteria are met |

Purchase of intangible assets

When purchasing intangible assets, the initial cost includes:

· Purchase price

Import duties

· Non-refundable taxes included in the purchase price

· Other costs directly related to preparing the asset for its intended use

The attribution of costs to cost ceases from the moment when the intangible asset becomes suitable for its intended use, regardless of when its actual use began.

Example 1

The company acquires exclusive rights to distribute the film. The cost of exclusive rights is 500,000 rubles. During the conclusion of the transaction, the company resorted to legal assistance. The cost of legal services is 25,000 rubles. To prepare for the use of rights, the company incurred expenses in the amount of RUB 75,000.

Thus, the cost of intangible assets upon initial recognition will be 600,000 rubles. (RUB 500,000 + RUB 25,000 + RUB 75,000)

Exchange

Intangible assets received in exchange for another asset are measured at the fair value of the asset given up or received3 (whichever is more evident). In the event that the fair value of assets cannot be reliably estimated, the intangible asset is taken into account at the book value of the transferred asset.

Acquisition of intangible assets through a government subsidy

Intangible assets received as government subsidies, at the discretion of the company, can be accounted for both at fair value and at the nominal value (cost) of the asset plus costs directly attributable to preparing the intangible assets for use.

Example 2

The company received a state quota to catch 1,500 tons of squid per year for 10 years. To obtain a quota, the company paid registration fees in the amount of 50,000 rubles. Assume that the company has the right to sell the quota and that there is an active market for such quotas. The fair value of the quota provided by the state is estimated at RUB 5,000,000.

If the company initially recognizes the quota at fair value, then the cost of the intangible asset is equal to RUB 5,000,000.

If the company recognizes a quota at cost, then the cost of intangible assets is 50,000 rubles.

Acquisition of intangible assets during a business combination

Intangible assets acquired in a business combination are initially measured at fair value at the acquisition date. It is important to recognize all identifiable intangible assets whose fair value can be reliably measured separately from goodwill, regardless of whether the asset was recognized prior to the business combination or not.

Example 3

During the acquisition of a newspaper company, the subscriber database was identified. (Assume that similar databases are freely bought and sold). The acquired organization did not recognize this object as an intangible asset. The fair value of the database is RUB 120,000.

The cost of the database upon initial recognition from the buyer company should be 120,000 rubles.

Creation of intangible assets within the company

IAS 38 divides the asset creation process into two stages: research and development.

Expenses at the research stage are always recognized as period expenses, since at this stage the company cannot demonstrate that there is an intangible asset that can bring economic benefits to the company in the future.

Intangible assets arising at the development stage can only be recognized if the company can show:

· the technical feasibility of completing the creation of the intangible asset so that it is ready for use or sale;

· intention to complete the creation of intangible assets, as well as to use or sell it;

· your ability to use or sell intangible assets;

· the method of obtaining probable future economic benefits from intangible assets;

· availability of sufficient technical, financial and other resources to complete the development, as well as the use or sale of intangible assets;

· the ability to reliably estimate the costs associated with intangible assets during its development.

The cost of an internally generated intangible asset represents the total amount of expenses incurred from the moment the asset meets all recognition criteria and the company can demonstrate that all of the above conditions have been met.

The cost of intangible assets created by the company includes:

· costs of materials and services used in the process of creating intangible assets;

· labor costs for employees directly related to the development of intangible assets;

· costs of registering legal rights;

· depreciation of equipment, as well as patents and licenses used to create intangible assets;

· other costs directly related to the creation of intangible assets.

If the stages within the framework of one project cannot be divided, then the entire project is recognized as research and all costs for it are written off as period expenses. There is no new intangible asset in the financial statements.

If the costs of an intangible asset were initially recognized as an expense of the period in previous reporting, then they cannot subsequently be restored and recognized as part of the cost of the intangible asset.

Example 4

The company is developing new production technology.

During 2005, the monthly costs associated with this development amounted to 25,000 rubles. From August 1, 2005, production technology began to meet the criteria for recognition of intangible assets. In 2006, the process of finalizing the new technology and preparing it for use took place. The company's expenses amounted to 100,000 rubles.

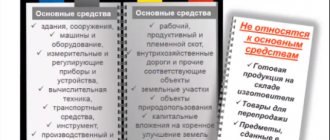

Criteria for classifying assets as intangible assets

To accept an object for accounting as an intangible asset, in accordance with

clause 3 PBU 14/2007

, it is necessary to simultaneously fulfill seven conditions:

Condition 1:

| The asset must be capable of delivering economic benefits to the organization in the future. In particular, the asset is intended:

|

Condition 2:

| The entity must have the right to receive the economic benefits that the asset is capable of generating. Including the organization has properly executed documents confirming: The existence of the asset itself and the right of a given organization to the result of intellectual activity or a means of individualization:

There must also be restrictions on the access of other persons to such economic benefits - control over the object. |

Condition 3:

| An asset can be separated or separated (identified) from other assets. |

Condition 4:

The asset is intended to be used for a long time:

|

Condition 5:

| The entity does not intend to sell the asset within 12 months. |

Condition 6:

| The actual (initial) cost of the object can be reliably determined. |

Condition 7:

| The asset does not have a tangible form. |

In accordance with the provisions of paragraph.

4 PBU 14/2007, if all seven of the above conditions are met, intangible assets include, for example:

- works of science, literature and art;

- programs for electronic computers;

- inventions;

- utility models;

- breeding achievements;

- production secrets (know-how);

- trademarks and service marks.

The intangible assets also take into account the business reputation that arose in connection with the acquisition of an enterprise as a property complex (in whole or part thereof).

Intangible assets do not include :

- Expenses associated with the formation of a legal entity (organizational expenses).

- Intellectual and business qualities of the organization’s personnel, their qualifications and ability to work.

In accordance with paragraph.

5 PBU 14/2007, the accounting unit for intangible assets is an inventory item.

An inventory object is a set of rights arising from one:

- patent,

- certificates,

- agreement on the alienation of the exclusive right to the result of intellectual activity (to a means of individualization)

- and so on.,

designed to perform certain independent functions.

A complex object , including several protected results of intellectual activity, can also be recognized as an inventory object of intangible assets

- film,

- other audiovisual work,

- theatrical performance,

- multimedia product,

- unified technology.

Accounting for the costs of refining and improving computer programs

Any computer program becomes outdated quite quickly. As a result, the company has to spend money on its completion and improvement. The procedure for accounting for these costs depends on whether an independent object of copyright arises as a result or not. According to GOST 28806-90 “Quality of software. Terms and definitions” modification of the program can be carried out:

- to eliminate defects;

— to improve the software;

- to adapt it to the changes that have occurred and current requirements.

According to civil law, derivative works are classified as objects of copyright. This is a creative reworking of another, previously created work. In addition, composite works are also included in such objects, provided that they are the result of creative work in the selection or arrangement of materials.

Processing and modification of computer programs are considered to be any changes, with the exception of adaptation (making changes to allow the program to work on specific technical means or under the control of specific additional programs).

As a rule, the processing of a program is carried out not by the copyright holder, but on his behalf by another person within the framework of a copyright agreement. Therefore, the results of such processing are subject to copyright. The author's order agreement may provide for one of the following options:

— alienation to the customer of the exclusive right to a work that should have been created by the author;

— granting the customer the right to use this work within the limits established by the contract.

In the first case, the rules on the agreement on the alienation of exclusive rights are applied to the author's order agreement. The second contains the provisions provided for in a license agreement granting the right to use the work.

Suppose that as a result of refinement, an independent object of copyright arises, to which the company receives exclusive rights. The transfer of such rights to the modified program satisfies the conditions under which it is considered an intangible asset. In this case, the inventory object of intangible assets is considered to be a set of rights arising from one patent, certificate, or alienation agreement. Consequently, such expenses will be taken into account as an independent and separate intangible asset.

In this case, the previous intangible asset (old version of the program) either continues to be registered (if the company uses it) or is written off (if the company uses only the new version). In the second case, the residual cost of the program is included in other expenses.

The company received exclusive rights to the computer program. Its initial cost was 560,000 rubles. Subsequently, the program was finalized and modernized. The company received exclusive rights to the results of this work. Rework costs amounted to RUB 236,000. (including VAT - 36,000 rubles). After modernization, the old version of the program was no longer used. At this moment, depreciation was accrued on it in the amount of 75 0 00 rubles.

These operations are reflected in the following records:

Debit 19 Credit 60 (76)

— 36,000 rub. — VAT is reflected on the costs of modernizing the program;

Debit 08-5 Credit 60 (76)

- 200,000 rubles 0) - expenses for modernizing the program are taken into account;

Debit 68 Credit 19

— 36,000 rub. — VAT on expenses for finalizing the program is accepted for deduction;

Debit 04 Credit 08-5

— 200,000 rub. — modernization costs are accounted for as a separate intangible asset;

Debit 05 Credit 04

— 75,000 rub. — depreciation was written off according to the previous version of the program;

Debit 91-2 Credit 04

— 485,000 rub.0) — the residual value of the previous version of the program has been written off.

If, as a result of processing or finalization of the program, an independent object of copyright does not arise (for example, a modification of a computer program is carried out to eliminate defects), then these costs are included in expenses for ordinary activities. They are not reflected as expenses for the acquisition of intangible assets. At the same time, they can be written off from expense accounts either at a time or gradually over the expected period of use of the modified intangible asset. The procedure for writing off such costs (one time or gradually) must be determined by the company's accounting policy.

Example

Let's go back to the previous example. Let us assume that as a result of the revision, a new object of exclusive rights was not created. It is assumed that the new version of the program will be used for 16 months.

In this situation, such costs are reflected in the entries:

Debit 19 Credit 60 (76)

— 36,000 rub. — VAT is reflected on the costs of modernizing the program;

Debit 20 (44) Credit 60 (76)

- 200,000 rubles 0) - expenses for modernizing the program are taken into account;

Debit 68 Credit 19

— 36,000 rub. — VAT on expenses for finalizing the program is accepted for deduction.

Situation 1

According to the company's accounting policy, such costs are written off at a time. In this case, the company records the following:

Debit 90-2 Credit 20 (26, 44)

— 200,000 rub. — expenses for modernizing the program were written off.

Situation 2

According to the company's accounting policy, such costs are written off gradually over the period to which they relate. In this situation, they are written off monthly by posting:

Debit 90-2 Credit 20 (44)

— 12,500 rub. (RUB 200,000: 16 months) - part of the costs for finalizing the program was written off.

Based on materials from the reference book “Annual Report” under general. edited by V. Vereshchaki

What regulations cover the concept of the initial cost of intangible assets?

The concept of intangible assets (intangible assets), as well as their initial cost, is disclosed in PBU 14/2007, which is periodically amended with important amendments and additions. In mid-2021, amendments were made to the PBU, which gave the right to organizations using simplified accounting methods to write off the cost of intangible assets as expenses for ordinary activities at the time of incurring expenses, and not through depreciation.

The procedure for forming the initial value of intangible assets as an object of depreciable property for tax accounting purposes is reflected in Art. 257 Tax Code of the Russian Federation. There is no fundamental difference in the composition of expenses in tax and accounting. The exceptions are insurance costs, interest on loans, and exchange rate differences, which will increase the cost of intangible assets in accounting, but will be included in non-operating expenses in tax accounting.

And one more difference. If tax accounting establishes the minimum value of an object to include it in depreciable property, then for accounting purposes there are no cost restrictions.

ConsultantPlus experts explained at what cost intangible assets are reflected in accounting. Get free demo access to K+ and go to the tax guide to find out all the details of this procedure.

The article “Drawing up an accounting policy in an organization” will help you to competently approach the issue of forming an accounting policy.

Change in the value of intangible assets

PBU 14/2007 determines that the value of intangible assets is not subject to change in accounting, except in cases of revaluation and impairment. It turns out that the modernization of intangible assets will not affect its value both in accounting and tax accounting. Revaluation of intangible assets is permissible, but entails an obligation to regularly carry out this procedure, which leads to constant transaction costs. Gardium took this point into account when developing a service for assessing intangible assets. To revaluate an asset, we initially form a long-term financial model of the client’s business, and then update it annually. Therefore, our customers receive assessment reports in a timely manner and at a reduced price. Request a call to clarify details.

The most obvious way is to include the costs of modernizing intangible assets as part of the costs of ordinary activities. But this approach prevents the enterprise from capitalizing through developments.

Carrying out modernization operations of intangible assets

The principle of modernizing an intangible asset is practically no different from modernizing a fixed asset. Simply due to the specifics of accounting for intangible assets, both in accounting and tax accounting, a separate document in the configuration is provided for carrying out the operation of the modernization itself. More details about how the operation of modernizing fixed assets is implemented in the configuration are described in the corresponding article “Carrying out operations of modernizing fixed assets.”

The accumulation of any costs associated with the modernization of an intangible asset occurs at the construction site in the context of cost items in account 1542 “Manufacture of intangible assets.

For example, let's include as expenses the amount of services of a programmer who configured our software.

After the costs are reflected (collected, accumulated) at the corresponding construction site, these amounts are attributed to the increase in the value of the intangible asset using the document “Modernization of intangible assets”.

The header of the document indicates the construction site from which modernization costs are written off. On the “Accounting and Tax Accounting” tab, the capital investment accounting account is indicated, which accumulates modernization costs (1542) and the amount of costs. Modernization amounts can be filled in automatically based on accounting data at the time the document was generated - the “Calculate amounts” button. If necessary, these amounts can be adjusted manually.

Then, in the tabular section on the “Intangible assets” tab, the assets to be modernized are indicated, after which the accounting information is filled in using the “Fill in – For list of intangible assets” button. According to the accounting data at the time of document generation, accounting amounts and depreciation parameters, as well as distributed modernization amounts, are filled in.

When reflecting the results of modernization, the document “Modernization of Intangible Assets” can set new parameters for calculating depreciation in accounting:

- useful life;

- expected value of the production parameter (volume of production);

- residual value, on the basis of which depreciation is calculated in the future.

The new value for calculating depreciation is calculated automatically as the residual value of the asset at the end of the month. In this case, only the calculation of the amount of depreciation for the month in which the modernization took place occurs, and not its actual accrual. The new cost for calculating depreciation is not subject to manual adjustment, but if necessary, you can manually adjust the components from which it is calculated in the tabular part of the document.

Expenses included in the initial cost of intangible assets

The legislator provides an open list of expenses that will constitute the initial cost of an intangible asset. This means that the cost can be increased by any expenses if they are justified and related to the acquisition of intangible assets or the provision of conditions for its subsequent use. In paragraphs 8, 9 PBU 14/2007 reflect the following expenses:

- payment under an agreement for the alienation of intellectual property or other types of obtaining the right to use intellectual property;

- remuneration to intermediary agents who took part in the acquisition of the asset;

- duties (including customs), fees, non-refundable taxes;

- consulting and other services related to the collection and analysis of information before purchasing an intangible asset;

- remuneration of those employees who took part in the creation of intangible assets, research and technical development, as well as mandatory social contributions from the amount of this salary;

- payment under contracts for the provision of services (performance of work) related to research or development.

This list is open - it is possible to include intangible assets and other similar expenses in the price.

For tax accounting purposes, the initial cost of intangible assets is the total cost of their acquisition (creation, production) and bringing them to a state of suitability for use. The initial cost, as well as all further information about the intangible asset, is reflected in the tax registers.

EXPLANATIONS from ConsultantPlus: Accounting for the costs of acquiring intangible assets depends on whether the asset is depreciable property or not…. Find out how to take into account the costs of acquiring intangible assets when calculating income tax in the Ready-made solution from K+ by receiving free demo access to the system.

In tax accounting, revaluation of intangible assets is unacceptable. Therefore, when carrying out a revaluation for accounting purposes, it is necessary to understand that as a consequence of this event a difference will arise with tax accounting.

Features of revaluation of intangible assets

Subsequent assessment of intangible assets is carried out in accordance with the requirements of Chapter 3 of PBU 14/2007.

In accordance with clause 16 of PBU 14/2007,

the actual (initial) cost of an intangible asset at which it is accepted for accounting is not subject to change, except in the following cases:

- revaluation,

- impairment of intangible assets.

A commercial organization may revalue groups of similar intangible assets no more than once a year (at the end of the reporting year) (clause 17 of PBU 14/2007):

- at the current market value , determined solely based on data from the active market of the specified intangible assets.

When deciding on the revaluation of intangible assets that are part of a homogeneous group, it should be taken into account that in the future these assets must be revalued regularly so that the value at which they are reflected in the financial statements does not differ significantly from the current market value.

In accordance with paragraph.

19 PBU 14/2007, revaluation of intangible assets is carried out by recalculating their residual value.

Wherein

the amount of revaluation as a result of revaluation is credited:

- to the organization’s additional capital to account 83 “Additional capital”.

The amount of additional valuation of an intangible asset, equal to the amount of its depreciation carried out in previous reporting years and attributed to the financial result as other expenses, is credited:

- into the financial result as other income (account 91.1 “Other income”).

The amount of write-down of an intangible asset as a result of revaluation relates to:

- to the financial result as other expenses (account 91.2 “Other expenses”).

The amount of depreciation of intangible assets refers to:

- to reduce the organization’s additional capital formed from the amounts of the additional valuation of this asset carried out in previous reporting years.

The excess of the amount of depreciation of intangible assets over the amount of its revaluation credited to the organization’s additional capital as a result of revaluation carried out in previous reporting years refers to:

- to the financial result as other expenses.

When an intangible asset is disposed of, the amount of its additional valuation is transferred from the organization’s additional capital:

- to the account of the organization’s retained earnings (uncovered loss) (account 84 “Retained earnings (uncovered loss)”).

The results of the revaluation of intangible assets carried out at the end of the reporting year are subject to reflection in accounting

apart

.

Intangible assets can be tested for impairment in the manner prescribed by International Financial Reporting Standards (clause 22 of PBU 14/2007). The provisions of PBU 14/2007 do not establish a definition of the active market for intangible assets. At the same time, PBU 14/2007 does not establish the mandatory involvement of an independent appraiser when revaluing intangible assets. And, accordingly, the value of intangible assets indicated in the report of an independent appraiser, although recognized as market value in accordance with current legislation, cannot be taken into account for accounting purposes if the valuation was not made using the active market method . Let's take a closer look at this point.

In accordance with Article 3 of the Federal Law of July 29, 1998. No. 135-FZ “On Valuation Activities in the Russian Federation”, the market value of the valuation object is understood as the most probable price at which this valuation object can be alienated on the open market in a competitive environment, when the parties to the transaction act reasonably, having all the necessary information, and the value of the transaction price is not reflected in any extraordinary circumstances, that is, when:

- one of the parties to the transaction is not obliged to alienate the object of valuation, and the other party is not obliged to accept execution;

- the parties to the transaction are well aware of the subject of the transaction and act in their own interests;

- the valuation object is presented on the open market through a public offer, typical for similar valuation objects;

- the price of the transaction represents a reasonable remuneration for the object of evaluation and there was no coercion to complete the transaction in relation to the parties to the transaction on any part;

- payment for the valuation object is expressed in monetary form.

At the same time, in accordance with Article 14 of Law No. 135-FZ, the appraiser has the right:

- apply independently methods for assessing the subject of assessment in accordance with assessment standards.

That is, it is not obliged to evaluate intangible assets solely according to active market data, but can use other valuation methods, for example:

- costly method

- income method

- and so on.

Paragraph 78 of International Accounting Standard (IAS) 38 “Intangible Assets” contains the following information regarding the active market for intangible assets:

In relation to intangible assets, the presence of an active market is a rare, but nevertheless possible phenomenon.

For example, in some jurisdictions there may be an active market

- licenses to transport passengers,

- fishing licenses,

- production quotas,

- there are no restrictions on transfer.

However, the presence of an active market is excluded if it is:

- about brands,

- newspaper title data,

- rights to release music albums and films,

- patents or trademarks,

- since each of the listed assets has a unique character.

In addition, although intangible assets are the subject of purchase and sale, the terms of the contracts are agreed upon by buyers and sellers individually, and transactions are carried out quite rarely.

For these reasons, the price paid for one asset is not always sufficient evidence of the fair value of another asset.

In addition, pricing information is often not publicly available.

Based on all of the above, the practical implementation of the revaluation of intangible assets for accounting purposes seems to be a very difficult and unrealistic task.

Preparing for revaluation

Reassessment involves preparation. It consists of checking the presence of assets that will be revalued. The corresponding rule is given in Order of the Ministry of Finance No. 91 of October 13, 2003. The decision to conduct a revaluation is supported by an administrative document. It is necessary to draw up a list of assets with which work will be carried out. The list includes the following information about assets:

- Name.

- Date of purchase.

- The date on which the object was accepted for accounting.

If the asset is not purchased, but created by the company itself, you need to indicate the date of construction.

Intangible assets are included in the contribution to the authorized capital

How to evaluate intellectual property and intangible assets resulting from the registration of this property if it was received as a contribution to the authorized capital? The initial cost in this case is defined as a monetary value agreed upon by the founders (participants) of the organization (clause 11 of PBU 14/2007). It is important to take into account the restrictions provided by law. Thus, when assessing non-monetary contributions in business companies, the involvement of an independent appraiser is required. And the value of the intangible asset contributed to the authorized capital cannot be determined by the participants to be higher than the value calculated by an independent appraiser (Clause 2 of Article 66.2 of the Civil Code of the Russian Federation).

Intangible asset received under an exchange agreement

When purchasing intangible assets under an exchange agreement, each party to the transaction must reflect both the sale of their assets transferred in exchange and the posting of the values received in return.

Let's look at these operations using an example. An organization acquires the exclusive right to a computer program in exchange for its goods. The total cost of goods is 230,000 rubles, incl. VAT 18%. The cost of goods is 162,000 rubles. The purchased program is not subject to VAT (clause 26, clause 2, article 149 of the Tax Code of the Russian Federation). The exchange was recognized as equal.

We present the accounting records of the acquirer of intangible assets in the table:

Depreciation calculation

Depreciation for each intangible item must be calculated monthly. In this case, accruals must begin in the month following the month the intangible asset was put into operation.

Example

Fregat LLC bought and registered the exclusive right to a special invention, this fact was confirmed by a special patent. On February 26, the agreement on the alienation of exclusive rights was registered with Rospatent, and the intangible asset itself was accepted for accounting and, accordingly, put into operation.

Amortization of this intangible asset should be calculated and accrued starting from March of the current year. Let us recall that in accounting there are three methods for calculating depreciation of intangible assets: linear, the reducing balance method and the method of writing off value in proportion to the volume of production or work. Whereas in tax accounting there are only two methods: linear and nonlinear.

Note that when using each of these methods, depreciation of intangible assets must be calculated based on its service life. The latter, in turn, is determined based on the validity period of a patent, certificate, license to use exclusive rights or other documents (for example, a contract) confirming the company’s right to a given intangible asset.

The residual value of fixed assets and intangible assets is determined as the difference between their original cost and the amount of depreciation accrued over the period of operation (clause 1 of Article 257 of the Tax Code of the Russian Federation).

Comments and opinions

In the letter of the Ministry of Finance of Russia dated May 17, 2018 No. 03-03-06/1/33132,

officials explain how, for profit tax purposes, the costs of refining intangible assets can be taken into account. Examples of such assets that require further development and improvement are computer programs and databases.

Based on clause 3 of Art. 257 of the Tax Code of the Russian Federation in tax accounting, the initial cost of amortizable intangible assets is defined as the amount of expenses for their acquisition or creation and bringing them to the state in which they are suitable for use, with the exception of VAT and excise taxes, except for the cases provided for in the Tax Code of the Russian Federation. But unlike fixed assets, although intangible assets are depreciated, an increase in their initial value as a result of additional equipment, modernization, or reconstruction is not provided for by the provisions of the Tax Code of the Russian Federation.

In paragraphs 26 clause 1 art. 264 of the Tax Code of the Russian Federation establishes that other expenses associated with production and sales include expenses associated with the acquisition of the right to use computer programs and databases under agreements with the copyright holder - under license and sublicense agreements. These expenses also include expenses for the acquisition of exclusive rights to computer programs worth less than the amount of the cost of depreciable property, defined in paragraph 1 of Art. 256 of the Tax Code of the Russian Federation, that is, 100,000 rubles.

In accordance with paragraph 1 of Art. 272 of the Tax Code of the Russian Federation, expenses are recognized in the reporting or tax period in which these expenses arise based on the terms of the transactions. If the transaction does not contain such conditions and the relationship between income and expenses cannot be clearly defined or is determined indirectly, the expenses are distributed by the taxpayer independently. Thus, the costs of reworking an intangible asset are taken into account during the period of use of the intangible asset.

In paragraph 2 of Art. 258 of the Tax Code of the Russian Federation establishes that for a computer program or database to which the taxpayer has an exclusive right, he can establish their useful life independently, but not less than two years.

If a non-exclusive right was obtained under a license, then the useful life of the asset is determined as follows:

- if, under the terms of the agreement for the acquisition of non-exclusive rights, a period for using computer programs is established, then expenses related to several reporting periods are taken into account when calculating the tax base evenly during these periods;

- if the terms of the agreement cannot determine the period for using computer programs, then the expenses incurred are distributed taking into account the principle of uniform recognition of income and expenses, and the taxpayer sets the period for their distribution himself.

This was indicated, for example, in the letter of the Ministry of Finance of Russia dated 08/31/12 No. 03-03-06/2/95.

What are we leading to? Imagine that during the period of ownership of the license several modifications to the program occurred at once. Then it turns out that for each such modification there will be its own accounting period! The first revision will be evenly distributed over the entire remaining license term from the date of this revision. The second - for the entire remaining period from the moment of its implementation. And so on.

Intangible asset received free of charge

The initial cost of an intangible asset, which was received under a gift agreement, is determined based on its current market value as of the date of its entry into accounting in account 08 “Investments in non-current assets” (Order of the Ministry of Finance dated October 31, 2000 No. 94n). The current market value of the intangible asset on the date of capitalization is the amount that could be received as a result of the sale of the object on this date. Due to the absence, as a rule, of an active market for intangible assets, and also due to the uniqueness of such property, the current market value can be determined on the basis of an expert assessment (clause 13 of PBU 14/2007).

We also remind you that donating an object worth more than 3,000 rubles between commercial organizations is prohibited by law (Clause 1 of Article 575 of the Civil Code of the Russian Federation).

Intangible assets: transactions when purchasing an asset

Let us remind you that intangible assets are taken into account at their original cost. The order of its formation depends on the method of receipt of objects, and we talked about this in our material. The accounting records generated at the same time depend on the method of receipt of intangible assets into the organization. We present typical ones below. Let us note right away that the initial cost of intangible assets is formed by the debit of account 08 “Investments in non-current assets”. And then, when an object is accepted for accounting, it is debited to account 04 “Intangible assets” (Order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n):

Debit account 04 – Credit account 08

When accepting intangible assets for accounting, this posting is always applied; it does not depend on the method of receipt of the asset. The latter only affects transactions for the formation of the initial cost of an intangible asset on account 08.

So, when purchasing an intangible asset for a fee, the wiring is usually as follows:

Debit of account 08 “Investments in non-current assets” - Credit of account 60 “Settlements with suppliers and contractors”

However, even if intangible assets were acquired, transactions are not always limited only to settlements with suppliers and contractors. After all, the initial cost may include various duties:

Debit of account 08 – Credit of account 76 “Settlements with various debtors and creditors”

And even interest on loans and borrowings, when the acquired intangible asset is recognized as an investment asset (clause 10 of PBU 14/2007):

Debit of account 08 – Credit of accounts 66 “Settlements for short-term loans and borrowings”, 67 “Settlements for long-term loans and borrowings”

NMA – business reputation

Business reputation is a special intangible asset, which differs from other intangible assets, both in the acquisition method and in the following methods:

- assessments,

- depreciation charges.

In accordance with the provisions of Article 132 of the Civil Code, an enterprise as an object of rights is recognized as:

- a property complex used to carry out business activities.

The enterprise as a whole, as a property complex, is recognized as real estate in accordance with paragraph 1 of Article 132 of the Civil Code of the Russian Federation.

The enterprise as a whole or part of it may be the object of:

- purchase and sale,

- collateral

- rent,

- other transactions related to the establishment, change and termination of property rights.

The enterprise as a property complex includes

all types of property

intended for its activities, including:

- land,

- building,

- buildings, structures

- equipment,

- inventory,

- raw materials,

- products,

- rights of claim,

- debts,

- rights to designations that individualize an enterprise, its products, works and services (commercial designation, trademarks, service marks),

- other exclusive rights, unless otherwise provided by law or agreement.

The sale of an enterprise as a property complex is carried out in accordance with the provisions of Article 559 of the Civil Code of the Russian Federation.

In accordance with clause 1 of Article 559 of the Civil Code of the Russian Federation, under a contract for the sale of an enterprise, the seller undertakes to transfer the ownership of the enterprise as a whole to the buyer as a property complex, with the exception of rights and obligations that the seller does not have the right to transfer to other persons.

Unless otherwise provided by the contract, then the following are transferred to the buyer (clause 2 of Article 559 of the Civil Code of the Russian Federation):

1. Exclusive rights to means of individualization of the enterprise, products, works or services of the seller:

- commercial designation,

- trademark,

- service sign.

2. The rights to use such means of individualization belonging to him on the basis of licensing agreements.

In accordance with paragraph 3 of Art. 559, the rights of the seller received on the basis of a permit (license) to engage in the relevant activity are not subject to transfer to the buyer of the enterprise (unless otherwise established by law or other legal acts).

In this case, the transfer to the buyer as part of the enterprise:

- obligations, the fulfillment of which by the buyer is impossible in the absence of such permission (license), does not relieve the seller from corresponding obligations to creditors.

For failure to fulfill such obligations, the seller and buyer are jointly and severally liable to creditors.

In accordance with the provisions of Article 560 of the Civil Code of the Russian Federation, the agreement for the sale of an enterprise is concluded in writing by drawing up one document signed by the parties (clause 2 of Article 434 of the Civil Code of the Russian Federation), with the obligatory attachment to it of the documents specified in clause 2 of Art. 561 Civil Code.

At the same time, in accordance with paragraph 2 of Article 560 of the Civil Code of the Russian Federation, failure to comply with the form of the agreement for the sale of an enterprise entails its invalidity.

In addition, until the end of February 2013, the agreement for the sale of the enterprise is subject to:

- state registration and is considered concluded from the moment of such registration.

Please note: The requirement for state registration will not apply to contracts concluded after 03/01/2013 in accordance with the provisions of paragraph 8 of Article 2 of the Law of December 30, 2012 No. 302-FZ “On Amendments to Chapters 1, 2, 3 and 4 parts of the first Civil Code of the Russian Federation."

In accordance with paragraph 1 of Article 561 of the Civil Code of the Russian Federation, the composition and cost of the enterprise being sold are determined in the agreement for the sale of the enterprise:

- based on a complete inventory of the enterprise, carried out in accordance with the established rules for such inventory.

Before signing a sales agreement for an enterprise, the following must be drawn up and reviewed by the parties:

- inventory act,

- balance sheet,

- conclusion of an independent auditor on the composition and value of the enterprise,

- a list of all debts (liabilities) included in the enterprise, indicating the creditors, the nature, size and timing of their claims.

The property, rights and obligations specified in the above documents are subject to transfer by the seller to the buyer (unless otherwise follows from the rules of Article 559 of the Civil Code of the Russian Federation and is not established by agreement of the parties).

In accordance with paragraph 42 of PBU 14/2007, for accounting purposes, the value of acquired business reputation is determined by calculation:

- as the difference between the purchase price paid to the seller when acquiring an enterprise as a property complex (in whole or part thereof), and the sum of all assets and liabilities on the balance sheet as of the date of its purchase (acquisition).

At the same time, a positive business reputation should be considered as:

- the premium paid by the buyer in anticipation of future economic benefits associated with the acquired unidentifiable assets, and accounted for as a separate inventory item.

Negative business reputation should be considered as:

- discount on price provided to the buyer due to the lack of factors of the presence of stable buyers, reputation for quality, marketing and sales skills, business connections, management experience, level of personnel qualifications, etc.

Acquired business reputation is amortized over 20 years (but not longer than the life of the organization).

Depreciation charges for positive business reputation are determined using the straight-line method.

Negative business reputation in full is included in the financial results of the organization as other income (clause 45 of PBU 14/2007).

Reflection in accounting

Let's look at the basic accounting entries that will be needed to reflect intangible assets in accounting.

Acquisition of intangible assets

- Debit 08 “Investments in non-current assets” Credit 60 “Settlements with suppliers and contractors”

acceptance of intangible assets for accounting;

- VAT on the purchased object;

- payment to the supplier by bank transfer (or cash);

- VAT creditable;

- commissioning of intangible assets.

Amortization of an intangible asset

- Debit 20, 23, 44 (according to cost accounting accounts) Credit 04, 05 (depending on the method determined by the accounting policy)

monthly reflection of depreciation of intangible assets.

Write-off of an intangible asset

- Debit 05 “Amortization of intangible assets” Credit 04 “Intangible assets”

reflects the amount of accumulated depreciation of intangible assets;

- the residual value of the intangible asset is written off (if any);

- loss on disposal is reflected.

Implementation of intangible assets

- Debit 05 “Amortization of intangible assets” Credit 04 “Intangible assets”

accumulated depreciation;

- the residual value is shown (if available);

- the buyer's debt has formed;

- VAT on sales is reflected;

- payment has been received from the buyer.

Initial cost of intangible assets in transactions

The initial cost of intangible assets is collected on account 08 “Investments in non-current assets”. Acceptance of an object for accounting as an intangible asset is reflected by the posting:

Dt 04 Kt 08.

You can read about how to audit account 08 in the article “Audit of investments in non-current assets (account 08)”.

The results of the revaluation increase the additional capital of the enterprise and are documented by posting:

Dt 04 Kt 83.

To correctly reflect the transaction in account 83, you should open a subaccount “Increase in the value of non-current assets as a result of revaluation”.

The result of the markdown in accounting will look like this:

Dt 91.2 Kt 04.

If you need to reflect the additional valuation of intangible assets, which is equal to the amount of the previously carried out markdown, then the posting will be as follows:

Dt 04 Kt 91.1.

In the opposite situation, when first an additional valuation was made, and then a markdown, the result reduces the additional capital, which is reflected by the posting:

Dt 83 Kt 04.

Postings for depreciation of intangible assets

When calculating amortization of intangible assets, accounting entries may be as follows:

Debit of accounts 20 “Main production”, 26 “General business expenses”, 44 “Sales expenses”, 08 “Investments in non-current assets”, 97 “Deferred expenses”, etc. – Credit of account 05

The debited account depends on where the intangible asset is used and what is provided for by the accounting policies of the organization. Eg:

- account 20 is applied when intangible assets are used in the production of products, performance of work or provision of services;

- account 26 – when using the asset for management purposes;

- on account 44, trade organizations will take into account the depreciation of intangible assets;

- account 08 is required when intangible assets are used when creating a new item of intangible assets or in the process of creating an item of fixed assets;

- account 97 can be used when an intangible asset is used in the development of new production facilities or units.

Valuation of intangible assets on the balance sheet

Features of the valuation of intangible assets do not affect the order of their reflection in the balance sheet. It does not matter how the initial value of an intangible asset was formed and whether it was revalued, intangible assets are reflected in the balance sheet at their residual value (clause 35 of PBU 4/99). This means that in order to reflect the value of intangible assets in the balance sheet asset, it is necessary to subtract the depreciation accrued on them from the original (replacement) cost of intangible assets.

Postings when writing off intangible assets

At the time of writing off an intangible asset from accounting, it is first necessary to close the depreciation account (account 05). And then the residual value of intangible assets is subject to write-off. Postings for its write-off depend on how the object is disposed of.

In the above example, when goods are exchanged for an intangible asset item, the seller of intangible assets must reflect the disposal of the item. Let’s assume that his asset was also included in the intangible assets, its initial cost was 195,000 rubles, and the depreciation accrued at the time of disposal was 19,000 rubles. Let us recall that the asset is exchanged for goods worth 230,000 rubles, which will be the sale value of the intangible assets.

Let's present the transactions for the disposal of intangible assets and the receipt of goods in exchange in the table: