Write-off of fixed assets (FPE) that do not meet the asset criteria to off-balance sheet account 02 is possible both during an inventory carried out for the purpose of generating annual reporting (for other mandatory reasons), and during the year - as necessary. 1C experts talk about the regulated procedure for such write-offs and how to reflect the write-off operations of fixed assets that do not meet the criteria for asset recognition in the 1C: Public Institution Accounting 8 programs, editions 1 and 2.

Off-balance sheet account 002 - what is it intended for?

Off-balance sheet accounts in accounting are intended to reflect values that do not belong to the enterprise by right of ownership, that is, those that are in temporary use. These can be not only inventory items, but also conditional rights and obligations:

Account 002 in accounting is an active account; any receipt of inventory items is reflected as a debit of the account, and disposal (movement) as a credit. Valuables in accounting account 002 are accepted at the value indicated in the accompanying documents. If there is no value, then in a conditional or quantitative assessment.

Features of off-balance sheet accounting

Off-balance sheet accounts are a special section of the Chart of Accounts (approved by Order of the Ministry of Finance dated October 31, 2000 No. 94n).

Off-balance sheet accounts were separated into a separate group of accounts due to their specifics: objects on them are reflected by a simple entry, that is, only by debit or credit of the account. In off-balance sheet property accounts, the accountant takes into account assets that are temporarily held by the organization and do not belong to it.

Some company obligations and documents accounted for in a special manner are also written off to off-balance sheet accounts - read the details in the article “Rules for maintaining accounting on off-balance sheet accounts.”

Which inventory items are taken into account on account 002

Let's take a closer look at account 002 “Inventory assets accepted for safekeeping.” Account 002 takes into account values that the company, for a number of reasons, cannot reflect on the balance sheet:

- The received goods are defective, damaged, do not meet the stated requirements and characteristics specified in the supply agreement and must be returned to the supplier;

- According to the terms of the contract, ownership of the goods passes not at the time of shipment, but upon payment;

- Inventory and materials are accounted for under the pledge agreement;

- Inventory and materials have been paid for by the buyer, but have not yet been transported from the warehouse for technical or other valid reasons, that is, they are temporarily in safekeeping;

- Inventory and materials were received from the bailor under a storage agreement;

- The goods and materials were received by mistake, by an exchange agreement, etc.

Regulatory regulation

From 01/01/2018, when maintaining budgetary accounting, accounting of state (municipal) budgetary and autonomous institutions, the Federal Accounting Standard for Public Sector Organizations “Fixed Assets”, approved.

by order of the Ministry of Finance of Russia dated December 31, 2016 No. 257n (hereinafter referred to as the Standard). According to paragraph 7 of the Standard, fixed assets are tangible assets. Paragraph 8 of the Standard states:

Excerpt from the document

“Tangible value is subject to recognition in accounting as part of fixed assets (hereinafter referred to as the object of fixed assets), provided that the subject of accounting predicts the receipt of economic benefits or useful potential from its use.

Objects of fixed assets that do not bring economic benefits to the accounting entity, do not have useful potential and in respect of which the receipt of economic benefits are not envisaged in the future, are accounted for in the off-balance sheet accounts of the Working Chart of Accounts of the accounting entity, approved by the accounting entity within the framework of its accounting policy.”

In accordance with subparagraph “b” of paragraph 45 of the Standard, recognition of an object of fixed assets in accounting as an asset is terminated in the event of disposal of the property, as well as when the subject of accounting decides to stop using the fixed asset for the purposes provided for when recognizing fixed assets, and the termination receipt by the subject of accounting of economic benefits or useful potential from the further use of the subject of fixed assets by the subject of accounting. When an item of fixed assets is ceased to be recognized as an asset by the accounting entity, the disposal of the fixed assets item from the accounting records is reflected on the corresponding balance sheet accounts - by crediting the corresponding balance sheet accounts for accounting for fixed assets (clause 46 of the Standard).

It should be noted that even before the entry into force of the Standard “Fixed Assets”, similar provisions were in the Instructions for the Application of the Unified Chart of Accounts, approved. by order of the Ministry of Finance of Russia dated December 1, 2010 No. 157n (hereinafter referred to as Instruction No. 157n). According to paragraph 51 of Instruction No. 157n, the decision to write off a fixed asset item is made on the basis of moral and physical wear and tear of the fixed asset item, the inappropriateness of further use of the fixed asset item, its unsuitability, the impossibility or ineffectiveness of its restoration. At the same time, paragraph 335 of Instruction No. 157n provides that until the moment of disposal or destruction, property in respect of which a decision has been made to write off (cessation of operation) should be recorded in off-balance sheet account 02 “Tangible assets accepted for storage.”

Refer to the accounting instructions for the relevant accounting entries. For example, according to paragraph 10 of the Instructions for the Application of the Chart of Accounts for Budget Accounting, approved. by order of the Ministry of Finance of Russia dated December 6, 2010 No. 162n (hereinafter referred to as Instruction No. 162n) as amended by order of the Ministry of Finance of Russia dated August 17, 2015 No. 127n:

Excerpt from the document

“the disposal of fixed assets that have become unusable, when a decision is made to write them off, is reflected in the debit of the corresponding analytical accounts, account 010400000 “Depreciation” (010411410 - 010413410, 010415410, 010418410, 010431410 - 010438410), account 04 0110172 “Income from operations with assets "and the credit of the corresponding analytical accounts of account 010100000 "Fixed assets" (010111410 - 010113410, 010115410, 010118410, 010131410 - 010138410), with the simultaneous reflection of retired property on off-balance sheet account 02 "Mothers" valuables accepted for storage" until the moment of its dismantling and (or) disposal;

when making a decision to write off for other reasons, as well as when making a decision to terminate the operation of an accounting object, including due to physical, moral wear and tear of an accounting object - by debiting the corresponding analytical accounting accounts, account 010400000 “Depreciation”, account 040110172 “Revenue” from operations with assets" and the credit of the corresponding analytical accounts of account 010100000 "Fixed Assets" with the simultaneous reflection of retired property on the off-balance sheet account 02 "Tangible assets accepted for storage" until its dismantling and (or) disposal;".

According to paragraph 12 of the Instructions for the application of the Chart of Accounts for accounting of budgetary institutions, approved. by order of the Ministry of Finance of Russia dated December 16, 2010 No. 174n (hereinafter referred to as Instruction No. 174):

Excerpt from the document

“when making a decision to write off for other reasons, as well as when making a decision to terminate the operation of an accounting object, including due to physical or moral wear and tear of an accounting object, - by debiting the corresponding analytical accounting accounts, account 010400000 “Depreciation”, account 040110172 “Revenue” from operations with assets” and the credit of the corresponding analytical accounts of account 010100000 “Fixed assets”. At the same time, decommissioned property items received for storage until their dismantling and (or) disposal are reflected in off-balance sheet account 02 “Tangible assets accepted for storage”;.”

According to paragraph 34 of Instruction No. 157n, “disposal of fixed assets, intangible, non-produced assets, inventories for which a service life has been established (including as a result of a decision to write them off) is carried out, unless otherwise established by the specified Instructions, on based on the decision of the permanent commission for the receipt and disposal of assets, drawn up by a supporting document (primary (consolidated) accounting document) - an Act in the form established by regulatory legal acts adopted in accordance with the legislation of the Russian Federation by the Ministry of Finance of the Russian Federation."

By letter of the Ministry of Finance of Russia dated December 15, 2017 No. 02-07-07/84237, the Guidelines for the application of the federal accounting standard for public sector organizations “Fixed assets”, approved. by order of the Ministry of Finance of Russia dated December 31, 2016 No. 257n (hereinafter referred to as the Guidelines).

Section 10 of the Methodological Instructions clarifies: “The Commission for Receipt and Disposal draws up a Write-off Act (f. 0504104), which must contain the basis for making a decision to discontinue the use of a fixed asset item. Such a decision can also be made by the inventory commission, about which an Act on the results of the inventory is drawn up (f. 0504835), which serves as the basis for the disposal of fixed assets from the balance sheet. Based on the decisions made by the commission, the accounting department draws up an Accounting Certificate (f. 0504833), which reflects accounting records on the disposal of fixed assets from the balance sheet while simultaneously reflecting information about the specified property items on off-balance sheet account 02 “Tangible assets accepted for storage.”

Section 3 of the Methodological Instructions clarifies: “Items of fixed assets for which the commission for the receipt and disposal of assets of the accounting entity has established the ineffectiveness of further operation, repair, restoration (non-compliance with asset criteria) are subject to reflection on off-balance sheet account 02 “Tangible assets accepted for storage” until further determination of the functional purpose of the specified property (involvement in economic turnover, sale or write-off). No further depreciation is charged on these property items.”

According to the final provisions of Section 3 of the Methodological Instructions: “In order to identify objects of fixed assets that, during ownership (use) ceased to meet the criteria of assets, the commission of the accounting entity when conducting an inventory determines the status of the object, characterizing its condition (in operation, temporarily not in operation, reconstructed etc.), and the target function (operated, subject to repair (restoration)."

For this purpose, by order of the Ministry of Finance of Russia dated November 17, 2017 No. 194n, changes were made to form 0504087 “Inventory list (matching statement) for objects of non-financial assets”, approved. by order of the Ministry of Finance of Russia dated March 30, 2015 No. 52n (hereinafter referred to as Order No. 52). Columns have been added to it to reflect the status of the accounting object (gr. and the target function of the asset (gr. 10). The Guidelines for the use of form 0504087 (Part 3 of Appendix No. 5 to Order No. 52n) provide recommendations for filling out new columns.

by order of the Ministry of Finance of Russia dated March 30, 2015 No. 52n (hereinafter referred to as Order No. 52). Columns have been added to it to reflect the status of the accounting object (gr. and the target function of the asset (gr. 10). The Guidelines for the use of form 0504087 (Part 3 of Appendix No. 5 to Order No. 52n) provide recommendations for filling out new columns.

Section 3 of the Methodological Instructions also states that “identification of property items that do not meet the criteria of an asset is possible both during an inventory carried out for the purpose of generating annual reporting (on other mandatory grounds), and during the year - as necessary.”

Thus, writing off fixed assets that do not meet the asset criteria to off-balance sheet account 02 is possible both during an inventory carried out for the purpose of generating annual reporting (for other mandatory reasons), and during the year - as necessary. Such write-off is carried out in the usual manner - in the current period or on December 31 of the reporting year, if the inventory was carried out for the purpose of preparing annual accounting (financial) statements (clause 20 of Instruction No. 157n).

Typical transactions for off-balance sheet account 002

| Account Dt | Kt account | Transaction amount, rub. | Wiring Description | A document base |

| 002 | — | 10 000 | Received for safekeeping goods and materials that were found to be defective, non-compliant with quality, assortment and subject to return due to violation of contractual obligations | Invoices TORG-12, 1-T, M-15, certificate of discovery of defects in goods, accounting certificate |

| — | 002 | 10 000 | Inventory items returned to the supplier are written off off-balance sheet | Invoice TORG-12, act of discovery of defects in goods |

| 002 | — | 12 000 | Received for safekeeping of goods and materials, with special conditions for the transfer of ownership, for example, after payment | Invoices TORG-12, 1-T |

| — | 002 | 12 000 | Inventories written off off-balance sheet due to the transfer of ownership to the buyer | Bank statement |

| 002 | — | 15 000 | Goods and materials, paid for but not removed by the buyer, were accepted for safekeeping | Invoice TORG-12 |

| — | 002 | 15 000 | Inventories left by the buyer for safekeeping are written off from off-balance sheet accounting. | Consignment note 1-T |

| 002 | — | 18 000 | Received goods and materials under a storage agreement | Transfer and acceptance certificate MX-1, accounting certificate |

| — | 002 | 18 000 | Return of goods and materials to the owner under a storage agreement | Act MX-3, accounting certificate |

| 002 | — | 20 000 | Inventory and materials were accepted for safekeeping due to the pledgor’s failure to fulfill obligations under the pledge agreement | Pledge agreement, accounting certificate |

| — | 002 | 20 000 | Inventory and materials received under a pledge agreement were sold | Invoice TORG-12 |

Approval procedure

Currently, there is a Regulation on the specifics of writing off federal property, approved by Decree of the Government of the Russian Federation of October 14, 2010 No. 834 (hereinafter referred to as the Regulation on Write-off). This resolution defines the specifics of writing off movable and immovable property in federal ownership and applies to all federal government institutions, regardless of their type. According to clause 2 of the Regulations on Write-off, write-off of federal property is understood as a set of actions related to the recognition of property as unsuitable for further use for its intended purpose and (or) disposal due to the complete or partial loss of consumer properties, including physical or moral wear and tear, or having been retired from use. possession, use and disposal due to death or destruction, as well as the impossibility of establishing its location. The meaning of writing off property in this paragraph partly coincides with the conditions for recognizing property as an asset given in paragraph 8 of the GHS OS, with the exception that this paragraph talks about the need to take into account property that is not recognized as an asset off the balance sheet. And according to the Regulations on write-off, property disposed of during write-off, as a rule, is on the balance sheet until the final decision of its owner. The regulation on write-off requires the creation on an ongoing basis of a commission to prepare and make the appropriate decision. Note! In accordance with clause 7 of the Regulations on write-off, the period for consideration by the write-off commission of documents submitted to it should not exceed 14 days. The procedure for agreeing on a decision to write off property at the federal level is regulated by the joint Order of the Ministry of Economic Development of the Russian Federation and the Ministry of Finance of the Russian Federation dated March 10, 2011 No. 96/30n. According to clause 3 of this procedure, federal executive authorities are given 45 calendar days from the moment they receive the relevant documents for their consideration or for sending a refusal to approve the write-off decision. As can be seen from the above, the period of approval procedures until the moment of write-off can last about two months, and in practice this period can be even longer.

Accounting for transactions on account 002 using an example

Romashka LLC shipped products worth RUB 59,000 to the buyer. The item had not been paid for on the date of shipment. According to the contract, ownership passes to the buyer upon payment.

In the buyer’s accounting, we will reflect the received goods on off-balance sheet account 002 with the following entries:

| Account Dt | Kt account | Transaction amount, rub. | Wiring Description |

| 002 | — | 50 000 | The goods are accepted for off-balance sheet accounting |

| 19 | 60 | 9 000 | VAT presented by the supplier is reflected |

| On the date of payment: | |||

| 60 | 51 | 59 000 | Payment made to supplier |

| — | 002 | 50 000 | Goods written off balance sheet |

| 41 | 60 | 50 000 | The goods are accepted for balance sheet accounting at the time of transfer of ownership |

| Dt 68/VAT | 19 | 9 000 | Accepted for deduction of VAT presented by the supplier |

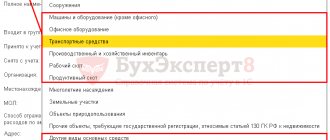

How to group objects

The federal standard introduces new principles for combining fixed assets. Instead of two groups (“Non-residential premises” and “Structures”), the new classification has one - “Non-residential premises (buildings and structures)”. In the new classification, there were also no separate groups for the library collection, soft furnishings, jewelry and jewelry; all these accounts are transferred to the “Other fixed assets” group.

Keep records according to the new rules in the program “Kontur-Accounting Budget”

But investment real estate is allocated - real estate, parts thereof or movable property intended for rental. The accountant should study which of the objects that are listed on account 01 will need to be transferred to the OS category.

| Instruction No. 157n (as amended on September 27, 2017) | Federal standard "Fixed assets" |

| 0 10101 000 “Residential premises” | 0 10101 000 “Residential premises” |

| 0 10102 000 “Non-residential premises” | 0 10102 000 “Non-residential premises (buildings and structures)” |

| 0 10103 000 “Structures” | 0 10103 000 “Investment property” |

| 0 10104 000 “Machinery and equipment” | 0 10104 000 “Machinery and equipment” |

| 0 10105 000 "Vehicles" | 0 10105 000 "Vehicles" |

| 0 10106 000 “Industrial and household equipment” | 0 10106 000 “Industrial and household inventory” |

| 0 10107 000 “Library fund” | 0 10107 000 “Biological resources” |

| 0 10108 000 “Soft inventory” 0 10109 000 “Jewelry and jewelry” 0 10110 000 “Other fixed assets” | 0 10108 000 “Other fixed assets” |

To correctly take into account OS according to the updated groups, objects must be moved: exclude objects from one group and include them in another. Their cost does not change.

Fixed assets between accounts are transferred one-time, based on the situation at the beginning of January 2021, through account 0 401 30 000 “Financial result of past reporting periods”. The basis for the transfer is an accounting certificate (form 0504833).

What has changed in reporting

The developers of the federal standard did not ignore reporting issues. As of January 1, 2021, accountants must report the book value of assets, depreciation method, accumulated depreciation, and more. It is important to reflect in the reporting changes in the valuation of objects in the reporting period, which will affect the SPI, and the depreciation method. In addition, it is necessary to provide a comparison of the residual value of the object at the beginning and end of the reporting period.

Maintain budget accounting and generate reports in the Kontur-Accounting Budget program

Information must be prepared for all groups of fixed assets, this applies to investment real estate, assets with zero residual value, idle facilities, etc. Before the FAS “Fixed Assets” came into force, the institution included reporting information only for some types of fixed assets. Now information about the amounts is reflected in the reporting, but not for all groups that are listed in the standard. Therefore, in the near future we expect changes to Instruction No. 157n, related, in particular, to accounts 0 10100 000, as well as the appearance of new lines in forms 0503168, 0503768, as well as balance sheet 0503130, 0503730. These changes will be reflected in the reporting for 2018.